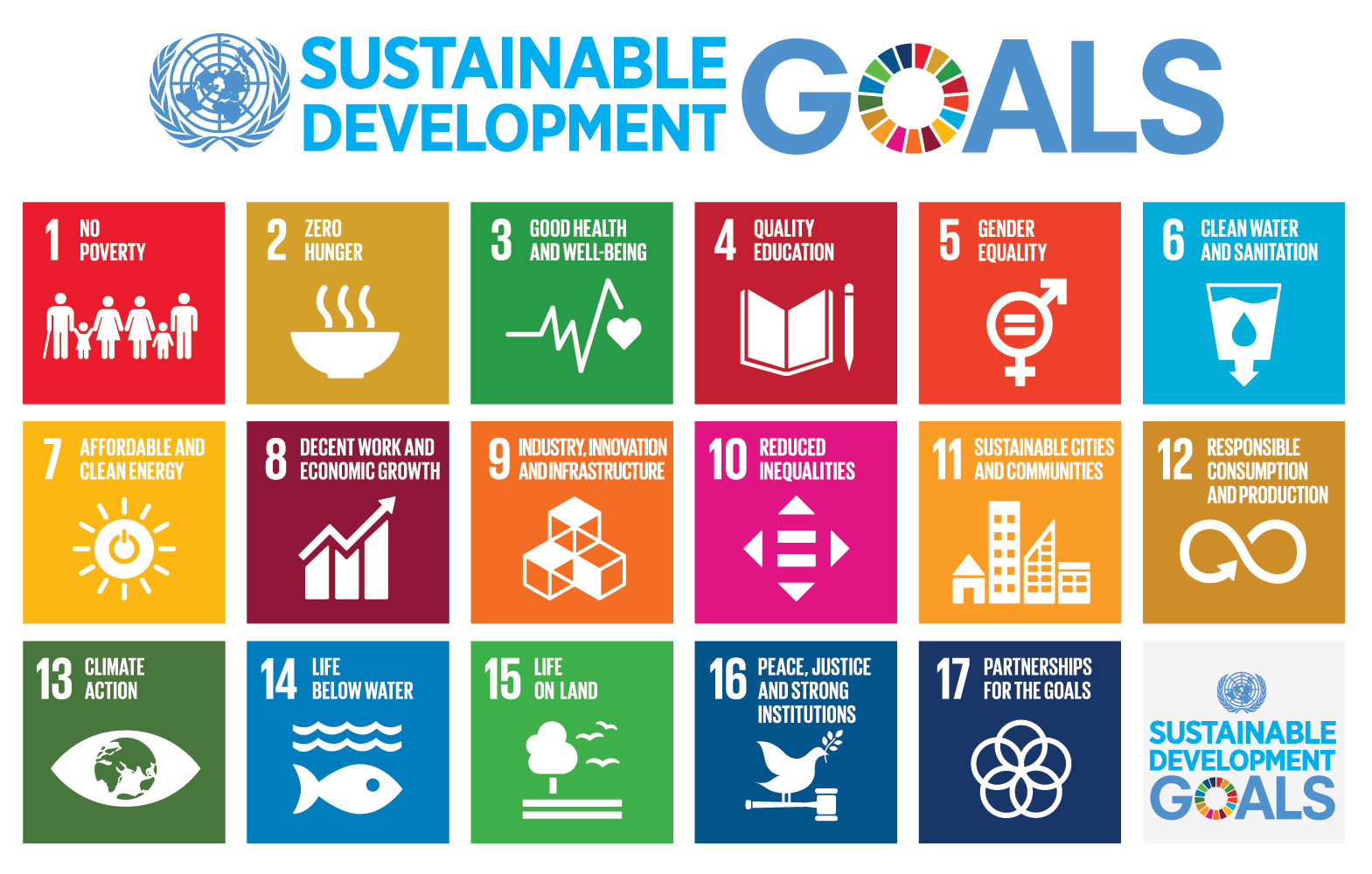

While we have sound plans to establish a profitable airline, planning to operate carbon-neutral, #greenwashing and lip-services dominate responses we get from “impact” investors, why our model cannot be supported. And the same what is heard and seen from politicians and public funds.

Now the last weeks, the “green strategy” is a big issue in the media. European Investment Bank claiming to be be the “Sustainability Bank”. The Mission Hydrogen 24 hour workshop. The reality check on to German Rail’s sustainability. Or the facts about the “global recycling champion” Germany. So let me summarize these reports. And call for any serious investors interested to make a true impact, to talk to us and learn the big impact we want to make. While establishing a profitable, future-focused airline.

German Rail & 100% Sustainable Power?

