Working in aviation marketing on CheckIn.com and recently on research related to airline route development, it makes me mad to see how

airports mismanage their data

Passenger Statistics

For more than 10 % of the airports, using two main sources for data (airport, Wikipedia) and cross checking with the industry source, the ANNA.aero “databases” (Excel files, not “data sources) the data does not compute! So we spend an awful amount of time not just collecting that data, mostly from complicated pages that we have to manually scan, but the data we get, proves then to be “approximate” on core numbers like “passengers” handled by the airports. As reported before, ANNA.aero disqualified for us for anything but a cross-check, once we learned that even within their Excel files, the sum of the months does not necessarily compute to the given annual total… The same we found true on the “usual suspect” sources.

Asking the airports for their last passenger numbers, many cannot give them on a monthly basis, many give us numbers that are obviously wrong but most don’t even bother to answer. Where we get numbers, often they are a table in a Word document or an e-Mail, often in a PDF where if you try to copy that very table to a spreadsheet, it comes out as unformatted text, causing more work. Not to talk about image-files, where you must extract them, writing them off that image… With more than 600 airports we happen to have on file at CheckIn.com, that is no fun, that is frustrating.

Know your numbers? Not an issue at airports. Digital? Naaw, why bother?

Landing & Handling Fees

The last months, we approached airports under route planning constraints, asking them for a given aircraft type and load (giving also MTOW and seats) for the cost for the landing and handling at their airport. As we did not find their Standard Ground Handling Agreement and fees online. Maybe we missed to find it, but excuse me, is that our problem? Where we found them, they are often outdated (more than three years old), headlining the year of validity, so factual outdated.

Out of 63, only a good dozen replied within three weeks. Out of those replies, only five responses where useful. Five. The others responded sending us their files, often only landing or handling, frequently not both. Only some of those warned us, referring us to the ground handling companies.

Excuse me? We ask an average cost. Even your ground handlers have an average handling cost. You don’t know? So what do you sell me?

That route planning friend I referred to in my December post (promoted Jan 1st) just told me this week, he doesn’t have faith in airport marketing. Only very few would do their job right and focus on facts. Most would focus on fiction. And he reminded me of my December post and Erfurt.

Airport Marketing – Fact of Fiction?

Honestly, I have no idea. I had faith in my fellow marketing colleagues at airports. But most what I get is “dreamlands”. Digging into the numbers, you find black holes the size of a galaxy. You find logical mistakes. What you don’t find is the numbers you need as an airline. Guesswork. Ideas. Biased ideas at that. Brings me back to my friend. He confirmed, even with their established, substantial size, they had the same problem with airport fees, keep having them with about any new airport they consider flying to. That’s why one day they have to send someone there and inquire on-site. Bug them until the numbers are on the table. And usually he says: “Usually, that takes too much time”.

Are we living in a digital world? We may. Airports still mostly does not.

My friend told me: This is why Routes is such a success. Because you still need to talk to the airports to get what you need. No, they do not provide that on their website. No, they do not understand how to provide data (spread sheet, not Word, PDF or a fancy “image”). Not ANNA.aero, Route Shop or Routes Exchange, where he confirmed to me, he does not find any facts but fancy “marketing” without foundation. Our comparison we did for him of our catchment area findings compared to those sources he said proved most valuable to him – internally and externally. If they don’t even use a free service like ours to compare and qualify their guesstimates, if they cannot respond to the offset, how to trust any figures they provide you?

He calls TheRouteShop and Routes Online the “big show-off stages” (on- and offline). He says, his and his team’s main function is to look behind that show-off, to find out where it’s trustworthy facts and where an empty hull. Assess the risk. “Their job should be to provide us the facts to make sound decisions. All they do is adding smoke screens and to boast.”

Food for Thought…

Comments welcome!

