Today I had a conference call and a major topic was Spain and how our (German) governments banned travel again. And publicly justifies under gross neglect of their own rules. Those “development” showing persistence to deny change. And the “Wag the Dog” syndrome, pointing the fingers at others to distract from own mistakes.

Today I had a conference call and a major topic was Spain and how our (German) governments banned travel again. And publicly justifies under gross neglect of their own rules. Those “development” showing persistence to deny change. And the “Wag the Dog” syndrome, pointing the fingers at others to distract from own mistakes.

The second topic was about the way, aviation “recovers”, the managements’ strategies.

Political Lock-Down on Travel

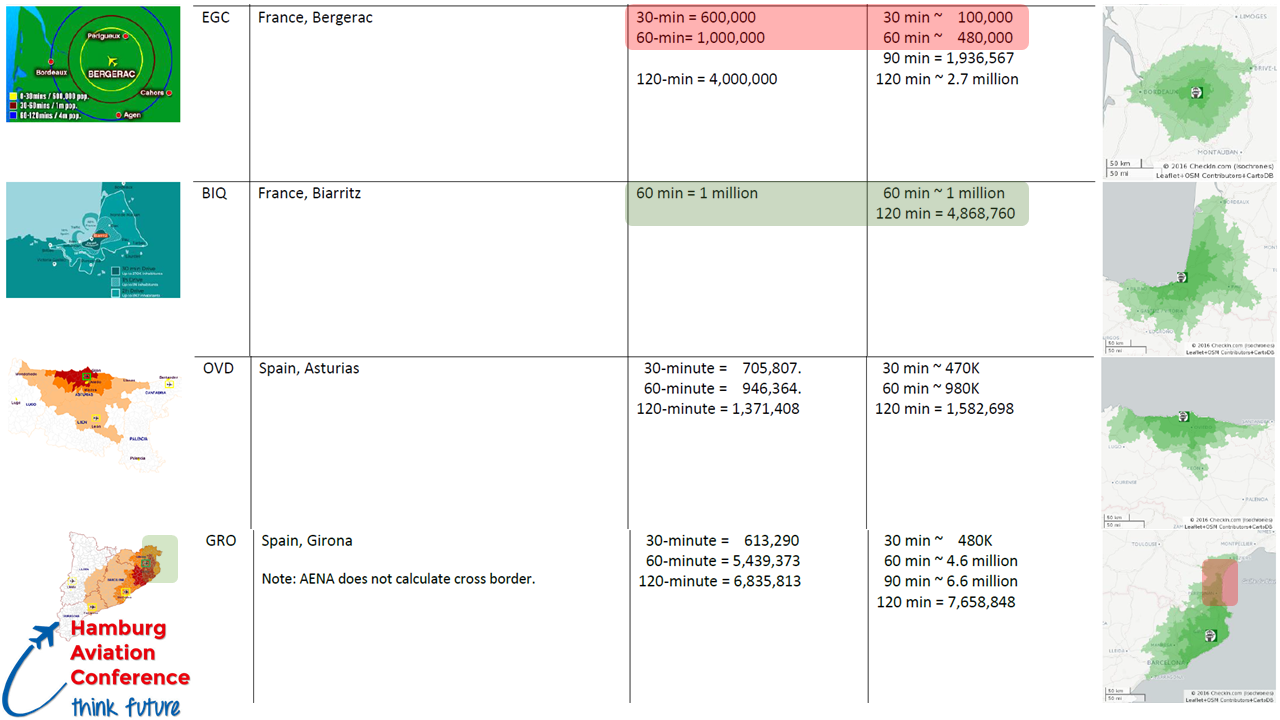

This week, our (German) government issued an official “travel warning” for Spain. It is legal requirement that German travel industry must enable free unplanned returns from regions a travel warning is issued for, which in turn also results in tour operators shelving all offers for regions such warnings are issued for. In line with that legal impact, TUI instantly cancelled all flights and packages to Spain.

In clear ignorance of those facts, the German Health Minister Jens Spahn claims that it is still possible to do vacation in Spain, travelers just needing to be careful… Say what?

Either this is cognitive dissonance, or – and I am afraid it’s that – Spahn and German government tries to distract from own mistakes by “pointing finger” at Spain. It’s the old “wag the dog”. Make up a crisis elsewhere.

