I am very, very happy that I started speaking to Family Offices and regret that the Pandemic forced a reschedule of one event and kept me from attending another this week. But I am grateful to be allowed attending the first Family Office virtual conferences. It’s a rather steep learning curve. I am grateful for any event reference or invitation that I got and hopefully will still get.

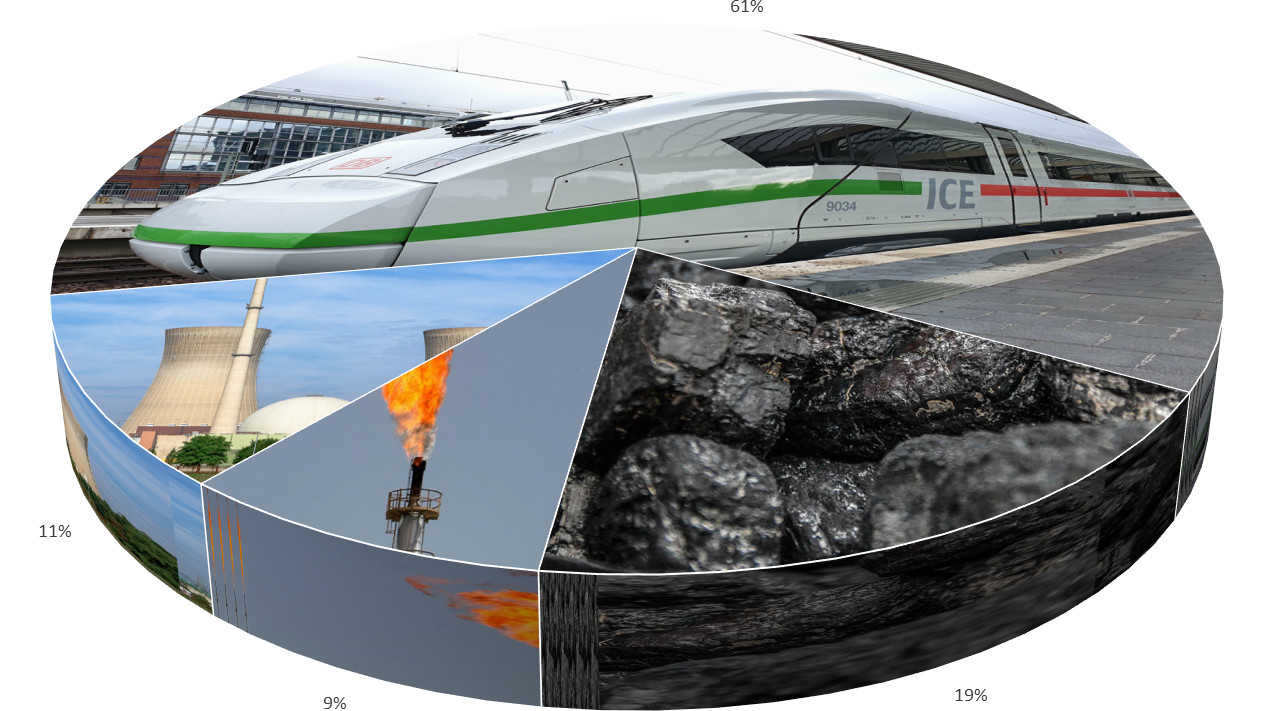

Given today’s jabbering by the EU Commission (Mme. von der Leyen) that they – wow – will reduce the CO2 to 55% of the 1990-level … Oh wow? Shall I be impressed? Or cry? EU parliament would have been okay with 60% the news say. But even as is, this “deal” is full of small-print and not really worth the paper it’s written on.

We must be better to make an impact. And we better stop lip-services, white- and greenwashing but address the issues we can address today. Or this expert saying we’re way too late is right.

Though this is totally in line with my initial experience about “impact investing”. Lots of talk and lip services, with little substance too. Hard to find the ones that believe that this is something real.

And what industry is more in desperate need for a sustainability makeover. And having the chance for it?

Aviation Impact Investment

… a Barrel Burst?

While we have clear plans to become Carbon-Neutral in realistically in three to five years, you got to start. And an “impact investor” told me this week that we are too little innovative. Really?

While we have clear plans to become Carbon-Neutral in realistically in three to five years, you got to start. And an “impact investor” told me this week that we are too little innovative. Really?

The EU plans give airlines 15 more years to fly dirty. Yes, that is a barrel burst! You got to be kidding me. But sure, it’s completely in line with German and European aviation lobbying, managed well by Lufthansa, Ryanair and the likes. Lufthansa, the airline with the single-largest bailout package in Europe but with virtually no ties attached, especially none about job saving or evolution into turning “green” and flying clean(er). And in Hamburg I heard the synkerosene pilot suffered from disinterest by Lufthansa, aside of a single carbon-neutral flight by Lufthansa Cargo. A nice example of greenwashing!

I’ve summarized the possibilities to turn aviation carbon-neutral for a start (and what comes then) into another article Clean Aviation Whitewashing and the Real Deal, which I publish simultaneously with this article. But the Future of Clean Aviation is Now. It just needs someone with a real interest to start the process. No talking, no lip-services, no whitewashing, but the real deal! With a real ROI.

