The #panaceadistraction disqualifies many #impactinvestments as greenwashing. A look at realpolitik in impactinvesting.

The #panaceadistraction disqualifies many #impactinvestments as greenwashing. A look at realpolitik in impactinvesting.

The Trigger: Lubomila’s COP21 statement

!["Our Obsession with technology will slow down the green transition.” [Lubomila Jordanova]](https://foodforthought.barthel.eu/wp-content/uploads/2021/11/Jordanova-Lubomila-Techfocus-slows-down-green-transition.jpg) Having been reminded again of Lubomila Jordanova‘s statement for the U.N. Climate Change Conference 2021, it bugs me, how little has changed in those past two years. Working with climate activists up to United Nations levels, I find a lot of what we call #academicthinking, more about Science Fiction than about taking what we have to the market. A #panaceadistraction if I’ve ever seen one.

Having been reminded again of Lubomila Jordanova‘s statement for the U.N. Climate Change Conference 2021, it bugs me, how little has changed in those past two years. Working with climate activists up to United Nations levels, I find a lot of what we call #academicthinking, more about Science Fiction than about taking what we have to the market. A #panaceadistraction if I’ve ever seen one.

And while #buzzwords used by investors are #disruptiveinvestments, #sustainableinvestments and the like, a big part of the #panaceadistraction is their focus on (classic) “boxes” to invest in. Can’t tell, how many times in the past decades I have heard, that our ideas wouldn’t fit the box. #thinkoutsidethebox and #thinkbeyond.

