Two (good) articles today about the riskiness of starting up an airline and the comments they got shared with, triggered some controversial thoughts with me.

The Articles + Comments

OAG summarized on the Evolution of airlines since 2019 (just before the Pandemic) to today. While their findings are very interesting, there is a tone in the summary and a resulting summarization by Tim (someone I generally value) that I happen to disagree with. OAG’s John Grant wrote:

OAG summarized on the Evolution of airlines since 2019 (just before the Pandemic) to today. While their findings are very interesting, there is a tone in the summary and a resulting summarization by Tim (someone I generally value) that I happen to disagree with. OAG’s John Grant wrote:

“Airline start-ups are incredibly difficult, cash rapidly disappears and securing the necessary operating licences frequently takes longer than expected and that’s even before sourcing aircraft, securing slots, avoiding the competition, and building all the necessary reservations systems and back-office support functions.”

And Tim shared the full post with a comment: “OAG is a great data resource for large scale review and schedule activity. This data really doe strike a chord. Airlines are a very risky business. This is very illustrative.”

The other one was an analysis by McKinsey, checking on the aviation value chain’s recovery shared by Patrick, which he introduced with these words: “McKinsey & Company has done an interesting analysis of the aviation value chain. For each subsector, they’ve calculated the “economic profit”, meaning (return on invested capital – weighted average cost of capital) x invested capital. In other words, are firms in that sector creating or destroying value? Their conclusion: only fuel suppliers and freight forwarders created value last year, and airports and airlines lost a lot!”

The Economist’s (My) Response

As an economist by original education and having experience with Startups and Business Angels, I do happen to believe in a sound “business case”. As an airliner, I learned with American to focus on the business case. Like to reconsider twice before approving any waiver on fare rules or trying to upsell to the more expensive (i.e. more flexible) air fare. But I also learned the value of a renowned brand (AA) and service. Or to treat your colleagues as your most valuable customers – they help you sell each and every day. And can ruin a customer relation as quickly.

As an economist by original education and having experience with Startups and Business Angels, I do happen to believe in a sound “business case”. As an airliner, I learned with American to focus on the business case. Like to reconsider twice before approving any waiver on fare rules or trying to upsell to the more expensive (i.e. more flexible) air fare. But I also learned the value of a renowned brand (AA) and service. Or to treat your colleagues as your most valuable customers – they help you sell each and every day. And can ruin a customer relation as quickly.

In “global fares training”, I learned the cost of a flight transfer, something that I never forgot; thanks Ruth King (our fares trainer), I will never forget you.

At Northwest Airlines, I learned that airlines and their managers just sold “cheap”. With full flights in summer season, the airline generated losses on the transatlantic flights. A lesson I’ve seen later over and again. Most sales staff had neither information, nor idea about the “yield” they had to generate to fly profitable. Northwest focused on a minimum yield (revenue per seat-mile) half of that of American. Then sold at that yield as the standard “special fare” and making group offers or “reseller-rebates” below that rate aplenty. As I summarized 2019 on my article about why airlines keep failing, “know your cost”.

Yes, talking about Why Do Airlines Keep Failing. It’s the same response I have on the above two mentioned articles. And many like them. At ASRA 2008, I emphasized brand faces. But I also told those brand faces – the airline sales managers – that they are not there to sell the cheapest price. Anyone can do that, the Internet lives of that. A real sales manager understands that they have to sell the high-end tickets.

Live story, also happened today. Qatar Airways passengers (mother and three kindergarden-aged kids) arrived with >18 hour delay in Düsseldorf. German Rail (clerk) sold tickets to the customer to pick up the passengers that are neither change- nor refundable. So they had to buy completely new (expensive) tickets. A good clerk of this company renowned for it’s unpunctual trains (<60%) would have mentioned the possibility of a flight delay and sold the slightly more expensive tickets that allow for a change. Or at least the optional insurance.

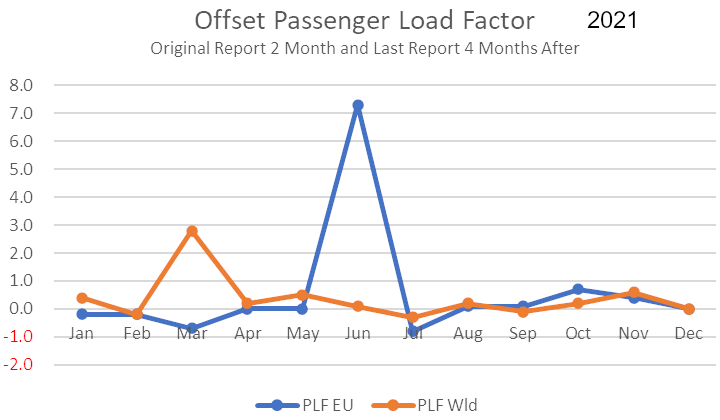

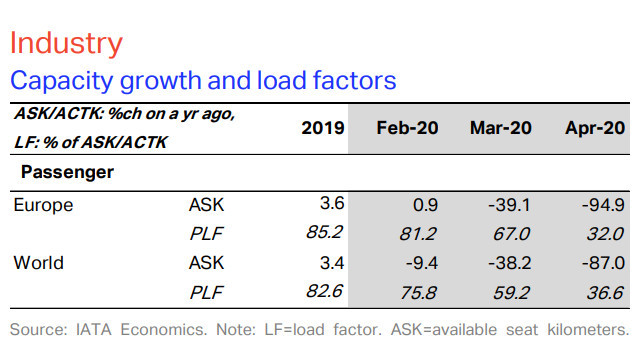

So thinking back to my experiences with Northwest and other such airlines, it’s my questioning about KPIs as well. If my KPI is load and not revenue, I must expect to loose money. It remains beyond me, why airlines offer connecting flight at what a rough calculation on Ryanair or easyJet CASK/CASM (cost per available seat km/mile) proves as below cost, even without the “stop en-route” (landing fees, complexity, etc.). Those are managers who had a nap, when their tutors talked about sound economical calculation? And I keep questioning, why airlines publish loads without revenue per seat. To date, we have hundreds, if not thousands of flights every day, that fly full but loose money. All this is confirmed by the above mentioned and many other such articles.

The Fairy-Tale of Loss Making Airlines

To claim “aviation” is a loss making business is true and can’t be further from the truth.

To claim “aviation” is a loss making business is true and can’t be further from the truth.

Yes, many airlines are loss making. And it fits the common reasons I elaborated before. And yes, you can make airlines very profitable, if you have a management that thinks just a bit outside the box and applies economic rules to their modus operandi (mode of operation). But this also goes in line with route development and other areas. If you don’t have your numbers under control and focus on the ones that are “good to sell to shareholders”, you’ll fail.

Like with any company, with any startup, in and outside the aviation sphere, we must constantly have an understanding of our cost. And of the competition. What is it our customer wants? There is a psychological price. If you missed that in your economics studies, make your Internet-search for it now. If you have sales teams, train them to upsell the seats. Sell the higher yield fares. Not at a discount, but at a value!

