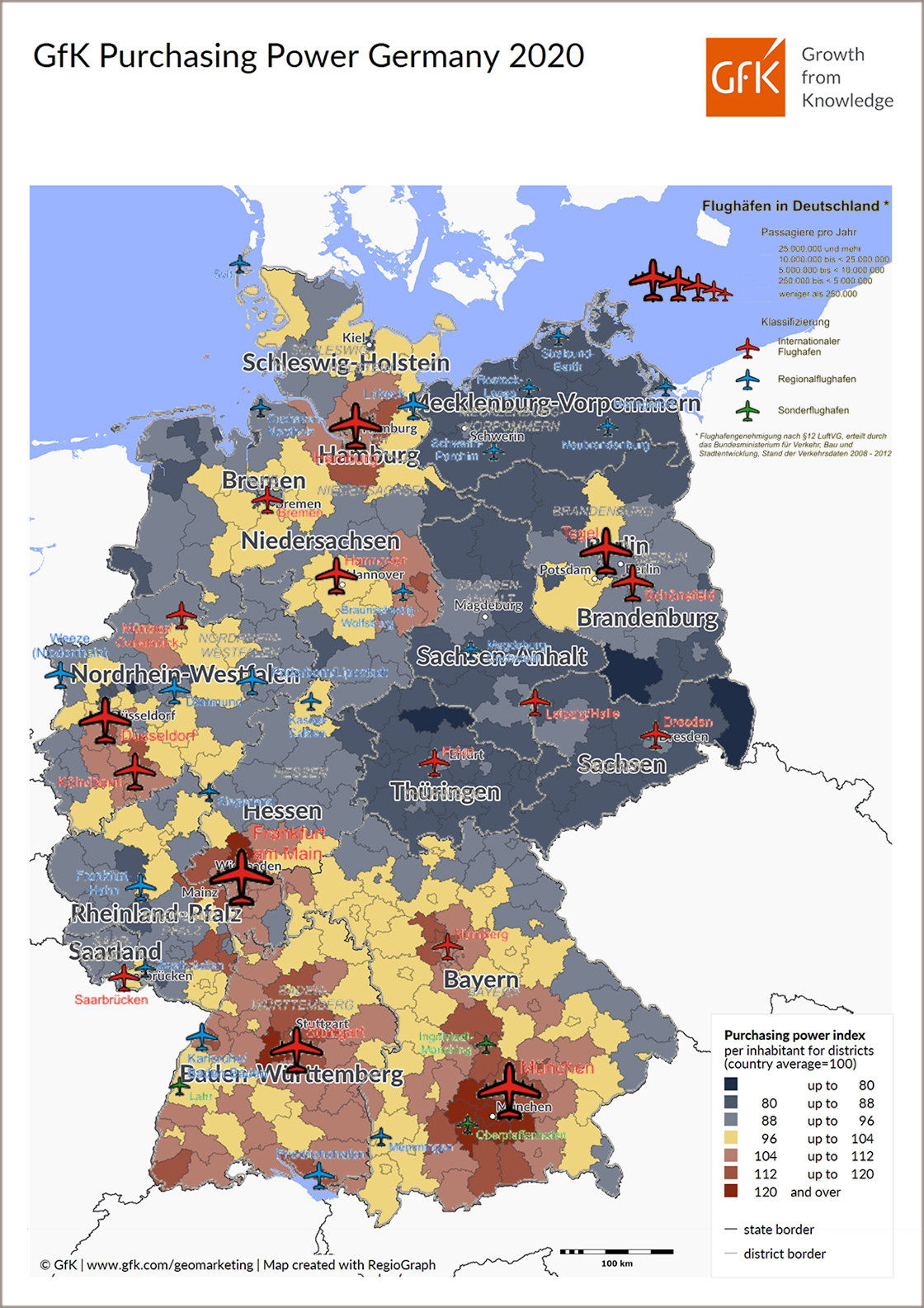

You all know my graphic merging the GFK purchasing power map with the Wikipedia map of airports that I use to visualize the relation between the both.

You all know my graphic merging the GFK purchasing power map with the Wikipedia map of airports that I use to visualize the relation between the both.

Now my friend Ged had put together some numbers, simplifying but following mostly what I used myself in discussions with tourism offices, chamber of commerce, politicos and the other stakeholders that in Germany frequently fight against their airports. Those stakeholders keep failing to understand the commercial impact of “their airports”. In Germany, it’s “airport bashing”. Aircraft noise being an enemy. Transportation statistics on environmental issues beautified to condemn the airlines, I just wrote about the #flygskam reality check.

I have some improvements, but maybe you want to see the info about Ged’s presentation first?

https://simpleflying.com/new-airline-routes-are-worth-huge-amounts-to-destinations/

There are some shortcomings that from experience I do address when talking to the local stakeholders beyond airports. But most politicians I found to prefer airport bashing to understanding. And most airports (not all, there is a slow change) work alone on the route development process. Stakeholders like chambers of commerce, tourism boards, politicians or local media focusing on “other things”. And my original use case was Erfurt with Cirrus Airlines, when I tried to attract KLM to Amsterdam with 70-seat aircraft.

So let me quickly adjust Ged’s numbers.

So let me quickly adjust Ged’s numbers.