Spain is said to be extreme in its adherence to the Corona rules. It is not “Spains” fault if German tourists party and ignore those rules intentionally. And then return with infections. So this is a cloud screen by Minister Spahn and his political cronies.

A German proverb: “Who sits in the glass house shouldn’t throw with stones.” Taken residence for the pandemicfor the pandemic with the family in Germany again, I can assure you, we have our own problems with Corona here and the politicos still fail to follow a clear strategy. Exceptions to their own rules being the rule, not the exception…

The Myth of Aviation Recovery

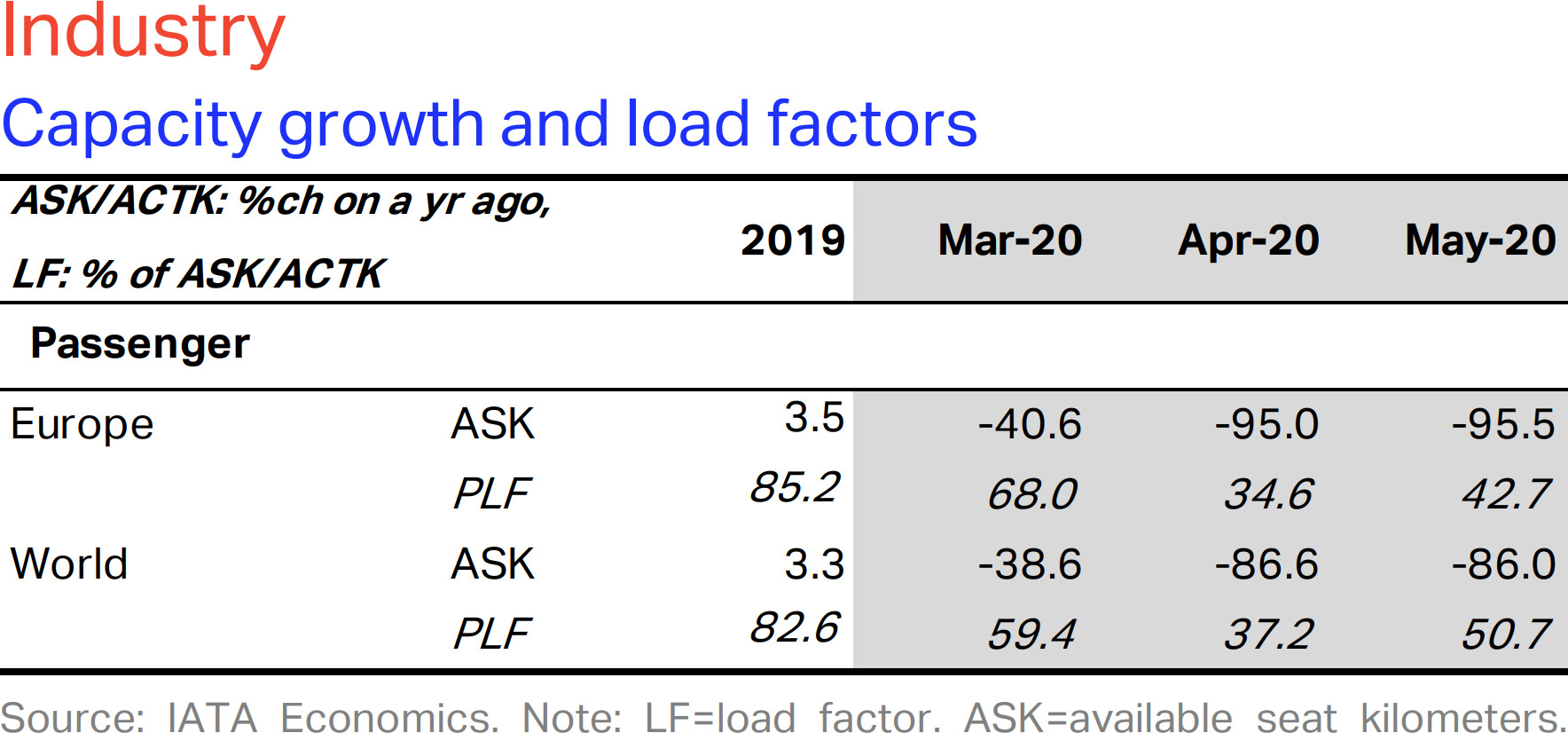

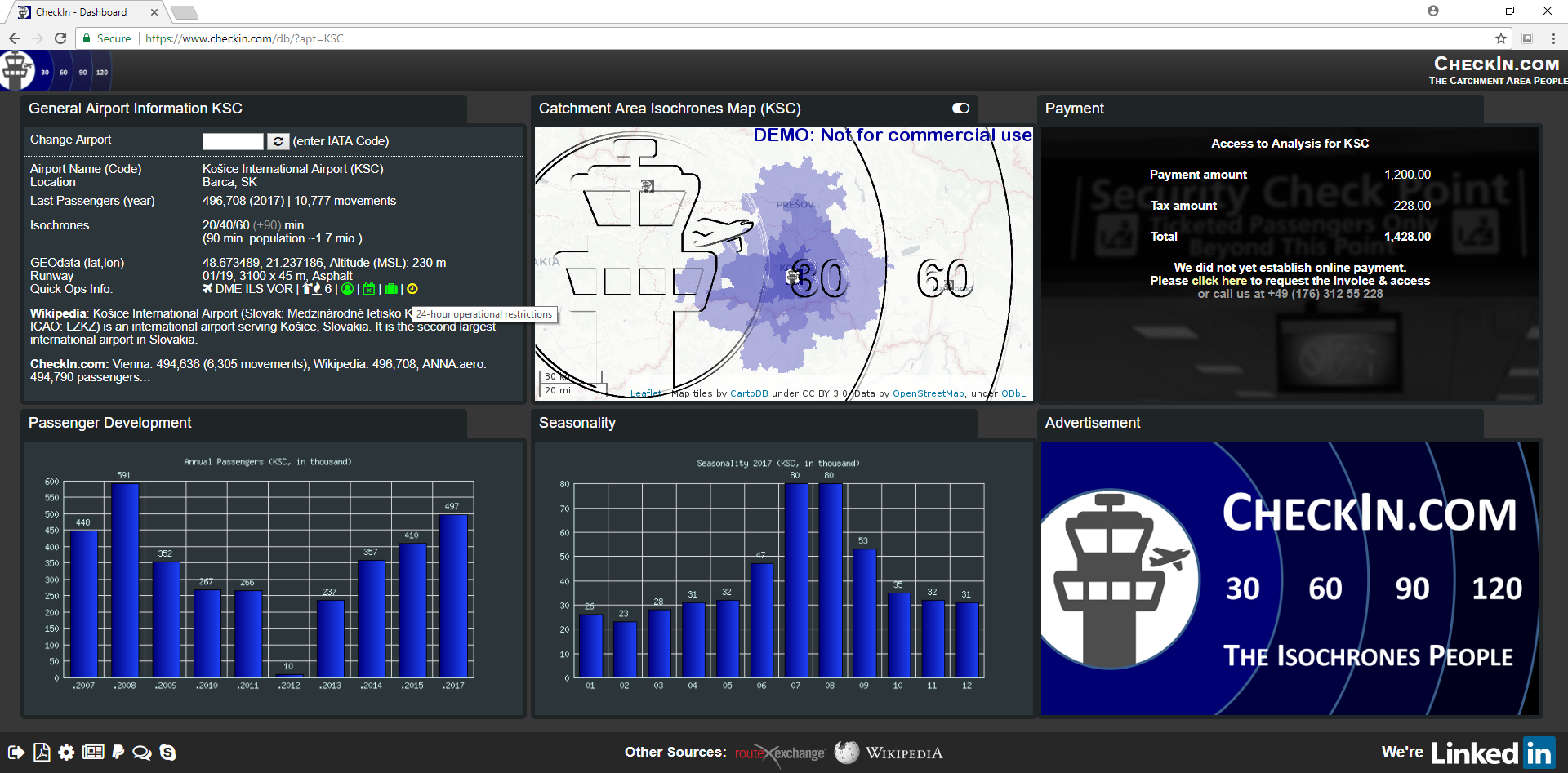

The past weeks, I had ongoing disagreements with my friends at OAG, ch-aviation, RDG, Routes, ANNA.aero, etc., etc. Disagreement on the media-focus on recovery of flight services as a sign of recovery of our industry. As I mentioned in my recent blog on Corona Cognitive Dissonance and Whitewashing Statistics, to bring all those aircraft back to the air while the load factors plummeted from ~85% to ~35% (April) in line with evaporating ticket prices, dropping by 20-30%, depending on the statistics source.