This is one reason, I do not believe we can make Kolibri ever happen by taking over an already failing or failed airline. Wrong structures, wrong thinking in place. I learned this lesson with Air Berlin. The force of inertia was simply too strong. There are some airline that make revenue, but even their managers I find often blindly “follow the worms” (a Pink Floyd referral, yes, the picture is lemmings).

This is one reason, I do not believe we can make Kolibri ever happen by taking over an already failing or failed airline. Wrong structures, wrong thinking in place. I learned this lesson with Air Berlin. The force of inertia was simply too strong. There are some airline that make revenue, but even their managers I find often blindly “follow the worms” (a Pink Floyd referral, yes, the picture is lemmings).

(That’s) The Way Airlines Operate

But unfortunately, all investors we talk to, always think inside their boxes. Can’t tell how many talks I had to radically change our approach and take A320 and do like everyone else does. Ain’t that contrary to the concept of Unique Selling Propositions?

And has ever a “disruptive investment” (another investor buzz word) been developed out of the box using the same thinking? The same values (I’m the cheapest)?

The others are usually starting to tell you that you have to start with smaller amount of money. Sure way to burn your money is a cheap business plan. As OAG writes “getting to size is so important”. You can’t produce a low cost in small numbers. For us, the ideal mix is seven aircraft, where the “administrative overhead cost” becomes manageable. i.e. You have the same cost if you maintain one – or seven aircraft. The same reservations office (just less staff and calls), only little less marketing. You must outsource your operations (at cost) to share the necessary organization with other small airlines. Etc., etc.

To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

But even taking that into account, we believe the business and financial plans we developed are sound. And profitable from the outset. With a focus on services and a military-style responsibility “for ours” (no “HR” in that company), a “service-focused concept”. Everyone to pull on the same side of the rope. Yes, not starting with a dead corpse, trying to revive, adds some bureaucratic hurdles. But it allows you to think outside the box and instead of following the worms (or other airlines), to do things “right”.

So ever since I entered into the business, I learned at American Airlines under Bob Crandall how to do things right. And learned over and again that the same mistakes are made by short-sighted, narrow-minded managers. And I know all the reasoning used to distract and divert off the incompetence to operate an economically sound business. Usually, I account this as “no faith in your brand”. That then goes along with topics I mentioned before, like brand dissolution (airlines are often academic example), missing USPs, etc. – Cobalt CEO told me about their USP shortly before their demise “We are Cypriotic”. Seriously? When I started, Lufthansa was the brand. Lufthanseat was the employee. All employees of American Airlines knew “Proud to be AAmerican”. Then came the button counters. And mighty AAmerican was taken over by their once-small rival U.S. Airways. Another box of memories.

So yes, airlines are often a loss making business. With bureaucrats leading them into disaster. Sometimes fast, often times a veeeery long death. Air Berlin and Alitalia are very good examples. “Too big to fail”? Simply “prestigious”? And there are “the others”. Airlines that have an idea about what they are doing. That know their niche(s). That know their cost and marketing. That value their brand. That build a reputation. Until button counters (aka. bureaucrats) take over.

I hope that someone of my hundreds if not thousands of readers (hard to believe, that’s what my server stats claim I’d have) knows some investor with the guts to understand that profitable aviation and sustainable aviation can be the same thing. That the stories those consultancies and their statistics and reports tell have two sides to the coin. And that we get a chance to proof, that climate neutral flying is no heresy, but the future of flight.

Food for Thought – Jürgen

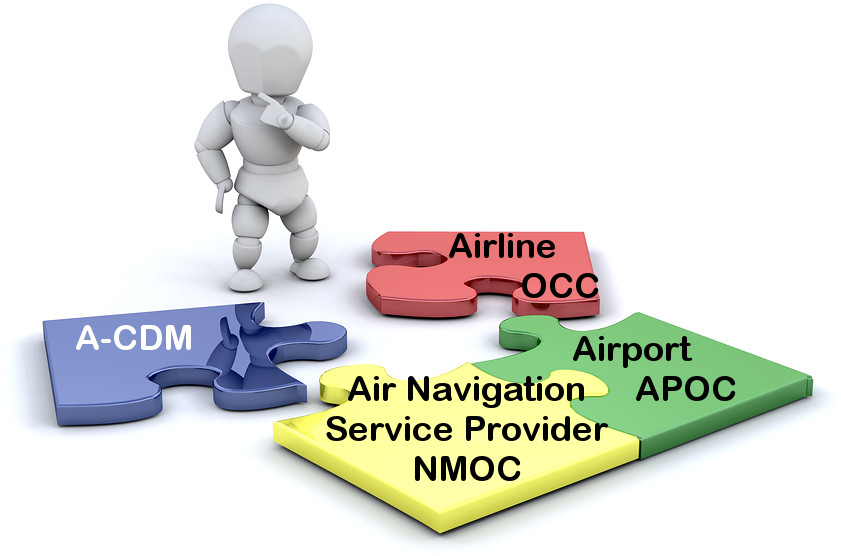

Last week, I had a lengthy phone call with an airport manager in the U.S. Snow-Belt, asking me about ideas, how to break up the silo thinking that keeps all his ideas about a common airport operations center as a basis for some A-CDM-style development from moving forward. Next winter approaching, he’s worried about repeating the past years’ experience of unnecessary delays. “The airline always knows better” he complained to me. If we offer them solution, it’s not theirs, so it’s being turned down. Communication is faulty and in crisis, everyone works on their own. #talkthetalk

Last week, I had a lengthy phone call with an airport manager in the U.S. Snow-Belt, asking me about ideas, how to break up the silo thinking that keeps all his ideas about a common airport operations center as a basis for some A-CDM-style development from moving forward. Next winter approaching, he’s worried about repeating the past years’ experience of unnecessary delays. “The airline always knows better” he complained to me. If we offer them solution, it’s not theirs, so it’s being turned down. Communication is faulty and in crisis, everyone works on their own. #talkthetalk Now give me a break. When I read this “promo” on LinkedIn, is it just me, seeing the fault in it?

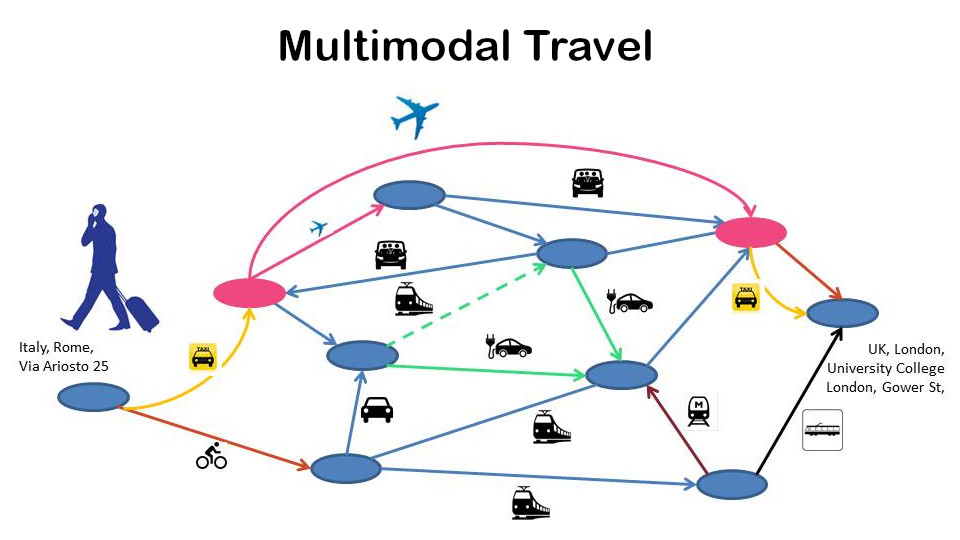

Now give me a break. When I read this “promo” on LinkedIn, is it just me, seeing the fault in it? Our vision for what was to be Cytric, that we wanted to follow, a vision not existing now, 25 years later, was to enter the home address, the destination address and the system would provide you the best travel options for you to get to the airport using car, rail, taxi, whatever, fly towards your destination and again take rail, taxi, rental car, whatever, to get to where you needed to go.

