Last week it started with a analysis by the German Association for Environment and Nature (BUND), hitting the headline news claiming that seven of the 14 regional airports in Germany would be expendable. Which was a welcome story for the media. While I still hope that they come to senses, I am afraid that history shows their sole focus on populism (next election) and hypocrisy. Including their attempts to distract from their failures managing the ongoing Corona crisis.

Last week it started with a analysis by the German Association for Environment and Nature (BUND), hitting the headline news claiming that seven of the 14 regional airports in Germany would be expendable. Which was a welcome story for the media. While I still hope that they come to senses, I am afraid that history shows their sole focus on populism (next election) and hypocrisy. Including their attempts to distract from their failures managing the ongoing Corona crisis.

More articles and posts surfaced this week that airports should be privatized.

Focus on votes reminds me too much on “shareholder value”, being accused to have a sole short-term profit-maximization interest and none for long-term success, sustainability or social responsibility. Same stupid.

Today the headline news is about the Thuringian president of their Court of Auditors recommending the closure of Erfurt-Weimar Airport, building on the above analysis.

Closing Erfurt-Weimar Airport? And others Regionals?

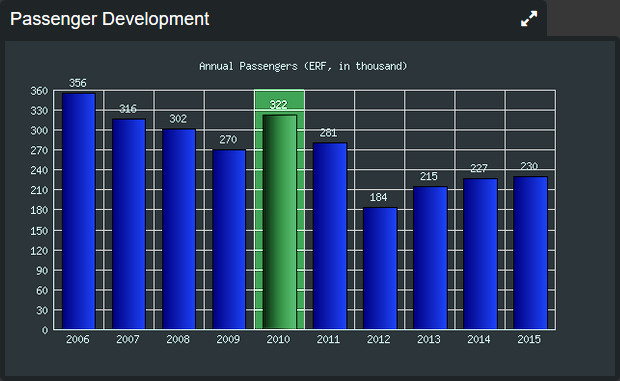

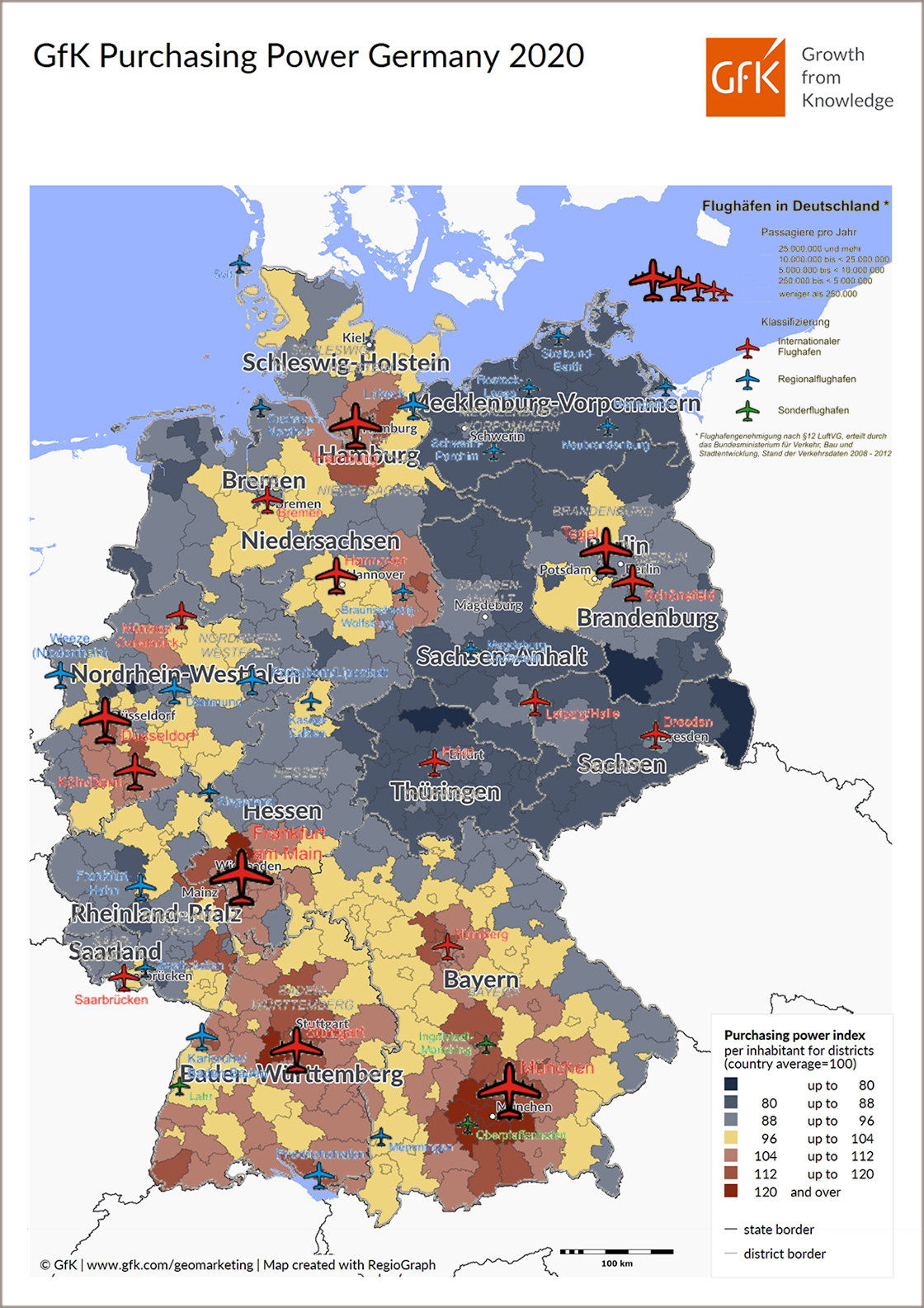

As you may recall, 2009/10, I’ve been managing Marketing, Press/P.R. and Corporate Communications at the Erfurt Airport, one of the seven now questioned. Which is my example of why German airports fail thanks to populistic airport bashing by the local politicos and most of the media. And an idiotic, short-sighted focus on “outgoing” holiday charter flights. I am adamant about my justified opinion that given a positive support and strategy, the airport would be worth a million passengers and an economic operation. If they’d cash in on incoming.

As you may recall, 2009/10, I’ve been managing Marketing, Press/P.R. and Corporate Communications at the Erfurt Airport, one of the seven now questioned. Which is my example of why German airports fail thanks to populistic airport bashing by the local politicos and most of the media. And an idiotic, short-sighted focus on “outgoing” holiday charter flights. I am adamant about my justified opinion that given a positive support and strategy, the airport would be worth a million passengers and an economic operation. If they’d cash in on incoming.

