Discussing about the individual impact we make, the topic gains interest. What is your own, personal net-impact to our planet? So I decided to summarize some of the posts and comments I had on the topic on LinkedIn.

In line with previous posts about #lipservices, #cognitivedissonance and #wishfulthinking. And a #realitycheck for others, claiming “sustainability” that they do not deliver upon.

Self-Esteem over Sustainability

A clear article on it was today’s post by SEDO-founder Tim Schumacher Search: “People should only be classed as billionaires when they remove a billion tons of CO2 from the atmosphere.” referring to the CNBC article questioning the sustainability investments of Jeff Bezos (Amazon), Elon Musk (Tesla, SpaceX) and Bill Gates (Microsoft founder).

A clear article on it was today’s post by SEDO-founder Tim Schumacher Search: “People should only be classed as billionaires when they remove a billion tons of CO2 from the atmosphere.” referring to the CNBC article questioning the sustainability investments of Jeff Bezos (Amazon), Elon Musk (Tesla, SpaceX) and Bill Gates (Microsoft founder).

In my comment, I emphasized that we need no ESG, but #sustainabilityaccounting. And much of what I see from these and other investors is showing their response to their conscience, focusing their activities on things they understand, but also things that have an impact to their self-esteem. And there was also this Open Letter to Bill Gates, reflecting on his #cognitivedissonance or #lipservices. I believe it’s simply cognitive dissonance. Keep in mind, these people also live in their social (media) bubble.

Role Models

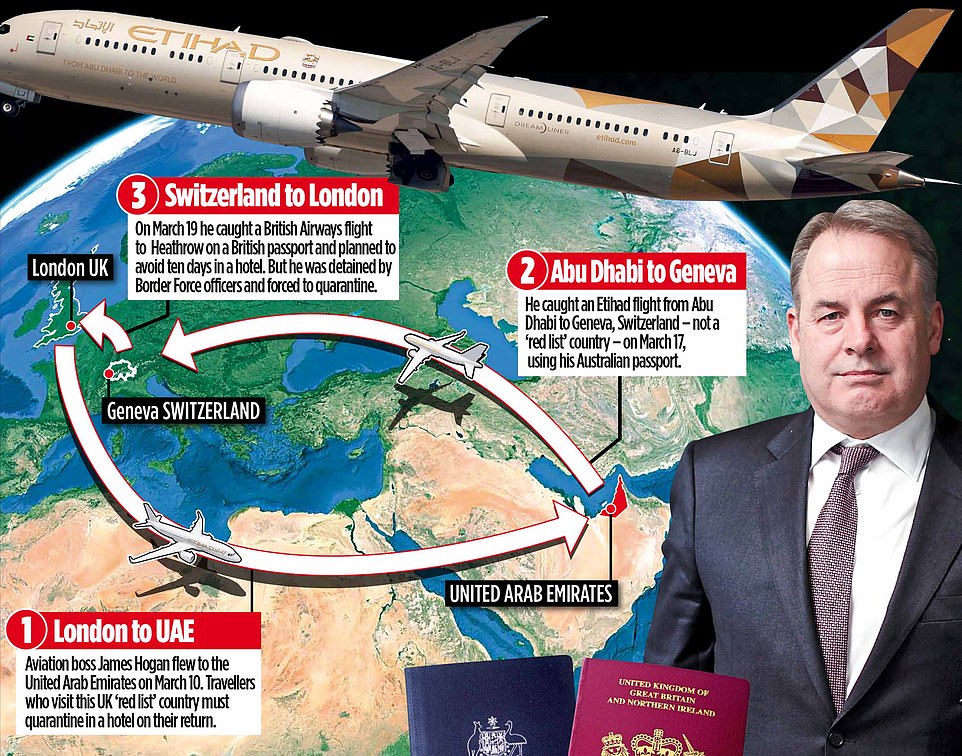

Yesterday, there was a report about industry leader/face James Hogan, former CEO of Etihad, caught in the act, trying to circumvent the Corona rules in place. It underlined my post two weeks ago, that we have airlines skipping pre-flight corona-testing regime. A disservice to an industry trying very hard to make flying safe! I’m sure he regrets that idea now, not having considered the repercussions of being caught.