Impact Investment in IT & AI … What Impact?

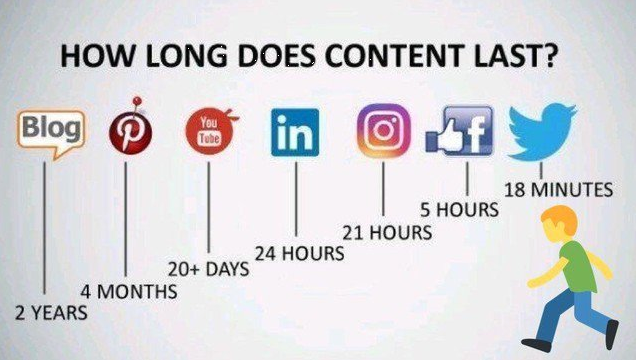

There is a lot of buzz ongoing about Impact Investment in IT and AI. Whereas I just wrote about Big Data & AI, feedback from family offices principals recently confirm my assumption. Of one emphasizing that ESG “tools” are usually a means to white- and greenwash family offices’ IT investments. And as I posted that on LinkedIn, got a lot of feedback from other family office principals that IT hardly makes a real impact by itself. It’s simply a profit-focused investment, mostly just improving existing processes or digitalizing them.

There is a lot of buzz ongoing about Impact Investment in IT and AI. Whereas I just wrote about Big Data & AI, feedback from family offices principals recently confirm my assumption. Of one emphasizing that ESG “tools” are usually a means to white- and greenwash family offices’ IT investments. And as I posted that on LinkedIn, got a lot of feedback from other family office principals that IT hardly makes a real impact by itself. It’s simply a profit-focused investment, mostly just improving existing processes or digitalizing them.

There also was a discussion this week about “decision making AI” or “decision support IT”. From my aviation background, I see IT as an important support tool. One that improves productivity, but more important safety. I do not see an IA-tool taking more than a supportive role at the time being. But I see a lot of claims that direction, which I can only consider white- and greenwashing.

It’s a Trust Thing

In my opinion, there is no “impact investing” if you don’t find the right managers with a mindset to leave the beaten path and find profitable developments in the industry. For KOLIBRI.aero we don’t just think about carbon-neutral aviation. Or some solar parks. We think beyond! We understand it’s our duty to make an impact. Investing into our people and the regions we serve. To foster gender equality, diversity and to develop a future beyond our own. In turn, KOLIBRI.aero addresses not two or three, but all 17 of the U.N. Sustainability Development Goals.

In the overall plans, there is one issue being in the U.N. SDGs and EU’s TEN-T, regional connectivity at affordable price. Going carbon-neutral is more important on that in our opinion, but there are obstacles that must be overcome, that is a journey. Decently paid, qualified jobs and ongoing, structured training to fight against poverty. Ideas aplenty on how to establish a disruptive airline, that shows how sustainable aviation can be. If you look outside the box. If you embrace “sustainability”, even the notoriously loss-making scapegoat aviation can change.

The Quick and Dirty

On the other side – and back to the topic of my previous article, Big Data and AI provide quick success stories. So much easier to use those for white- and greenwashing. But real impact investment may not be so sexy, it may take a longer breath. To turn around our world is a journey, no sprint. It’s why even UBS recently confirmed in a webinar that family offices are more likely the ones truly investing into impact. Because they think long-term. About family impact across generations. Not as politicos or banks or “institutional investors” and venture capitalists in quick, maximized returns, happily overlooking the negative impacts for an improved profitability.

On the other side – and back to the topic of my previous article, Big Data and AI provide quick success stories. So much easier to use those for white- and greenwashing. But real impact investment may not be so sexy, it may take a longer breath. To turn around our world is a journey, no sprint. It’s why even UBS recently confirmed in a webinar that family offices are more likely the ones truly investing into impact. Because they think long-term. About family impact across generations. Not as politicos or banks or “institutional investors” and venture capitalists in quick, maximized returns, happily overlooking the negative impacts for an improved profitability.

