Since the beginning of flying, aviation learns (often too late) from mistakes. There are some questions rising from the recent debacles at Haneda Airport of an Airbus A350-900 crashing into a Coast Guard aircraft and the Boeing 737-Max9 loosing a dummy door in-flight, that I find noteworthy to share. I will not mention the airlines, considering them victims.

Neither will pour blame over Boeing only again, at Haneda it was an Airbus raising questions. In my humble opinion, think the entire industry has an issue relating to “safety first” recently. And I am afraid, the “commercial focus” on the cost of safety hasn’t ended with the Boeing 737Max debacle with an amok running flight system driving two fully loaded aircraft into the ground just before the Pandemic.

Haneda (Airbus)

An Airbus A350-900 aircraft crashed into a small Japan Coast Guard Dash-8 aircraft at Tokyo Haneda airport, killing all people aboard the Dash-8. No fatalities aboard the Airbus A350-900. Which in hindsight is a miracle to many experts I heard talking the last days.

An Airbus A350-900 aircraft crashed into a small Japan Coast Guard Dash-8 aircraft at Tokyo Haneda airport, killing all people aboard the Dash-8. No fatalities aboard the Airbus A350-900. Which in hindsight is a miracle to many experts I heard talking the last days.

- Airbus Fire Sensors

“After the aircraft came to a stop the cockpit crew was not aware of any fire, however, flight attendants reported fire from the aircraft. The purser went to the cockpit and reported the fire and received instruction to evacuate. Evacuation thus began with the two front exits (left and right) closest to the cockpit. Of the other 6 emergency exits 5 were already in fire, only the left aft exit was still usable. The Intercom malfunctioned, communication from the aft aircraft with the cockpit was thus impossible. As result the aft flight attendants gave up receiving instructions from the cockpit and opened the emergency exit on their own initiative” (Source). Later information says there was a several minutes of delay because of missing or misinformation between cockpit and cabin. So why was the communication malfunctioning in that situation? Why were the pilots unaware? Even Haneda Tower should have informed them instantly of that danger! Why haven’t they? And … and why does the crew have to get approval from the flight deck to evacuate when the aircraft is burst into flames and mortal danger imminent? - Airbus Evac Procedures

Good thing first: The captain [reported only later] was the last one to leave the aircraft. 18 minutes after the aircraft came to a stop. (Source). Wait a minute … 18 Minutes??

Given he aircraft burned out and was on fire rather instantly after the collision, what the heck have those passengers been thinking or doing? I’ve seen my first flight attendant training back in 1989, the emergency training a major part of the training courses. The shouts, day and night in the training center echoing in my ears: “Move it, move it. Get out of my way!”. But 18 minutes? Especially with the issue of 5 out of 8 emergency exits blocked by fire when the purser went to the cockpit to get evac approval?! I believe both Boeing and the airline must have to review the procedures urgently.

Side note. I find it rather telling that there is a lot, a big lot of footage (images, video) of the A350-900, but virtually none of the smaller Dash-8 suffering all the fatalities. At least, I didn’t see or find any? A nice example of “biased news reporting”?

