Discussing Airport Development on a general and global scale lately with some renowned influencers in this industry, there were some thoughts, I would like to share today.

Who’s the Customer?

Who’s the Customer?

It was rather fascinating to discuss the “customer” issue with airports recently. Though despite we all know that we compete about the passengers, the airline is just as much a customer of the airport as are ground handling companies. As we published in our case study on Zurich’s new deicing management, one of the main cost savings factors, reflecting millions of savings (Euro, Dollar, …) comes from reduction of delay, faster recovery from overall delays or disruptions. With passengers and airlines alike benefiting from “pre-tactical” information.

Keeping the Status Quo

or why only the dead fish swims with the stream? There is a great tendency in our industry today to wait and see “others” and especially “the big ones” to invest in new technologies and try them. And only with many years of delays implement the investment into the own budget plans and maybe get it year(s) later. Be that the use of (free) WiFi at the airports for all customers or CDM developments to the benefit of airport operations – especially under adverse conditions.

Saving, no matter the cost

Saving, no matter the cost

A common argument against the investment is that the status quo functions. Airlines are i.e. “used” to have major delays during and after winter events. The throughput is lower, flights must be cancelled, after disruptions, the recovery takes time. Zurich having saved +20 million Euros in one season alone by “managed” deicing is a good counter example. With other airports/airlines stalling the implementation of the tool for their airports/terminals “for cost reasons”. Sorry, I will never get used to burning the amounts of money our industry does. We invest into “customer experience” but don’t bother about reducing flight delays.

Collaboration vs. Silo

Collaboration vs. Silo

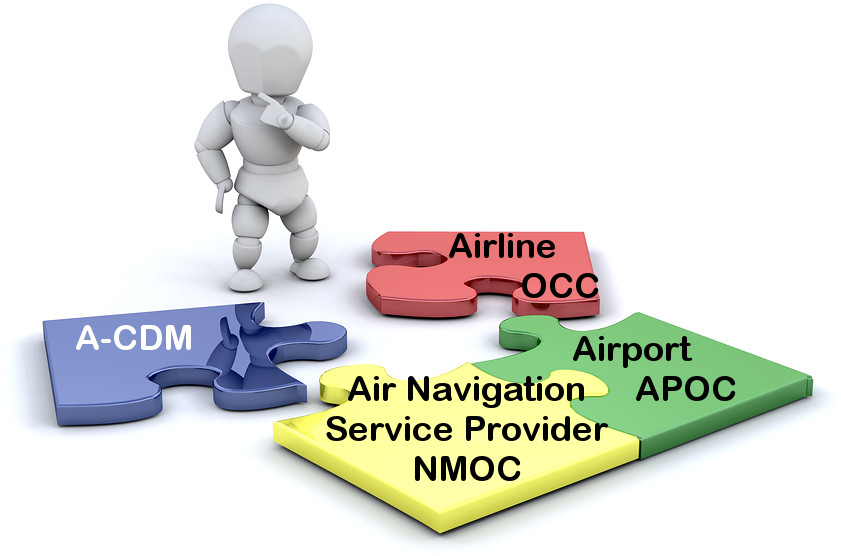

The global Civil Air Navigation Services Organisation (CANSO) and the Airports Council International have declared Airport Collaborative Decision Making (A-CDM) a management matter, joining forces in the promotion of the concept. Now airports and airlines alike keep pointing out that they have no common data. A major U.S. airport disqualifying it with the example that they don’t even get an Estimated Time of Arrival (ETA) or Departure (ETD) from their airlines. They learn of arrivals or departures once the aircraft is on approach or on engine start-up or pushback – thanks to kind information by the tower. The operator of a terminal at one major hub tells us, collaboration won’t work at their airport as the terminal operators strongly competing. Yes, there are workarounds possible (considering the controlled apron/tarmac area “the airport”), but as long as airlines and ground handlers keep up such self-understanding, we are a long way from “effective operations” or even a basic management of delays, disruptions and recovery.

Airport Strategy

In the discussion, we also talked about airport strategy. New airports are being build without giving consideration to A-CDM or TAMS (Total Airport Management, expanding A-CDM into the land side), but focusing on fancy design. (New) Nordic airports having trouble with the positioning of their deicing pads (also called “Central Deicing Facilities” or CDFs). Space for an “Airport Operations Control Center” (APOC) being later taken from existing office space, instead of pre-planning the necessity. Airport Operators like Avialliance, Vinci or even Fraport (a CDM-airport) focus on CDM locally, instead of considering solutions that improve the airport group. Just some thoughts on the issue as we discussed it and I joggled down my notes…

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

I still will likely work another 15 years at minimum – maybe 20 or more! Many retirees are still fit to work and get bored if they don’t. The majority of students taking up their first new job will be with the company less than five years in the end. Inexperienced and with low salaries companies invest heavily to train them on the jobs they do (or risk to invest into their mistakes). Whereas you can hire experienced people who know their jobs, make less (costly) mistakes and who have a “knowing” touch, usually good for building trust with new customers or prospects.

