Side Note

Dear Readers. I’ve spend a quite large amount of my “free” time on qualifying myself on online-PR, -marketing, SEO, SEM, SEA. All those buzzwords that I summarized a bit in the new SEO-optimized page Unhyping Online Marketing (SEO SEM SEA). So I didn’t have spare time to focus on the topics but made note, what to address in the upcoming blog posts.

As I told a friend, it mostly scratches on the surface only, where I could pour some salt into open wounds. Most fun for me was to make that article SEO-perfect, though it does make it a bit hard to read… And it became so much, that I decided to put it in a page, not a blog article (post). If you didn’t read it yet, if you’re in marketing or online, you might want to after reading this post.

What did trigger is the statistics on active users vs. leechers. I know a lot of you read, though most of you I don’t know who you are. I sure do appreciate anyone “outing” themselves to me that they read my blog. Send me a mail to juergen at barthel eu if you don’t want to comment in the blog.

Quo Vadis Virtual Airlines?

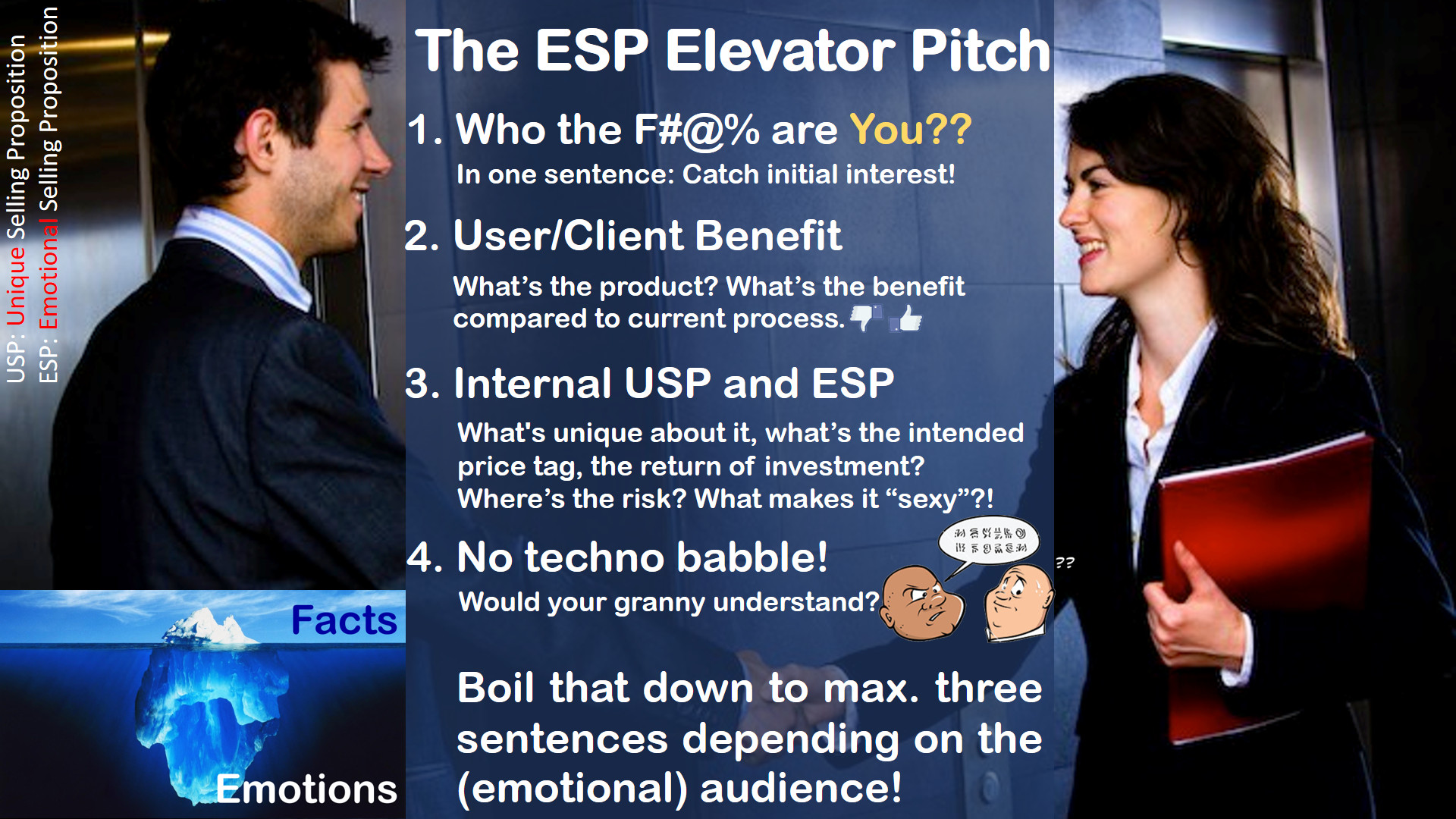

Many new airlines come without business concept. What is the business model? What is the USP? Have you made a sincere SWOT analysis? Know your internal and external strenghts, opportunities, weaknesses and threats? Or do you believe with a small, leased fleet, paid maintenance, some commercial off-the-shelf software and some flights in summer to the secondary holiday destinations you can stand up to the existing big airlines? What’s your niche and is it safe and sufficient enough? Else, you simply build up a market for the big ones and find yourself pushed aside – another “victim” to the ongoing consolidation. Nothing new. Nothing unexpected.

