This week and last I attended two aviation financing conferences by Airfinance Journal, one in Japan, one in Latin America. Then I read an article by National Geographic, demanding that travel should be considered an essential human activity. But that is something I find so very often. Thinking Outside the Box and understanding psychologically different mindsets is Not Everyone’s Cup of Tea.

Airfinance Journal Virtual Events

I am sure you remember my recent blog about why I consider Virtual Conferences a Barrel Burst.

I am sure you remember my recent blog about why I consider Virtual Conferences a Barrel Burst.

Whereas a conference for me is a place we do networking, for which I am immensely grateful for Airfinance Journal (AFJ) to allow me attending the event. I sure couldn’t have afforded travel to Japan and Latin America. And thanks to their added focus on networking, it turned out some very promising new contacts to discuss KOLIBRI.aero with.

Let us have a look at the Latin America event which ended yesterday.

The Great Pretender

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge.

Whereas AFJ added a virtual networking lounge, there were the same, I’d say ten, people in there, only once the (too small) window showing the delegates forced me to scroll with more than four delegates in the networking lounge.

Saving the delegate list and not counting the dupes I came up with 720 delegates. An awesome conference. 42 of which “filled out” their profile. Only. The others failed to use a free way to promote who they are and what they, respectively their companies do.

I happen to believe from what I have seen that most of the delegates of the online conference were obviously pretenders, signing up, but not showing up. Not even taking the time to log in and fill out their profile. Do they know there are such?

Virtual Networking

Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

Then there was a “dedicated networking”, where more than 50 registered for (I think the host said 64). We were seven (plus AFJ moderator, plus one totally unresponsive), so roughly 9 out of 10 having registered for it did not show up. For some reason, being in aviation so long, “no shows” is something I consider exceptionally rude. Not just careless, but outright rude. Because there are people, taking the effort to organize something good and then people simply don’t show? It is extremely frustrating for whoever works this out to provide you a service!

For the few being there, I believe it was better than if it would have been crowded. I just hope I didn’t talk too much!

Overall, it just confirms my assumption that less than 10% of the registered delegates showed up at all. Of which again, how many have been speakers? 21?

Not My Cup of Tea?

Again, these two events showed that there are different mindsets at play and it should be worthwhile to understand the motivation behind it.

Again, these two events showed that there are different mindsets at play and it should be worthwhile to understand the motivation behind it.

I’ve seen that before, 20-odd years ago, when I organized the Airline Industry Stammtisch in Frankfurt. Many sign up for the event, to show their bosses, never intending to go there and spend their “valuable” time off elsewhere. Others, like me at AFJ do see the opportunity and value in networking.

A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

A very good and valuable event, especially in Corona times. But it seems, at least from the outside, that most of the “delegates” were pretenders and never showed up on the website, never “participated”. Those people missed out on supporting a good event and torpedoed a valuable effort. From my side, I can only thank AFJ. The next step to improve the events in my opinion will be to automatically add the delegates to the networking lounge to enable messaging. Let them “opt-out”… There’s no e-Mail or other personal information shared, beyond the attendee list that delegates have access to anyway.

And they might want to promote to the delegates to fill out their profile… That’s free marketing and free networking!

Learning Curve?

The next event coming up in two weeks as Airfinance Journal China, then followed by Asia Pacific. Hopefully the “delegates” are motivated to not only register to show-off to their bosses, but to really attend? And use the networking opportunities AFJ provides?

The next event coming up in two weeks as Airfinance Journal China, then followed by Asia Pacific. Hopefully the “delegates” are motivated to not only register to show-off to their bosses, but to really attend? And use the networking opportunities AFJ provides?

Because else, such virtual conferences turn to be a barrel burst. And that would not value AFJ but do them a big disservice! Did I mention? Aside failing on your job (or why would you sign up?), it backfires; no-one really likes “Dateileichen” (file corpses).

Of Nestlings and Birds of Passage

Then there was that article on National Geographic: Why Travel Should Be Considered an Essential Human Activity

Which is another example of people focusing on their own life style, ignorant to others’ needs, motivation, life style. As I commented right away on LinkedIn:

A dozen years ago, I spoke with a friend/student, trying to convince her to join the aviation industry. There’s three types of people.

- Nestlings, staying all their life in one place, except for the one or other vacation. A flight of more than two hours takes them to the unknown they fear.

- Precocials, leaving home to move elsewhere and get settled. They travel for vacation and VFR.

- Birds of Passage. They go, where live takes them, are open to the new and for them travel is a reward and each destination an adventure they embrace.

If you talk to nestlings, they will oppose your notion that travel would be “essential”. At the same time, they tend to be nationalistic and protective about their local environment. And the first to shut-down borders and travel. It’s those, “thinking different” being “in power” we have to catch and convince. To do that, we must understand their different “gut feeling”.

