|

Important News: Help us evolve our analyses from PDF (with map-image) to instant, web-based access (including export for further use!). Join our crowdfunding at Indiegogo and spread the word please! |

|

[Update: Crowdfunding ended]

by Jürgen Barthel

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

|

Important News: Help us evolve our analyses from PDF (with map-image) to instant, web-based access (including export for further use!). Join our crowdfunding at Indiegogo and spread the word please! |

|

[Update: Crowdfunding ended]

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

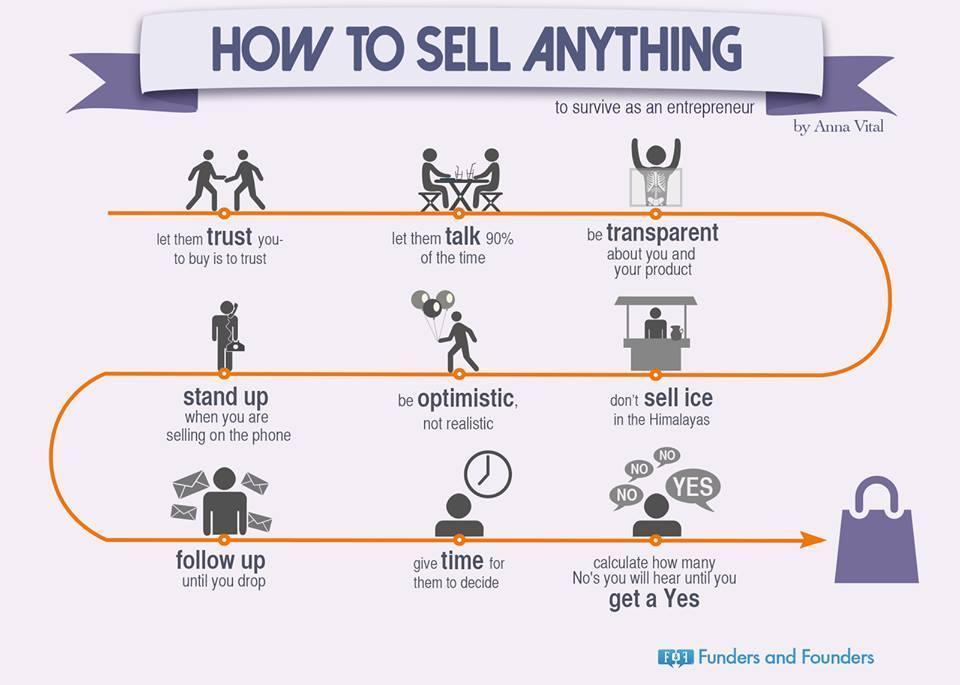

During my initial business education, more than 30 years ago, the General Manager of the company hosting me for the practical part told me: “Someone else always can sell cheaper”. At the time, concepts like “USPs” (Unique Selling Propositions) had not been “common”, but it practically was about how to position for success.

During my initial business education, more than 30 years ago, the General Manager of the company hosting me for the practical part told me: “Someone else always can sell cheaper”. At the time, concepts like “USPs” (Unique Selling Propositions) had not been “common”, but it practically was about how to position for success.

The mantra in the aviation industry is to be always the cheapest. The mantra in procurement / purchasing is to buy the cheapest. In Germany, we have two different words for “cheap”. Billig and preiswert: Billig is cheap. Preiswert is “worth the price”.

Another old saying is “You get, what you pay for”. And yet another saying I heard in procurement is: “Save money, no matter the cost”.

But my friend Richard told me some 15 years ago that there is a psychological price. He also told me that IT (what we both worked in and now work again in) is the first thing that procurement “saves” upon, as they don’t understand its value.

So if it is not the price, what could it be?

A unique identity could be one. For airlines: When I started in the industry, I could distinguish airline crews by their uniform. Today, the differences in the uniforms are so minor that flight attendants of different airlines standing in one group can not be distinguished any more.

For conferences, I keep refering to Hamburg Airport Marketing. From afar they can be identified. And even promoting Hamburg big on the shirts, it doesn’t look “cheap”, but gives identity! It can be even worn at the “business casual evening event”. And believe me, if you look for the Hamburg team, you do find them!

Though for some reason inexplicable to me, many sales managers deny to wear uniform, much less some easily identifiable wardrobe as that. They seemingly prefer to blend in with all the other black ties. Though why you want your company and products and yourself to “blend in” instead of standing out, is simply beyond me 🙂

If you can establish a unique identity, your customers associate intuively with your product, you increase your reseller base, as they will remember you when opportunity arises. If your reputation is bad, all you can do is to undercut your competitors in price. If that is your USP, I’d say you may have the problem with the fact that always, someone else can produce cheaper.

Quality is a good USP. And quality comes in many aspects. Part of quality can be friendliness – in the beginning of my career, at the time with American Airlines, we got “beaten in” that we always have to smile when interacting with other people. Not just customers, but also our own colleagues. As the saying goes “Formal courtesy between husband and wife is even more important than it is between strangers.” [Lazarus Long] – I found this especially true in companies. If you treat your own people bad, you will treat your customers likewise. Unfortunately, service is something that button sorters (accountants) don’t understand. Friendly Service does not have a price tag. Just if you don’t have it, you will pay the price. In lost customers.

Service is also how you manage with problems. Can you truly afford your customer(s) to be upset, just to save some money? Even if you do not pay, you got to talk to the customer and explain. Do not write. And don’t “outsource” your customer communication or you will loose them.

Time is also an essential difference maker. Why else would airlines reduce the prices if you connect making a detour through their hub (connecting airport), compared to a nonstop flight? In IT, time to delivery is of essence. Too many companies succeed by selling you dreams, but failing to deliver. Leading to the next Soft USP:

Honesty. I was tought early in my life to never lie if possible. Bend the truth, better tell some truth that makes the people believe you lie (and proof them better later). When Obama visited Erfurt, press asked. All I communicated was “The Pilots’ Union said that Obama’s 747 cannot land in Erfurt”. What I did not tell them, that the Union’s “experts” had missed the fact that Air Force One is usually not “fully loaded” and has the advantage of some (so public sources say) 20% higher engine power. When it came to Erfurt, I had never lied. And ever since had a good standing with them. Honesty creates trust. If you lie once, you’ll have a hard time to recover.