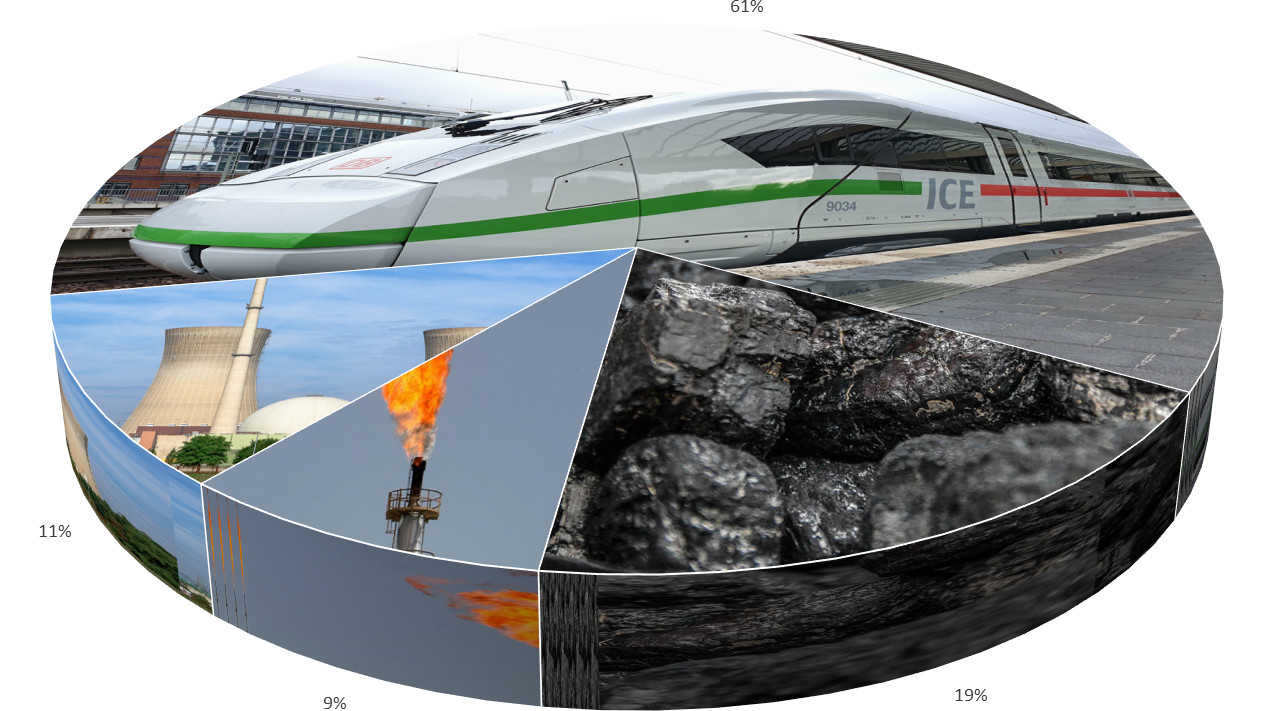

Don’t get me wrong, this ain’t new. There have been reports about this ever since they started their fake promotion about 100% sustainable power. But just this week, German Television did a reality check, with rather devastating results!

Don’t get me wrong, this ain’t new. There have been reports about this ever since they started their fake promotion about 100% sustainable power. But just this week, German Television did a reality check, with rather devastating results!

Just 61% of German Rail’s power comes from renewable energy. 28% come from coal and natural gas, where German Rail partly owns the latest built coal power plant, built against all public opposition. German Rail has long-year delivery contracts for atomic power. And only 33 out of 5,679 railway stations are powered from renewable energies, 0.5 % … And by 2038 (17 years from now) German Rail wants to increase the use of sustainable power to only 80%, targeting 100% only for 2050.

That excludes non-rail business, like Schenker logistics, clearly focusing on Dieseltrucks. Where container transport by rail is more than six times more ecofriendly than trucks. But having demolished most of the industrial accesses, parallel tracks and being delayed on major infrastructure projects like the European North-South rail axis, now backfires and cannot be remedied quickly.

ECB & EIB – the Sustainability Banks?

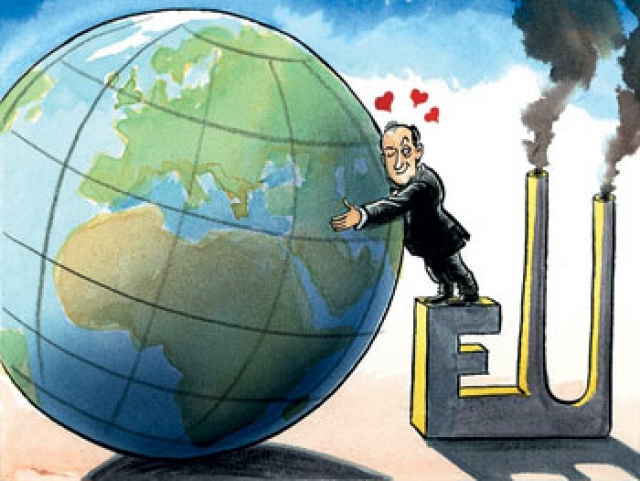

While we talk with impact investors, we do also understand the European Central and the European Investment Bank claiming to be “Sustainability Banks”. Talking with the very same investors being “naturally” and clearly interested in sustainable projects, we asked why they would not make use of those funds to complement an investment into Kolibri or other impact investments.

While we talk with impact investors, we do also understand the European Central and the European Investment Bank claiming to be “Sustainability Banks”. Talking with the very same investors being “naturally” and clearly interested in sustainable projects, we asked why they would not make use of those funds to complement an investment into Kolibri or other impact investments.

The feedback I get is painfully clear. They do not work with the EIB (or other government fund programs) for the bureaucratic process required to be “approved” as an investor. I have multiple statements that attempts to support the investment failed. Assumption being voiced that those funds again go to the big players and into unqualified “green projects” that are mostly about #greenwashing. That includes a claim that EIB funds new aircraft for the dinosaurs – without any requirement(s) for those aircraft or the airline to develop a strategy to reduce their carbon footprint.

I also reached out to one of the experts in my network, working closely with those banks and doing studies on their sustainability, asking why venture capital or family offices don’t work closer with such government funds: “But what you report from your interactions with public investors is true even for smaller and less ambitious projects and companies in that public VC funds invest only if the concept is validated by the market in one way or the other. In other words, only if someone else confirmed the commercial success elsewhere.

Germany – the Global Recycling Champion?

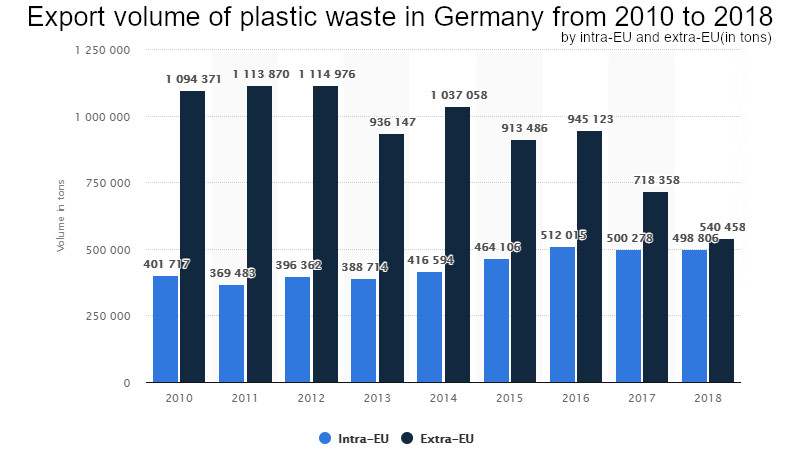

Reality is, that Germany is the global champion in export of plastic trash. Instead of a strict recycling regime, 80% of the trash collected from the recycling bins is being either exported or burned.