Our vision for what was to be Cytric, that we wanted to follow, a vision not existing now, 25 years later, was to enter the home address, the destination address and the system would provide you the best travel options for you to get to the airport using car, rail, taxi, whatever, fly towards your destination and again take rail, taxi, rental car, whatever, to get to where you needed to go. Speaking about Business Travel Management, we don’t need data typists any more. In the good old days, travel agents were the experts, knowing how to get the traveler from A to B, halfway (or all) around the world… Then came the GDS and the travel agents became data interfaces to the big data accessed through travel computers being connected with mighty servers. Something we call cloud computing today, using “dummy terminals”. Using codes like AN19DECFRAMIA and SS1B1M2 to search for and book a flight. Or similar complicated tools to book a rail ticket.

Speaking about Business Travel Management, we don’t need data typists any more. In the good old days, travel agents were the experts, knowing how to get the traveler from A to B, halfway (or all) around the world… Then came the GDS and the travel agents became data interfaces to the big data accessed through travel computers being connected with mighty servers. Something we call cloud computing today, using “dummy terminals”. Using codes like AN19DECFRAMIA and SS1B1M2 to search for and book a flight. Or similar complicated tools to book a rail ticket. It is why I believe we need regional aviation and we need more of it. Smaller aircraft, connecting secondary cities, offering quick and direct connection. Hubs are good for the global networks. And as I kept and keep emphasizing. Regional airports must not look out, how to get their locals out to the world. But to

It is why I believe we need regional aviation and we need more of it. Smaller aircraft, connecting secondary cities, offering quick and direct connection. Hubs are good for the global networks. And as I kept and keep emphasizing. Regional airports must not look out, how to get their locals out to the world. But to  As I approached it back in 2016/17 and shared the learning curve at

As I approached it back in 2016/17 and shared the learning curve at  An older

An older

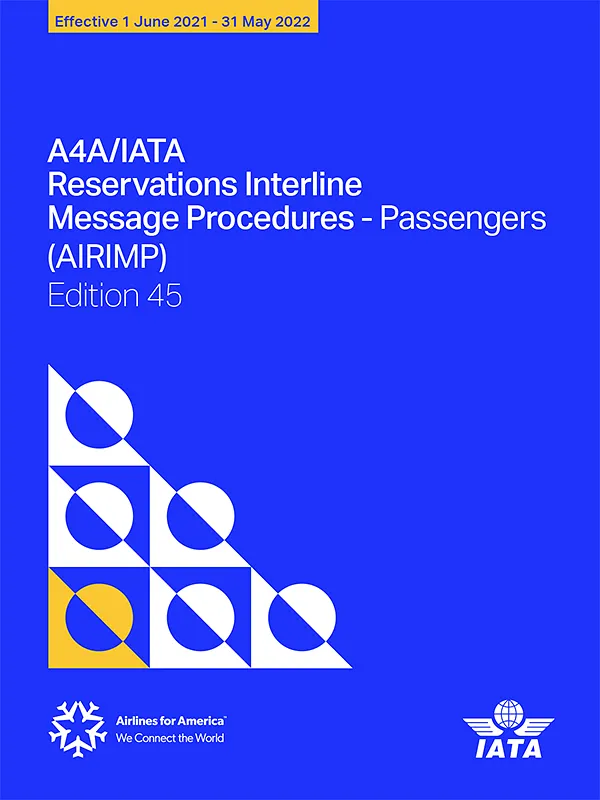

Our main problem is that our Powers-That-Be still consider themselves in a competition. Data is value, so put it in siloes. Where OpenStreetMap enabled mapping solutions, aviation data is still locked away. It takes two months until IATA publishes passenger data, after four months those numbers happen to differ substantially.

Our main problem is that our Powers-That-Be still consider themselves in a competition. Data is value, so put it in siloes. Where OpenStreetMap enabled mapping solutions, aviation data is still locked away. It takes two months until IATA publishes passenger data, after four months those numbers happen to differ substantially. Where aviation in the 1960s to -80s was a pacemaker in global eCommerce, it is now limping behind. Can tell stories about replies from industry bodies when I informed them about factual mistakes in their data. And their ignorance shown by neither directing the report to their PTBs, nor updating the faulty information. Instead of working together to develop the aviation of the future, we have conservative forces in play that hinder real development. Be that about A-CDM, data interfaces, data intelligence. We limp behind and instead of doing, we #talkthetalk.

Where aviation in the 1960s to -80s was a pacemaker in global eCommerce, it is now limping behind. Can tell stories about replies from industry bodies when I informed them about factual mistakes in their data. And their ignorance shown by neither directing the report to their PTBs, nor updating the faulty information. Instead of working together to develop the aviation of the future, we have conservative forces in play that hinder real development. Be that about A-CDM, data interfaces, data intelligence. We limp behind and instead of doing, we #talkthetalk.

The very same issue is it about hydrogen powered passenger flights, Airbus recently promoted as their “Zero-Emission Aircraft”. Again, the physical challenge.

The very same issue is it about hydrogen powered passenger flights, Airbus recently promoted as their “Zero-Emission Aircraft”. Again, the physical challenge. From my work on a solar powered WIG 2008, replacing it’s diesel-engine with an hydrogen-engine, I understood hydrogen as the future. Clean electrolysis using solar power (and wind, bio mass and other sustainable energy sources) and salted water, whereas desalination facilities produce the surplus salt to augment seawater to the level needed for the electrolysis. So sunny regions with access to seawater have a “natural advantage” to develop the infrastructure to create hydrogen.