Honesty. I was tought early in my life to never lie if possible. Bend the truth, better tell some truth that makes the people believe you lie (and proof them better later). When Obama visited Erfurt, press asked. All I communicated was “The Pilots’ Union said that Obama’s 747 cannot land in Erfurt”. What I did not tell them, that the Union’s “experts” had missed the fact that Air Force One is usually not “fully loaded” and has the advantage of some (so public sources say) 20% higher engine power. When it came to Erfurt, I had never lied. And ever since had a good standing with them. Honesty creates trust. If you lie once, you’ll have a hard time to recover.

These are sure just examples. But it strikes me odd, how many companies, especially in aviation, do not have an understanding of their business culture and their USPs. But if you don’t communicate that to your own, how do you think your customers will learn about them?

A final example for this article today shall be Apple. I loved Apple. Past tense. They made the first smart phones. All others copied them. Now they struggle and their answer is “me too”-products. What was their USP?

A final example for this article today shall be Apple. I loved Apple. Past tense. They made the first smart phones. All others copied them. Now they struggle and their answer is “me too”-products. What was their USP?

I took the iPhone6 into my hand and decided: Too big. My iPhone 4S does all I need. Intuitively and without some double tab on home to be able to access the upper screen.

If I want to watch video, I use my tablet (did I mention I shunned the iPad and got a Windows-Hybrid?).

So Apple lost a customer. Because they evolved from the pioneers to the ones limping behind. It would be time for them to reassess their USPs, their business propositions and their strategy. Then maybe they might find that they left frustrated customers behind with their “bigger is better” and instead made their phones expensive Samsung-clones, just without a “Mini”.

Sell, sell, sell. But if you do not know what you sell, all you do is lower the price until someone buys. I predict that fate even for Apple. But if you can explain the differences, if you can explain the quality, you hardly need to sell. The people buy. Though that requires management to understand and support that, to drive, not being driven.

Hmm… None of the business plans and their revisions I worked on took less than several weeks to come from an idea or product to a sales strategy for the different “customers”. Capital investors, buyers, suppliers, partners. And to answer the main three questions (beyond the idea) that all business plans contain:

Once you can answer these three questions, you have your sales strategies, your elevator pitches, you understand. Then all you still need to do is: Communicate it to your people! Spread the word.

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Academic – Epidemic

Academic – EpidemicDuring my vacation, I just had another discussion with a “senior manager”, showing how little many of these highly paid people understand about the value of networking. It often seems to me that this is nothing they ever learned during their university times…?

People buy from people, not technologies.

No matter, how good your product is, no-one will believe it, if they don’t believe they “know” it.

I had some questions and statements (Q) repeadetly the last years and think it might be wise to share my answers (A). If that stuff is voiced that often, you may be faced with the same smart people…

Q: “It’s very much about being at the right point at the right time.”

A: And the right point is the mind of the someone who thinks about buying. If you’re not in the mind, you won’t come to mind and you won’t sell.

Q: “Why should I go to this event, I can talk to them on the phone.”

Q: “Why should I go to this event, I can talk to them on the phone.”

A: Do you know, how many phone calls that someone gets every week, from people trying to enter their mind and memory? At these events, like-minded people meet. With the possibility to speak longer with people and face to face, trust can be established. An important factor for purchasing decisions.

Q: “Why should I be active on LinkedIn?”

A: For one, there are a lot more people on LinkedIn than you likely ever meet on trade shows. If these people are allowed to attend trade shows in the first place…

Q: “Then why should I attend trade shows – the people I seek to meet are not there!”

A: Because even if they themselves are not there. Their colleagues who are allowed to go will tell them. If you leave some impression.

Q: “Is it better to have a stand or not?”

A: That depends. Can you attract people to your stand (it does require a catchy stand design and/or an established brand awareness). In my experience and for conferences with exhibition: If you are alone, skip the stand. Meet your audience face to face. Conferences are not about sitting around, but to meet and to talk to people! What I recommend though is that you use accessories that show who you are. Be it a cap, a polo-shirt (or light jacket) with logo or a catch phrase that attracts the right people to you, be it a bag – under all those black-ties, you got to stick out showing “Here I am!”

Interesting side note: I know a lot of sales & marketing people being too proud to “show off”. If you don’t want to show off (your product) you maybe got the wrong attitude for the job…

Q: Hey, I got invited for a speaker slot. I can present my product there.

A: If you can have a speaker slot, don’t use it to sell your product, but make sure you provide lasting value for your audience. If they are interested, they’ll be interested in your product. And after you paid for some of such slots, the organizers (if they’re worth their money) find you valuable and maybe even worth-while to invite or even pay you next time…

These opinions of managers do remind me too much of an old quote: “If you don’t try, you cannot win”.

But have they understood that they sell to people having their own priorities, agendas and opinions?

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

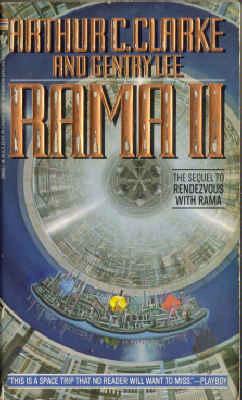

The following is a transcript from Chapter 4 of the 1979 book “Rama II”, a science fiction written by Arthur C. Clarke, author of 2001 and other bestsellers.

The similarities to the current global commercial (non-?)crisis are rather frightening and I’d like to leave the following further uncommented.

[…] An unrestrained burst of conspicuous consumption and global greed lasted for just under two years. Frantic acquisition of everything the human mind could create was superimposed on a weak economic infrastructure that had been already poised for a downturn in early 2130 . The looming recession was first postponed throughout 2130 and 2131 by the combined manipulative efforts of governments and financial institutions, even though the fundamental economic weaknesses were never addressed. With the renewed burst of buying in early 2132, the world jumped directly into another period of rapid growth. Production capacities were expanded, stock markets exploded, and both consumer confidence and total employment hit all-time highs. There was unprecedented prosperity and the net result was a short-term but significant improvement in the standard of living for almost all humans.