The Sustainability Lie: Stay inside Your Box

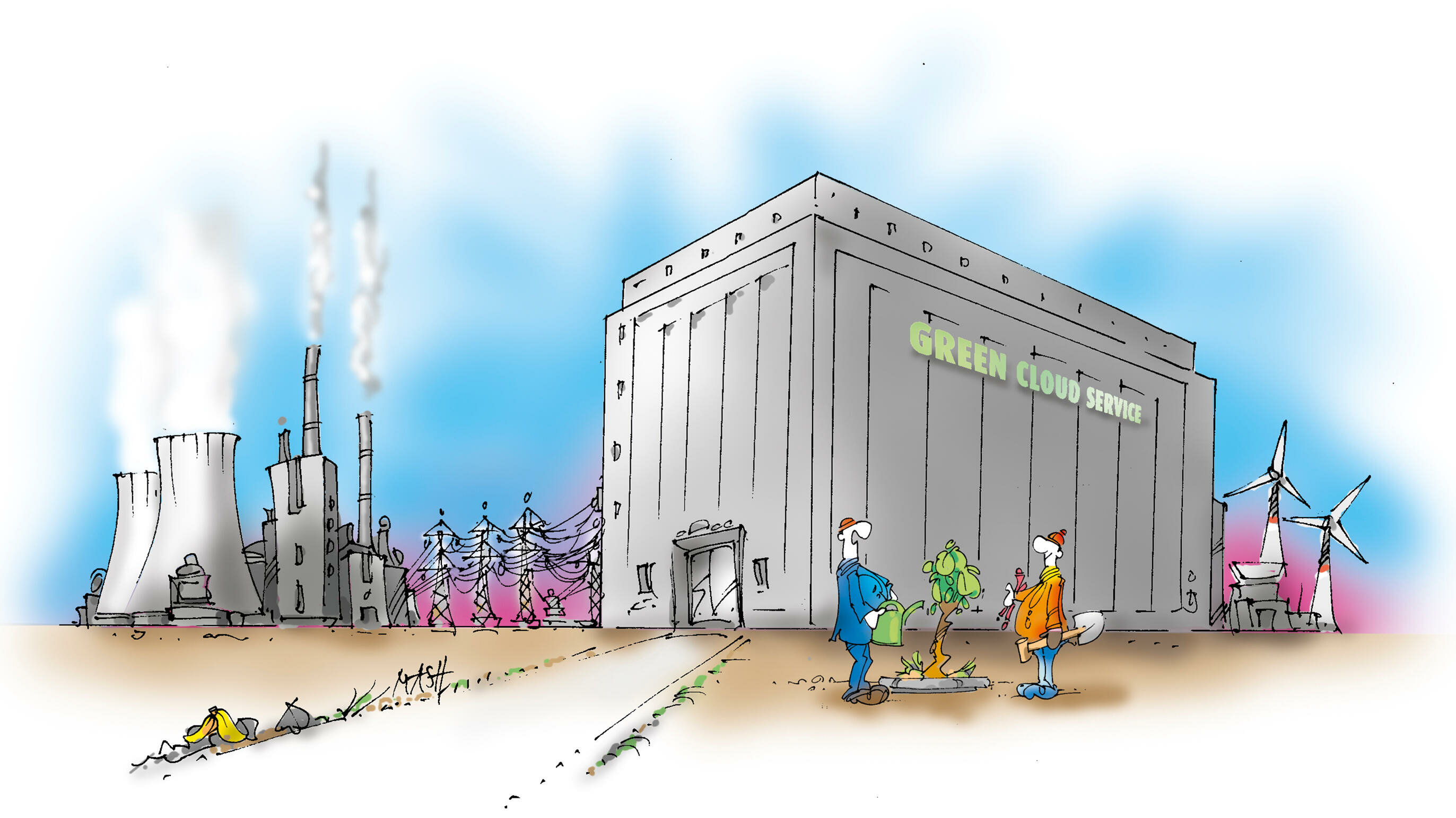

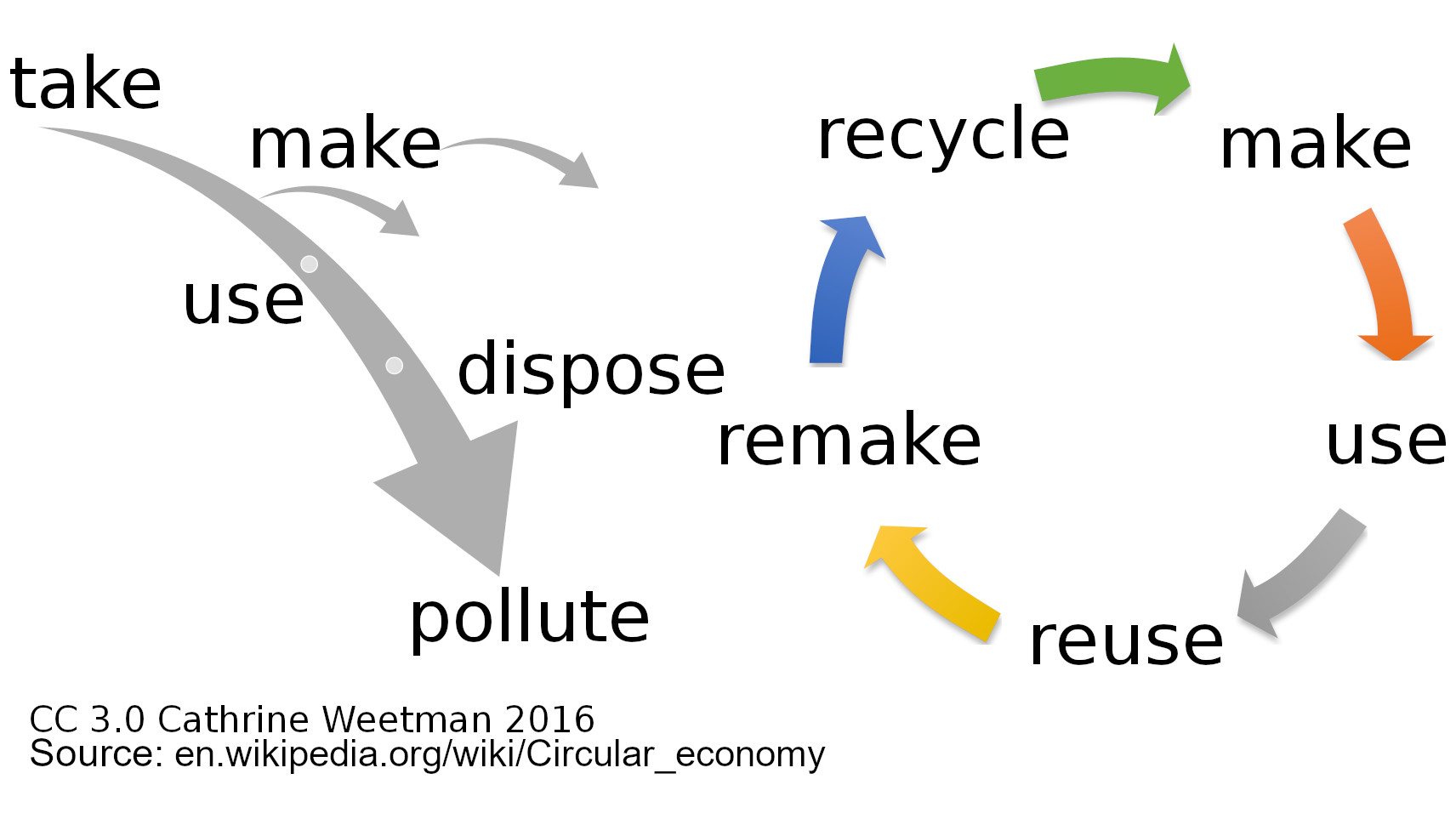

The direct “impact” is that #impactinvestments are mostly #greenwashing on #lifecycleassessment and #circulareconomy – very often blindsiding the #energydemand, using the cheap excuses of “we purchase #greenenergy or #climatecertificates … I was recently told that the industry creatively sells multiple times the amounts of “green” energy we create. I can imagine that. Aside of my #railshame-article, cleaning the green color of the mighty German #greenrail. Just another reference to the Sustainability-Energy Dilemma.

Or #artificialintelligence (just like space) – being a big dream (some consider it a threat). A big investment interest! Whereas most if not all of AI I’ve seen fits the statement that most AI is IA: More (or often less) Intelligent Algorithms. Yes Athena, Minerva and Mike Holmes, I’m waiting (wondering who understands that reference on the fly)…

Or #artificialintelligence (just like space) – being a big dream (some consider it a threat). A big investment interest! Whereas most if not all of AI I’ve seen fits the statement that most AI is IA: More (or often less) Intelligent Algorithms. Yes Athena, Minerva and Mike Holmes, I’m waiting (wondering who understands that reference on the fly)…

So how #sustainable is #impactinvesting really? And which #impactinvestors in reality are part of the mighty #greenwashingindustry? Or do they focus a bit too much on the #panaceadistraction instead?

A Look Back: Pioneering and Disrupting

As a kid, I saw those pioneering constructions on those triangle-shaped hang-gliders, today both bureaucracy and investors wouldn’t invest a penny. But they lead to paragliders, a huge industry today.

Back in 1995, the big four in aviation technology (Amadeus, Galileo, Sabre and Worldspan) actively and with might opposed the development of booking flights on web-basis. How “disruptive” was that “stupid” idea? And yes, I made it happen, together and funded by a visionary Louis Arnitz (RIP). And yeah, that was the time Bill Gates disqualified the Internet, promoting his Microsoft Network.

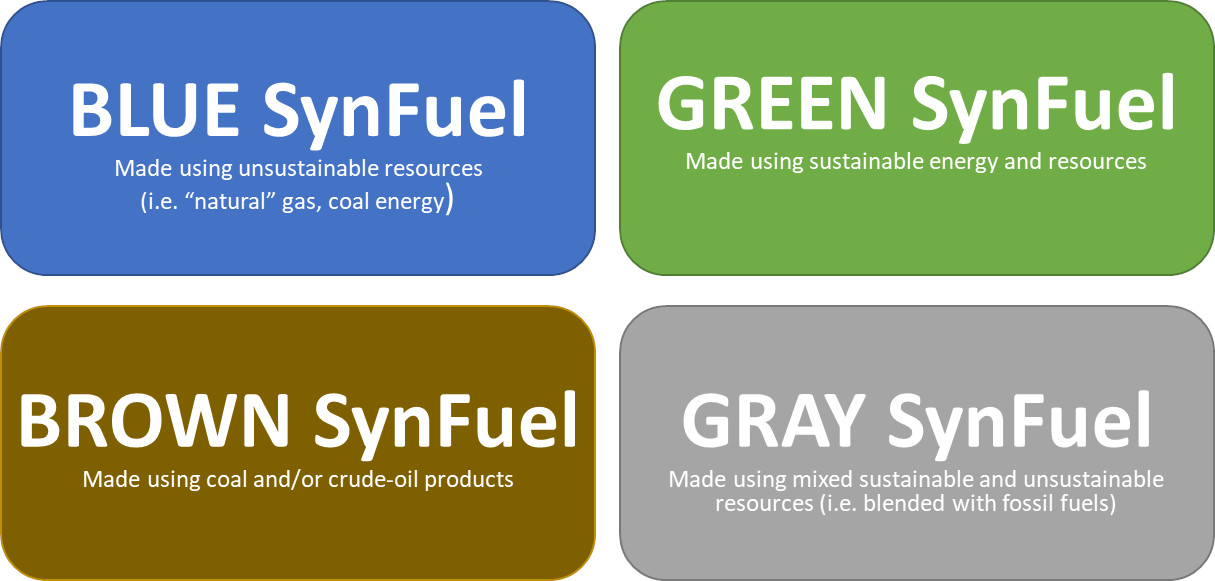

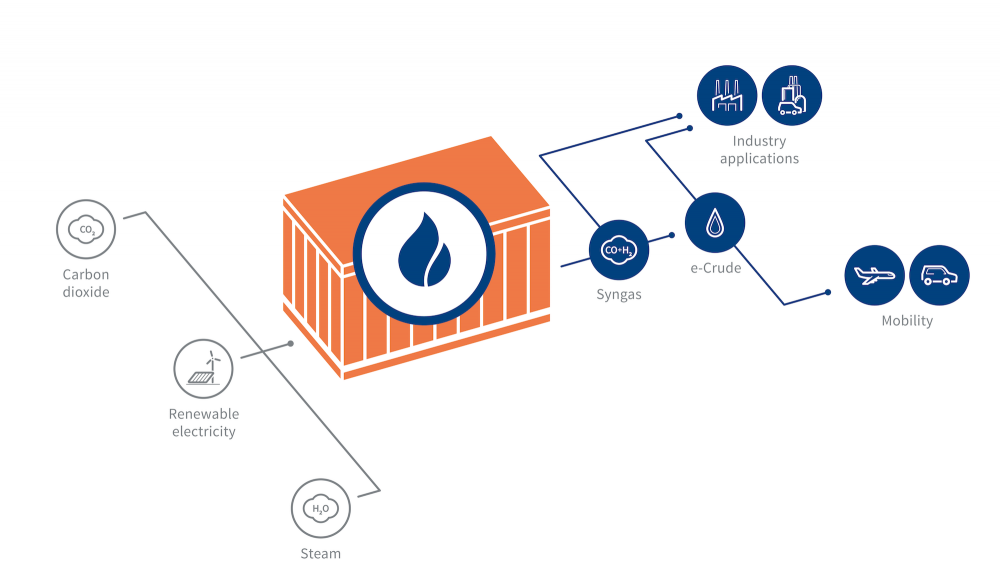

In 2008, I developed another “disruptive” idea of a hydrogen-powered WIG, to promote the need to think sustainable on a global aviation conference. While it made it through viability study into serious negotiations by a tropical government and a major green fund, it fell victim to Lehman, but I still think it should have been developed. Though since #synfuel came up (2019ish), my bets are on that technology, I even applied it to our plans for Kolibri, closing the huge black hole where before our ideas of #biofuels were more or less a band aid on a searing wound. Aside that I prefer we grow food on the fields and not biofuel-rape. And why is it rape has such a bad double-meaning?

In 2008, I developed another “disruptive” idea of a hydrogen-powered WIG, to promote the need to think sustainable on a global aviation conference. While it made it through viability study into serious negotiations by a tropical government and a major green fund, it fell victim to Lehman, but I still think it should have been developed. Though since #synfuel came up (2019ish), my bets are on that technology, I even applied it to our plans for Kolibri, closing the huge black hole where before our ideas of #biofuels were more or less a band aid on a searing wound. Aside that I prefer we grow food on the fields and not biofuel-rape. And why is it rape has such a bad double-meaning?

Though I’m a caller in the dark it seems, at least when talking with mighty investors – they fall back to their boxes and disqualify “aviation” as “not something we invest in”, without even a second look. #talkthetalk, focusing on the #panaceadistraction instead.

Think Positive: The Solutions are There!