There is the saying about how to make a million in aviation. Start with a billion. While I believe with a billion you can achieve something, the usual “airline startup” is 2-20 million. One or two leased A320 or B737. I call them mayflies. They fly one (high) season, maybe two. Then they have no more funds to sustain another low season and “fail”. A failure with prior announcement.

Regional Airlines vs. Low-Cost

Discussing “Regional Airlines” and “Low-Cost Airlines”, all the “experts” keep separating the two models. What they fail to see is the role of low-cost airlines in the regional aviation market.

“Regional Airlines”

The common “definition” of regional airline is to fly small aircraft, up to 100 seats. Often in a mixed fleet. Always at a high cost per seat. So the tickets by nature are and must be more expensive.

“Low Cost Airlines”

Different from Regional Airlines, the Low Cost airlines fly Airbus A320- or Boeing B737- family aircraft with 150 to 200, recently implementing even larger A321 and B737-9/900 with up to 240 seats.

Regional + Low Cost

Both airline types have something in common. Both fly point-to-point. Both classically focus on short and medium haul.

Both also establish some connecting services as their hubs. And airlines like FlyBE try to reduce the cost by using a single-type-aircraft fleet like FlyBE’s 54 Dash 8 Q400, though they have some other aircraft too. Air Baltic converts to a single-type A220-300, their CEO expressed even adding the A220-100 would complicate and increase the cost base. But the choice of aircraft defines the choice of airports and routes. Which leads to the next topic of this article:

The Passenger Airline Food Chain

30+ years ago, when I started in aviation, there was a very clear “food chain”. First came general aviation and holiday charter flights, feeding the demand for certain commercial routes or holiday destinations. When those flights became successful enough, they lost to regional airlines providing scheduled services at fixed times between A and B. The larger holiday charters lost to scheduled airlines and network carriers, taking over those lucrative routes. At the end of the food chain were the large network carriers, connecting smaller cities to their hubs and through the hubs connecting to the world.

Then came the Low-Cost carriers. And everything changed.

… Everything? Really?

The Rise of the Low Cost

So the model of the Low Cost Airlines was to use a single type aircraft fleet, such minimizing the complexity to operate the fleet. Be it exchange of broken aircraft, be it flight crew training (cabin and cockpit), maintenance, etc. Using the highly effective new Boeing 737 models, later also the A320, they focused on one thing. To provide the lowest cost per seat and such undercut the prices that the network carriers with their far higher complexities asked for.

They did not bother about the complexity of hub-services or – god beware – “interlining”, requiring baggage transfer, the need to secure the connection for the passengers, they connected secondary airports point-to-point. Just like the regional airlines, but at lower cost. All they did in fact, they cannibalized the upper end of the regional airlines and also competed with many regional flights of the network airlines. Given their USP of a very, very low cost per available seat kilometer (CASK) or mile (CASM), they covered their niche well and ate away from the profits of both small regional airlines, as well as the large network carriers.

Regional Airports vs. large Hubs

Regional Airports vs. large Hubs

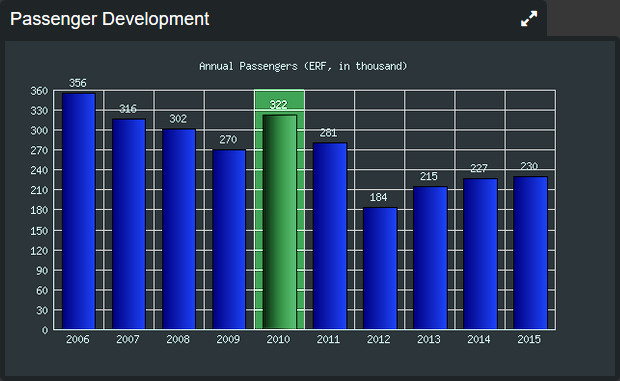

In the past, there was a clear distinction. Regional airports were small airports that were connected to the global air traffic networks by being connected to the hubs. So a regional airport only served a few scheduled flights, plus vacation charter. I had this concept also at the Erfurt-Weimar airport (ERF) 2009/10. Where they did not even understand their Munich flight they subsidized would connect them via Munich to the world. Cirrus Airlines as the operator was “Lufthansa Partner” without code-share into Star Alliance, not even with other airlines in the Lufthansa Group, so all the airport looked at was the few “Lufthansa connections” they could offer from their airport via Munich. Of which some even didn’t connect. In consequence, the locals did not look at those few connections, but focused to fly from Berlin or Frankfurt, both three hours travel time by train. Or they even took the train to Munich. If you know the added time you need in Berlin and Munich to get from the train station to the airport, you understand why I got upset. Simply to date my example of a gross misperception and belittlement of the airport’s value. Even worse, on my first day at the airport, I had to read an article in the main local newspaper that one political stakeholder promoted Arab stakeholders to come to Thuringia. By flying to Frankfurt and taking a bus (four hours minimum). Instead of flying via Munich…