[…] An unrestrained burst of conspicuous consumption and global greed lasted for just under two years. Frantic acquisition of everything the human mind could create was superimposed on a weak economic infrastructure that had been already poised for a downturn in early 2130 . The looming recession was first postponed throughout 2130 and 2131 by the combined manipulative efforts of governments and financial institutions, even though the fundamental economic weaknesses were never addressed. With the renewed burst of buying in early 2132, the world jumped directly into another period of rapid growth. Production capacities were expanded, stock markets exploded, and both consumer confidence and total employment hit all-time highs. There was unprecedented prosperity and the net result was a short-term but significant improvement in the standard of living for almost all humans.

By the end of the year in 2133, it had become obvious to some of the more experienced observers of human history that the “Raman Boom” was leading mankind toward disaster. Dire warnings of impending economic doom started being heard above the euphoric shouts of the millions who had recently vaulted into the middle and upper classes. Suggestions to balance budgets and limit credit at all levels of the economy were ignored. Instead, creative effort was expended to come up with one way after another of putting more spending power in the hands of a populace that had forgotten how to say wait, much less no, to itself.

The global stock market began to sputter in January of 2134 and there were predictions of a coming crash. But to most humans spread around the Earth and throughout the scattered colonies in the solar system, the concept of such a crash was beyond comprehension. After all, the world economy had been expanding for over nine years, the last two years at a rate unparalleled in the previous two centuries. World leaders insisted that they had finally found the mechanisms that could truly inhibit the downturns of the capitalistic cycles. And the people believed them—until early May of 2134.

During the first three months of the year the global stock markets went inexorably down, slowly at first, then in significant drops. Many people, reflecting the superstitious attitude toward cometary visitors that had been prevalent for two thousand years, somehow associated the stock market’s difficulties with the return of Halley’s Comet. Its apparition starting in March turned out to be far brighter than anyone expected. For weeks scientists all over the world were competing with each other to explain why it was so much more brilliant than originally predicted. After it swooped past perihelion in late March and began to appear in the evening sky in mid-April, its enormous tail dominated the heavens.

In contrast, terrestrial affairs were dominated by the emerging world economic crisis. On May 1, 2134, three of the largest international banks announced that they were insolvent because of bad loans. Within two days a panic had spread around the world. The more than one billion home terminals with access to the global financial markets were used to dump individual portfolios of stocks and bonds. The communications load on the Global Network System (GNS) was immense. The data transfer machines were stretched far beyond their capabilities and design specifications. Data gridlock delayed transactions for minutes, then hours, contributing additional momentum to the panic.

By the end of a week two things were apparent—that over half of the world’s stock value had been obliterated and that many individuals, large and small investors alike, who had used their credit options to the maximum, were now virtually penniless. The supporting data bases that kept track of personal bank accounts and automatically transferred money to cover margin calls were flashing disaster messages in almost 20 percent of the houses in the world.

In truth, however, the situation was much much worse. Only a small percentage of the transactions were actually clearing through all the supporting computers because the data rates in all directions were far beyond anything that had ever been anticipated. In computer language, the entire global financial system went into the “cycle slip” mode. Billions and billions of information transfers at lower priorities were postponed by the network of computers while the higher priority tasks were being serviced first.

The net result of these data delays was that in most cases individual electronic bank accounts were not properly debited, for hours or even days, to account for the mounting stock market losses, Once the individual investors realized what was occurring, they rushed to spend whatever was still showing in their balances before the computers completed all the transactions. By the time governments and financial institutions understood fully what was going on and acted to stop all this frenetic activity, it was too late. The confused system had crashed completely. To reconstruct what had happened required carefully dumping and interleaving the backup checkpoint files stored at a hundred or so remote centers around the world.

For over three weeks the electronic financial management system that governed all money transactions was inaccessible to everybody. Nobody knew how much money he had—or how much anyone else had. Since cash had long ago become obsolete, only eccentrics and collectors had enough bank notes to buy even a week’s groceries. People began to barter for necessities. Pledges based on friendship and personal acquaintance enabled many people to survive temporarily. But the pain had only begun. Every time the international management organization that oversaw the global financial system would announce that they were going to try to come back on-line and would plead with people to stay off their terminals except for emergencies, their pleas would be ignored, processing requests would flood the system, and the computers would crash again.

It was only two more weeks before the scientists of the world agreed on an explanation for the additional brightness in the apparition of Halley’s Comet. But it was over four months before people could count again on reliable data base information from the GNS. The cost to human society of the enduring chaos was incalculable. By the time normal electronic economic activity had been restored, the world was in a violent financial down-spin that would not bottom out until twelve years later. It would be well over fifty years before the Gross World Product would return to the heights reached before the Crash of 2134.

Food for Tought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

An interview in ATN with Girma Wake, Chairman, RwandAir triggered a question that spooks around for quite a while now.

ATN: Are you afraid that this new environment will bring more low-cost carriers or do you believe that this model does not fit into the African environment?

ATN: Are you afraid that this new environment will bring more low-cost carriers or do you believe that this model does not fit into the African environment?Can a regional carrier with small airlines operate low cost? Can a long haul carrier operate low cost? Why can’t the big ones operate low cost?

Just my idea on that: I truly believe that a small carrier can operate a low cost model. In the beginning the carriers operated large narrow-body like 737-800 or A320 with some 185 seats. More and more, they also operate smaller aircraft like the 737-700 or the A319. And the time the prices were really low are gone as well. In the end you have to cover cost of operations as well as secondary cost like marketing, call center, claims and refunds, taxes and the likes. Not to forget the kerosene as a main cost block, forcing the models to slowly converge. Did I mention Intersky’s regional low-cost operations?