First of all, I prefer frequency over size, so I think we should talk about i.e. a route with 100 seats. Instead of a trice weekly that fails to attract business travelers and suffers such from a higher seasonality, I’d look in turn at a daily service. So let’s keep to the example of an Amsterdam-service with KLM. As operated by KLM will also get you the more attractive ticket prices they can offer.

So over the year, a “daily service” accounts to six weekly flights or about 330 round trips. That accounts (at 100 seats) to 330 days x 1 flight/day x 100 seats x2 (return trip) = 66000 seats. Or slightly more than Ged’s assumption of 29,640 outbound seats we use for typical statistics, we have 33,000. Slightly more, but triggering commercial passengers helps to fill the plane and get some improved ticket revenue.

Talking about 90% load factor – and I agree with Ged, that is minimum what you better plan for nowadays, we need to sell 29,700 seats. For easier calculation, let’s say we must sell 30,000 seats.

Now comes Ged’s mistake, a rather common one, the “inside-out” look.

Now comes Ged’s mistake, a rather common one, the “inside-out” look.

Passengers never travel only one direction on a plane, ideally they originate on both sides. Different on summer charter flights, I know. But we talk scheduled and low cost services here. So depending on the destination, let’s take the simple equal distribution of in- and outbound travelers. So we talk about 15,000 travelers we target “inbound”.

Next I agree, € 250 total average spend per day for a four day trip is reasonable. But again, I’d adjust slightly here.

Not all travelers go to hotels, there usually is a valuable VFR traffic, visiting friends and relatives. So I’d use only a lower, more conservative €500 for trip spending.

But then Ged fails to use an important multiplier. EU (European Union) usually uses the factor 2.5 (sometimes 3) on the commercial value on any € “spent”. So for any passenger, we talk about 500€ multiplied by 2.5 = 1,250 €. At 15,000 travelers we talk about roughly 19 million € spending by all travelers.

What must be emphasized is the fact that the airline route will also trigger commercial relations with a positive impact to the commerce taxes for the regions as well as the attractivity. Especially on regional airports with such a connection, it will create new jobs, countering the rural exodus so many secondary regions suffer. That is, why the local chamber of commerce (and tourism) have such an impact. If tourism can fill more seats incoming than outgoing, the result becomes even more favorable. A 60/40 in-/outbound results in 3,000 more passengers adding on the incoming value of the flight or 3,750,000 €, totaling the effect to € 22,8 million. Full flights will result in increased frequency or larger airplanes.

If you focus on “holiday flights”, i.e. from an airport like Erfurt-Weimar to the Mediterranean

But given all that, the regions – as mentioned – fail to understand the impact to their commerce. Nor do they understand the financial risk an airline takes, calculating with “competitive” ticket prices they must fill the plane year-in/year-out. If the wonderful biased statistics by the airport marketing fail to materialize the passengers, if the airline looses 10% of the planned revenue, we can quickly talk that many or more million Euros being burned. You may be able to understand why an 80% discount on the “landing fees” are nothing more but an expected risk the airport takes. The brunt of the risk is with the airline.

That said, I remind my readers I am no fan of long-term “airline subsidies”. There are “PSO”-routes, called public service obligation. I would expect the (political) stakeholders of any regional airport to be well advised to fund a PSO-route to one of the big global hubs, but not by “any airline”, but by the hub-carrier. Reminder: German airport association ADV published that most passengers connect online (same airline) or within the airline alliances, there is only negligible numbers of passengers connecting “interline” (between unrelated airlines). Which in my opinion is a result of biased marketing, but it’s like it is now.

But generally, a route shall be set to the right sized aircraft, an attractive frequency and a strong point-to-point demand. Then there can be subsidies, better a real “risk sharing” to establish the route. If the airport/region believes in their own numbers and expectations, they should be willing to guarantee the break even load factor and revenue to the airline. Right? And like any business venture, there must be clear milestones – and an exit scenario if the expectations don’t match the real demand.

Which triggers the other issue. At the ISHKA Investing in Aviation Finance conference we discussed reasons for airline failures. One very common reason is the fact that airline managers don’t calculate according to their own cost base, but try to compete with ticket prices of their competitors. Not just the real ones, also the implied ones. Trying to fly low cost ignoring their different and higher own cost base. Negotiating new flight services, airports but especially the political stakeholders make it worse by “expecting” unrealistic low cost of operation. They demand that tickets must be cheap. If they, like in Germany, add taxes and make flying more expensive, they shoot their own foot.

Which triggers the other issue. At the ISHKA Investing in Aviation Finance conference we discussed reasons for airline failures. One very common reason is the fact that airline managers don’t calculate according to their own cost base, but try to compete with ticket prices of their competitors. Not just the real ones, also the implied ones. Trying to fly low cost ignoring their different and higher own cost base. Negotiating new flight services, airports but especially the political stakeholders make it worse by “expecting” unrealistic low cost of operation. They demand that tickets must be cheap. If they, like in Germany, add taxes and make flying more expensive, they shoot their own foot.

The financial impact on air travel is a two-sided coin. There is a major impact to commerce and regional income, especially on the incoming travel. But if you focus only on holiday charter flights without incoming, you deprive your region of an important commercial multiplier. In fact, I question your business case. And yes that goes to you Erfurt-Weimar, my prime, sad example.

On the other side, airlines are commercial companies. No airline can keep flying if load and revenue don’t justify.

Food for Thought

Comments welcome!