That said, if you talk crisis these days, it showed (most of) us, what privilege it is to be able to travel. And how quickly such privileges can be taken from us by forces beyond our control. And the lousy standing of travel lobbyists and lobbies with the decision makers.

A Lesson for the Crisis

Convincing the People to Fly Again

Convincing the People to Fly Again

In all the discussions, it seems to be common opinion that we must regain the travelers’ faith to fly again. Given the (painfully) slowly sinking-in fact that we never might have “the” super vaccine, we better adjust our communications. We must understand that there are us “birds of passage”, looking forward to new experiences and adventures, but also the ones that are afraid of the new, the conservatives, the nestlings. And some of them being politicos, in my humble experience a lot of them narrow-minded, cover-your-ass-types that do not make a move unless they have to. As seen at the beginning of the crisis. Then they overreact out of fear, understanding they made a mistake, trying to cover up hysterically to distract from the mistake. Or like Trump now was caught in the act, lying to the U.S. people to “not spread panic”. Whereas a healthy panic is good! It keeps us alert. And then we must adapt. It’s called evolution. But that’s something many people are mortally afraid of.

Think Outside the Box

There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

There are a lot of posts and speakers emphasizing that we must adapt to the crisis, think outside the box, then in the next minute turning back on why them keeping the status quo and doing as they always did would be the right thing. As they obviously fail to understand the thinking of their customers, shutting down the crisis, falling back to “safe thinking”. Just as most investors do.

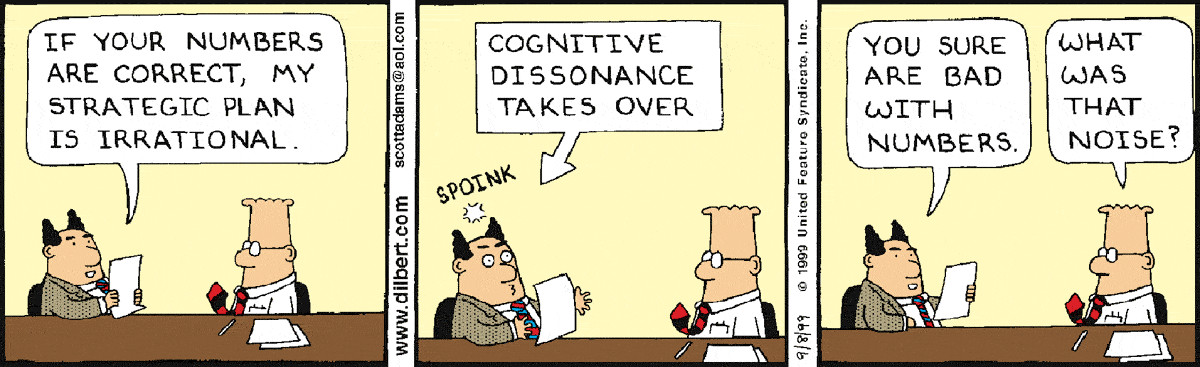

As painful as it was, in fact it was truly funny. A speaker at Airfinance Journal Japan, an aircraft lessor, emphasized the time being right for new airlines. When I approached him, he retreated to the fact that they never lease to start-ups and would never invest in a start-up airline. Oh yes: Cognitive Dissonance at it’s best, right? This is a quite common stance when we talk to “aviation investors”, failing to understand that “aircraft investor” is not “aviation”, but just one piece of the puzzle. We represent an opportunity to place 200 aircraft in 10 years. Which is big business. Once we get the launch funding secured.

Me too … Or doing things different?

While many still focusing “blindly” on “Airbus/Boeing” aircraft investments, they lost and loose money. It’s been a shark pond before the crisis, now that bubble imploded. At Airfinance Journal Latin America event, the best speaker was Walter Valarezo of DAE (Dubai Aerospace Capital), outlining the “abnormal normal” in the market pre-crisis. Now most investors curl up into a ball falling back to “old habits”.

While many still focusing “blindly” on “Airbus/Boeing” aircraft investments, they lost and loose money. It’s been a shark pond before the crisis, now that bubble imploded. At Airfinance Journal Latin America event, the best speaker was Walter Valarezo of DAE (Dubai Aerospace Capital), outlining the “abnormal normal” in the market pre-crisis. Now most investors curl up into a ball falling back to “old habits”.

USP is about “unique”. You don’t have a USP if you only copy what the others did. And stick to your modus operandi.

Fortunately there are some – very few but some – who do understand the opportunity, the need to think outside the box. Those are the ones we talk with. Will they help us launch the Kolibris? I guess they will. Let’s see how quickly we can convince them and their PTBs that change is good and our business plans are safe and sound. And benefits a great deal from this crisis.