… or The Neverending Story

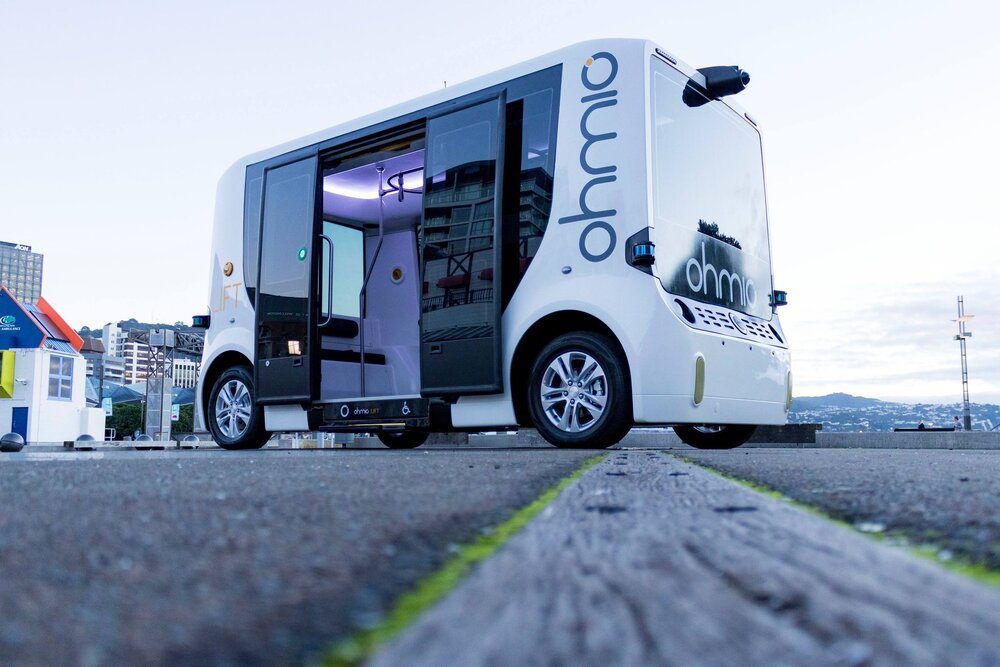

A German investor this week told me: “There is too little change in what you’re doing.” That investor referred to either air taxi or hyperloop. Whereas I’ve often enough expressed my concerns about air traffic control taking individual mobility into the third dimension and into potential conflict with commercial (and military) aviation. Just thinking about the increasing drone-warnings disrupting airport operations the past year. That is a very long way to go.

A German investor this week told me: “There is too little change in what you’re doing.” That investor referred to either air taxi or hyperloop. Whereas I’ve often enough expressed my concerns about air traffic control taking individual mobility into the third dimension and into potential conflict with commercial (and military) aviation. Just thinking about the increasing drone-warnings disrupting airport operations the past year. That is a very long way to go.

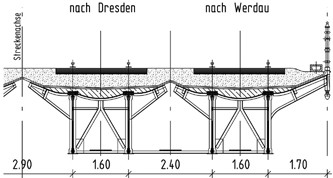

The same for hyperloop, which may connect high-density routes, similar to (German) Transrapid in China. Will this be more successful? The concept is around for more than half a century. And I don’t like the pipes over ground, even Roger Leloup planned them underground. I’ve written more than a year ago in the #flygskam Reality Check about it and about the so much smaller footprint an airport has.

