While sustainability and climate action become main-stream, everyone tries to promote themselves as sustainable. But a family office analyzing the startup proposals (see below) they received in the first half year of 2021 reported that more than 95% of the “green investment proposals” where clearly greenwashing!

Learning about the Sustainability-Energy Dilemma just disqualified many more #impactinvestments as #greenwashing. I also summarized quite many of my findings for the GITA Unconference in a presentation titled The Bumps on the Road to Sustainability (Speaker Notes).

This Whitepaper is meant as Food for Thought, to trigger more exchange on the topic and some thought thinking with you, my readers.

Definition: About “Impact Investing”?

In my humble opinion, real impact investment is when you consciously address what is the right thing. Before we learned about “impact investing”, Ndrec and I developed the business plans for Kolibri. We had a kind of “military view” on people. No “human resources”, but conscious understanding that it’s our job to give them motivation for their jobs. That no-one is “left behind” and in turn increase the loyalty and reduce staff turnover. We looked at the bases we planned throughout Europe, but looking at headquarters in Albania, we understood the need to look at the first SDGs. And doing this, we understood that we will likely shake-up the market. Simply by doing the right thing.

In my humble opinion, real impact investment is when you consciously address what is the right thing. Before we learned about “impact investing”, Ndrec and I developed the business plans for Kolibri. We had a kind of “military view” on people. No “human resources”, but conscious understanding that it’s our job to give them motivation for their jobs. That no-one is “left behind” and in turn increase the loyalty and reduce staff turnover. We looked at the bases we planned throughout Europe, but looking at headquarters in Albania, we understood the need to look at the first SDGs. And doing this, we understood that we will likely shake-up the market. Simply by doing the right thing.

Developing our business plan we understood the necessity to be competitive to existing bird of prey in the European Market, both the large network carriers’ feeder networks and the low cost airlines. Looking at it in a “military” way and looking into strategic “sustainability” then (to our own surprise) helped us to improve our profitability.

U.N. Sustainability Development Goals …

There are not one or two Sustainability Development Goals (SDGs) by the United Nations. There are 17!

There are not one or two Sustainability Development Goals (SDGs) by the United Nations. There are 17!

But most “impact investments” cover just one or two. I call this raisin picking. Very famous are SDG13 “climate action” and SDG5 “gender equality”, but also SDG7 “Affordable and Clean Energy. But what’s more important? Affordable? Or Clean? And what about the other SDGs?

… and Beyond the SDGs

Learning about the SDGs, I recognized that inclusiveness, diversity or religion are not addressed at all. Partially, they are part of the Human Rights. And it makes sense not to duplicate, but understand the SDGs as naturally complementing the Human Rights. Right?

For me, I summarize that under Respect and Tolerance. And that you think sustainable.

German proverb is “Action speaks louder than words”.

Or as my American friends say: It’s time to stop talk-the-talk, but walk-the-walk.

In general, it’s about doing the right thing and thinking ideas through. And if you want to make an impact, it’s a holistic question. What’s your overall and long-term impact. And then, how can you make that impact work for you. As true impact investment in general summarizes to

Impact Investing ain’t Philanthropy !

Do the Right Thing. And Make Money !

A Family Office Greenwashing Analysis

To write this as a “Whitepaper” article instead of a post was triggered by a discussion with a family office on #greenwashing.

Not allowed to share the source (it wasn’t Rennie Hoare), but would appreciate input on this, especially from #familyoffices and #impactinvestors! If you have your own numbers you’d be willing to share, please do so in the comments or reach out to me!

While the Family Office regularly check impact investment proposals for their real impact, their 2021 1st six months analysis turned out the worst ever:

For European startups, 93% of the business proposals they consider clear #whitewashing (undoubted). Including but not limited to investments into Bitcoin or fossil-based technology. 3% they see limited direct impact (small focus) like Synfuel without bothering the source, using natural gas (fossil) or energy from the grid. Or like a focus on “gender equality”, limited to a female founders team, but nothing beyond.

Summing up to 96% “insufficient impact = white- and #greenwashing.

The remaining <4% they understand the founders to have a real impact thinking “beyond SDGs”.

The remaining <4% they understand the founders to have a real impact thinking “beyond SDGs”.

< 3% (incl. ours) they consider “highly interesting” long-term.

