Recently, I attended the ISHKA conference Investing in Aviation Finance: Germany in Munich where one session addressed Why are airline bankruptcies still happening in a booming environment?

There are some, very few, very common reasons. And auditing airline business plans, start-ups and established, I keep raising the same questions.

What’s Your Business?

Back in the 90’s, I became the honorary member of the Airline Sales Representatives Association in Frankfurt. Aside the narrow-minded thinking of sales managers denying to understand that the emerging Internet was about sales channels, it kept and keeps bugging me, that they focused on their “sales channels”, denying responsibility for the new channels, as they had to be handled “by others”. In the beginning and to date, many if not most airlines have no personal e-Mail-contacts for their customers, be it travelers, travel agencies or online portals. The same applies to their smartphone numbers.

Back in the 90’s, I became the honorary member of the Airline Sales Representatives Association in Frankfurt. Aside the narrow-minded thinking of sales managers denying to understand that the emerging Internet was about sales channels, it kept and keeps bugging me, that they focused on their “sales channels”, denying responsibility for the new channels, as they had to be handled “by others”. In the beginning and to date, many if not most airlines have no personal e-Mail-contacts for their customers, be it travelers, travel agencies or online portals. The same applies to their smartphone numbers.

My former boss Louis Arnitz used a historic lesson to explain the change we faced converting FAO Travel, a “classic” business travel agency into i:FAO, the first European business travel portal. In the 19th century, rail companies built the railroads of America. Replacing the Pony Express. Then came those crazy flyers, “aviators”, in their small machines transporting mail. To date rail and air travel are not “connected” (very few exceptions). Because the managers understood the building of steel railroads as their business. Not the transport of people. And they still focus on the wrong priorities. Airline and Rail managers alike.

11 years ago, I wrote about the revival of the sales manager.

Know Your Cost

Speaking about Sales Managers ignorance to the cost of their airline’s operation, I found the fish stinks from the head first being a true proverb. I’ve met too many investors, airline managers, airport managers, not understanding the cost involved. Then they try to compete on the price with the large, established airlines. I have no idea, what those managers learned, I heavily doubt the quality of university education…

Speaking about Sales Managers ignorance to the cost of their airline’s operation, I found the fish stinks from the head first being a true proverb. I’ve met too many investors, airline managers, airport managers, not understanding the cost involved. Then they try to compete on the price with the large, established airlines. I have no idea, what those managers learned, I heavily doubt the quality of university education…

The recent failure of Ernest is a “classic”. They take little money, rent Boeing 737 or Airbus A320 family airplanes, in case of Ernest 1 A319 and 3 A320. Then they buy software licenses (COTS, Commercial Off The Shelf). They buy ground handling and maintenance. Something I learned studying Whole Sale & Foreign Economics 35 years ago: If you outsource, it is either more expensive or you they safe from the service levels they provide.