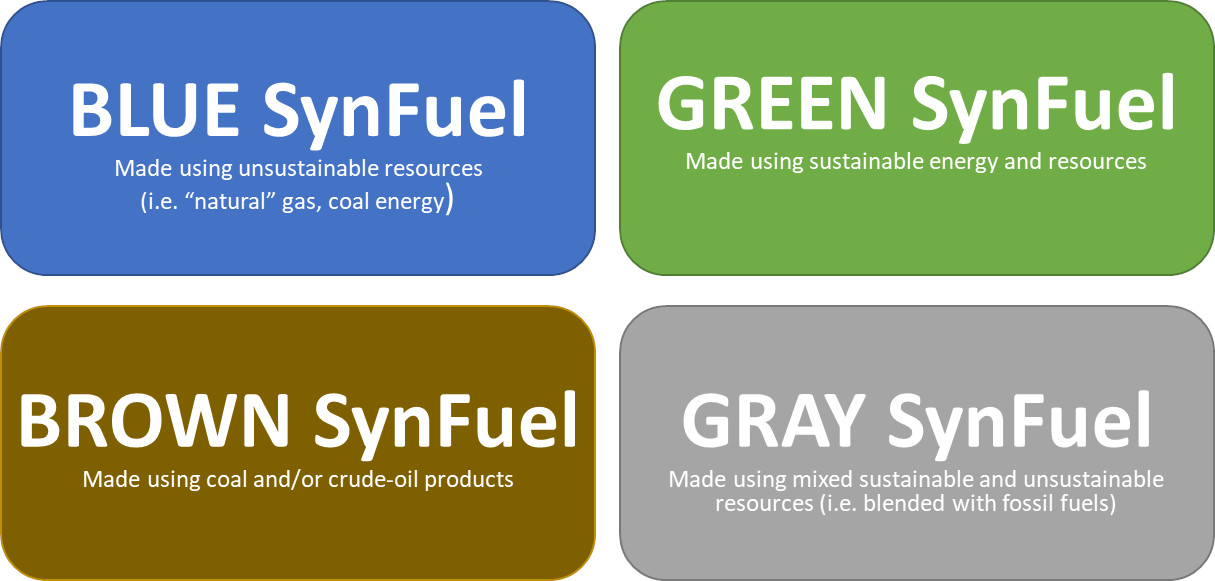

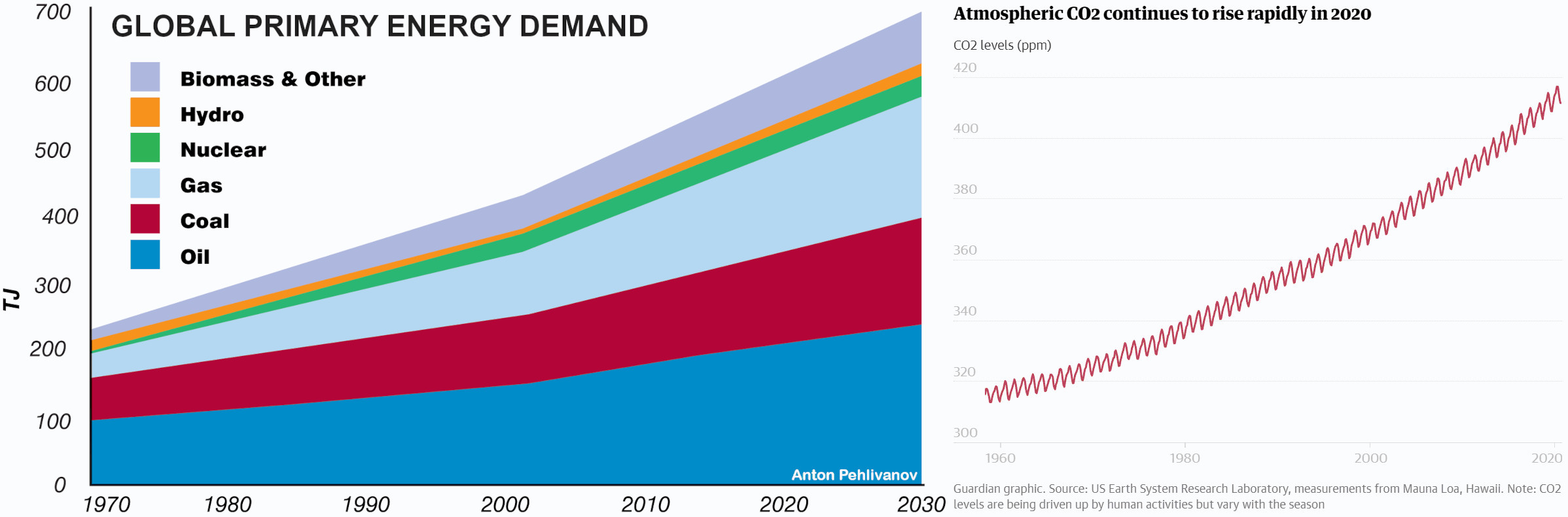

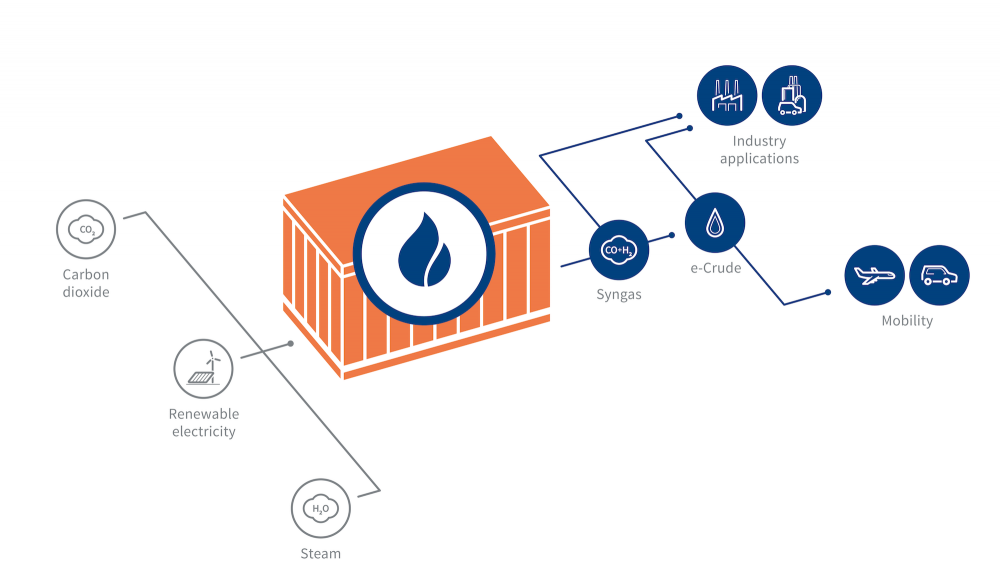

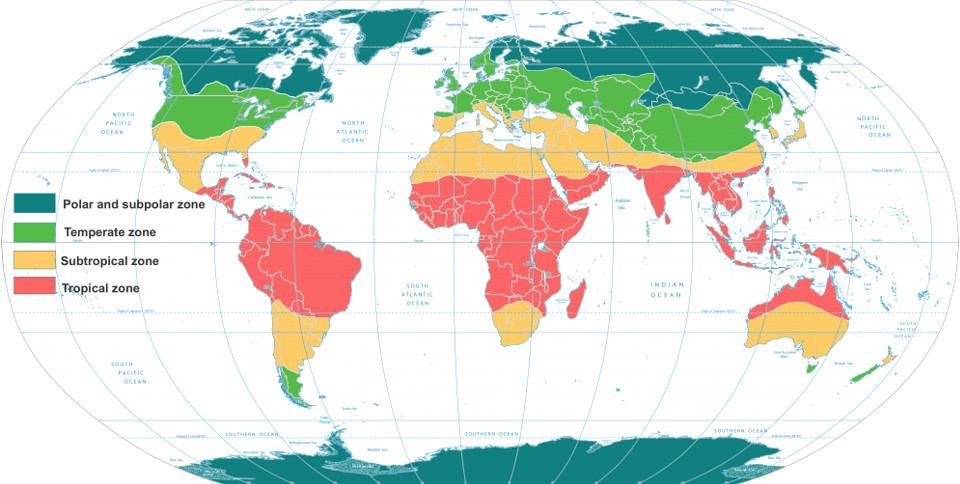

From my work on a solar powered WIG 2008, replacing it’s diesel-engine with an hydrogen-engine, I understood hydrogen as the future. Clean electrolysis using solar power (and wind, bio mass and other sustainable energy sources) and salted water, whereas desalination facilities produce the surplus salt to augment seawater to the level needed for the electrolysis. So sunny regions with access to seawater have a “natural advantage” to develop the infrastructure to create hydrogen. Aside, synfuel can be used quite easily as a buffer technology, using excess power to create synfuel during peak times and using it in common and tried power generators to recreate energy in low times. Until we have something better, Syngas is a clean energy source that can make us independent of crude-oil for power generation. a technology that can create a future for many “poor countries” in the “tropical belt”, the tropic (red) and subtropical zones (yellow), as their surplus of solar energy is way higher than what the northern hemisphere has in the temperate to polar zones.