Just my idea on that: I truly believe that a small carrier can operate a low cost model. In the beginning the carriers operated large narrow-body like 737-800 or A320 with some 185 seats. More and more, they also operate smaller aircraft like the 737-700 or the A319. And the time the prices were really low are gone as well. In the end you have to cover cost of operations as well as secondary cost like marketing, call center, claims and refunds, taxes and the likes. Not to forget the kerosene as a main cost block, forcing the models to slowly converge. Did I mention Intersky’s regional low-cost operations?

German DLR recently made a study on the fare levels. Comparable flights turned out i.e. an average fare incl. taxes/fees (selected days) like

| Ryanair (FR) | 78,78 |

| Easyjet (U2) | 97,44 |

| Germanwings (4U) | 144,33 |

| Air Berlin (AB) | 158,64 |

| Wizz (W6) | 69,99 |

With “low cost” and “traditional” airlines offering about the same price levels, it is about cost of operations and you got to cover your cost – low cost or “old model”.

IHS actually reports on the importance of low cost carriers for the smaller regional airports. With cost savings programs reducing services (and service), the “old carriers” loose quickly ground to the ever-expanding, young and hungry competitors. Where Lufthansa services about any German airport in the past, today Turkish Airlines offers more services to German Airports from Istanbul than Lufthansa from Frankfurt! easyJet (with a large base in Berlin) today operates more aircraft (199) than Air Berlin Group (153). And easyJet has 166 aircraft on order plus 100 options (Air Berlin Group 55 orders).

But easyJet can be booked in the GDS. There website even supports to book multiple flights connecting, which I did myself to the U.K. lately (via LGW). As I keep saying: The difference between Lufthansa or Air Berlin and easyJet is NOT that they are only bookable on the Internet (which is simply not true), but that easyJet doesn’t have legacy systems and processes – for easyJet, they focus on the business case! Where “airline sales” often gives special rates to portals and travel agency chains, easyJet does not see a benefit to sell low. They focus to sell high. So if you negotiate with them, you don’t negotiate competing the cheap fares. Also repeating myself: Anyone can sell “cheap”, you need no sales manager to do that.

And two remarks closing: Carolyn McCall, CEO of easyJet is known to understand and promote “service” as a unique selling proposition (USP). And WestJet with its Christmas Miracle had clearly a promotion for the WestJet trade mark in mind. While the “established” airlines keep diluting their own trade marks: What again has “Lufthansa” to do with “Germanwings” (Swiss, Austrian, …)? Ain’t they competitors?

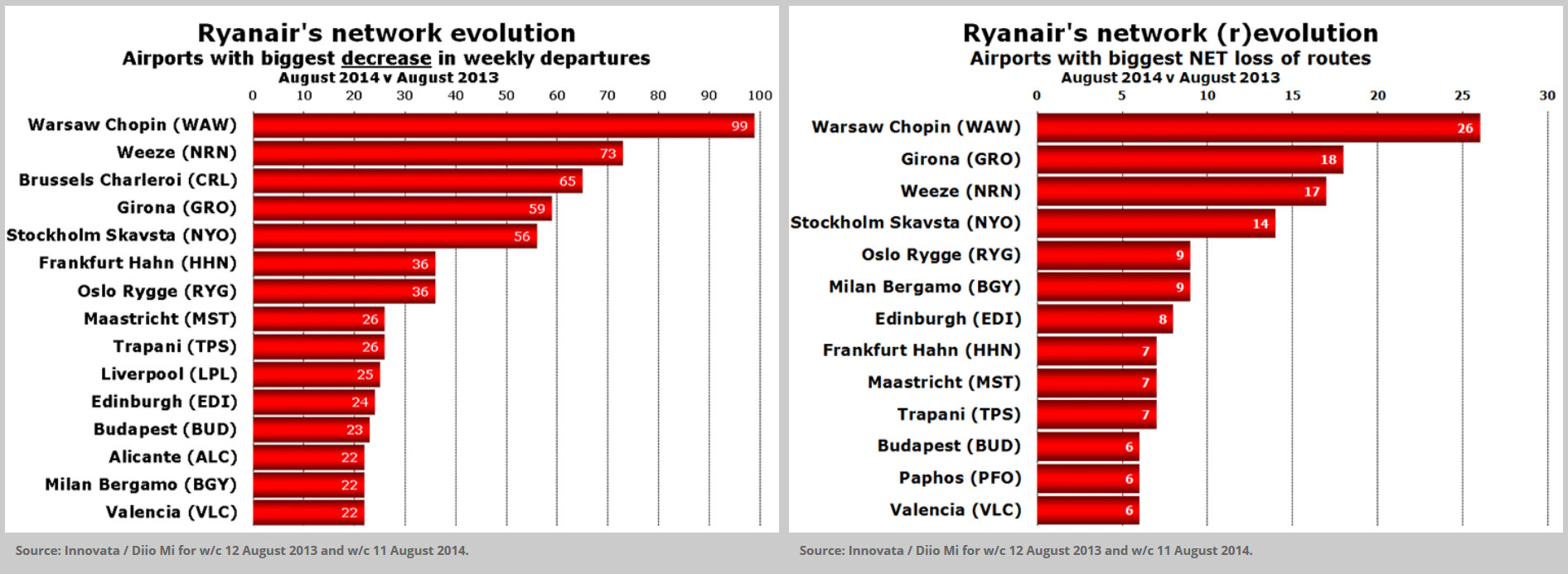

Post Scriptum: ANNA.aero just announced axing of Ryanair, mostly of regional routes.

You should not rely on Ryanair for anything more than a door opener to make your airport known… And as an airport and region, you should have a strategy to sustainably place your airport on the “road map” of the global aviation network. That requires a strategy, incoming, route feasibility studies and all that common homework.