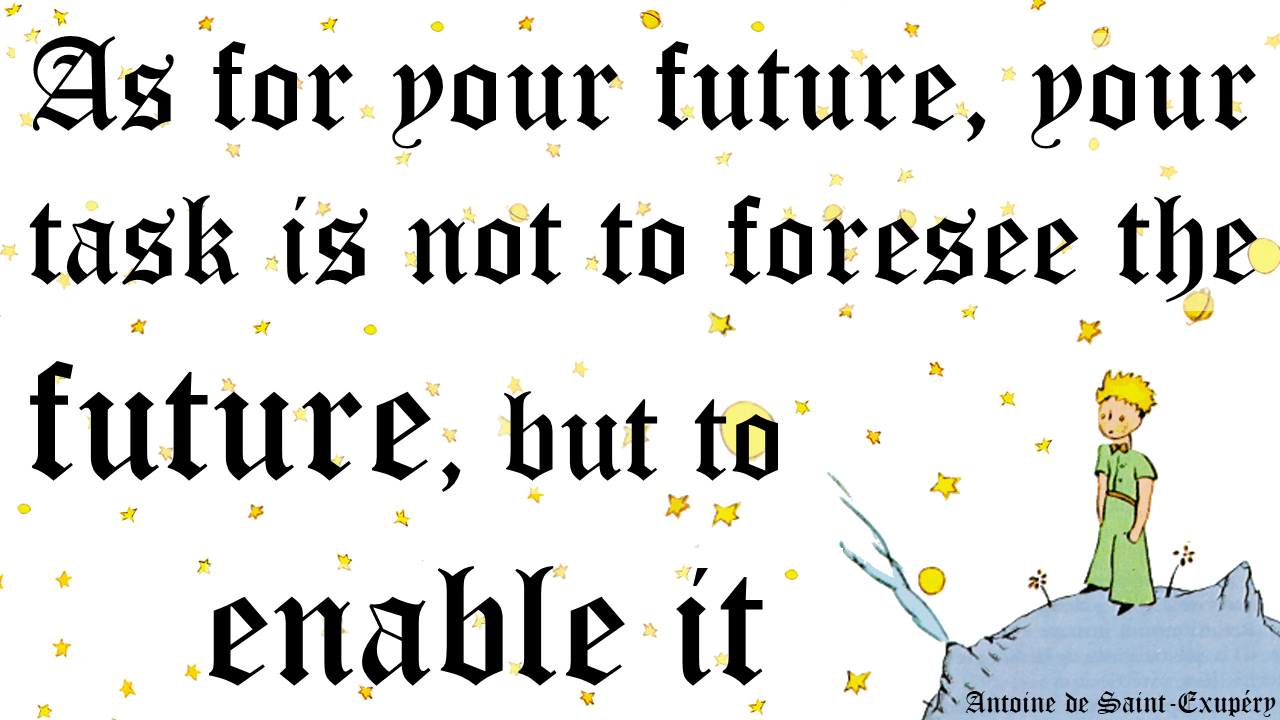

Portland (Boeing)

Above Portland, Oregon (USA), a Boeing 737-Max9 lost a “door plug” in-flight, by sheer luck, not causing any fatality. That this can end far more tragic is burned into my mind, remembering the Aloha Airlines 737 loosing its entire roof shortly after I’ve been there and flying Aloha. A flight attendant being ejected by the decompression. And given the picture, it makes one wonder on the miracle the entire aircraft didn’t break up. One of the many “near-misses” in my life to date. (Wikipedia)

Above Portland, Oregon (USA), a Boeing 737-Max9 lost a “door plug” in-flight, by sheer luck, not causing any fatality. That this can end far more tragic is burned into my mind, remembering the Aloha Airlines 737 loosing its entire roof shortly after I’ve been there and flying Aloha. A flight attendant being ejected by the decompression. And given the picture, it makes one wonder on the miracle the entire aircraft didn’t break up. One of the many “near-misses” in my life to date. (Wikipedia)

Following the two fatal disasters of 2018+2019 forcing the lengthy grounding and near-bankruptcy of Boeing, the new accident now “naturally” raises the question about the quality of Boeing engineering. In my humble opinion, it does raise the question especially about their constant claim of “Safety First”! With subject matter experts claiming loose screws having caused the door to come apart. What was that about four-eye principle on aircraft construction and all major maintenance?

The door was later found in a teacher’s back yard in Portland Oregon. Just like a phone from the aircraft, the pieces “sailed down”, aerodynamically similar to a Frisbee and landed almost unharmed.

Added 08Feb24: According to preliminary media reporting, there were bolts not just not fastened but missing. Say what??

Is the 737 MAX safe?

Fact: I will neither voluntarily fly, nor allow my immediate family to fly a 737 Max anytime soon. In my humble opinion (IMHO), that aircraft has been misconstructed from the outset and should be shelved for good. It only flies and is approved IMHO for commercial reasons; if it’d be grounded for good, the losses for Boeing can very well proof fatal. To me, it seems the door plug again was a “quick and dirty” solution. On the other end, I won’t “actively” avoid the aircraft, flying was and remains the most secure transport in the world. Just that any incident instantly receives scrutinous media coverage. But yes, booking flights, I usually happen to look at details – and given the choice, avoiding the MAX will be a clear decision making factor for me.