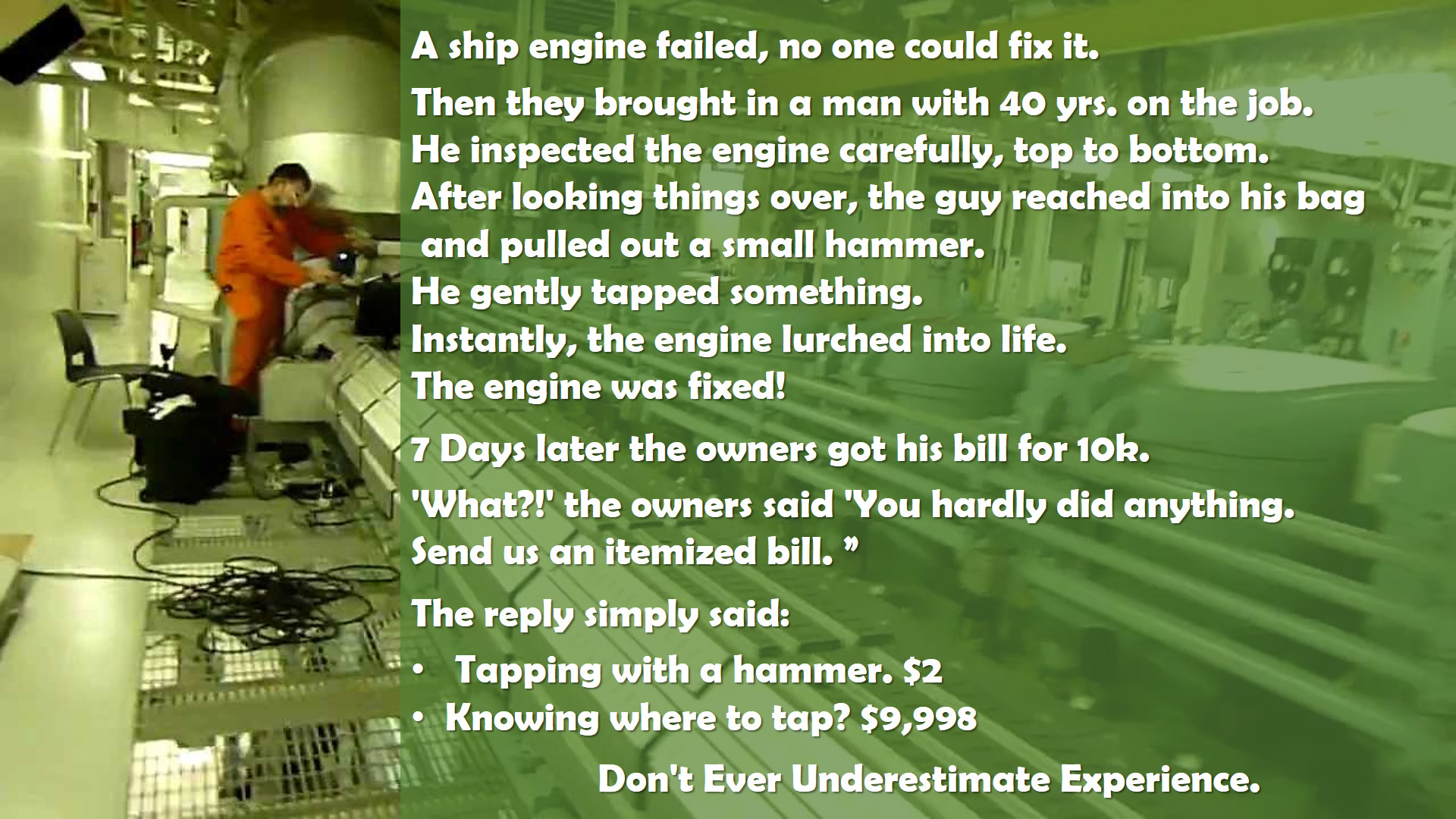

Something I keep telling about consulting. If you need someone with special knowledge for a short time, you “outsource”, you hire a consultant to do the job. If you need something long-term, you hire a consultant to develop the know-how within your company. Again, the job for the consultant is short term.

In both cases you pay for the experience.

Airline managers that do not understand their real CASK, their Cost per Available Seat Kilometer (or mile as CASM), are not doing their job! Airline managers that fire good people because they are “too expensive”, airline managers that save on “service”, don’t understand reputation and brand as important are being doomed from the outset.

So these airline startups come and believe that with some 10 million Euro, leasing the same (but usually older) aircraft, pay for outsourced maintenance, IT, ground handling, etc., etc. They truly believe they can “succeed” in the shark pond where an easyJet owns 70-80% of their fleet. Only some 20-25% being still paid off (until they own them), less than 3% being leased to cover for ad hoc demand. Where they run their own maintenance operation, their own ground handlers where they can. Then they have established processes and understanding of the cost of disruptions and delays – and cover them with an own fleet of spare aircraft. Do those small airline operators have any spare aircraft on hand when their aircraft fails them?

From Cobalt, Germany, Primera (alphabetical order), feedback said “disruption cost”, attributed i.e. to EU261 “passenger rights” to having been a major reason for their financial troubles. Still, most business plans, I was asked to have a look at last year failed to address that issue at all. Or they used “easyJet figures”, neglecting the fact that easyJet has a spare fleet to cover and minimize the effects of flight disruptions.

From Cobalt, Germany, Primera (alphabetical order), feedback said “disruption cost”, attributed i.e. to EU261 “passenger rights” to having been a major reason for their financial troubles. Still, most business plans, I was asked to have a look at last year failed to address that issue at all. Or they used “easyJet figures”, neglecting the fact that easyJet has a spare fleet to cover and minimize the effects of flight disruptions.

Even large airlines’ network managers keep ignoring those cost factors and then get surprised when a route fails. Others go to considerable lengths to understand the typical delays they incur on specific routes. Caused by the ground handler, the departure and/or arrival airport, taxi times, the air traffic control – or simply common weather issues like fog in Stuttgart.