I still will likely work another 15 years at minimum – maybe 20 or more! Many retirees are still fit to work and get bored if they don’t. The majority of students taking up their first new job will be with the company less than five years in the end. Inexperienced and with low salaries companies invest heavily to train them on the jobs they do (or risk to invest into their mistakes). Whereas you can hire experienced people who know their jobs, make less (costly) mistakes and who have a “knowing” touch, usually good for building trust with new customers or prospects.

Just screening all those wisdoms my friends keep sharing on LinkedIn and Facebook, here one from own experience…

Just screening all those wisdoms my friends keep sharing on LinkedIn and Facebook, here one from own experience…

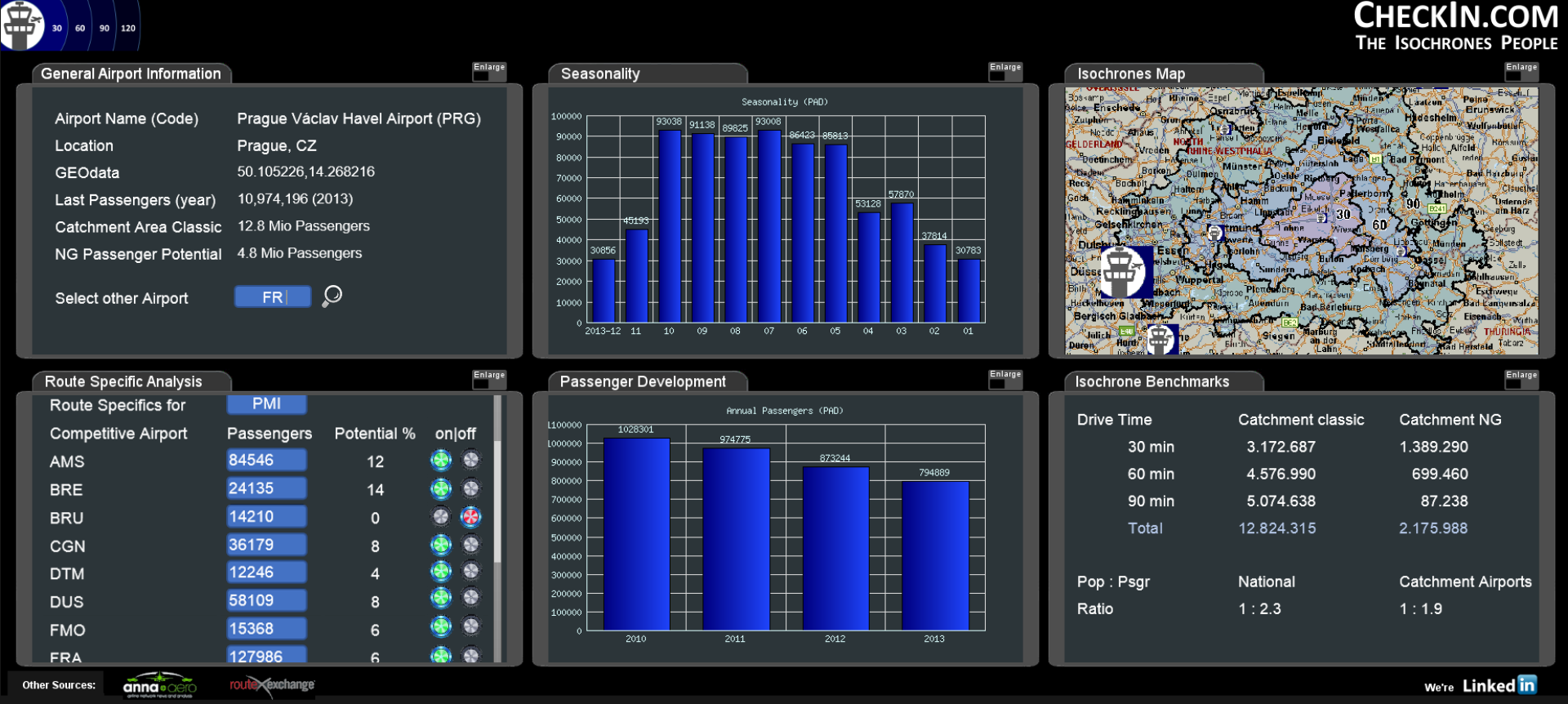

Another issue is drive times, where we have to deal with the fact that “unique administrative places” are not being found either in Google, nor by other on- and offline mapping tools. Often, road data is missing completely, making it impossible to calculate any drive times. Especially going east that caused us quite some headaches (and night shifts). So now finally, though with already some delay, we have everything covered. But we recognize that “mapping” is a major fuzziness, if we go with existing technologies – we should buy into commercial collections of administrative borders, though which also don’t completely match with the data we are having.

Another issue is drive times, where we have to deal with the fact that “unique administrative places” are not being found either in Google, nor by other on- and offline mapping tools. Often, road data is missing completely, making it impossible to calculate any drive times. Especially going east that caused us quite some headaches (and night shifts). So now finally, though with already some delay, we have everything covered. But we recognize that “mapping” is a major fuzziness, if we go with existing technologies – we should buy into commercial collections of administrative borders, though which also don’t completely match with the data we are having. So January 1st, we started the