Reality is, that Germany is the global champion in export of plastic trash. Instead of a strict recycling regime, 80% of the trash collected from the recycling bins is being either exported or burned.

The drop in export results directly from China having stopped and banned the import of plastic trash. So now, the pictures of plastic from African countries dominate the respective stories about German “recycling”.

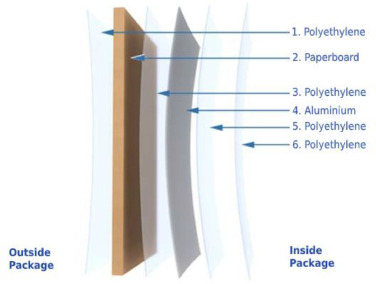

At the same time, the plastics industry is booming. And instead of developing sustainable packaging, the trend is clearly towards mixed-use, the known bad example being “Tetra Pak®“; a packaging made of several layers that make it exceptionally difficult to recycle. And the few recycling factories being more for greenwashing than for recycling any meaningful amounts of that stuff.

At the same time, the plastics industry is booming. And instead of developing sustainable packaging, the trend is clearly towards mixed-use, the known bad example being “Tetra Pak®“; a packaging made of several layers that make it exceptionally difficult to recycle. And the few recycling factories being more for greenwashing than for recycling any meaningful amounts of that stuff.

There was also a report on TV this week on Coca Cola and how they changed from the recycling glass bottles to throw-away plastic bottles and Aluminum cans. Which was the beginning of the end of bottle recycling. And how their lobbyists ever since fight any recycling requirements…

Aviation – the Scapegoat?

Now, how about “my industry”, how about aviation? And why is it constantly the scapegoat and blamed for global warming?

Now, how about “my industry”, how about aviation? And why is it constantly the scapegoat and blamed for global warming?

When the aviation industry claims that it’s only responsible for 2% of the CO2-emissions, this is also green-washing. As aircraft engines exhaust contains also other “greenhouse emissions” and many if not most not on ground level, but at high altitude. The “contrails” being a visual reflection that people “know” and can identify. Experts in a report about Airbus this week accounted the greenhouse emissions by aviation to 6%. Not much, but only 4% of the world population flies. And 6% is substantial.

So aside our plans to use Kolibri.aero to establish the infrastructure and certify the use of 100% synkerosene to fly carbon-neutral, we also understand the issue of the aircraft-engine exhaust will require further research into greenhouse-effects of the remaining exhaust. But which only can start, once we start flying “carbon-neutral”! And yesterday, I was challenged twice about synfuel and that we’d need to look at use of battery, hydrogen and fuel cells. Referring to a very academic presentation by Prof. Dr.-Ing. Josef Kallo of the German Aerospace Agency (DLR) about How to fly with Hydrogen, addressing fuel cells at the European Hydrogen Workshop by Mission Hydrogen GmbH (Ltd.).