< 1% “real impact”, mostly into rural development and green energy.

In the analysis they point out negative examples like investment into the Berlin Tesla Gigafactory, given the limited to negative impact to CO2 for electric cars and the devastating impact on the natural preserve they’ve selected to build it in. Aside it being an area in Germany suffering from drought (at 1.8m below ground), demanding millions of liters of water for the production.

ESG = Greenwashing

In general, I see two claims that disqualify ESG (Investing under consideration of Environmental, Social, Governance) as greenwashing.

Young-Jin Choi summarized one of the issues in his post commenting on an article by SSIR: “[ESGs] measure the degree to which a company’s economic value is at risk due to ESG factors.” Not their impact to the environment (social, climate, etc.)

Another is that you can only measure from a certain reference point. If you have data to compare to.

But this is like the Crystal Ball in airline route development. You look into the future. Make commitments, Set targets. “Measure” those targets. But only future will tell, if you reach those targets. Or if you fail. Or outperform them.

It’s mostly a tool for the dinosaurs (that includes self-proclaimed “impact investors”) to greenwash their limited sustainability efforts. And for those very reasons that includes

A.I. ESG Analysis = Greenwashing

I know some of my LinkedIn-contacts will want to kill me for such a statement (yes Ingo). But this is another way to put Sustainability into small boxes. And to select small investments that promise an optimized and quick result on the ESG side with as little effort as possible. To be then most likely used for mere Greenwashing.

I know some of my LinkedIn-contacts will want to kill me for such a statement (yes Ingo). But this is another way to put Sustainability into small boxes. And to select small investments that promise an optimized and quick result on the ESG side with as little effort as possible. To be then most likely used for mere Greenwashing.

Out of Sustainability, A.I. based ESG analysis looks at certain, easily measurable puzzle pieces and claims, especially some that can be quantified easily. But how do you “measure” the commitment of the founders, the management? The hurdles in the industry? Political and legal hurdles that must be overcome?

Aside, you know my take on “A.I.” – all claimed A.I. I’ve seen to date was about I.A. – more, or mostly less sophisticated “Intelligent Algorithms”.

EU Greenwashing

Talking with the European Investment Bank, the self-proclaimed European Sustainability Bank, I made two experiences, that show what their sustainability efforts are truly about.

Talking with the European Investment Bank, the self-proclaimed European Sustainability Bank, I made two experiences, that show what their sustainability efforts are truly about.

The first was about a potential investment into Kolibri to allow us to push instantly forward beyond establishing just another (profitable) regional airline into developing the means to develop into SynFuel. The response referred me to their Climate Roadmap, page 102, simply disqualifying any investments into aviation. Period.

The other one was in an online conference, where their VP Sustainability claimed their history in sustainability investment since 2007. But asked why there is no public information about their such investments, neither reports about successes, nor about failures from which we could learn, I was told “Oh, yes, we just started to look into that”.

The Sustainability-Energy Dilemma and Greenwashing

And mentioning my research findings on the topic as a trigger, this year the family office that shared those above findings added the #energyaccounting to their check-criteria. With quite, with very negative results.

That disqualifies i.e. data-center developments, even if they use some #greenwashing like providing heat for the neighborhood or block-chain needing excess data storage (and very little jobs or impact to people).