… Academic Thinking – Research Forever

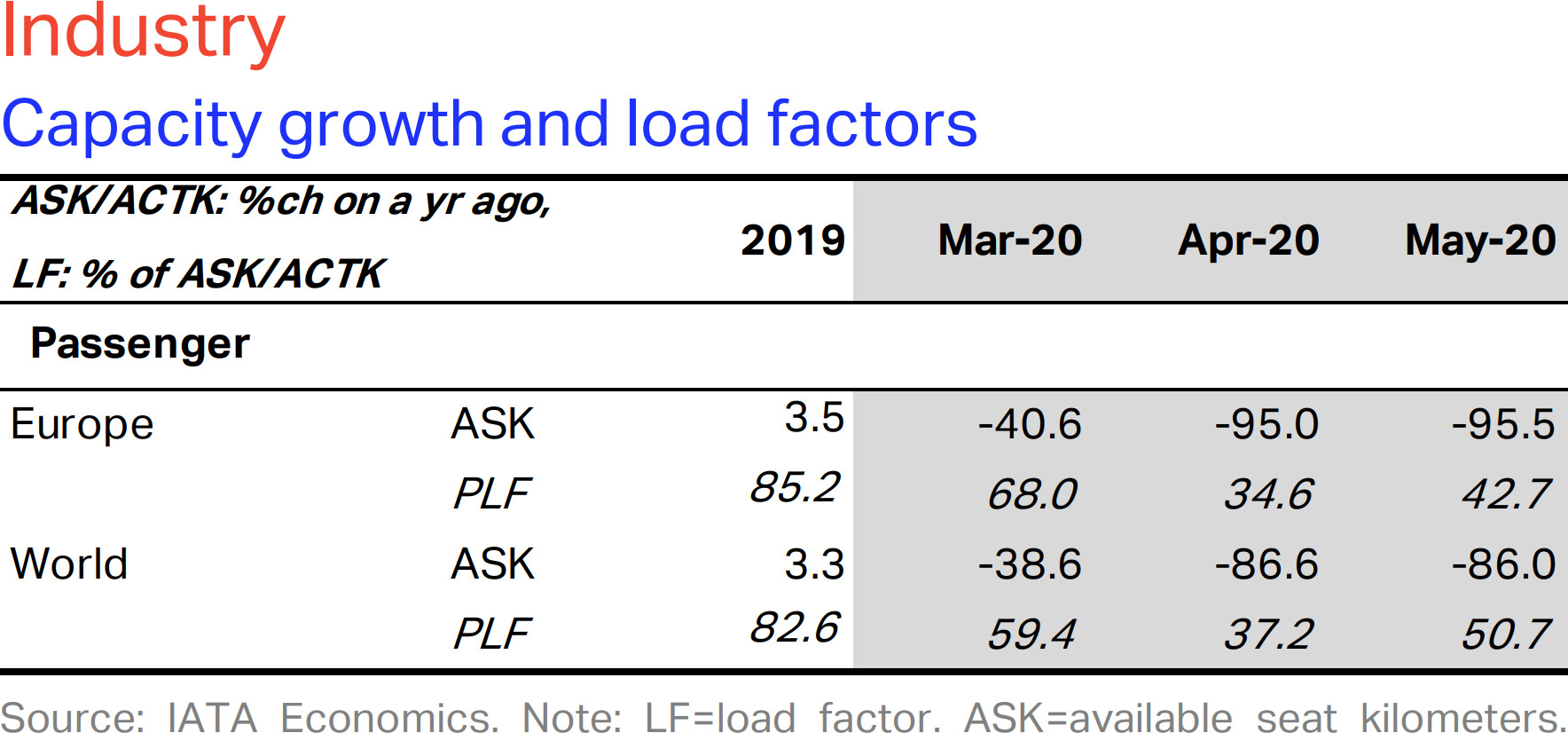

Global CO2 emissions dropped by 7%, with 11% in Europe due to Corona. Especially aviation reduced due to the lockdown by 22% global, some regions by 30%. But those are expected to come back quickly (Source).

Global CO2 emissions dropped by 7%, with 11% in Europe due to Corona. Especially aviation reduced due to the lockdown by 22% global, some regions by 30%. But those are expected to come back quickly (Source).

Now the EU says it turns the European Investment Bank into a Climate Bank. And they will focus on research. Or to give the dinosaurs a facelift. Maybe it makes more sense to look for ideas to apply the research results to the real world? Why is it that German Transrapid only runs in China, European Skype is now U.S. Microsoft, the first industrial Synkerosene-facility is being build in Norway (EU associated)? Examples aplenty. We research but we’re utterly incompetent turning research into practical products.

People should take rail the politicos wrote. Yeah, I can see Merkel spending a day to travel from Berlin to Brussels. An interesting LinkedIn post, and German Tagesschau reports “Strategy falls short of what is possible and necessary”. A carbon-neutral aviation we plan on existing technological solutions for 2025, latest 2027 for Kolibri and by 2030 operating +200 aircraft carbon-neutral.

People should take rail the politicos wrote. Yeah, I can see Merkel spending a day to travel from Berlin to Brussels. An interesting LinkedIn post, and German Tagesschau reports “Strategy falls short of what is possible and necessary”. A carbon-neutral aviation we plan on existing technological solutions for 2025, latest 2027 for Kolibri and by 2030 operating +200 aircraft carbon-neutral.

It’s embarrassing! Why does everyone find reasons not to invest in large-scale change? No, it is not quick, requires industrial site funding, but it’s about real change! Which in turn would apply pressure on the “establishment” to get their butts up and move. Get out of your comfort zone and make a change.

Divesting the Bad, Investing in Sustainability

There are exceptionally good examples recently, like Scottish Widows devesting “bad stocks” in the value of almost half a million Euro. Whoops?

There are exceptionally good examples recently, like Scottish Widows devesting “bad stocks” in the value of almost half a million Euro. Whoops?

And whoops again. But they work with Black Rock, a company with a very bad reputation, funding most of the dirty stocks in the world. But on the other side, Black Rock may have started their journey to change? Maybe the money divested may be well invested into those change makers?

Corona is a testing time for about everybody. But also an opportunity for new methods and thinking to rise.

Impact Investment for better ROI!

Though also notable, there is a bad misinterpretation that impact investment would mean low ROI. I think our business concept for Kolibri is looking at very competitive ROI at a residual risk below other investments. But it is so much easier to accuse impact investment to justify one owns look the other direction, right?

Though also notable, there is a bad misinterpretation that impact investment would mean low ROI. I think our business concept for Kolibri is looking at very competitive ROI at a residual risk below other investments. But it is so much easier to accuse impact investment to justify one owns look the other direction, right?

Impact Investment ain’t Philanthropy.

Invest into the future and benefit from it!

And as real impact investment gains support and more and more investors look at their investment portfolio and clear out the dirt, suddenly your “max-ROI”-investment in crude oil, guns or other “bad investments” will turn foul on you. Investment into the main investor in “bad business”, namely Black Rock will backfire on your own reputation. So Black Rock will likely recognize the headwinds and start divesting too? Not to be caught in the fray.

Funds, Indices, Shares or what?

Well, it’s always easy to invest into existing business. Buying in on indices or major shares, you don’t need to understand anything beyond their “performance” and “marketing message”. If they wash well enough, they might appear shining green or white, right?

Well, it’s always easy to invest into existing business. Buying in on indices or major shares, you don’t need to understand anything beyond their “performance” and “marketing message”. If they wash well enough, they might appear shining green or white, right?

As if we did not learn the very recent lessons from German Property Group, Wirecard? On a report that week, a Shortseller mentioned that the higher the interests and dividends, the likelier they are on a rush against the wall. So they look at those stocks first. As do greedy investors…

My very personal experience includes working for a company that became one of the “New Market winners” when they entered the stock market. Happened, after a short flash in the pan, they ended up a penny stock.

The “typical” aviation investment is aircraft funds. Whereas KPMG valued them at an average 4% return in 2019, look at all those assets now. Liabilities in most cases, because they had and have no USP. And even back in 2019, the big aircraft lessors being well established with the airlines made good returns, but many funds also underperformed or failed completely.