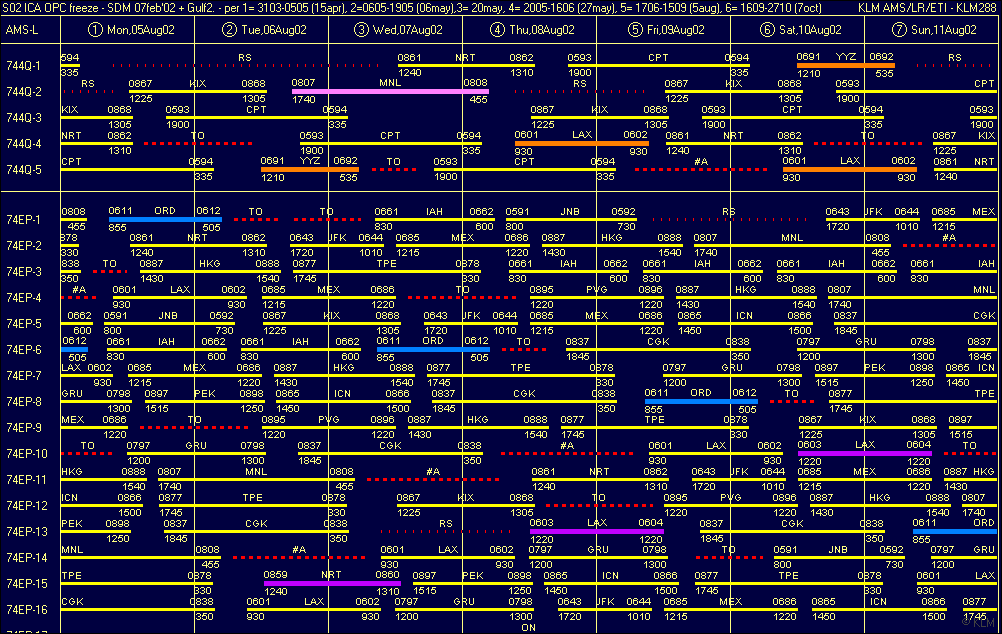

Back 10 years ago that was the reason I made the name change from Erfurt to Erfurt-Weimar possible from Marketing budget. Just before the shortsighted politicos – lead by then Minister for Traffic (“C.C.”) who saw it more important to invest into streets and highways – decided to “strategically” end all support for scheduled flights, which I had recommended to replace Munich-service with a sole Lufthansa- but without Star Alliance codesharing, with a KLM-service to Amsterdam to be connected to the world. With having compiled justification and statistical data supporting the case.

As I wrote three years ago, airports must embrace their changing role – which many airport managers and owners fail upon. And that is simply another example where the Corona crisis highlights the shortcomings. These shortcomings have been there before. We have too many “good weather managers” that keep running a company (beyond just airline, airport) and have no vision for it, no strategy. They handle day-to-day work and live inside their microverse without understanding or concern about the bigger picture.

As I wrote three years ago, airports must embrace their changing role – which many airport managers and owners fail upon. And that is simply another example where the Corona crisis highlights the shortcomings. These shortcomings have been there before. We have too many “good weather managers” that keep running a company (beyond just airline, airport) and have no vision for it, no strategy. They handle day-to-day work and live inside their microverse without understanding or concern about the bigger picture.

Should they now close Erfurt-Weimar (or either of the other questioned airports), it is a direct result of the local stakeholders failing to envision, demand and support a long-term sustainable strategy for the airport. And giving the public airport bashing by the stakeholders, I wouldn’t justify scheduled flights to Erfurt-Weimar either. It’s an example how short-sighted stakeholders run an economic driver into the ground. And just an example how politicos don’t think and guide, but brainlessly worship an implied public (voters) opinion and not act but only react to developments (incl. Corona).

CYA in action: Cover Your Ass. Don’t think, don’t move, don’t risk.

Strategic Indecision and Short Sight

As I’ve written in the two Food for Thoughts in December, there is the Financial Impact of Air Travel for the regions and their economy. If you understand and focus on the need for “incoming”, passengers coming into the region, bringing money to the region. Instead of the sole “outgoing” focus we see with most airports in the “developed countries”. And without this, there is no valid argument to invest into the airport, is there? But with a strategy, it makes sense to invest. Not to subsidize!

The other post in December was about Why Airlines Keep Failing, which is mostly the same reason why airports keep failing to live up to their expectations. No strategy, no stakeholder management (politicos, industry, media, public opinion, etc.). Erfurt-based Thuringian state development agency funding travel for delegations from Berlin, instead supporting the subsidized flights from and to Erfurt. Politicos publicly promoting to travel to Erfurt and Thuringia flying from Frankfurt, Berlin or Leipzig, then taking the train. And even with a Biathlon World Cup taking place in Thuringian Oberhof, places like Weimar, Eisenach and the Thuringian Forrest recreation are, travel to Thuringia not coming through Erfurt in their empty heads.