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in

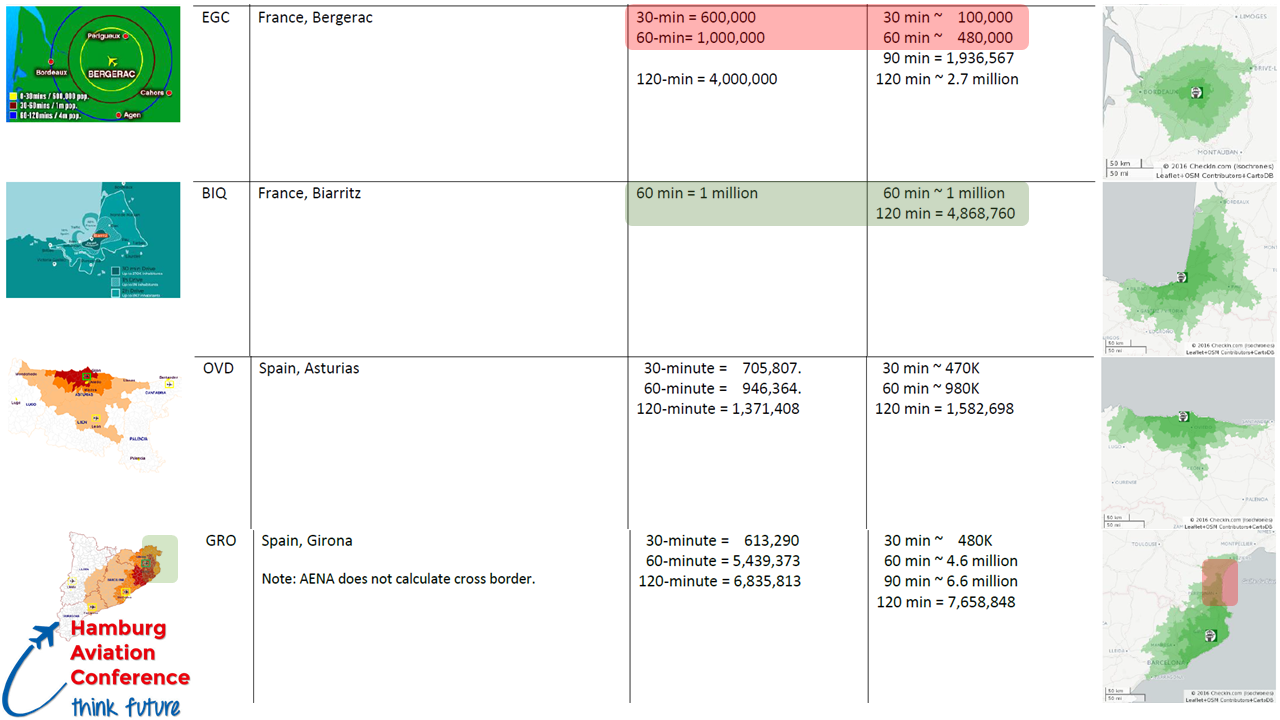

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in  Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.”

Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.”![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Ryanair

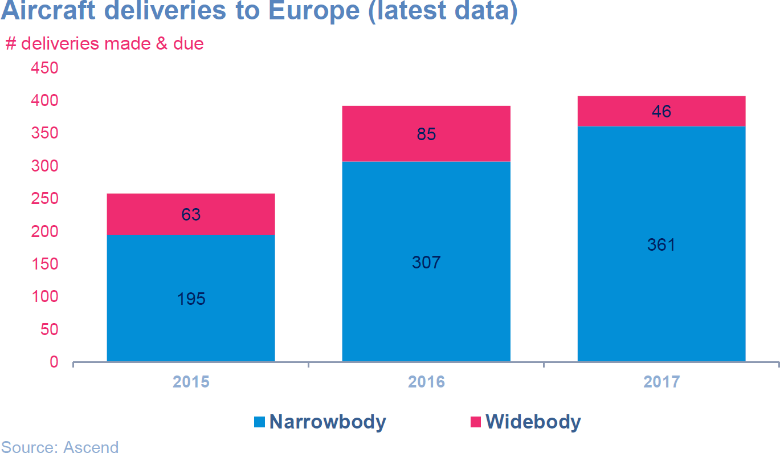

Ryanair I have questioned that approach ever since I first heard of it, as everyone in the aviation industry knew that we face a shortage of pilots. Given availability and demand, with the large number of aircraft orders, easyJet and Ryanair both are known to seek to sell aircraft from their enormous back-log of orders they placed with Airbus and Boeing. At Paris Air Show this year, I discussed with experts, confirming that this already backfires on both Airbus and Boeing, as they have to lower their own prices as those airlines handover the substantial discounts the gave the low cost airlines for their humongous orders.

