As I attended to be interviewed about the stuff we do at CheckIn.com, you can click the image to view the video on Facebook.

Reviewing the recent Hamburg Aviation Conference, the aviation conference addressing new developments and ideas, it boils down to a “known issue” for the future of the aviation industry:

To tear down the walls.

Data Silos … and it’s not new.

As outlined here in Food for Thought and have been asked to address at Passenger Terminal Expo, there were a lot of very fancy ideas and outlooks where we want to go. About any session addressed the “data silos”. There are a lot and I mean a lot of good ideas and developments taking place as we speak. But all of them are isolated ideas and developments. Look at what airline X does. See here airport Y.

Just one of the many statements at Hamburg Aviation Conference on the topic:

“The check-in process is a totally disjointed process” [Peter Parkes]

Remember my posts about Checkin 2015 and the follow up Check-in 2020?

The underlying line I hear, though not really addressed, just mentioned, is the data silos. Even when being mentioned, it was mentioned as something that “naturally” has to happen. But without it, all or most of those wonderful developments remain what they are. Silos. Be it an(other) airport-silo, an(other) airline-silo, silos being disconnected from the other silos within the same company.

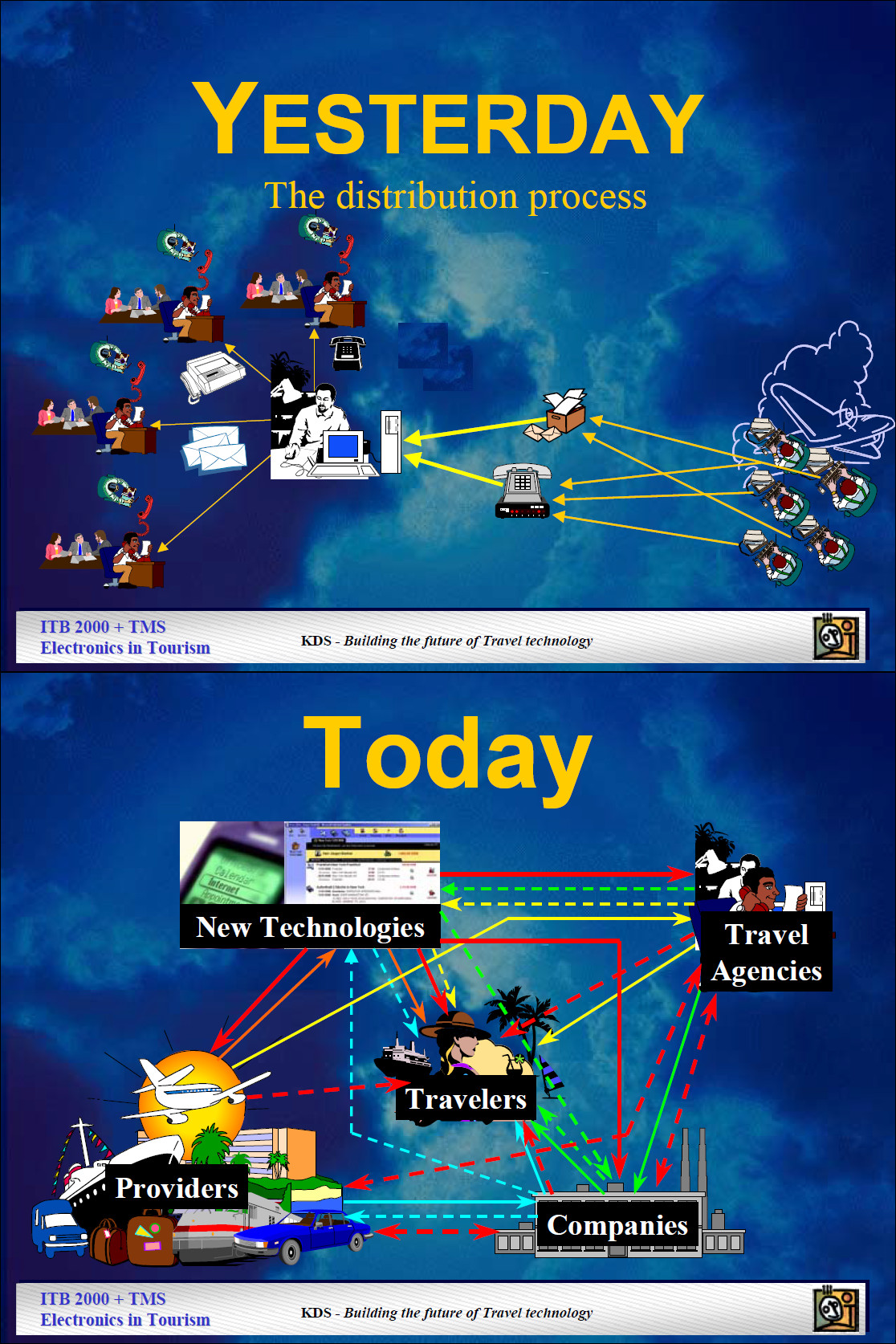

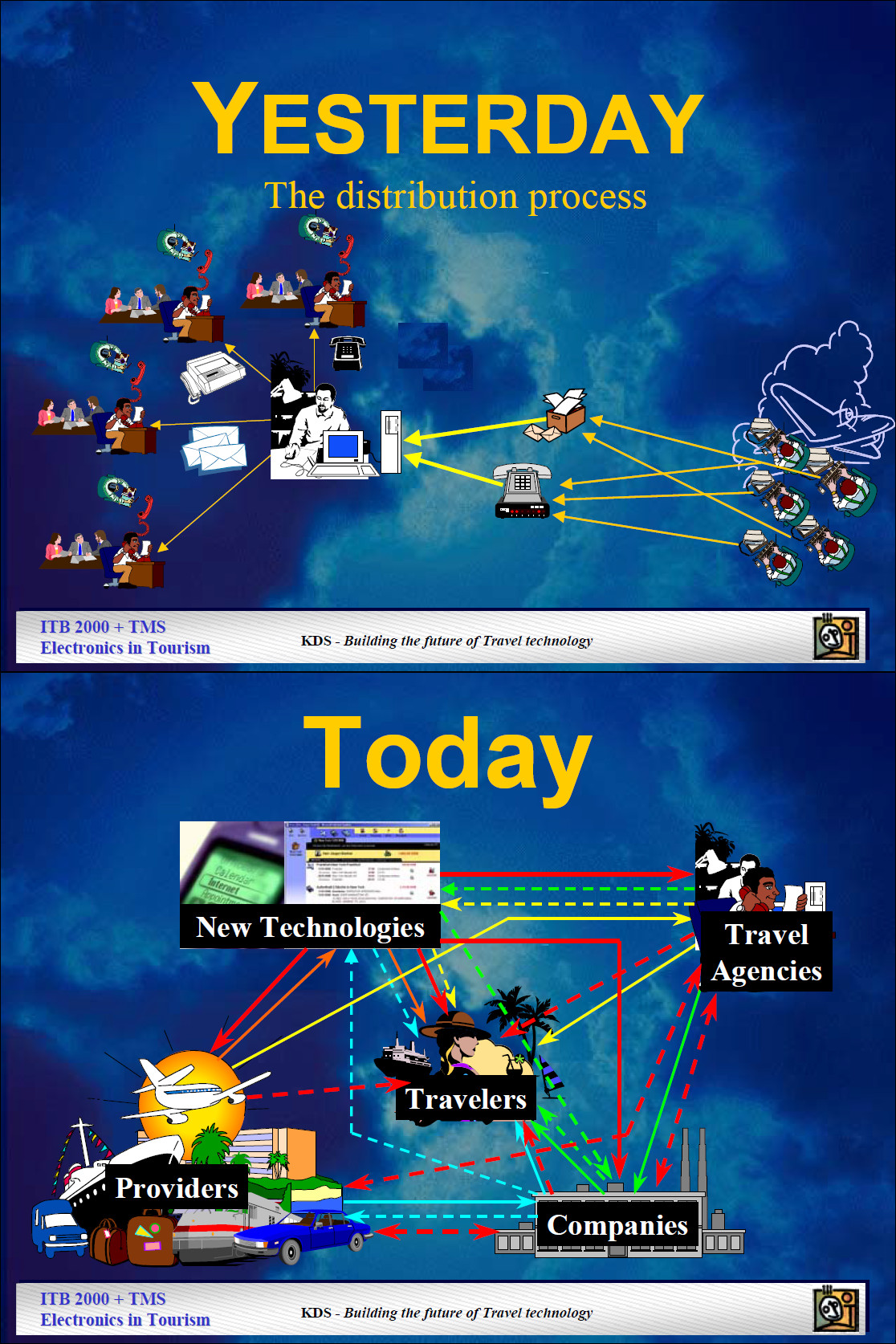

But. This. Is. Not. New! Together with Richard Eastman, from 1996 I emphasized the conversion from a whole sale model to a consumer driven model and the disintermediation in aviation distribution: Everyone deals with everyone. The example Yesterday / Today to the left is from my presentation at ITB in 2000.