Food for Thought

Comments welcome!

Is it really “new thinking”? Last December, pre-Corona, I outlined

Is it really “new thinking”? Last December, pre-Corona, I outlined

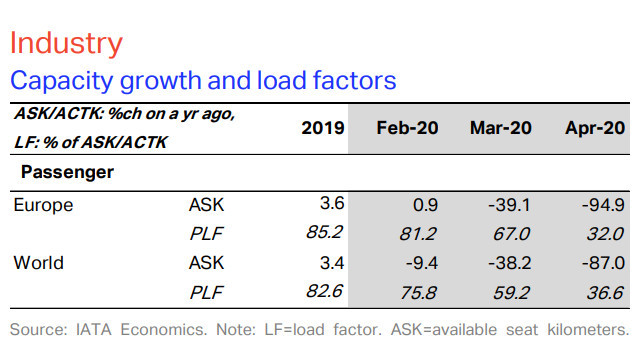

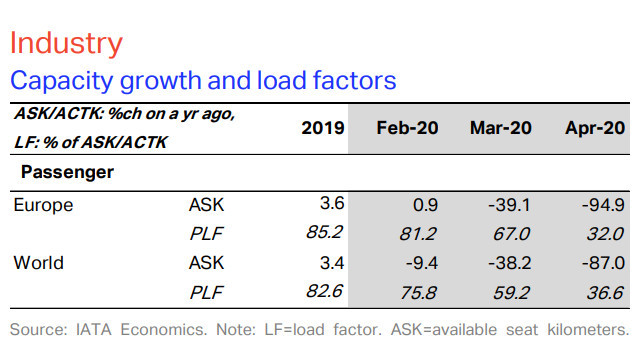

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Recent developments and posts really bug me. Don’t the writers of those posts recognize the cognitive dissonance? Yes, we must think positive. But there is a clear distinction between thinking positive and whitewashing or daydreaming. We have a crisis at hand and the “positive signals” aren’t as “positive” as those posts try to make them look like. They look at the marketing messages on the surface but fail to look the slightest bit deeper.

Yes, as you can see in the archive of my

Yes, as you can see in the archive of my  I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely.

I know, being a German and having taken residence with the family in Germany for the pandemic, I am somewhat biased on what happens here and especially Lufthansa. And that makes me puke. No, I can’t say that nicely.!["We are Listening. And We're Not Blind. This is Your Life. This is Your Time!" [Snow Patrol - Calling in the Dark]](https://foodforthought.barthel.eu/wp-content/uploads/2020/01/CallingintheDark.jpg)

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.”

To which he replied: “I couldn’t agree more. I have seen the same firsthand when it came to [product] engineering. Initially we were going to work with an established manufacturer and have them make modifications for us. That was quite the trip down the rabbit hole, and more trouble than it’s worth. Now we’ll get [products] that were custom engineered for us, from the ground up.” In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management.

In direct conversation, one of the later board members of Air Berlin told me, the airline would not kick the bucket because the new CEOs wouldn’t have good ideas, but because they failed on the heritage. The existing “networks”, afraid of the change, afraid to loose their job, torpedizing the management. As addressed in

As addressed in  Dinosaurs …

Dinosaurs … Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.

Doing a staged setup and focusing to stake our own claims, select strategic bases aggressively outselves, we can establish the company for a mere €30 million. € 15 million per additional base with seven aircraft and hundreds of (secure) jobs. A fraction of the food the dinosaurs demand to survive. Condor now half a billion? What evolutionary wonders we could achieve with that money.

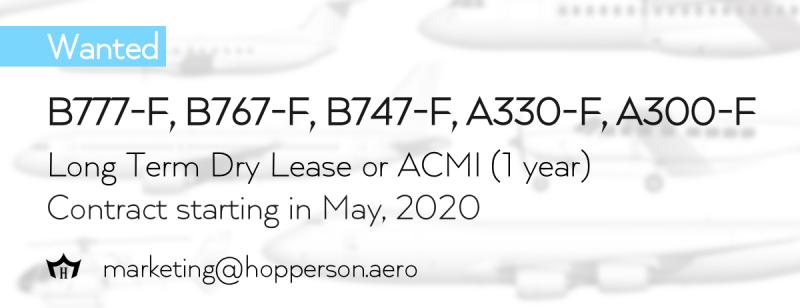

Bill Cumberlidge addressed P2F shortly in the ISHKA webinar. As the need for quick transport increases, the belly-freight in passenger aircraft has gone missing. That increases the demand for classic freighter aircraft. But keep in mind that this is a temporary peak only.

