The #panaceadistraction disqualifies many #impactinvestments as greenwashing. A look at realpolitik in impactinvesting.

The #panaceadistraction disqualifies many #impactinvestments as greenwashing. A look at realpolitik in impactinvesting.

The Trigger: Lubomila’s COP21 statement

!["Our Obsession with technology will slow down the green transition.” [Lubomila Jordanova]](https://foodforthought.barthel.eu/wp-content/uploads/2021/11/Jordanova-Lubomila-Techfocus-slows-down-green-transition.jpg) Having been reminded again of Lubomila Jordanova‘s statement for the U.N. Climate Change Conference 2021, it bugs me, how little has changed in those past two years. Working with climate activists up to United Nations levels, I find a lot of what we call #academicthinking, more about Science Fiction than about taking what we have to the market. A #panaceadistraction if I’ve ever seen one.

Having been reminded again of Lubomila Jordanova‘s statement for the U.N. Climate Change Conference 2021, it bugs me, how little has changed in those past two years. Working with climate activists up to United Nations levels, I find a lot of what we call #academicthinking, more about Science Fiction than about taking what we have to the market. A #panaceadistraction if I’ve ever seen one.

And while #buzzwords used by investors are #disruptiveinvestments, #sustainableinvestments and the like, a big part of the #panaceadistraction is their focus on (classic) “boxes” to invest in. Can’t tell, how many times in the past decades I have heard, that our ideas wouldn’t fit the box. #thinkoutsidethebox and #thinkbeyond.