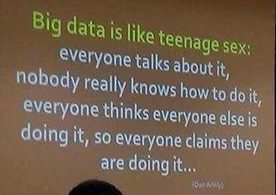

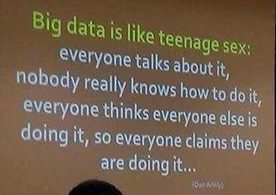

On the floor, there were many discussions that there is a need in “change managers”, as there are all those fancy solutions and understanding of the need. That again reminded me of my question, why after 20 years only 20 airports implemented A-CDM – in my opinion for the very same reason. Everyone talks about it, nobody really knows how to do it, everyone thinks everyone else is doing it, so everyone claims they are doing it…

On the floor, there were many discussions that there is a need in “change managers”, as there are all those fancy solutions and understanding of the need. That again reminded me of my question, why after 20 years only 20 airports implemented A-CDM – in my opinion for the very same reason. Everyone talks about it, nobody really knows how to do it, everyone thinks everyone else is doing it, so everyone claims they are doing it…

There were quite some discussions about the data silo issue and airports and tech companies telling about those very new and fancy solutions they develop. But when I look across to other airports, airlines or tech companies, I find they just build new Data Silos.

It’s not about Data Silos …

… but about Silo Thinking

Data Silos are simply the result of the real problem.

It’s about “who’s data is it?”. It is about the decision makers and stakeholders unwillingness, inability and misconception about a collaborative approach: “Give me your data but don’t date touch mine”… The very same as on the A-CDM side of our business.

The point when the aviation industry reinvented itself and evolved into e-Commerce was back in the 60s t0 80s, when the rise of the CRSs required standardized messages to exchange through the aviations teletype (telex) network. The birth of what today is AIRIMP. Nowadays, IATA works on “New Distribution Capabilities“, though there are fundamental issues when you compare airline sales to Amazon. Where Amazon works with warehouses and even opens own shops, the airline seat is one of the most perishable goods – something Amazon for good reason touches very differently.

The second large move was again forced, when in the mid 90s to 2000 the Internet forced the players to “get online”. Since 1994, I preached the need for airline sales to embrace that change.

I mentioned A-CDM and TAM as a starting point to tear down those walls, but I see a lot of not invented here responses.

Else … The Passenger Journey

Some of the really good ideas in the dead lock of silo thinking, where about one of the new hypes: The Passenger Journey.

Some of the really good ideas in the dead lock of silo thinking, where about one of the new hypes: The Passenger Journey.

When talking about the customer, how do we identify that very customer? By e-Mail? I just happen to change my employer at times. And I get a new address. I currently run three “main addresses” and use different ones for the various social networks. If you identify me by e-Mail, I use a different one when I travel for business than what I do personally. I’m two customers. Data Silos.

There was quite some talk about the need of the “passenger journey”, but also how fragmented that journey is. No wonder, the passenger being split to “airport customer”, “border control/security”, “airline” and the exchange of the traveler from one to the other complicated by Data Silos.

Around 2000, I mentioned in my annual presentation about Airline Sales & e-Commerce for the Airline Sales Representatives Association, that Google was said to identify a unique person within 20 searches, based on IP geographic area, typical questions, etc. That was what … 17 years ago? And we don’t even have a single source of truth for a passenger in aviation. Very often we have separate profiles even within an airline – for GDS/CRS (old legacy tools), check-in and operational processes, but separate for social network contacts. A customer contacting via Twitter or Facebook is (in my experience) usually not associated to the passenger profile! Some examples to the contrary, usually on the large and newer players (i.e. Norwegian, easyJet). Is this a premium customer on the social network or is it a first traveler? Is it someone enroute or at home? Data Silos.

At lunch we talked about another example. I may be a prime customer (“frequent flyer platinum”) at airline A, but I have trouble, getting recognition at airline B. Because it is not about being a frequent traveler, it’s solely about revenue. You are not with us, we don’t want youThat a good treatment of the frequent flyer on your competition might entice him/her to your own product is beyond the decision makers in most if not all airlines. Data Silos? Silo Thinking!

Else … Global WiFi access

On the “customer journey”, every stakeholder forces the customer to change Wifi on the way, use an app for the airport, the airline, the other airport, etc., etc. I mentioned that back in my Check-in 2020 blog.

Whooops. And my friend Stephan Uhrenbacher has to tell me he had an app developed that does it all: FLIO. But… Unfortunately the providers don’t want this, they oppose it and fight to not make this happen. And the airport WiFi is hardly in the control of the airport, but of “some provider” the airport just pays. So they want their log-in processes and pages and have no interest in “usability”. That being true especially on the U.S. market, where in addition the “free WiFi” very commonly fails and then the users complain about FLIO and not about the free WiFi provider of the particular airport. Stephan promised me, the idea is not dead, but yes, the task is not as easy as it might sound. Thanks to Data Silos.