Yesterday, there was a report about industry leader/face James Hogan, former CEO of Etihad, caught in the act, trying to circumvent the Corona rules in place. It underlined my post two weeks ago, that we have airlines skipping pre-flight corona-testing regime. A disservice to an industry trying very hard to make flying safe! I’m sure he regrets that idea now, not having considered the repercussions of being caught.

#cognitivedissonance : While flying itself may be safe, passengers aren’t! Anyone claiming flying to be “safe” shall better keep in mind that the virus spreads and new variants keep spreading by travelers. Also and a lot pre-tested passengers are infected but not yet positive, they then spread the virus in their destination.

: While flying itself may be safe, passengers aren’t! Anyone claiming flying to be “safe” shall better keep in mind that the virus spreads and new variants keep spreading by travelers. Also and a lot pre-tested passengers are infected but not yet positive, they then spread the virus in their destination.

#weareallinthistogether and the only safety I see in the vaccinations. And this ain’t the new measles I compared to early in the pandemic (May ’20), but more like the flu. A vaccination not available to everyone (yet). About which U.N. Secretary General António Guterres warns of #vaccinationalism. Also claiming the climate emergency. A caller in the dark?

The European Sustainability Bank

Then, let me talk about the decision makers at European Investment Bank (EIB). Claiming to be the European Sustainability Bank. In a conference by Geneva Macro Labs, I asked their head of climate office Elina Kamenitzer on her claim that they do green investments: Are there any success stories that proof the impact, the “impact” targets achieved ever since? Well, no. They “have to look into that now.” It’s about time.

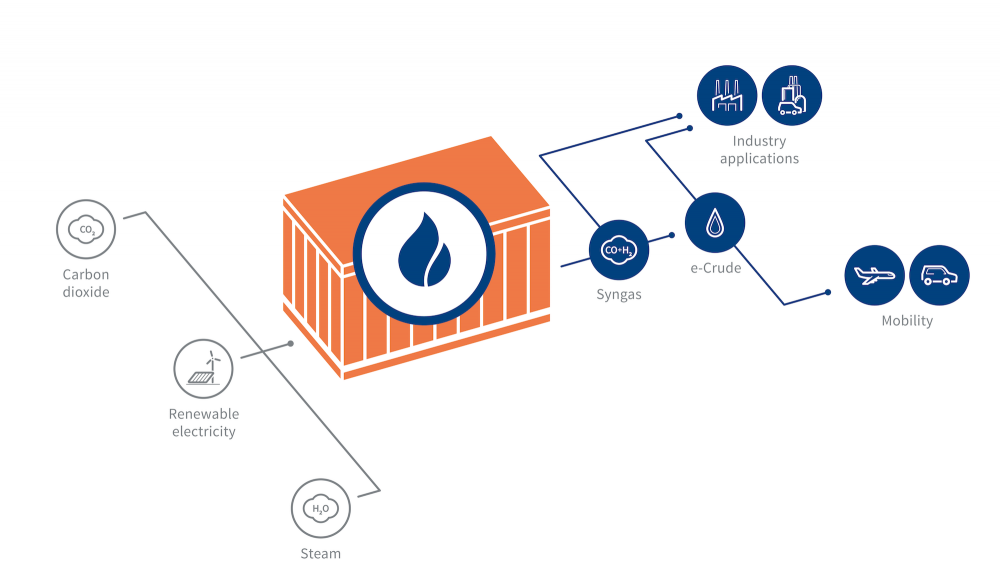

I also reached out to my now ex-point of contact in EIB, about a co-investment into our impact plans. With (a cheap) reference to their Roadmap and the decision there to not finance conventionally fueled aircraft (page 102), he disqualified any investments into aviation. In utter ignorance of what I believe he understood (I did remind him), that we have plans that are not aircraft-funding related. But i.e. development into a synfuel-ecosphere. Our plans cover all of the 17 SDGs, mostly with quantifiable targets that we sure plan to exceed on. If you’re convinced to do the right thing, that comes as a natural.