The Sustainability Lie: Stay inside Your Box

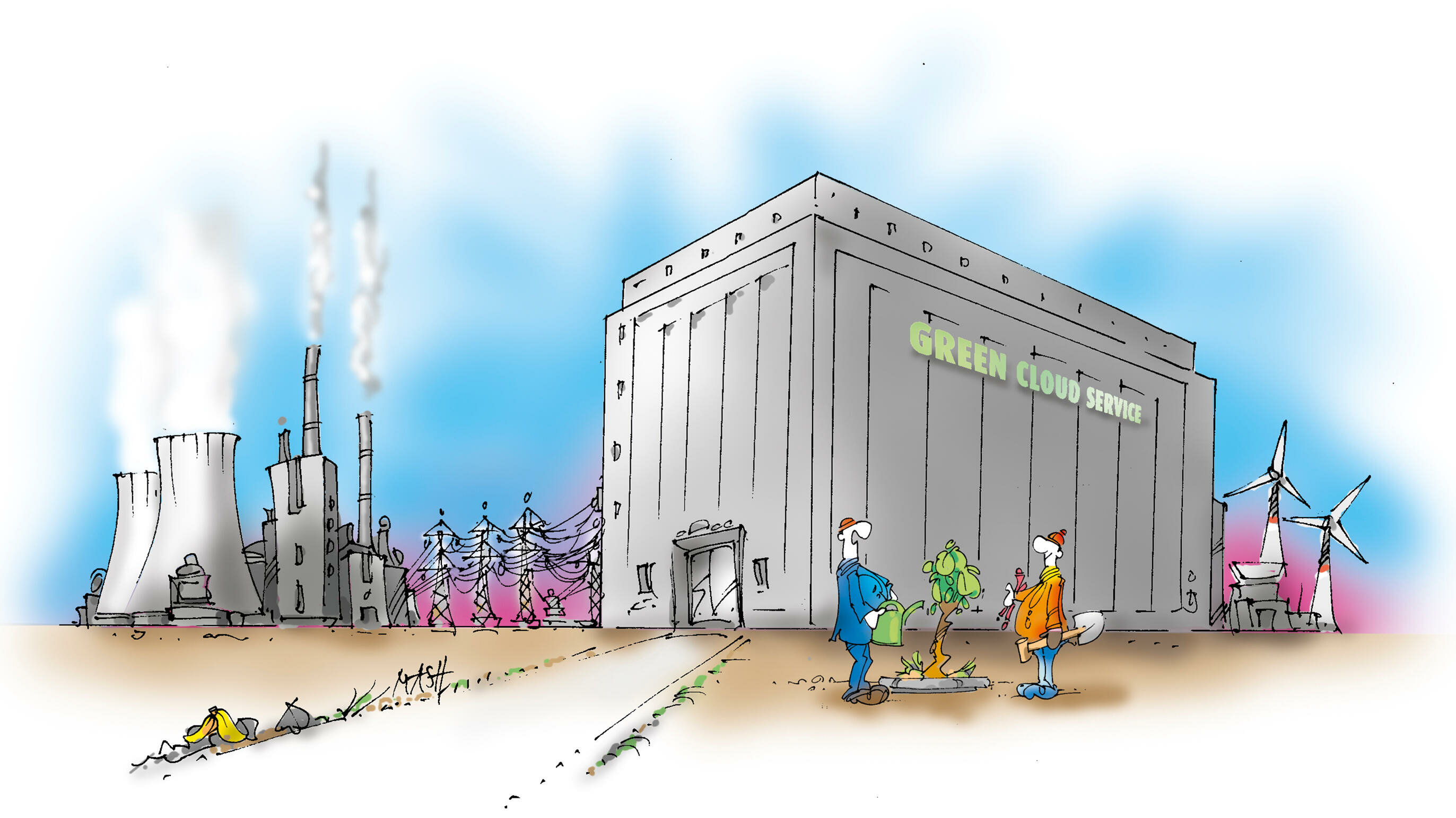

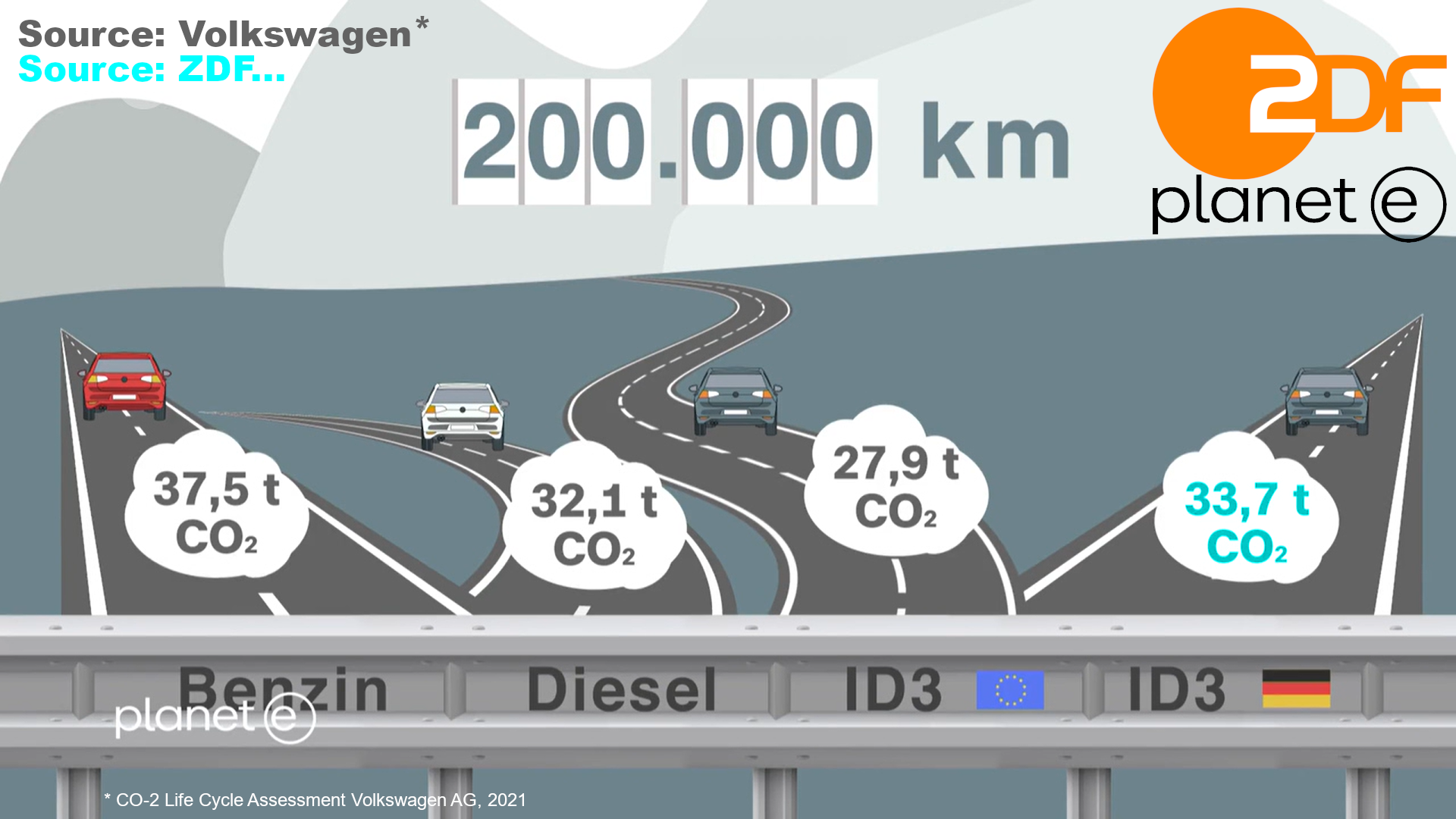

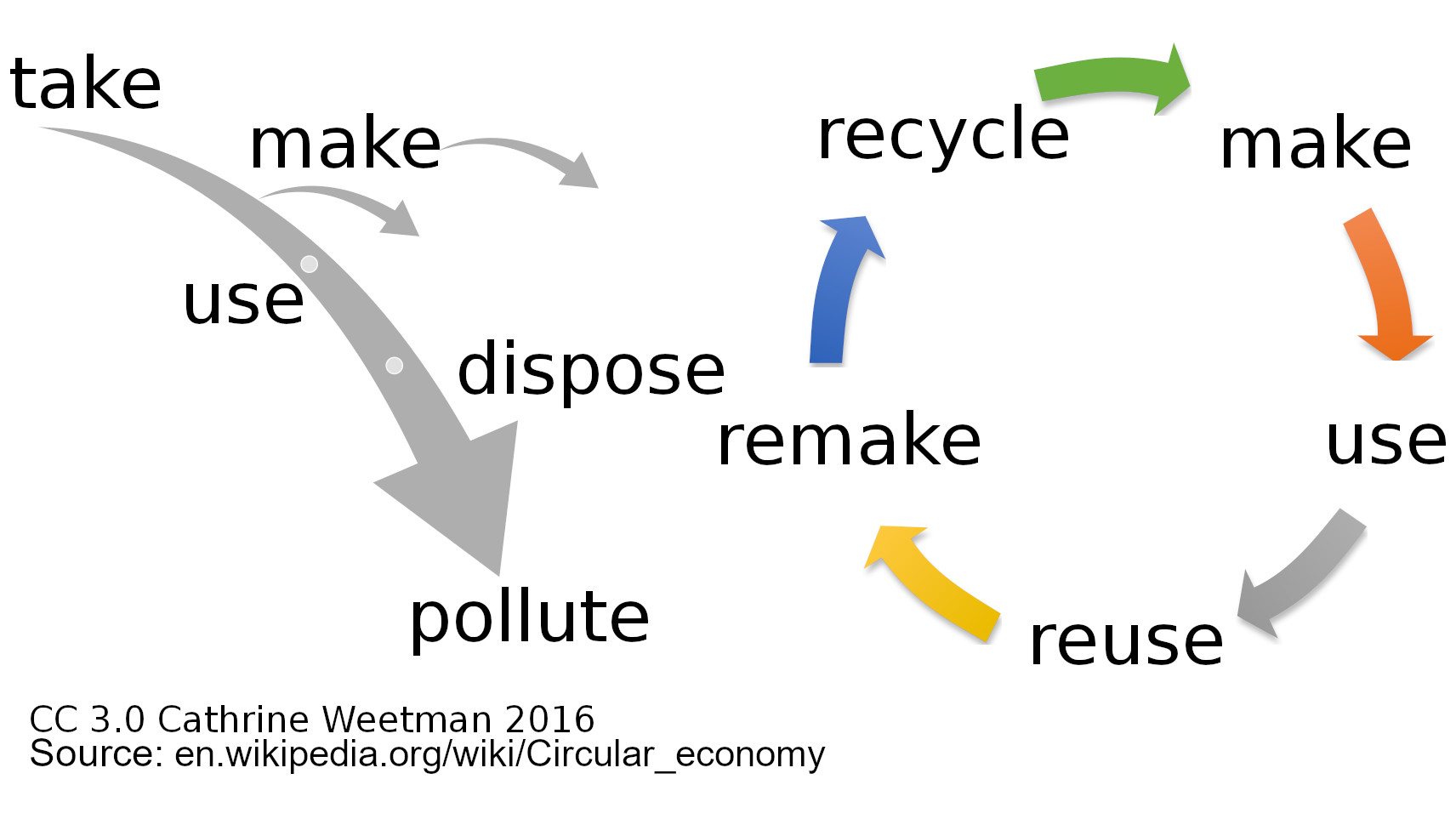

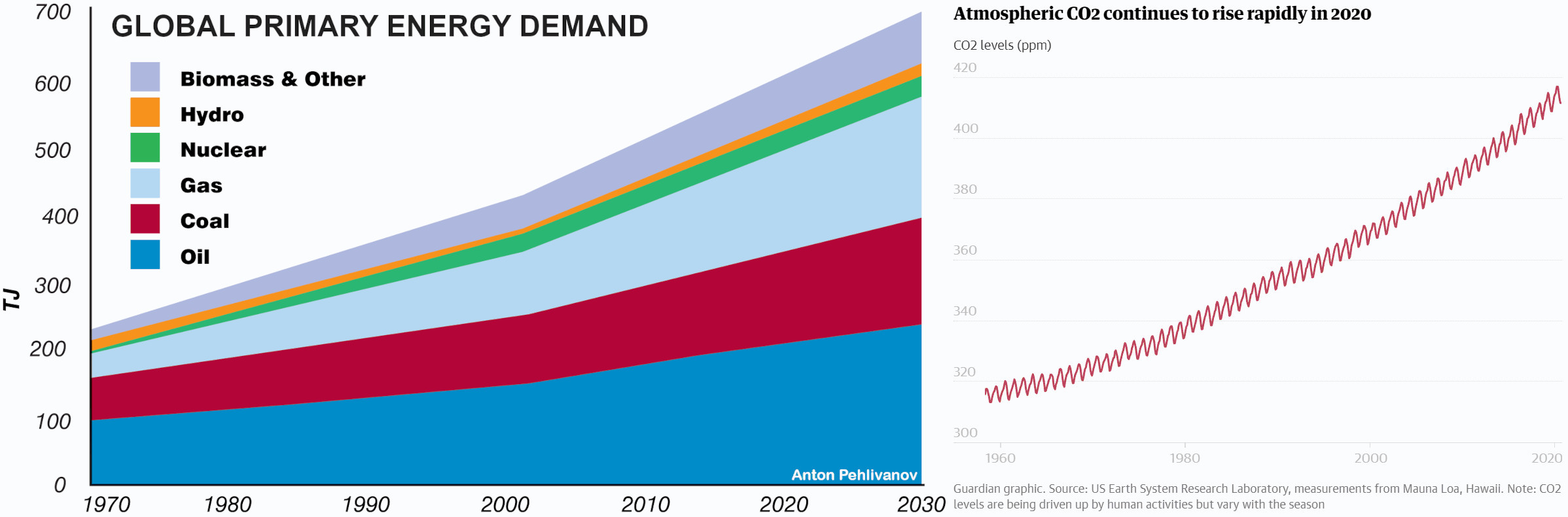

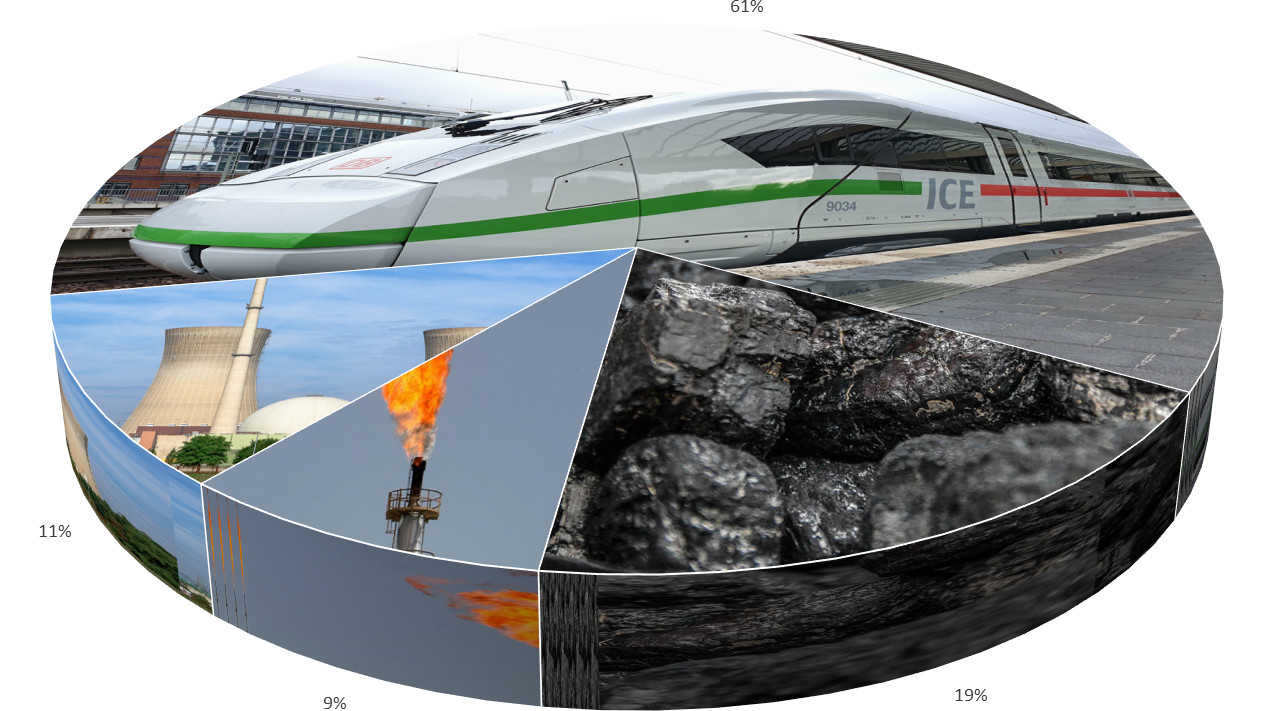

The direct “impact” is that #impactinvestments are mostly #greenwashing on #lifecycleassessment and #circulareconomy – very often blindsiding the #energydemand, using the cheap excuses of “we purchase #greenenergy or #climatecertificates … I was recently told that the industry creatively sells multiple times the amounts of “green” energy we create. I can imagine that. Aside of my #railshame-article, cleaning the green color of the mighty German #greenrail. Just another reference to the Sustainability-Energy Dilemma.

Or #artificialintelligence (just like space) – being a big dream (some consider it a threat). A big investment interest! Whereas most if not all of AI I’ve seen fits the statement that most AI is IA: More (or often less) Intelligent Algorithms. Yes Athena, Minerva and Mike Holmes, I’m waiting (wondering who understands that reference on the fly)…

Or #artificialintelligence (just like space) – being a big dream (some consider it a threat). A big investment interest! Whereas most if not all of AI I’ve seen fits the statement that most AI is IA: More (or often less) Intelligent Algorithms. Yes Athena, Minerva and Mike Holmes, I’m waiting (wondering who understands that reference on the fly)…

So how #sustainable is #impactinvesting really? And which #impactinvestors in reality are part of the mighty #greenwashingindustry? Or do they focus a bit too much on the #panaceadistraction instead?

A Look Back: Pioneering and Disrupting

As a kid, I saw those pioneering constructions on those triangle-shaped hang-gliders, today both bureaucracy and investors wouldn’t invest a penny. But they lead to paragliders, a huge industry today.

Back in 1995, the big four in aviation technology (Amadeus, Galileo, Sabre and Worldspan) actively and with might opposed the development of booking flights on web-basis. How “disruptive” was that “stupid” idea? And yes, I made it happen, together and funded by a visionary Louis Arnitz (RIP). And yeah, that was the time Bill Gates disqualified the Internet, promoting his Microsoft Network.