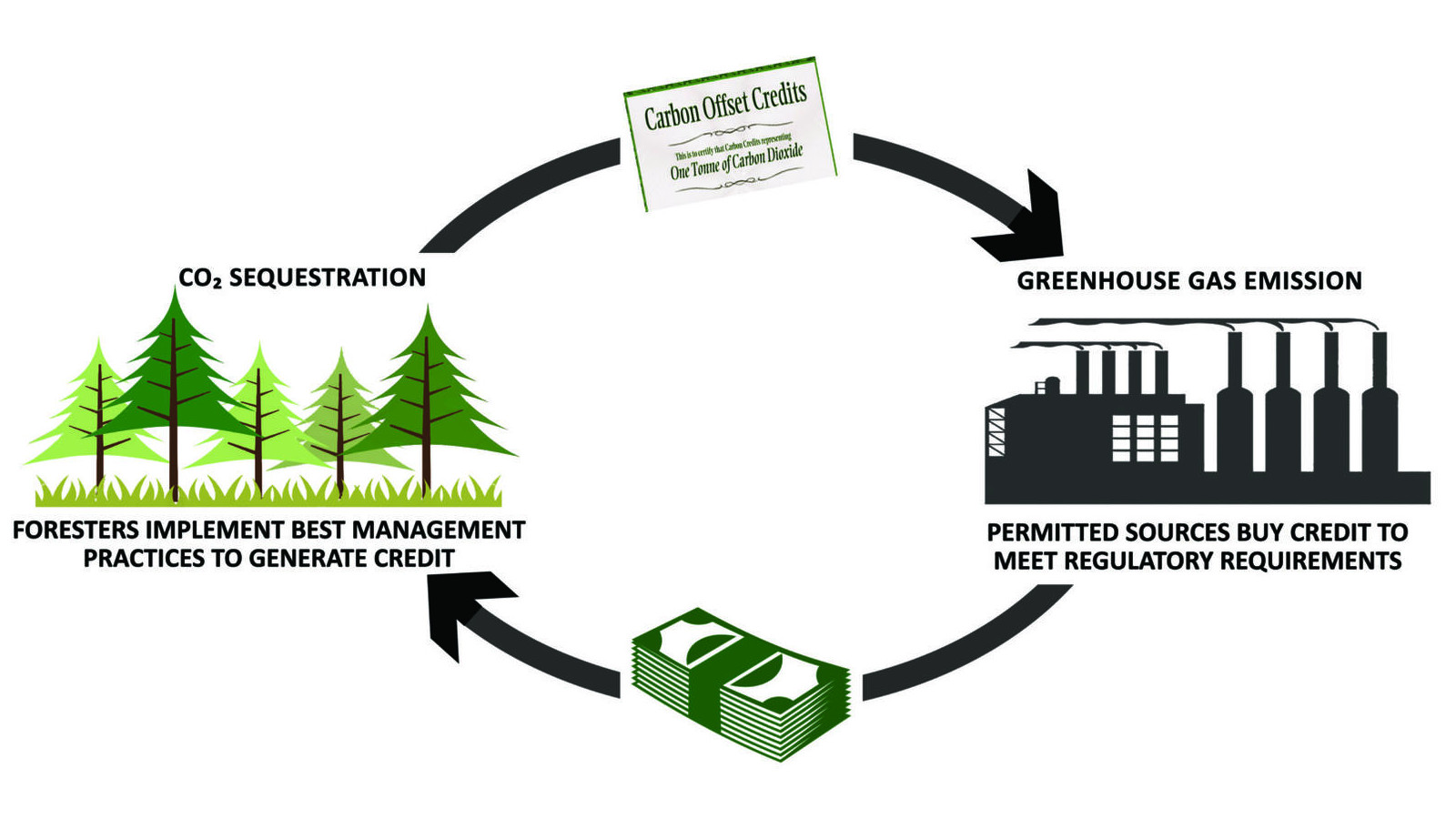

Carbon-Trading Greenwashing

Given the very low cost for carbon certificates, the family office disqualified #carbontrading. As while someone else does the impact, the buyers are not really motivated to change their own processes. #minimizeyourcarbonfootprint without cheating the family office put their demand for true impact investments.

Given the very low cost for carbon certificates, the family office disqualified #carbontrading. As while someone else does the impact, the buyers are not really motivated to change their own processes. #minimizeyourcarbonfootprint without cheating the family office put their demand for true impact investments.

While it helps to use carbon certificates to fund i.e. reforestation and other sustainable developments, it is vital to make those certificates so expensive, that they no longer work for the dinosaur industries as a means to greenwash instead of transforming their processes to sustainable levels.

Aside the problem that some industries can not produce completely clean. Movement is Energy. And I think about i.e. steel mills, who simply need a lot of energy. Just like aviation, if we truly want to get it away from fossil fuels. There is no “energy free” movement.

So instead of carbon trading in a one-size-fits-all approach, carbon trading must only be allowed inside an industry. And instead of selling of indulgences, targets for each industry must be defined, with credits for the respective R&D (research & development) investments. The reference value always being like 90% of the best-case. So if i.e. a steel mill heats with coal instead of hydrogen, but (green) hydrogen cooling is available, they will have to pay the offsets into R&D. Own or elsewhere.