See my recent blog about The Road to Environmentally Friendly Flying…

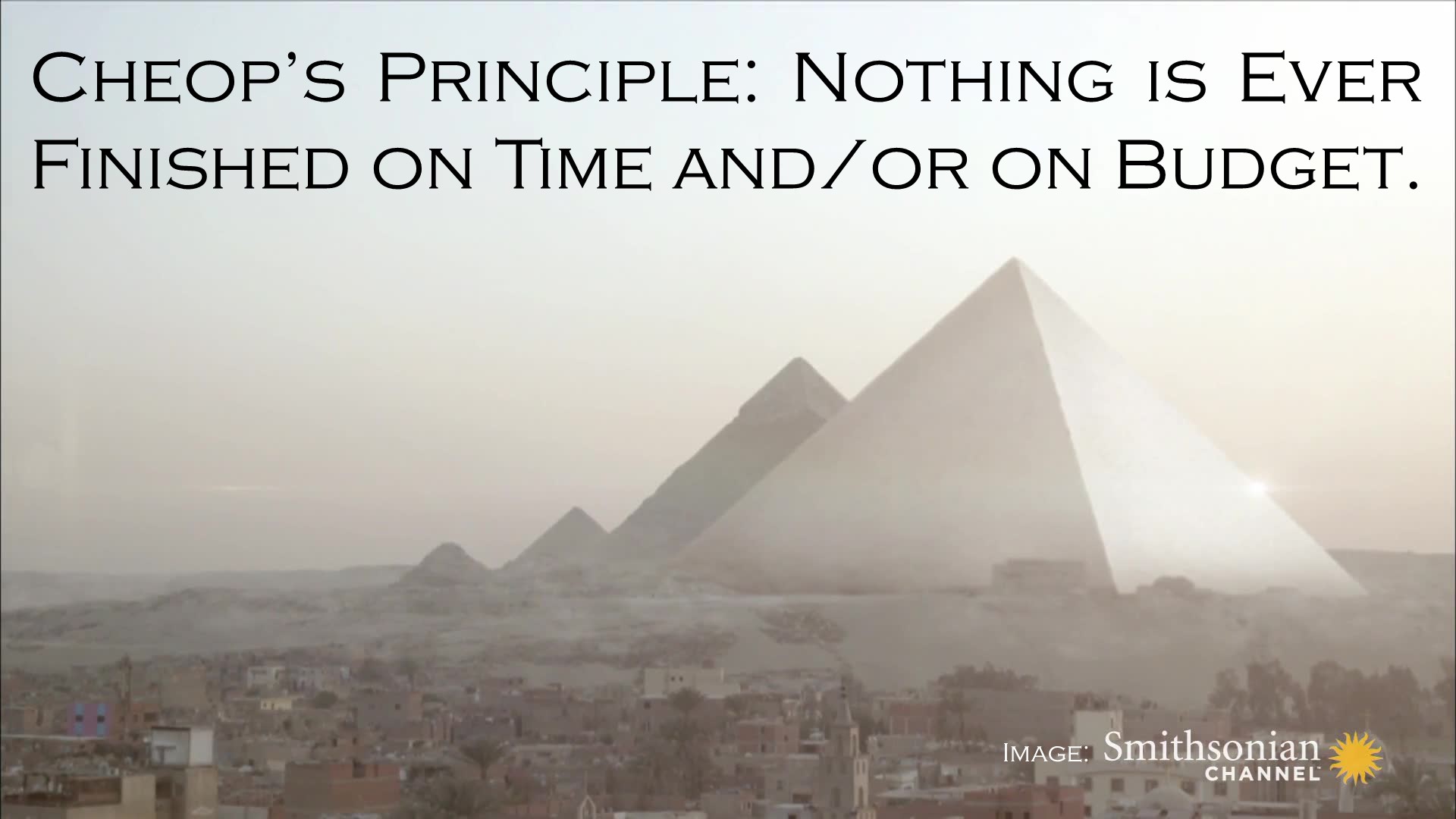

Electric, Fuel Cells and other Aviation #greenwashing

Speaking with one of those “challengers”, he argued that in 10 years the first regional aircraft will fly on fuel-cells. Being “project planning”, I’d say better add 50% reserve to that, then we talk about 15 years. And personally I still doubt that time line. And then we will have aircraft with 10, 20 or maybe 30 seats. With a range of one to two hours. When we will have aircraft that transports 100 seat? Or ones that can replace the 150-250 seats used by the low cost airlines? When do we expect aircraft to transport 250-350 passengers long haul? Hiding behind “Research”? Science Fiction…

Speaking with one of those “challengers”, he argued that in 10 years the first regional aircraft will fly on fuel-cells. Being “project planning”, I’d say better add 50% reserve to that, then we talk about 15 years. And personally I still doubt that time line. And then we will have aircraft with 10, 20 or maybe 30 seats. With a range of one to two hours. When we will have aircraft that transports 100 seat? Or ones that can replace the 150-250 seats used by the low cost airlines? When do we expect aircraft to transport 250-350 passengers long haul? Hiding behind “Research”? Science Fiction…

The argument given was that batteries and fuel cells will become more effective. Which I file under “cognitive dissonance“. What excess in miniaturization results in, we all experienced with the B787 batteries self-enflaming. Or the Samsung Galaxy Note 7 “fiasco”. Trying to mend the rules of physics is a true challenge. And that does not even cover the devastating ecological footprint not only of Lithium. If you want to wait for that to be resolved, we talk about “dirty” kerosene still in use in 20, 30 years!

And if that happens, our industry is worth being used as a scapegoat…

Change Happens – NOW!

Sustainable economy and global warming are big issues today, but most that we see is lip services. An investor group just recently checked impact investments for the “real” impact. They reported about 4% of all investments having a quantifiable impact or quantifiable targets. Only 4%. All others to be #greenwashing. On the “impact programs” of the 100 largest companies in Europe they found not a single one having more than one or two percent impact to global warming. Most of them being “lighthouse projects” that are being developed inside a “bubble” that does not immediately impact the company. Mostly lip-services addressing already established programs, but don’t really change the existing processes.

Sustainable economy and global warming are big issues today, but most that we see is lip services. An investor group just recently checked impact investments for the “real” impact. They reported about 4% of all investments having a quantifiable impact or quantifiable targets. Only 4%. All others to be #greenwashing. On the “impact programs” of the 100 largest companies in Europe they found not a single one having more than one or two percent impact to global warming. Most of them being “lighthouse projects” that are being developed inside a “bubble” that does not immediately impact the company. Mostly lip-services addressing already established programs, but don’t really change the existing processes.

One example mentioned being the Electrolyzer delivered to Salzgitter AG for delivering hydrogen to be used in their steel-making process. A “research project”, largely funded by the hydrogen program. And now, being still in research phase, trialing it’s impact, it’s a “lighthouse project”?

The Fight against #Greenwashing + Lip-Services

And today I was confronted again with “avoid flying” as the first and foremost advise to stop global warming. While people will fly, economy needs flight connections as well. What we need is to stop blaming aviation, but start changing it. And the governments and public funds won’t help, so we need bold investors with a mission to help establishing the environment that allows us to work together on the common goal. Clean flying. Flying without remorse. Flying with a conscious mind.