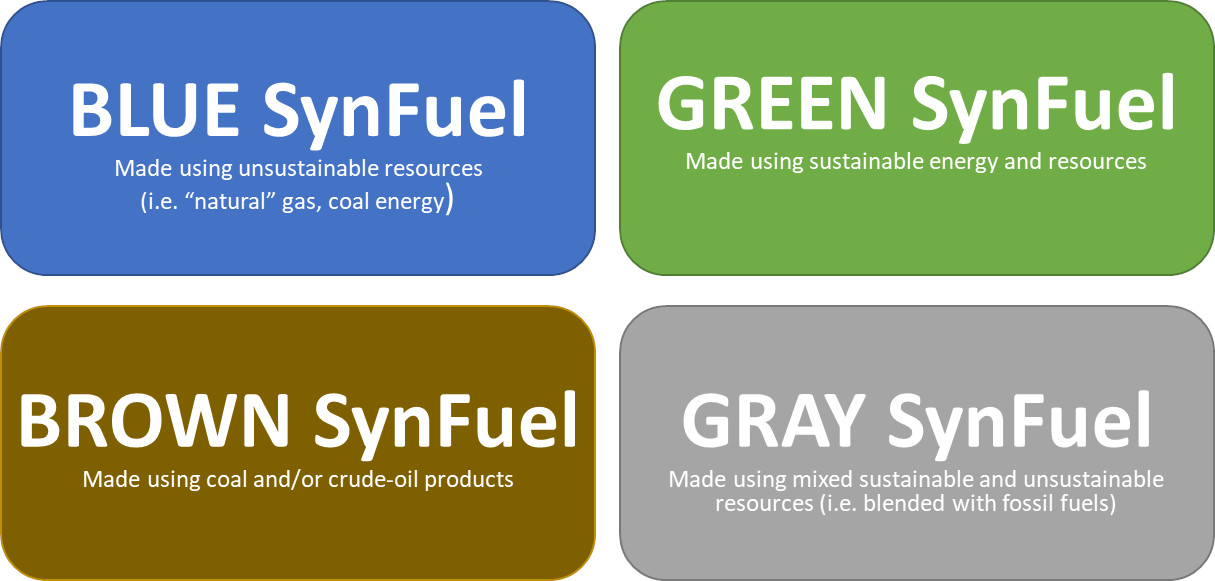

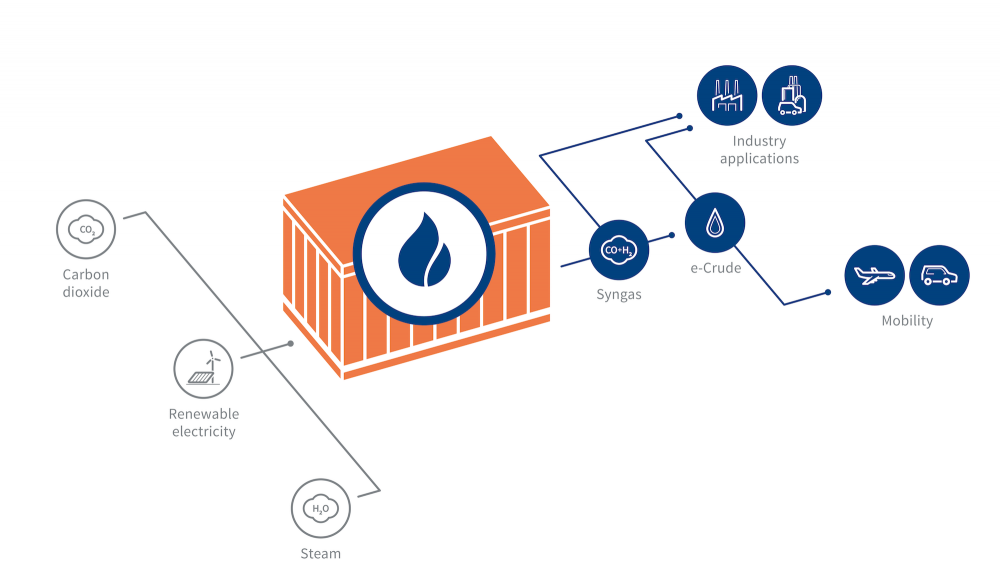

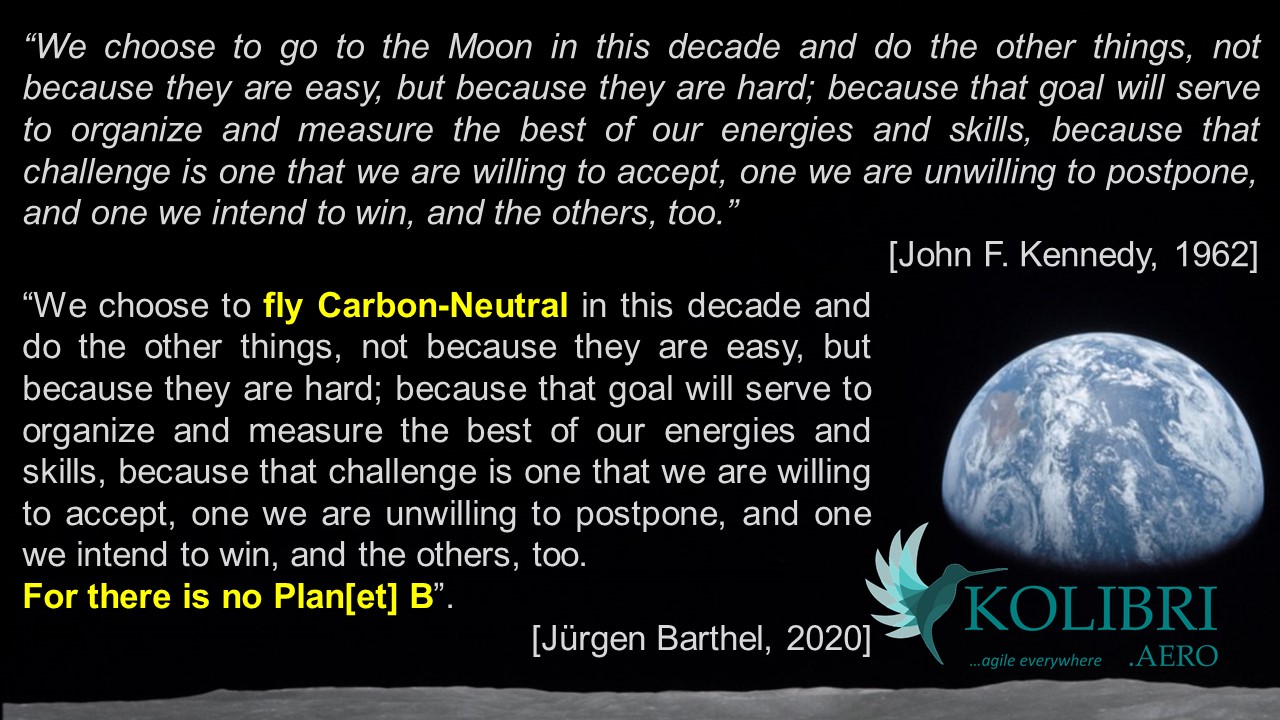

In 2008, I developed another “disruptive” idea of a hydrogen-powered WIG, to promote the need to think sustainable on a global aviation conference. While it made it through viability study into serious negotiations by a tropical government and a major green fund, it fell victim to Lehman, but I still think it should have been developed. Though since #synfuel came up (2019ish), my bets are on that technology, I even applied it to our plans for Kolibri, closing the huge black hole where before our ideas of #biofuels were more or less a band aid on a searing wound. Aside that I prefer we grow food on the fields and not biofuel-rape. And why is it rape has such a bad double-meaning?

In 2008, I developed another “disruptive” idea of a hydrogen-powered WIG, to promote the need to think sustainable on a global aviation conference. While it made it through viability study into serious negotiations by a tropical government and a major green fund, it fell victim to Lehman, but I still think it should have been developed. Though since #synfuel came up (2019ish), my bets are on that technology, I even applied it to our plans for Kolibri, closing the huge black hole where before our ideas of #biofuels were more or less a band aid on a searing wound. Aside that I prefer we grow food on the fields and not biofuel-rape. And why is it rape has such a bad double-meaning?

Though I’m a caller in the dark it seems, at least when talking with mighty investors – they fall back to their boxes and disqualify “aviation” as “not something we invest in”, without even a second look. #talkthetalk, focusing on the #panaceadistraction instead.

Think Positive: The Solutions are There!

There is so much #disruptivetech out there with a business case (aka #impactinvestment), beyond that I integrated into the plans I have for Kolibri, lacking the funding support, lacking the vision of those self-proclaimed #impactinvestors. And a lot of #talkthetalk again. i.e. #energybuffer technologies, alternative energy sources such as #tidalenergy – why only offshore-wind? Though nothing we do, nothing comes without a toll. Remember the #butterflyeffect and the Sustainability-Energy Dilemma.

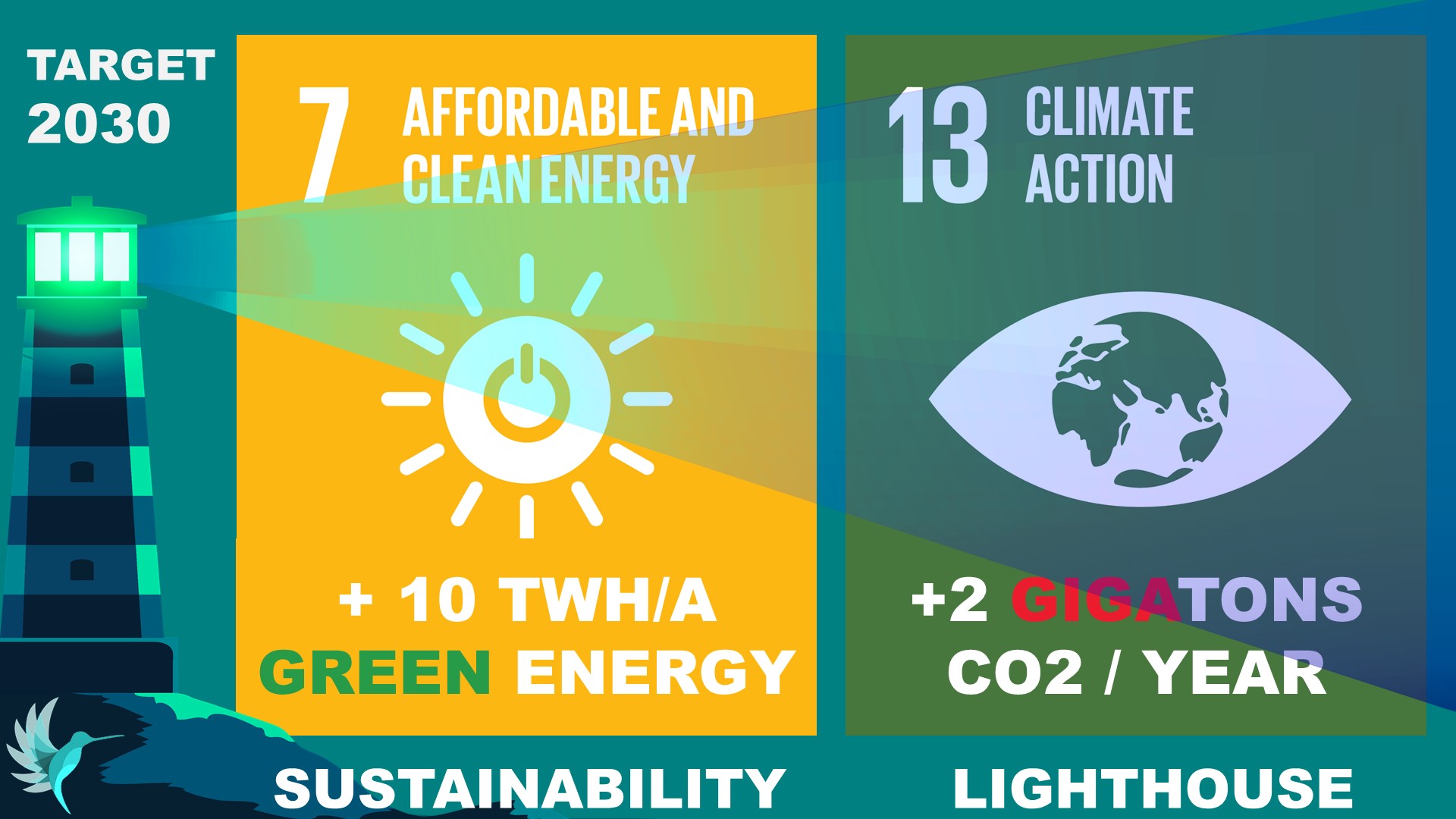

As a direct result, we have an exploding #sdgfundinggap for sustainability and climate developments. It’s not the first and not the last time, U.N. Secretary General Antonio Gutérres called and calls this #fartoolittlefartoolate.

Butterfly Effect, e-Mobility Lie and the Panacea Distraction

While my readers and followers know that I question #windpower and emobility for #greenwashing and short-term thinking, I also promote the fact that we need the change. We must act. Today.