Scheduled Incoming vs. Charter Outgoing

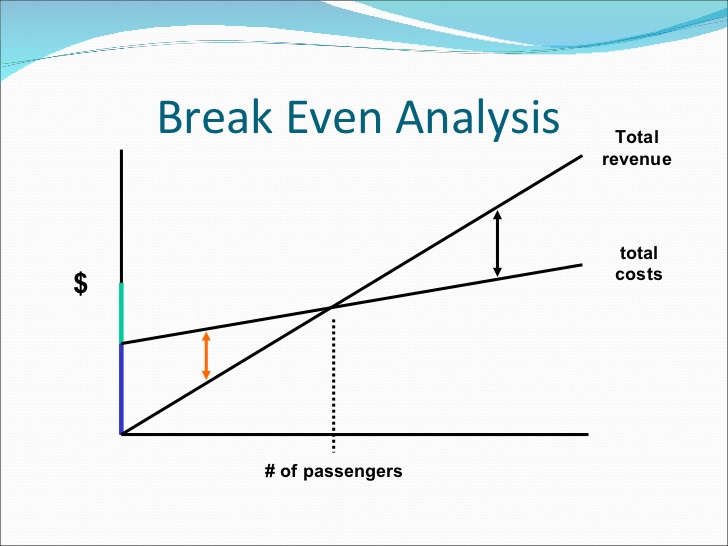

Again ,there is no reasoning to invest into an airport that only looks at outgoing summer charter flights. The money leaves the region and benefits the destination. Why would I subsidize that?

Again ,there is no reasoning to invest into an airport that only looks at outgoing summer charter flights. The money leaves the region and benefits the destination. Why would I subsidize that?

Without a strategic vision to use an airport incoming as an asset to connect the world to the region and cash in on the incoming air travel, it is a logical consequence to shut down an airport and write it off. In turn, you write off an asset for your region. If I call anything short sighted, this is a very good use case.

I keep explaining “seasoned airport managers” that airports need three foci.

- Connection with the global hubs and connectivity there

At Erfurt, it was a barrel burst to have a flight into Munich by Cirrus Airlines as “partner of Lufthansa”, but with only some Lufthansa code-share, but not even Star Alliance. It was why I very quickly promoted to replace that one with a KLM-Amsterdam-service. With very promising talks ongoing until the political stakeholders decided to shelve all support for scheduled flights. A good reason to end my work there. Aside me being told later that the discussions ceased as they called my number, reaching someone not able to communicate in English.

So connectivity to global hubs with code-sharing and/or interlining must be prime on any regional airport’s agenda. - Strategic Point-to-Point travel

Depending on commercial and strategic regional relations, direct flights between economic partner regions can and should be established. - Local Support

With “airport bashing” being too common, it is vital to promote the airport as a partner for the region. As a vital infrastructure to improve commerce and industry, incl. but not limited to tourism!

And yes. Summer charter flights are nice to have, and may contribute to the revenue, but they are commercially and strategically not a priority.

The Kolibri Offer

KOLIBRI.aero is looking for funding of the development of first and further bases. With seven aircraft, maintenance, infrastructure and several hundred jobs a € 15 million funding is needed. No subsidies but a bold investment with minimized residual risk, to be paid back with interest. Investment into local infrastructure will reflect long-term commitment. Further development of profit centers being part of the plans. Should you know airports being interested in such a joint development having regional funds to provide the capital but also demand for the new routes, we are happy to discuss details.

Food for Thought

Comments welcome!

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Computer Literacy

Computer Literacy Cloud Computing

Cloud Computing Aircraft System Redundancy

Aircraft System Redundancy Faith in The Computer

Faith in The Computer Fly by Wire, Drones and Air Taxis

Fly by Wire, Drones and Air Taxis A similar case is the automated drones as envisioned by Amazon, DHL and others, for automatic passenger delivery. As the air taxis, they will rely on a fully-automated flight planning and flight plan filing with the authorities’ computers. Simply to avoid in-air-collisions.