The past weeks, I had ongoing disagreements with my friends at OAG, ch-aviation, RDG, Routes, ANNA.aero, etc., etc. Disagreement on the media-focus on recovery of flight services as a sign of recovery of our industry. As I mentioned in my recent blog on Corona Cognitive Dissonance and Whitewashing Statistics, to bring all those aircraft back to the air while the load factors plummeted from ~85% to ~35% (April) in line with evaporating ticket prices, dropping by 20-30%, depending on the statistics source.

Now in May the load factors recovered to ~43%, though from a business travel management company I heard that those loads were “bought”, by lowering the ticket prices even further. And there was a slight decline in available seat kilometers in that month.

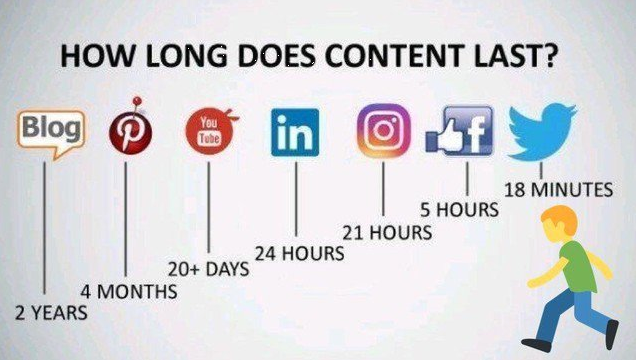

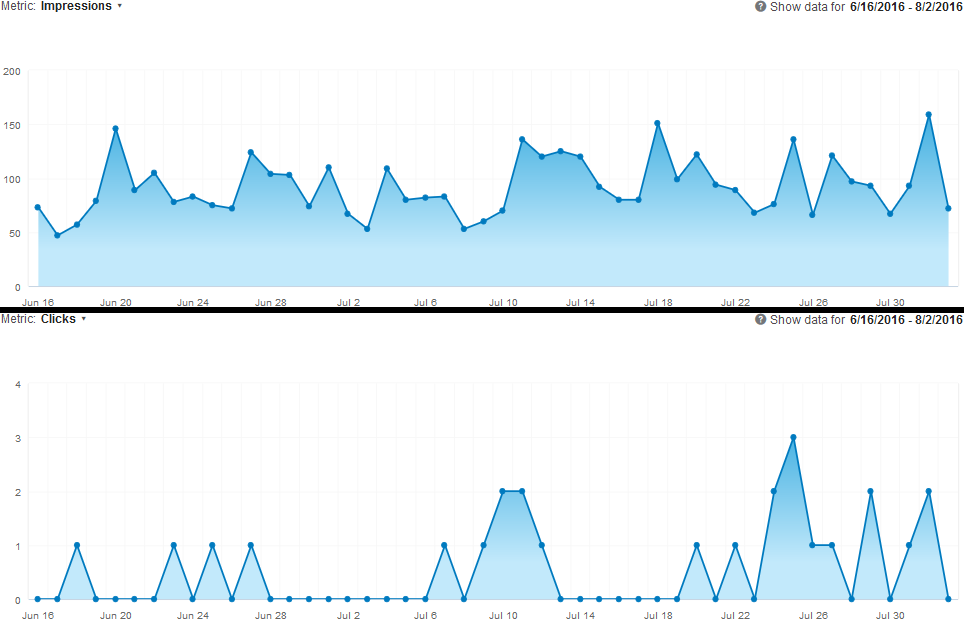

For years, I complain about the state of airline statistics availability. Nowhere “real time”, IATA statistics come three months after, the commercial sources report on flights and seats but have no clue about the load factors or ticket revenue. Real time? Really?