While my readers and followers know that I question #windpower and emobility for #greenwashing and short-term thinking, I also promote the fact that we need the change. We must act. Today.

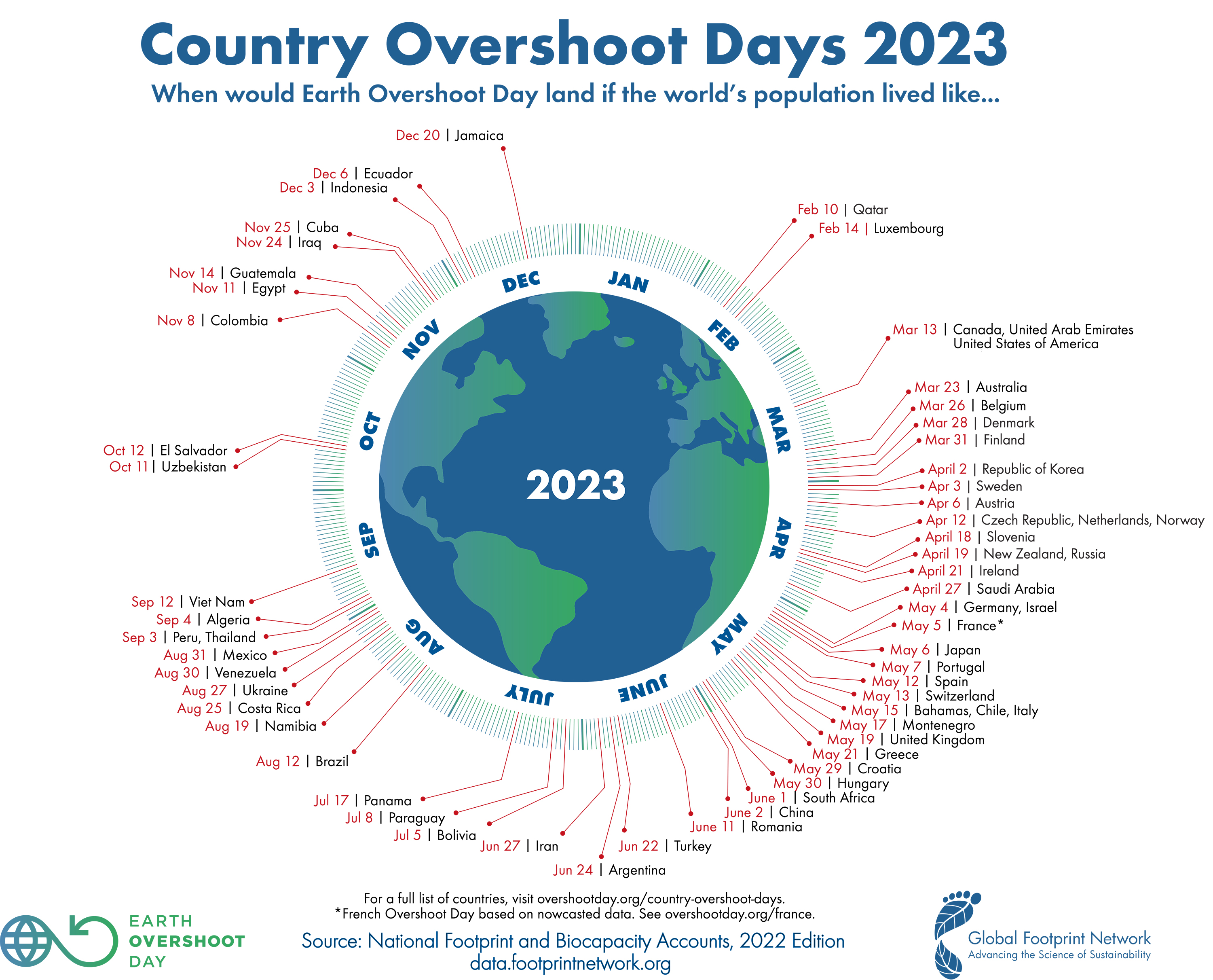

And while e-Mobility ain’t the panacea, politicians and media tries to make you believe, hydrogen and synfuels ain’t as impossible as they frequently claim either. It’s ambitious to turn our world away from cheap, endless “green” energy and the believe of endless resources. Earth Overshoot Day is bad enough, this year August 2nd. Looking at the country level I feel even more devastated (Germany was May 4th)

The Fairy Tale of Zero-Carbon

Basic physics: Movement requires energy. Anything we do requires energy. Travel from A to B, even when using a sail boat (as Greta Thunberg did to cross the Atlantic) requires Energy. And resources. As an economist, I know that anything comes at a price.

So there is no #zerocarbon. If we achieve #carbonneutral, we do very good! If we can reduce our abuse of our natural resources – beyond carbon – we do good. Our target must be to move Earth Overshoot Day to December 31st or later. Next year, in two years. Not even Kolibri will be 100% resource neutral. But if we can turn it 90-100% circular, if our energy consumption is renewable, we will have a major impact to Earth Overshoot Day.

Why Fossils are Problematic

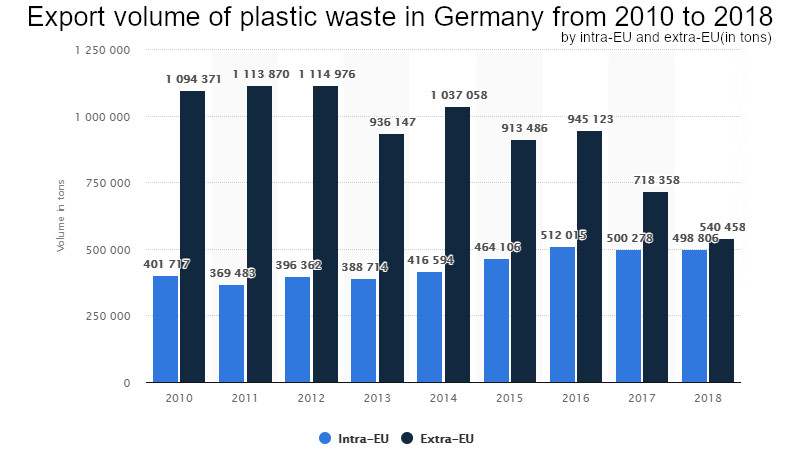

Fossils conserve climate gases. While Venus consists of very similar chemical setup, the climate gases on the planet are uncontained. In turn, temperatures there are above 400°C. If someone tells you, we can keep using conserved energy like fossils or the latest ideas using deep-sea manganese nodules, this is climate gases we add to a heavily saturated Earth atmosphere. This is, why yes, I believe we must end fossil consumption (incl. excessive use of plastics) as quickly as we can. Or reduce it to an absolute minimum. Yes, plastics have advantages, but mostly can be replaced by more sustainable solutions. And keep in mind, plastics are used and globally applied by the mighty, rich industry nations. Who’s richness being a result from securing and using cheap fossil energy.

Fossils conserve climate gases. While Venus consists of very similar chemical setup, the climate gases on the planet are uncontained. In turn, temperatures there are above 400°C. If someone tells you, we can keep using conserved energy like fossils or the latest ideas using deep-sea manganese nodules, this is climate gases we add to a heavily saturated Earth atmosphere. This is, why yes, I believe we must end fossil consumption (incl. excessive use of plastics) as quickly as we can. Or reduce it to an absolute minimum. Yes, plastics have advantages, but mostly can be replaced by more sustainable solutions. And keep in mind, plastics are used and globally applied by the mighty, rich industry nations. Who’s richness being a result from securing and using cheap fossil energy.

So mostly, this is about fighting the people who rely on cheap energy for their business models. Do I hear “digital” somewhere? 😂

So true #greeninvesting must focus on energy conservation and intelligent use of the energies we have. Personal, fossil, “renewable”. And yes, I put “renewable” into quotes… Just: #dontchooseextinction!

Holistic Approach and All-In

Another issue that keeps coming up in my discussions is that we must stop competing on sustainable solutions. This is a major, not even just an industry or generational challenge. It’s a global one. So let’s stop competing and start joining forces! Back to my example of offshore wind farms and tidal energy turbines. Why not using them side-by-side in the same sea region we anyway impact by building those humongous wind farm structures? Why not using old Oil Rigs to apply tidal energy turbines, clean them, make them an artificial island structure for sea life (also arial one)?