There is so much #disruptivetech out there with a business case (aka #impactinvestment), beyond that I integrated into the plans I have for Kolibri, lacking the funding support, lacking the vision of those self-proclaimed #impactinvestors. And a lot of #talkthetalk again. i.e. #energybuffer technologies, alternative energy sources such as #tidalenergy – why only offshore-wind? Though nothing we do, nothing comes without a toll. Remember the #butterflyeffect and the Sustainability-Energy Dilemma.

As a direct result, we have an exploding #sdgfundinggap for sustainability and climate developments. It’s not the first and not the last time, U.N. Secretary General Antonio Gutérres called and calls this #fartoolittlefartoolate.

Butterfly Effect, e-Mobility Lie and the Panacea Distraction

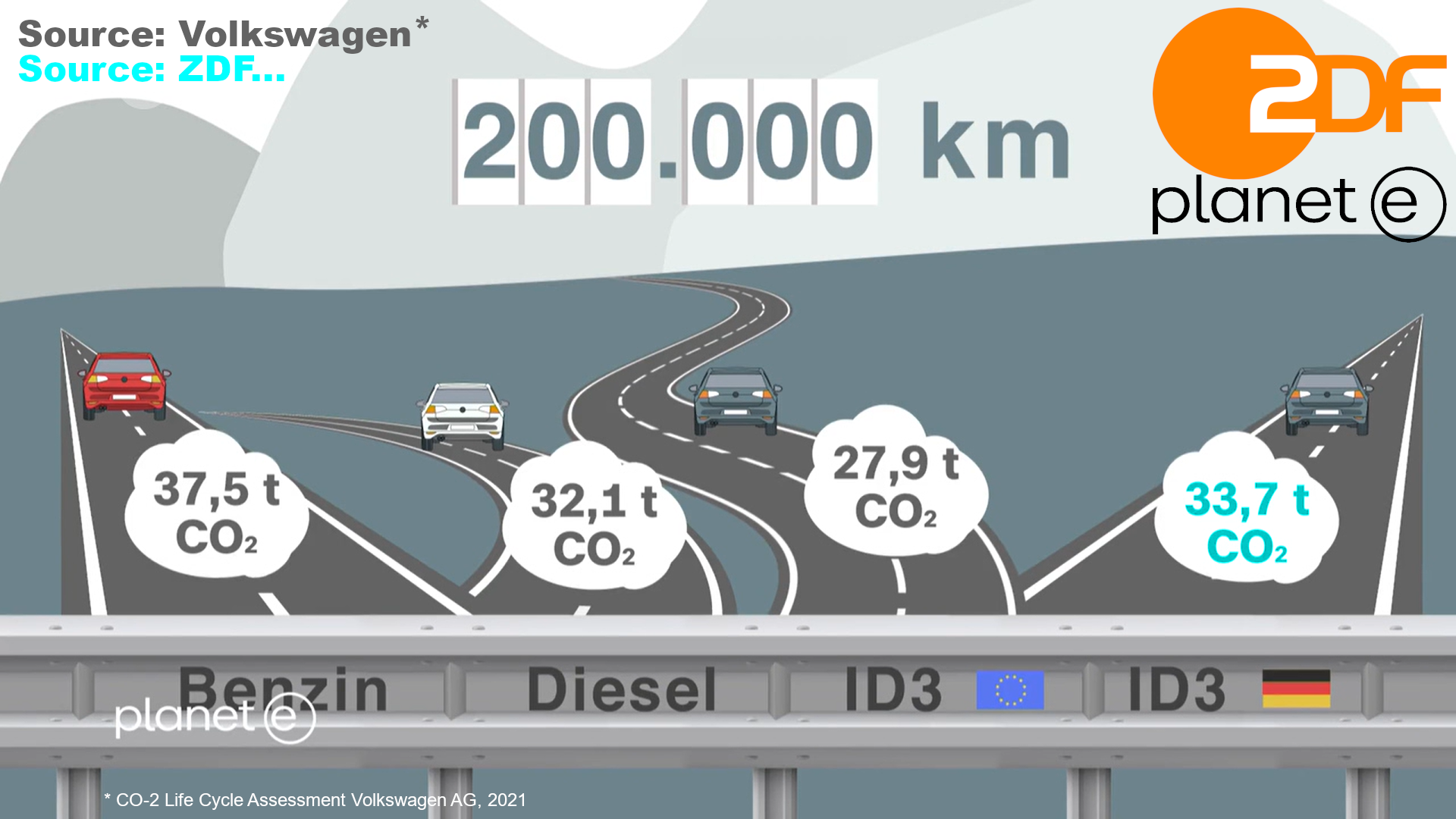

While my readers and followers know that I question #windpower and emobility for #greenwashing and short-term thinking, I also promote the fact that we need the change. We must act. Today.

While my readers and followers know that I question #windpower and emobility for #greenwashing and short-term thinking, I also promote the fact that we need the change. We must act. Today.

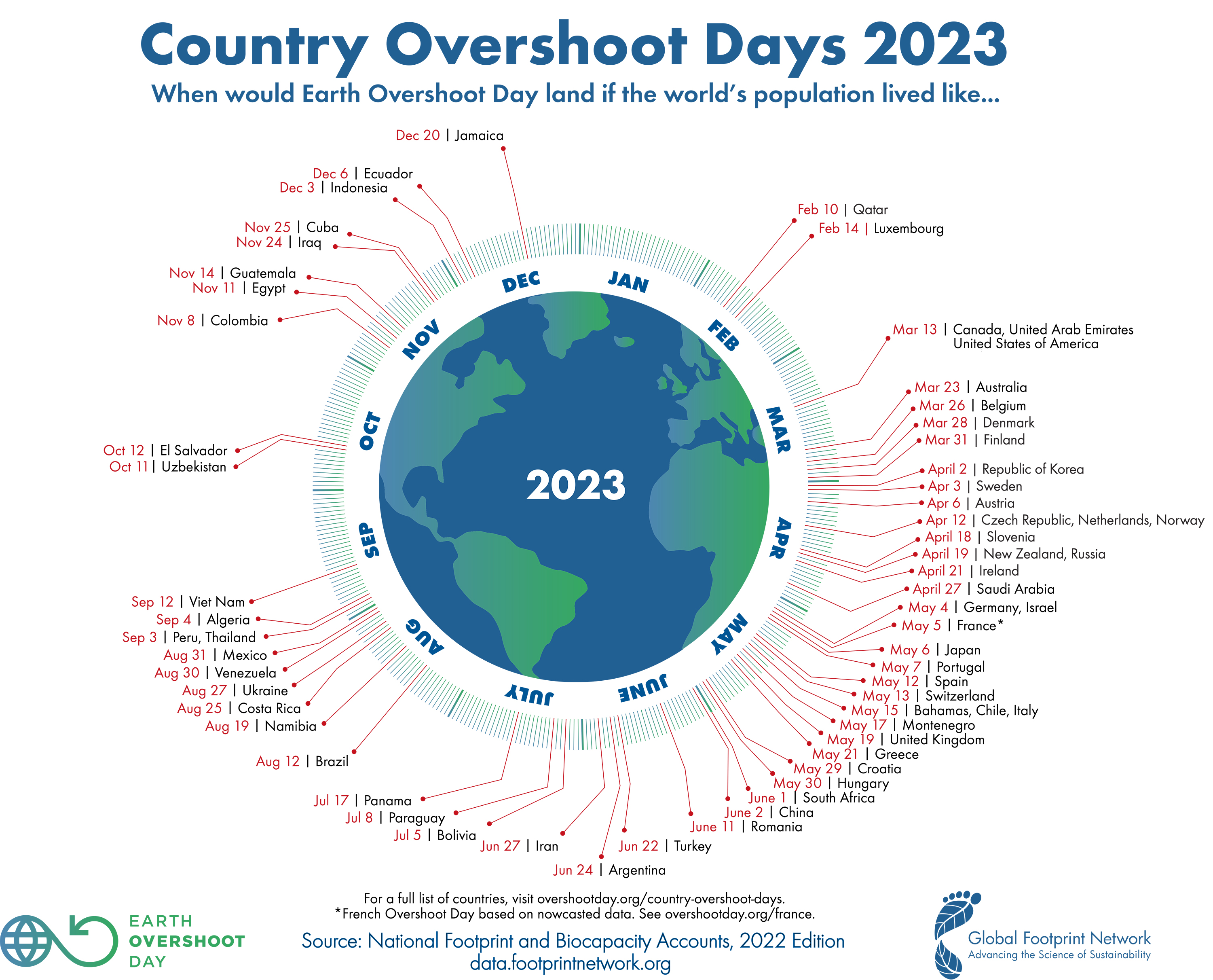

And while e-Mobility ain’t the panacea, politicians and media tries to make you believe, hydrogen and synfuels ain’t as impossible as they frequently claim either. It’s ambitious to turn our world away from cheap, endless “green” energy and the believe of endless resources. Earth Overshoot Day is bad enough, this year August 2nd. Looking at the country level I feel even more devastated (Germany was May 4th)