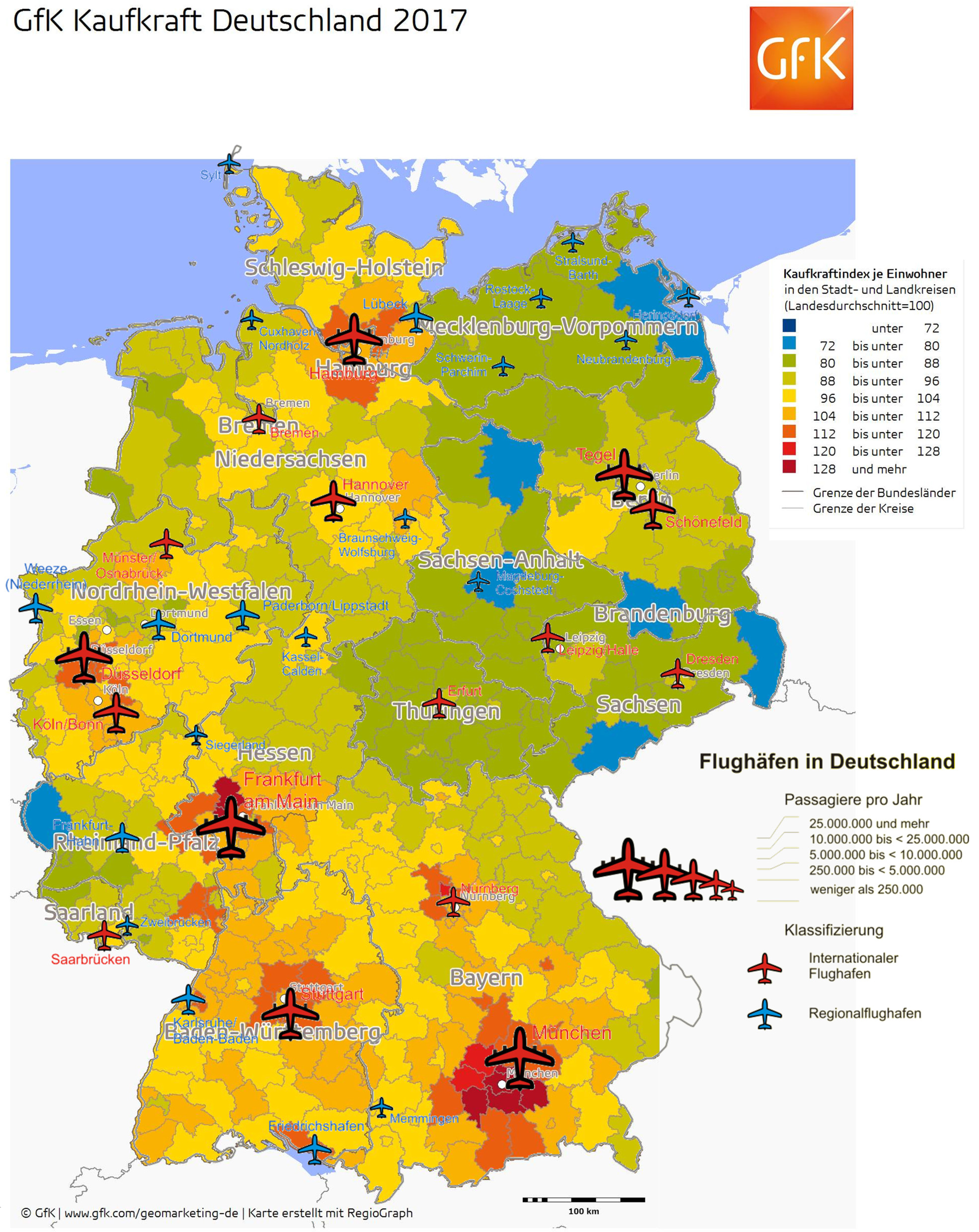

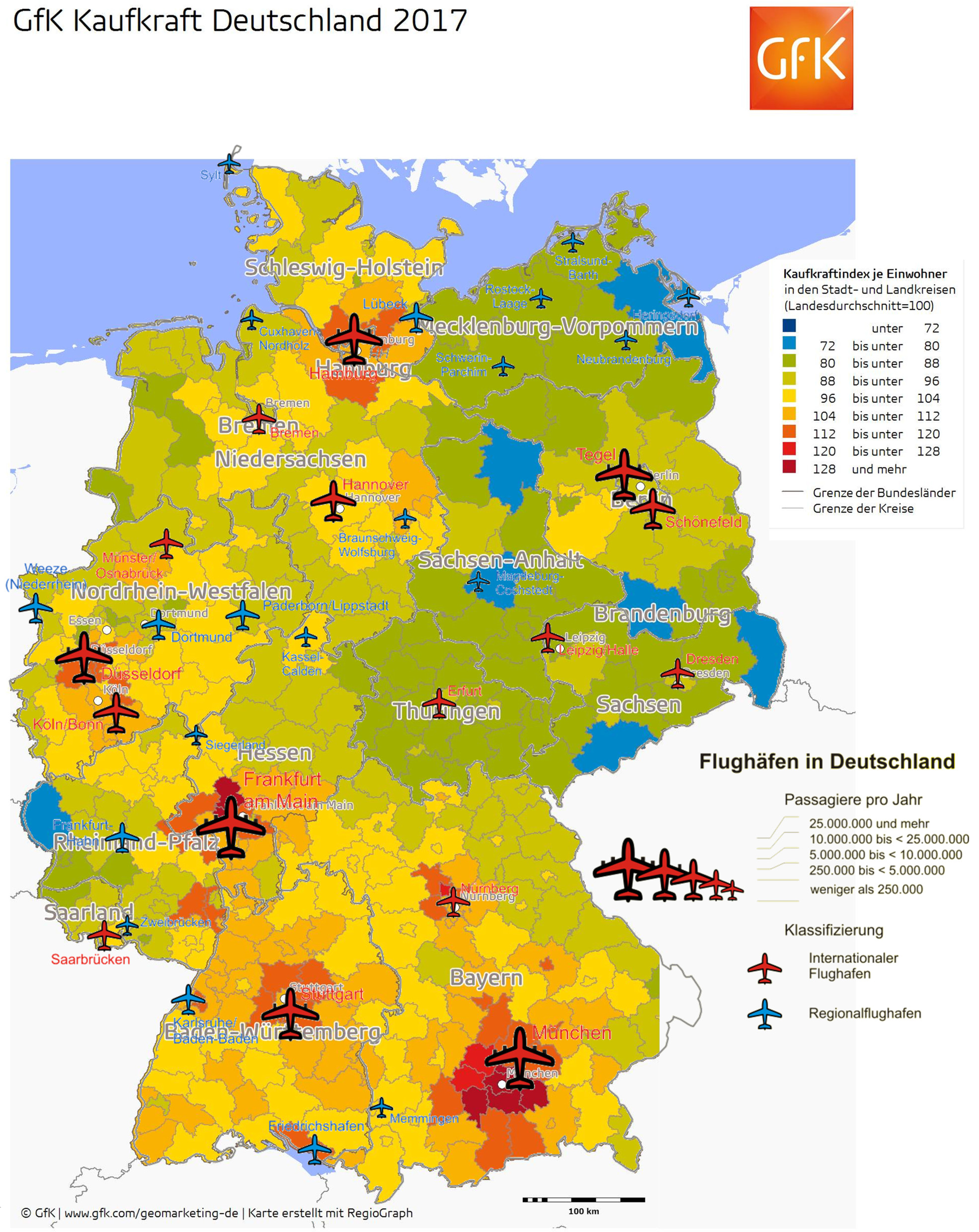

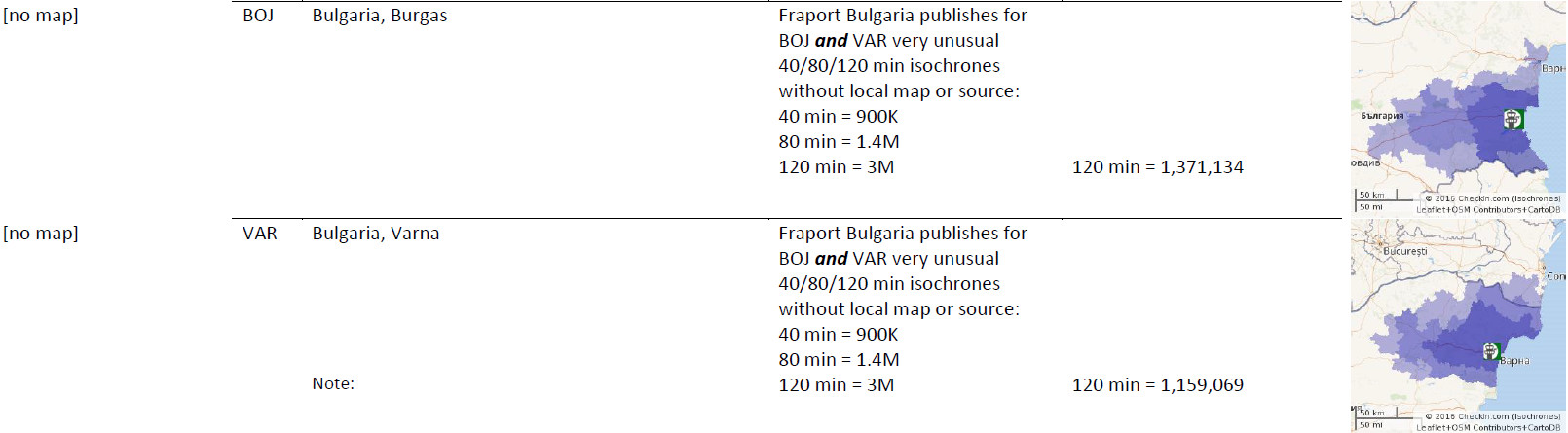

Working with regional airports, my experience is a very strong tendency to short-sell themselves, belittle the own region. It is not made any easier that there are virtually no regional statistics about travel demand and the IT “solutions” are being biased to make big airports bigger and neglect the small airports. As I explained in the December 2017 article about the bias of route viability analyses.