Another issue that keeps coming up in my discussions is that we must stop competing on sustainable solutions. This is a major, not even just an industry or generational challenge. It’s a global one. So let’s stop competing and start joining forces! Back to my example of offshore wind farms and tidal energy turbines. Why not using them side-by-side in the same sea region we anyway impact by building those humongous wind farm structures? Why not using old Oil Rigs to apply tidal energy turbines, clean them, make them an artificial island structure for sea life (also arial one)?

Live Cycle Assessment and Earth Overshoot Day

What I learned in my discussions with “green” activists up to government and U.N. levels, is that there is a lot of #wishfulthinking out there. A lot of #cognitivedissonance, reasoning to oneself that the bad-doing ain’t “that bad” or even good. And a #greenwashingindustry that uses that to protect their status quo. Not just at “all cost”, but in fact at the cost of our living and breathing environment!

What I learned in my discussions with “green” activists up to government and U.N. levels, is that there is a lot of #wishfulthinking out there. A lot of #cognitivedissonance, reasoning to oneself that the bad-doing ain’t “that bad” or even good. And a #greenwashingindustry that uses that to protect their status quo. Not just at “all cost”, but in fact at the cost of our living and breathing environment!

To identify Greenwashing quickly, I mentioned to look at energy bill. United Nations urges to look at the #lifecycleanalysis and an end to end #circulareconomy. We must stop #raisinpicking to fake green, but what is our impact to the planet. Then we talk about #realimpactinvestment. And not at another #panaceadistraction

Food for Thought!

Comments welcome

Is your job “system relevant”? If you work in home office, I can tell you the answer is No. If you work in consulting, I can very likely tell you the answer being No. Working in aviation and transport, the answer very likely is No. And if your salary is above average, the answer also very likely is No.

Is your job “system relevant”? If you work in home office, I can tell you the answer is No. If you work in consulting, I can very likely tell you the answer being No. Working in aviation and transport, the answer very likely is No. And if your salary is above average, the answer also very likely is No.

My “intern” boss (again) taught me respect for everyone. The guy on the fork-lift, the cleaners, truck drivers and “secretaries” (yeah, we still had those). He taught us to set up the coffee when it was empty and not bother the secretaries. To clean up ourselves to make the cleaners’ jobs easier. To think beyond our petty box as “office workers” and value the hard work of the real workers. Also to question, but then also embrace the value of our work. IF we added value.

My “intern” boss (again) taught me respect for everyone. The guy on the fork-lift, the cleaners, truck drivers and “secretaries” (yeah, we still had those). He taught us to set up the coffee when it was empty and not bother the secretaries. To clean up ourselves to make the cleaners’ jobs easier. To think beyond our petty box as “office workers” and value the hard work of the real workers. Also to question, but then also embrace the value of our work. IF we added value.

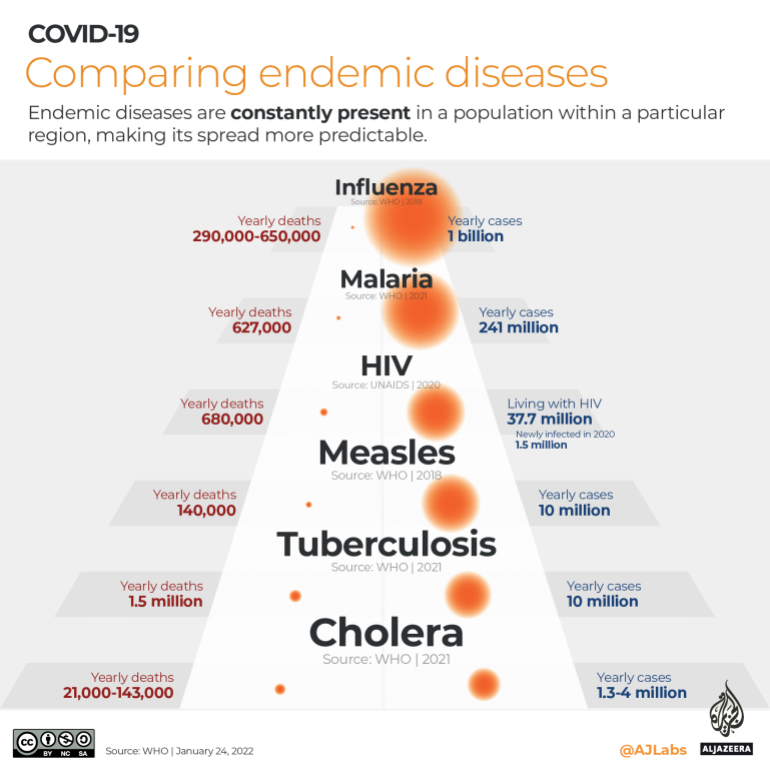

In the first year of the pandemic, in the first wave in May, I voiced my expectation already of Corona

In the first year of the pandemic, in the first wave in May, I voiced my expectation already of Corona

The next big challenge is the look across borders and out of the “industry nations”. Over and again, news about vaccines that expired in the richer nations were met by the ones of i.e. African countries being delivered expiring vaccines or even ones that were not certified in the donor countries. At the same time, vaccines like the Russian Sputnik were still not “certified”. In turn, my own mother-in-law was denied entry into Europe as she got Sputnik, to visit to take care of my kids in my absence, while Yulia (my wife) works full time too.

The next big challenge is the look across borders and out of the “industry nations”. Over and again, news about vaccines that expired in the richer nations were met by the ones of i.e. African countries being delivered expiring vaccines or even ones that were not certified in the donor countries. At the same time, vaccines like the Russian Sputnik were still not “certified”. In turn, my own mother-in-law was denied entry into Europe as she got Sputnik, to visit to take care of my kids in my absence, while Yulia (my wife) works full time too. “Principle Hope” and the Saint-Florian’s Principle dominate our industry: “Oh holy dear Saint Florian, don’t burn my house, take the neighbors one.”

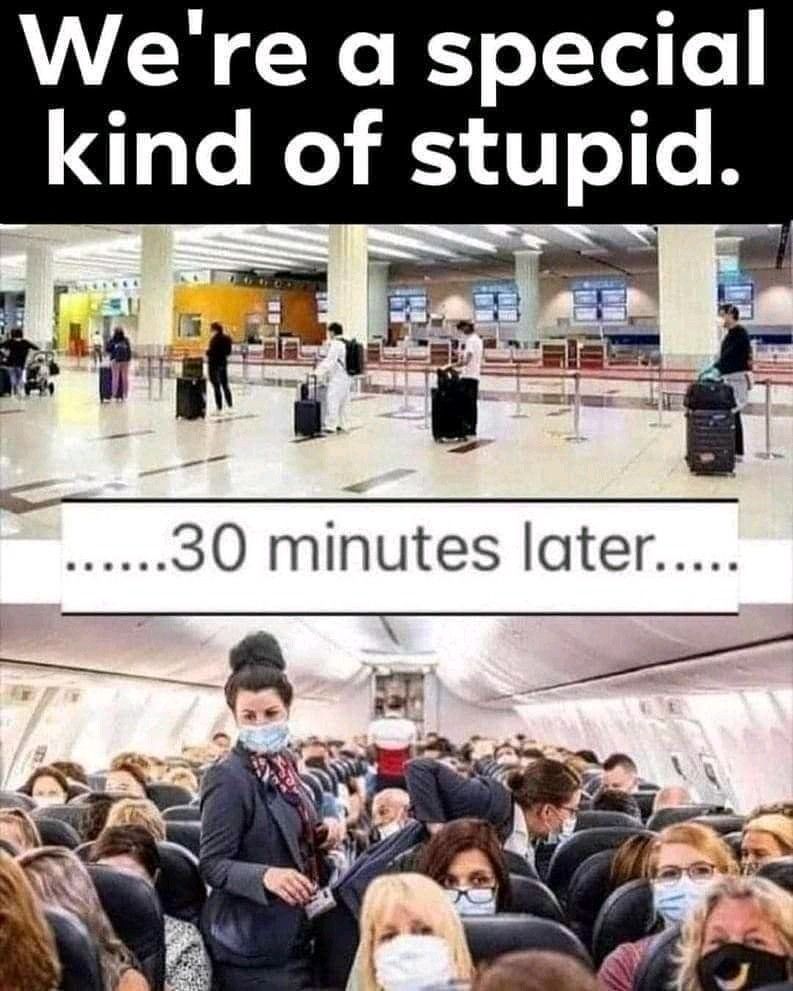

“Principle Hope” and the Saint-Florian’s Principle dominate our industry: “Oh holy dear Saint Florian, don’t burn my house, take the neighbors one.” Airports would be well advised to have processes in place to ensure #testingregime for the current and future infections., demanding and assuring the ability for pre-flight testing.