I also reached out to my now ex-point of contact in EIB, about a co-investment into our impact plans. With (a cheap) reference to their Roadmap and the decision there to not finance conventionally fueled aircraft (page 102), he disqualified any investments into aviation. In utter ignorance of what I believe he understood (I did remind him), that we have plans that are not aircraft-funding related. But i.e. development into a synfuel-ecosphere. Our plans cover all of the 17 SDGs, mostly with quantifiable targets that we sure plan to exceed on. If you’re convinced to do the right thing, that comes as a natural.

But that ain’t what the bureaucrats at EIB look at, is it?

So back to the article topic:

What is Your Impact?

There is a petition against greenwashing on Change.org I urge you to sign! Discussing on that one, we had several discussions on how to define greenwashing. Whereas family office principals told me ESG would be the role model for greenwashing. A good idea, meanwhile abused. There may be some investors who understand the meaning of it. But not many.

There is a petition against greenwashing on Change.org I urge you to sign! Discussing on that one, we had several discussions on how to define greenwashing. Whereas family office principals told me ESG would be the role model for greenwashing. A good idea, meanwhile abused. There may be some investors who understand the meaning of it. But not many.

It is the same about claims to be “sustainable”. Another family office principal told me, that out of the 2020 impact investments, only 4% were having clear impact to improve on SDGs. 96% were disqualified as they just claimed without goals and targets but simple claims misreading the causes. Nice if you plan SDG5 Gender Equality on your hiring process, but without clear targets on how to improve. Or if you abuse SDG9 Industry, Innovation and Infrastructure for your “innovative IT project”.

Only Net Impact is Real Impact

We came to the conclusion that real impact is about net impact. And that “impact” is about reduction of the strain we put on the planet. To reduce power consumption by 10% but planning to increase the total power needs by 30% is intentional abuse of the sustainability claim.

There are many good examples out there, beyond what we plan at Kolibri. But we speak a lot with investors that want to cash-in on us before we launched. And investors, investing little money into small projects, more like a philanthropy, but an impact investment. Paying for a clean conscience, paying for their other daily sins. I just told one of the family office principals. We are looking not for those classic investors. We are targeting the family office space, as there are more investors than elsewhere wo take sustainability to heart. Who focus on it. Who are understanding that an impact investment might not be as profitable as i.e. Bitcoin. But it’s the right thing to do. And

Impact Investment ain’t philanthropy. Do good and make money!

So this time, not just Food for Thought, but a clear question:

What is Your Impact?

Feedback welcome…

While we talk with impact investors, we do also understand the European Central and the European Investment Bank claiming to be “Sustainability Banks”. Talking with the very same investors being “naturally” and clearly interested in sustainable projects, we asked why they would not make use of those funds to complement an investment into Kolibri or other impact investments.

While we talk with impact investors, we do also understand the European Central and the European Investment Bank claiming to be “Sustainability Banks”. Talking with the very same investors being “naturally” and clearly interested in sustainable projects, we asked why they would not make use of those funds to complement an investment into Kolibri or other impact investments.