A similar case is the automated drones as envisioned by Amazon, DHL and others, for automatic passenger delivery. As the air taxis, they will rely on a fully-automated flight planning and flight plan filing with the authorities’ computers. Simply to avoid in-air-collisions.

So let me quickly adjust Ged’s numbers.

So let me quickly adjust Ged’s numbers. Now comes Ged’s mistake, a rather common one, the “inside-out” look.

Now comes Ged’s mistake, a rather common one, the “inside-out” look.

Which triggers the other issue. At the

Which triggers the other issue. At the

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

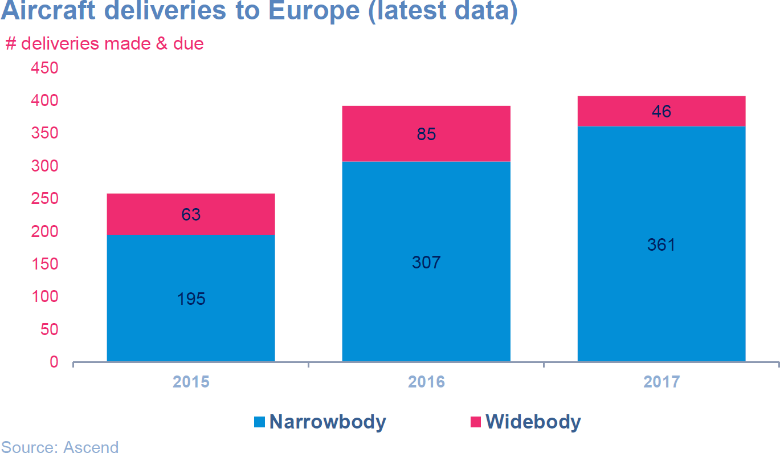

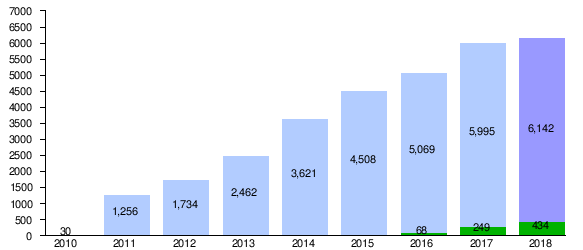

Now all those airlines have operated Airbus A320 and/or Boeing 737. An aircraft in surplus, a saturated market, flooded not only by the aircraft makers but also by lease offers from the low-cost airlines seeking utilization for their own surplus. And while everyone wants aircraft in summer, the eroding revenues do not pay enough for those airlines to survive the winter. I learned so long ago, an ice cream shop needs to create enough revenue to survive the winter.

Now all those airlines have operated Airbus A320 and/or Boeing 737. An aircraft in surplus, a saturated market, flooded not only by the aircraft makers but also by lease offers from the low-cost airlines seeking utilization for their own surplus. And while everyone wants aircraft in summer, the eroding revenues do not pay enough for those airlines to survive the winter. I learned so long ago, an ice cream shop needs to create enough revenue to survive the winter.