The Fairy Tale of Zero-Carbon

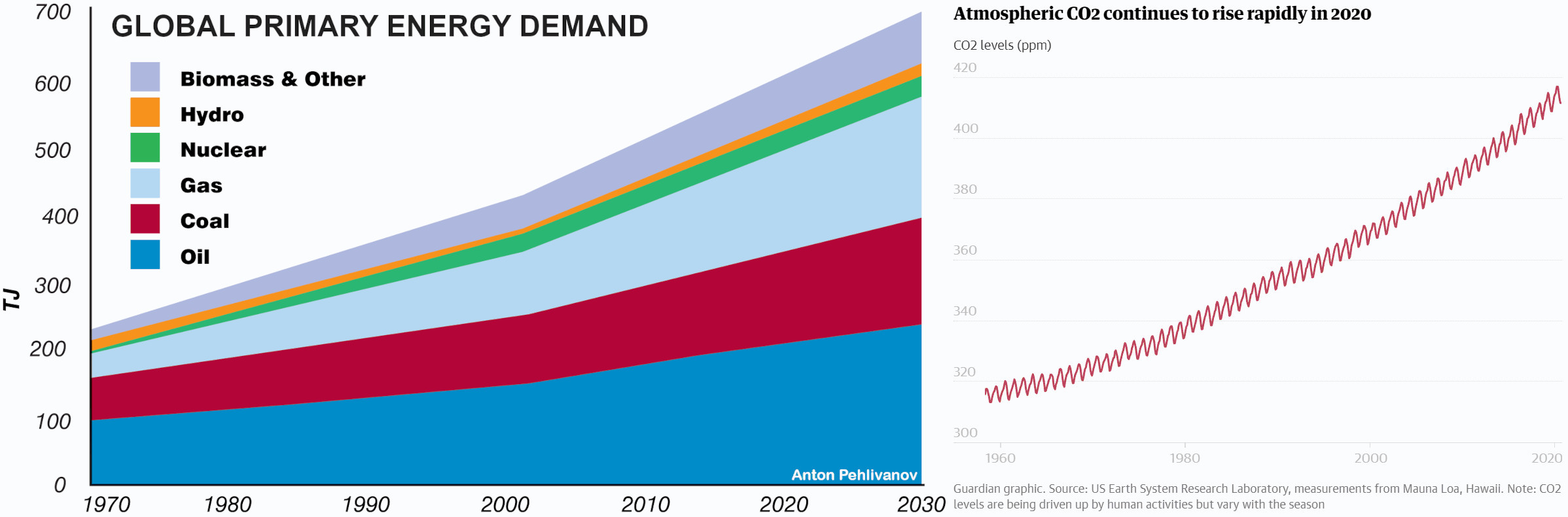

Basic physics: Movement requires energy. Anything we do requires energy. Travel from A to B, even when using a sail boat (as Greta Thunberg did to cross the Atlantic) requires Energy. And resources. As an economist, I know that anything comes at a price.

So there is no #zerocarbon. If we achieve #carbonneutral, we do very good! If we can reduce our abuse of our natural resources – beyond carbon – we do good. Our target must be to move Earth Overshoot Day to December 31st or later. Next year, in two years. Not even Kolibri will be 100% resource neutral. But if we can turn it 90-100% circular, if our energy consumption is renewable, we will have a major impact to Earth Overshoot Day.

Why Fossils are Problematic

Fossils conserve climate gases. While Venus consists of very similar chemical setup, the climate gases on the planet are uncontained. In turn, temperatures there are above 400°C. If someone tells you, we can keep using conserved energy like fossils or the latest ideas using deep-sea manganese nodules, this is climate gases we add to a heavily saturated Earth atmosphere. This is, why yes, I believe we must end fossil consumption (incl. excessive use of plastics) as quickly as we can. Or reduce it to an absolute minimum. Yes, plastics have advantages, but mostly can be replaced by more sustainable solutions. And keep in mind, plastics are used and globally applied by the mighty, rich industry nations. Who’s richness being a result from securing and using cheap fossil energy.

Fossils conserve climate gases. While Venus consists of very similar chemical setup, the climate gases on the planet are uncontained. In turn, temperatures there are above 400°C. If someone tells you, we can keep using conserved energy like fossils or the latest ideas using deep-sea manganese nodules, this is climate gases we add to a heavily saturated Earth atmosphere. This is, why yes, I believe we must end fossil consumption (incl. excessive use of plastics) as quickly as we can. Or reduce it to an absolute minimum. Yes, plastics have advantages, but mostly can be replaced by more sustainable solutions. And keep in mind, plastics are used and globally applied by the mighty, rich industry nations. Who’s richness being a result from securing and using cheap fossil energy.

So mostly, this is about fighting the people who rely on cheap energy for their business models. Do I hear “digital” somewhere? 😂

So true #greeninvesting must focus on energy conservation and intelligent use of the energies we have. Personal, fossil, “renewable”. And yes, I put “renewable” into quotes… Just: #dontchooseextinction!

Holistic Approach and All-In

Another issue that keeps coming up in my discussions is that we must stop competing on sustainable solutions. This is a major, not even just an industry or generational challenge. It’s a global one. So let’s stop competing and start joining forces! Back to my example of offshore wind farms and tidal energy turbines. Why not using them side-by-side in the same sea region we anyway impact by building those humongous wind farm structures? Why not using old Oil Rigs to apply tidal energy turbines, clean them, make them an artificial island structure for sea life (also arial one)?

Another issue that keeps coming up in my discussions is that we must stop competing on sustainable solutions. This is a major, not even just an industry or generational challenge. It’s a global one. So let’s stop competing and start joining forces! Back to my example of offshore wind farms and tidal energy turbines. Why not using them side-by-side in the same sea region we anyway impact by building those humongous wind farm structures? Why not using old Oil Rigs to apply tidal energy turbines, clean them, make them an artificial island structure for sea life (also arial one)?

Live Cycle Assessment and Earth Overshoot Day

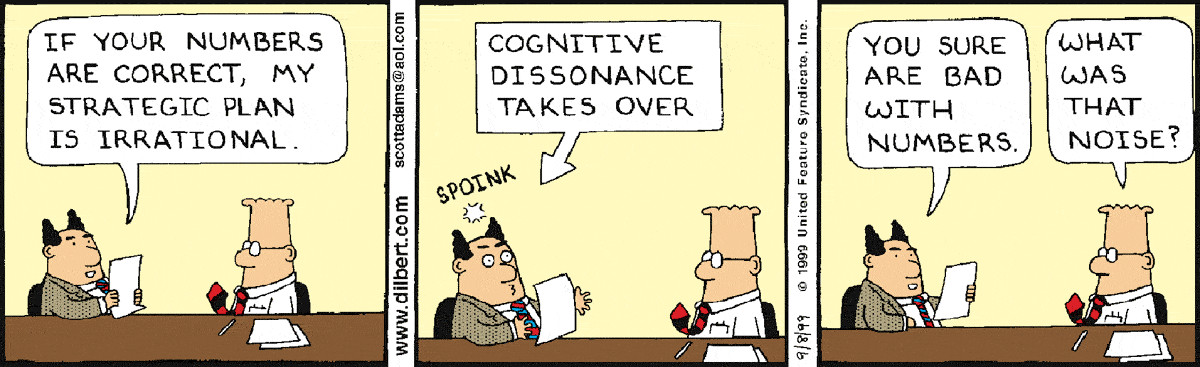

What I learned in my discussions with “green” activists up to government and U.N. levels, is that there is a lot of #wishfulthinking out there. A lot of #cognitivedissonance, reasoning to oneself that the bad-doing ain’t “that bad” or even good. And a #greenwashingindustry that uses that to protect their status quo. Not just at “all cost”, but in fact at the cost of our living and breathing environment!

What I learned in my discussions with “green” activists up to government and U.N. levels, is that there is a lot of #wishfulthinking out there. A lot of #cognitivedissonance, reasoning to oneself that the bad-doing ain’t “that bad” or even good. And a #greenwashingindustry that uses that to protect their status quo. Not just at “all cost”, but in fact at the cost of our living and breathing environment!