Food for Thought

Comments welcome

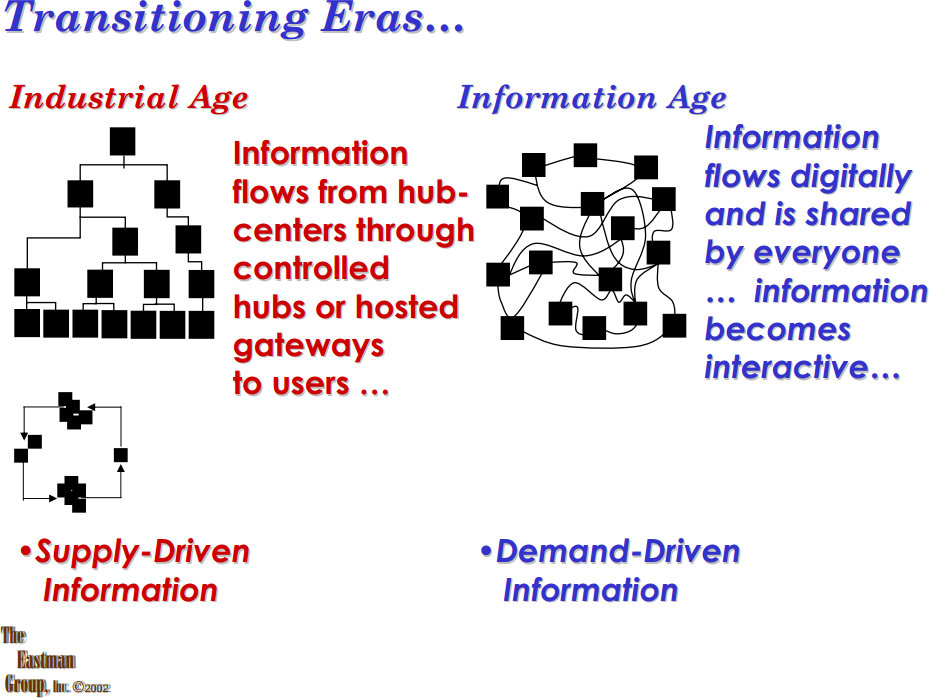

Having addressed “Airline Sales & e-Commerce” in presentations between 1994 and 2007, I became honorary member in 1999. I have tried to raise awareness for the changes our industry faces but now regretfully have to accept the official disbanding of the association effective August 1st, 2014.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

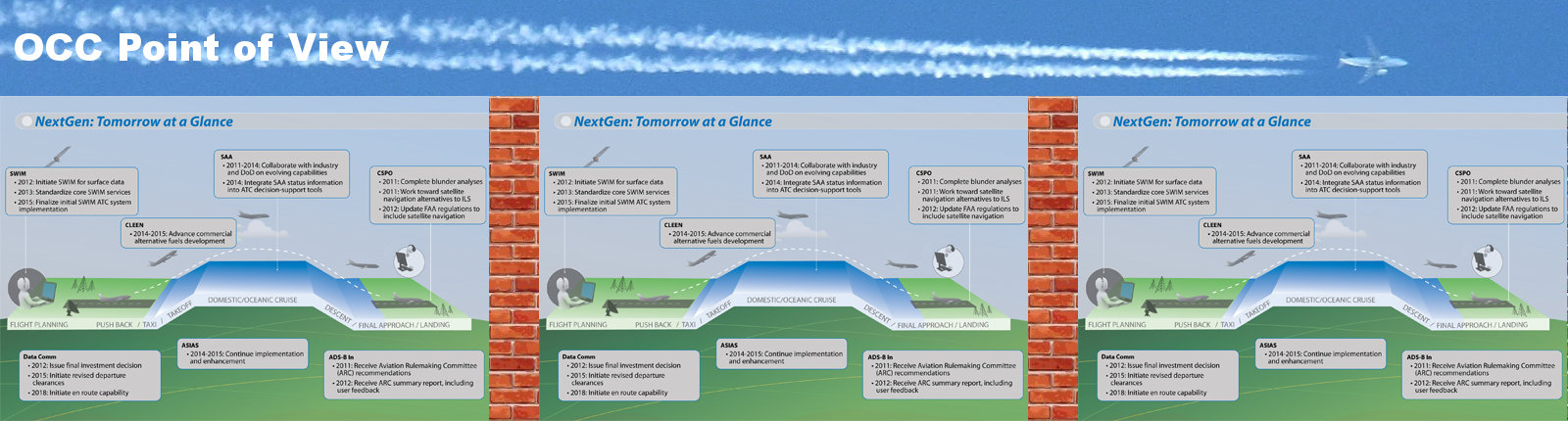

Returning from World ATM Congress in Barcelona (with the IHS Jane’s ATC Innovation Award in my baggage!), I think it’s time to address some feedback on an issue that I keep discussing in LinkedIn and elsewhere: The need to “link” the Airlines Operations Control Center (OCC) and the APOC (Airport Operations Center), the latter being a vital part in A-CDM.

Unfortunately, I see it happening frequently that these “control centers” live in their own little universe with little to no links to their peers. Talking about “Big Data”, Sabre as well as Amadeus and Travelport are “big data players”, though in danger to keep the silo thinking up too long.

Where Sabre once brought global e-Commerce to aviation, back in the 60s, back in the mid-80s, we installed the first Sabre Terminals in European travel agencies, aviation now stumbles behind on the possibilities of global e-Commerce, thanks mostly to technical limitations. As no-one wants to invest… If AA wouldn’t have invested at the time, where would we all be today? But is TPF (Transaction Processing Facility) still the core of our being? Or is it time to move on?

“When we are taught aviation at university we get the impression of how advanced aviation technology really is. When we start working, we are at awe, how little common sense or state-of-the-art is applied in aviation technologies.”

[a student at DLR German Aerospace Agency I recently talked to]

Some keywords what I mean to address here are definitions such as A-CDM (vs. CDM) and Departure – or concepts like Collaboration or Rotation

What is the difference between an Airline Operations Control Center (OCC) and an Airport Operations Center (APOC)? And what about the Air Traffic Control’s Network Management Operations Center (NMOC)? And where is the “collaborative aspect” in these?

Right now, they are just three different data silos and collaboration, where it exists, is on a very small local level.