Tech Greenwashing

While I do understand “Tech” to be part of the solution, given the Sustainability-Energy Dilemma the #greenwashing is especially strong in that market. That is especially true I’m afraid for the fashion-investments in blockchain or cryptocurrencies. How common Tech Greenwashing is, the Ritossa Family Office Summit in Monaco showed. Main topics being Crypto Currencies and Block Chain – even speakers at the events questioning their “sustainability”.

While I do understand “Tech” to be part of the solution, given the Sustainability-Energy Dilemma the #greenwashing is especially strong in that market. That is especially true I’m afraid for the fashion-investments in blockchain or cryptocurrencies. How common Tech Greenwashing is, the Ritossa Family Office Summit in Monaco showed. Main topics being Crypto Currencies and Block Chain – even speakers at the events questioning their “sustainability”.

Don’t get me wrong here. I am active in the Global Impact Tech Alliance (GITA) and the Greentech Alliance (GTA). And technology is a major part of the airline industry. Plan A, leading the GTA even called to sign a Petition Against Greenwashing on Change.org. But.

It is very common that “tech” claims to be “impact investment”, but in most cases, they fail to deliver on that claim. Raisin’ picking and misinterpreting “impact” to make their own efforts “green”. Mostly I’m afraid that is intentional, some is cognitive dissonance resolution. A general quick solution to verify the real impact is the question of the net power demand, short- term and on a 10-year scale?

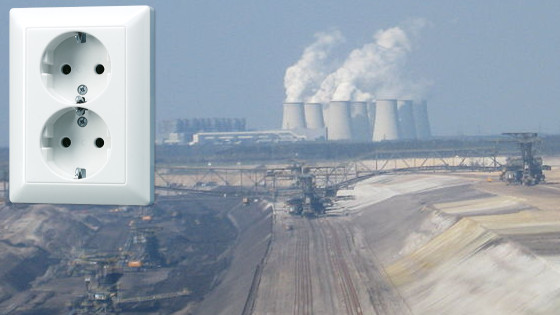

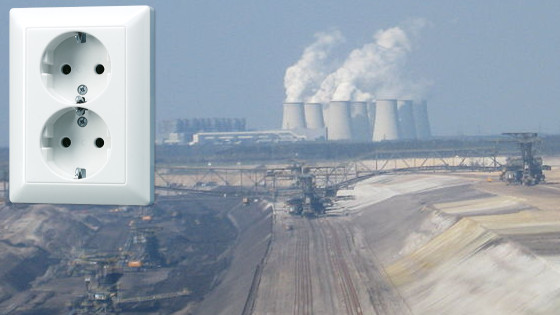

Electricity Greenwashing

Aside the data centers. What infrastructure is needed to distribute the energy? For mobility. Electric cars or aircraft? The large container ships? Addressing this in the Sustainability-Energy Dilemma article, this is a major mix between cognitive dissonance, lip services and greenwashing.

And when we talk about electricity infrastructure. Let’s talk about rural regions. Coal or gasoline comes “packaged”, buffered. You can fill your car and drive when needed. This week we discussed nuclear energy, Italy just reconsiders. There are also mini-reactors that produce less energy but also said to have no risk of a nuclear runaway. Especially for airports or steel mills, that could be interesting? Transmutation also a possible solution to reduce radioactivity and the amounts of radioactive trash? Transmutation reactors also generating energy.

And again. Where does all that electric energy come from? How do you buffer it? A lot of answers we need. And while we will need to solve the Sustainability-Energy Dilemma we need to think outside the box. To avoid Greenwashing.