The new incident brings up feedback that I got during the 2019 grounding media uproar. Questions why the “better” Boeing 757 was shelved. It didn’t have the low profile causing engineering complications as there wasn’t enough space under the 737’s wing. Which led to the fatal idea of MCAS, later being the cause for the two fatal crashes killing 346 people. And commercial reasons leading not only to base that on a single sensor (instead of the originally planned three), false readings causing the misinformation of MCAS causing the crashes. But also to the secret implementation not shared with the pilots to avoid potential demand for an “expensive” full type-rating as a new aircraft.

Conclusions

Flight Safety is back to “reactive”. But aircraft engineering must be proactively focused on flight safety! As must be processes, just like the evacuation of aircraft under grim circumstances! Ever since the beginning of flight safety with the Comet-disasters back in the 1950s, aviation “reacted” to disasters. A lesson we also learned with aircraft deicing.

I truly believe that flight safety ain’t a luxury. Just like “service” or “sustainability” being only identified as “cost factors” by finance-focused aviation managers. The recent “cases” are just more examples where things went awry and off track. There are enough cases, not just old, but rather recent, when airlines in distress started to save on the aircraft safety and maintenance. Usually reducing it to the rule-book, “encouraging” their maintenance staff to “look the other way” and to delay parts replacement in questionable situations. Or to have supervisors “sign off” as the additional pair of eyes but in fact reducing it to a single pair of eyes on the job! To safe cost.

Boeing engineers are well advised to return to spend a few more screws and bolts on securing a door plug and to demand four-eye-principle on their construction.

Airbus better finds out, what too so long to evacuate the aircraft.

All else is to be looked at when the incident reports come out. And media is well advised to not just jump the incident, but also report on the final findings. Not 1:1 copying the press release, but questioning them. I think that would be good for (shareholder-value-focused) “managers” to not stray from “Safety First”. As in the end, it’s a trust thing.

Food for Thought

Comments welcome…

OAG summarized on the

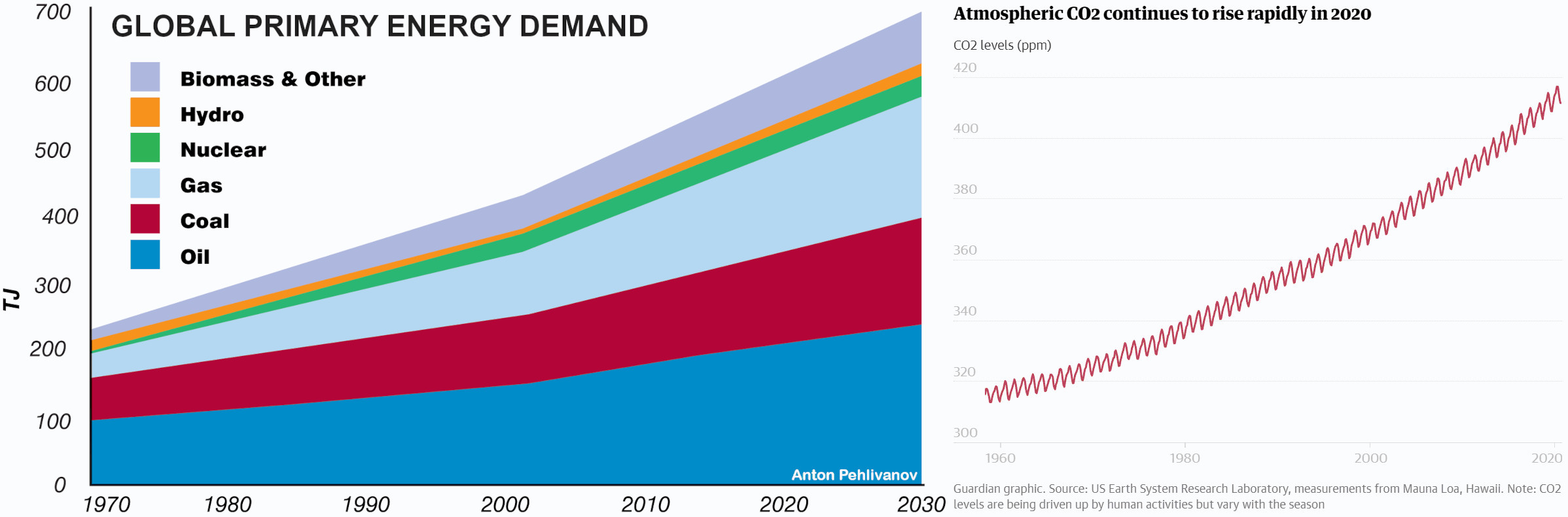

OAG summarized on the  To claim “aviation” is a loss making business is true and can’t be further from the truth.