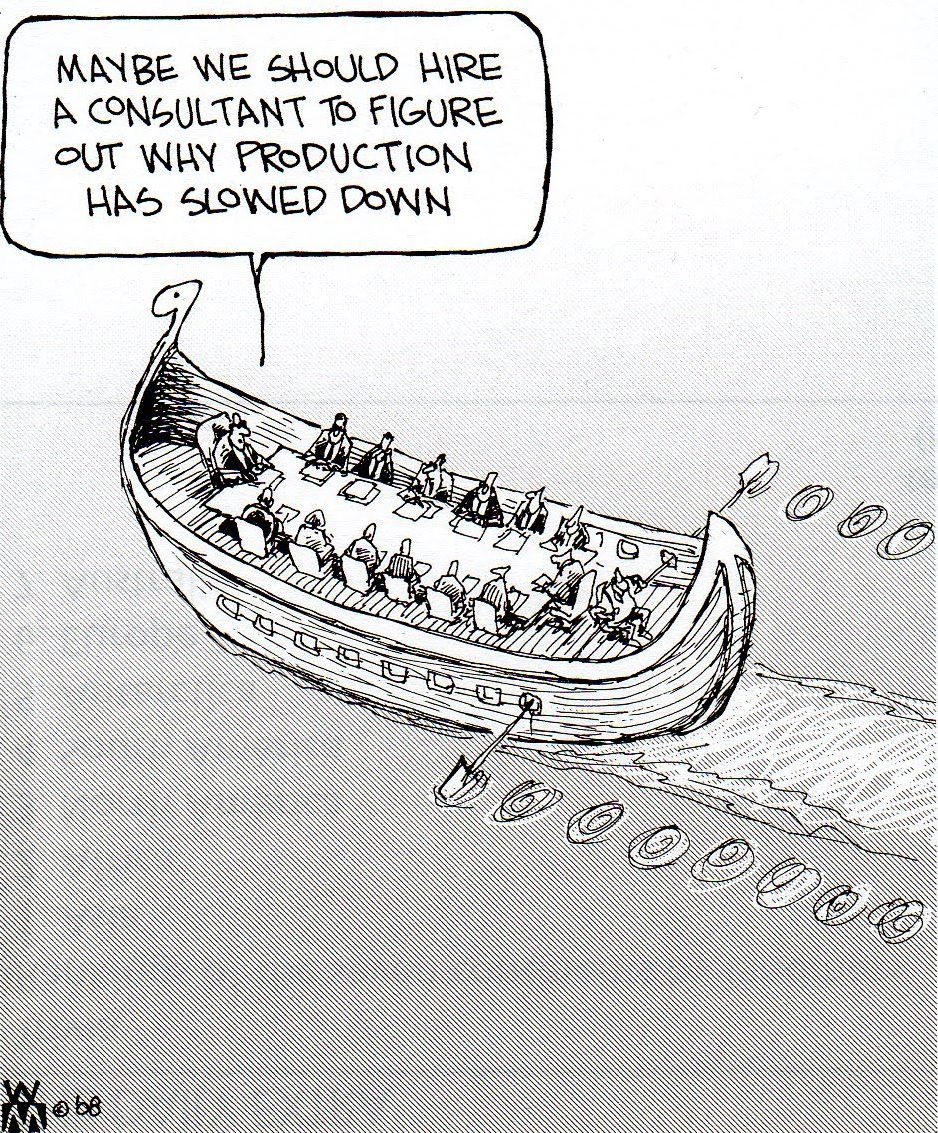

In today’s discussion, it was emphasized that airline managers try to survive using the “classic” approaches. First of all: Be cheap. Second: Push flights to the air. By doing that, they have obviously lost all track of their cost of operations. And the conference call group agreed that we will see quite some groundings in Europe ongoing for the next year. As the airlines keep piling up Corona Debt. Even Lufthansa is said to have already started on demanding further bail-out in spring, when they burned up the € 9 billion they recently got.

Time for New Thinking

Is it really “new thinking”? Last December, pre-Corona, I outlined Why Airlines Keep Failing. The reasons are still the same, just multiplied by Corona.

Is it really “new thinking”? Last December, pre-Corona, I outlined Why Airlines Keep Failing. The reasons are still the same, just multiplied by Corona.