Bill Cumberlidge addressed P2F shortly in the ISHKA webinar. As the need for quick transport increases, the belly-freight in passenger aircraft has gone missing. That increases the demand for classic freighter aircraft. But keep in mind that this is a temporary peak only. The main issue there seems not to be the demand for conversions exceeding the available resources, companies with the experience in such conversions.

The main issue there seems not to be the demand for conversions exceeding the available resources, companies with the experience in such conversions. While there is a current peak, promising a use of lots of large freight aircraft (A380, B747, B777, B767, A330, A300, etc., etc.) that demand bubble will last maximum one year.

While there is a current peak, promising a use of lots of large freight aircraft (A380, B747, B777, B767, A330, A300, etc., etc.) that demand bubble will last maximum one year. But how many containers does a single container giant today transport? And how many of those can you put onboard an A380 or B747? There were a lot of hurray and self-praise of airlines that one aircraft transported 500,000 masks to somewhere. Whereas the population there is a multiple of that number. Airfreight is expensive and a drop on a hot stone.

But how many containers does a single container giant today transport? And how many of those can you put onboard an A380 or B747? There were a lot of hurray and self-praise of airlines that one aircraft transported 500,000 masks to somewhere. Whereas the population there is a multiple of that number. Airfreight is expensive and a drop on a hot stone. Another, very standard “fallback idea” is the “End-of-Life”-strategy to cannibalize the surplus aircraft for spare parts. Given the immense surplus of 150-240-seat aircraft, this bubble is instantly doomed. In several expert discussions I heard 50%, even up to 70% of the fleets to be grounded. Recovery of likely 80% within two years. Let’s say we decommission 20%. Which ones? Where? Who starts?

Another, very standard “fallback idea” is the “End-of-Life”-strategy to cannibalize the surplus aircraft for spare parts. Given the immense surplus of 150-240-seat aircraft, this bubble is instantly doomed. In several expert discussions I heard 50%, even up to 70% of the fleets to be grounded. Recovery of likely 80% within two years. Let’s say we decommission 20%. Which ones? Where? Who starts? Cognitive Dissonance: Who Pays the Bill

Cognitive Dissonance: Who Pays the Bill

Freight Use + Repatriation Flights

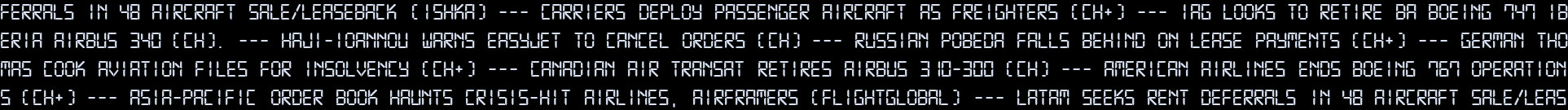

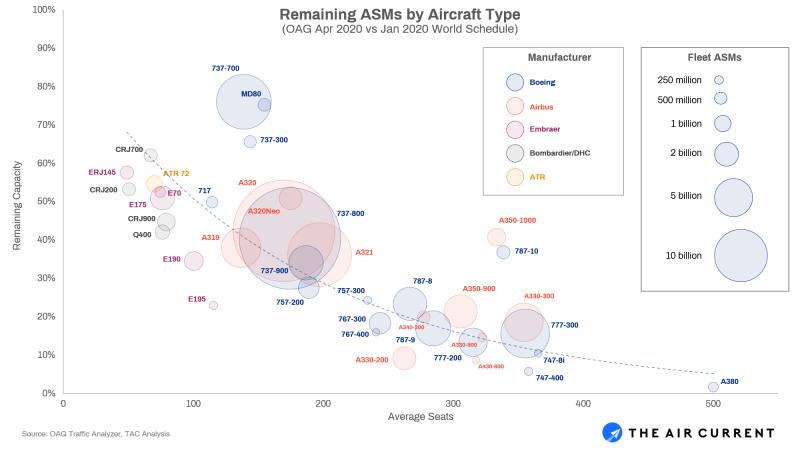

Freight Use + Repatriation Flights Very visible is the mass grounding of large aircraft. The Airbus A380 is already no longer built, now airlines retire, decommission that aircraft in large numbers. Flightradar showed quite some of those aircraft being flown to the scrap-yards, also called aircraft graveyards. The same applies to many 747s, not being “parked”, but decommissioned. The same fate even seems to hit the Boeing 777. Coronavirus also seems to seal the fate of many Boeing 767. For all those aircraft, more than 80% are grounded – many of which are being decommissioned for good.

Very visible is the mass grounding of large aircraft. The Airbus A380 is already no longer built, now airlines retire, decommission that aircraft in large numbers. Flightradar showed quite some of those aircraft being flown to the scrap-yards, also called aircraft graveyards. The same applies to many 747s, not being “parked”, but decommissioned. The same fate even seems to hit the Boeing 777. Coronavirus also seems to seal the fate of many Boeing 767. For all those aircraft, more than 80% are grounded – many of which are being decommissioned for good.