I have questioned that approach ever since I first heard of it, as everyone in the aviation industry knew that we face a shortage of pilots. Given availability and demand, with the large number of aircraft orders, easyJet and Ryanair both are known to seek to sell aircraft from their enormous back-log of orders they placed with Airbus and Boeing. At Paris Air Show this year, I discussed with experts, confirming that this already backfires on both Airbus and Boeing, as they have to lower their own prices as those airlines handover the substantial discounts the gave the low cost airlines for their humongous orders. Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

Another issue is a feedback I got from a financial expert. There are financial funds for aircraft. All those funds currently suffer as soon as the initial leasing is over from eroding revenue, often resulting in substantial financial losses even before the end of the first 10 years. Thanks to the eroding prices of A320 and B737 aircraft, thanks to the low cost airlines passing on the substantial discounts they received from the aircraft makers on their mass-deals, result in a faster drop of value than anyone anticipated. As FlightGlobal reported already back in 2014 in their special report

Another issue is a feedback I got from a financial expert. There are financial funds for aircraft. All those funds currently suffer as soon as the initial leasing is over from eroding revenue, often resulting in substantial financial losses even before the end of the first 10 years. Thanks to the eroding prices of A320 and B737 aircraft, thanks to the low cost airlines passing on the substantial discounts they received from the aircraft makers on their mass-deals, result in a faster drop of value than anyone anticipated. As FlightGlobal reported already back in 2014 in their special report  With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut?

With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut? While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple.

While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple. easyJet on the Move?

easyJet on the Move? A320/321neo. A Change-Maker?

A320/321neo. A Change-Maker? Quo Vadis easyJet?

Quo Vadis easyJet? The last weeks were rather challenging. Speaking at Passenger Terminal Expo on Data Silos, Silo Thinking and the need to Tear Down the Walls, Yulia and I also worked on the update of the airport passenger statistics, adding movements to the database to expand our information. And we fell right back into

The last weeks were rather challenging. Speaking at Passenger Terminal Expo on Data Silos, Silo Thinking and the need to Tear Down the Walls, Yulia and I also worked on the update of the airport passenger statistics, adding movements to the database to expand our information. And we fell right back into

ANNA.aero maintains what they call the

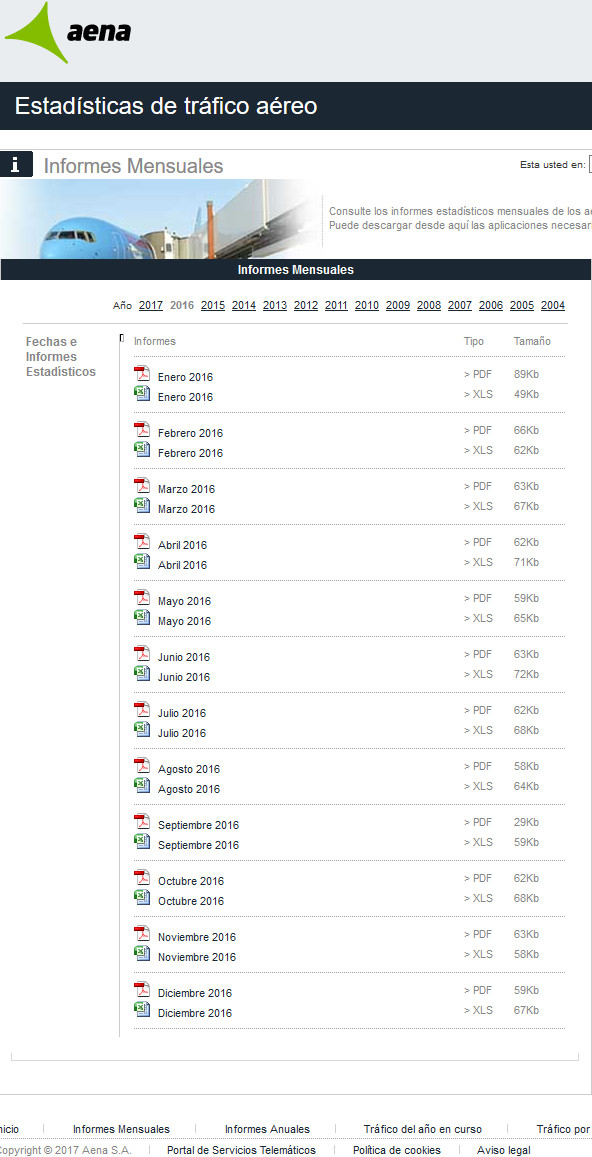

ANNA.aero maintains what they call the  We find several sources for public accessible data. Sometimes you find it on the airport’s own website, somewhere in “Statistics”, sometimes in a press release, usually not in one, but in 12 press releases (see image). And even when publishing the annual numbers in one file, the file comes as a PDF, formatted that they cannot be extracted into a table but copy into one value a line. On a complex table, that renders that useless. So the airport forces users of their data to write the data off the PDF? You can’t be serious, can you?? Sometimes national airport associations publish the data, usually monthly. After we found them to occasionally change the formatting and order even within a given year, we double-check that on the import, burning valuable time. Then we learned to now download monthly data before the annual one was available, as we also happened to fall the trap of intermittent changes (see ANNA.aero). Many such files do not contain the airport codes. But the airport name in the national language. Upper case. No, that does not compute easily and is prone to cause data errors.