To identify Greenwashing quickly, I mentioned to look at energy bill. United Nations urges to look at the #lifecycleanalysis and an end to end #circulareconomy. We must stop #raisinpicking to fake green, but what is our impact to the planet. Then we talk about #realimpactinvestment. And not at another #panaceadistraction

Food for Thought!

Comments welcome

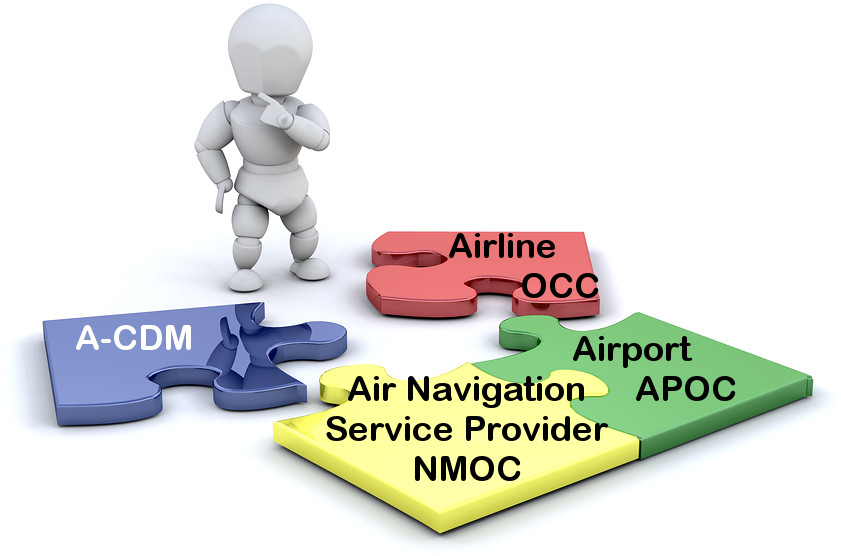

Last week, I had a lengthy phone call with an airport manager in the U.S. Snow-Belt, asking me about ideas, how to break up the silo thinking that keeps all his ideas about a common airport operations center as a basis for some A-CDM-style development from moving forward. Next winter approaching, he’s worried about repeating the past years’ experience of unnecessary delays. “The airline always knows better” he complained to me. If we offer them solution, it’s not theirs, so it’s being turned down. Communication is faulty and in crisis, everyone works on their own. #talkthetalk

Last week, I had a lengthy phone call with an airport manager in the U.S. Snow-Belt, asking me about ideas, how to break up the silo thinking that keeps all his ideas about a common airport operations center as a basis for some A-CDM-style development from moving forward. Next winter approaching, he’s worried about repeating the past years’ experience of unnecessary delays. “The airline always knows better” he complained to me. If we offer them solution, it’s not theirs, so it’s being turned down. Communication is faulty and in crisis, everyone works on their own. #talkthetalk Now give me a break. When I read this “promo” on LinkedIn, is it just me, seeing the fault in it?

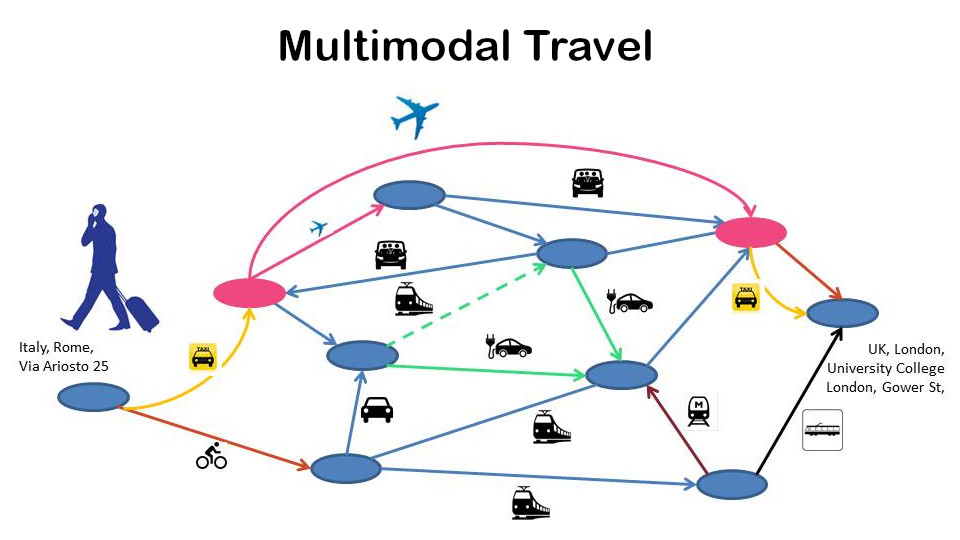

Now give me a break. When I read this “promo” on LinkedIn, is it just me, seeing the fault in it? Our vision for what was to be Cytric, that we wanted to follow, a vision not existing now, 25 years later, was to enter the home address, the destination address and the system would provide you the best travel options for you to get to the airport using car, rail, taxi, whatever, fly towards your destination and again take rail, taxi, rental car, whatever, to get to where you needed to go.

Our vision for what was to be Cytric, that we wanted to follow, a vision not existing now, 25 years later, was to enter the home address, the destination address and the system would provide you the best travel options for you to get to the airport using car, rail, taxi, whatever, fly towards your destination and again take rail, taxi, rental car, whatever, to get to where you needed to go. Speaking about Business Travel Management, we don’t need data typists any more. In the good old days, travel agents were the experts, knowing how to get the traveler from A to B, halfway (or all) around the world… Then came the GDS and the travel agents became data interfaces to the big data accessed through travel computers being connected with mighty servers. Something we call cloud computing today, using “dummy terminals”. Using codes like AN19DECFRAMIA and SS1B1M2 to search for and book a flight. Or similar complicated tools to book a rail ticket.

Speaking about Business Travel Management, we don’t need data typists any more. In the good old days, travel agents were the experts, knowing how to get the traveler from A to B, halfway (or all) around the world… Then came the GDS and the travel agents became data interfaces to the big data accessed through travel computers being connected with mighty servers. Something we call cloud computing today, using “dummy terminals”. Using codes like AN19DECFRAMIA and SS1B1M2 to search for and book a flight. Or similar complicated tools to book a rail ticket. It is why I believe we need regional aviation and we need more of it. Smaller aircraft, connecting secondary cities, offering quick and direct connection. Hubs are good for the global networks. And as I kept and keep emphasizing. Regional airports must not look out, how to get their locals out to the world. But to

It is why I believe we need regional aviation and we need more of it. Smaller aircraft, connecting secondary cities, offering quick and direct connection. Hubs are good for the global networks. And as I kept and keep emphasizing. Regional airports must not look out, how to get their locals out to the world. But to  As I approached it back in 2016/17 and shared the learning curve at