Airports would be well advised to have processes in place to ensure #testingregime for the current and future infections., demanding and assuring the ability for pre-flight testing.

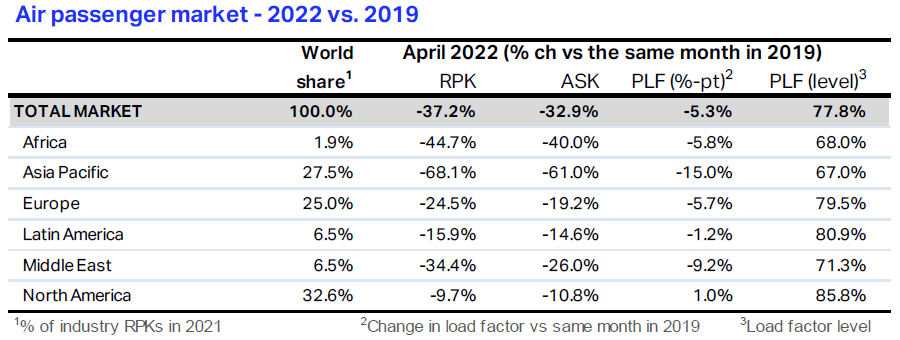

Reports I read fed hopes again about a summer recovery in Europe. A recovery now threatened by the new BA.5 variant spreading throughout Europe. And again, what is the airlines’ role in spreading those new variants so quickly across countries? And Lufthansa recently cancelled 600 flights (5%) for lack of staff. A main reason being the infection of their own. Mainly infected “at work”. What was that again about employee health protection? Naaaw, let’s not play it safe, let’s go back to old normal?

Reports I read fed hopes again about a summer recovery in Europe. A recovery now threatened by the new BA.5 variant spreading throughout Europe. And again, what is the airlines’ role in spreading those new variants so quickly across countries? And Lufthansa recently cancelled 600 flights (5%) for lack of staff. A main reason being the infection of their own. Mainly infected “at work”. What was that again about employee health protection? Naaaw, let’s not play it safe, let’s go back to old normal? Speaking to airline and airport managers, they prioritize no “new normal” which they promoted in the beginning of the pandemic. But they focus to “renormalize” back to the old normal. Which bites them in the butt over and again. Demands are to lift mask and testing requirements. In an obvious ignorance of the pandemic development. In line with political developments, but not in line with the infection rates.

Speaking to airline and airport managers, they prioritize no “new normal” which they promoted in the beginning of the pandemic. But they focus to “renormalize” back to the old normal. Which bites them in the butt over and again. Demands are to lift mask and testing requirements. In an obvious ignorance of the pandemic development. In line with political developments, but not in line with the infection rates. There can be reasons to fly an aircraft even empty.

There can be reasons to fly an aircraft even empty. Another would be to rotate the pilots to make sure they all keep their “type rating”, their license to fly the aircraft. Which also expires just too quickly. And while airlines now recognize the shortfall on pilots that they had either “laid off” (fired) and (or) didn’t support in keeping their type rating, the current feedback from pilots is that airlines still fail to have programs in place to rotate the pilots as good as they could to keep the type-ratings.

Another would be to rotate the pilots to make sure they all keep their “type rating”, their license to fly the aircraft. Which also expires just too quickly. And while airlines now recognize the shortfall on pilots that they had either “laid off” (fired) and (or) didn’t support in keeping their type rating, the current feedback from pilots is that airlines still fail to have programs in place to rotate the pilots as good as they could to keep the type-ratings.

While the aviation industry and it’s Powers-That-Be (PTBs) argue that we must delay sustainable flight in face of the crisis, I am on a complete opposite belief. We must, but we failed, to take the crisis as a chance for overdue change. Instead of investing into sustainable fuels and developments, into optimizing the airspace, our PTB try to go back to old normal. Then finding reasons to delay the change further.

While the aviation industry and it’s Powers-That-Be (PTBs) argue that we must delay sustainable flight in face of the crisis, I am on a complete opposite belief. We must, but we failed, to take the crisis as a chance for overdue change. Instead of investing into sustainable fuels and developments, into optimizing the airspace, our PTB try to go back to old normal. Then finding reasons to delay the change further.

And we talk about leveling the energy to a sustainable level. Use as much energy as you return. Like

And we talk about leveling the energy to a sustainable level. Use as much energy as you return. Like  The war in the Ukraine will impact not just long-haul travel, like the reestablishing of the polar route avoiding Russian air space. And that we can not trust in “neutral air space” we learned when Belarus took down a civil aircraft from transit with the sole reason to jail a political opponent living in exile abroad.

The war in the Ukraine will impact not just long-haul travel, like the reestablishing of the polar route avoiding Russian air space. And that we can not trust in “neutral air space” we learned when Belarus took down a civil aircraft from transit with the sole reason to jail a political opponent living in exile abroad.

Another issue that slowly reaches the public is the issue of batteries catching fire. First major reports were on the

Another issue that slowly reaches the public is the issue of batteries catching fire. First major reports were on the  Worse, recently despite their relative low numbers, electric cars are increasingly reported to catch fire. Some at first loading at a standard, approved home loading facility, others while driving. Different from gasoline, a thermal runaway and the resulting battery explosions cause a much higher real danger to the cars passengers. And it does not help to distinguish the fire, but such car must be placed into a water tank for several days to cool down the batteries. And after a fire, such cars usually are beyond any recycling. The picture just one example of the many that can be found on the Internet.

Worse, recently despite their relative low numbers, electric cars are increasingly reported to catch fire. Some at first loading at a standard, approved home loading facility, others while driving. Different from gasoline, a thermal runaway and the resulting battery explosions cause a much higher real danger to the cars passengers. And it does not help to distinguish the fire, but such car must be placed into a water tank for several days to cool down the batteries. And after a fire, such cars usually are beyond any recycling. The picture just one example of the many that can be found on the Internet. Incorrect disposal of Li-ion batteries can have a devastating environmental impact on the environment, sparking the need for recycling (

Incorrect disposal of Li-ion batteries can have a devastating environmental impact on the environment, sparking the need for recycling (

German Automotive Club ADAC just recently reported the average range of electric cars being about 350 km (220 miles), up from 250 km (150 miles) five years ago. Thinking about my role as an airline sales manager some years ago, for a road trip, I traveled frequently more than 500 km a day. Then I shall load the car after a half day, sitting around while waiting? Keep in mind, that corporate fleets and rental cars are the main buyers of new cars! And they don’t buy them because they park them most of the time…?

German Automotive Club ADAC just recently reported the average range of electric cars being about 350 km (220 miles), up from 250 km (150 miles) five years ago. Thinking about my role as an airline sales manager some years ago, for a road trip, I traveled frequently more than 500 km a day. Then I shall load the car after a half day, sitting around while waiting? Keep in mind, that corporate fleets and rental cars are the main buyers of new cars! And they don’t buy them because they park them most of the time…? As I mentioned in my post about

As I mentioned in my post about  Ready Player One? I love SciFi. There’s a lot really good ideas how we could merge individual transportation needs with “public” transportation. But that’s SciFi. We need to take the best ideas and evolve our transportation to sustainable ways in the real world. We must reduce energy. Integrate transport modes. Why does it remind me of the question why the big train stations are not at the airports? The “new” Berlin Airport being a perfectly bad example on this!

Ready Player One? I love SciFi. There’s a lot really good ideas how we could merge individual transportation needs with “public” transportation. But that’s SciFi. We need to take the best ideas and evolve our transportation to sustainable ways in the real world. We must reduce energy. Integrate transport modes. Why does it remind me of the question why the big train stations are not at the airports? The “new” Berlin Airport being a perfectly bad example on this!

At the Unconference of the

At the Unconference of the  So IPCC leaked that

So IPCC leaked that

Talk- the-Talk or Walk-the-Walk?