The “typical” aviation investment is aircraft funds. Whereas KPMG valued them at an average 4% return in 2019, look at all those assets now. Liabilities in most cases, because they had and have no USP. And even back in 2019, the big aircraft lessors being well established with the airlines made good returns, but many funds also underperformed or failed completely.

Shareholder value got a very bad reputation, didn’t it? As if all shareholders would believe in Max-ROI? How about some long-term benefits, how about impact, sustainability and a return that is above the inflation rate and what your bank pays? But that is to my experience and observations the normal “manager type” our world suffers from. Maximizing the own short-term remuneration and bonuses, leaving a wreck behind. Back to IT-investments?

… or what?

Especially thinking about impact investment, we need long-term thinking. Something bank managers, institutional investors and venture capitalists fail to provide. We need people thinking in decades, in generations. We need Family Offices, private investors. And we need company managers, entrepreneurs, founders thinking not in three years at max ROI, but in 10 years and a real ROI, including but beyond monetary. Maybe at a much better ROI than those straw-fire-startups burn up?

What Impact Do You Target?

What’s the “Impact” you want to make? Is Tesla truly the future? Or is it more hydrogen? How about impact on poverty? Why not investing in “developing countries”, poor countries? Giving them the infrastructure and tools to develop themselves. Another German history lesson. While the leading industry nations cannibalized German technology, machines, entire factories, it left a void in it’s wake. A void that was filled with the help of the Marshall Plan leading Germany into the Wirtschaftswunder.

The investments back in those days did not target the surviving companies, but enabled startups. The remains of those funds are known as KfW, Germany’s Bank for Reconstruction.

Impact vs. Whitewashing

My final topic today is to take a look at the United Nations Sustainable Development Goals or U.N. SDGs.

Good Health & Wellbeing = biotech, right? Every biotech something claims to be SDG3, even the pharma-giants o chem-giant BASF.

Or Decent work and economic growth also used a lot for good argument to be “sustainable”. The Real Estate industry talks a lot about their focus on 9 and 11. Those are just the ones I see a lot “abused”. But also tech companies claiming sustainable under 3 ,4, 5 and 10… Be careful if someone tells you they’d be “sustainable” under consideration of the SDGs.

I like the approach of some family offices very much, that they qualify the real impact. Over time, what is the change. Targets, Milestones. And understanding that real change takes real efforts.

Food for Thought

Comments welcome!

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge. Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service! A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

Convincing the People to Fly Again

Convincing the People to Fly Again There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

Is it really “new thinking”? Last December, pre-Corona, I outlined

Is it really “new thinking”? Last December, pre-Corona, I outlined

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.”

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.” In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management.

In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management. As addressed in

As addressed in  Dinosaurs …

Dinosaurs … Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.

Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.

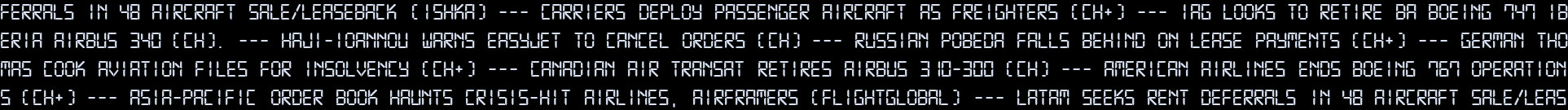

Freight Use + Repatriation Flights

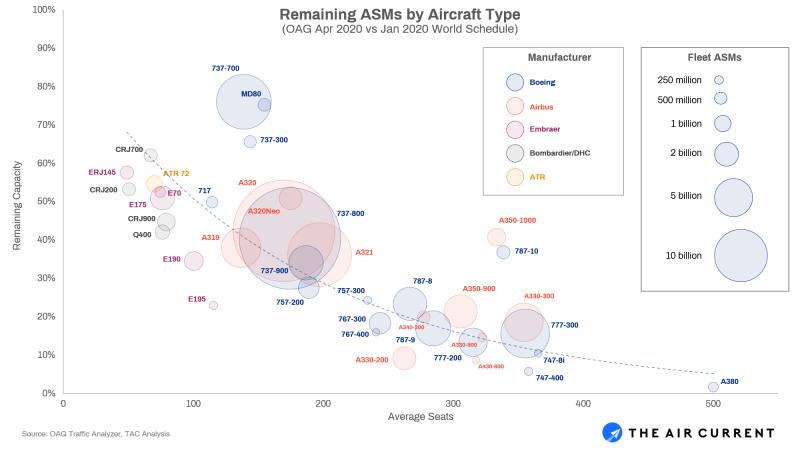

Freight Use + Repatriation Flights Very visible is the mass grounding of large aircraft. The Airbus A380 is already no longer built, now airlines retire, decommission that aircraft in large numbers. Flightradar showed quite some of those aircraft being flown to the scrap-yards, also called aircraft graveyards. The same applies to many 747s, not being “parked”, but decommissioned. The same fate even seems to hit the Boeing 777. Coronavirus also seems to seal the fate of many Boeing 767. For all those aircraft, more than 80% are grounded – many of which are being decommissioned for good.