As I approached it back in 2016/17 and shared the learning curve at  An older

An older

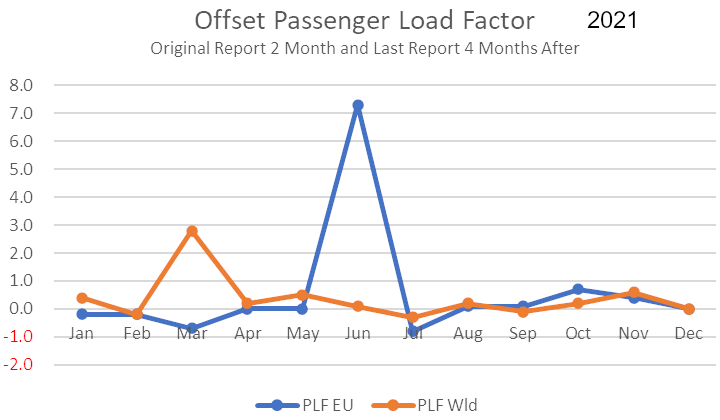

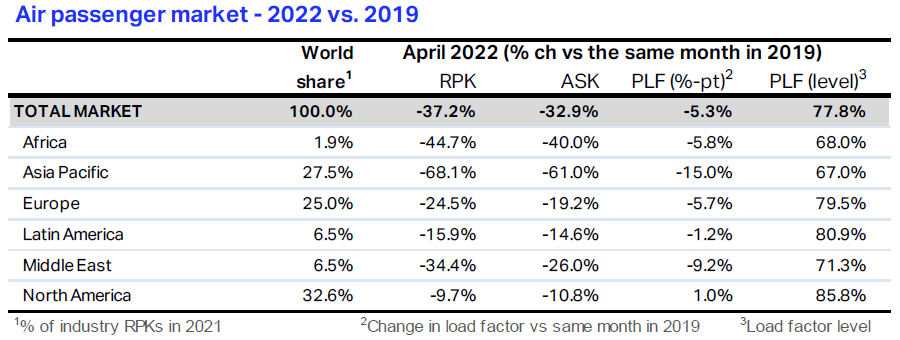

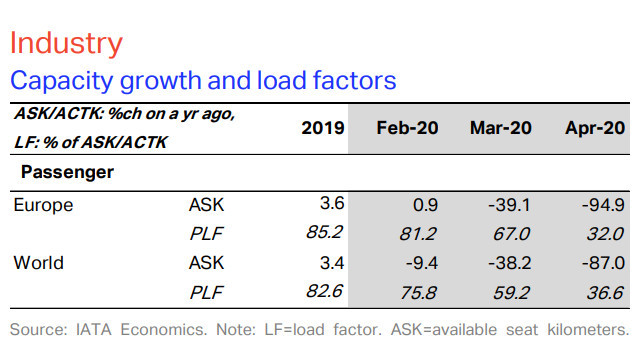

Our main problem is that our Powers-That-Be still consider themselves in a competition. Data is value, so put it in siloes. Where OpenStreetMap enabled mapping solutions, aviation data is still locked away. It takes two months until IATA publishes passenger data, after four months those numbers happen to differ substantially.

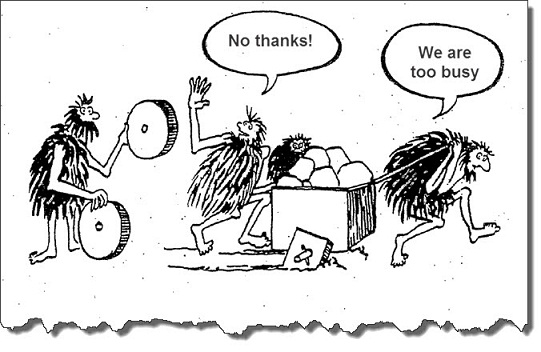

Our main problem is that our Powers-That-Be still consider themselves in a competition. Data is value, so put it in siloes. Where OpenStreetMap enabled mapping solutions, aviation data is still locked away. It takes two months until IATA publishes passenger data, after four months those numbers happen to differ substantially. Where aviation in the 1960s to -80s was a pacemaker in global eCommerce, it is now limping behind. Can tell stories about replies from industry bodies when I informed them about factual mistakes in their data. And their ignorance shown by neither directing the report to their PTBs, nor updating the faulty information. Instead of working together to develop the aviation of the future, we have conservative forces in play that hinder real development. Be that about A-CDM, data interfaces, data intelligence. We limp behind and instead of doing, we #talkthetalk.

Where aviation in the 1960s to -80s was a pacemaker in global eCommerce, it is now limping behind. Can tell stories about replies from industry bodies when I informed them about factual mistakes in their data. And their ignorance shown by neither directing the report to their PTBs, nor updating the faulty information. Instead of working together to develop the aviation of the future, we have conservative forces in play that hinder real development. Be that about A-CDM, data interfaces, data intelligence. We limp behind and instead of doing, we #talkthetalk.

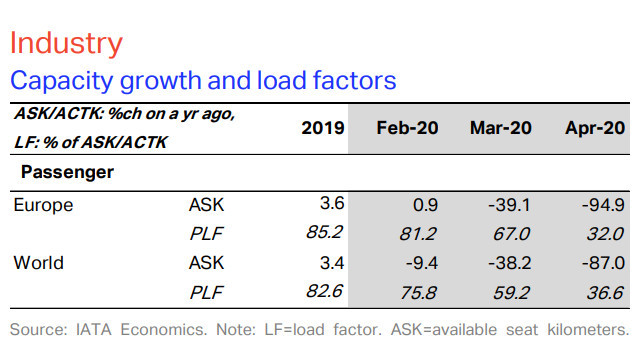

In the first year of the pandemic, in the first wave in May, I voiced my expectation already of Corona

In the first year of the pandemic, in the first wave in May, I voiced my expectation already of Corona

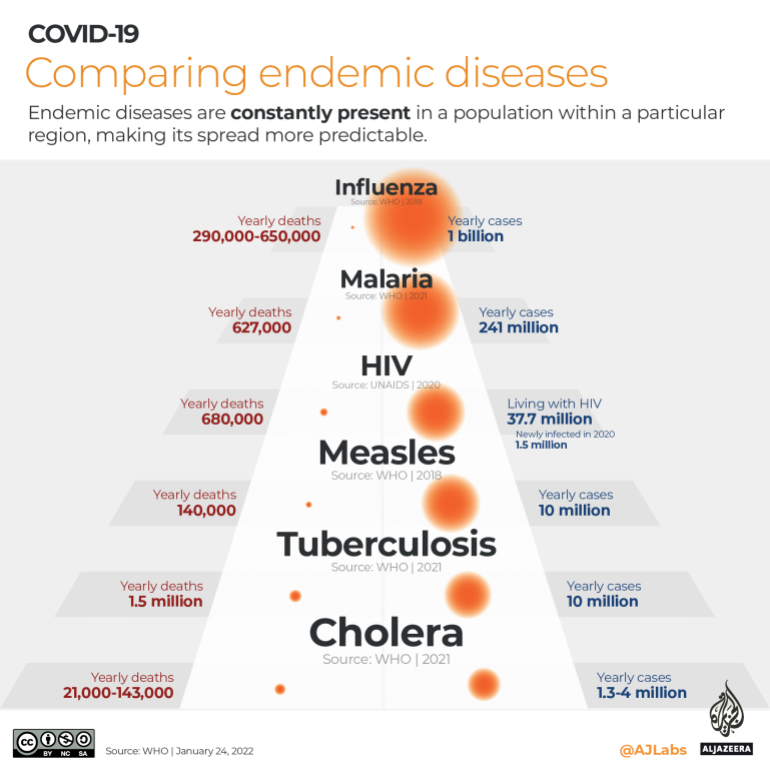

The next big challenge is the look across borders and out of the “industry nations”. Over and again, news about vaccines that expired in the richer nations were met by the ones of i.e. African countries being delivered expiring vaccines or even ones that were not certified in the donor countries. At the same time, vaccines like the Russian Sputnik were still not “certified”. In turn, my own mother-in-law was denied entry into Europe as she got Sputnik, to visit to take care of my kids in my absence, while Yulia (my wife) works full time too.

The next big challenge is the look across borders and out of the “industry nations”. Over and again, news about vaccines that expired in the richer nations were met by the ones of i.e. African countries being delivered expiring vaccines or even ones that were not certified in the donor countries. At the same time, vaccines like the Russian Sputnik were still not “certified”. In turn, my own mother-in-law was denied entry into Europe as she got Sputnik, to visit to take care of my kids in my absence, while Yulia (my wife) works full time too. “Principle Hope” and the Saint-Florian’s Principle dominate our industry: “Oh holy dear Saint Florian, don’t burn my house, take the neighbors one.”

“Principle Hope” and the Saint-Florian’s Principle dominate our industry: “Oh holy dear Saint Florian, don’t burn my house, take the neighbors one.” Airports would be well advised to have processes in place to ensure #testingregime for the current and future infections., demanding and assuring the ability for pre-flight testing.

Airports would be well advised to have processes in place to ensure #testingregime for the current and future infections., demanding and assuring the ability for pre-flight testing.