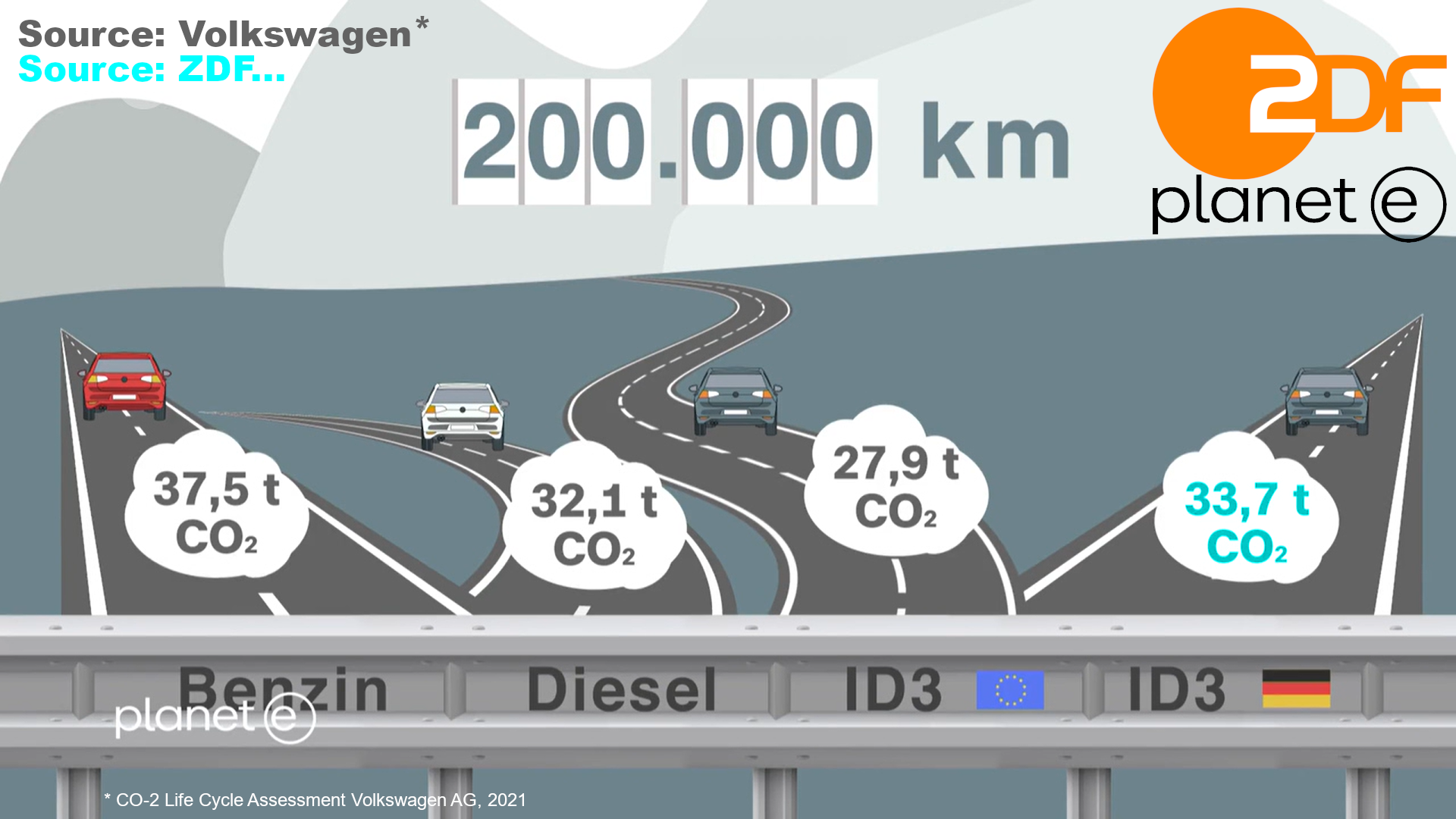

e-Mobility Greenwashing

There was an interesting documentary questioning e-Mobility. Given a life-cycle assessment by Volkswagen themselves only showed electric cars slightly better than Diesel, giving favorable “interpretation” of energy sources. Taking instead the German energy mix, the result was actually worse than Diesel and still only marginally (10%) less than a classic fuel-powered car. Now let me come back to SynFuel. Or hydrogen or fuel cells. Though they didn’t compare to those.

There was an interesting documentary questioning e-Mobility. Given a life-cycle assessment by Volkswagen themselves only showed electric cars slightly better than Diesel, giving favorable “interpretation” of energy sources. Taking instead the German energy mix, the result was actually worse than Diesel and still only marginally (10%) less than a classic fuel-powered car. Now let me come back to SynFuel. Or hydrogen or fuel cells. Though they didn’t compare to those.

This again is in line with the response I got from the German Research Institute for the Energy Industry (ffe.de), one of the influential lobbying groups, simply assuming energy import for large industries like aviation. Blinders. And in my opinion intentional greenwashing.