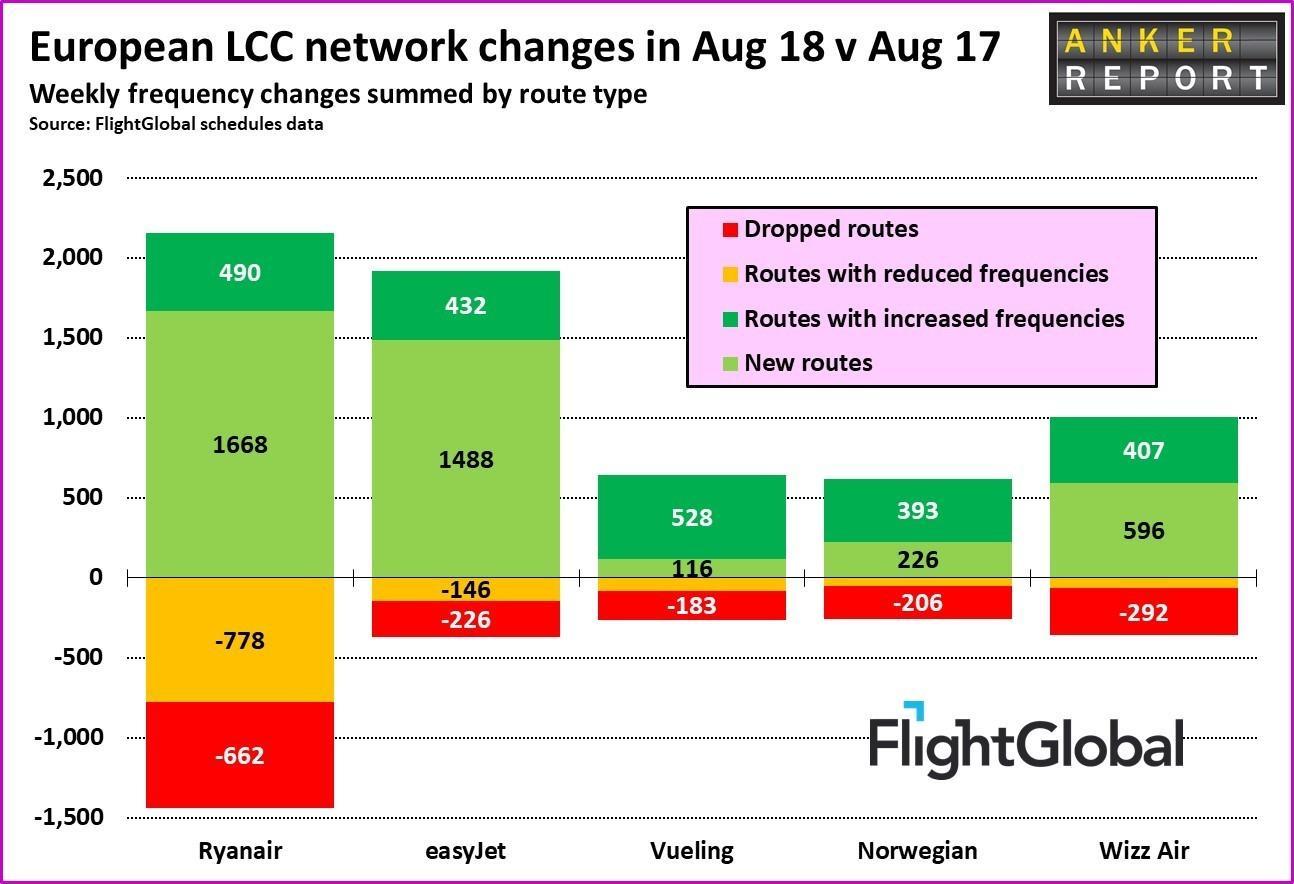

Then we come to the flight crews. While pilots usually are either type-rated on the Airbus A320-family or Boeing 737-family, a mixed Boeing/Airbus-fleet either requires respective crews for each aircraft or the cross type-rating. While pilots usually pay for their flight training, in return, they require high salaries in order to pay off for their – substantial – investment. Even Ryanair now faces the consequences of their “outsourcing” and slave-kind payments of their pilots. While I keep seeing their pilots recruiters immediately jumping on Primera Air but also trying to convince pilots from South America or Asia, if they don’t change their attitude to their pilots, they will keep having problems. Their recent announcement to close the base in Bremen and Eindhoven and reduce the base in Weeze are simply puffing. As Ralph Anker showed in his