The OCC focuses to limit the negative impact any disruptions have on the operation of any single aircraft in the fleet. The OCC is – so far – the only point that has a rotational point of view, looking at the entire rotation of the aircraft and trying to minimize the impact of disruptions not just on the flight in question, but for all the ones following that particular “segment” (flight A to B).

With increasing legal demand to reimburse passengers on late or canceled flights beyond the value of their net fare they paid, this is were money for the airline is burned. And impact of disruptions and delays at the airport or in the air space may be a nuisance for the work at the airport or the air traffic controllers, but they have a commercial impact on the airline:

With increasing legal demand to reimburse passengers on late or canceled flights beyond the value of their net fare they paid, this is were money for the airline is burned. And impact of disruptions and delays at the airport or in the air space may be a nuisance for the work at the airport or the air traffic controllers, but they have a commercial impact on the airline:

They are expensive.

Nevertheless, I seem to be rather alone in that point of view in discussions. Yes, there is an intellectual understanding at airports and ANSPs, but I have a gut-feeling, that it does not “compute” there really: Or why is it, that many ANSPs are not having their representative in the APOC? Not to talk about direct links yet. Or in the OCC? Or why do many APOCs not have direct (data) links to the OCCs of even their most important airlines?

One discussion a few days ago addressed the definition of “departure”. And it is such a basic difference in definition, it hit me like a hammer, making me understand the impact of that different perception! When air traffic control talks about departure, they talk about the take-off of the aircraft (ATOT). When the airline and airports talk about the departure, they often talk about the time, the aircraft leaves it’s parking position at the terminal or on the apron, the off-block-time (AOBT). I had trouble, understanding, why an airport should invest into a “Pre-Departure Sequencer” instead of a DMAN in the delair-definition. The difference is based on the same subtle misperception of departure. The PDS and most “DMANs” out there focus on the TOBT, taking somewhat into account the delivery of the aircraft “in time” to the runway. Based on a rather “static” assumption of ATC capacity. The DMAN in delair perception optimizes the “real” departure. Taking into account minimum separation of aircraft, depending on the Standard Instrument Departure (SID) route and other highly complex parameters, the DMAN calculates the best TOBT. Thus, no matter the general disruptions at the airport and the real throughput on the runway by ATC, it delivers as many aircraft as possible for departure. That maximises the throughput and in turn minimizing the recovery time after general delays or disruptions.

One discussion a few days ago addressed the definition of “departure”. And it is such a basic difference in definition, it hit me like a hammer, making me understand the impact of that different perception! When air traffic control talks about departure, they talk about the take-off of the aircraft (ATOT). When the airline and airports talk about the departure, they often talk about the time, the aircraft leaves it’s parking position at the terminal or on the apron, the off-block-time (AOBT). I had trouble, understanding, why an airport should invest into a “Pre-Departure Sequencer” instead of a DMAN in the delair-definition. The difference is based on the same subtle misperception of departure. The PDS and most “DMANs” out there focus on the TOBT, taking somewhat into account the delivery of the aircraft “in time” to the runway. Based on a rather “static” assumption of ATC capacity. The DMAN in delair perception optimizes the “real” departure. Taking into account minimum separation of aircraft, depending on the Standard Instrument Departure (SID) route and other highly complex parameters, the DMAN calculates the best TOBT. Thus, no matter the general disruptions at the airport and the real throughput on the runway by ATC, it delivers as many aircraft as possible for departure. That maximises the throughput and in turn minimizing the recovery time after general delays or disruptions.

All that though happens at the given airport, i.e. Zürich. Talking with airports about departure management, the issue is about always that ATC (the ANSP) does not participate in the departure management, does not provide the needed information and – heresy! – how could we just imply that we could sort out the sequence for the air traffic controller? It works in Zurich? Heresy!

Is A-CDM not an FAA and Eurocontrol requirement? Burn it at the stake!

The impact of the aircraft rotation and why A-CDM is something airlines should consider linking OCC to APOC, consider to spend time though the ANSPs who initiated the entire process are the ones stumbling behind their once shining visions of collaborative approaches:

Because the ANSP thinks in “Silo” and leg (flight from A to B).

A friend just recently told me about a major market, offering free access to the excellent flight-data for all flights within the region to the ANSP of a neighboring region, giving this to be offered in reverse to them. The neighboring ANSP (smaller) is not interested, the data is for sale. And they don’t see the additional value having access to the live flight data offered to them. Excuse me? That is Silo thinking.

And that is, why aviation technology today is way behind other industries. Because there is still silo-thinking. “Collaborative Decision Making” is a nice concept, but it fails real life on a large scale for the narrow-minded thinking of the people who’s job it would be to push the idea! It’s not about the bigger picture, but simply about own benefit. People call that “Greed” and it’s a mortal sin.

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

New Airport Insider recently published a blog by one of who they call the “Generation Y”, students, getting ready for the travel and aviation industry. What triggered my attention there was a very basic, though very common misperception, what I call “the inside-out-look”.

New Airport Insider recently published a blog by one of who they call the “Generation Y”, students, getting ready for the travel and aviation industry. What triggered my attention there was a very basic, though very common misperception, what I call “the inside-out-look”.

What’s wrong with that?

That is rather easy. If you provide flight services, you fly both directions. Worse, if you subsidize any airport, you likely do it to attract commerce to your region (tourism is commerce too). You likely don’t do it to make the people in your region to take their money elsewhere. As such, the focus of airports and politicians alike must be on the outside in, or as we say in the travel industry; the incoming.

In the example, which is very common, the French author considered “rail” a competitor to flight. Which is true on the inside-out-look, or outgoing, but it’s simply missing the point once you look outside-in.