So taking all those common and neglected factors into account: What’s your cost? CASK is one value for the entire company – do you understand the performance on the specific route or airport? Why is it often the same airports “failing”? Maybe they shouldn’t be overly optimistic but be more realistic? And yes, that is the same airports believing if they reduce the landing fee, it would have some decision making impact on the airlines’ cost. It’s that level of non-understanding that causes constant and ongoing failures – not just for newcomers or small airlines.

What’s Your USP

Shortly prior their demise, a board member of Cobalt answered my question about their USP: “We’re Cypriot.”

Say what? Competing against easyJet and other low cost and classic network carriers, that is all there is for a USP?

His second answer about USP was “We’re cheaper.”

Okay. You operate 2 A319 and 4 A320. easyJet operates what, more than 330 A320 family aircraft. You think you’re “cheaper”? Really?

Another airline answered my same standard question with: We fly different routes.

Well… Hard to not be nasty. They just wonder that on their most successful routes, the other, bigger carriers kick their butts and take over those routes.

Carolin McCall understood “service” to be a difference maker. Since her leave, very quickly they dropped from my “role model” and preferred airline to “me too”. Taking over aircraft from Air Berlin with additional and “bulkier” seats, I suddenly experienced less leg space. Their airport manager at one of their hubs found himself quickly “obsolete”, the new paradigm being “cost savings”. In turn they seized my (half-sized) cabin bag due to “full overheads”. Aside the seat next to me being empty, there was more than enough space below the seat. Heard meanwhile from many frequent flyers they no longer wait if they have an aisle seat but make sure they have their seat and the cabin baggage with them. Would be indeed interesting to have some statistics how that impacts boarding time.

Carolin McCall understood “service” to be a difference maker. Since her leave, very quickly they dropped from my “role model” and preferred airline to “me too”. Taking over aircraft from Air Berlin with additional and “bulkier” seats, I suddenly experienced less leg space. Their airport manager at one of their hubs found himself quickly “obsolete”, the new paradigm being “cost savings”. In turn they seized my (half-sized) cabin bag due to “full overheads”. Aside the seat next to me being empty, there was more than enough space below the seat. Heard meanwhile from many frequent flyers they no longer wait if they have an aisle seat but make sure they have their seat and the cabin baggage with them. Would be indeed interesting to have some statistics how that impacts boarding time.

So what’s your USP? Price? Okay Mr. O’Leary… But what’s an LCC? Ryanair flies into the big airports recently. That’s another story I plan to address in the new year. So again, what’s your USP? How can you secure that people buy your product, that it’s not simply exchangeable with some cheaper airline? Back 35+ years, my boss in whole sale told me: “There’s always someone cheaper.” And several years later, the boss of “low cost airline” Continental Gordon Bethune said:

Interesting enough, in my recent qualification in Online Marketing, P.R., I learned the same values being valid in the online world. Nothing new. What’s your USP? Know your Strengths, Weaknesses, Oportunities and Threats – internally and externally and build your business case. Then you come to your own USPs. And you will likely not invest into some airlines with a few aircraft. Or into aircraft owners with a few A320 or B737 aircraft they try to place in a sated market. If you’re an investor (or know such), send them over to Kolibri.aero ツ

The Virtual Airline

As mentioned above and before and again. I usually don’t believe in the survival of virtual airlines. A few leased aircraft of the same kind than their competitors, outsourced IT, ground handling, maintenance and other “services”, often even the call and service center (to “GSAs”). Then they believe to be competitive to the large players. If you operate in an un- or under-served market, you may be able to ask for the higher ticket prices required by your increased cost levels. Most airlines I see trying to take off or change their business to survive try to compete to the large network and low cost carriers, but without a secure market (using the same aircraft).

As mentioned above and before and again. I usually don’t believe in the survival of virtual airlines. A few leased aircraft of the same kind than their competitors, outsourced IT, ground handling, maintenance and other “services”, often even the call and service center (to “GSAs”). Then they believe to be competitive to the large players. If you operate in an un- or under-served market, you may be able to ask for the higher ticket prices required by your increased cost levels. Most airlines I see trying to take off or change their business to survive try to compete to the large network and low cost carriers, but without a secure market (using the same aircraft).

Aviation – and the dying continues … Look at the fleet, at complexity at size and type. Do they have spare(s) in case of disruptions? How much do they fly (make money)? Look at the pricing model and if that reflects the higher CASK. I’ve not seen a single failure in the past years that was not clearly a result of those common causes.

Food for Thought

Comments Welcome!

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Just reading with great interest in

Just reading with great interest in

This week I addressed the issue of General Sales Agents (GSA).

This week I addressed the issue of General Sales Agents (GSA).