To claim “aviation” is a loss making business is true and can’t be further from the truth. This is one reason, I do not believe we can make

This is one reason, I do not believe we can make  To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

Is your job “system relevant”? If you work in home office, I can tell you the answer is No. If you work in consulting, I can very likely tell you the answer being No. Working in aviation and transport, the answer very likely is No. And if your salary is above average, the answer also very likely is No.

Is your job “system relevant”? If you work in home office, I can tell you the answer is No. If you work in consulting, I can very likely tell you the answer being No. Working in aviation and transport, the answer very likely is No. And if your salary is above average, the answer also very likely is No.

My “intern” boss (again) taught me respect for everyone. The guy on the fork-lift, the cleaners, truck drivers and “secretaries” (yeah, we still had those). He taught us to set up the coffee when it was empty and not bother the secretaries. To clean up ourselves to make the cleaners’ jobs easier. To think beyond our petty box as “office workers” and value the hard work of the real workers. Also to question, but then also embrace the value of our work. IF we added value.

My “intern” boss (again) taught me respect for everyone. The guy on the fork-lift, the cleaners, truck drivers and “secretaries” (yeah, we still had those). He taught us to set up the coffee when it was empty and not bother the secretaries. To clean up ourselves to make the cleaners’ jobs easier. To think beyond our petty box as “office workers” and value the hard work of the real workers. Also to question, but then also embrace the value of our work. IF we added value. I recently attended a multi-week project by United Nations Climate Action on Circular Economy. And the need for lifecycle-assessment. But it was also mostly #talkthetalk and academic ideas. And I had several objectives that then led to my image about the panacea distraction.

I recently attended a multi-week project by United Nations Climate Action on Circular Economy. And the need for lifecycle-assessment. But it was also mostly #talkthetalk and academic ideas. And I had several objectives that then led to my image about the panacea distraction.![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

![Man in the Mirror [Michael Jackson]](https://foodforthought.barthel.eu/wp-content/uploads/2020/04/Man-in-the-Mirror-Michael-Jackson.jpg)

1971 (yes, 40 years ago and as a kid) I became a fan of Roger Leloup, spending my pocket money on comics. And when Hyperloop became a buzz, I couldn’t help it to remember Leloup’s Vinean transport system.

1971 (yes, 40 years ago and as a kid) I became a fan of Roger Leloup, spending my pocket money on comics. And when Hyperloop became a buzz, I couldn’t help it to remember Leloup’s Vinean transport system. And the buzz-topic A.I.? Aside the fact that all A.I. I learn of still is just I.A. – more or mostly less sophisticated

And the buzz-topic A.I.? Aside the fact that all A.I. I learn of still is just I.A. – more or mostly less sophisticated  To make a real change, you need a team of entrepreneurs thinking outside the box. Way outside the box. But with an experience on pioneering work, overcoming the

To make a real change, you need a team of entrepreneurs thinking outside the box. Way outside the box. But with an experience on pioneering work, overcoming the