Else … Ryanair, Air Berlin & Lufthansa

Kenny Jacobs in his very interesting interview announced they complained legally about the Lufthansa/Air Berlin merger, saying that is what it is, being called a “lease” business or whatever. As such, Germany remains a protected market with Lufthansa dominating 62% of the domestic travel.

in his very interesting interview announced they complained legally about the Lufthansa/Air Berlin merger, saying that is what it is, being called a “lease” business or whatever. As such, Germany remains a protected market with Lufthansa dominating 62% of the domestic travel.

Side note: That also goes in line with the trade press reporting the remaining Air Berlin being not sustainable. Questioning if Air Berlin is now simply bled dry, leaving the commercially loss making parts in the remaining company, accepting the bankruptcy as a logical end to it. I happen to agree with that assessment.

He also announced they will feed to Aer Lingus and Norwegian on an “interline light” model but with baggage thru-check. Another step from Low Cost to classic operations model. As I kept emphasizing in my Airlines Sales & e-Commmerce presentations. Low Cost will only need a business case to provide “classic” services. Also nice to remember that ANNA.aero article a year ago (right).

He also announced they will feed to Aer Lingus and Norwegian on an “interline light” model but with baggage thru-check. Another step from Low Cost to classic operations model. As I kept emphasizing in my Airlines Sales & e-Commmerce presentations. Low Cost will only need a business case to provide “classic” services. Also nice to remember that ANNA.aero article a year ago (right).

Ryanair develops inhouse, for speed and prioritization of development. Ryanair decided to stop looking at other airlines what they do on their digital strategy, but they look at digital pacemakers, Amazon, Facebook, etc. to learn what they can do to attract the customer.

WiFi onboard? Consumers want to use their own devices on board. But the bandwidth inflight is not sufficient for mass communications. He believes the speed to come up in two years, but then the bandwidth demand will also increase. Yes, for long haul, but on regional flights not a real issue he believes.

User Centric Design

Konsta Hansson of Reaktor.aero had an interesting look into user centric design, not to decide for the user what he needs, but find out what the user needs and leave out the rest. He questioned if a check-in is a given need – or just a legacy process. Using RFID and e-Passports, I strongly agree with him.

Konsta Hansson of Reaktor.aero had an interesting look into user centric design, not to decide for the user what he needs, but find out what the user needs and leave out the rest. He questioned if a check-in is a given need – or just a legacy process. Using RFID and e-Passports, I strongly agree with him.

Question I’d have and could not answer is based on the assumption that “check-in” is obsolete, how would you really refresh processes from the existing legacy processes to a completely digital process? And how do you manage the necessary change management with stake-holders like government bodies? Data Silos.

Who’s Customer is it? A Revenue Issue

Shall the passenger be shopping in the airport or in the airplane?

Shall the passenger be shopping in the airport or in the airplane?

My three friends Stefan, Daniel and Marjan were on stage, discussing the different models the airports have to decide upon about their revenue stream for the passenger, called “ancillary revenues”. Daniel emphasized that within 20 years, the revenue for the airports no longer comes from the airlines. But (declining) from the in airport shops and (increasingly) the aerotropolis.

With Ryanair talking about “free tickets”, keep in mind, there is nothing such as a free meal. Someone will have to pay the air ticket somewhere in the process.

Summary: Start Moving

There was a lot of visionary ideas about where to go, but rather little about how to get there. The above concerns were quickly voiced but not identified as concerns. Steps taken are taken by individual stake holders (technology companies) and less on a development of common standards. So we have fantastic ideas, but we all keep develop our own individual standards = Data Silos. And worse: Silo Thinking!

There was a lot of visionary ideas about where to go, but rather little about how to get there. The above concerns were quickly voiced but not identified as concerns. Steps taken are taken by individual stake holders (technology companies) and less on a development of common standards. So we have fantastic ideas, but we all keep develop our own individual standards = Data Silos. And worse: Silo Thinking!

We talk about “passenger journey” but the solutions are neither user centric nor easy to use. There was recently a story on LinkedIn titled Brand suicide case study: British Airways I strongly recommend… It is a good example about Data Silos, Silo Thinking and not specific to the named airlines. The same story unfortunately is true for most airlines. What we need is a management effort to Tear Down the Walls!

Food for Thought!

Comments welcome

… and if you happen to have a job for me looking after this, please keep in mind I am a job seeker!

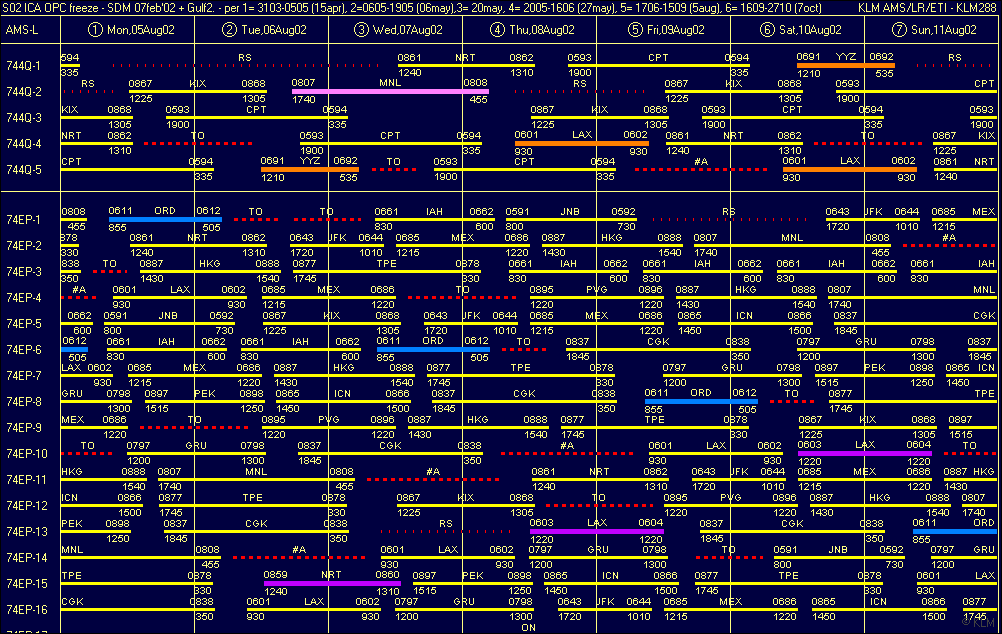

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket!

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket! In 2014 I wrote this article about Airport Operations Center (APOC), Airline Operations Control Center (OCC) and ATC’s Network Operations Center (NMOC) and how they do not communicate with each other. I asked just recently about a common airline system with decent, contemporary, f***ing basic interfaces and learned that none of my precious industry expert friends knows such. Worse, I got more feedback than I wanted about the issues all my friends in this industry can tell about; where thanks to missing such data flow, the right hand does not know what the left one is doing. In the process, trying to improve a bad situation, but working with different information, making things often enough worse.

In 2014 I wrote this article about Airport Operations Center (APOC), Airline Operations Control Center (OCC) and ATC’s Network Operations Center (NMOC) and how they do not communicate with each other. I asked just recently about a common airline system with decent, contemporary, f***ing basic interfaces and learned that none of my precious industry expert friends knows such. Worse, I got more feedback than I wanted about the issues all my friends in this industry can tell about; where thanks to missing such data flow, the right hand does not know what the left one is doing. In the process, trying to improve a bad situation, but working with different information, making things often enough worse. And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.

And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple.

While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple. easyJet on the Move?

easyJet on the Move? A320/321neo. A Change-Maker?

A320/321neo. A Change-Maker? Quo Vadis easyJet?

Quo Vadis easyJet?

The last weeks were rather challenging. Speaking at Passenger Terminal Expo on Data Silos, Silo Thinking and the need to Tear Down the Walls, Yulia and I also worked on the update of the airport passenger statistics, adding movements to the database to expand our information. And we fell right back into

The last weeks were rather challenging. Speaking at Passenger Terminal Expo on Data Silos, Silo Thinking and the need to Tear Down the Walls, Yulia and I also worked on the update of the airport passenger statistics, adding movements to the database to expand our information. And we fell right back into

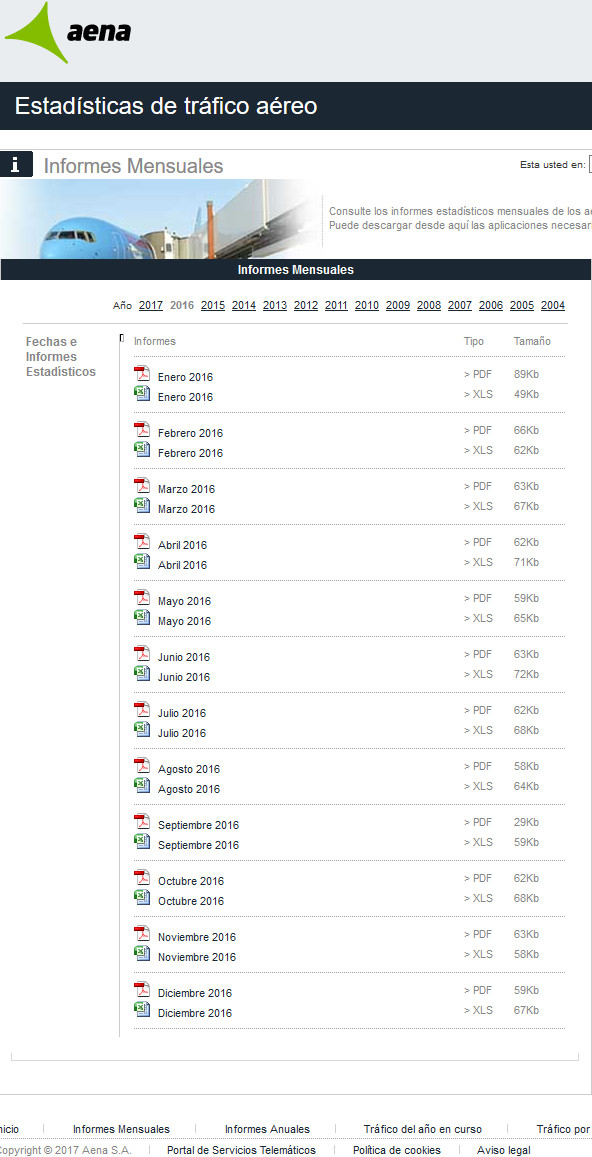

ANNA.aero maintains what they call the

ANNA.aero maintains what they call the  We find several sources for public accessible data. Sometimes you find it on the airport’s own website, somewhere in “Statistics”, sometimes in a press release, usually not in one, but in 12 press releases (see image). And even when publishing the annual numbers in one file, the file comes as a PDF, formatted that they cannot be extracted into a table but copy into one value a line. On a complex table, that renders that useless. So the airport forces users of their data to write the data off the PDF? You can’t be serious, can you?? Sometimes national airport associations publish the data, usually monthly. After we found them to occasionally change the formatting and order even within a given year, we double-check that on the import, burning valuable time. Then we learned to now download monthly data before the annual one was available, as we also happened to fall the trap of intermittent changes (see ANNA.aero). Many such files do not contain the airport codes. But the airport name in the national language. Upper case. No, that does not compute easily and is prone to cause data errors.

We find several sources for public accessible data. Sometimes you find it on the airport’s own website, somewhere in “Statistics”, sometimes in a press release, usually not in one, but in 12 press releases (see image). And even when publishing the annual numbers in one file, the file comes as a PDF, formatted that they cannot be extracted into a table but copy into one value a line. On a complex table, that renders that useless. So the airport forces users of their data to write the data off the PDF? You can’t be serious, can you?? Sometimes national airport associations publish the data, usually monthly. After we found them to occasionally change the formatting and order even within a given year, we double-check that on the import, burning valuable time. Then we learned to now download monthly data before the annual one was available, as we also happened to fall the trap of intermittent changes (see ANNA.aero). Many such files do not contain the airport codes. But the airport name in the national language. Upper case. No, that does not compute easily and is prone to cause data errors.

Ow-my-gawd, but I’m German, what about my personal data and stuff?

Ow-my-gawd, but I’m German, what about my personal data and stuff? And I do not want to get another app. Ages ago, I decided to limit myself to 10 newsletters and two or three social networks. Facebook I use mostly privately. LinkedIn for business. And LinkedIn being “difficult” both in Russia and China is an issue of concern. Google+ I dropped. I use airline apps on my travels, in fact only to get the boarding pass into my phone’s “wallet”. I used some apps for airport information, just recently learned about

And I do not want to get another app. Ages ago, I decided to limit myself to 10 newsletters and two or three social networks. Facebook I use mostly privately. LinkedIn for business. And LinkedIn being “difficult” both in Russia and China is an issue of concern. Google+ I dropped. I use airline apps on my travels, in fact only to get the boarding pass into my phone’s “wallet”. I used some apps for airport information, just recently learned about

On the floor, there were many discussions that there is a need in “change managers”, as there are all those fancy solutions and understanding of the need. That again reminded me of my question, why

On the floor, there were many discussions that there is a need in “change managers”, as there are all those fancy solutions and understanding of the need. That again reminded me of my question, why

Some of the really good ideas in the dead lock of silo thinking, where about one of the new hypes: The Passenger Journey.

Some of the really good ideas in the dead lock of silo thinking, where about one of the new hypes: The Passenger Journey. in his very interesting

in his very interesting  He also announced they will feed to Aer Lingus and Norwegian on an “interline light” model but with baggage thru-check. Another step from Low Cost to classic operations model. As I kept emphasizing in my Airlines Sales & e-Commmerce presentations. Low Cost will only need a business case to provide “classic” services. Also nice to remember that

He also announced they will feed to Aer Lingus and Norwegian on an “interline light” model but with baggage thru-check. Another step from Low Cost to classic operations model. As I kept emphasizing in my Airlines Sales & e-Commmerce presentations. Low Cost will only need a business case to provide “classic” services. Also nice to remember that  Konsta Hansson

Konsta Hansson

Mark from OAG directed my attention this week on OAG’s Punctuality League, which they offer for free

Mark from OAG directed my attention this week on OAG’s Punctuality League, which they offer for free  It can only be an indicator, as both sources fail to relate the one to the other. My first question would be to correlate the on-time performance to the hub airlines. Because it is utterly unfair to blame an airport, if their major hub airline is notoriously late.

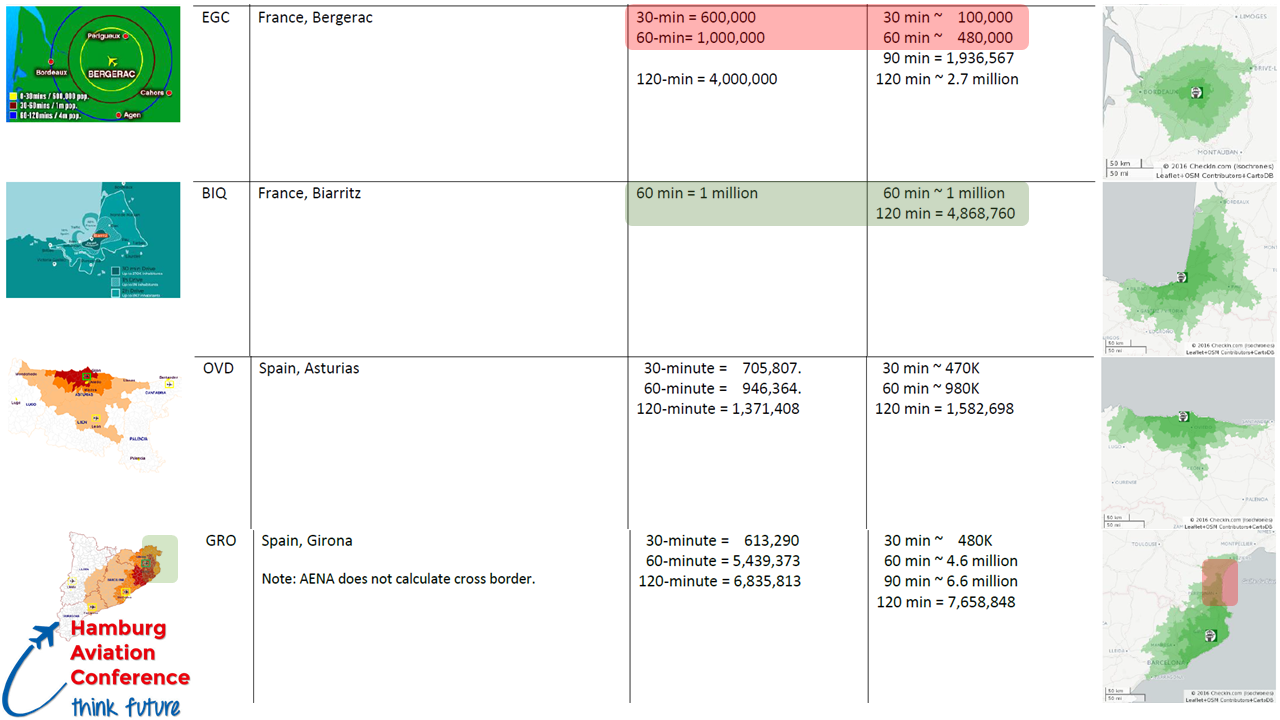

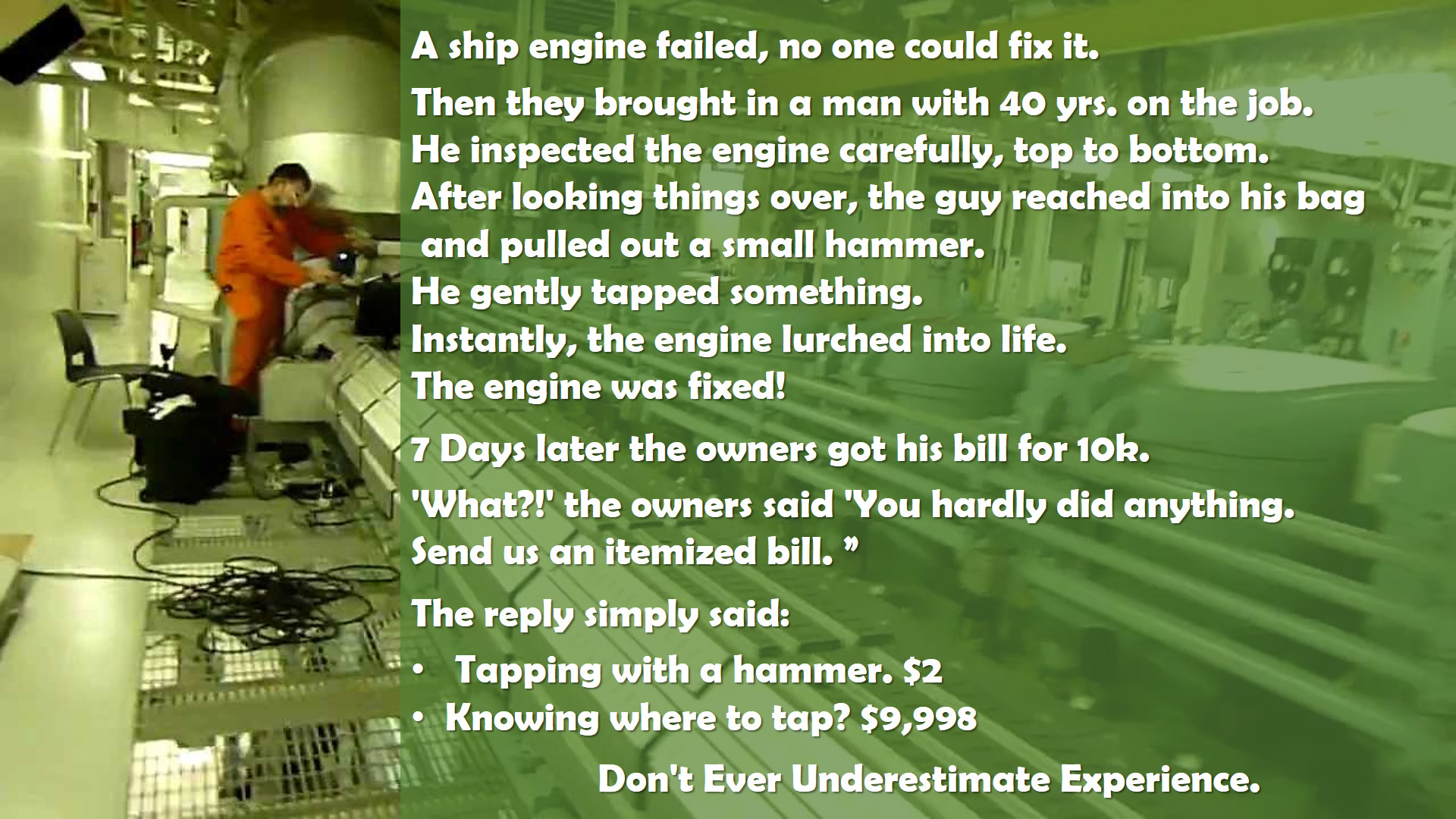

It can only be an indicator, as both sources fail to relate the one to the other. My first question would be to correlate the on-time performance to the hub airlines. Because it is utterly unfair to blame an airport, if their major hub airline is notoriously late. Yes, for CheckIn.com we emphasize that all that data can only be indicators. To be interpreted by an experienced network planner. Because a single new flight makes a major impact on a new or small airport, but has little statistical relevance on a major hub. Saying that, isochrones are in itself valuable statistical data and we put them into our analyses for a reason. As they are a necessity in comparison with the catchment area analysis to interpret the possible impact for a route. In forecasting, you work with indicators, you have no facts.

Yes, for CheckIn.com we emphasize that all that data can only be indicators. To be interpreted by an experienced network planner. Because a single new flight makes a major impact on a new or small airport, but has little statistical relevance on a major hub. Saying that, isochrones are in itself valuable statistical data and we put them into our analyses for a reason. As they are a necessity in comparison with the catchment area analysis to interpret the possible impact for a route. In forecasting, you work with indicators, you have no facts. At the same time you work with big data, so the more data you work with, the more vital it is to get them from a sound source and have them integrated into a common system. Whereas most established data providers, be it OAG, Flight Stats, SITA, etc. have not yet addressed that for a “good reason”. But as an industry, it is vital we add this and integration is very high on our back log at CheckIn.com of what we where we want to go!

At the same time you work with big data, so the more data you work with, the more vital it is to get them from a sound source and have them integrated into a common system. Whereas most established data providers, be it OAG, Flight Stats, SITA, etc. have not yet addressed that for a “good reason”. But as an industry, it is vital we add this and integration is very high on our back log at CheckIn.com of what we where we want to go!