So January 1st, we started the  Then came the shock. Within days, Jürgen went into sickleave, undergoing a major surgery Feb 27th, taken completely out of the loop for the better part of 14 days and being still hospitalized (4th week), depriving us from the most knowledgable and networked expert in our team. He is well now, still recovering, still hospitalized. The tumors identified turned out a haemangiome (as “known” since 2002) and a benign neuroendokrineous one.

Then came the shock. Within days, Jürgen went into sickleave, undergoing a major surgery Feb 27th, taken completely out of the loop for the better part of 14 days and being still hospitalized (4th week), depriving us from the most knowledgable and networked expert in our team. He is well now, still recovering, still hospitalized. The tumors identified turned out a haemangiome (as “known” since 2002) and a benign neuroendokrineous one. Having the drive time calculations completeted for Europe, we will now start to work on North America already. With the custom tool received by

Having the drive time calculations completeted for Europe, we will now start to work on North America already. With the custom tool received by  Then we have to find a web-agency that can do it (the famous needle in the haystack problem). But without map(s), the dashboard is incomplete, so there must be some “placeholder” while we create the map(s). All those tasks we now have to do on our own finally summed up to the painful decision to reschedule the development plans and skip Routes. Which was especially hard on Jürgen to convince, who is a great fan of that event. We do hope you can understand the reasoning behind our decision and appreciate your feedback – supportive, critical, honest. And if you have ideas how to speed up our agenda, if you have reference to a real good web-agency, you are very welcome! Just a little bit

Then we have to find a web-agency that can do it (the famous needle in the haystack problem). But without map(s), the dashboard is incomplete, so there must be some “placeholder” while we create the map(s). All those tasks we now have to do on our own finally summed up to the painful decision to reschedule the development plans and skip Routes. Which was especially hard on Jürgen to convince, who is a great fan of that event. We do hope you can understand the reasoning behind our decision and appreciate your feedback – supportive, critical, honest. And if you have ideas how to speed up our agenda, if you have reference to a real good web-agency, you are very welcome! Just a little bit