Talk- the-Talk or Walk-the-Walk? What about the cargo fleets on the oceans, rivers, in the air and on the road? If ESG doesn’t have a way to set targets and adjust to plans, what is it really good for? Are “data centers” and “digital” part of the solution? Or more part of the problem? Don’t get me wrong, there are good IT projects that will make impact. But most are just more

What about the cargo fleets on the oceans, rivers, in the air and on the road? If ESG doesn’t have a way to set targets and adjust to plans, what is it really good for? Are “data centers” and “digital” part of the solution? Or more part of the problem? Don’t get me wrong, there are good IT projects that will make impact. But most are just more

I also reached out to my now

I also reached out to my now  There is a

There is a

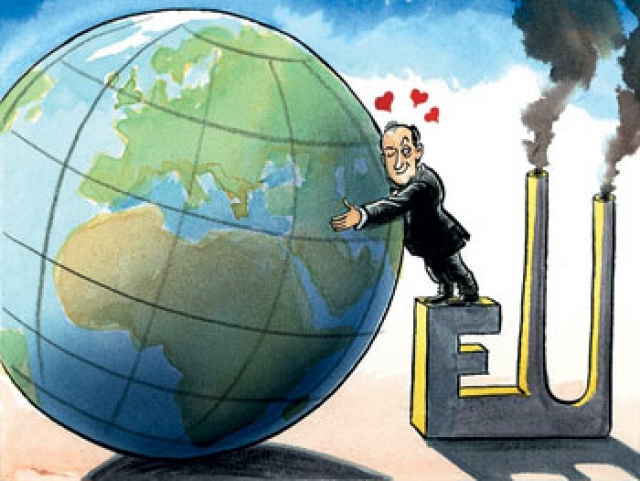

While we talk with impact investors, we do also understand the European Central and the European Investment Bank claiming to be “Sustainability Banks”. Talking with the very same investors being “naturally” and clearly interested in sustainable projects, we asked why they would not make use of those funds to complement an investment into Kolibri or other impact investments.

While we talk with impact investors, we do also understand the European Central and the European Investment Bank claiming to be “Sustainability Banks”. Talking with the very same investors being “naturally” and clearly interested in sustainable projects, we asked why they would not make use of those funds to complement an investment into Kolibri or other impact investments.

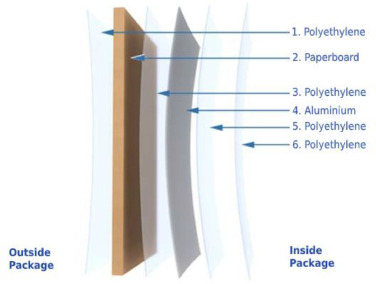

At the same time, the plastics industry is booming. And instead of developing sustainable packaging, the trend is clearly towards mixed-use, the known bad example being “Tetra Pak®“; a packaging made of several layers that make it exceptionally

At the same time, the plastics industry is booming. And instead of developing sustainable packaging, the trend is clearly towards mixed-use, the known bad example being “Tetra Pak®“; a packaging made of several layers that make it exceptionally  Now, how about “my industry”, how about aviation? And why is it constantly the scapegoat and blamed for global warming?

Now, how about “my industry”, how about aviation? And why is it constantly the scapegoat and blamed for global warming? Speaking with one of those “challengers”, he argued that in 10 years the first regional aircraft will fly on fuel-cells. Being “project planning”, I’d say better add 50% reserve to that, then we talk about 15 years. And personally I still doubt that time line. And then we will have aircraft with 10, 20 or maybe 30 seats. With a range of one to two hours. When we will have aircraft that transports 100 seat? Or ones that can replace the 150-250 seats used by the low cost airlines? When do we expect aircraft to transport 250-350 passengers long haul? Hiding behind “Research”? Science Fiction…

Speaking with one of those “challengers”, he argued that in 10 years the first regional aircraft will fly on fuel-cells. Being “project planning”, I’d say better add 50% reserve to that, then we talk about 15 years. And personally I still doubt that time line. And then we will have aircraft with 10, 20 or maybe 30 seats. With a range of one to two hours. When we will have aircraft that transports 100 seat? Or ones that can replace the 150-250 seats used by the low cost airlines? When do we expect aircraft to transport 250-350 passengers long haul? Hiding behind “Research”? Science Fiction… Sustainable economy and global warming are big issues today, but most that we see is lip services. An investor group just recently checked impact investments for the “real” impact. They reported about 4% of all investments having a quantifiable impact or quantifiable targets. Only 4%. All others to be #greenwashing. On the “impact programs” of the 100 largest companies in Europe they found not a single one having more than one or two percent impact to global warming. Most of them being “lighthouse projects” that are being developed inside a “bubble” that does not immediately impact the company. Mostly lip-services addressing already established programs, but don’t really change the existing processes.

Sustainable economy and global warming are big issues today, but most that we see is lip services. An investor group just recently checked impact investments for the “real” impact. They reported about 4% of all investments having a quantifiable impact or quantifiable targets. Only 4%. All others to be #greenwashing. On the “impact programs” of the 100 largest companies in Europe they found not a single one having more than one or two percent impact to global warming. Most of them being “lighthouse projects” that are being developed inside a “bubble” that does not immediately impact the company. Mostly lip-services addressing already established programs, but don’t really change the existing processes. “But how about electric flying?” you might ask? Yes, how about it? In December 2013, a battery on a Boeing 787 Dreamliner caught fire. It was later attributed to a “design flaw”. Yes, Boeing had quite some trouble even before the MAX-disaster.

“But how about electric flying?” you might ask? Yes, how about it? In December 2013, a battery on a Boeing 787 Dreamliner caught fire. It was later attributed to a “design flaw”. Yes, Boeing had quite some trouble even before the MAX-disaster. But I also learned the downsides of Hydrogen, disabling it for large aircraft. Say what? Didn’t Airbus not just promote their vision of

But I also learned the downsides of Hydrogen, disabling it for large aircraft. Say what? Didn’t Airbus not just promote their vision of  There is a very strong force of inertia in aviation about turning “green”. Like other problems in aviation management, such as their disbelieve in branding, the resulting focus on “cheap” as the sole difference and a missing loyalty for partners and employees alike. that, plus missing USPs made airlines a running gag about ROI. But as in all other industries, you cannot expect change and disruptions with blind managers. You need vision.

There is a very strong force of inertia in aviation about turning “green”. Like other problems in aviation management, such as their disbelieve in branding, the resulting focus on “cheap” as the sole difference and a missing loyalty for partners and employees alike. that, plus missing USPs made airlines a running gag about ROI. But as in all other industries, you cannot expect change and disruptions with blind managers. You need vision. There is a lot of buzz ongoing about Impact Investment in IT and AI. Whereas I just wrote about

There is a lot of buzz ongoing about Impact Investment in IT and AI. Whereas I just wrote about

On the other side – and back to the topic of my previous article,

On the other side – and back to the topic of my previous article,  A German investor this week told me: “There is too little change in what you’re doing.” That investor referred to either air taxi or hyperloop. Whereas I’ve often enough expressed my concerns about air traffic control taking individual mobility into the third dimension and into potential conflict with commercial (and military) aviation. Just thinking about the increasing drone-warnings disrupting airport operations the past year. That is a very long way to go.

A German investor this week told me: “There is too little change in what you’re doing.” That investor referred to either air taxi or hyperloop. Whereas I’ve often enough expressed my concerns about air traffic control taking individual mobility into the third dimension and into potential conflict with commercial (and military) aviation. Just thinking about the increasing drone-warnings disrupting airport operations the past year. That is a very long way to go. Global CO2 emissions dropped by 7%, with 11% in Europe due to Corona. Especially aviation reduced due to the lockdown by 22% global, some regions by 30%. But those are expected to come back quickly (

Global CO2 emissions dropped by 7%, with 11% in Europe due to Corona. Especially aviation reduced due to the lockdown by 22% global, some regions by 30%. But those are expected to come back quickly ( There are exceptionally good examples recently, like

There are exceptionally good examples recently, like  Though also notable, there is a bad misinterpretation that impact investment would mean low ROI. I think our business concept for Kolibri is looking at very competitive ROI at a residual risk below other investments. But it is so much easier to accuse impact investment to justify one owns look the other direction, right?

Though also notable, there is a bad misinterpretation that impact investment would mean low ROI. I think our business concept for Kolibri is looking at very competitive ROI at a residual risk below other investments. But it is so much easier to accuse impact investment to justify one owns look the other direction, right? The “typical” aviation investment is aircraft funds. Whereas KPMG valued them at an average 4% return in 2019, look at all those assets now. Liabilities in most cases, because they had and have no USP. And even back in 2019, the big aircraft lessors being well established with the airlines made good returns, but many funds also underperformed or failed completely.

The “typical” aviation investment is aircraft funds. Whereas KPMG valued them at an average 4% return in 2019, look at all those assets now. Liabilities in most cases, because they had and have no USP. And even back in 2019, the big aircraft lessors being well established with the airlines made good returns, but many funds also underperformed or failed completely.