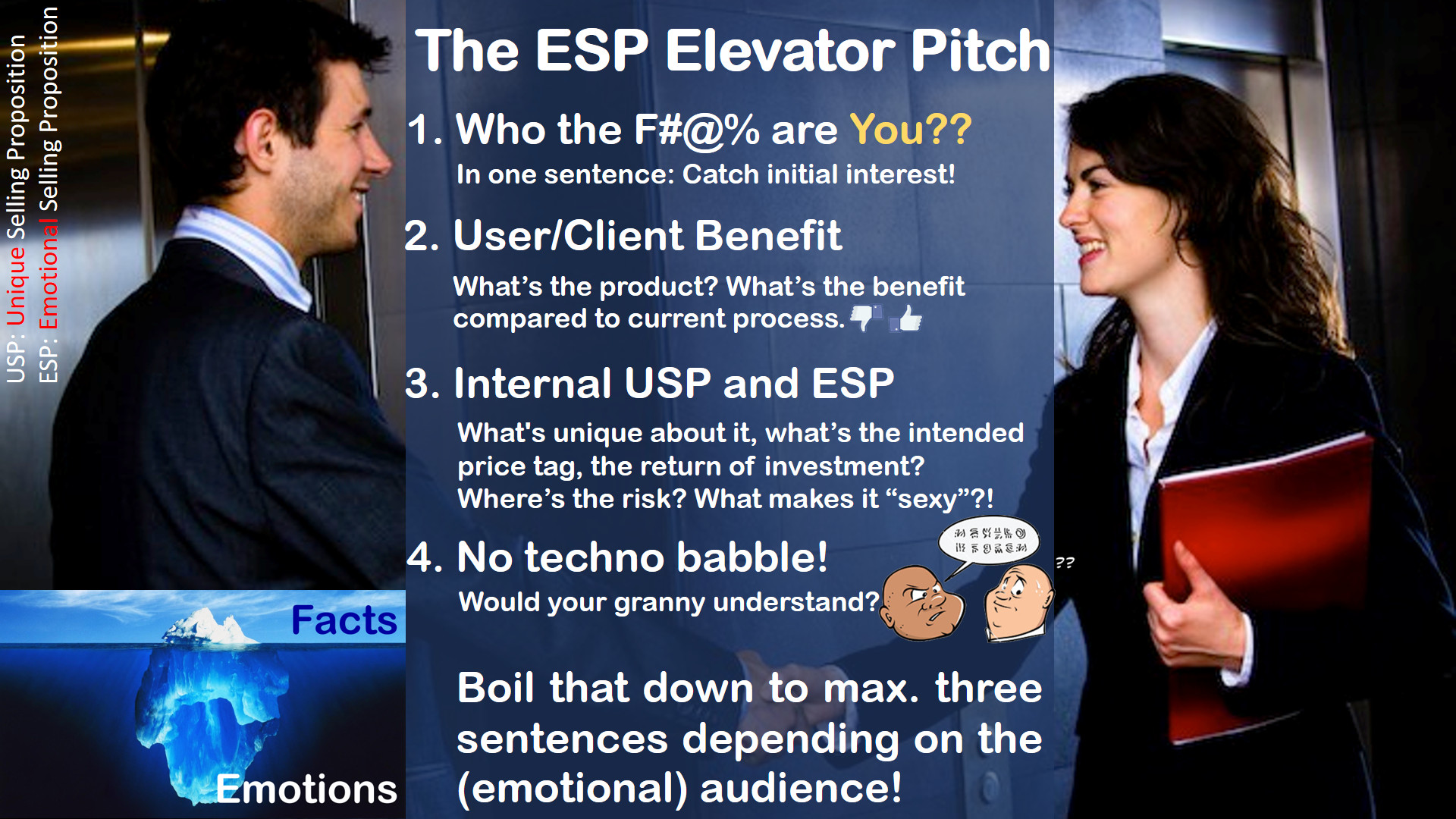

Any little startup understands the need for USPs, unique selling propositions. What makes them different? In the eyes of the customers, in the eyes of the investors. They understand the need for profitability. They know their cost. If you have a big war chest (or get it funded by a government bailout), you can temporarily “invest” in competitive routes. Often enough the likes of Lufthansa pre-crisis abused their market power forcing competitors, even so-called “partners” into insolvency. My own experience includes the first German Wings (the remainders then acquired by Lufthansa), Cirrus Airlines, Contact Air (Lufthansa regional partners) or more recently Air Berlin.