Aside the issue to have the energy infrastructure not set up in the rich industrial states, but what about poor countries. Gasoline (or synfuel) is easy to distribute. And even in the rich countries, the sheer amount of green energy needed exceeds the capacities for years to come. So take off the blinders that narrow your look and think globally. Else, it’s greenwashing!

Air Taxi Greenwashing

Lilium, Volocopter, promotes the positive impact of their electric (or hydrogen) air taxi. One billion Euro invested into Lilium so far and no prototype jet. But there are many concerns, and not even touching air traffic control when people use air taxi to fly to the airport, the operational challenge was recently addressed by McKinsey. Another nice summary on Air Taxi on SimpleFlying. Another issue addressed recently was the question of the energy per passenger kilometer. As it is rather ineffective to fly VTOL (vertical Take-Off and Landing). Which brings us back to the Sustainability-Energy Dilemma.

Lilium, Volocopter, promotes the positive impact of their electric (or hydrogen) air taxi. One billion Euro invested into Lilium so far and no prototype jet. But there are many concerns, and not even touching air traffic control when people use air taxi to fly to the airport, the operational challenge was recently addressed by McKinsey. Another nice summary on Air Taxi on SimpleFlying. Another issue addressed recently was the question of the energy per passenger kilometer. As it is rather ineffective to fly VTOL (vertical Take-Off and Landing). Which brings us back to the Sustainability-Energy Dilemma.

Aside my telling that I expect those Air Taxis to be more a solution for very rural areas, if we find a way to get the energy there. For the rich and mighty. More like replacing helicopters, be it the ones in New York or in Siberia. But as McKinsey questioned, it’s hardly imaginable, how that should work with thousands of air taxis roaming cities skies.

But very ineffective to conserve energy, for which an Air “Bus” (not Airbus) would naturally be more effective. As we must get away from all that “individual transport” to a public and mass transportation system. All else in my opinion is greenwashing.

Short Term Thinking

Given the sheer scale of the Sustainability-Energy Dilemma, any quick impact is naturally having a limited real impact. To transform entire industries like transport, still mills and other raw materials processing or develop vertical farming into an industrial size scale? Develop alternatives to meat is one side, to change habits like our eating is another (for birthday or other treats I love to visit the local steak house).

Given the sheer scale of the Sustainability-Energy Dilemma, any quick impact is naturally having a limited real impact. To transform entire industries like transport, still mills and other raw materials processing or develop vertical farming into an industrial size scale? Develop alternatives to meat is one side, to change habits like our eating is another (for birthday or other treats I love to visit the local steak house).

And Earth is rather inert. It will take time until our changes will create an impact on a global scale.

And Earth is rather inert. It will take time until our changes will create an impact on a global scale.