What stroke me odd was the Embraer E195, showing 75% grounded, as well as 65% of the E190s. Both very good aircraft. But very few, large operators grounding their Embraer fleet in favor or their Boeing/Airbus operations seem to have resulted in their large groundings.

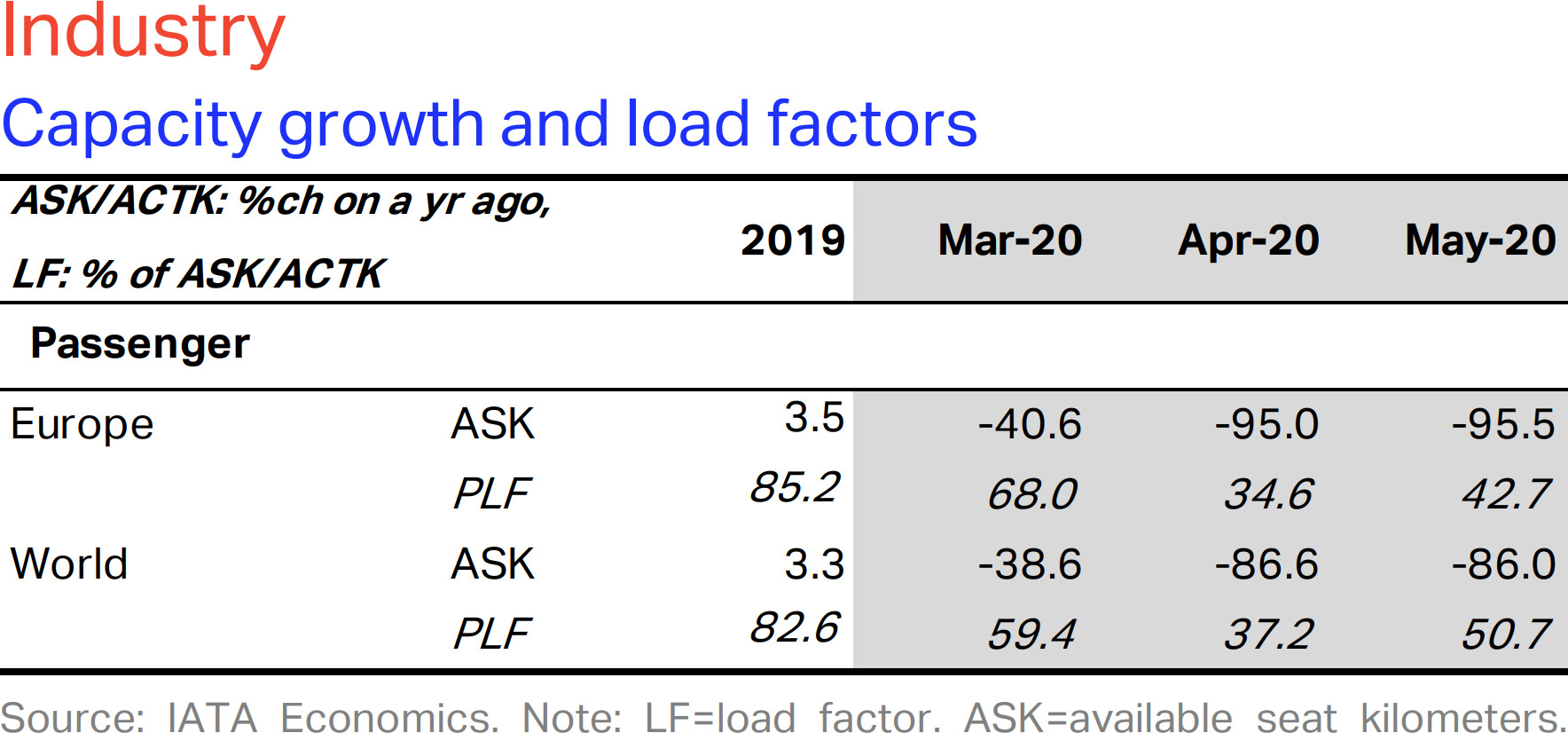

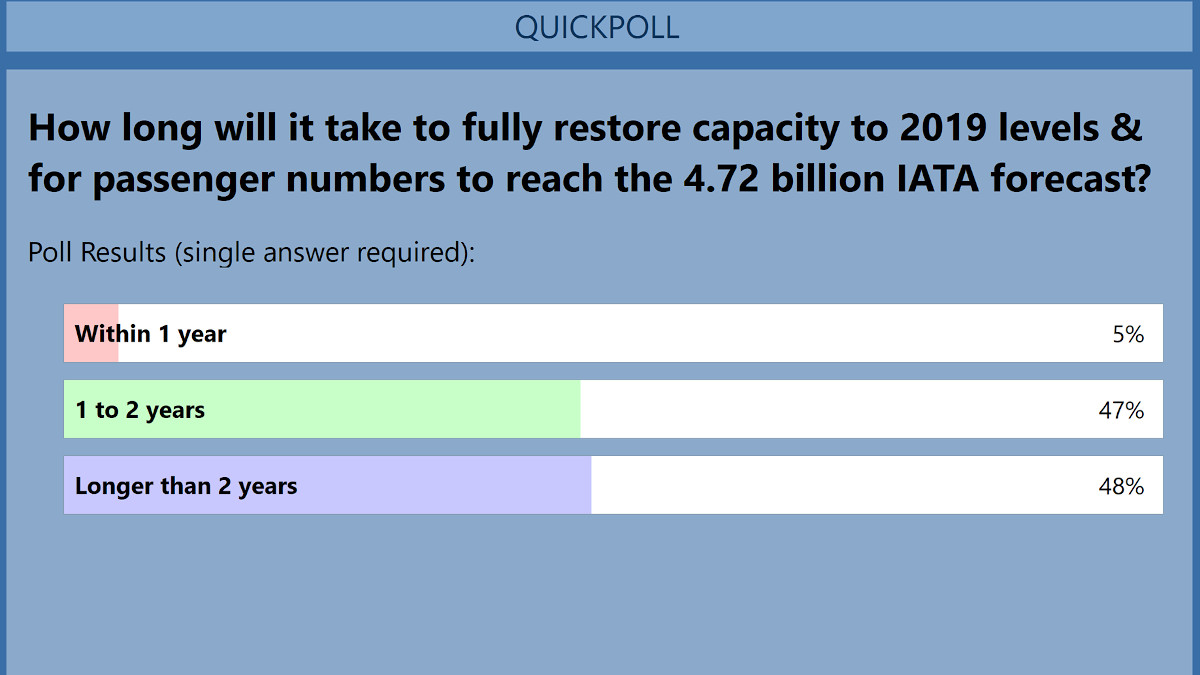

What stroke me odd was the Embraer E195, showing 75% grounded, as well as 65% of the E190s. Both very good aircraft. But very few, large operators grounding their Embraer fleet in favor or their Boeing/Airbus operations seem to have resulted in their large groundings. Optimists outlook is a two-year return to “normal” (AF/KL). Flightglobal headlines

Optimists outlook is a two-year return to “normal” (AF/KL). Flightglobal headlines  As outlines in my Corona Papers, IMF Managing Director Kristalina Georgieva warns of the

As outlines in my Corona Papers, IMF Managing Director Kristalina Georgieva warns of the  Now Flightglobal headlines that