Aside of Germany, France and a handful other nations, train is usually no issue. Within these countries, train is very competitive on the local market, especially the high speed trains like French TGV or German ICE. But now I go abroad. Into another country. I go into any travel agency, even in France or Germany and ask for international travel. Give me a guess: How often will they offer you train, even i.e. Paris-Frankfurt? All they intuitively look for in phase 1 is “flight”. Is the city the client wants to connect to bookable on the GDS (Global Travel Booking System)? If not, the agent (hopefully without showing you) rolls the eyes, curses you and starts looking up how the f*** to get you to that godforsaken town you ask for…

Aside of Germany, France and a handful other nations, train is usually no issue. Within these countries, train is very competitive on the local market, especially the high speed trains like French TGV or German ICE. But now I go abroad. Into another country. I go into any travel agency, even in France or Germany and ask for international travel. Give me a guess: How often will they offer you train, even i.e. Paris-Frankfurt? All they intuitively look for in phase 1 is “flight”. Is the city the client wants to connect to bookable on the GDS (Global Travel Booking System)? If not, the agent (hopefully without showing you) rolls the eyes, curses you and starts looking up how the f*** to get you to that godforsaken town you ask for…

In short: If you have an airport “nearby” with scheduled services that link you into the global aviation networks on the GDSs (connections are important), you are visible. Else, you’re an annoyance. If there is an airport “nearby”, travelers may take train, bus, rental car or taxi for the remainder of the trip.

Likely, not knowing the language, maybe not even the local alphabeth, it’s going to be a taxi or a car from a large (global) rental car company offering navigation system. Or a personal pickup…

Likely, not knowing the language, maybe not even the local alphabeth, it’s going to be a taxi or a car from a large (global) rental car company offering navigation system. Or a personal pickup…

Later, the train may become a competitor. But that’s another story. To trigger global commercial interest, an airport is a strategic answer.

But not just the airports, but also the connectivity by scheduled flights, which can be booked in the GDS, connecting the airport to the global aviation networks! Second lesson, most local-minded politicos miss to understand with their inside-out-look…

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Aside other sources, I copy the content of that news with kind approval of Momberger Airport Information:

Passengers travelling with British Airways through London Heathrow Airport Terminal 5 have begun to test the personalized digital bag tag being developed by the airline. Microsoft Employees have been chosen to take part in a month-long trial, using a specially adapted version of the British Airways app, to provide essential feedback that will help shape the final product. The digital bag tag, which contains all of a passenger’s baggage details, could eventually replace the need for a new paper tag for every flight. Comprehensive testing of the tag has already taken place to make sure that it works in a live airport environment and can stand up to the rigours of airport baggage systems and everyday travel. Customers on the trial will use a Nokia Lumia Windows smartphone to check in, chose their seat and obtain their mobile boarding pass. Each will be equipped with a specially adapted version of the British Airways app, which automatically updates the digital bag tag with a unique barcode, containing new flight details and an easy-to-see view of their bag’s destination – just by holding the mobile phone over it. They can then save time by quickly dropping their bag off at a dedicated bag drop desk, before going straight through security. The personalized digital bag tags have been specially developed by British Airways, in partnership with Densitron Displays, and Designworks Windsor. #963.AIT4

These news upset me as much as the one I read about Amadeus trying a bag tagging based on 3G-technology. Or Air France and other airlines introducing “home-print” bag tags.

As I mentioned two years ago in my little article about a possible check-in-scenario for 2015, I would see a far more reasonable approach (and easy/fast to bring to market) by the aviation industry to use established standards. Why do they use a QR-code with a modified layout? Anything to hide? Or simply to do it different? Which by the way equals “more expensive”, faulty and slow. And – worse of all: Incompatible like VHS and Betamax…

Why do they try to implement and sell expensive, non-industry-standard-compliant stuff here? Why not using existing and proven technologies like RFID or the newer (but to be standard) NFC? Why force me to use an “App” (and where can I get online when being abroad?) or even worse, an expensive 3G-Network technology?

In addition to my (somewhat delayed) prediction about Check-in 2015, I’d also like to see a common free airport WiFi system; wherever an airport offers free WiFi, it’s a common log-in worldwide. Maybe even the same for inflight, just a quick cost note if not free. Or at least a common log-in-process. Enabling to register “globally” is an added value for the Jet Set. And would encourage safer WPA2-connections. “CDM” in action – across aviation industry stakeholders 😉

I’m allowed to dream, right?