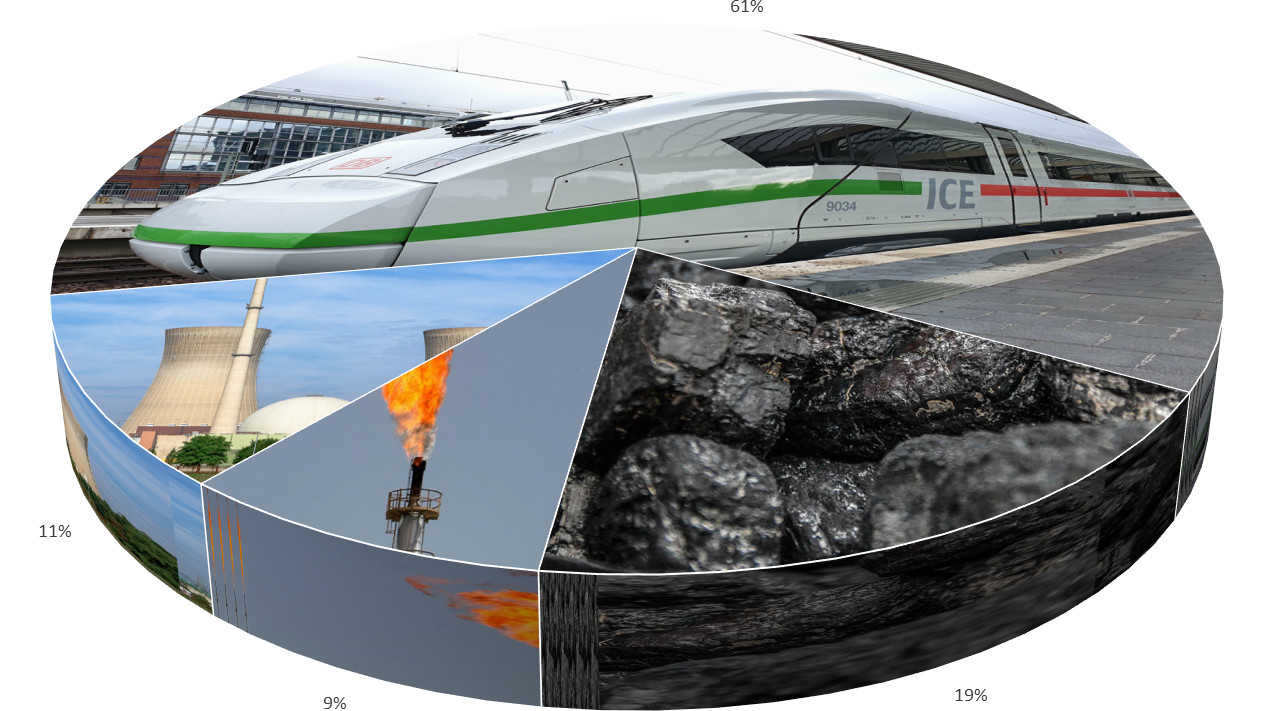

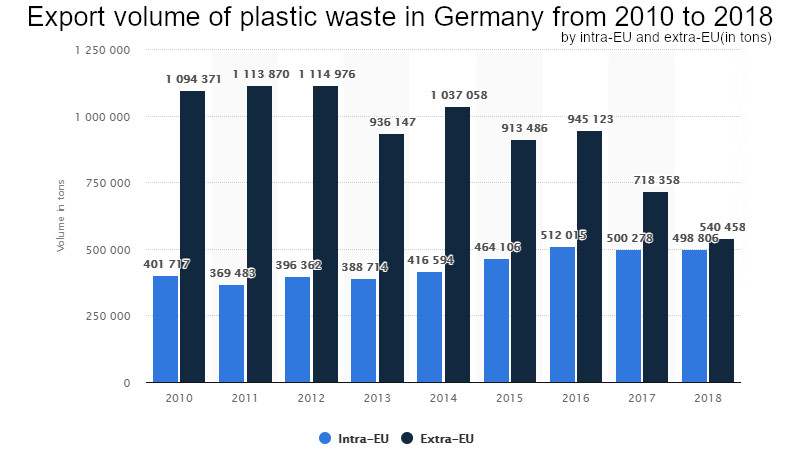

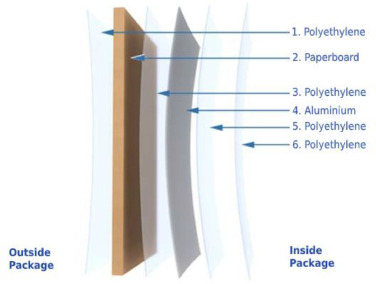

At the same time, the plastics industry is booming. And instead of developing sustainable packaging, the trend is clearly towards mixed-use, the known bad example being “Tetra Pak®“; a packaging made of several layers that make it exceptionally