Then we come to the flight crews. While pilots usually are either type-rated on the Airbus A320-family or Boeing 737-family, a mixed Boeing/Airbus-fleet either requires respective crews for each aircraft or the cross type-rating. While pilots usually pay for their flight training, in return, they require high salaries in order to pay off for their – substantial – investment. Even Ryanair now faces the consequences of their “outsourcing” and slave-kind payments of their pilots. While I keep seeing their pilots recruiters immediately jumping on Primera Air but also trying to convince pilots from South America or Asia, if they don’t change their attitude to their pilots, they will keep having problems. Their recent announcement to close the base in Bremen and Eindhoven and reduce the base in Weeze are simply puffing. As Ralph Anker showed in his

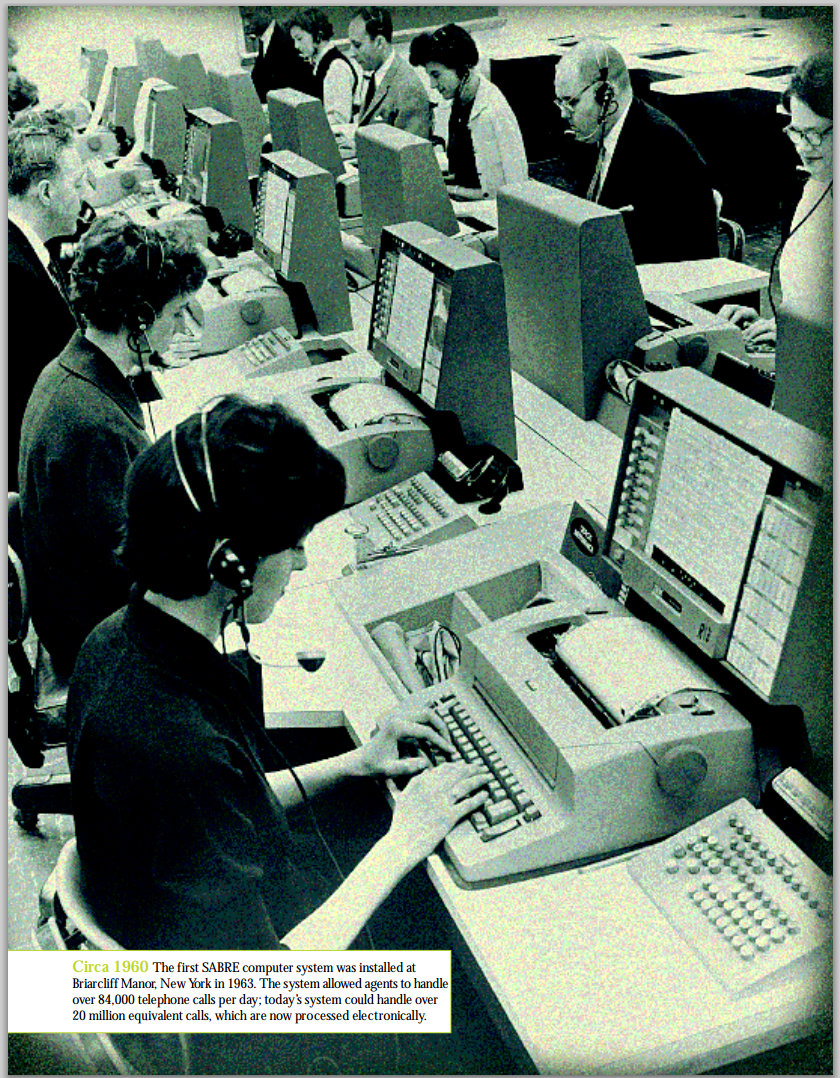

Clear as can be, there is no “software panacea” either. In North America, the closest thing in my experience is

Clear as can be, there is no “software panacea” either. In North America, the closest thing in my experience is

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in  Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.”

Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.”