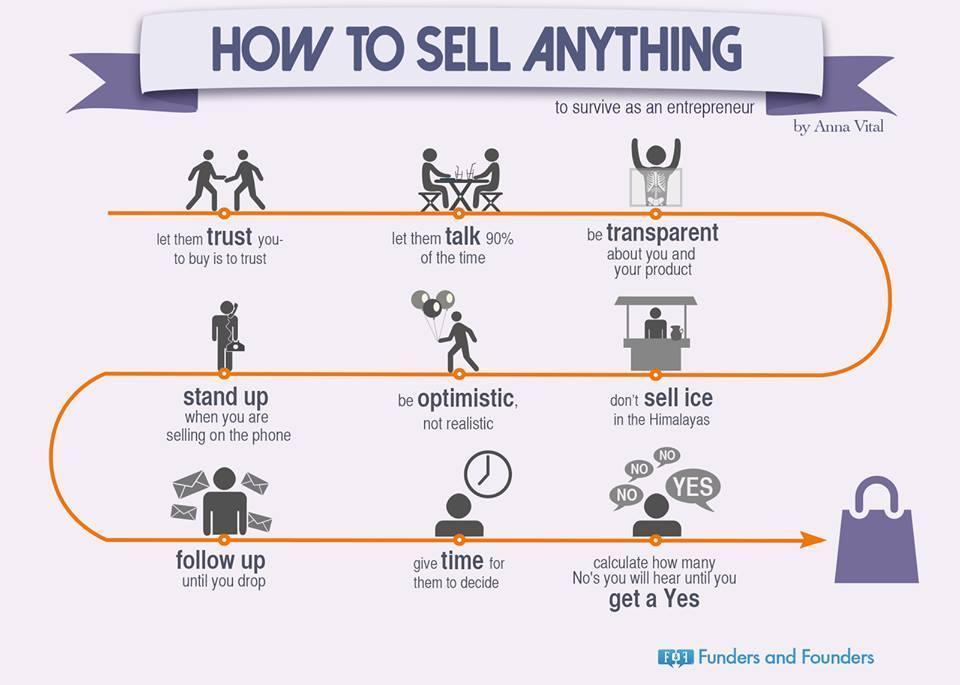

During my initial business education, more than 30 years ago, the General Manager of the company hosting me for the practical part told me: “Someone else always can sell cheaper”. At the time, concepts like “USPs” (Unique Selling Propositions) had not been “common”, but it practically was about how to position for success.

During my initial business education, more than 30 years ago, the General Manager of the company hosting me for the practical part told me: “Someone else always can sell cheaper”. At the time, concepts like “USPs” (Unique Selling Propositions) had not been “common”, but it practically was about how to position for success.

Honesty. I was tought early in my life to never lie if possible. Bend the truth, better tell some truth that makes the people believe you lie (and proof them better later). When Obama visited Erfurt, press asked. All I communicated was “The Pilots’ Union said that Obama’s 747 cannot land in Erfurt”. What I did not tell them, that the Union’s “experts” had missed the fact that Air Force One is usually not “fully loaded” and has the advantage of some (so public sources say) 20% higher engine power. When it came to Erfurt, I had never lied. And ever since had a good standing with them. Honesty creates trust. If you lie once, you’ll have a hard time to recover.

Honesty. I was tought early in my life to never lie if possible. Bend the truth, better tell some truth that makes the people believe you lie (and proof them better later). When Obama visited Erfurt, press asked. All I communicated was “The Pilots’ Union said that Obama’s 747 cannot land in Erfurt”. What I did not tell them, that the Union’s “experts” had missed the fact that Air Force One is usually not “fully loaded” and has the advantage of some (so public sources say) 20% higher engine power. When it came to Erfurt, I had never lied. And ever since had a good standing with them. Honesty creates trust. If you lie once, you’ll have a hard time to recover. A final example for this article today shall be Apple. I loved Apple. Past tense. They made the first smart phones. All others copied them. Now they struggle and their answer is “me too”-products. What was their USP?

A final example for this article today shall be Apple. I loved Apple. Past tense. They made the first smart phones. All others copied them. Now they struggle and their answer is “me too”-products. What was their USP? Academic – Epidemic

Academic – Epidemic Q: “Why should I go to this event, I can talk to them on the phone.”

Q: “Why should I go to this event, I can talk to them on the phone.”

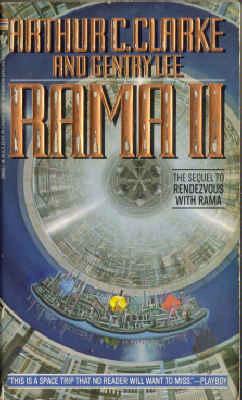

[…] An unrestrained burst of conspicuous consumption and global greed lasted for just under two years. Frantic acquisition of everything the human mind could create was superimposed on a weak economic infrastructure that had been already poised for a downturn in early 2130 . The looming recession was first postponed throughout 2130 and 2131 by the combined manipulative efforts of governments and financial institutions, even though the fundamental economic weaknesses were never addressed. With the renewed burst of buying in early 2132, the world jumped directly into another period of rapid growth. Production capacities were expanded, stock markets exploded, and both consumer confidence and total employment hit all-time highs. There was unprecedented prosperity and the net result was a short-term but significant improvement in the standard of living for almost all humans.