Very visible is the mass grounding of large aircraft. The Airbus A380 is already no longer built, now airlines retire, decommission that aircraft in large numbers. Flightradar showed quite some of those aircraft being flown to the scrap-yards, also called aircraft graveyards. The same applies to many 747s, not being “parked”, but decommissioned. The same fate even seems to hit the Boeing 777. Coronavirus also seems to seal the fate of many Boeing 767. For all those aircraft, more than 80% are grounded – many of which are being decommissioned for good.

What stroke me odd was the Embraer E195, showing 75% grounded, as well as 65% of the E190s. Both very good aircraft. But very few, large operators grounding their Embraer fleet in favor or their Boeing/Airbus operations seem to have resulted in their large groundings.

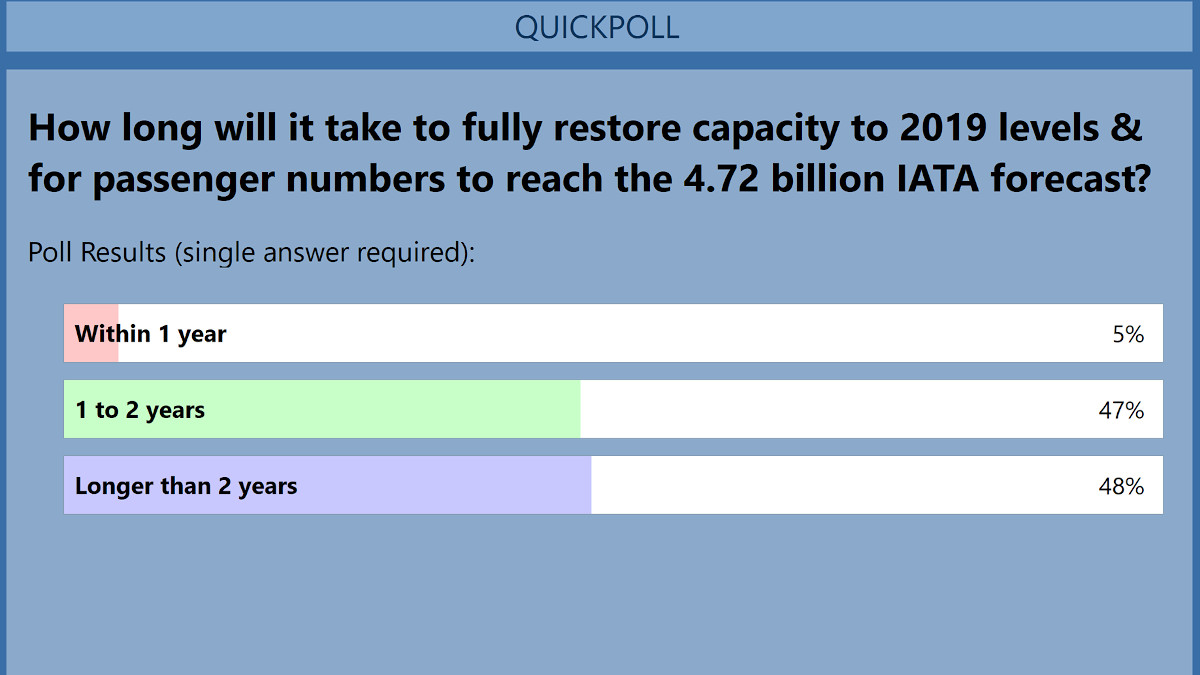

What stroke me odd was the Embraer E195, showing 75% grounded, as well as 65% of the E190s. Both very good aircraft. But very few, large operators grounding their Embraer fleet in favor or their Boeing/Airbus operations seem to have resulted in their large groundings. Optimists outlook is a two-year return to “normal” (AF/KL). Flightglobal headlines

Optimists outlook is a two-year return to “normal” (AF/KL). Flightglobal headlines  As outlines in my Corona Papers, IMF Managing Director Kristalina Georgieva warns of the

As outlines in my Corona Papers, IMF Managing Director Kristalina Georgieva warns of the  Now Flightglobal headlines that

Now Flightglobal headlines that  In a recent conference call, two attending tour operators flight purchasing managers emphasized a recovery on the basis of previously high density high volume routes. They emphasized that while VFR (visiting friends and relatives) will recover a bit faster, the “normal” traveler will be busy recovering their jobs and lives and income – they expect only very little demand for the typical vacation for 2020. And they, as tour operator flight experts raised a question: “Who will want to spend some hours in an airplane having the reputation of being a sardine can?” This will even impact the vacation travel in 2021 and beyond. There will be a revival of ground-based and localized travel at the expense of air travel. It will take time to recover from that blow.

In a recent conference call, two attending tour operators flight purchasing managers emphasized a recovery on the basis of previously high density high volume routes. They emphasized that while VFR (visiting friends and relatives) will recover a bit faster, the “normal” traveler will be busy recovering their jobs and lives and income – they expect only very little demand for the typical vacation for 2020. And they, as tour operator flight experts raised a question: “Who will want to spend some hours in an airplane having the reputation of being a sardine can?” This will even impact the vacation travel in 2021 and beyond. There will be a revival of ground-based and localized travel at the expense of air travel. It will take time to recover from that blow. Business Travel

Business Travel An exception the BTMs mentioned: Travelers who went through the infection and are such immune and noncontagious may be the first to start traveling again. But it was also consensus that a comparison to flu vaccination would be not comparable, after all the hysterics we went through.