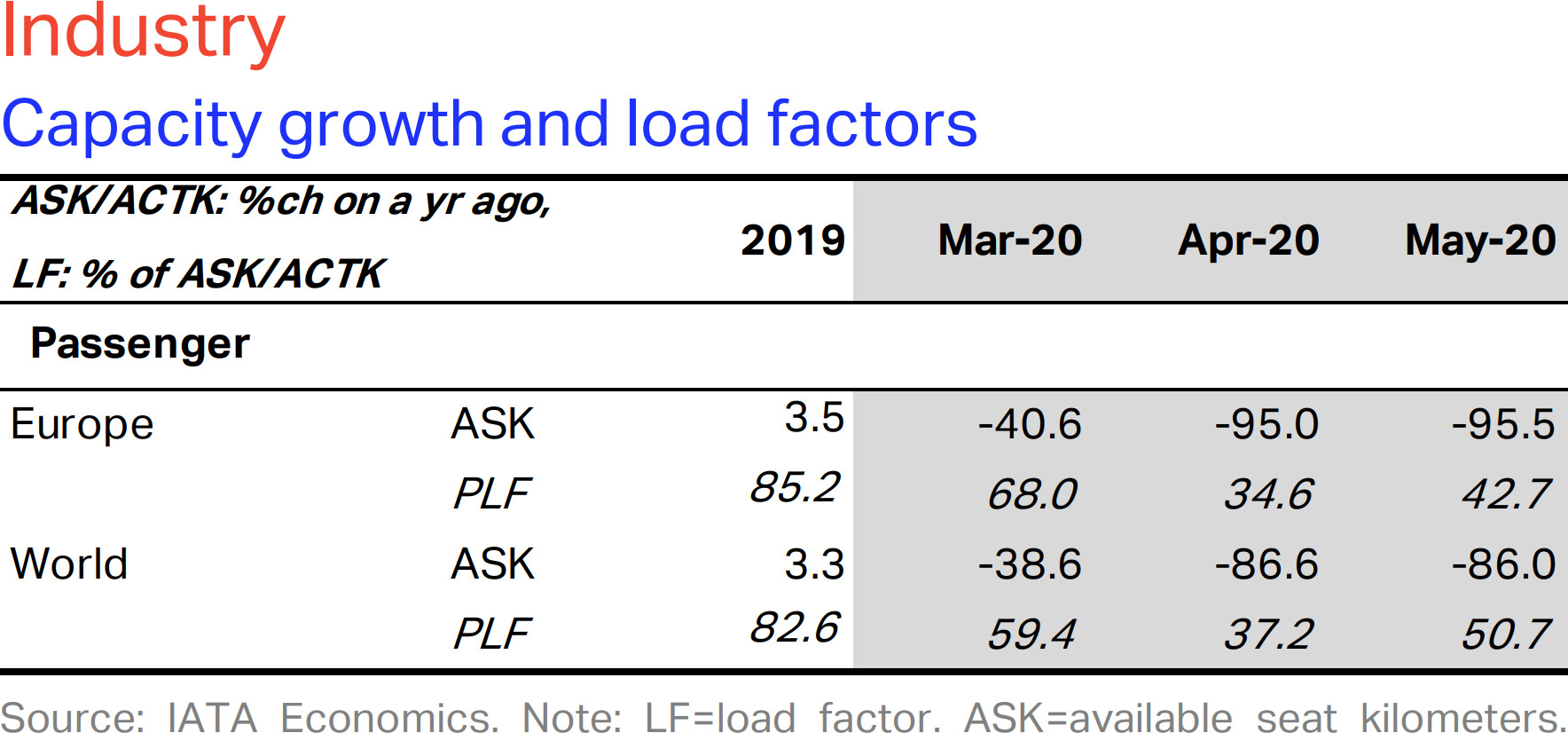

At the same time, the plastics industry is booming. And instead of developing sustainable packaging, the trend is clearly towards mixed-use, the known bad example being “Tetra Pak®“; a packaging made of several layers that make it exceptionally  Now, how about “my industry”, how about aviation? And why is it constantly the scapegoat and blamed for global warming?