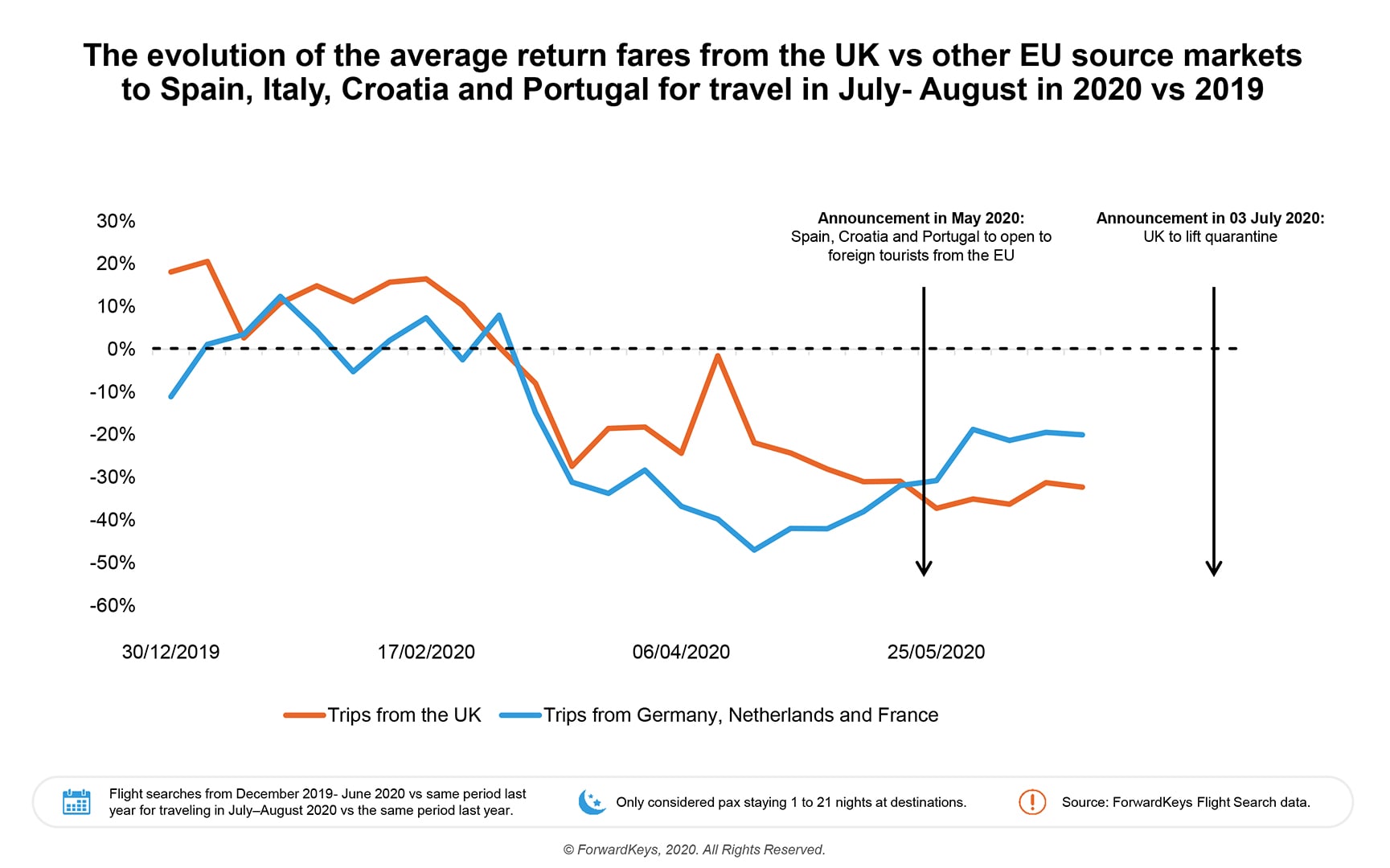

Reports I read fed hopes again about a summer recovery in Europe. A recovery now threatened by the new BA.5 variant spreading throughout Europe. And again, what is the airlines’ role in spreading those new variants so quickly across countries? And Lufthansa recently cancelled 600 flights (5%) for lack of staff. A main reason being the infection of their own. Mainly infected “at work”. What was that again about employee health protection? Naaaw, let’s not play it safe, let’s go back to old normal?

Reports I read fed hopes again about a summer recovery in Europe. A recovery now threatened by the new BA.5 variant spreading throughout Europe. And again, what is the airlines’ role in spreading those new variants so quickly across countries? And Lufthansa recently cancelled 600 flights (5%) for lack of staff. A main reason being the infection of their own. Mainly infected “at work”. What was that again about employee health protection? Naaaw, let’s not play it safe, let’s go back to old normal? Speaking to airline and airport managers, they prioritize no “new normal” which they promoted in the beginning of the pandemic. But they focus to “renormalize” back to the old normal. Which bites them in the butt over and again. Demands are to lift mask and testing requirements. In an obvious ignorance of the pandemic development. In line with political developments, but not in line with the infection rates.

Speaking to airline and airport managers, they prioritize no “new normal” which they promoted in the beginning of the pandemic. But they focus to “renormalize” back to the old normal. Which bites them in the butt over and again. Demands are to lift mask and testing requirements. In an obvious ignorance of the pandemic development. In line with political developments, but not in line with the infection rates. There can be reasons to fly an aircraft even empty.

There can be reasons to fly an aircraft even empty. Another would be to rotate the pilots to make sure they all keep their “type rating”, their license to fly the aircraft. Which also expires just too quickly. And while airlines now recognize the shortfall on pilots that they had either “laid off” (fired) and (or) didn’t support in keeping their type rating, the current feedback from pilots is that airlines still fail to have programs in place to rotate the pilots as good as they could to keep the type-ratings.

Another would be to rotate the pilots to make sure they all keep their “type rating”, their license to fly the aircraft. Which also expires just too quickly. And while airlines now recognize the shortfall on pilots that they had either “laid off” (fired) and (or) didn’t support in keeping their type rating, the current feedback from pilots is that airlines still fail to have programs in place to rotate the pilots as good as they could to keep the type-ratings.

While the aviation industry and it’s Powers-That-Be (PTBs) argue that we must delay sustainable flight in face of the crisis, I am on a complete opposite belief. We must, but we failed, to take the crisis as a chance for overdue change. Instead of investing into sustainable fuels and developments, into optimizing the airspace, our PTB try to go back to old normal. Then finding reasons to delay the change further.

While the aviation industry and it’s Powers-That-Be (PTBs) argue that we must delay sustainable flight in face of the crisis, I am on a complete opposite belief. We must, but we failed, to take the crisis as a chance for overdue change. Instead of investing into sustainable fuels and developments, into optimizing the airspace, our PTB try to go back to old normal. Then finding reasons to delay the change further.

And we talk about leveling the energy to a sustainable level. Use as much energy as you return. Like

And we talk about leveling the energy to a sustainable level. Use as much energy as you return. Like  The war in the Ukraine will impact not just long-haul travel, like the reestablishing of the polar route avoiding Russian air space. And that we can not trust in “neutral air space” we learned when Belarus took down a civil aircraft from transit with the sole reason to jail a political opponent living in exile abroad.

The war in the Ukraine will impact not just long-haul travel, like the reestablishing of the polar route avoiding Russian air space. And that we can not trust in “neutral air space” we learned when Belarus took down a civil aircraft from transit with the sole reason to jail a political opponent living in exile abroad.

Another issue that slowly reaches the public is the issue of batteries catching fire. First major reports were on the

Another issue that slowly reaches the public is the issue of batteries catching fire. First major reports were on the  Worse, recently despite their relative low numbers, electric cars are increasingly reported to catch fire. Some at first loading at a standard, approved home loading facility, others while driving. Different from gasoline, a thermal runaway and the resulting battery explosions cause a much higher real danger to the cars passengers. And it does not help to distinguish the fire, but such car must be placed into a water tank for several days to cool down the batteries. And after a fire, such cars usually are beyond any recycling. The picture just one example of the many that can be found on the Internet.

Worse, recently despite their relative low numbers, electric cars are increasingly reported to catch fire. Some at first loading at a standard, approved home loading facility, others while driving. Different from gasoline, a thermal runaway and the resulting battery explosions cause a much higher real danger to the cars passengers. And it does not help to distinguish the fire, but such car must be placed into a water tank for several days to cool down the batteries. And after a fire, such cars usually are beyond any recycling. The picture just one example of the many that can be found on the Internet. Incorrect disposal of Li-ion batteries can have a devastating environmental impact on the environment, sparking the need for recycling (

Incorrect disposal of Li-ion batteries can have a devastating environmental impact on the environment, sparking the need for recycling (

German Automotive Club ADAC just recently reported the average range of electric cars being about 350 km (220 miles), up from 250 km (150 miles) five years ago. Thinking about my role as an airline sales manager some years ago, for a road trip, I traveled frequently more than 500 km a day. Then I shall load the car after a half day, sitting around while waiting? Keep in mind, that corporate fleets and rental cars are the main buyers of new cars! And they don’t buy them because they park them most of the time…?