[…] An unrestrained burst of conspicuous consumption and global greed lasted for just under two years. Frantic acquisition of everything the human mind could create was superimposed on a weak economic infrastructure that had been already poised for a downturn in early 2130 . The looming recession was first postponed throughout 2130 and 2131 by the combined manipulative efforts of governments and financial institutions, even though the fundamental economic weaknesses were never addressed. With the renewed burst of buying in early 2132, the world jumped directly into another period of rapid growth. Production capacities were expanded, stock markets exploded, and both consumer confidence and total employment hit all-time highs. There was unprecedented prosperity and the net result was a short-term but significant improvement in the standard of living for almost all humans. ATN: Are you afraid that this new environment will bring more low-cost carriers or do you believe that this model does not fit into the African environment?

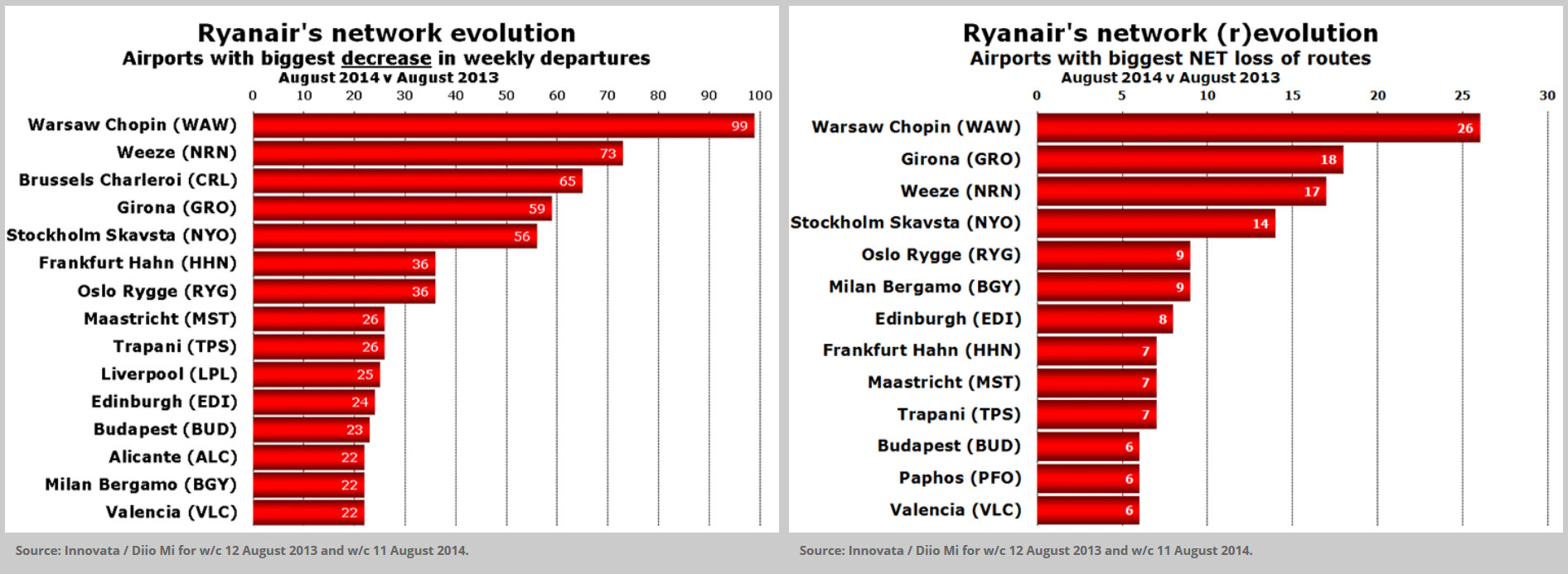

ATN: Are you afraid that this new environment will bring more low-cost carriers or do you believe that this model does not fit into the African environment? Just my idea on that: I truly believe that a small carrier can operate a low cost model. In the beginning the carriers operated large narrow-body like 737-800 or A320 with some 185 seats. More and more, they also operate smaller aircraft like the 737-700 or the A319. And the time the prices were really low are gone as well. In the end you have to cover cost of operations as well as secondary cost like marketing, call center, claims and refunds, taxes and the likes. Not to forget the kerosene as a main cost block, forcing the models to slowly converge. Did I mention Intersky’s regional low-cost operations?

Just my idea on that: I truly believe that a small carrier can operate a low cost model. In the beginning the carriers operated large narrow-body like 737-800 or A320 with some 185 seats. More and more, they also operate smaller aircraft like the 737-700 or the A319. And the time the prices were really low are gone as well. In the end you have to cover cost of operations as well as secondary cost like marketing, call center, claims and refunds, taxes and the likes. Not to forget the kerosene as a main cost block, forcing the models to slowly converge. Did I mention Intersky’s regional low-cost operations?