We find several sources for public accessible data. Sometimes you find it on the airport’s own website, somewhere in “Statistics”, sometimes in a press release, usually not in one, but in 12 press releases (see image). And even when publishing the annual numbers in one file, the file comes as a PDF, formatted that they cannot be extracted into a table but copy into one value a line. On a complex table, that renders that useless. So the airport forces users of their data to write the data off the PDF? You can’t be serious, can you?? Sometimes national airport associations publish the data, usually monthly. After we found them to occasionally change the formatting and order even within a given year, we double-check that on the import, burning valuable time. Then we learned to now download monthly data before the annual one was available, as we also happened to fall the trap of intermittent changes (see ANNA.aero). Many such files do not contain the airport codes. But the airport name in the national language. Upper case. No, that does not compute easily and is prone to cause data errors.

While “the world” meets at

While “the world” meets at  Right after Routes Americas, there’s the second (annually first) European event which we now have as a “must go” on the agenda:

Right after Routes Americas, there’s the second (annually first) European event which we now have as a “must go” on the agenda:

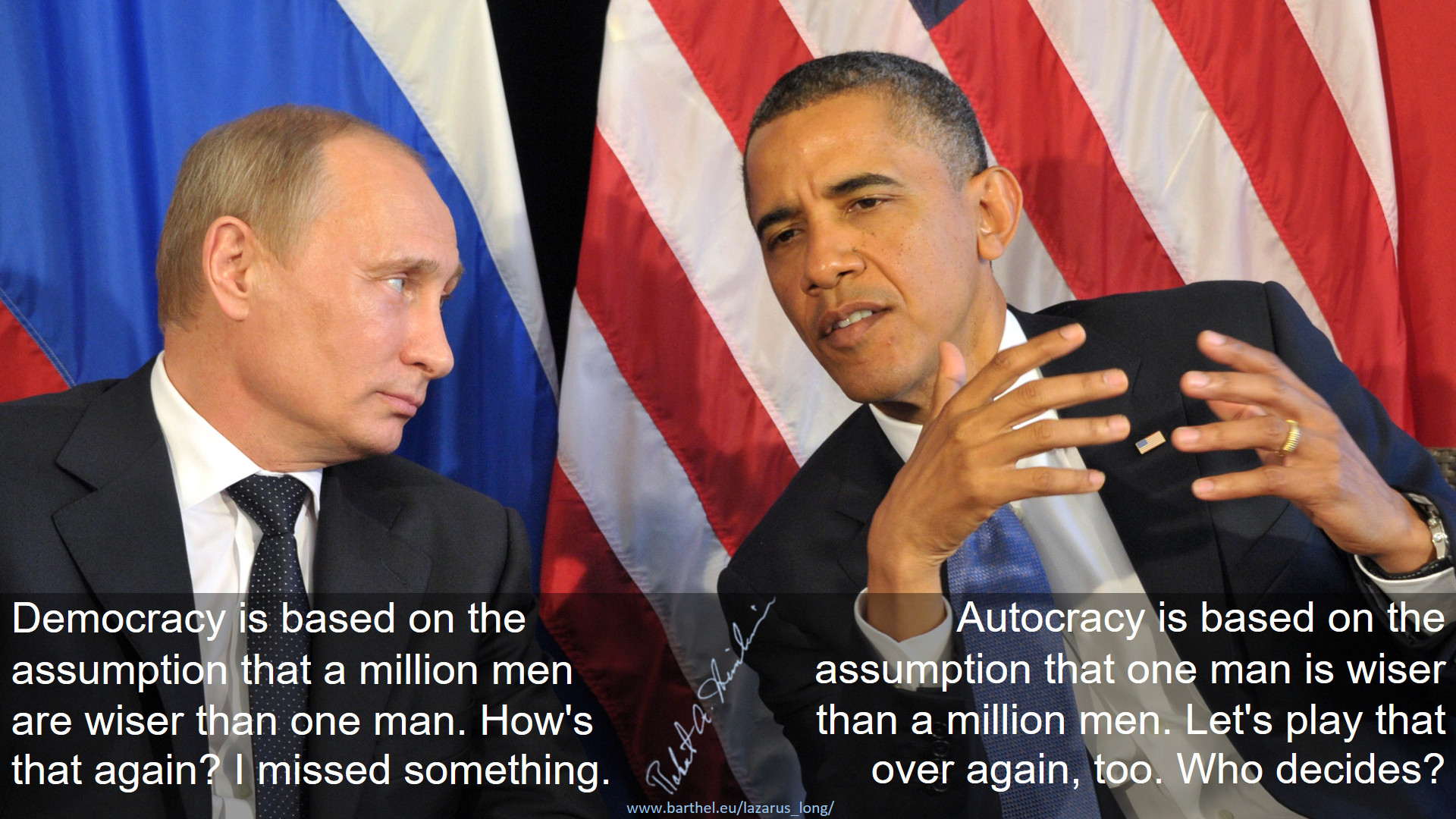

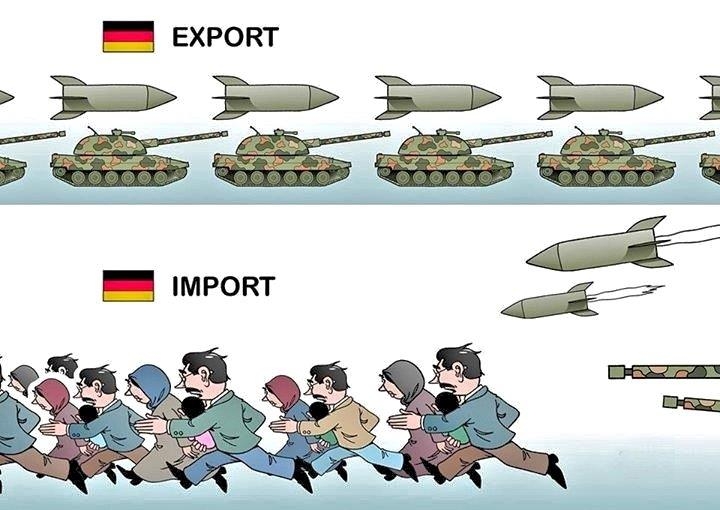

It’s interesting to see the Western-dominated Wikipedia’s wording, approving the coup against a democratically elected president but at the same time condemning any actions by the Crimean, Eastern Ukrainians. Condemning the Russian support that they have been asked for by those regions. It’s not that Wikipedia does not mention it. Propaganda is more subtle. It’s in the wording and the amount of explanation you give or keep. It’s that exact example that makes Russians (people!) question “Western democracy”. Or the neutrality even of a trusted source like Wikipedia – it’s written mostly by Americans. With the best intentions. But in the political environment they work from. It’s hard to fight off that subtle, omnipresent propaganda…