I also reached out to my now

I also reached out to my now  There is a

There is a

Is it really “new thinking”? Last December, pre-Corona, I outlined

Is it really “new thinking”? Last December, pre-Corona, I outlined

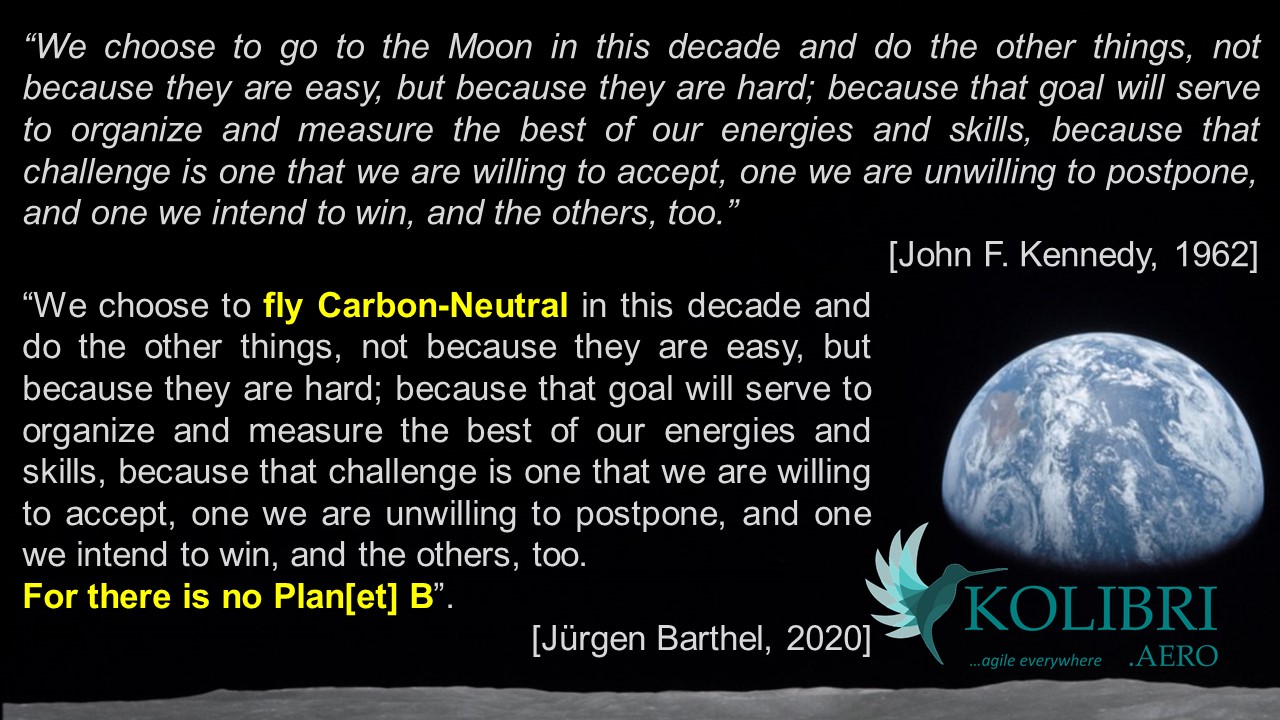

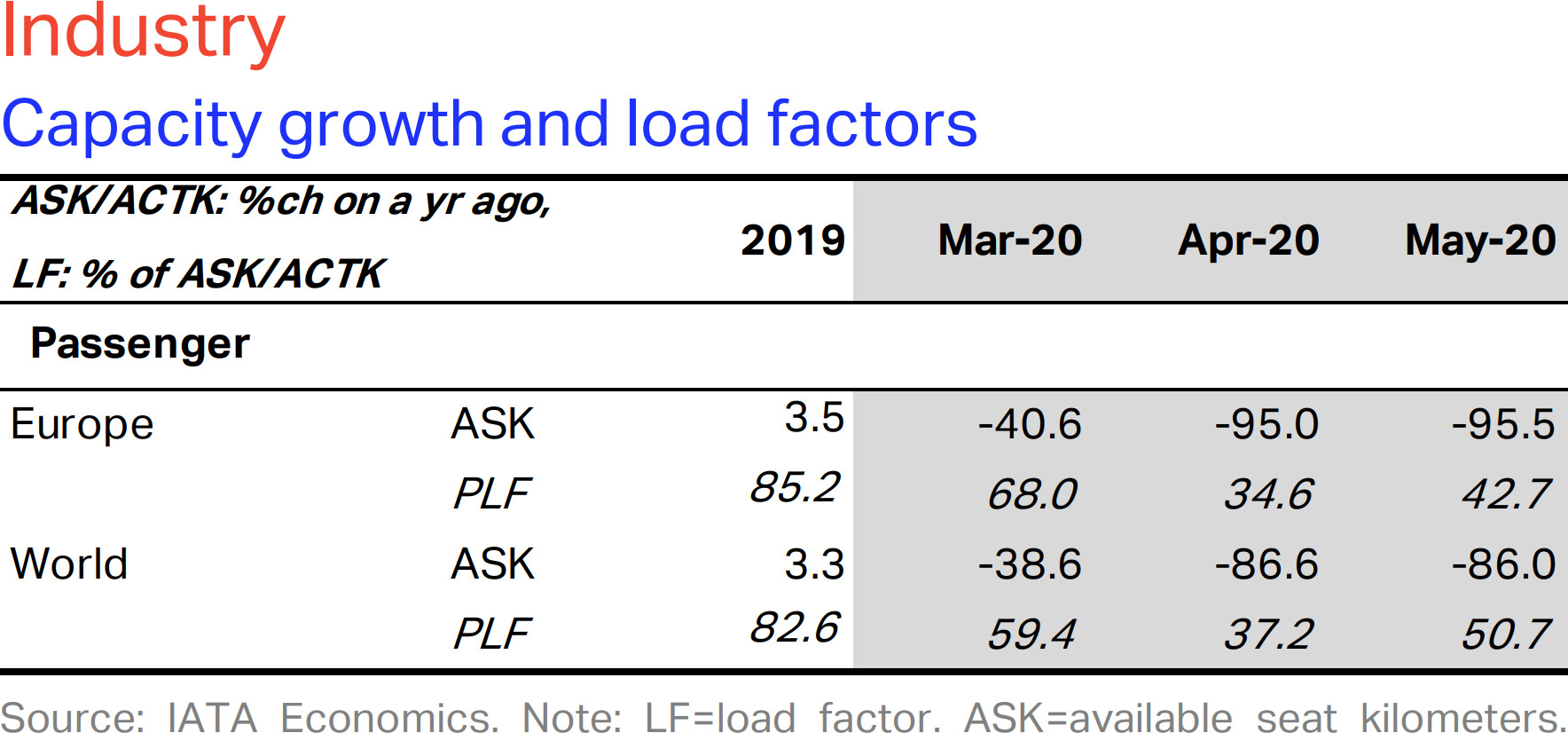