And when I wrote about Air Berlin three years ago, I asked “Lessons Learned?” … Hmm. Obviously not. And when I wrote about Why Airlines Keep Failing, it wasn’t any “new rules” either.

And while Jens Spahn emphasized the solidarity inside the company and that Lufthanseaten (what Lufthansa employees call themselves) stand together in crises… What a cognitive dissonance. His “shareholder value” focus is legendary – I don’t believe he ever learned what “loyalty” meant. Given “short work” in Germany, there would not be real need to fire employees. But he and his manager-cronies, the moment they got the € 9 billion warned of 22,000 layoffs being “necessary”. Hypocrite!

Doing Things Right…

If you need some help to map out a strategy to survive this crisis, I could need some paid consulting. The unpaid kind keeps me busy but not the family paid. Which is the same for so many others “made redundant”.

And if you are or know an investor interesting to do things right, we are seeking funding for an Airline 2.0 – focused on USPs and profits. But also on real aviation sustainability (not the typical whitewashing we see in aviation to date). And on real corporate social responsibility. Which starts with your own. Either contact me or come 8-9 December to the Prestel & Partner Family Offices Forum in Zürich at The Dolder Grand.

Food for Thought

Comments welcome!

Call Quality, Disruptions

Call Quality, Disruptions What it does keep reminding me is that for 2002, in the wake of 9/11, we had the very same discussion. And I brought in a video-conferencing-specialist to speak at ITB Travel Technology Congress. And while the big players added video conference rooms to their portfolio, they turned to dust-bins quickly. I know, c’mon, that was 20 years ago. And we simply don’t tend to learn from history. There’s all the young smart-asses leaving university. They have no experience with extensive travel, their live has been virtual, they are still to learn the lessons.

What it does keep reminding me is that for 2002, in the wake of 9/11, we had the very same discussion. And I brought in a video-conferencing-specialist to speak at ITB Travel Technology Congress. And while the big players added video conference rooms to their portfolio, they turned to dust-bins quickly. I know, c’mon, that was 20 years ago. And we simply don’t tend to learn from history. There’s all the young smart-asses leaving university. They have no experience with extensive travel, their live has been virtual, they are still to learn the lessons. The last issue is emotional, psychological. Which we found out post-9/11 already. There is the factor of “importance” when you are send to travel to meet your client. And I do not speak about the true importance to show your flag at your client. But the perceived importance for the traveler.

The last issue is emotional, psychological. Which we found out post-9/11 already. There is the factor of “importance” when you are send to travel to meet your client. And I do not speak about the true importance to show your flag at your client. But the perceived importance for the traveler. Naaaw. No it won’t. I have video calls with my family when traveling, my mom living 600 km away, friends around the world. And especially during the lock-down I keep with my network attending webinars, video and voice-only conference and one-on-one calls. And can’t wait to see all my counterparts in person either on conferences, on business trips and visits. Video-calls replace phone calls. But they don’t have what it takes to replace the real face-to-face.

Naaaw. No it won’t. I have video calls with my family when traveling, my mom living 600 km away, friends around the world. And especially during the lock-down I keep with my network attending webinars, video and voice-only conference and one-on-one calls. And can’t wait to see all my counterparts in person either on conferences, on business trips and visits. Video-calls replace phone calls. But they don’t have what it takes to replace the real face-to-face.

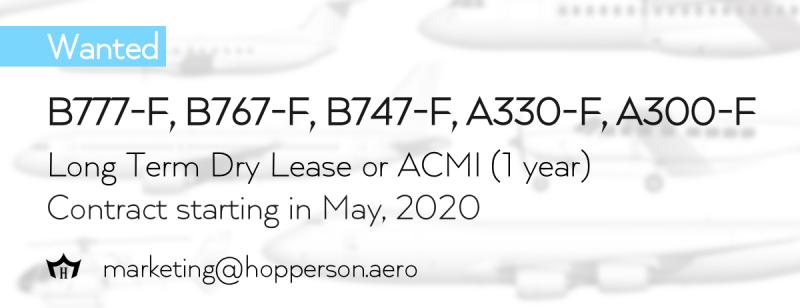

Bill Cumberlidge addressed P2F shortly in the ISHKA webinar. As the need for quick transport increases, the belly-freight in passenger aircraft has gone missing. That increases the demand for classic freighter aircraft. But keep in mind that this is a temporary peak only.

