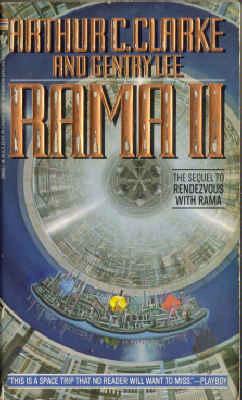

The following is a transcript from Chapter 4 of the 1979 book “Rama II”, a science fiction written by Arthur C. Clarke, author of 2001 and other bestsellers.

The similarities to the current global commercial (non-?)crisis are rather frightening and I’d like to leave the following further uncommented.

4 THE GREAT CHAOS

[…] An unrestrained burst of conspicuous consumption and global greed lasted for just under two years. Frantic acquisition of everything the human mind could create was superimposed on a weak economic infrastructure that had been already poised for a downturn in early 2130 . The looming recession was first postponed throughout 2130 and 2131 by the combined manipulative efforts of governments and financial institutions, even though the fundamental economic weaknesses were never addressed. With the renewed burst of buying in early 2132, the world jumped directly into another period of rapid growth. Production capacities were expanded, stock markets exploded, and both consumer confidence and total employment hit all-time highs. There was unprecedented prosperity and the net result was a short-term but significant improvement in the standard of living for almost all humans.

[…] An unrestrained burst of conspicuous consumption and global greed lasted for just under two years. Frantic acquisition of everything the human mind could create was superimposed on a weak economic infrastructure that had been already poised for a downturn in early 2130 . The looming recession was first postponed throughout 2130 and 2131 by the combined manipulative efforts of governments and financial institutions, even though the fundamental economic weaknesses were never addressed. With the renewed burst of buying in early 2132, the world jumped directly into another period of rapid growth. Production capacities were expanded, stock markets exploded, and both consumer confidence and total employment hit all-time highs. There was unprecedented prosperity and the net result was a short-term but significant improvement in the standard of living for almost all humans.

By the end of the year in 2133, it had become obvious to some of the more experienced observers of human history that the “Raman Boom” was leading mankind toward disaster. Dire warnings of impending economic doom started being heard above the euphoric shouts of the millions who had recently vaulted into the middle and upper classes. Suggestions to balance budgets and limit credit at all levels of the economy were ignored. Instead, creative effort was expended to come up with one way after another of putting more spending power in the hands of a populace that had forgotten how to say wait, much less no, to itself.

The global stock market began to sputter in January of 2134 and there were predictions of a coming crash. But to most humans spread around the Earth and throughout the scattered colonies in the solar system, the concept of such a crash was beyond comprehension. After all, the world economy had been expanding for over nine years, the last two years at a rate unparalleled in the previous two centuries. World leaders insisted that they had finally found the mechanisms that could truly inhibit the downturns of the capitalistic cycles. And the people believed them—until early May of 2134.

During the first three months of the year the global stock markets went inexorably down, slowly at first, then in significant drops. Many people, reflecting the superstitious attitude toward cometary visitors that had been prevalent for two thousand years, somehow associated the stock market’s difficulties with the return of Halley’s Comet. Its apparition starting in March turned out to be far brighter than anyone expected. For weeks scientists all over the world were competing with each other to explain why it was so much more brilliant than originally predicted. After it swooped past perihelion in late March and began to appear in the evening sky in mid-April, its enormous tail dominated the heavens.

In contrast, terrestrial affairs were dominated by the emerging world economic crisis. On May 1, 2134, three of the largest international banks announced that they were insolvent because of bad loans. Within two days a panic had spread around the world. The more than one billion home terminals with access to the global financial markets were used to dump individual portfolios of stocks and bonds. The communications load on the Global Network System (GNS) was immense. The data transfer machines were stretched far beyond their capabilities and design specifications. Data gridlock delayed transactions for minutes, then hours, contributing additional momentum to the panic.

By the end of a week two things were apparent—that over half of the world’s stock value had been obliterated and that many individuals, large and small investors alike, who had used their credit options to the maximum, were now virtually penniless. The supporting data bases that kept track of personal bank accounts and automatically transferred money to cover margin calls were flashing disaster messages in almost 20 percent of the houses in the world.

In truth, however, the situation was much much worse. Only a small percentage of the transactions were actually clearing through all the supporting computers because the data rates in all directions were far beyond anything that had ever been anticipated. In computer language, the entire global financial system went into the “cycle slip” mode. Billions and billions of information transfers at lower priorities were postponed by the network of computers while the higher priority tasks were being serviced first.

The net result of these data delays was that in most cases individual electronic bank accounts were not properly debited, for hours or even days, to account for the mounting stock market losses, Once the individual investors realized what was occurring, they rushed to spend whatever was still showing in their balances before the computers completed all the transactions. By the time governments and financial institutions understood fully what was going on and acted to stop all this frenetic activity, it was too late. The confused system had crashed completely. To reconstruct what had happened required carefully dumping and interleaving the backup checkpoint files stored at a hundred or so remote centers around the world.

For over three weeks the electronic financial management system that governed all money transactions was inaccessible to everybody. Nobody knew how much money he had—or how much anyone else had. Since cash had long ago become obsolete, only eccentrics and collectors had enough bank notes to buy even a week’s groceries. People began to barter for necessities. Pledges based on friendship and personal acquaintance enabled many people to survive temporarily. But the pain had only begun. Every time the international management organization that oversaw the global financial system would announce that they were going to try to come back on-line and would plead with people to stay off their terminals except for emergencies, their pleas would be ignored, processing requests would flood the system, and the computers would crash again.

It was only two more weeks before the scientists of the world agreed on an explanation for the additional brightness in the apparition of Halley’s Comet. But it was over four months before people could count again on reliable data base information from the GNS. The cost to human society of the enduring chaos was incalculable. By the time normal electronic economic activity had been restored, the world was in a violent financial down-spin that would not bottom out until twelve years later. It would be well over fifty years before the Gross World Product would return to the heights reached before the Crash of 2134.

Food for Tought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)