German Automotive Club ADAC just recently reported the average range of electric cars being about 350 km (220 miles), up from 250 km (150 miles) five years ago. Thinking about my role as an airline sales manager some years ago, for a road trip, I traveled frequently more than 500 km a day. Then I shall load the car after a half day, sitting around while waiting? Keep in mind, that corporate fleets and rental cars are the main buyers of new cars! And they don’t buy them because they park them most of the time…? As I mentioned in my post about

As I mentioned in my post about  Ready Player One? I love SciFi. There’s a lot really good ideas how we could merge individual transportation needs with “public” transportation. But that’s SciFi. We need to take the best ideas and evolve our transportation to sustainable ways in the real world. We must reduce energy. Integrate transport modes. Why does it remind me of the question why the big train stations are not at the airports? The “new” Berlin Airport being a perfectly bad example on this!

Ready Player One? I love SciFi. There’s a lot really good ideas how we could merge individual transportation needs with “public” transportation. But that’s SciFi. We need to take the best ideas and evolve our transportation to sustainable ways in the real world. We must reduce energy. Integrate transport modes. Why does it remind me of the question why the big train stations are not at the airports? The “new” Berlin Airport being a perfectly bad example on this!

1971 (yes, 40 years ago and as a kid) I became a fan of Roger Leloup, spending my pocket money on comics. And when Hyperloop became a buzz, I couldn’t help it to remember Leloup’s Vinean transport system.

1971 (yes, 40 years ago and as a kid) I became a fan of Roger Leloup, spending my pocket money on comics. And when Hyperloop became a buzz, I couldn’t help it to remember Leloup’s Vinean transport system. I just recently discussed our ideas for sustainable aviation. They are not new either. And more like a logical development from my first ideas about a hydrogen-powered WIG in 2008 as a n example to senior airline managers to think about sustainability. Then making use of current developments and understanding the merits of SynFuel. And thanks to discussions with Sustainable Aero Lab (thanks Mario!) leading to my understanding of the

I just recently discussed our ideas for sustainable aviation. They are not new either. And more like a logical development from my first ideas about a hydrogen-powered WIG in 2008 as a n example to senior airline managers to think about sustainability. Then making use of current developments and understanding the merits of SynFuel. And thanks to discussions with Sustainable Aero Lab (thanks Mario!) leading to my understanding of the  To make a real change, you need a team of entrepreneurs thinking outside the box. Way outside the box. But with an experience on pioneering work, overcoming the

To make a real change, you need a team of entrepreneurs thinking outside the box. Way outside the box. But with an experience on pioneering work, overcoming the

The very same issue is it about hydrogen powered passenger flights, Airbus recently promoted as their “Zero-Emission Aircraft”. Again, the physical challenge.

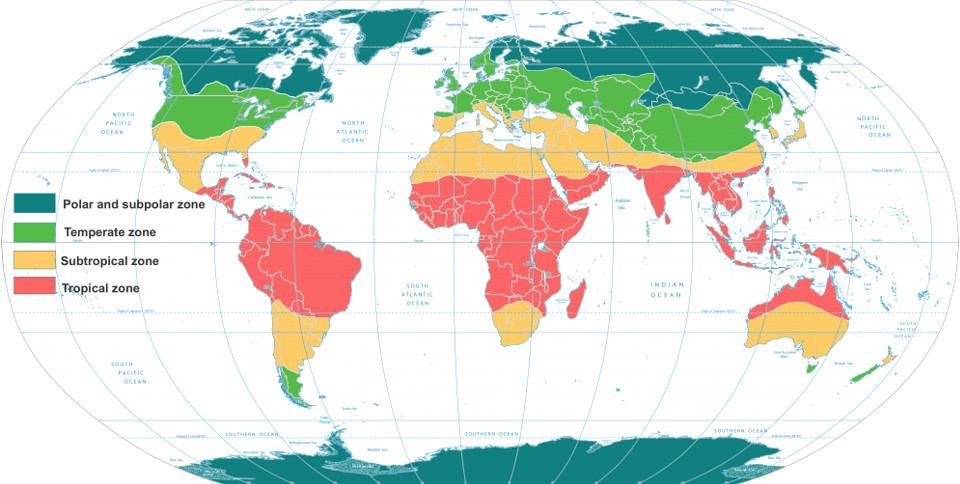

The very same issue is it about hydrogen powered passenger flights, Airbus recently promoted as their “Zero-Emission Aircraft”. Again, the physical challenge. Aside, synfuel can be used quite easily as a buffer technology, using excess power to create synfuel during peak times and using it in common and tried power generators to recreate energy in low times. Until we have something better, Syngas is a clean energy source that can make us independent of crude-oil for power generation. a technology that can create a future for many “poor countries” in the “tropical belt”, the tropic (red) and subtropical zones (yellow), as their surplus of solar energy is way higher than what the northern hemisphere has in the temperate to polar zones.

Aside, synfuel can be used quite easily as a buffer technology, using excess power to create synfuel during peak times and using it in common and tried power generators to recreate energy in low times. Until we have something better, Syngas is a clean energy source that can make us independent of crude-oil for power generation. a technology that can create a future for many “poor countries” in the “tropical belt”, the tropic (red) and subtropical zones (yellow), as their surplus of solar energy is way higher than what the northern hemisphere has in the temperate to polar zones.

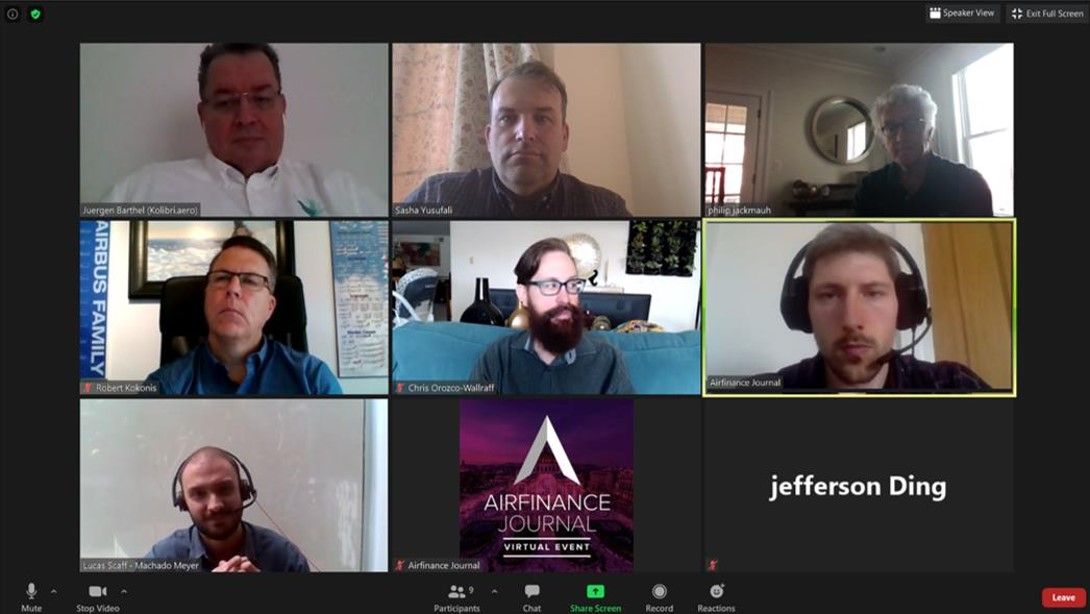

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge. Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

Convincing the People to Fly Again

Convincing the People to Fly Again There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Yes, as you can see in the archive of my

Yes, as you can see in the archive of my  I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely.

I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely. I was kind of shocked this week, when German Tagesthemen, one of the main news channel mentioned already that this may not be the end, but just the beginning of an expensive further bail-out series for the airline and it’s many subsidiaries. But if they burned 5 billion in three months, how long can they sustain the drought before they burned up the added nine billion?

I was kind of shocked this week, when German Tagesthemen, one of the main news channel mentioned already that this may not be the end, but just the beginning of an expensive further bail-out series for the airline and it’s many subsidiaries. But if they burned 5 billion in three months, how long can they sustain the drought before they burned up the added nine billion?!["We are Listening. And We're Not Blind. This is Your Life. This is Your Time!" [Snow Patrol - Calling in the Dark]](https://foodforthought.barthel.eu/wp-content/uploads/2020/01/CallingintheDark.jpg)

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.”

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.” In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management.

In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management. As addressed in

As addressed in  Dinosaurs …

Dinosaurs … Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.

Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.