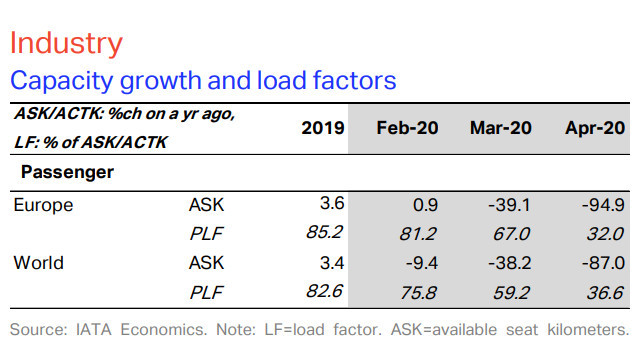

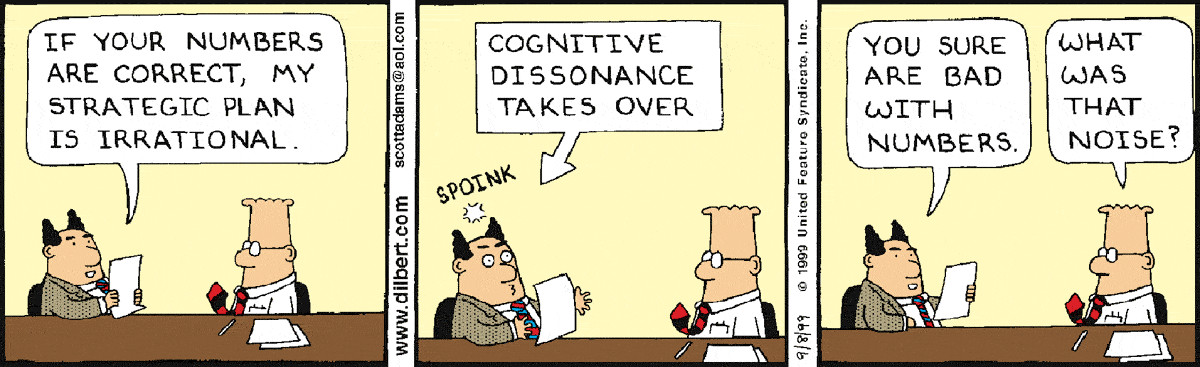

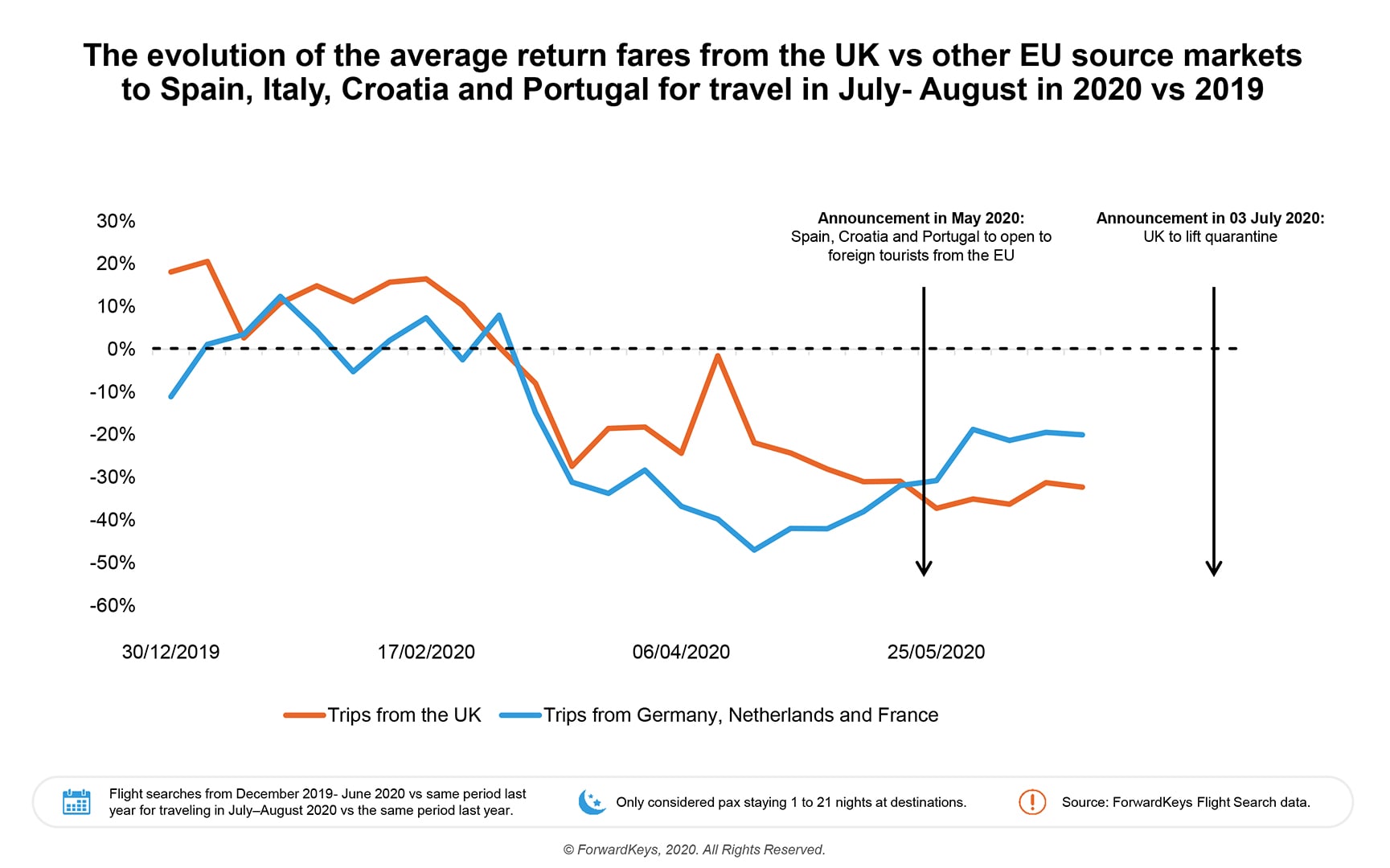

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Yes, as you can see in the archive of my

Yes, as you can see in the archive of my  I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely.

I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely.!["We are Listening. And We're Not Blind. This is Your Life. This is Your Time!" [Snow Patrol - Calling in the Dark]](https://foodforthought.barthel.eu/wp-content/uploads/2020/01/CallingintheDark.jpg)