Evolution of regional hubs

Especially in Europe, the political strategy about aviation is “thinking small”, new airports like Berlin are planned too small from the beginning. Airports that were planned for growth, like Munich when moved from “Riem” to “Erding” face political opposition to execute the expansion, adding the originally planned runways. Even London, instead of a bold move to establish a new airport, decided to just add a new Runway to London-Heathrow. A move that will quickly face the same problems Heathrow has today, of inheritance in terminal structures, slot constraints, a limit to the expansion. Should Boris Johnson in the recent turmoil follow Theresa May, there are some hopes that he revitalizes the “new airport” idea for London.

A necessary step to compete with the new “global hubs” in Istanbul, Dubai, etc., build to size of about 150 million passengers. Berlin? Build to 27 million passengers, when finally ready one day. Current news questions the next opening data in October 2020… As German “Postillon24” satire site published 2015: Archaeologists discover historical ruins of unimaginable dimensions in the south of Berlin (link to Google translated page in English)…

A necessary step to compete with the new “global hubs” in Istanbul, Dubai, etc., build to size of about 150 million passengers. Berlin? Build to 27 million passengers, when finally ready one day. Current news questions the next opening data in October 2020… As German “Postillon24” satire site published 2015: Archaeologists discover historical ruins of unimaginable dimensions in the south of Berlin (link to Google translated page in English)…

With the large hubs increasingly slot constrained, i.e. Amsterdam simply “out of slots”, the only way is to bypass those airports and increasingly fly to smaller cities. An example can be American Airlines, adding Dubrovnik on the Balkan Adria to their destinations. Sure, the low-cost airlines have a history understanding the value of point-to-point services between smaller, “regional” airports. Basel, as a first base of easyJet evolved into a major hub for the low-cost airline. Business case given, the operation of a regional hub can make sense… And didn’t we joke about easyX when Air Asia X flew to London-Gatwick with majority of travelers connecting onto easyJet…

So far, many of the “low cost airlines” (i.e. Eurowings, Norwegian) focus on larger airports as their hubs; Düsseldorf, Cologne, Barcelona and the likes. Their decision makers obviously are not bold enough to leave the beaten path and go new ways. Ryanair moved into Frankfurt, but it’s said they are not doing well there. Wizz and others establish small bases in regional airports and then grow them, benefiting both the airport, the region and commerce in the regions. Given the slot constraints on the “mega hubs”, we will see a lot more development of regional airports, point-to-point services and hubs. For those airports and their regional development stakeholders, one of the main tasks is to change the perception from “feeder airport” to a bold understanding of their own values and needs – which directly served regional routes make sense? I know, this is a recurring topic on this blog…

The Future of Airports

My friends at Passenger Terminal World, also doing the Passenger Terminal Expo, recently collected views on the future of airports. Personally, I found those views rather conservative. Very focused on the adjusting the status quo, no bold jumps at all. But for several years, some bold ideas keep resurfacing of which I’d like to address two.

The Circular Runway

The Circular Runway on first sight is an intruiging concept. You could land anywhere, never a “runway overrun”, never the wrong wind direction and while one plane takes off on the one side, another lands on the other. But.

There are some questions that I believe this idea will never make it to reality. Usually, there is a given wind direction and airplanes take off and land against the wind. So instead of a straight runway you have a circular one that allows to take off and land exactly against the wind. While the remainder of the runway remains unused. A nice to have? Or a lot of sealed ground for no gain?

The other setback is if you exceed the capacity. Adding another circular runway? If need be crossing runways use less space and allow parallel operations. # And they can be started with one runway, adding as demand requires.

Given both those issues, I think will be good reason to stick to the existing straight runways.

Drive Through

Drive Through Airport Terminal

The Drive Through Terminal is also an interesting concept that the designers invented for large airports. But in fact, there are a lot of setbacks from such a terminal that make it less ideal for such airports, but more ideal for regional airports. What I like is the possibility of weather independent operation thanks to the roof, as well as the guide rail system to transport the aircraft from arrival to departure.

The first problem is on large airports that there are airline using differently sized aircraft. So you have classic terminals and drive-through ones only for certain aircraft? On regional airports and low-cost airports, the terminal could be optimized for standard aircraft from 70 seats up to A320/B737 families with up to 240 passengers. Should there be a larger aircraft, it can be handled on the apron.

The other problem with the proposed design is the ignorance of what any airport operations manager can sing of: Disruptions during the turnaround. Once the airplane enters the process, there are now ways to replace the aircraft (see image left). On a small, regional airport, that can be overcome rather easily using one or two lanes only, allowing the aircraft on any stop to be “extracted” or “added” into the “line”.