An exception the BTMs mentioned: Travelers who went through the infection and are such immune and noncontagious may be the first to start traveling again. But it was also consensus that a comparison to flu vaccination would be not comparable, after all the hysterics we went through. All this lead to the expectation that even on former high density routes, the use of B757, A321LR and such smaller airplanes may be the first routes to recover on long haul. Some very high density routes may recover using larger aircraft such as the remaining B747s or B777s. Where I see Emirates likely to stake their claims quickly, possibly even basing some of their aircraft out of country to serve remote routes.

All this lead to the expectation that even on former high density routes, the use of B757, A321LR and such smaller airplanes may be the first routes to recover on long haul. Some very high density routes may recover using larger aircraft such as the remaining B747s or B777s. Where I see Emirates likely to stake their claims quickly, possibly even basing some of their aircraft out of country to serve remote routes. As for the anticipated return in passenger numbers, except for the very high density routes like New York-London, airlines will start with shorter hub-to-hub-routes, like back in the 80s the availability of two-leg-connections between any two cities will be limited, three-leg connections again becoming quite normal. Expectation was also voiced that most operators will shelve most, if not all twin-aisle aircraft.

As for the anticipated return in passenger numbers, except for the very high density routes like New York-London, airlines will start with shorter hub-to-hub-routes, like back in the 80s the availability of two-leg-connections between any two cities will be limited, three-leg connections again becoming quite normal. Expectation was also voiced that most operators will shelve most, if not all twin-aisle aircraft. Given the expectation of questionable safety regarding load factors and demand for 150-240-seat aircraft, this will be a turning point for the low-cost industry. For a long time, I considered “low-cost” carriers (LCC) as a cost-sensitive regional aviation player. Connecting point-to-point without a focus on connecting traffic. As the fleets grew, the routes got longer, the LCCs started experimenting with classic concepts like GDS-sales, hub-services and connecting flights, etc., etc. As the classic airlines learned to adapt to the new competition. It was long questioned on conferences and other discussions, if you can still group LCCs, that dates back even to fierce discussions about the status of Air Berlin as a LCC.

Given the expectation of questionable safety regarding load factors and demand for 150-240-seat aircraft, this will be a turning point for the low-cost industry. For a long time, I considered “low-cost” carriers (LCC) as a cost-sensitive regional aviation player. Connecting point-to-point without a focus on connecting traffic. As the fleets grew, the routes got longer, the LCCs started experimenting with classic concepts like GDS-sales, hub-services and connecting flights, etc., etc. As the classic airlines learned to adapt to the new competition. It was long questioned on conferences and other discussions, if you can still group LCCs, that dates back even to fierce discussions about the status of Air Berlin as a LCC. In most of the webinars, calls and discussions of the past weeks, the expectation was expressed that as regional flights were the last to be cancelled, they will be the first ones to recover. 150-240 seats are the domain of the former LCCs. There problem will be the very slow growth of passenger numbers post-crisis. Suddenly their “more seats” turn from benefit at full load into a severe challenge. Similar to tour operators, they will focus their recovery on the former high density routes. In a perfect scenario, they would slowly pick up speed. Realistically, they will rush it, risking a lot, flying below cost. How long they can sustain that must be seen. If aviation truly cuts back to traffic of the 1990s, the demand for flights served by 150-240 seat aircraft will be rather limited. A lot of Airbus-320- and Boeing-737-families’ aircraft will be grounded for time to come. With a devastating impact to aircraft leasing companies focusing on those aircraft.

In most of the webinars, calls and discussions of the past weeks, the expectation was expressed that as regional flights were the last to be cancelled, they will be the first ones to recover. 150-240 seats are the domain of the former LCCs. There problem will be the very slow growth of passenger numbers post-crisis. Suddenly their “more seats” turn from benefit at full load into a severe challenge. Similar to tour operators, they will focus their recovery on the former high density routes. In a perfect scenario, they would slowly pick up speed. Realistically, they will rush it, risking a lot, flying below cost. How long they can sustain that must be seen. If aviation truly cuts back to traffic of the 1990s, the demand for flights served by 150-240 seat aircraft will be rather limited. A lot of Airbus-320- and Boeing-737-families’ aircraft will be grounded for time to come. With a devastating impact to aircraft leasing companies focusing on those aircraft.

Pending question was if there will be enough consolidation to leave enough niches for the survivors. Or if the stabbing and fighting for routes will continue – with the pre-crisis effect on revenues and commercial sustainability of the air carriers. While we all expressed hope for the first, we all fear that airline managers will fall back into their old modus-operandi to focus on marked share and loads instead of revenue and profit.

Pending question was if there will be enough consolidation to leave enough niches for the survivors. Or if the stabbing and fighting for routes will continue – with the pre-crisis effect on revenues and commercial sustainability of the air carriers. While we all expressed hope for the first, we all fear that airline managers will fall back into their old modus-operandi to focus on marked share and loads instead of revenue and profit. The recovery will be slowed down as “low-cost” models at the beginning will such pose high risk – low return, airlines will need to focus initially on low load factors but the need to create profit after the drought.