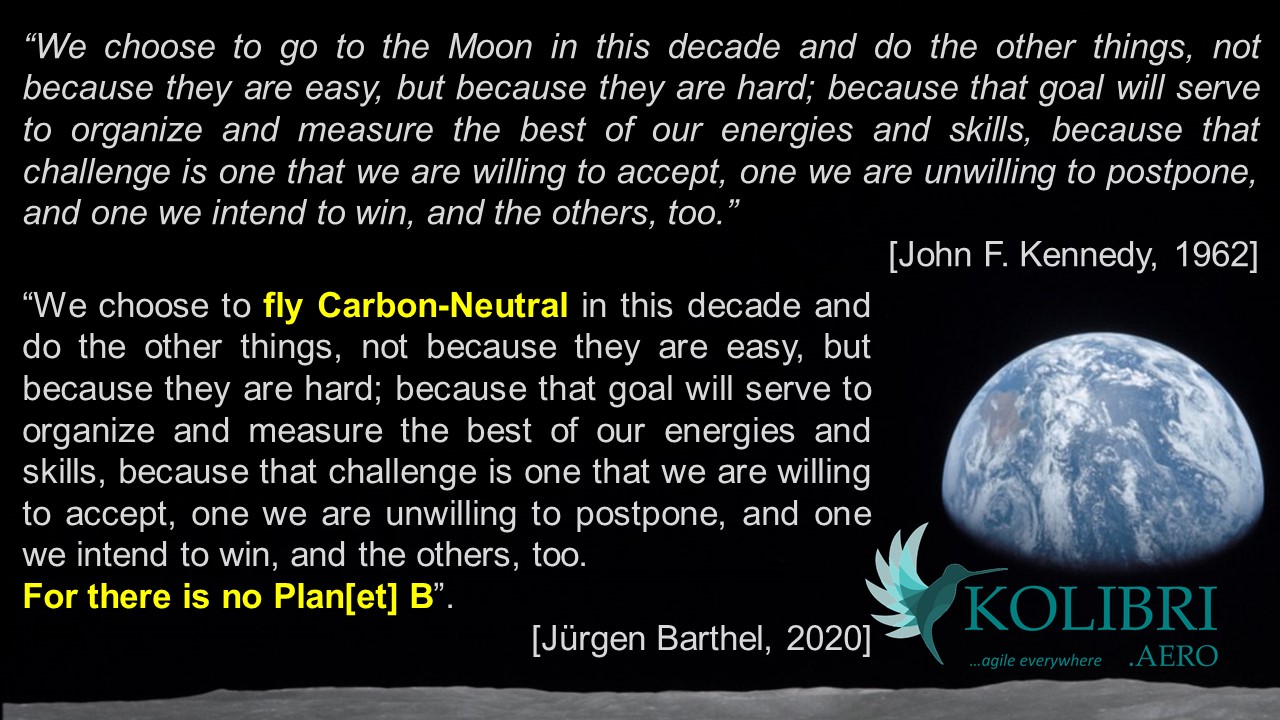

We choose to fly Carbon-Neutral in this decade. And do the other things. Not because they are fashionable and easy, but because they must be done. But we can’t do it alone, we need investors that are interested in more than greenwashing their conscience, but the ones supporting the real thing. Investors that understand this is a big deal, it’s disruptive, it’s a journey. A journey that needs conviction, founders with the commitment and vision to make it happen…

Food for Thought

Investors welcome!

The very same issue is it about hydrogen powered passenger flights, Airbus recently promoted as their “Zero-Emission Aircraft”. Again, the physical challenge.

The very same issue is it about hydrogen powered passenger flights, Airbus recently promoted as their “Zero-Emission Aircraft”. Again, the physical challenge. Developing Kolibri, from the outset we thought about using contemporary aircraft allowing us to use bio-fuel. Though bio-kerosene must be “blended”. Must be mixed at least one to one with the classic, dirty kerosene. Often, it is mixed like “E10” gasoline, only 10% “bio”. It’s not uncommon to have a

Developing Kolibri, from the outset we thought about using contemporary aircraft allowing us to use bio-fuel. Though bio-kerosene must be “blended”. Must be mixed at least one to one with the classic, dirty kerosene. Often, it is mixed like “E10” gasoline, only 10% “bio”. It’s not uncommon to have a  From my work on a solar powered WIG 2008, replacing it’s diesel-engine with an hydrogen-engine, I understood hydrogen as the future. Clean electrolysis using solar power (and wind, bio mass and other sustainable energy sources) and salted water, whereas desalination facilities produce the surplus salt to augment seawater to the level needed for the electrolysis. So sunny regions with access to seawater have a “natural advantage” to develop the infrastructure to create hydrogen.

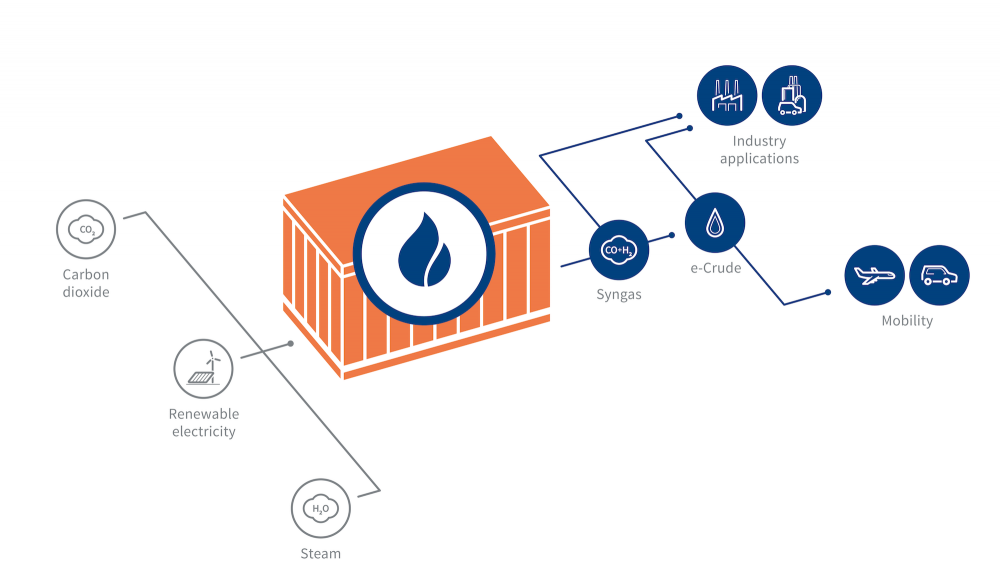

From my work on a solar powered WIG 2008, replacing it’s diesel-engine with an hydrogen-engine, I understood hydrogen as the future. Clean electrolysis using solar power (and wind, bio mass and other sustainable energy sources) and salted water, whereas desalination facilities produce the surplus salt to augment seawater to the level needed for the electrolysis. So sunny regions with access to seawater have a “natural advantage” to develop the infrastructure to create hydrogen. Two years ago Sunfire’s Synfuel triggered my attention, from a National Geographic report – not reported in Germany, but in the U.S. … I instantly understood synfuel a perfect solution to replace our plans to invest in expensive electric and hydrogen powered ground fleet, still with the need to have Diesel-powered trucks and emergency generators in an airline, with syndiesel. And to develop into synkerosene to replace biokerosene.