Now, how about “my industry”, how about aviation? And why is it constantly the scapegoat and blamed for global warming? Speaking with one of those “challengers”, he argued that in 10 years the first regional aircraft will fly on fuel-cells. Being “project planning”, I’d say better add 50% reserve to that, then we talk about 15 years. And personally I still doubt that time line. And then we will have aircraft with 10, 20 or maybe 30 seats. With a range of one to two hours. When we will have aircraft that transports 100 seat? Or ones that can replace the 150-250 seats used by the low cost airlines? When do we expect aircraft to transport 250-350 passengers long haul? Hiding behind “Research”? Science Fiction…

Speaking with one of those “challengers”, he argued that in 10 years the first regional aircraft will fly on fuel-cells. Being “project planning”, I’d say better add 50% reserve to that, then we talk about 15 years. And personally I still doubt that time line. And then we will have aircraft with 10, 20 or maybe 30 seats. With a range of one to two hours. When we will have aircraft that transports 100 seat? Or ones that can replace the 150-250 seats used by the low cost airlines? When do we expect aircraft to transport 250-350 passengers long haul? Hiding behind “Research”? Science Fiction… Sustainable economy and global warming are big issues today, but most that we see is lip services. An investor group just recently checked impact investments for the “real” impact. They reported about 4% of all investments having a quantifiable impact or quantifiable targets. Only 4%. All others to be #greenwashing. On the “impact programs” of the 100 largest companies in Europe they found not a single one having more than one or two percent impact to global warming. Most of them being “lighthouse projects” that are being developed inside a “bubble” that does not immediately impact the company. Mostly lip-services addressing already established programs, but don’t really change the existing processes.

Sustainable economy and global warming are big issues today, but most that we see is lip services. An investor group just recently checked impact investments for the “real” impact. They reported about 4% of all investments having a quantifiable impact or quantifiable targets. Only 4%. All others to be #greenwashing. On the “impact programs” of the 100 largest companies in Europe they found not a single one having more than one or two percent impact to global warming. Most of them being “lighthouse projects” that are being developed inside a “bubble” that does not immediately impact the company. Mostly lip-services addressing already established programs, but don’t really change the existing processes.

“But how about electric flying?” you might ask? Yes, how about it? In December 2013, a battery on a Boeing 787 Dreamliner caught fire. It was later attributed to a “design flaw”. Yes, Boeing had quite some trouble even before the MAX-disaster.

“But how about electric flying?” you might ask? Yes, how about it? In December 2013, a battery on a Boeing 787 Dreamliner caught fire. It was later attributed to a “design flaw”. Yes, Boeing had quite some trouble even before the MAX-disaster. Many of you remember that back in 2008 I worked with investors and potential climate-sensitive customer we worked on a hydrogen-powered WIG (wing in ground). Combining the then existing research platform SeaFalcon with a common hydrogen-engine and refining hydrogen from solar power. Back in the days, we got a viability study funded to work out the business case based on Maldivian Air Taxi. Very successful business case in fact. Then came Lehman and we never further followed up on it, something I regret to date. Back 2009/10, we could have proved the business case for carbon-free flying.

Many of you remember that back in 2008 I worked with investors and potential climate-sensitive customer we worked on a hydrogen-powered WIG (wing in ground). Combining the then existing research platform SeaFalcon with a common hydrogen-engine and refining hydrogen from solar power. Back in the days, we got a viability study funded to work out the business case based on Maldivian Air Taxi. Very successful business case in fact. Then came Lehman and we never further followed up on it, something I regret to date. Back 2009/10, we could have proved the business case for carbon-free flying. But I also learned the downsides of Hydrogen, disabling it for large aircraft. Say what? Didn’t Airbus not just promote their vision of

But I also learned the downsides of Hydrogen, disabling it for large aircraft. Say what? Didn’t Airbus not just promote their vision of  Synkerosene – Hydrogen reloaded

Synkerosene – Hydrogen reloaded There is a very strong force of inertia in aviation about turning “green”. Like other problems in aviation management, such as their disbelieve in branding, the resulting focus on “cheap” as the sole difference and a missing loyalty for partners and employees alike. that, plus missing USPs made airlines a running gag about ROI. But as in all other industries, you cannot expect change and disruptions with blind managers. You need vision.