The other problem with the proposed design is the ignorance of what any airport operations manager can sing of: Disruptions during the turnaround. Once the airplane enters the process, there are now ways to replace the aircraft (see image left). On a small, regional airport, that can be overcome rather easily using one or two lanes only, allowing the aircraft on any stop to be “extracted” or “added” into the “line”.

The third issue is the issue of parallel handling, supporting connecting flights. While the first aircraft boards, the other just comes in. But what I think can be a practical approach is to have drive through in a two step process. Disembarking, embarking – go. If there is a problem, on both “stations”, the airplane can be pulled out backwards or front. Several airplanes could be managed in parallel.

The last issue is the passenger facilities, including and not limited to contemporary airport cities

Summary

There are a lot of ideas out there, but the main hurdle is the conservatism. Airplanes to date are serviced on the left, boarded on the right. A relic. But to change such requires not only different airports but also different airplanes. I doubt I will live to see such a change. Other issues can and should come. So I see the rise of the regionals, also the drive through terminal.

Food for Thought

Comments welcome

Back to the introduction. I’d love to hear from you. You can out yourself on mail, WhatsApp, Viber, here in the comments, that you’re one of the frequent readers of my blogs. It is motivational, believe me. And if you haven’t read it yet, you might want to smile about my SEO-optimized summary of three months studies:

Unhyping Online Marketing (SEO SEM SEA)

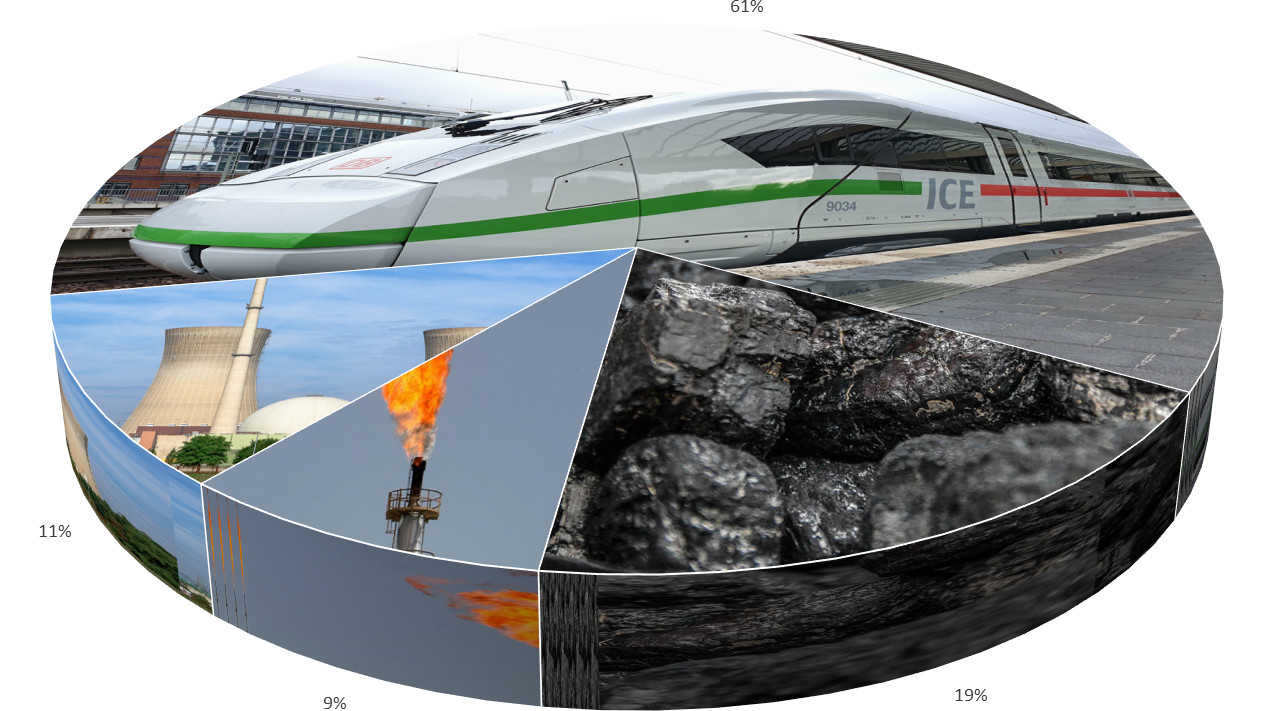

But there was another article even more to the point: “Where there is a will there is not always a train“. But there are some issues that are unrealistic. The numbers of German Rail are biased and greenwashed. They claim to use only “Green Power”. But in fact, published by the German Federal Environmental Agency, their power comes from the public grid and no matter what “deals” they do, it is grid power. And on the grid, in 2018 only 16.6% has been “Green” (Source). The energy industry accounts for 85% of all Greenhouse Gases of which 98% CO2, the remainder being mostly Methane (CH4) and nitrous oxide (N2O) (Source).