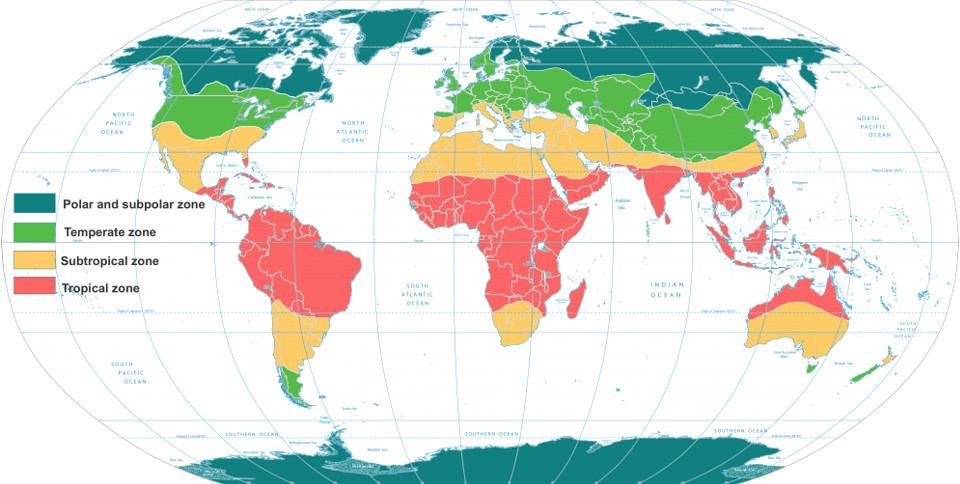

Two years ago Sunfire’s Synfuel triggered my attention, from a National Geographic report – not reported in Germany, but in the U.S. … I instantly understood synfuel a perfect solution to replace our plans to invest in expensive electric and hydrogen powered ground fleet, still with the need to have Diesel-powered trucks and emergency generators in an airline, with syndiesel. And to develop into synkerosene to replace biokerosene. Aside, synfuel can be used quite easily as a buffer technology, using excess power to create synfuel during peak times and using it in common and tried power generators to recreate energy in low times. Until we have something better, Syngas is a clean energy source that can make us independent of crude-oil for power generation. a technology that can create a future for many “poor countries” in the “tropical belt”, the tropic (red) and subtropical zones (yellow), as their surplus of solar energy is way higher than what the northern hemisphere has in the temperate to polar zones.

Aside, synfuel can be used quite easily as a buffer technology, using excess power to create synfuel during peak times and using it in common and tried power generators to recreate energy in low times. Until we have something better, Syngas is a clean energy source that can make us independent of crude-oil for power generation. a technology that can create a future for many “poor countries” in the “tropical belt”, the tropic (red) and subtropical zones (yellow), as their surplus of solar energy is way higher than what the northern hemisphere has in the temperate to polar zones.

There is a very strong force of inertia in aviation about turning “green”. Like other problems in aviation management, such as their disbelieve in branding, the resulting focus on “cheap” as the sole difference and a missing loyalty for partners and employees alike. that, plus missing USPs made airlines a running gag about ROI. But as in all other industries, you cannot expect change and disruptions with blind managers. You need vision.

There is a very strong force of inertia in aviation about turning “green”. Like other problems in aviation management, such as their disbelieve in branding, the resulting focus on “cheap” as the sole difference and a missing loyalty for partners and employees alike. that, plus missing USPs made airlines a running gag about ROI. But as in all other industries, you cannot expect change and disruptions with blind managers. You need vision.

There is a lot of buzz ongoing about Impact Investment in IT and AI. Whereas I just wrote about

There is a lot of buzz ongoing about Impact Investment in IT and AI. Whereas I just wrote about

On the other side – and back to the topic of my previous article,

On the other side – and back to the topic of my previous article,  A German investor this week told me: “There is too little change in what you’re doing.” That investor referred to either air taxi or hyperloop. Whereas I’ve often enough expressed my concerns about air traffic control taking individual mobility into the third dimension and into potential conflict with commercial (and military) aviation. Just thinking about the increasing drone-warnings disrupting airport operations the past year. That is a very long way to go.