There is a very strong force of inertia in aviation about turning “green”. Like other problems in aviation management, such as their disbelieve in branding, the resulting focus on “cheap” as the sole difference and a missing loyalty for partners and employees alike. that, plus missing USPs made airlines a running gag about ROI. But as in all other industries, you cannot expect change and disruptions with blind managers. You need vision.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge. Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service! A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

Convincing the People to Fly Again

Convincing the People to Fly Again There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

Is it really “new thinking”? Last December, pre-Corona, I outlined

Is it really “new thinking”? Last December, pre-Corona, I outlined

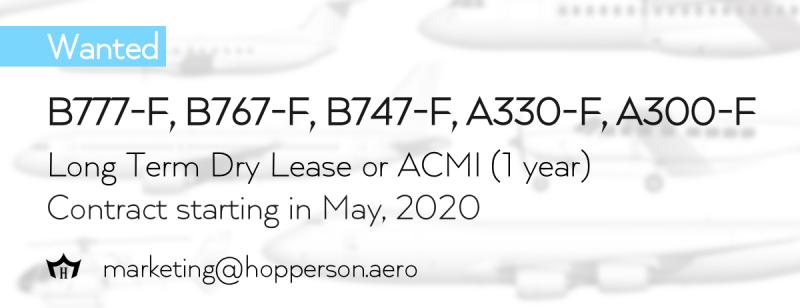

Bill Cumberlidge addressed P2F shortly in the ISHKA webinar. As the need for quick transport increases, the belly-freight in passenger aircraft has gone missing. That increases the demand for classic freighter aircraft. But keep in mind that this is a temporary peak only.

Bill Cumberlidge addressed P2F shortly in the ISHKA webinar. As the need for quick transport increases, the belly-freight in passenger aircraft has gone missing. That increases the demand for classic freighter aircraft. But keep in mind that this is a temporary peak only. The main issue there seems not to be the demand for conversions exceeding the available resources, companies with the experience in such conversions.

The main issue there seems not to be the demand for conversions exceeding the available resources, companies with the experience in such conversions. While there is a current peak, promising a use of lots of large freight aircraft (A380, B747, B777, B767, A330, A300, etc., etc.) that demand bubble will last maximum one year.

While there is a current peak, promising a use of lots of large freight aircraft (A380, B747, B777, B767, A330, A300, etc., etc.) that demand bubble will last maximum one year. But how many containers does a single container giant today transport? And how many of those can you put onboard an A380 or B747? There were a lot of hurray and self-praise of airlines that one aircraft transported 500,000 masks to somewhere. Whereas the population there is a multiple of that number. Airfreight is expensive and a drop on a hot stone.

But how many containers does a single container giant today transport? And how many of those can you put onboard an A380 or B747? There were a lot of hurray and self-praise of airlines that one aircraft transported 500,000 masks to somewhere. Whereas the population there is a multiple of that number. Airfreight is expensive and a drop on a hot stone. Another, very standard “fallback idea” is the “End-of-Life”-strategy to cannibalize the surplus aircraft for spare parts. Given the immense surplus of 150-240-seat aircraft, this bubble is instantly doomed. In several expert discussions I heard 50%, even up to 70% of the fleets to be grounded. Recovery of likely 80% within two years. Let’s say we decommission 20%. Which ones? Where? Who starts?

Another, very standard “fallback idea” is the “End-of-Life”-strategy to cannibalize the surplus aircraft for spare parts. Given the immense surplus of 150-240-seat aircraft, this bubble is instantly doomed. In several expert discussions I heard 50%, even up to 70% of the fleets to be grounded. Recovery of likely 80% within two years. Let’s say we decommission 20%. Which ones? Where? Who starts? Cognitive Dissonance: Who Pays the Bill

Cognitive Dissonance: Who Pays the Bill