It’s interesting to see the Western-dominated Wikipedia’s wording, approving the coup against a democratically elected president but at the same time condemning any actions by the Crimean, Eastern Ukrainians. Condemning the Russian support that they have been asked for by those regions. It’s not that Wikipedia does not mention it. Propaganda is more subtle. It’s in the wording and the amount of explanation you give or keep. It’s that exact example that makes Russians (people!) question “Western democracy”. Or the neutrality even of a trusted source like Wikipedia – it’s written mostly by Americans. With the best intentions. But in the political environment they work from. It’s hard to fight off that subtle, omnipresent propaganda…

Two weeks ago, a

Two weeks ago, a  My personal interpretation: When the elected president tried to sign a strong bond with Russia (still independent), Europe tried to force Ukraine to side with Europe instead (dependency), forcing it into an unmanageable situation. When they messed up they stuck to their self-invented stories not to confess their mess-up. And the mess up will remain unresolved for European politicos now fight the deamons they let loose.

My personal interpretation: When the elected president tried to sign a strong bond with Russia (still independent), Europe tried to force Ukraine to side with Europe instead (dependency), forcing it into an unmanageable situation. When they messed up they stuck to their self-invented stories not to confess their mess-up. And the mess up will remain unresolved for European politicos now fight the deamons they let loose.

The Arabian Spring

The Arabian Spring Turkey

Turkey