Aside, synfuel can be used quite easily as a buffer technology, using excess power to create synfuel during peak times and using it in common and tried power generators to recreate energy in low times. Until we have something better, Syngas is a clean energy source that can make us independent of crude-oil for power generation. a technology that can create a future for many “poor countries” in the “tropical belt”, the tropic (red) and subtropical zones (yellow), as their surplus of solar energy is way higher than what the northern hemisphere has in the temperate to polar zones.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge. Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service! A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

Convincing the People to Fly Again

Convincing the People to Fly Again There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Last week it started with a

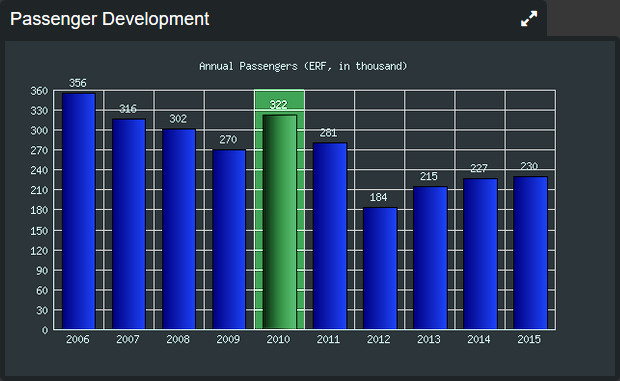

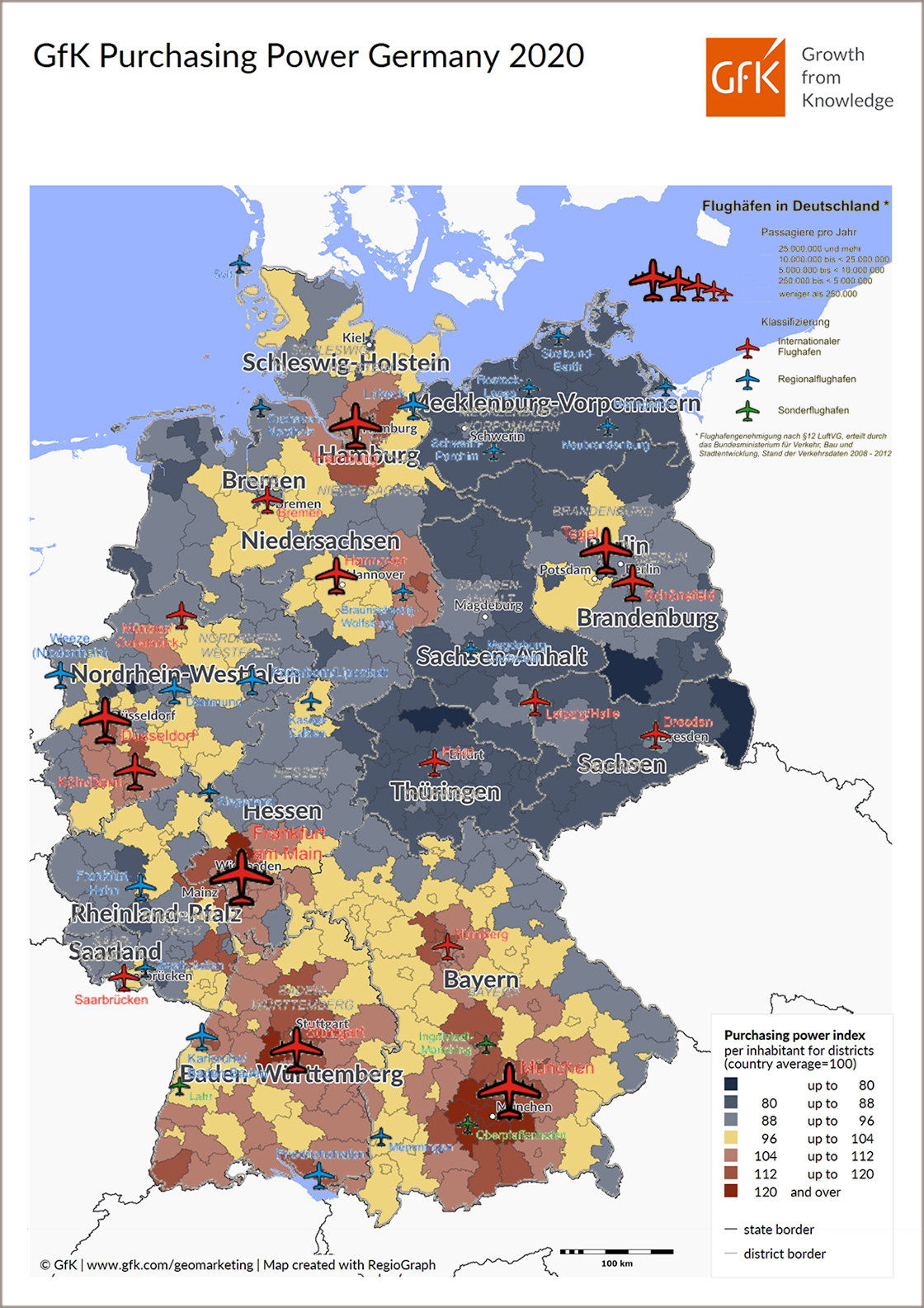

Last week it started with a  As you may recall, 2009/10, I’ve been managing Marketing, Press/P.R. and Corporate Communications at the Erfurt Airport, one of the seven now questioned. Which is my example of why German airports fail thanks to populistic airport bashing by the local politicos and most of the media. And an idiotic, short-sighted focus on “outgoing” holiday charter flights. I am adamant about my justified opinion that given a positive support and strategy, the airport would be worth a million passengers and an economic operation. If they’d cash in on incoming.