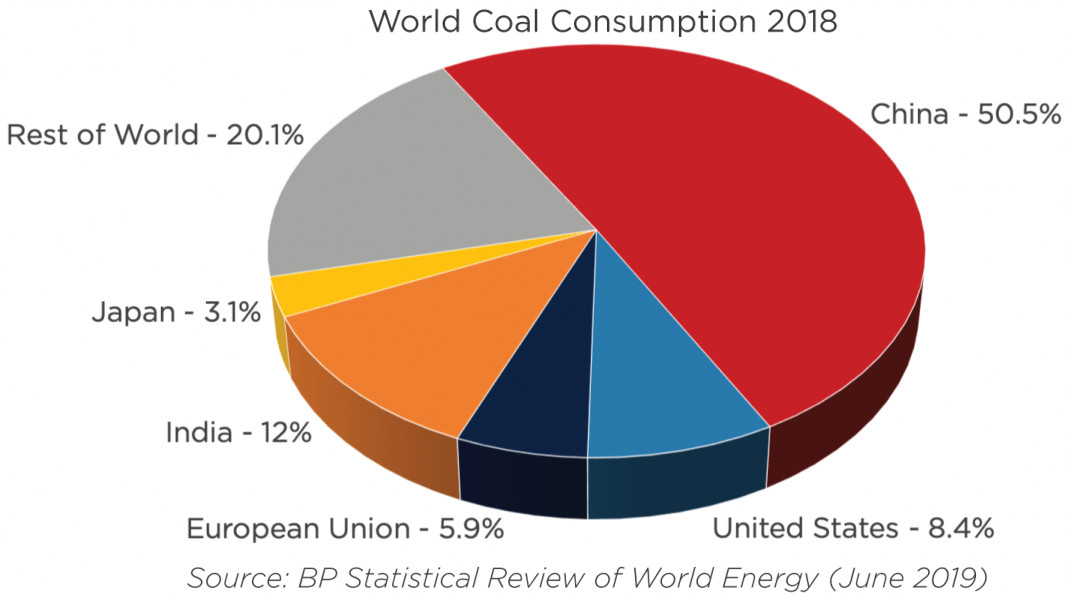

To make it worse we have countries (like China) and industries, that keep stalling. China for example just recently announced they won’t produce any more coal power plants elsewhere, but won’t make a change before 2030 … that is nine years and a lot of time to reconsider. And right now, 50% of the coal CO2 is generated in China. Greenwashing. And this is not just China.

Nor Germany or Europe, where I also see a lot of lip-services and greenwashing.

… or Long Term Green?

So thinking long-term, a look again at Kolibri. Is it impact or greenwashing? At short outlook, we’d be more greenwashing. While we plan immediate investments in one of the poor regions of Europe, developing not just a company, but an entire region, our plans involve 6-7 million liters of kerosene per year. But replacing that much kerosene requires energy. And not simply “some” energy, but sustainable!

So thinking long-term, a look again at Kolibri. Is it impact or greenwashing? At short outlook, we’d be more greenwashing. While we plan immediate investments in one of the poor regions of Europe, developing not just a company, but an entire region, our plans involve 6-7 million liters of kerosene per year. But replacing that much kerosene requires energy. And not simply “some” energy, but sustainable!

Just like established airlines. So while we do some things on the other SDGs, the most important one, climate, we fail too. Initially. Though initially, built on unique selling propositions (USPs), we start profitable from the outset. And then we have long-term plans and commitments. And given our 10-year commitment to develop a fleet operating on green synfuel … in my understanding, that is what makes us a real impact investment. Though we would likely fail on “ESG” or other petty boxes.

For aviation alone we will need hundreds and thousands of terawatts of “alternative” energy if we want to replace fossil fuels. That is rather independent of the replacement, be it hydrogen, electric or synfuel. Because you can’t replace the energy from the fossils with something “energy-free”. So where does the energy come from? Not from the wall-jack.

What About Plastic?

80 million tons of plastics are in the oceans. And if we don’t change, this will become more than 200 million tons by 2040. There are enough reports on the web. Look i.e. for The Great Atlantic Garbage Patch (or Pacific or …). And those are not new, but also stuff like Ocean Cleanup efforts must be very long-term and come with negative repercussions. Another example for the proverb that the road to hell is paved with good intentions.

80 million tons of plastics are in the oceans. And if we don’t change, this will become more than 200 million tons by 2040. There are enough reports on the web. Look i.e. for The Great Atlantic Garbage Patch (or Pacific or …). And those are not new, but also stuff like Ocean Cleanup efforts must be very long-term and come with negative repercussions. Another example for the proverb that the road to hell is paved with good intentions.

But can we replace plastics with other materials? There was a report about Coca-Cola’s transformation from the largest global bottle recycler to the largest global plastic poluter. And fact: Swimming off the Albanian coast, I saw too much plastic swimming whenever I went into the sea. Including a Coke-bottle every now and then! Do we need to pack bananas or cucumbers in plastic? Really?

And just a reminder, plastics are mostly created from crude oil. And my friends from The Concept develop sustainable packaging for many years, not just since it recently becomes fashionable. Then I pick up a coffee at McDonalds and they deny to use my reusable coffee mug but demand to give me their plastic coated coffee cups with a plastic lid. So again, it’s mostly about greenwashing and lip services!

The Truth About Impact Investing

In my discussion with the family office, I questioned “impact investing” as mostly greenwashing. Receiving rather enthusiastic approval.

In my discussion with the family office, I questioned “impact investing” as mostly greenwashing. Receiving rather enthusiastic approval.

And I received more support from other sides for the assessment that we need industrial scale investment to truly make a change. It’s a generational challenge. One we can’t go alone, but we need to join forces. And there are simply too many green associations and other intermediaries that all target the same, but not joining forces. In turn, not able to address the big picture, but looking at their small piece of the puzzle, competing for the same startups and investors.

So is it all about greenwashing? Or are we having a chance for some real change?

Food for Thought

Comments welcome!