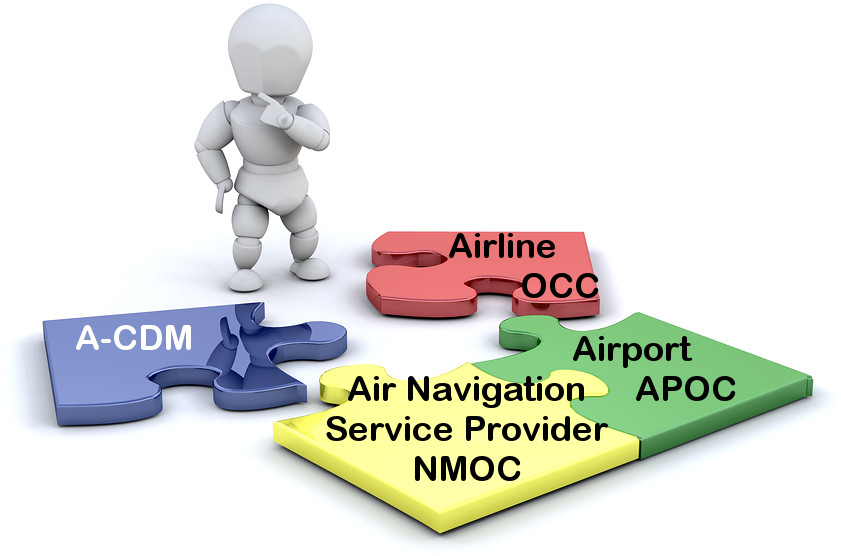

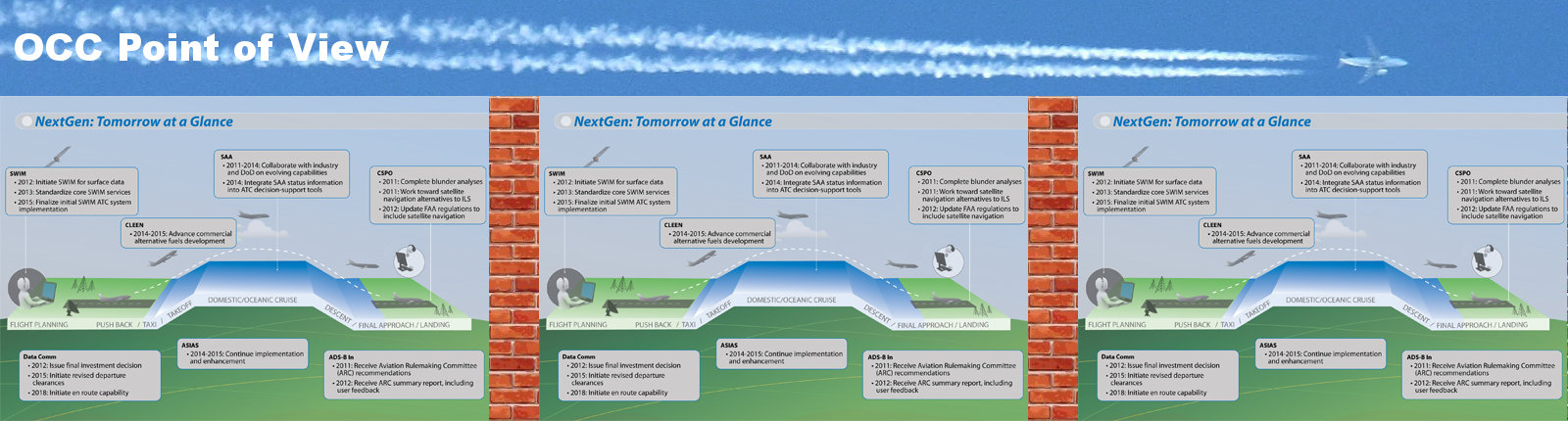

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket!

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket! In 2014 I wrote

In 2014 I wrote  And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.

And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.