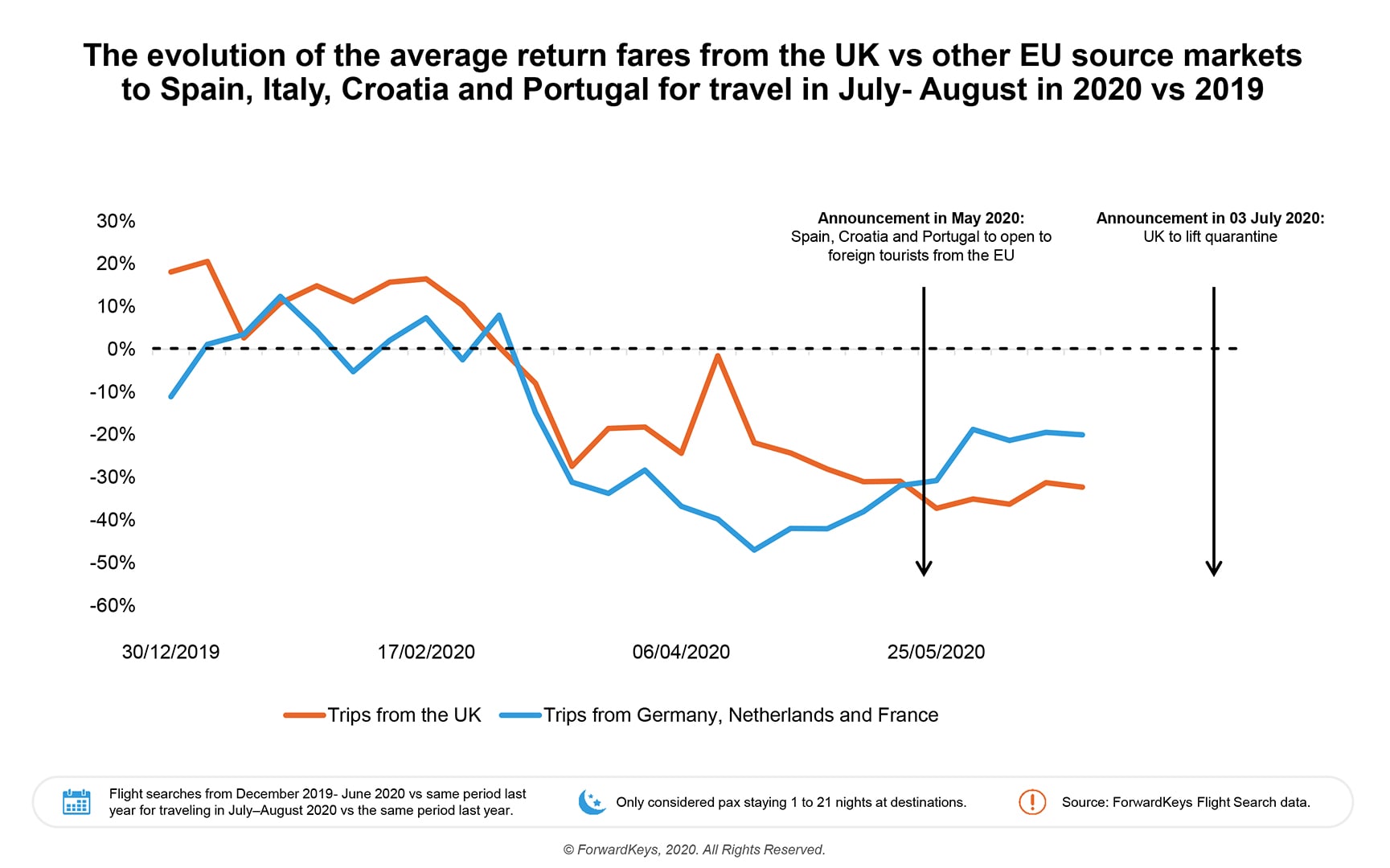

Now Flightglobal headlines that  In a recent conference call, two attending tour operators flight purchasing managers emphasized a recovery on the basis of previously high density high volume routes. They emphasized that while VFR (visiting friends and relatives) will recover a bit faster, the “normal” traveler will be busy recovering their jobs and lives and income – they expect only very little demand for the typical vacation for 2020. And they, as tour operator flight experts raised a question: “Who will want to spend some hours in an airplane having the reputation of being a sardine can?” This will even impact the vacation travel in 2021 and beyond. There will be a revival of ground-based and localized travel at the expense of air travel. It will take time to recover from that blow.

In a recent conference call, two attending tour operators flight purchasing managers emphasized a recovery on the basis of previously high density high volume routes. They emphasized that while VFR (visiting friends and relatives) will recover a bit faster, the “normal” traveler will be busy recovering their jobs and lives and income – they expect only very little demand for the typical vacation for 2020. And they, as tour operator flight experts raised a question: “Who will want to spend some hours in an airplane having the reputation of being a sardine can?” This will even impact the vacation travel in 2021 and beyond. There will be a revival of ground-based and localized travel at the expense of air travel. It will take time to recover from that blow. Business Travel

Business Travel An exception the BTMs mentioned: Travelers who went through the infection and are such immune and noncontagious may be the first to start traveling again. But it was also consensus that a comparison to flu vaccination would be not comparable, after all the hysterics we went through.

An exception the BTMs mentioned: Travelers who went through the infection and are such immune and noncontagious may be the first to start traveling again. But it was also consensus that a comparison to flu vaccination would be not comparable, after all the hysterics we went through. All this lead to the expectation that even on former high density routes, the use of B757, A321LR and such smaller airplanes may be the first routes to recover on long haul. Some very high density routes may recover using larger aircraft such as the remaining B747s or B777s. Where I see Emirates likely to stake their claims quickly, possibly even basing some of their aircraft out of country to serve remote routes.

All this lead to the expectation that even on former high density routes, the use of B757, A321LR and such smaller airplanes may be the first routes to recover on long haul. Some very high density routes may recover using larger aircraft such as the remaining B747s or B777s. Where I see Emirates likely to stake their claims quickly, possibly even basing some of their aircraft out of country to serve remote routes. As for the anticipated return in passenger numbers, except for the very high density routes like New York-London, airlines will start with shorter hub-to-hub-routes, like back in the 80s the availability of two-leg-connections between any two cities will be limited, three-leg connections again becoming quite normal. Expectation was also voiced that most operators will shelve most, if not all twin-aisle aircraft.