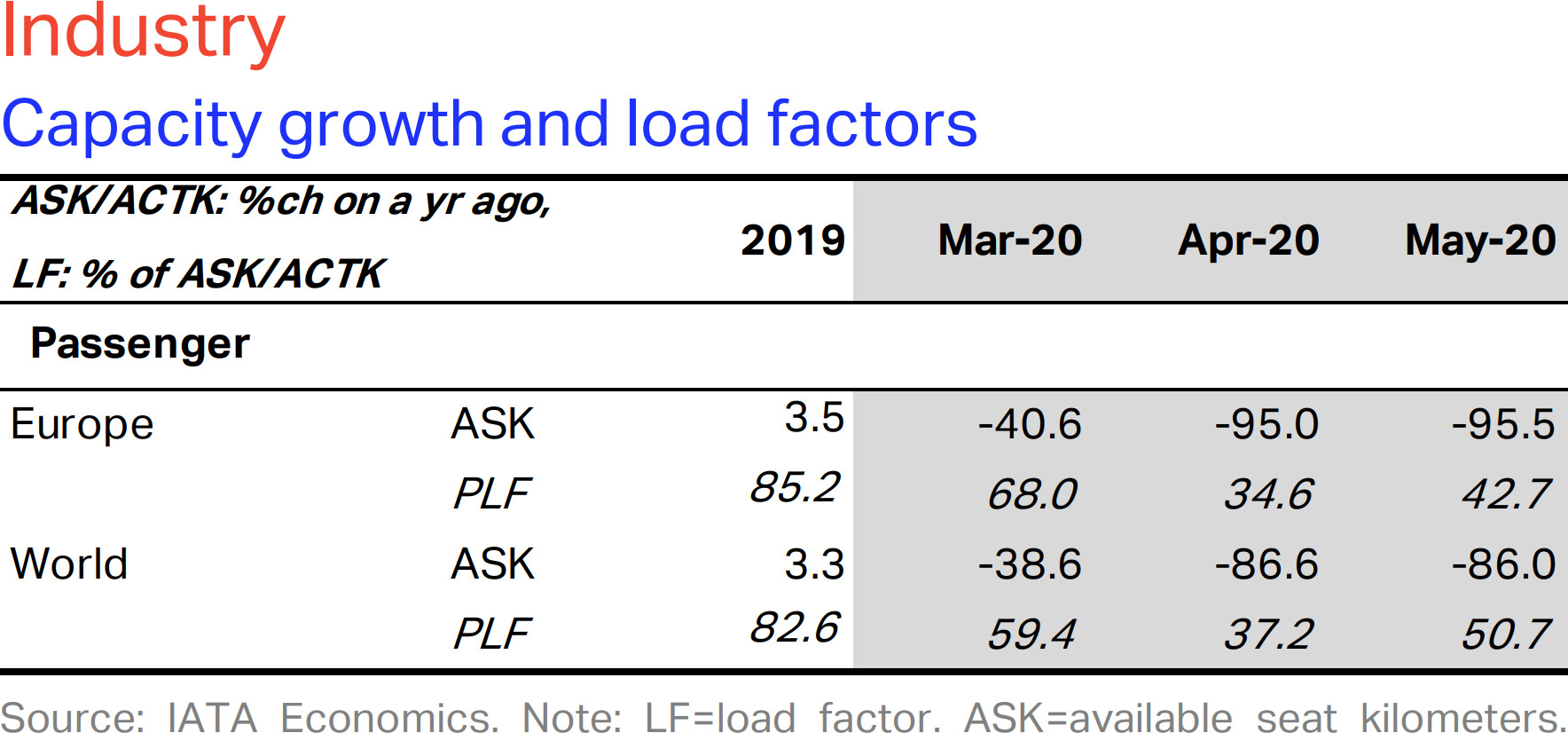

A German investor this week told me: “There is too little change in what you’re doing.” That investor referred to either air taxi or hyperloop. Whereas I’ve often enough expressed my concerns about air traffic control taking individual mobility into the third dimension and into potential conflict with commercial (and military) aviation. Just thinking about the increasing drone-warnings disrupting airport operations the past year. That is a very long way to go. Global CO2 emissions dropped by 7%, with 11% in Europe due to Corona. Especially aviation reduced due to the lockdown by 22% global, some regions by 30%. But those are expected to come back quickly (

Global CO2 emissions dropped by 7%, with 11% in Europe due to Corona. Especially aviation reduced due to the lockdown by 22% global, some regions by 30%. But those are expected to come back quickly ( There are exceptionally good examples recently, like

There are exceptionally good examples recently, like  Well, it’s always easy to invest into existing business. Buying in on indices or major shares, you don’t need to understand anything beyond their “performance” and “marketing message”. If they wash well enough, they might appear shining green or white, right?

Well, it’s always easy to invest into existing business. Buying in on indices or major shares, you don’t need to understand anything beyond their “performance” and “marketing message”. If they wash well enough, they might appear shining green or white, right? The “typical” aviation investment is aircraft funds. Whereas KPMG valued them at an average 4% return in 2019, look at all those assets now. Liabilities in most cases, because they had and have no USP. And even back in 2019, the big aircraft lessors being well established with the airlines made good returns, but many funds also underperformed or failed completely.

The “typical” aviation investment is aircraft funds. Whereas KPMG valued them at an average 4% return in 2019, look at all those assets now. Liabilities in most cases, because they had and have no USP. And even back in 2019, the big aircraft lessors being well established with the airlines made good returns, but many funds also underperformed or failed completely.

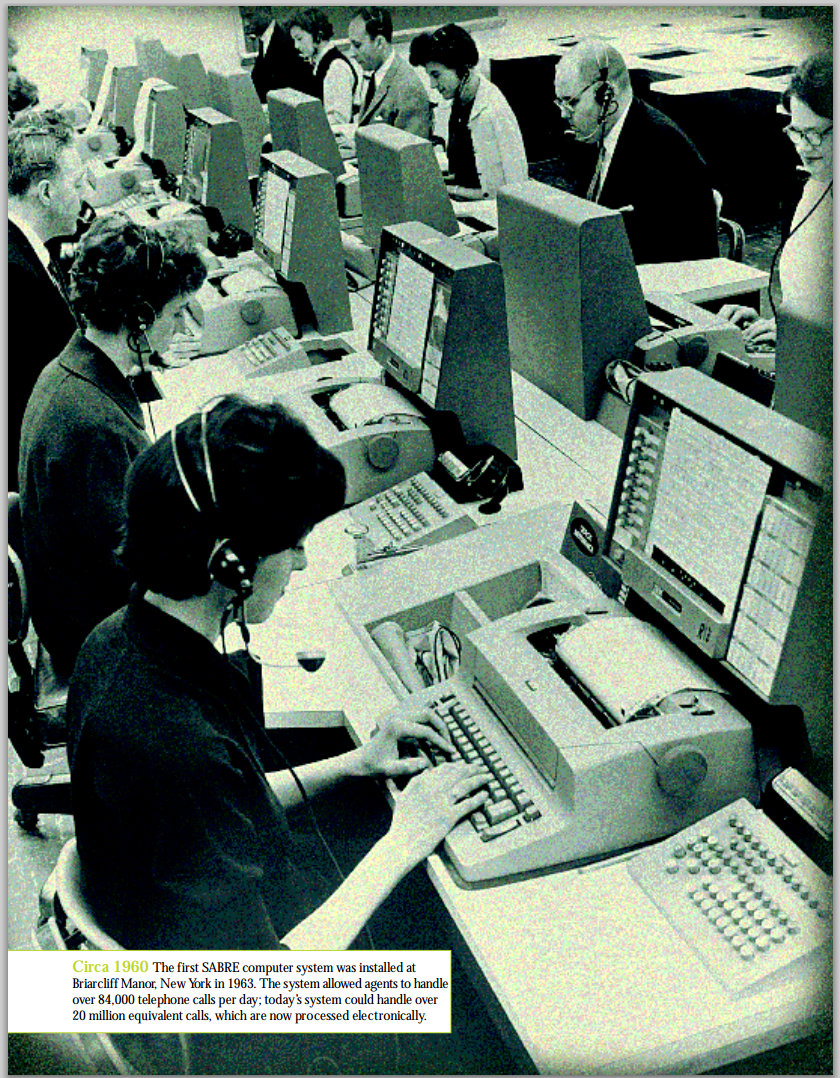

SABRE

SABRE Passenger Statistics

Passenger Statistics Looking at

Looking at  The only ones I see that manage their big data are actually Amazon, Google, Facebook. Recently learned that for any click on Amazon, they collect some 150 variables on their user. It’s frightening. Then they put you in boxes. Me? In a box? Me, an advocate for #thinkoutsidethebox …

The only ones I see that manage their big data are actually Amazon, Google, Facebook. Recently learned that for any click on Amazon, they collect some 150 variables on their user. It’s frightening. Then they put you in boxes. Me? In a box? Me, an advocate for #thinkoutsidethebox … In the early 2000s, I was actively supporting e-Mail SSL-encryption, using a service by SSL-provider Thawte. Their motto has settled in me: It’s a Trust Thing. Which is a human thing. And from years of experience I don’t trust “data”. Data does not look you in the eye, it does not understand grayscale, data is Zero or One. Black or White.