But there was another article even more to the point: “Where there is a will there is not always a train“. But there are some issues that are unrealistic. The numbers of German Rail are biased and greenwashed. They claim to use only “Green Power”. But in fact, published by the German Federal Environmental Agency, their power comes from the public grid and no matter what “deals” they do, it is grid power. And on the grid, in 2018 only 16.6% has been “Green” (Source). The energy industry accounts for 85% of all Greenhouse Gases of which 98% CO2, the remainder being mostly Methane (CH4) and nitrous oxide (N2O) (Source).

Given the devastating destruction of the natural environment in Lithium mining, I do not understand that politicians push forward battery-based e-Mobility. Using fuel-cell technology we can use the existing gas stations infrastructure. Refueling takes only about five minutes! And given a broad use will lower the prices and make the technology available on smaller cars too. They can even power scooters, so don’t tell me it doesn’t work for a compact car!

Given the devastating destruction of the natural environment in Lithium mining, I do not understand that politicians push forward battery-based e-Mobility. Using fuel-cell technology we can use the existing gas stations infrastructure. Refueling takes only about five minutes! And given a broad use will lower the prices and make the technology available on smaller cars too. They can even power scooters, so don’t tell me it doesn’t work for a compact car! There is an important advantage of air travel to both rail and road that is frequently not addressed. The issue of ground sealing!

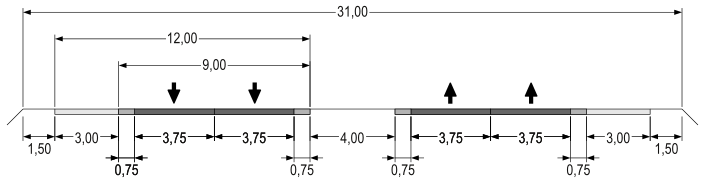

There is an important advantage of air travel to both rail and road that is frequently not addressed. The issue of ground sealing! A highway with four lanes is about 31 m wide with about 24 m being sealed. A 50 km highway such seals about 1.2 million m², so three times as much as a single airport. Highways are known to be an insurmountable obstacle for wildlife.

A highway with four lanes is about 31 m wide with about 24 m being sealed. A 50 km highway such seals about 1.2 million m², so three times as much as a single airport. Highways are known to be an insurmountable obstacle for wildlife.

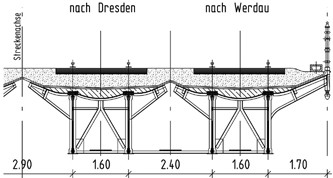

Rail

Rail

Regional Airports vs. large Hubs

Regional Airports vs. large Hubs A necessary step to compete with the new “global hubs” in Istanbul, Dubai, etc., build to size of about 150 million passengers. Berlin? Build to 27 million passengers, when finally ready one day. Current news questions the next opening data in October 2020… As German “Postillon24” satire site published 2015:

A necessary step to compete with the new “global hubs” in Istanbul, Dubai, etc., build to size of about 150 million passengers. Berlin? Build to 27 million passengers, when finally ready one day. Current news questions the next opening data in October 2020… As German “Postillon24” satire site published 2015:

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

BlueSwanDaily believes in the future of

BlueSwanDaily believes in the future of  I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

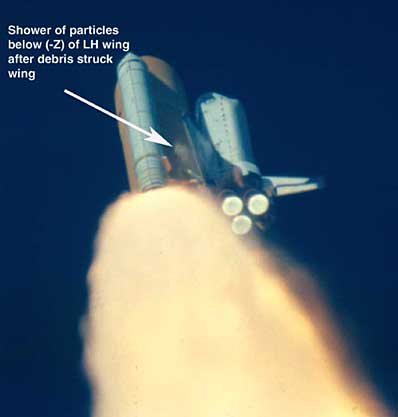

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in

Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.”

Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.” As many of the readers of this blog know, I am somewhat personally attached to that little airport in Central Germany, Erfurt-Weimar.

As many of the readers of this blog know, I am somewhat personally attached to that little airport in Central Germany, Erfurt-Weimar. First day at work, the GM of Tourism Thuringia, Bärbel Grönegres was quoted in the local newspaper (TA, 02Mar09), having visited the United Arab Emirates to promote medical tourism to Thuringia. Having a Munich-Erfurt flight by Lufthansa-Partner

First day at work, the GM of Tourism Thuringia, Bärbel Grönegres was quoted in the local newspaper (TA, 02Mar09), having visited the United Arab Emirates to promote medical tourism to Thuringia. Having a Munich-Erfurt flight by Lufthansa-Partner  The next winter, the Thuringian Olympic athletes brought home a record number of medals. But at the following ITB, it was more important to promote

The next winter, the Thuringian Olympic athletes brought home a record number of medals. But at the following ITB, it was more important to promote  In order to promote the government-funded route, after fierce discussions, Cirrus Airlines agreed to offer a low-cost ticket at 99€ return, having only about 6€ after the high taxes on the ticket. That offer was made available especially to the Thuringian government offices and the state development agency (LEG). Nevertheless, LEG planned and executed delegations traveling with the train to Berlin to take flights from Berlin, instead of promoting the route. The same also for the ministries and ministers. Even the responsible minister taking flights from Frankfurt and Munich instead of using the PSO-route he signed responsible for. During the months we’ve actively promoted that 99€-fare also to the industry and the travel agencies and also had it largely available, not one of the flights used up the 99€ tickets allocated to them. Being at the verge of a bankruptcy, Cirrus Airlines finally ceased to operate that route in December 2010.