As you may recall, 2009/10, I’ve been managing Marketing, Press/P.R. and Corporate Communications at the Erfurt Airport, one of the seven now questioned. Which is my example of why German airports fail thanks to populistic airport bashing by the local politicos and most of the media. And an idiotic, short-sighted focus on “outgoing” holiday charter flights. I am adamant about my justified opinion that given a positive support and strategy, the airport would be worth a million passengers and an economic operation. If they’d cash in on incoming. As I wrote three years ago, airports must embrace their

As I wrote three years ago, airports must embrace their

Again ,there is no reasoning to invest into an airport that only looks at outgoing summer charter flights. The money leaves the region and benefits the destination. Why would I subsidize that?

Again ,there is no reasoning to invest into an airport that only looks at outgoing summer charter flights. The money leaves the region and benefits the destination. Why would I subsidize that?

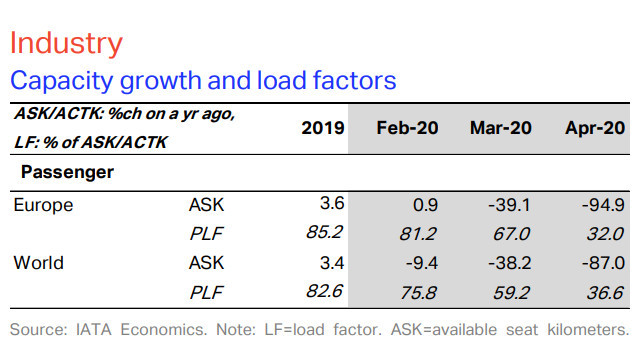

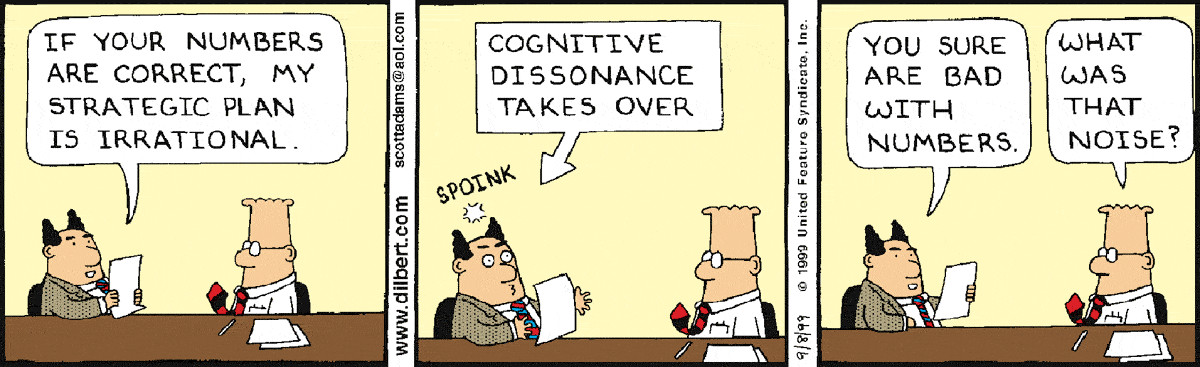

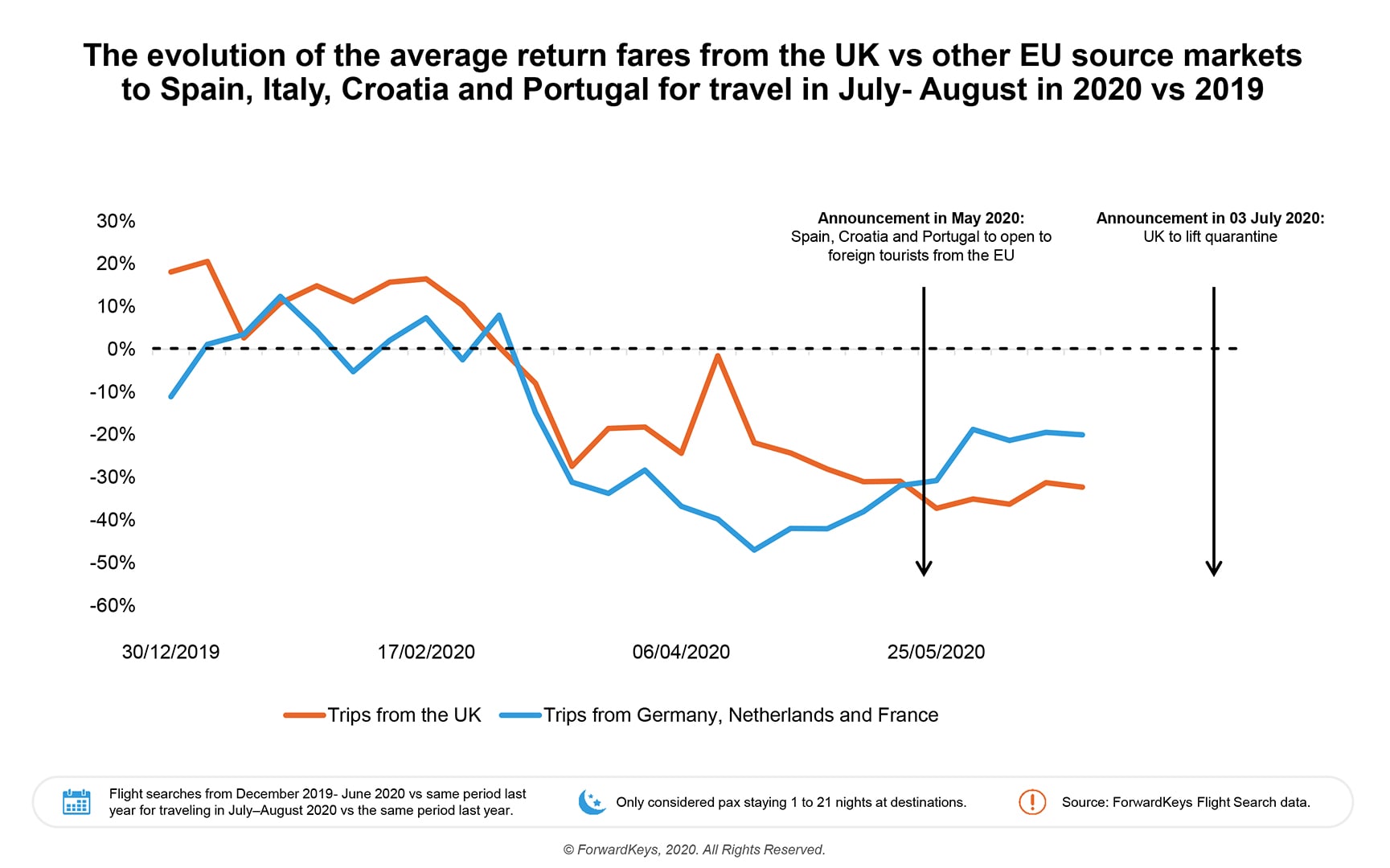

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Yes, as you can see in the archive of my

Yes, as you can see in the archive of my  I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely.

I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely. I was kind of shocked this week, when German Tagesthemen, one of the main news channel mentioned already that this may not be the end, but just the beginning of an expensive further bail-out series for the airline and it’s many subsidiaries. But if they burned 5 billion in three months, how long can they sustain the drought before they burned up the added nine billion?

I was kind of shocked this week, when German Tagesthemen, one of the main news channel mentioned already that this may not be the end, but just the beginning of an expensive further bail-out series for the airline and it’s many subsidiaries. But if they burned 5 billion in three months, how long can they sustain the drought before they burned up the added nine billion?!["We are Listening. And We're Not Blind. This is Your Life. This is Your Time!" [Snow Patrol - Calling in the Dark]](https://foodforthought.barthel.eu/wp-content/uploads/2020/01/CallingintheDark.jpg)

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.”

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.” In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management.

In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management. As addressed in

As addressed in  Dinosaurs …

Dinosaurs … Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.

Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.

Freight Use + Repatriation Flights

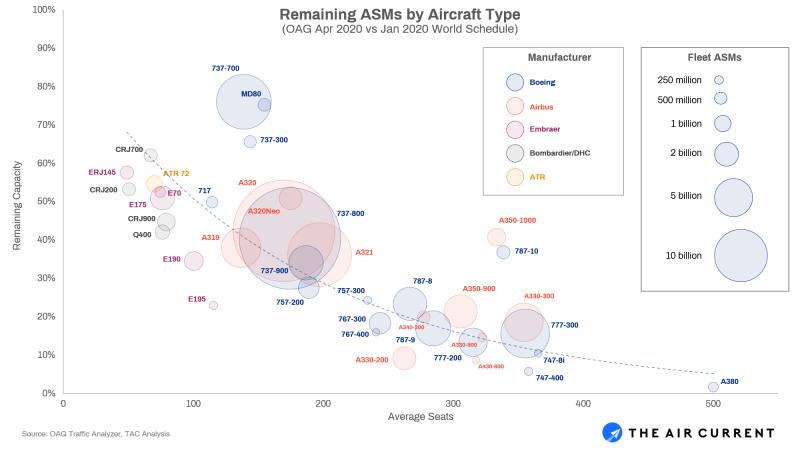

Freight Use + Repatriation Flights Very visible is the mass grounding of large aircraft. The Airbus A380 is already no longer built, now airlines retire, decommission that aircraft in large numbers. Flightradar showed quite some of those aircraft being flown to the scrap-yards, also called aircraft graveyards. The same applies to many 747s, not being “parked”, but decommissioned. The same fate even seems to hit the Boeing 777. Coronavirus also seems to seal the fate of many Boeing 767. For all those aircraft, more than 80% are grounded – many of which are being decommissioned for good.

Very visible is the mass grounding of large aircraft. The Airbus A380 is already no longer built, now airlines retire, decommission that aircraft in large numbers. Flightradar showed quite some of those aircraft being flown to the scrap-yards, also called aircraft graveyards. The same applies to many 747s, not being “parked”, but decommissioned. The same fate even seems to hit the Boeing 777. Coronavirus also seems to seal the fate of many Boeing 767. For all those aircraft, more than 80% are grounded – many of which are being decommissioned for good.

What stroke me odd was the Embraer E195, showing 75% grounded, as well as 65% of the E190s. Both very good aircraft. But very few, large operators grounding their Embraer fleet in favor or their Boeing/Airbus operations seem to have resulted in their large groundings.

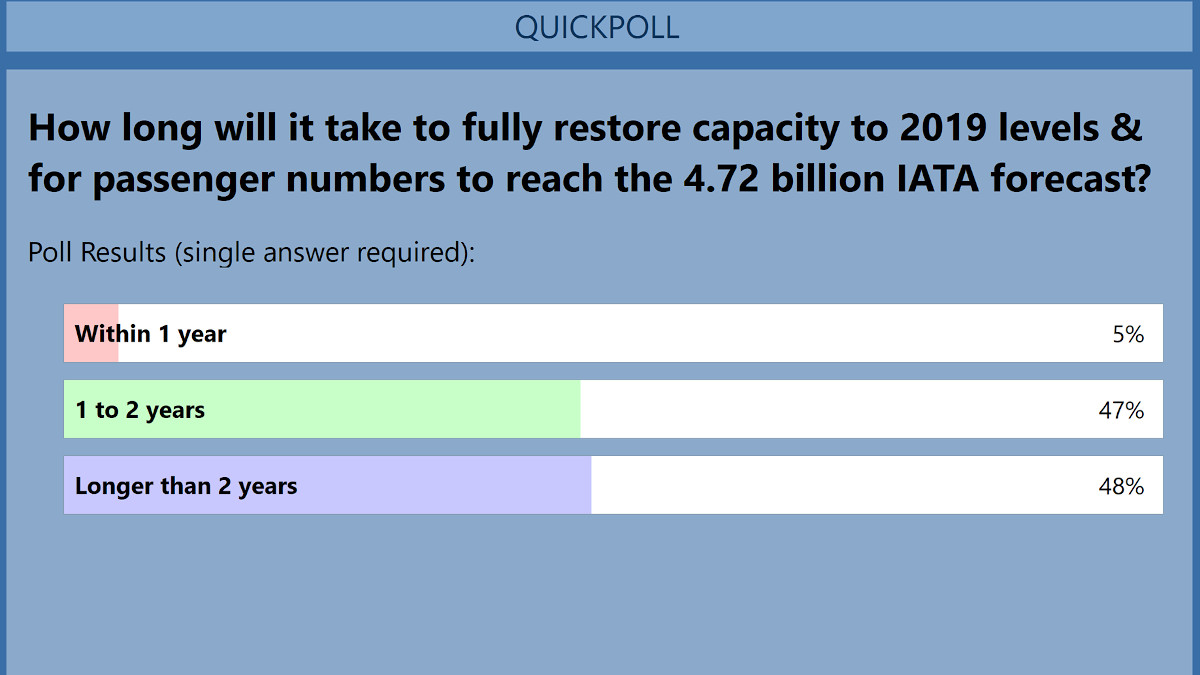

What stroke me odd was the Embraer E195, showing 75% grounded, as well as 65% of the E190s. Both very good aircraft. But very few, large operators grounding their Embraer fleet in favor or their Boeing/Airbus operations seem to have resulted in their large groundings. Optimists outlook is a two-year return to “normal” (AF/KL). Flightglobal headlines

Optimists outlook is a two-year return to “normal” (AF/KL). Flightglobal headlines  As outlines in my Corona Papers, IMF Managing Director Kristalina Georgieva warns of the

As outlines in my Corona Papers, IMF Managing Director Kristalina Georgieva warns of the  Now Flightglobal headlines that

Now Flightglobal headlines that  In a recent conference call, two attending tour operators flight purchasing managers emphasized a recovery on the basis of previously high density high volume routes. They emphasized that while VFR (visiting friends and relatives) will recover a bit faster, the “normal” traveler will be busy recovering their jobs and lives and income – they expect only very little demand for the typical vacation for 2020. And they, as tour operator flight experts raised a question: “Who will want to spend some hours in an airplane having the reputation of being a sardine can?” This will even impact the vacation travel in 2021 and beyond. There will be a revival of ground-based and localized travel at the expense of air travel. It will take time to recover from that blow.

In a recent conference call, two attending tour operators flight purchasing managers emphasized a recovery on the basis of previously high density high volume routes. They emphasized that while VFR (visiting friends and relatives) will recover a bit faster, the “normal” traveler will be busy recovering their jobs and lives and income – they expect only very little demand for the typical vacation for 2020. And they, as tour operator flight experts raised a question: “Who will want to spend some hours in an airplane having the reputation of being a sardine can?” This will even impact the vacation travel in 2021 and beyond. There will be a revival of ground-based and localized travel at the expense of air travel. It will take time to recover from that blow. Business Travel

Business Travel An exception the BTMs mentioned: Travelers who went through the infection and are such immune and noncontagious may be the first to start traveling again. But it was also consensus that a comparison to flu vaccination would be not comparable, after all the hysterics we went through.

An exception the BTMs mentioned: Travelers who went through the infection and are such immune and noncontagious may be the first to start traveling again. But it was also consensus that a comparison to flu vaccination would be not comparable, after all the hysterics we went through. All this lead to the expectation that even on former high density routes, the use of B757, A321LR and such smaller airplanes may be the first routes to recover on long haul. Some very high density routes may recover using larger aircraft such as the remaining B747s or B777s. Where I see Emirates likely to stake their claims quickly, possibly even basing some of their aircraft out of country to serve remote routes.

All this lead to the expectation that even on former high density routes, the use of B757, A321LR and such smaller airplanes may be the first routes to recover on long haul. Some very high density routes may recover using larger aircraft such as the remaining B747s or B777s. Where I see Emirates likely to stake their claims quickly, possibly even basing some of their aircraft out of country to serve remote routes. As for the anticipated return in passenger numbers, except for the very high density routes like New York-London, airlines will start with shorter hub-to-hub-routes, like back in the 80s the availability of two-leg-connections between any two cities will be limited, three-leg connections again becoming quite normal. Expectation was also voiced that most operators will shelve most, if not all twin-aisle aircraft.

As for the anticipated return in passenger numbers, except for the very high density routes like New York-London, airlines will start with shorter hub-to-hub-routes, like back in the 80s the availability of two-leg-connections between any two cities will be limited, three-leg connections again becoming quite normal. Expectation was also voiced that most operators will shelve most, if not all twin-aisle aircraft. Given the expectation of questionable safety regarding load factors and demand for 150-240-seat aircraft, this will be a turning point for the low-cost industry. For a long time, I considered “low-cost” carriers (LCC) as a cost-sensitive regional aviation player. Connecting point-to-point without a focus on connecting traffic. As the fleets grew, the routes got longer, the LCCs started experimenting with classic concepts like GDS-sales, hub-services and connecting flights, etc., etc. As the classic airlines learned to adapt to the new competition. It was long questioned on conferences and other discussions, if you can still group LCCs, that dates back even to fierce discussions about the status of Air Berlin as a LCC.

Given the expectation of questionable safety regarding load factors and demand for 150-240-seat aircraft, this will be a turning point for the low-cost industry. For a long time, I considered “low-cost” carriers (LCC) as a cost-sensitive regional aviation player. Connecting point-to-point without a focus on connecting traffic. As the fleets grew, the routes got longer, the LCCs started experimenting with classic concepts like GDS-sales, hub-services and connecting flights, etc., etc. As the classic airlines learned to adapt to the new competition. It was long questioned on conferences and other discussions, if you can still group LCCs, that dates back even to fierce discussions about the status of Air Berlin as a LCC. In most of the webinars, calls and discussions of the past weeks, the expectation was expressed that as regional flights were the last to be cancelled, they will be the first ones to recover. 150-240 seats are the domain of the former LCCs. There problem will be the very slow growth of passenger numbers post-crisis. Suddenly their “more seats” turn from benefit at full load into a severe challenge. Similar to tour operators, they will focus their recovery on the former high density routes. In a perfect scenario, they would slowly pick up speed. Realistically, they will rush it, risking a lot, flying below cost. How long they can sustain that must be seen. If aviation truly cuts back to traffic of the 1990s, the demand for flights served by 150-240 seat aircraft will be rather limited. A lot of Airbus-320- and Boeing-737-families’ aircraft will be grounded for time to come. With a devastating impact to aircraft leasing companies focusing on those aircraft.

In most of the webinars, calls and discussions of the past weeks, the expectation was expressed that as regional flights were the last to be cancelled, they will be the first ones to recover. 150-240 seats are the domain of the former LCCs. There problem will be the very slow growth of passenger numbers post-crisis. Suddenly their “more seats” turn from benefit at full load into a severe challenge. Similar to tour operators, they will focus their recovery on the former high density routes. In a perfect scenario, they would slowly pick up speed. Realistically, they will rush it, risking a lot, flying below cost. How long they can sustain that must be seen. If aviation truly cuts back to traffic of the 1990s, the demand for flights served by 150-240 seat aircraft will be rather limited. A lot of Airbus-320- and Boeing-737-families’ aircraft will be grounded for time to come. With a devastating impact to aircraft leasing companies focusing on those aircraft.

Pending question was if there will be enough consolidation to leave enough niches for the survivors. Or if the stabbing and fighting for routes will continue – with the pre-crisis effect on revenues and commercial sustainability of the air carriers. While we all expressed hope for the first, we all fear that airline managers will fall back into their old modus-operandi to focus on marked share and loads instead of revenue and profit.

Pending question was if there will be enough consolidation to leave enough niches for the survivors. Or if the stabbing and fighting for routes will continue – with the pre-crisis effect on revenues and commercial sustainability of the air carriers. While we all expressed hope for the first, we all fear that airline managers will fall back into their old modus-operandi to focus on marked share and loads instead of revenue and profit. The recovery will be slowed down as “low-cost” models at the beginning will such pose high risk – low return, airlines will need to focus initially on low load factors but the need to create profit after the drought.

The recovery will be slowed down as “low-cost” models at the beginning will such pose high risk – low return, airlines will need to focus initially on low load factors but the need to create profit after the drought. With

With

Now, surprise surprise, the current crisis proves that this is the very same with aircraft investors. If you just look at aircraft but have no idea how to use it, you’re doomed. It will work a while, it did work a while. But even before Corona, this model was doomed and I addressed it. If an investor invests into the aircraft but outsources (the risk of) the operation. Then those small failing airlines return the aircraft after not paying the bills for several months.

Now, surprise surprise, the current crisis proves that this is the very same with aircraft investors. If you just look at aircraft but have no idea how to use it, you’re doomed. It will work a while, it did work a while. But even before Corona, this model was doomed and I addressed it. If an investor invests into the aircraft but outsources (the risk of) the operation. Then those small failing airlines return the aircraft after not paying the bills for several months. Since starting to turn the idea that turned out to become

Since starting to turn the idea that turned out to become

So let me quickly adjust Ged’s numbers.

So let me quickly adjust Ged’s numbers. Now comes Ged’s mistake, a rather common one, the “inside-out” look.

Now comes Ged’s mistake, a rather common one, the “inside-out” look. Which triggers the other issue. At the

Which triggers the other issue. At the