In the early 2000s, I was actively supporting e-Mail SSL-encryption, using a service by SSL-provider Thawte. Their motto has settled in me: It’s a Trust Thing. Which is a human thing. And from years of experience I don’t trust “data”. Data does not look you in the eye, it does not understand grayscale, data is Zero or One. Black or White.

Is Big Data really something good? Or is it like the saying from the early 1980s: 1984 was already back in ’77. Just no-one realized it. And yes, that was Pre-Internet.

Is Big Data really something good? Or is it like the saying from the early 1980s: 1984 was already back in ’77. Just no-one realized it. And yes, that was Pre-Internet. As with everything, it’s a question about extremes. In itself, Big Data is not bad, but we need rules, especially ones addressing privacy and limitations. Like what separates the bad from the good? Just because they say so? I keep thinking about the 1998 movie

As with everything, it’s a question about extremes. In itself, Big Data is not bad, but we need rules, especially ones addressing privacy and limitations. Like what separates the bad from the good? Just because they say so? I keep thinking about the 1998 movie  The Sleeping Giant?

The Sleeping Giant?

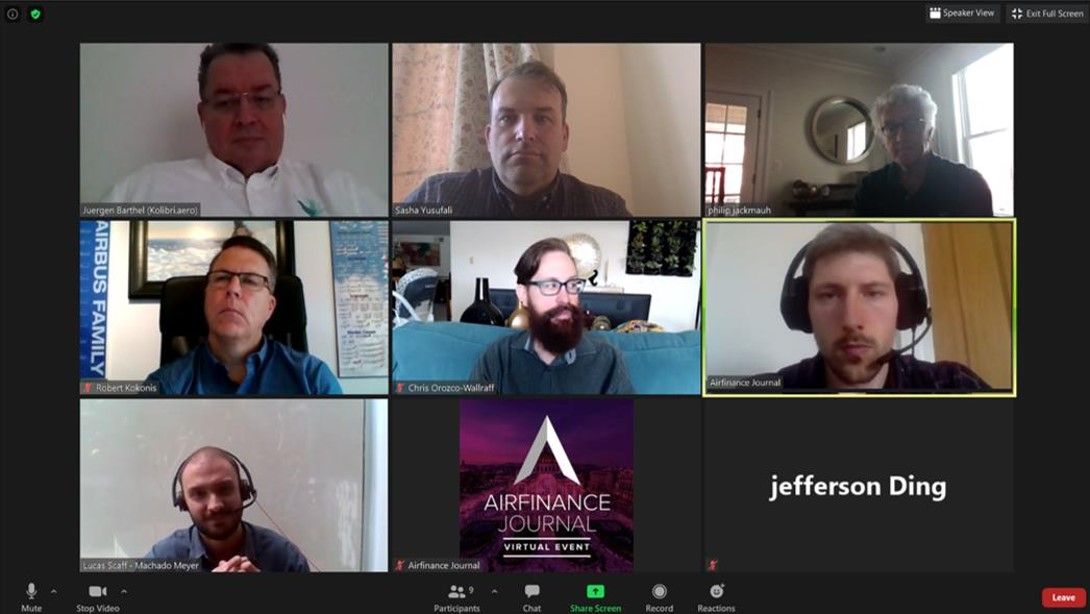

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge. Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service! A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

Convincing the People to Fly Again

Convincing the People to Fly Again There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

![“For those who agree or disagree, it is the exchange of ideas that broadens all of our knowledge” [Richard Eastman]](https://foodforthought.barthel.eu/wp-content/uploads/2016/08/eastman_quote.jpg)

In 2016 with

In 2016 with  There was an

There was an  In October that year, mighty

In October that year, mighty

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Last week it started with a

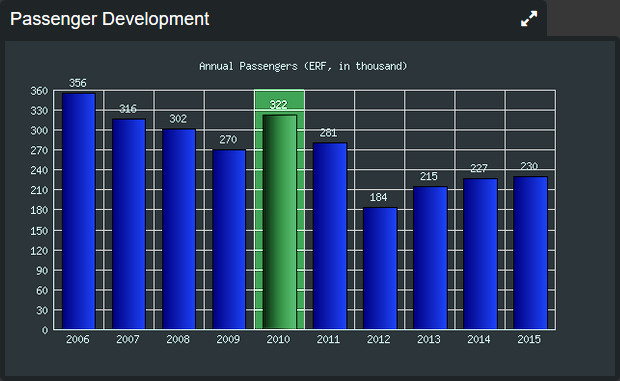

Last week it started with a  As you may recall, 2009/10, I’ve been managing Marketing, Press/P.R. and Corporate Communications at the Erfurt Airport, one of the seven now questioned. Which is my example of why German airports fail thanks to populistic airport bashing by the local politicos and most of the media. And an idiotic, short-sighted focus on “outgoing” holiday charter flights. I am adamant about my justified opinion that given a positive support and strategy, the airport would be worth a million passengers and an economic operation. If they’d cash in on incoming.

As you may recall, 2009/10, I’ve been managing Marketing, Press/P.R. and Corporate Communications at the Erfurt Airport, one of the seven now questioned. Which is my example of why German airports fail thanks to populistic airport bashing by the local politicos and most of the media. And an idiotic, short-sighted focus on “outgoing” holiday charter flights. I am adamant about my justified opinion that given a positive support and strategy, the airport would be worth a million passengers and an economic operation. If they’d cash in on incoming. As I wrote three years ago, airports must embrace their

As I wrote three years ago, airports must embrace their

Again ,there is no reasoning to invest into an airport that only looks at outgoing summer charter flights. The money leaves the region and benefits the destination. Why would I subsidize that?

Again ,there is no reasoning to invest into an airport that only looks at outgoing summer charter flights. The money leaves the region and benefits the destination. Why would I subsidize that?