In order to promote the government-funded route, after fierce discussions, Cirrus Airlines agreed to offer a low-cost ticket at 99€ return, having only about 6€ after the high taxes on the ticket. That offer was made available especially to the Thuringian government offices and the state development agency (LEG). Nevertheless, LEG planned and executed delegations traveling with the train to Berlin to take flights from Berlin, instead of promoting the route. The same also for the ministries and ministers. Even the responsible minister taking flights from Frankfurt and Munich instead of using the PSO-route he signed responsible for. During the months we’ve actively promoted that 99€-fare also to the industry and the travel agencies and also had it largely available, not one of the flights used up the 99€ tickets allocated to them. Being at the verge of a bankruptcy, Cirrus Airlines finally ceased to operate that route in December 2010. By the time, working with the local industry associations, political parties I have been able to increase the passenger numbers by about 20 percent. In fact, to date, the airport is far from the 320 thousand passengers I left them with. With Weimar being the neighboring but historically better known city internationally, I pushed forward the renaming to Erfurt-Weimar with the attempt to improve the incoming for the airport. Paid almost completely from the limited marketing budget. A strategic decision executed after our parting-of-ways in December 2010 after my two-year contract was not extended in the wake of the retreat of Cirrus Airlines. A strategic decision though made obsolete by the “political” decision by traffic minister Christian Carius to not replace the route as I recommended with an Amsterdam-service. Sad decision indeed, as with our parting ways, the discussions with KLM were simply discontinued (KLM calling my number reached someone speaking German only, I was gone) and despite their interest in a PSO (public service obligation) financial route support, we had discussed flights based on mere startup incentives and marketing support.

By the time, working with the local industry associations, political parties I have been able to increase the passenger numbers by about 20 percent. In fact, to date, the airport is far from the 320 thousand passengers I left them with. With Weimar being the neighboring but historically better known city internationally, I pushed forward the renaming to Erfurt-Weimar with the attempt to improve the incoming for the airport. Paid almost completely from the limited marketing budget. A strategic decision executed after our parting-of-ways in December 2010 after my two-year contract was not extended in the wake of the retreat of Cirrus Airlines. A strategic decision though made obsolete by the “political” decision by traffic minister Christian Carius to not replace the route as I recommended with an Amsterdam-service. Sad decision indeed, as with our parting ways, the discussions with KLM were simply discontinued (KLM calling my number reached someone speaking German only, I was gone) and despite their interest in a PSO (public service obligation) financial route support, we had discussed flights based on mere startup incentives and marketing support. Opposing myself ongoing subsidies, to demand a route but to leave the (substantial) risk completely with the airline is neither the answer. Whereas comparing the

Opposing myself ongoing subsidies, to demand a route but to leave the (substantial) risk completely with the airline is neither the answer. Whereas comparing the

Now since I started in aviation 30 years ago, the market has drastically changed. In the good old days, there were (often highly subsidized) “national airlines”, used to promote the country. Back in my early days, the airlines were the executive for the tourist offices and also worked closely with commercial development agencies. But ever since, those national airlines have either adapted or went out of business. The emerging “low cost” airlines virtually evaporated the income of the airlines, competition becoming fierce.

Now since I started in aviation 30 years ago, the market has drastically changed. In the good old days, there were (often highly subsidized) “national airlines”, used to promote the country. Back in my early days, the airlines were the executive for the tourist offices and also worked closely with commercial development agencies. But ever since, those national airlines have either adapted or went out of business. The emerging “low cost” airlines virtually evaporated the income of the airlines, competition becoming fierce.

While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple.

While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple. easyJet on the Move?

easyJet on the Move? A320/321neo. A Change-Maker?

A320/321neo. A Change-Maker? Quo Vadis easyJet?

Quo Vadis easyJet?

What we will need is a serious, joint discussion about the future business model in aviation. At the moment there is no discussion. There’s the airlines, the airports and business models that cannot work. And we need to have the politicos and the usually government-controlled ATC (and border control, security, etc.), we have to have the ground handlers, the shops and all other players on the table. You can’t reconstruct all the small airports. We don’t need a fight. We got to work together for a sustainable business model. ERA, AAAE, IATA, ICAO, this is your call.

What we will need is a serious, joint discussion about the future business model in aviation. At the moment there is no discussion. There’s the airlines, the airports and business models that cannot work. And we need to have the politicos and the usually government-controlled ATC (and border control, security, etc.), we have to have the ground handlers, the shops and all other players on the table. You can’t reconstruct all the small airports. We don’t need a fight. We got to work together for a sustainable business model. ERA, AAAE, IATA, ICAO, this is your call. While “the world” meets at

While “the world” meets at  Right after Routes Americas, there’s the second (annually first) European event which we now have as a “must go” on the agenda:

Right after Routes Americas, there’s the second (annually first) European event which we now have as a “must go” on the agenda: