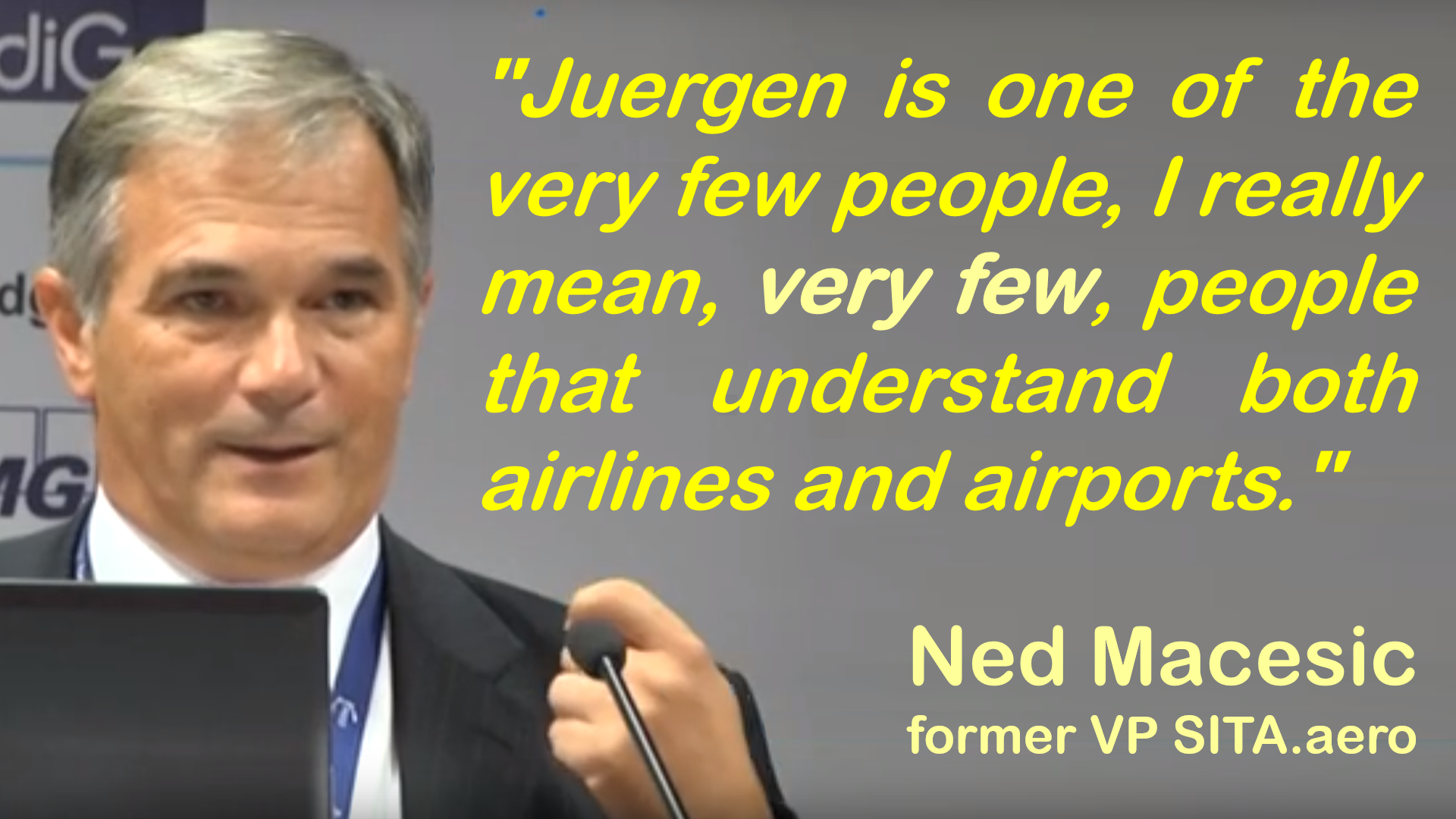

[Ned Macesic, former VP SITA.aero]

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads-1200x675.jpg)

While we work here on a business plan for a new airline, we did discuss and disqualified many of the existing airline models. Is that negative? Or realistic?

These days some news hit me in short succession, that make me rethink the assessment my friend Ndrec and I made when discussing possible, viable business models for a new airline.

I did the picture above a mere year ago. Meanwhile Niki is gone too, as is Virgin America. Mighty Norwegian being said to be likely acquired by IAG shortly. We have “new” players like Blue Air. But the question for any new business case must be:

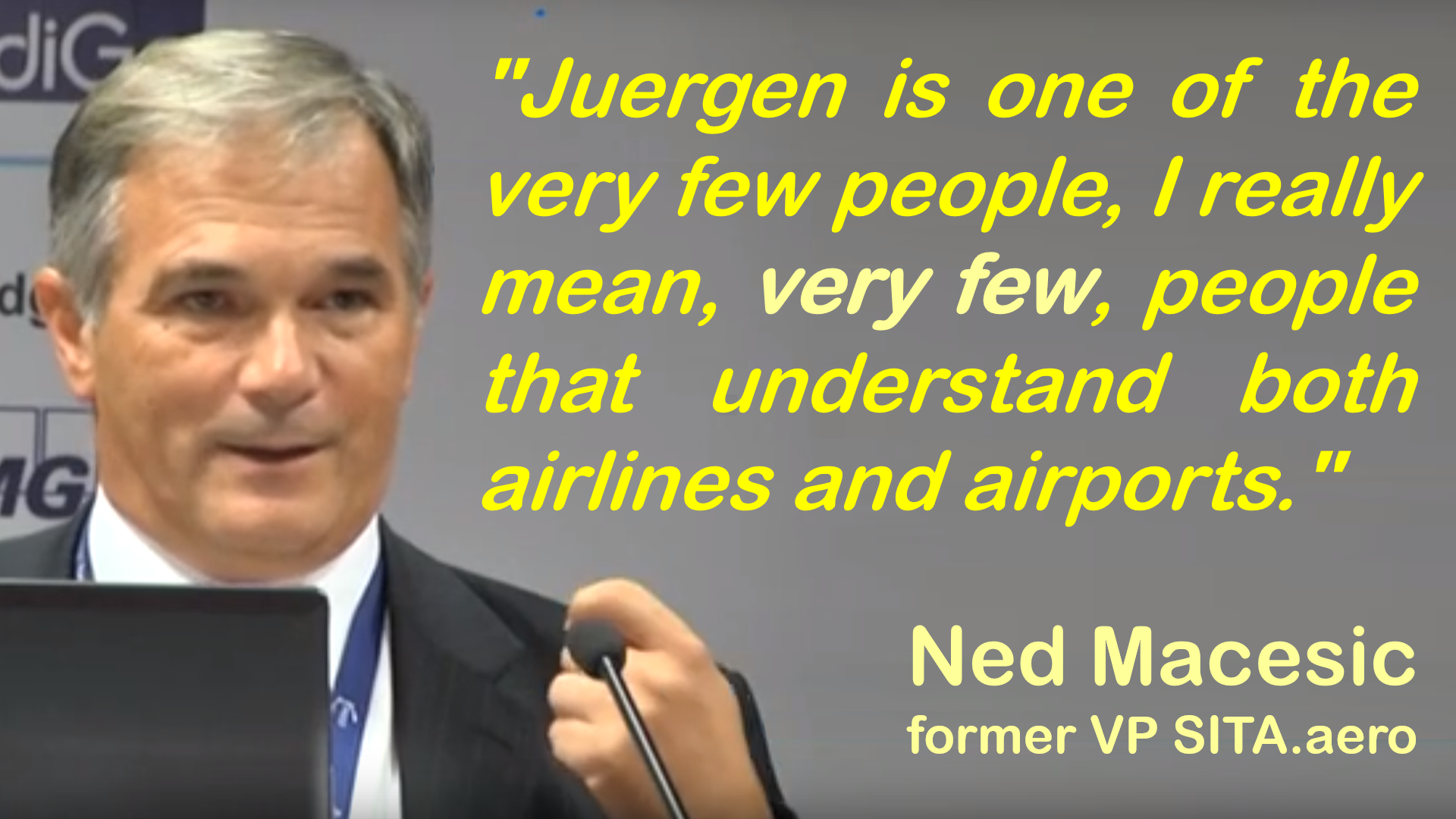

What is Your (E-)USP?

Now Ray Webster, former CEO of easyJet opened the Routes Europe Conference with a keynote:

“I don’t see long-haul low-cost as a viable model. Operating a small aircraft across the Atlantic is not efficient, and low-cost carriers aren’t going to fill a 787 or an A380”

Ray Webster, former CEO easyJet

Even students traveling on longer flights do want more services the longer the flight gets.

In contradiction to that assessment, Eurowings now opens up New York-services, taken over from the late Air Berlin operating from Düsseldorf. We all looked at Norwegian, though their “success story” also seemingly was bought on the cost of revenue, the airline now is said to be acquired rather shortly by British Airways/Iberia holding IAG (also owning Aer Lingus).

Whereas I simply do not understand the “brand strategy” of either Lufthansa or IAG…

The work on a business plan for a new airline was triggered last year initially by some investors, going down the same “me-too”-dead end using old, inefficient Boeing 737-aircraft. Cheap to get, but their fuel consumptions renders them virtually useless.

BlueSwanDaily believes in the future of Supersonic… Are you kidding me? Yes, I believe supersonic will come, but expensive niche for the rich and wealthy. No real change to the Concorde business model.

BlueSwanDaily believes in the future of Supersonic… Are you kidding me? Yes, I believe supersonic will come, but expensive niche for the rich and wealthy. No real change to the Concorde business model.

I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean Wingship seems a ready-to-go WIG, though using conventional fuel, no green hydrogen or battery powered e-engines]

I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean Wingship seems a ready-to-go WIG, though using conventional fuel, no green hydrogen or battery powered e-engines]

So we looked at models that differ from the existing ones. Where are unservered or underserved markets and why are they not served well? One issue sure is the airline analysis tools misleading their users to “established routes” and airports.

So we started with the original intent of a small scale operation. And recognized why so many such projects are doomed. There is a pilot shortage hovering on the horizon, Ryanair running pilot acquisition as far as South America and Asia. Most airlines do not value their workers but drain them.

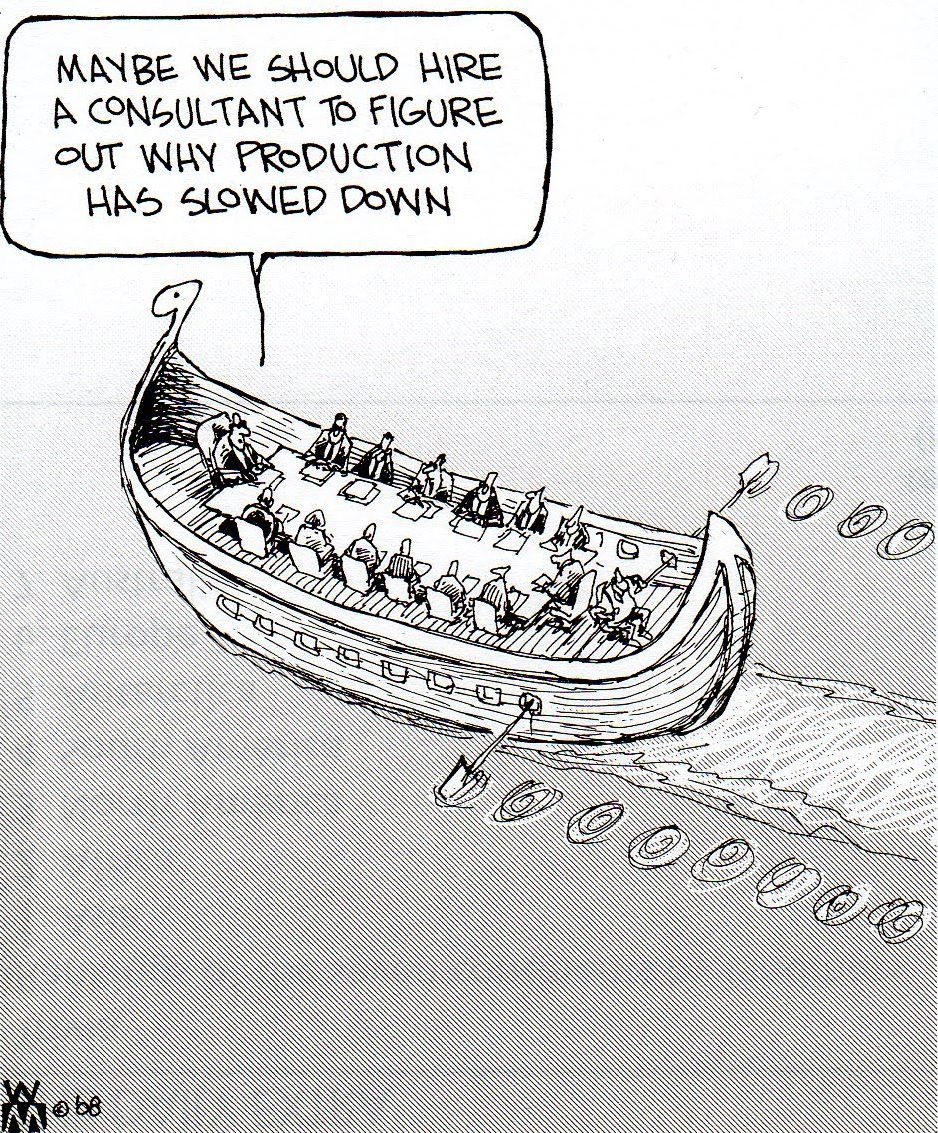

And having discussed the very same issue again yesterday with friends who must relocate in the automotive industry as a direct consequence of overpaid managers, back again, using old images:

Maybe. Just maybe. I believe Ndrec and I came up with a sound business idea, which requires far higher investment than we originally envisioned. Coming with a round and sound business plan paying off that major investment in 10 years safe. Because we do have a unique selling proposition (USP). Because we do have an emotional USP. Because we thought it through and instead of failing at the first obstacle, we save cost from day one and make this a company to work for?

And working on that, we learned a big deal about the faults of the airlines we see in the market. And it boils down to the normal questions: What’s your (emotional) USP? What makes you different, why should the intended consumer decide to use your product. We see too much “me too” in the market. Buy your market share in the B737/A320 shark pond?

30+ years ago, my training officer told me that joke:

A man starts a business selling screws.

His friends questions him: “You buy

the screws for 1 €, you sell them for 95c?

How do you want to make money?”

“Oh, the quantity does it!”

My training officer told me to look after yours. Not only in the company, also your supply chain. Make sure you have long-term suppliers selling you the quality you need for a good reputation.

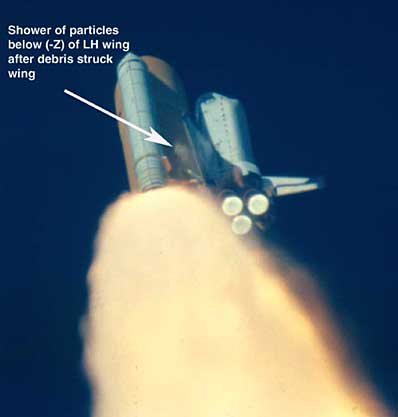

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

I’ve paid very high (in hard Euro) for another lesson. Starting with a sound idea (regional airlines’ franchise concept to share cost and operate a larger scale of operations), it turned out later that the stakeholders did not look for a franchise, but a means to start their own small operation and “share” the cost with the other small players. Clearly understanding the small operations to face obstacles they cannot overcome on their own. Could not. Cannot. Will not. A costly mistake I made. But lesson learned!

Then at delair I learned about airline disruptions and how our industry uses historic processes to “manage” somehow. How airlines use manpower instead of intelligence to cope i.e. with a winter storm.

With Ndrec, I found a seasoned manager understanding the need to either do it right – or don’t do it. And we got surprised how much money we save if we do it right! Not short term, there we need more to invest. But then very shortly, within less than 10 years. Now we reached the point of the reality check: Will we find solvent institutional investors helping us to pull this off? Cross your fingers.

For all those other airlines out there… Do your homework. First and foremost: What’s your USP? What’s the business case?

Food for Thought

Comments welcome

Michael Strauss of Pass Consulting, developer of an “aggregator” system for travel distribution systems addressed his thoughts on why the NDC (IATA for “New” Distribution Capability) is already “old” (it’s XML, not contemporary JSON for one) and why we still need the GDS.

Michael Strauss of Pass Consulting, developer of an “aggregator” system for travel distribution systems addressed his thoughts on why the NDC (IATA for “New” Distribution Capability) is already “old” (it’s XML, not contemporary JSON for one) and why we still need the GDS.

I find all those developments Michael addresses to be “baby steps”. And is it 18 months already again since I questioned the very same thing? Quo Vadis OBE?

Carefully tiptoeing around, while I still wait for the first airlines to make the bold step, leave the tangle box, cut the spider webs, dust off the past and make bold moves embracing the possibilities “digital” offers us. The likes of a C.R. and R.B. Smith back when they gave birth to what eventually became CRS,, GDS, PSS. Or Louis Arnitz (and myself) making Internet-Amadeus-booking reality, when all the GDSs told us, this is impossible and tried to protect the holistic, old way. Good, GetThere launched about the same time, but when we started, all it’s infancy could was to take a Sabre-entry and return the GDS-output. But yes, that gave us the idea.

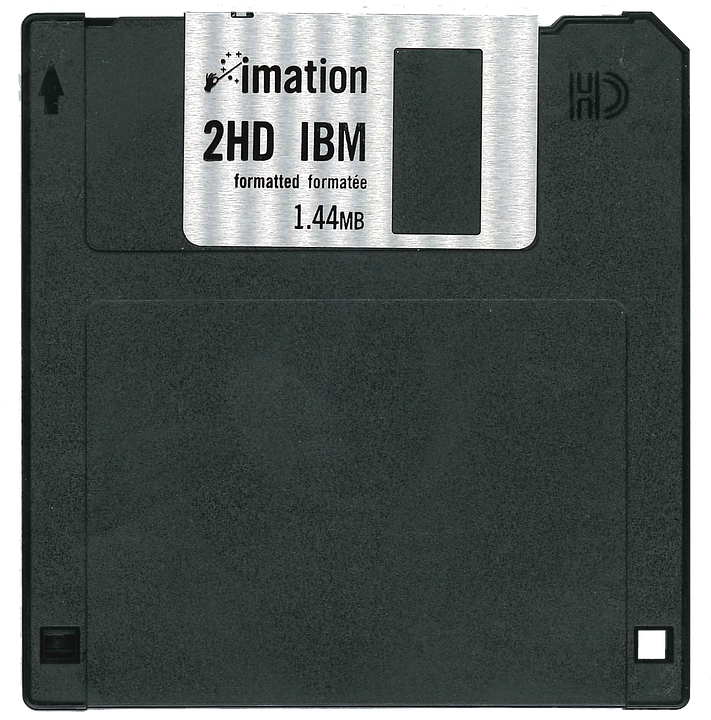

Now we are “surprised” that Cytric bypasses the GDS-side of Amadeus, linking directly to Altea (Lufthansa direct link). I just happen to wonder if Louis Arnitz also fondly remembers that “white paper” he wrote about “Mozart” (what later became Cytric). Few people remember the evolution from “Woodside Travel Trust” (today Radius) “Hotel Disk” (3.5″ ‘floppy’) to eHotel or that eHotel has been a spin-off of what became Cytric… It just tells me, how the GDSs keep the thumb on the thinking of our self-proclaimed experts. A battle they can’t win if they don’t embrace (carefully) those changes you so nicely summarize. Working on an airline’s business plan, I just emphasized that I see the future of travel distribution with Facebook, LinkedIn, Google, Amazon. Individual like a book. Common as a book.

20 years ago (!) my friend Richard Eastman emphasized disintermediation at ITB Travel Technology congress. And that it is about packaging what the traveler wants.

20 years ago (!) my friend Richard Eastman emphasized disintermediation at ITB Travel Technology congress. And that it is about packaging what the traveler wants.

Voice recognition like “Alexa, book our vacation”. GDSs? Aggregators? Airline seat? Car Rental? Hotel transfer? Restaurant? Or …

Things I would have overseen…

Richard emphasized, the consumer does not want to bother about all those detail. They want an offer. And consume. GDS? Aggreggators? NDC? …?

Hey Richard, that was 20 years ago we discussed and envisioned those things. Ain’t it faszinating, how our industry keeps stalling…?

Food for Thought!

Comments welcome…

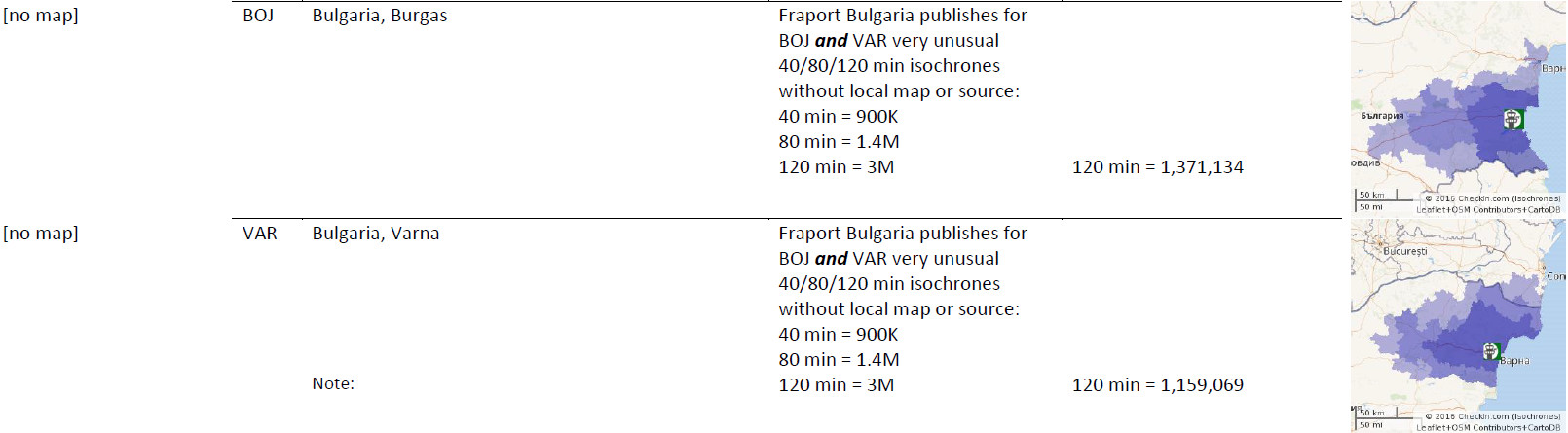

Working in aviation marketing on CheckIn.com and recently on research related to airline route development, it makes me mad to see how

airports mismanage their data

For more than 10 % of the airports, using two main sources for data (airport, Wikipedia) and cross checking with the industry source, the ANNA.aero “databases” (Excel files, not “data sources) the data does not compute! So we spend an awful amount of time not just collecting that data, mostly from complicated pages that we have to manually scan, but the data we get, proves then to be “approximate” on core numbers like “passengers” handled by the airports. As reported before, ANNA.aero disqualified for us for anything but a cross-check, once we learned that even within their Excel files, the sum of the months does not necessarily compute to the given annual total… The same we found true on the “usual suspect” sources.

Asking the airports for their last passenger numbers, many cannot give them on a monthly basis, many give us numbers that are obviously wrong but most don’t even bother to answer. Where we get numbers, often they are a table in a Word document or an e-Mail, often in a PDF where if you try to copy that very table to a spreadsheet, it comes out as unformatted text, causing more work. Not to talk about image-files, where you must extract them, writing them off that image… With more than 600 airports we happen to have on file at CheckIn.com, that is no fun, that is frustrating.

Know your numbers? Not an issue at airports. Digital? Naaw, why bother?

The last months, we approached airports under route planning constraints, asking them for a given aircraft type and load (giving also MTOW and seats) for the cost for the landing and handling at their airport. As we did not find their Standard Ground Handling Agreement and fees online. Maybe we missed to find it, but excuse me, is that our problem? Where we found them, they are often outdated (more than three years old), headlining the year of validity, so factual outdated.

Out of 63, only a good dozen replied within three weeks. Out of those replies, only five responses where useful. Five. The others responded sending us their files, often only landing or handling, frequently not both. Only some of those warned us, referring us to the ground handling companies.

Excuse me? We ask an average cost. Even your ground handlers have an average handling cost. You don’t know? So what do you sell me?

That route planning friend I referred to in my December post (promoted Jan 1st) just told me this week, he doesn’t have faith in airport marketing. Only very few would do their job right and focus on facts. Most would focus on fiction. And he reminded me of my December post and Erfurt.

Honestly, I have no idea. I had faith in my fellow marketing colleagues at airports. But most what I get is “dreamlands”. Digging into the numbers, you find black holes the size of a galaxy. You find logical mistakes. What you don’t find is the numbers you need as an airline. Guesswork. Ideas. Biased ideas at that. Brings me back to my friend. He confirmed, even with their established, substantial size, they had the same problem with airport fees, keep having them with about any new airport they consider flying to. That’s why one day they have to send someone there and inquire on-site. Bug them until the numbers are on the table. And usually he says: “Usually, that takes too much time”.

Are we living in a digital world? We may. Airports still mostly does not.

My friend told me: This is why Routes is such a success. Because you still need to talk to the airports to get what you need. No, they do not provide that on their website. No, they do not understand how to provide data (spread sheet, not Word, PDF or a fancy “image”). Not ANNA.aero, Route Shop or Routes Exchange, where he confirmed to me, he does not find any facts but fancy “marketing” without foundation. Our comparison we did for him of our catchment area findings compared to those sources he said proved most valuable to him – internally and externally. If they don’t even use a free service like ours to compare and qualify their guesstimates, if they cannot respond to the offset, how to trust any figures they provide you?

He calls TheRouteShop and Routes Online the “big show-off stages” (on- and offline). He says, his and his team’s main function is to look behind that show-off, to find out where it’s trustworthy facts and where an empty hull. Assess the risk. “Their job should be to provide us the facts to make sound decisions. All they do is adding smoke screens and to boast.”

Food for Thought…

Comments welcome!

Sure, now that North America again suffers from extreme winter, experts arguing if it’s another “Polar Vortex”, there is some background on Business Insider. Fact is, it hit North America hard again, causing major flight disruptions, not only in the North, but also “down South”. Suddenly I experience a surge of interest in “Deicing Management”.

The major issue I am asked is how to keep the airport operational, whereas that is the wrong approach. You can’t fight Mother Nature, not even Mr. President can, no matter how god-like he believes to be. You can manage the repercussions. You can minimize the impact, optimize the handling to recover quickly from an airport closure.

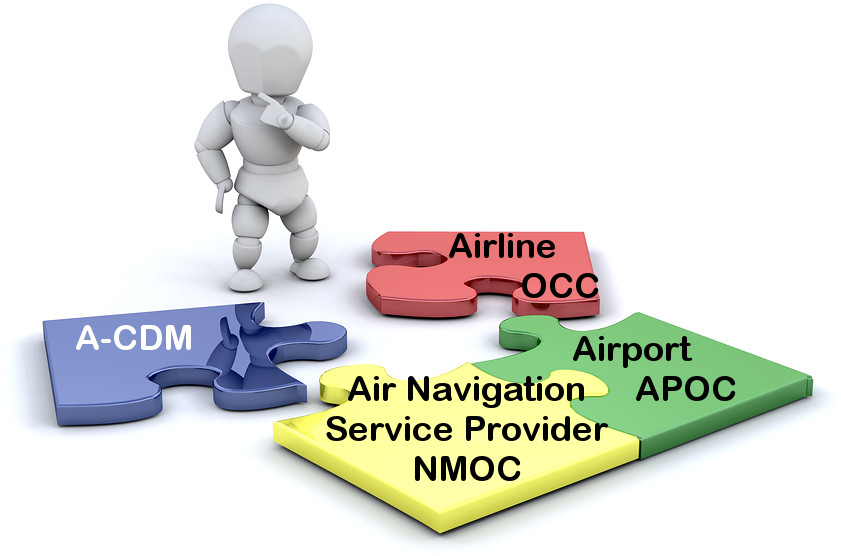

This must be more seen on a collaborative approach and I just thought to come back to the typical questions once again, as they reappear these days. If you’re interested, there are quite some posts on this blog addressing disruption management or A-CDM.

No, there is no “quick panacea” for this. Any deicing manager should be able to tell you that you cannot change a running winter operation, you implement the changes outside the season, train your staff and improve the processes. Listen to them!

A common question is: “Which software tool?”

Clear as can be, there is no “software panacea” either. In North America, the closest thing in my experience is Saab-Sensis Aerobahn. In most cases of who’s asking, it simply is overkill. First step is to start to collaborate. Deicing is not an issue of the ground handler, or the airline, or the airport, but the ground handler, the airline and the airport. All together. If you don’t collaborate, the tools don’t help you. If your processes are “stand alone” and not integrated into a master process “turn around”, using a software does not help you. There are tools that work that can help you improve your processes, but most my inquiries end here. For some reason, airport (and airline) managers seem to believe (almost a religious faith) that they need software to solve their problems. It is hard to explain that they need to “think”, that it might be more reasonable to invest into a consulting, sitting together, looking at the processes, talking to the stakeholders and in a proper process start the transformation to collaborative decision making, starting potentially with deicing.

Clear as can be, there is no “software panacea” either. In North America, the closest thing in my experience is Saab-Sensis Aerobahn. In most cases of who’s asking, it simply is overkill. First step is to start to collaborate. Deicing is not an issue of the ground handler, or the airline, or the airport, but the ground handler, the airline and the airport. All together. If you don’t collaborate, the tools don’t help you. If your processes are “stand alone” and not integrated into a master process “turn around”, using a software does not help you. There are tools that work that can help you improve your processes, but most my inquiries end here. For some reason, airport (and airline) managers seem to believe (almost a religious faith) that they need software to solve their problems. It is hard to explain that they need to “think”, that it might be more reasonable to invest into a consulting, sitting together, looking at the processes, talking to the stakeholders and in a proper process start the transformation to collaborative decision making, starting potentially with deicing.

Another common question: “But this only works on large airports?”

Yes and no. The large airports are usually more bureaucratic, have developed “structures”, or more accurately “silo structures”. Where on small airports there is a natural collaboration as people have multiple functions and small hierarchies, the large airports have departments that tend to separate themselves from the larger good. Exaggerating, each department is the only valuable, the only one understanding, the hub of the(ir limited) universe. The other departments only interfere and make things difficult. That silo thinking is more common the larger the company. But also small airports have the possibility to establish a collaborative approach. They might not even need software to do that…? Software can overcome the workers reluctance to share information by doing it for them. And speeding up data exchange instead of waiting that someone shares an information. As we discussed in the LinkedIn group CDM@airport many times, A-CDM is not about technology, but about collaboration. That is people first. The technology is a tool.

Aircraft Rotations, Winter Operations and Forecasting

In the discussions, I keep emphasizing to look beyond the individual airport and think about the airlines involved. Their flights get delayed or worse, they get stuck. Bad enough at the airport, the aircraft is expected to fly to more than one city. In 2014, JetBlue had to cancel all flights for a day to “reset” the network, bring aircraft and crews where they were supposed to be (and give the crews the legally required rest). Thousands of travelers were stranded during the 2014 Polar Vortex disruptions. The same year, I discussed with Zürich about the possibility to proactively inform the airlines about the delay forecast, enabling them to cancel a flight to Zürich to avoid it getting stuck there. It lead to the hen-egg issue, if then enough airlines cancel their flights, there would be no delay…? An idea was a penalty/bonus-system, giving an airline that helps avoiding a delay situation today a priority on their departure tomorrow. The idea was disqualified implying the airlines’ inability to understand and agree on the concept…

Just some more

Food for Thought

Comments welcome

The last months we worked with two regional airport operators on a route viability analysis both airports see as a exceptionally promising: Saarbrücken (SCN) to Reggio Calabria (REG).

Their problem is that it is rather difficult to get the hard-facts on it. Based on our work with CheckIn.com Airportinfo, they thought we might be the right people to look into this.

At first, talking to airline network planners, I was referred to the analysis tool providers. Though interesting, I got the “results” from four of those tools, three “disqualifying” the route, the third one (more correctly) failing with the information of insufficient data. The problem is, that the route in question has never been served before. There are some “comparable” routes, we found the two tools returning results used, from airports in the vicinity of Saarbrücken to Catania (CTA) on Sicily or to Lamezia Terme (SUF) in Calabria.

Then we were referred to the ACI “standard” QSI (Quality Service Indicator), specifying how a route potential is being calculated. There is a very nice introduction to QSI on the website of the North American chapter of ACI Airports Council International. But if you read that introduction, you are going to get very quickly to “factors” and “coefficients”. And that they are variables, subject to interpretation and weighting, they are “relative values”. And while I found my usually very open sources at IATA, OAG and FlightGlobal distinctly tight-lipped, when I called and asked about QSI, they quickly confirmed that their tool follows those principles and how much and why their tool is better than their competitors.

One airline network planning director clearly told me those tools they use, but they are useful only on existing (or to some extend historically existing) routes. As he had provided me his initial impression on that route, I questioned his initial response and he confirmed that they use those tools with an “almost religious” faith. So if they look into a new route, knowing their tools to have a bias towards existing routes, if their tool returns “not viable”, it builds a major obstacle to get them to look into such route.

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in The Numbers Game, we once more were confronted with conflicting data. Public data on Eurostat shows different numbers for outgoing HHN-SUF compared to incoming SUF-HHN. All numbers “close by”, but in most cases, the numbers did not correspond to the other sources! So what “quality” do we talk, if we in a single industry cannot agree to a fixed value?

So we also had a look ourselves into the “route data”, getting statistical data from those other routes from Eurostat (avia_par), the airports, two of the tool providers, as well as three airlines. As discussed in The Numbers Game, we once more were confronted with conflicting data. Public data on Eurostat shows different numbers for outgoing HHN-SUF compared to incoming SUF-HHN. All numbers “close by”, but in most cases, the numbers did not correspond to the other sources! So what “quality” do we talk, if we in a single industry cannot agree to a fixed value?

Okay, so we decided we take the average of the different values we received. Then we compared to the various catchment areas from our CheckIn.com Airportinfo analyses, both the pure isochrone-populations as well as our competitive analysis. Where we found once more that the drive-time zones themselves resulted in major offsets, rendering any attempt to interpret the results as useless. On the competitive reach, we found some “trends”, though it showed clearly that the more routes an airport has, the more choice such is given to the traveler, the lower the average choice of a traveler for a specific route. But even with those constraints, looking at the catchment area confirmed potential interest in the route.

More interesting, I found that aside of Eurowings with about 75-80% load factor on their flights, all other airlines operated with load factors of around 80-85% and up to 90% on an annual basis. Such, it seems that overall, there is very high demand for travel between the regions. But the tools disqualify flights. Hmm.

Working on a viability study, other approaches are to look at the regional demand. Where we got confirmed, what we knew before. There are no reasonable statistics on a regional level. Yes, you get all the statistics on a small scale from Saarbrücken to Italy. Or from Reggio Calabria to Germany. Okay on Luxemburg. But is Italy Northern Italy with higher purchasing power, commerce and industry? Or Calabria? Is Germany Munich, Berlin, Hamburg, Düsseldorf, Stuttgart, Frankfurt – or Saarland or Saarbrücken? You. Got. To. Be. Kidding. Me.

So yes, we can see how much of the industry is where (percentages), how many “Italians” live in the Saarbrücken region, but without there local research (they have done), we could not know that their “Italians” are mostly from not just Calabria (state) but Reggio Calabria (city)… Whereas we talk about many “2nd generation”, having German passports, not showing up in those “statistics”.

So yes, we did the numbers crunching, but those numbers are to be taking with a big grain of salt. Discussing this with my friend, that afore-mentioned airline network planning director, I could “see” his smile. “You check some basics, to get a feeling and have some numbers to confront the Powers-That-Be (PTBs) in those regions with. Then you travel there and confront them and learn that all you learned is useless and why. Then you talk to the PTBs and learn if and why they believe it makes sense, you question them from your experience and then you decide if it makes sense to take the risk and fly – or not.” And he referred to my 2012 post on the Crystal Ball and told me that he liked my conclusion in it: “I take a big long stick and grope in the dark. It requires expertise, experience and good guesswork to do something with all that information you get. Good luck is part of the business.”

Hmmm… It confirms what I recently told the Minister President of Thuringia, discussing on Facebook about population emigration they suffer. Emphasizing the need to better support the airport to attract incoming business and the necessity for scheduled flights, I told him, it is not the airport acquiring airlines, it is the region. As soon as an airline network planner researches Erfurt and finds all the negative buzz about that small airport there, if they hear the PTBs having promoted bus service from Frankfurt when they had a flight connecting them to Munich, when they learn that the state officials and commercial (state-paid) delegations traveled from Berlin or Frankfurt instead, they understand that the people in the region do not support flight services. They’ll look at the story behind the closure of Altenburg. Then they likely look for locations where the PTBs support flights. Politicians, local industry, tour operators, the people and the media. Discounts on landing fees are a minor factor on the cost and risk of an airline operation. (Except for Ryanair?). They are an indicator, if the region is willing to support the flights.

I am afraid, that Minister President did not understand that, he instantly fell back into the “airport bashing”, questioning, why in the past the airport’s subsidized flight services did not succeed. No, he did not heed my words. In fact, he was prejudiced and simply did not listen but took his “instinctive” fall-back position on “airport”.

Working with small regional airports over the past years, I know many airports heeding such words, their PTBs in strong and unquestioning support of “their” (regional) airport. Who publicly want their airport and want it to succeed. Who fight for it and take a stand in discussions for their airport. And yes, Connect or Routes Europe are places where you can meet and talk to them. Though there I also heard just recently (again) that many airlines are showing interest in the big airports only and the small have trouble getting a time slot to make their case. Where Connect° had the advantage on the small airports.

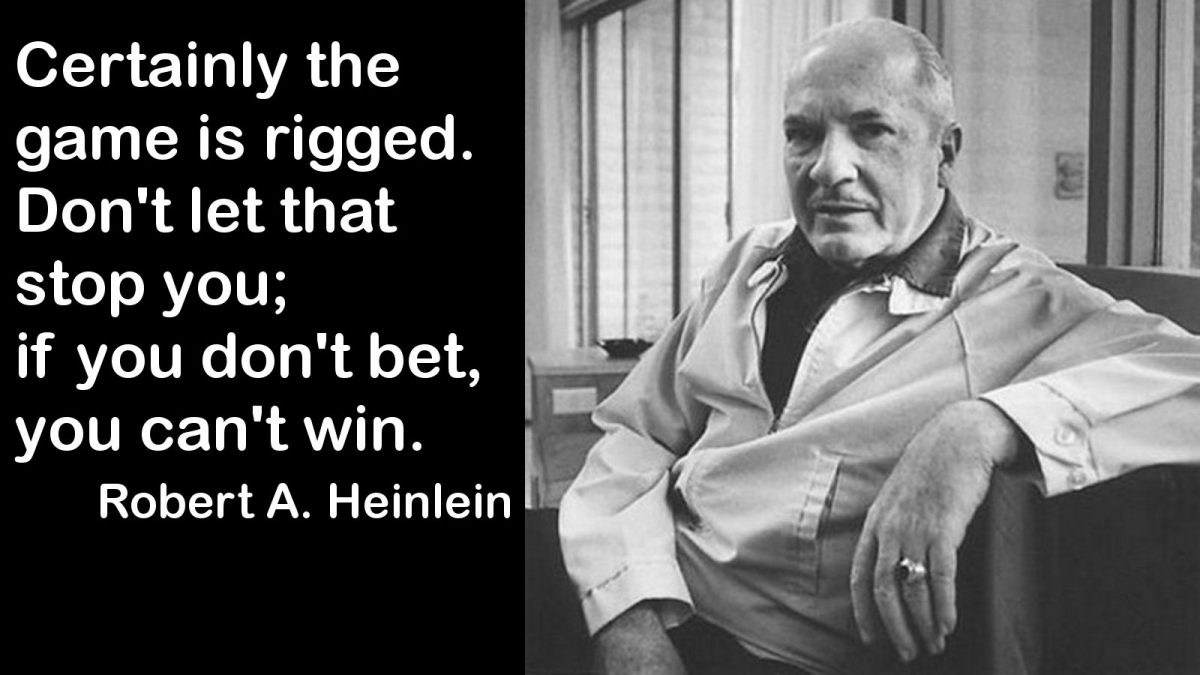

Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.”

Coming back to the issue of this post. My airline friend and I discussed for several hours (thank you!). And rather at the end, he emphasized, why he invests only little time in “analyses”. Because all those analyses will promote the big buddies. They will confirm business potential on the large airports with data silos full of supporting statistics. But they will disqualify any of the small airports solely based on the fact that there are no “supportive statistics”. Following our discussion, he wrote me a very short message: “Jürgen, the game is rigged. Your catchment area stuff is the first thing I saw to give me a somewhat unbiased view on smaller airports in years. Those [other] analysis tools are sold to sell us statistics. Stupid network planners and the ones trying to play it safe and by the books, requesting the QSI. It’s why mostly the small airlines, who can’t afford those tools start new routes.” And why he emphasized to me that he and anyone in his team wouldn’t bother about any route viability studies based on the statistical history of the airport, except for an indicator. “If you play it safe, you just follow the crowd.”

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads-1200x675.jpg)

In the past weeks, we got shocking news. Where the insolvency of Air Berlin was more or less expected, the grounding of some 20 thousand flights impacting more than 700 thousand passengers by Ryanair – attributed to a “pilot shortage” – as well as the recent demise of Monarch Airlines came more of a surprise.

Air Berlin sure was no surprise. In fact, when Lufthansa senior manager Thomas Winkelmann in February joined Air Berlin, everyone in the industry knew that he wasn’t taking such post leaving Lufthansa Group, but to prepare for a takeover by Lufthansa. At the same time (February) Etihad “extended” their cooperation, Etihad, being main investor at Air Berlin’s arch enemy Lufthansa? Then they wet-leased 28 aircraft (all A319 and many of their A320s) to Lufthansa’s low cost subsidiary Eurowings, five more to Lufthansa subsidiary Austrian Airlines…? All 321s to be given to Niki, former Air Berlin subsidiary, in December 2016 Air Berlin sold all stakes in Niki to Etihad. Niki now being rumored to be sold to Austrian Airlines…?

To be surprised like Ryanair’s Michael O’Leary, now calling “fire” such is hypocritical. What I do find questionable is the handling of long-haul flights, Lufthansa has (never had in my opinion) the intention to take over Air Berlin, they just positioned themselves for a prime spot, preparing the inevitable insolvency to secure the prime pieces for themselves. Yes Michael O’Leary is right, but a surprise? Calling now for “law and order”, him who bends the rules every time he can?

Air Berlin made many mistakes, trying to evolve from a specialist in tourism flights with a strong USP with their hubs in Nuremberg and Palma de Mallorca to become … something? A low cost airline? A scheduled airline? Operating a mixed fleet of A320- and B737-family aircraft, but also small Bombardier Dash-8 Q400 (50 seat turboprop). Trying to operate low cost, but also doing feeder flights for Etihad? And long-haul flights using five A330 aircraft? As a German saying goes: “Alles, aber nichts richtig”: Everything, but nothing right.

What I see mostly critical is the intentional “mismanagement” of the A330, also the Dash-8’s seem more like a neglected annoyance, not an asset. And a management considering a success to save 80% of more than eight thousand jobs. So 1.600 will loose their jobs. Well done Mr. Winkelmann, I’m sure you will get a bonus and a job promotion for that (blistering sarcasm).

What I find fascinating indeed is the interest of Lufthansa and easyJet in the A320 aircraft. But that I’ll come to below.

Ryanair

RyanairSo now how about Ryanair? Ryanair used an “outsourcing” model, where Ryanair did not employ pilots directly, but through some questionable constructions (typically Ryanair that) they made the pilots operate as self-employed, only paying them for flight hours. No social security, sick-leave, guaranteed vacation. Several countries (including Germany) started legal investigations in that model.

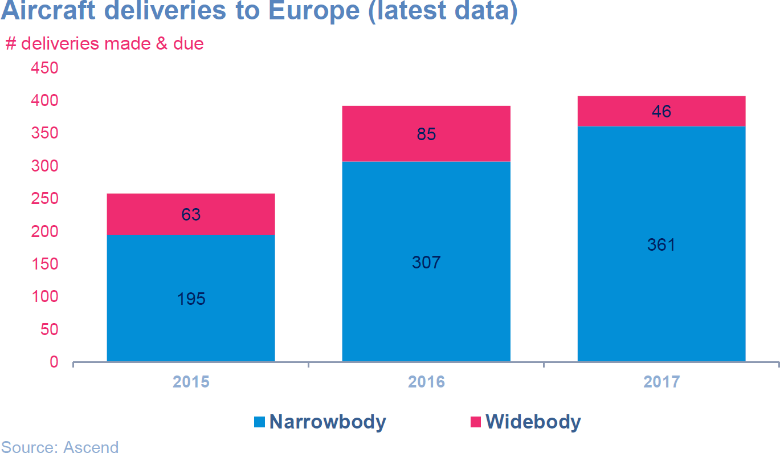

I have questioned that approach ever since I first heard of it, as everyone in the aviation industry knew that we face a shortage of pilots. Given availability and demand, with the large number of aircraft orders, easyJet and Ryanair both are known to seek to sell aircraft from their enormous back-log of orders they placed with Airbus and Boeing. At Paris Air Show this year, I discussed with experts, confirming that this already backfires on both Airbus and Boeing, as they have to lower their own prices as those airlines handover the substantial discounts the gave the low cost airlines for their humongous orders.

I have questioned that approach ever since I first heard of it, as everyone in the aviation industry knew that we face a shortage of pilots. Given availability and demand, with the large number of aircraft orders, easyJet and Ryanair both are known to seek to sell aircraft from their enormous back-log of orders they placed with Airbus and Boeing. At Paris Air Show this year, I discussed with experts, confirming that this already backfires on both Airbus and Boeing, as they have to lower their own prices as those airlines handover the substantial discounts the gave the low cost airlines for their humongous orders.

Canadian CAE released a study at Paris Air Show claiming “50% of the pilots who will fly the world’s commercial aircraft in 10 years have not yet started to train”.

So aside a saturation of the European market with A320 and Boeing 737, we are short on pilots. Now Ryanair “pilot management” increasingly questioned, it is no wonder that pilots are open to “competitive offers”. It’s about how you treat your staff. Now Ryanair pilots not really employed by Ryanair, what keeps them from taking up better offers? Then Ryanair decided to change the fiscal (and vacation) year to the calendar year and did not take into account that this will result in a shift in vacation demand in the process? Obviously the managers did armchair decisions, not thinking them through.

To my believe, this situation is a mix of Ryanair bending the rules, offering tickets at prices below any reasonable levels. Confirming my concerns about “hidden income” Ryanair applies. It would be interesting to have a look into Ryanair calculations as how they can offer flights with average fares below the common cost of Kerosene. Not even talking about the aircraft, staff, administration and maintenance. Though yes, I know markets where they also charge more reasonable “average fares”, seems they not everywhere find ways to milk the regions for subsidies of questionable legality.

Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

Update: Financial Times reported 750 thousand future bookings having been cancelled, other media says more than 800 thousand future passengers, of which more than 100 thousand are stranded and only a minority covered by tour operators’ insurance for packaged travel…

I have worked on projects with investors buying into Boeing 737. Instantly I questioned the business case for that aircraft. On the one side I hear from airline network planners how increasingly difficult it is to find viable routes for their aircraft. 189 seats usually. On the other side, being bound to those aircraft families to keep the complexity = cost in check, they now add even bigger aircraft with 220-240 seats to their fleet. How that should “improve” the situation is simply beyond me. All that can do is to cannibalize other routes, fly less often.

Now there is a pilot shortage, airlines operating those aircraft are fighting to utilize the aircraft with a sustainable revenue. Insolvencies like Monarch Airlines with 35 aircraft and their flight and cabin crews will likely result in a short relieve for the likes of Ryanair. But given the new aircraft deliveries, that is a drop on a hot stone.

I believe, the market is oversaturated. When “Low Cost” started, the A320 and B737 offered the best cost per seat and loads to compete with existing airlines on the “common” routes. For regional aviation, that aircraft was and is too big. Nowadays we see a consolidation of airlines operating that aircraft, be it Alitalia, Air Berlin, Monarch but even Ryanair, though for different reasons.

Another issue is a feedback I got from a financial expert. There are financial funds for aircraft. All those funds currently suffer as soon as the initial leasing is over from eroding revenue, often resulting in substantial financial losses even before the end of the first 10 years. Thanks to the eroding prices of A320 and B737 aircraft, thanks to the low cost airlines passing on the substantial discounts they received from the aircraft makers on their mass-deals, result in a faster drop of value than anyone anticipated. As FlightGlobal reported already back in 2014 in their special report Finance & Leasing, Norwegian established their own leasing subsidiary to try to sell or lease their surplus orders. And they’ve not been the only one, easyJet and Ryanair do the same, trying to get rid of the liability those aircraft became.

Another issue is a feedback I got from a financial expert. There are financial funds for aircraft. All those funds currently suffer as soon as the initial leasing is over from eroding revenue, often resulting in substantial financial losses even before the end of the first 10 years. Thanks to the eroding prices of A320 and B737 aircraft, thanks to the low cost airlines passing on the substantial discounts they received from the aircraft makers on their mass-deals, result in a faster drop of value than anyone anticipated. As FlightGlobal reported already back in 2014 in their special report Finance & Leasing, Norwegian established their own leasing subsidiary to try to sell or lease their surplus orders. And they’ve not been the only one, easyJet and Ryanair do the same, trying to get rid of the liability those aircraft became.

While that gives airlines access to competitive (low) priced aircraft, it ruins both the aircraft makers own price policy, as well as it cannibalizes the business model of the institutional aircraft lessors.

With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut?

With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut?

And yes, we just work on a business plan for such a “new model” making use of new ideas, unique selling propositions for investors, travelers and airports. No magic involved, just some creativity and willingness to think different.

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads-1200x675.jpg)

As many of the readers of this blog know, I am somewhat personally attached to that little airport in Central Germany, Erfurt-Weimar.

As many of the readers of this blog know, I am somewhat personally attached to that little airport in Central Germany, Erfurt-Weimar.

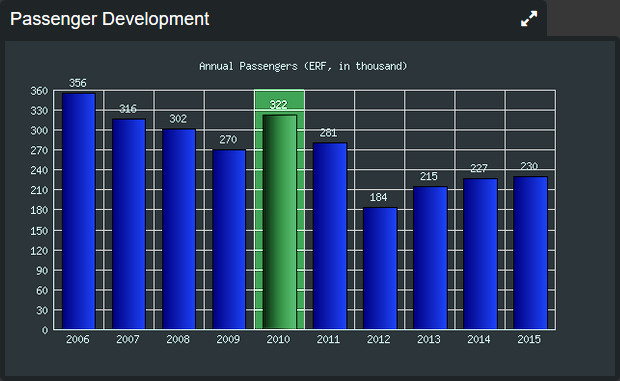

Last week I was taken into a discussion by Thuringia’s Minister President Bodo Ramelow, about how to stop the down-spiral of emigrating Thuringians. Which reminded me about the likewise discussion we had in 2009 shortly before I joined Erfurt Airport with the task to stop their downward-spiral on their passengers.

What I was faced with was an extremely negative image of the airport within the region. And a lot of demands on how to do business from amateurs in the industry, politicians, tourist offices, etc.

First day at work, the GM of Tourism Thuringia, Bärbel Grönegres was quoted in the local newspaper (TA, 02Mar09), having visited the United Arab Emirates to promote medical tourism to Thuringia. Having a Munich-Erfurt flight by Lufthansa-Partner Cirrus Airlines at the time, she recommended the Arabs to take a flight to Frankfurt, to be picked up with a bus for a +3 hour tour to Thuringia. Tourism material did not contain reference to the airport. Questioned about the reason, her reply was “Who knows, how much longer we will have that flight”. Ever since, that became a prime example I use for “negative thinking” or “calling for disaster”.

First day at work, the GM of Tourism Thuringia, Bärbel Grönegres was quoted in the local newspaper (TA, 02Mar09), having visited the United Arab Emirates to promote medical tourism to Thuringia. Having a Munich-Erfurt flight by Lufthansa-Partner Cirrus Airlines at the time, she recommended the Arabs to take a flight to Frankfurt, to be picked up with a bus for a +3 hour tour to Thuringia. Tourism material did not contain reference to the airport. Questioned about the reason, her reply was “Who knows, how much longer we will have that flight”. Ever since, that became a prime example I use for “negative thinking” or “calling for disaster”.

The next winter, the Thuringian Olympic athletes brought home a record number of medals. But at the following ITB, it was more important to promote Franz Liszt, who lived a dozen years in Weimar. The fact that the Russian-Orthodox chapel, Grand Dutchess Maria Pavlovna who’s invitation brought him to Weimar has built and got buried in is under direct protectorate of the Russion Orthodox “pope”, the Patriarch, such making it a pilgrimage site for the Russian Orthodox church has completely failed to trigger any support by Weimar or Thuringia Tourism. Air Berlin reported it to be a “known reason” for a substantial part of their Russian Berlin-passengers to add Weimar to their travel plans.

The next winter, the Thuringian Olympic athletes brought home a record number of medals. But at the following ITB, it was more important to promote Franz Liszt, who lived a dozen years in Weimar. The fact that the Russian-Orthodox chapel, Grand Dutchess Maria Pavlovna who’s invitation brought him to Weimar has built and got buried in is under direct protectorate of the Russion Orthodox “pope”, the Patriarch, such making it a pilgrimage site for the Russian Orthodox church has completely failed to trigger any support by Weimar or Thuringia Tourism. Air Berlin reported it to be a “known reason” for a substantial part of their Russian Berlin-passengers to add Weimar to their travel plans.

In order to promote the government-funded route, after fierce discussions, Cirrus Airlines agreed to offer a low-cost ticket at 99€ return, having only about 6€ after the high taxes on the ticket. That offer was made available especially to the Thuringian government offices and the state development agency (LEG). Nevertheless, LEG planned and executed delegations traveling with the train to Berlin to take flights from Berlin, instead of promoting the route. The same also for the ministries and ministers. Even the responsible minister taking flights from Frankfurt and Munich instead of using the PSO-route he signed responsible for. During the months we’ve actively promoted that 99€-fare also to the industry and the travel agencies and also had it largely available, not one of the flights used up the 99€ tickets allocated to them. Being at the verge of a bankruptcy, Cirrus Airlines finally ceased to operate that route in December 2010.

In order to promote the government-funded route, after fierce discussions, Cirrus Airlines agreed to offer a low-cost ticket at 99€ return, having only about 6€ after the high taxes on the ticket. That offer was made available especially to the Thuringian government offices and the state development agency (LEG). Nevertheless, LEG planned and executed delegations traveling with the train to Berlin to take flights from Berlin, instead of promoting the route. The same also for the ministries and ministers. Even the responsible minister taking flights from Frankfurt and Munich instead of using the PSO-route he signed responsible for. During the months we’ve actively promoted that 99€-fare also to the industry and the travel agencies and also had it largely available, not one of the flights used up the 99€ tickets allocated to them. Being at the verge of a bankruptcy, Cirrus Airlines finally ceased to operate that route in December 2010.

By the time, working with the local industry associations, political parties I have been able to increase the passenger numbers by about 20 percent. In fact, to date, the airport is far from the 320 thousand passengers I left them with. With Weimar being the neighboring but historically better known city internationally, I pushed forward the renaming to Erfurt-Weimar with the attempt to improve the incoming for the airport. Paid almost completely from the limited marketing budget. A strategic decision executed after our parting-of-ways in December 2010 after my two-year contract was not extended in the wake of the retreat of Cirrus Airlines. A strategic decision though made obsolete by the “political” decision by traffic minister Christian Carius to not replace the route as I recommended with an Amsterdam-service. Sad decision indeed, as with our parting ways, the discussions with KLM were simply discontinued (KLM calling my number reached someone speaking German only, I was gone) and despite their interest in a PSO (public service obligation) financial route support, we had discussed flights based on mere startup incentives and marketing support.

By the time, working with the local industry associations, political parties I have been able to increase the passenger numbers by about 20 percent. In fact, to date, the airport is far from the 320 thousand passengers I left them with. With Weimar being the neighboring but historically better known city internationally, I pushed forward the renaming to Erfurt-Weimar with the attempt to improve the incoming for the airport. Paid almost completely from the limited marketing budget. A strategic decision executed after our parting-of-ways in December 2010 after my two-year contract was not extended in the wake of the retreat of Cirrus Airlines. A strategic decision though made obsolete by the “political” decision by traffic minister Christian Carius to not replace the route as I recommended with an Amsterdam-service. Sad decision indeed, as with our parting ways, the discussions with KLM were simply discontinued (KLM calling my number reached someone speaking German only, I was gone) and despite their interest in a PSO (public service obligation) financial route support, we had discussed flights based on mere startup incentives and marketing support.

Opposing myself ongoing subsidies, to demand a route but to leave the (substantial) risk completely with the airline is neither the answer. Whereas comparing the CheckIn.com-data about airport catchment areas with the data provided by airports we found that data to be completely off-set in a majority of cases. It caused us to make basic data available for free. But if the data provided by the airport is not hard, but guesstimates or outright lies, when the airline starts a flight based on that data, the airline takes the risk. To not only does the airport sneak out of the responsibility, they increase the airlines’ risk – is that a game? Or serious business?

Opposing myself ongoing subsidies, to demand a route but to leave the (substantial) risk completely with the airline is neither the answer. Whereas comparing the CheckIn.com-data about airport catchment areas with the data provided by airports we found that data to be completely off-set in a majority of cases. It caused us to make basic data available for free. But if the data provided by the airport is not hard, but guesstimates or outright lies, when the airline starts a flight based on that data, the airline takes the risk. To not only does the airport sneak out of the responsibility, they increase the airlines’ risk – is that a game? Or serious business?

Now since I started in aviation 30 years ago, the market has drastically changed. In the good old days, there were (often highly subsidized) “national airlines”, used to promote the country. Back in my early days, the airlines were the executive for the tourist offices and also worked closely with commercial development agencies. But ever since, those national airlines have either adapted or went out of business. The emerging “low cost” airlines virtually evaporated the income of the airlines, competition becoming fierce.

Now since I started in aviation 30 years ago, the market has drastically changed. In the good old days, there were (often highly subsidized) “national airlines”, used to promote the country. Back in my early days, the airlines were the executive for the tourist offices and also worked closely with commercial development agencies. But ever since, those national airlines have either adapted or went out of business. The emerging “low cost” airlines virtually evaporated the income of the airlines, competition becoming fierce.

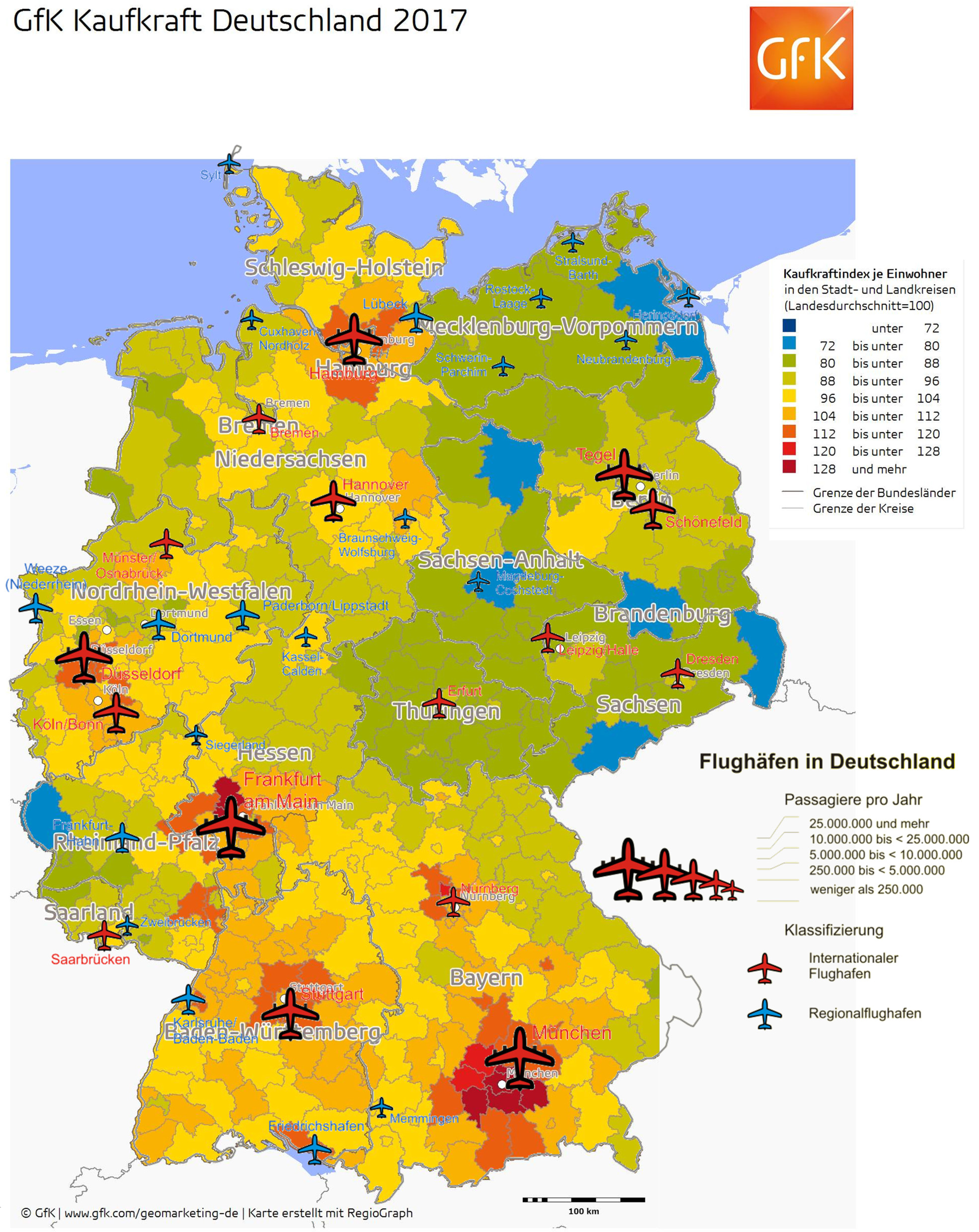

As I keep emphasizing with my updated image of Purchasing Power and Airports, there is a relation between a strong airport and the regional purchasing power. It is indeed a hen/egg issue, but if you are a small airport in a weak region, maybe it makes sense to consider how to attract travel (tourism, commerce) to your region. Not how to drain your region of the money by sending the population to the Mediterranean for vacation, but by having incoming, scheduled services, by adding point-to-point routes and to attract low cost airlines.

As I keep emphasizing with my updated image of Purchasing Power and Airports, there is a relation between a strong airport and the regional purchasing power. It is indeed a hen/egg issue, but if you are a small airport in a weak region, maybe it makes sense to consider how to attract travel (tourism, commerce) to your region. Not how to drain your region of the money by sending the population to the Mediterranean for vacation, but by having incoming, scheduled services, by adding point-to-point routes and to attract low cost airlines.

If we do not talk about PSO (Public Service Obligation) where the government pays for basic flight services, if you build an airport and wait for airlines to find you, keep on sleeping (and burning money). So if you are a small airport and you have little to no money, what can you do?

The airport is part of the region’s infrastructure. As such, it needs to be integrated into a political and commercial strategy. Whereas in the example of Erfurt-Weimar, the airport is being kept as a scapegoat, being challenged in one sentence for the aviation noise (a good joke with so few flights) and for not having flights. A political punch-ball.

Other, successful airports like Memmingen in Southern Germany are integrated into and understood as a strategic value for the regional development. In fact, Memmingen is not politico-owned but owned by more than 60 co-owners from the region’s industry. Such, instead of being a scapegoat for political power games, everyone in the region understands the need to actively support the airport. Anyone harassing the airport confronts everyone in the region. A political suicide!

At Erfurt, I was asked to establish flights to Moscow. One company. 10 employees. Even with a small (expensive) 50-seat aircraft and weekly flights only (which are usually not sufficient for commercial demand), we talk about 40 seats by 52 weeks in two directions or 4.160 tickets to sell every year. But for a decent offer that is useful to the industry, you need at least twice weekly flights.

Leaving that task to attract airlines to the airport alone, at the same time running blame games and scapegoating, the airport cannot justify such flight. But what if the state development agency and the chambers of commerce, on demand by the political PTBs (powers-that-be) qualify the demand from all those small and midsized companies? Not on a low-cost, but with reasonable ticket prices. Not at prime time at the maximum risk for the airline. Maybe instead of a weekly, can the region sustain a double or even triple-weekly flight making it interesting for the companies in the region? Are those companies willing to support the launch period by committing to use the flight, even if slightly more expensive than a flight from Frankfurt or Berlin? Keep in mind, the people have to get there, you also pay for gasoline/parking or rail. Transport to those hubs is not free either. And the longer check-in times make them even less attractive, right?

Interesting approach. I’ve talked to several smaller airports where they agreed that their chamber of commerce and regional development agencies “pre-purchased” tickets at the cost of the average ticket price needed to cover the operational cost. Then they to sell it to their members. Not covering the full cost of operations, but simply taking their share of the risk! Why should they not, if they believe in the numbers and data they provide to the airline to promote their business case?

Then talk about Tourism. Given such flight, are the local tourism PTBs ready to promote such flight in the outlying region? What about other promotion? Don’t leave it to the airport! Is there a joint concept by the political PTBs, the state development and commerce PTBs, the tourism PTBs on what flight they want, how they will promote the flights?

“We have an airport”. That’s nice. But not enough.

And for a Minister President even only on a state level? You better think about a strategy. Or close down the airport. Having flight to summer vacation is not enough. It drains money from your region into those destinations. What’s in it for you? Why do you fund an airport? No scheduled services? No incoming? Do your homework.

It’s no longer the job of the airline to promote your region! They simply don’t have the funds to do that. It’s not their business case.

It is the job of the political, commercial and tourism PTBs to qualify what they finance an airport for and come up with ideas and business cases for airlines to take the risk to fly there. And no, a “business case” is not necessarily paying subsidies. If you have a good business case that the airline will make money on the route by flying paying passengers, I can rest assure you that the airline will prefer that over subsidies that are usually associated to political nightmares.

Compiling sound numbers is a good start… And yeah, I might be willing to help you with that.

Food for Thought!

Feedback welcome…

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads-1200x675.jpg)

Discussing Routes conferences, I recently appreciated several discussions about the imbalance of route financing in Europe. In the discussion, we boiled it down to a simple question:

As we all know, airlines struggle to make money. Which I personally believe is a house-made problem. The use of legacy systems, legacy distribution models make the legacy carriers operate on a cost per seat that’s no longer competitive. In the 70s, a cheap return flight Frankfurt-New York was 2.500 German Marks, about 1.300 Euros. That was 40 years ago. Today the cheap flights sell for below 400 Euros. Return! So the revenue melted away. The cost for aircraft and seats got cheaper too with bigger aircraft. The fixed cost of the flight divided by seats. But that’s another story.

So who are the players in the game.

Let us look at my example I keep using consulting airlines and airports about new routes. At Join! we usually start discussing new routes with airports and quickly learn day in / day out: Everyone wants new Routes, the analyses supporting the case are mostly biased, it all looks sunny-shiny, but no, they don’t want to take the risk. In EU-Europe, they are often not even allowed to take the risk. How stupid is that?

So we usually approach the chamber of commerce, state development agencies and such asking for concrete demand for the routes the airport asks for. All we usually get is some wishful thinking. This company wants flights there? How many seats a year? 4-6… You got to be kidding me…? When we tell them the simple maths, they frequently retreat and have no answer.

An A319 has 124 seats. At 80% average load (which is low nowadays), we talk about 96 seats. Which have to sell out and inbound. At four flight pairs a day (five to six weekdays, two to four on weekends), we talk about eight legs in average (more is better). At 365 days, we talk about 280 thousand passengers the aircraft should fly every year. Let’s take out some maintenance, but we still get to a target of 250 thousand passengers. For each daily return flight, we talk about 200 seats target. For a double daily, double that.

The A320 or 737-800 is around 189 seats, so roughly 50% more.

Keep in mind there are disruptions. Less frequently on the technical side, the aircraft makers understand the cost involved in a technical grounding. But the airline has to have resources to survive such groundings. But we also talk about weather related flight cancellations. Flights remaining empty for the one or other reasons. Days people tend not to fly (religious holidays), fluctuation in demand… We talk about delays made worse by passenger compensations required by law. The disappearance of interline agreements allowing for involuntary rerouting of the passengers, not to talk about regional routes where the flight might be the only choice.

The cost of aircraft, crew, kerosene, insurance, distribution, maintenance etc. pp. being calculated, adding the “taxes and fees” on top, you talk about a cost per seat per leg at 80% load factor as somewhere between 70 and 100 Euro. On a 99 Euro return fare on the Erfurt-Munich flight in 2010, Cirrus Airlines after taxes and fees had less than seven Euros.

The airports are restricted in what they can do, usually to discounts on the local fees. So the classic:

The Airline Takes the Risk. The very common approach. Yes, we give you discount on the landing fees. A drop on a (very) hot stone.

Guaranteed Load. Classically the field of tour operators, purchasing a fixed number of seats on the flights. Works very well in high season, but in the past two decades, the number of flights where the tour operator charters the aircraft became negligible. Even in that market, most flights are “set up” by the airline and then marketed to a number of tour operators. Once the shit hits the fan, as recently i.e. in Turkey, the tour operators cancel their seat allocations leaving the airline suddenly with unfilled air planes. But the aircraft is still there, it costs money!

A similar approach is to get such guaranteed seats from corporate clients, though they usually demand “lowest fare” for the guarantee at “last seat guarantee”, adding difficulty on the pricing games the airline can play. So a good airline sales makes sure to keep the flexibility. We discussed the purchase of (virtual) ticket stock at cost per seat + X, but very few of the corporations demanding a specific route then come up and commit. So we’re back to the airline taking the risk.

So in reality, we can (and have to) look at realistic scenarios.

“What are the facts? Again and again and again-what are the facts? Shun wishful thinking, ignore divine revelation, forget what “the stars foretell,” avoid opinion, care not what the neighbors think, never mind the unguessable “verdict of history”–what are the facts, and to how many decimal places? You pilot always into an unknown future; facts are your single clue. Get the facts!” [Lazarus Long]

And even with all the facts, navigating the future is a risk. Get what you can in the best quality. The better and unbiased the data, the less your risk!

If you know me, I am no fan of subsidies. You got to understand who benefits and to what extend. Get the maths down. then invest.

On the other side, there may be reason for permanent “subsidies” by the region flown from and to. As they benefit from better flight connections, from tourists, business travelers, commerce, taxes. Why is it that I keep asking if anyone has some sound research to share about the impact of a new flight to the economy? Why are the state development agencies “in need” but unable to qualify that impact to their economy? I am still convinced airports like Erfurt-Weimar, Lübeck or Kassel need scheduled services to be connected to the global aviation networks. Not to the nearby hubs that they can reach easily with rail or car. But studies exist that confirm that beyond four hours drive time a flight makes sense.

Temporary Investment

Risk Sharing

Who benefits?

0 - click to show Jürgen you liked the post![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads-1200x675.jpg)

[edited]

Sharing the Bloomberg headline What Do You Want, Cheap Airfare or an On-Time Flight? Daniel (S.) today quoted from the article on LinkedIn: “An ultra-low-cost carrier will never, ever try to be as punctual as a big legacy #airline. Being on time all or most of the time costs money.”

After an initial misunderstanding we agree: That is stupid!

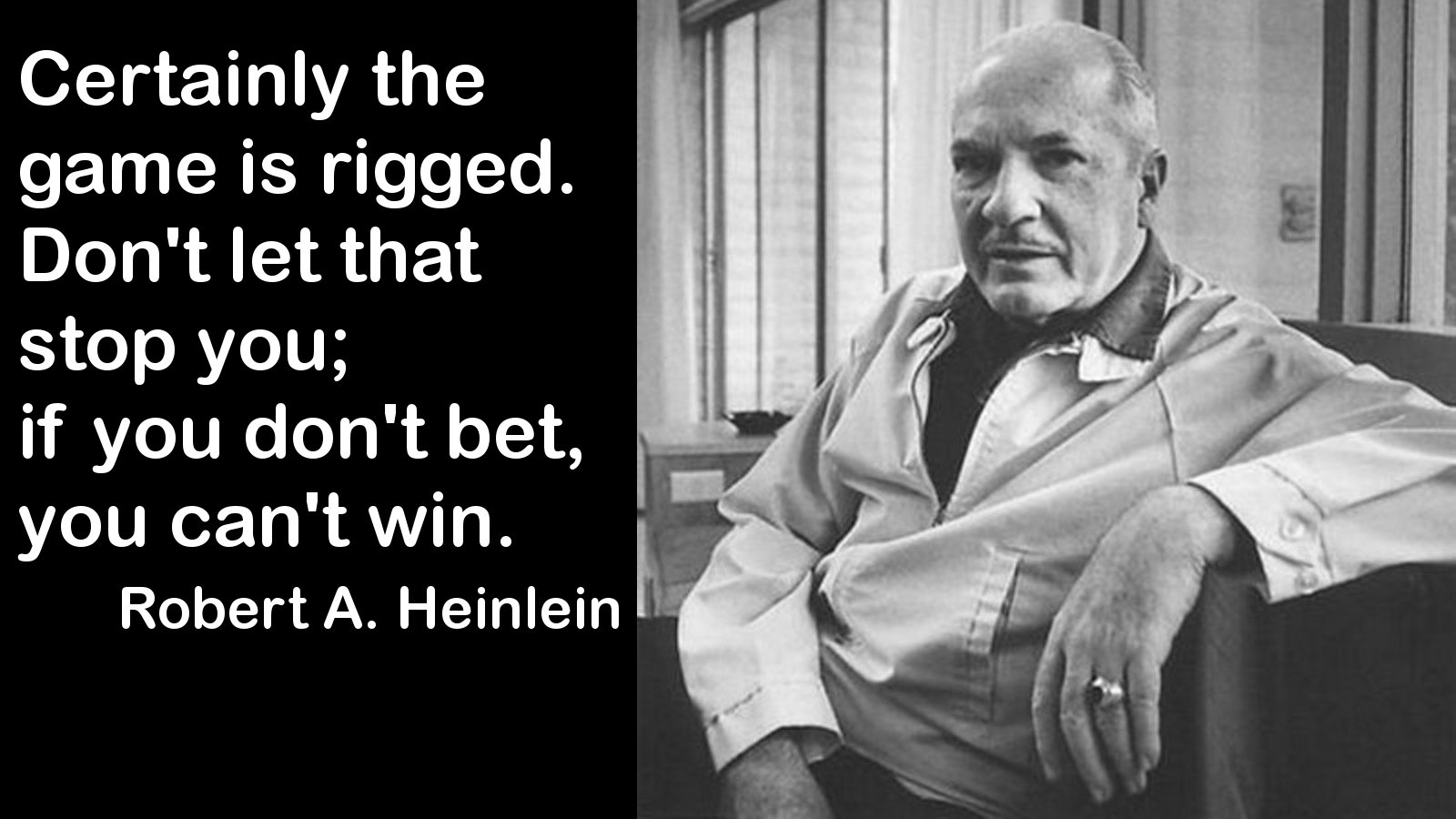

Delay and disruption management are the single most important influenceable cost factors in aviation today!

Yes, we can make good aircraft deals, we use revenue management to sell out tickets as expensive as we can in the low-cost world. But operations is the single most important cost driver we can influence today. We can neglect it, like many seasoned airline and airport managers do, we can deny and ignore it. And loose money.

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket!

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket!

In 2014 I wrote this article about Airport Operations Center (APOC), Airline Operations Control Center (OCC) and ATC’s Network Operations Center (NMOC) and how they do not communicate with each other. I asked just recently about a common airline system with decent, contemporary, f***ing basic interfaces and learned that none of my precious industry expert friends knows such. Worse, I got more feedback than I wanted about the issues all my friends in this industry can tell about; where thanks to missing such data flow, the right hand does not know what the left one is doing. In the process, trying to improve a bad situation, but working with different information, making things often enough worse.

In 2014 I wrote this article about Airport Operations Center (APOC), Airline Operations Control Center (OCC) and ATC’s Network Operations Center (NMOC) and how they do not communicate with each other. I asked just recently about a common airline system with decent, contemporary, f***ing basic interfaces and learned that none of my precious industry expert friends knows such. Worse, I got more feedback than I wanted about the issues all my friends in this industry can tell about; where thanks to missing such data flow, the right hand does not know what the left one is doing. In the process, trying to improve a bad situation, but working with different information, making things often enough worse.

I also heard just this week, how airline managers love the big planes (A380), a Lufthansa manager was quoted that they love the big bird, but that they don’t know if they can ever be operated long-term commercially revenue-making. Or read a comment, how much these airline “managers” love new inflight entertainment and seats and fancy stuff. But don’t understand, why Windows-XP-machines in their OCC need replacement. It’s “fancy”, touchable, visible to see the airplane or fancy seats, but no-one sees the impact of deicing. Okay, we have a winter-delay. Who cares, we’ve calculated it into our prices forever and it’s been always like this. It can be improved? Who cares.

And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.

And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.

So while I know that seasoned managers in aviation act that stupid and short-sighted. Delay and Disruption Management is the single most important factor we can influence to save big money.

As I should have known Daniel’s opinion, i.e. from his LinkedIn article about why airlines burn money every day I keep myself referring to.

And if you need someone to discuss such projects or to manage them? Keep me in mind. And Daniel 😉

Food for Thought

Comments welcome!