As for the anticipated return in passenger numbers, except for the very high density routes like New York-London, airlines will start with shorter hub-to-hub-routes, like back in the 80s the availability of two-leg-connections between any two cities will be limited, three-leg connections again becoming quite normal. Expectation was also voiced that most operators will shelve most, if not all twin-aisle aircraft. Given the expectation of questionable safety regarding load factors and demand for 150-240-seat aircraft, this will be a turning point for the low-cost industry. For a long time, I considered “low-cost” carriers (LCC) as a cost-sensitive regional aviation player. Connecting point-to-point without a focus on connecting traffic. As the fleets grew, the routes got longer, the LCCs started experimenting with classic concepts like GDS-sales, hub-services and connecting flights, etc., etc. As the classic airlines learned to adapt to the new competition. It was long questioned on conferences and other discussions, if you can still group LCCs, that dates back even to fierce discussions about the status of Air Berlin as a LCC.

Given the expectation of questionable safety regarding load factors and demand for 150-240-seat aircraft, this will be a turning point for the low-cost industry. For a long time, I considered “low-cost” carriers (LCC) as a cost-sensitive regional aviation player. Connecting point-to-point without a focus on connecting traffic. As the fleets grew, the routes got longer, the LCCs started experimenting with classic concepts like GDS-sales, hub-services and connecting flights, etc., etc. As the classic airlines learned to adapt to the new competition. It was long questioned on conferences and other discussions, if you can still group LCCs, that dates back even to fierce discussions about the status of Air Berlin as a LCC. In most of the webinars, calls and discussions of the past weeks, the expectation was expressed that as regional flights were the last to be cancelled, they will be the first ones to recover. 150-240 seats are the domain of the former LCCs. There problem will be the very slow growth of passenger numbers post-crisis. Suddenly their “more seats” turn from benefit at full load into a severe challenge. Similar to tour operators, they will focus their recovery on the former high density routes. In a perfect scenario, they would slowly pick up speed. Realistically, they will rush it, risking a lot, flying below cost. How long they can sustain that must be seen. If aviation truly cuts back to traffic of the 1990s, the demand for flights served by 150-240 seat aircraft will be rather limited. A lot of Airbus-320- and Boeing-737-families’ aircraft will be grounded for time to come. With a devastating impact to aircraft leasing companies focusing on those aircraft.

In most of the webinars, calls and discussions of the past weeks, the expectation was expressed that as regional flights were the last to be cancelled, they will be the first ones to recover. 150-240 seats are the domain of the former LCCs. There problem will be the very slow growth of passenger numbers post-crisis. Suddenly their “more seats” turn from benefit at full load into a severe challenge. Similar to tour operators, they will focus their recovery on the former high density routes. In a perfect scenario, they would slowly pick up speed. Realistically, they will rush it, risking a lot, flying below cost. How long they can sustain that must be seen. If aviation truly cuts back to traffic of the 1990s, the demand for flights served by 150-240 seat aircraft will be rather limited. A lot of Airbus-320- and Boeing-737-families’ aircraft will be grounded for time to come. With a devastating impact to aircraft leasing companies focusing on those aircraft.

Pending question was if there will be enough consolidation to leave enough niches for the survivors. Or if the stabbing and fighting for routes will continue – with the pre-crisis effect on revenues and commercial sustainability of the air carriers. While we all expressed hope for the first, we all fear that airline managers will fall back into their old modus-operandi to focus on marked share and loads instead of revenue and profit.

Pending question was if there will be enough consolidation to leave enough niches for the survivors. Or if the stabbing and fighting for routes will continue – with the pre-crisis effect on revenues and commercial sustainability of the air carriers. While we all expressed hope for the first, we all fear that airline managers will fall back into their old modus-operandi to focus on marked share and loads instead of revenue and profit. The recovery will be slowed down as “low-cost” models at the beginning will such pose high risk – low return, airlines will need to focus initially on low load factors but the need to create profit after the drought.

The recovery will be slowed down as “low-cost” models at the beginning will such pose high risk – low return, airlines will need to focus initially on low load factors but the need to create profit after the drought. With

With

Now, surprise surprise, the current crisis proves that this is the very same with aircraft investors. If you just look at aircraft but have no idea how to use it, you’re doomed. It will work a while, it did work a while. But even before Corona, this model was doomed and I addressed it. If an investor invests into the aircraft but outsources (the risk of) the operation. Then those small failing airlines return the aircraft after not paying the bills for several months.

Now, surprise surprise, the current crisis proves that this is the very same with aircraft investors. If you just look at aircraft but have no idea how to use it, you’re doomed. It will work a while, it did work a while. But even before Corona, this model was doomed and I addressed it. If an investor invests into the aircraft but outsources (the risk of) the operation. Then those small failing airlines return the aircraft after not paying the bills for several months. Since starting to turn the idea that turned out to become

Since starting to turn the idea that turned out to become