Bill Cumberlidge addressed P2F shortly in the ISHKA webinar. As the need for quick transport increases, the belly-freight in passenger aircraft has gone missing. That increases the demand for classic freighter aircraft. But keep in mind that this is a temporary peak only. The main issue there seems not to be the demand for conversions exceeding the available resources, companies with the experience in such conversions.

The main issue there seems not to be the demand for conversions exceeding the available resources, companies with the experience in such conversions. While there is a current peak, promising a use of lots of large freight aircraft (A380, B747, B777, B767, A330, A300, etc., etc.) that demand bubble will last maximum one year.

While there is a current peak, promising a use of lots of large freight aircraft (A380, B747, B777, B767, A330, A300, etc., etc.) that demand bubble will last maximum one year. But how many containers does a single container giant today transport? And how many of those can you put onboard an A380 or B747? There were a lot of hurray and self-praise of airlines that one aircraft transported 500,000 masks to somewhere. Whereas the population there is a multiple of that number. Airfreight is expensive and a drop on a hot stone.

But how many containers does a single container giant today transport? And how many of those can you put onboard an A380 or B747? There were a lot of hurray and self-praise of airlines that one aircraft transported 500,000 masks to somewhere. Whereas the population there is a multiple of that number. Airfreight is expensive and a drop on a hot stone. Another, very standard “fallback idea” is the “End-of-Life”-strategy to cannibalize the surplus aircraft for spare parts. Given the immense surplus of 150-240-seat aircraft, this bubble is instantly doomed. In several expert discussions I heard 50%, even up to 70% of the fleets to be grounded. Recovery of likely 80% within two years. Let’s say we decommission 20%. Which ones? Where? Who starts?

Another, very standard “fallback idea” is the “End-of-Life”-strategy to cannibalize the surplus aircraft for spare parts. Given the immense surplus of 150-240-seat aircraft, this bubble is instantly doomed. In several expert discussions I heard 50%, even up to 70% of the fleets to be grounded. Recovery of likely 80% within two years. Let’s say we decommission 20%. Which ones? Where? Who starts? Cognitive Dissonance: Who Pays the Bill

Cognitive Dissonance: Who Pays the Bill

![“For those who agree or disagree, it is the exchange of ideas that broadens all of our knowledge” [Richard Eastman]](https://foodforthought.barthel.eu/wp-content/uploads/2016/08/eastman_quote.jpg)

![Richard Eastman “For those who agree or disagree, it is the exchange of ideas that broadens all of our knowledge” [Richard Eastman]](http://foodforthought.barthel.eu/wp-content/uploads/2016/08/eastman_quote.jpg)

… or the question of leeching.

… or the question of leeching.

![Lunchmoney Lewis - I've Got Bills [Unhyping Online Marketing] Lunchmoney Lewis - I've Got Bills [Unhyping Online Marketing]](https://i.ytimg.com/vi/ETM8rrqrTW8/hqdefault.jpg)

![Snow Patrol - Calling in the Dark We are Listening ... and we're not Blind! This is your Life. This is your Time [Snow Patrol - Calling in the Dark]](http://foodforthought.barthel.eu/wp-content/uploads/2020/01/CallingintheDark.jpg)

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

BlueSwanDaily believes in the future of

BlueSwanDaily believes in the future of  I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

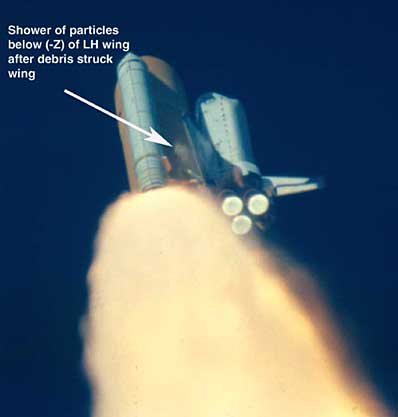

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.