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

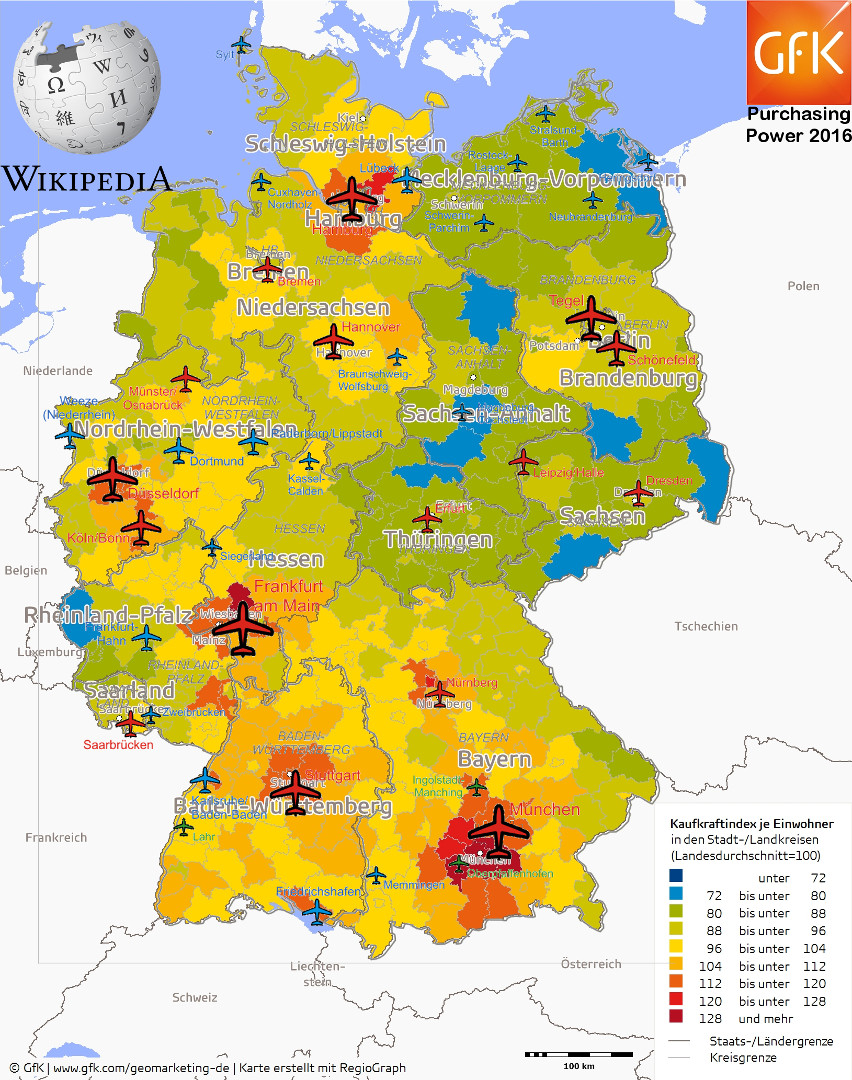

If you ask yourself, why Germany and Europe and their Aviation Industry stumbles behind on a global scale, ask our politicians! Ask them why new airports are being built in Turkey (+150 Mio. passengers) and Dubai (+160 Mio. passengers), triple the capacities of Frankfurt (56 Mio. passengers), more than double that of London-Heathrow (70 Mio. passengers). Each! More even than all London Airports together have – and they operate at their limits, new expansion stalled in bureaucracies. And ask them, why German Airlines go bankrupt (Augsburg Airways, Cirrus Airlines, Contact Air, OLT, …), struggle to survive (Lufthansa) or are already steered by Arabs (i.e. Air Berlin, Darwin Airline) … Our answers? “Air Passenger Duty“, night curfews, stop of 3rd runway in Munich (instead of Transrapid), Capital Airport disaster in Berlin, etc., etc.

There was a time, when German Lufthansa was the measure of all things. Without Lufthansa, i.e. the Boeing 737 would never have been build, nor become the most successful airplane type of all times.

Today the big shots are called by the Arab airlines, Emirates wiht 39 Airbus A380 just ordered another 140 of that mega-airplane, their fleet of 200 aircraft triples with more than 400 new aircraft on order. And Lufthansa’s Star Alliance partner Turkish Airlines doubles the fleet, adding almost 200 to the existing 200. And as mentioned, Istanbul gets another airport (they have two already) for another 150 million passengers, three times as many as Frankfurt manages today.

Lufthansas order list may look similar, but most of the aircraft needs to replace older generation “gas hogs”. And with 10 A380 and another four on order, with 29 747 with just 10 new on order, Lufthansa is in no position to play in the same league as an Emirates.

As Carthage and Rome have been the centre of the world in there time, as was Genoa (Columbus) or Bombay. Always the metropolises where strategically located at trade routes. And as shipping (the one on the water) got competition by rail, street and aviation, developments in aircraft construction shot airports like Shannon or Anchorage into the insignificance of history.

My former boss compared this with the old American railroad tycoons. Their self-conception was to build rail tracks and operate large iron horses, not the mass transport of people and goods. As the first aircraft were developed, they belittled these developments. As the World Wide Web developed, Microsoft belittled this development and to date limps reactively behind current developments (the Windows 8 Apps are simply uncompetitive compared to their Apple paragons).

My former boss compared this with the old American railroad tycoons. Their self-conception was to build rail tracks and operate large iron horses, not the mass transport of people and goods. As the first aircraft were developed, they belittled these developments. As the World Wide Web developed, Microsoft belittled this development and to date limps reactively behind current developments (the Windows 8 Apps are simply uncompetitive compared to their Apple paragons).

And currently, the politicians of the “industry nations” miss to set the right tracks for the future. Would Moscow get the Russian corruption in check, no politicians would dare to challenge the authoritarian regime of this resource rich country. Just as they handle China with velvet gloves, knowing exactly that money rules the world and in the end, if they want to “profit” from the business, they dodge their high moral and ethics first… And aviation is simply a punching ball for them, screaming “noise” and “pollution”, no matter the major, largely unsubsidized developments in quieter and fuel efficient aircraft… Yeah, don’t think, just hit’em and milk’em!

And currently, the politicians of the “industry nations” miss to set the right tracks for the future. Would Moscow get the Russian corruption in check, no politicians would dare to challenge the authoritarian regime of this resource rich country. Just as they handle China with velvet gloves, knowing exactly that money rules the world and in the end, if they want to “profit” from the business, they dodge their high moral and ethics first… And aviation is simply a punching ball for them, screaming “noise” and “pollution”, no matter the major, largely unsubsidized developments in quieter and fuel efficient aircraft… Yeah, don’t think, just hit’em and milk’em!At the same time Lufthansa impairs it’s cooperation with Star Alliance Partner Turkish Airlines, with the reasoning that they would “unfairly” pull longhaul passengers to their hub in Istanbul. “Obstinacy” you call that I think. Because factually, in the current political sludge and struggle for survival, Lufthansa has nothing substantial to counter such developments

Aviation in Europe: Lufthansa and Air Berlin have rested too long on their successes, Western politicians simply understand aviation as a milk cow they can drain, ignoring the negative repercussions to commerce of their decisions against aviation development. Even Ryanir “stumbles” and frantically tries to reshape the own, aggressive business model, replacing it in fact with a core-different business model. If that will succeed? I doubt it.

My expectations: One global hub will remain in Europe. With Easyjet and current focus by Norwegian, London has a good chance, if they get their capacity problems managed. London isn’t dependent on the drip of British Airways as are Frankfurt (Lufthansa) or Paris (Air France), being tied to these airling operators for the better or worse.

Passengers from or to Europe then will fly with regional feeder services into the real global hubs in Moscow, Istanbul, Abu Dhabi or Dubai. As a hub to South America Portugal could position itself, but also Madrid and Morocco (outside the EU) are showing ambitions, a prophecy being rather risky there.

The traffic and commerce streams are changing. And I have concerns about the ability of the industry nations politicians to realize that the world suddenly bypasses them. And when they wake up, it will simply be too late.