The recovery will be slowed down as “low-cost” models at the beginning will such pose high risk – low return, airlines will need to focus initially on low load factors but the need to create profit after the drought. With

With

Now, surprise surprise, the current crisis proves that this is the very same with aircraft investors. If you just look at aircraft but have no idea how to use it, you’re doomed. It will work a while, it did work a while. But even before Corona, this model was doomed and I addressed it. If an investor invests into the aircraft but outsources (the risk of) the operation. Then those small failing airlines return the aircraft after not paying the bills for several months.

Now, surprise surprise, the current crisis proves that this is the very same with aircraft investors. If you just look at aircraft but have no idea how to use it, you’re doomed. It will work a while, it did work a while. But even before Corona, this model was doomed and I addressed it. If an investor invests into the aircraft but outsources (the risk of) the operation. Then those small failing airlines return the aircraft after not paying the bills for several months. Since starting to turn the idea that turned out to become

Since starting to turn the idea that turned out to become ![“For those who agree or disagree, it is the exchange of ideas that broadens all of our knowledge” [Richard Eastman]](https://foodforthought.barthel.eu/wp-content/uploads/2016/08/eastman_quote.jpg)

![Richard Eastman “For those who agree or disagree, it is the exchange of ideas that broadens all of our knowledge” [Richard Eastman]](http://foodforthought.barthel.eu/wp-content/uploads/2016/08/eastman_quote.jpg)

… or the question of leeching.

… or the question of leeching.

![Lunchmoney Lewis - I've Got Bills [Unhyping Online Marketing] Lunchmoney Lewis - I've Got Bills [Unhyping Online Marketing]](https://i.ytimg.com/vi/ETM8rrqrTW8/hqdefault.jpg)

![Snow Patrol - Calling in the Dark We are Listening ... and we're not Blind! This is your Life. This is your Time [Snow Patrol - Calling in the Dark]](http://foodforthought.barthel.eu/wp-content/uploads/2020/01/CallingintheDark.jpg)

But there was another article even more to the point: “

But there was another article even more to the point: “

Given the devastating

Given the devastating  There is an important advantage of air travel to both rail and road that is frequently not addressed. The issue of ground sealing!

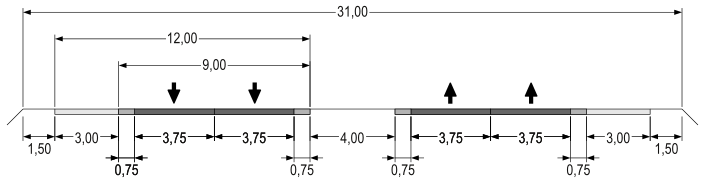

There is an important advantage of air travel to both rail and road that is frequently not addressed. The issue of ground sealing! A highway with four lanes is about 31 m wide with about 24 m being sealed. A 50 km highway such seals about 1.2 million m², so three times as much as a single airport. Highways are known to be an insurmountable obstacle for wildlife.

A highway with four lanes is about 31 m wide with about 24 m being sealed. A 50 km highway such seals about 1.2 million m², so three times as much as a single airport. Highways are known to be an insurmountable obstacle for wildlife.

Rail

Rail

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

In my opinion, it will be a short-lived circus, once we start to bring them back to reality. Because the reality check shows the hypocrisy of their arguments. Yes, take the ship to travel, as if they wouldn’t be known to pest the air with their Diesel engines…? Take the train. Where trains are available, that is. If not, sure you take the bus. Compared to the latest aircraft with contemporary engines, that will not be so eco-friendly either. Yes, I’ve seen those “fake statistics” that don’t take the secondary effects into account, like ground sealing building highways, the cost for lithium mining, for recycling.

In my opinion, it will be a short-lived circus, once we start to bring them back to reality. Because the reality check shows the hypocrisy of their arguments. Yes, take the ship to travel, as if they wouldn’t be known to pest the air with their Diesel engines…? Take the train. Where trains are available, that is. If not, sure you take the bus. Compared to the latest aircraft with contemporary engines, that will not be so eco-friendly either. Yes, I’ve seen those “fake statistics” that don’t take the secondary effects into account, like ground sealing building highways, the cost for lithium mining, for recycling.

It reminds me of my time at Erfurt-Weimar Airport, the “green heart” of Germany. Where the PTBs (powers-that-be if you know me) didn’t support the scheduled service they paid, but flew from Berlin instead, where they didn’t fund setup of a reasonable route (ERF-AMS) but simply cancelled the ERF-MUC flight without a replacement, such taking the airport of the public aviation grid. The “green heart of Germany”. Overgrown with moss.

It reminds me of my time at Erfurt-Weimar Airport, the “green heart” of Germany. Where the PTBs (powers-that-be if you know me) didn’t support the scheduled service they paid, but flew from Berlin instead, where they didn’t fund setup of a reasonable route (ERF-AMS) but simply cancelled the ERF-MUC flight without a replacement, such taking the airport of the public aviation grid. The “green heart of Germany”. Overgrown with moss.

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!