… and the Ongoing Demise of Small and Mid-Sized Airlines

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at American Airlines to Seattle to pick up their first 737s, an airline I have had a personal attachment to, went into insolvency grounding all aircraft after many years of financial losses. The demise of Air Berlin 2017 brought easyJet on their home-apron in Berlin in force, no longer some competition, but clear one-on-one. Such the chance to establish lucrative routes in Berlin evaporated. Instead of benefiting from the demise of their largest local competitor, Germania had to sit aside, watching the threat growing.

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at American Airlines to Seattle to pick up their first 737s, an airline I have had a personal attachment to, went into insolvency grounding all aircraft after many years of financial losses. The demise of Air Berlin 2017 brought easyJet on their home-apron in Berlin in force, no longer some competition, but clear one-on-one. Such the chance to establish lucrative routes in Berlin evaporated. Instead of benefiting from the demise of their largest local competitor, Germania had to sit aside, watching the threat growing.

Germania did, what they had to do, they focused on niches. Niches that were too small, to fragile to give them safety. Routes they developed well always threatened to be taken over by their competitors operating with lower cost. Erbil, under threat of war, Beirut, …? They announced a base in Pristina (Kosovo). They ordered A320neo, in an attempt to stay somewhat competitive to their competitors like easyJet also introducing the modernized aircraft. Else they operated tourism charter flights – which are in great demand in summer, but one after another airline in that market files for bankruptcy at the end of the season. And Germania published financial troubles as early as August 1st, 2018. So they could not do what needed to be done: Generate enough money in summer to succeed across the harsh winter.

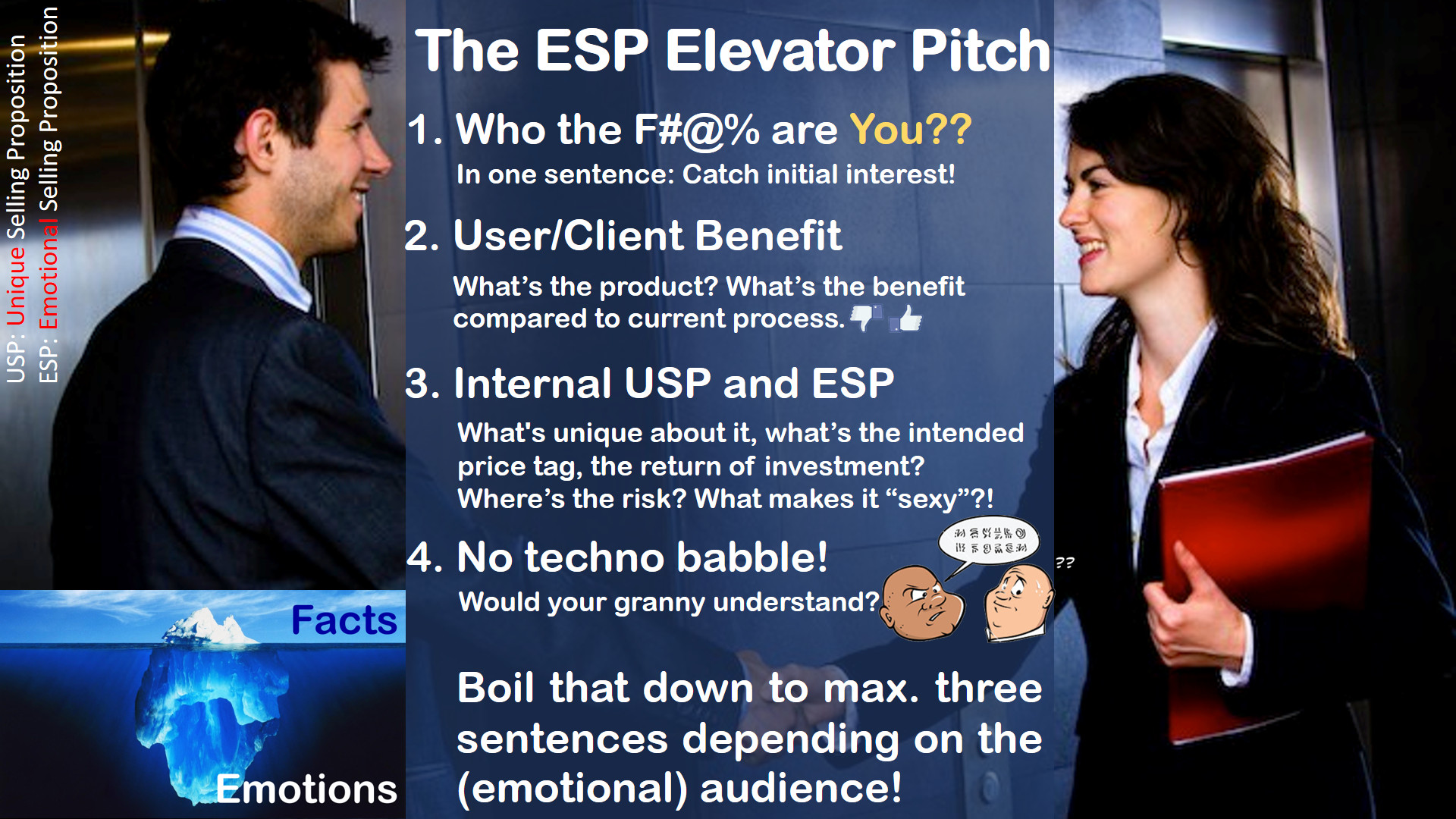

You cannot succeed if you play it small, if your cost is not competitive to your competitors. Not the small virtual airline competitors, the other “day flies” lasting one summer season, two at best, but the big ones. The easyJets, Ryanairs, Wizzes, etc. It’s not fuel cost development that kills you. It’s bad management. It’s a strategy without USPs or with very weak ones – there’s reason, the other airlines don’t bother the routes Germania did.

And as I outlined in an article I published on LinkedIn, this was no sudden issue, they lost money for years!

As it is being said, the unexpected increase on EU261-expenses, the “EU passenger rights” also had it’s impact on the financial situation. If you sell a ticket for € 100 and you must compensate € 300, it does impact your revenue. So back to the topic – flight disruptions.

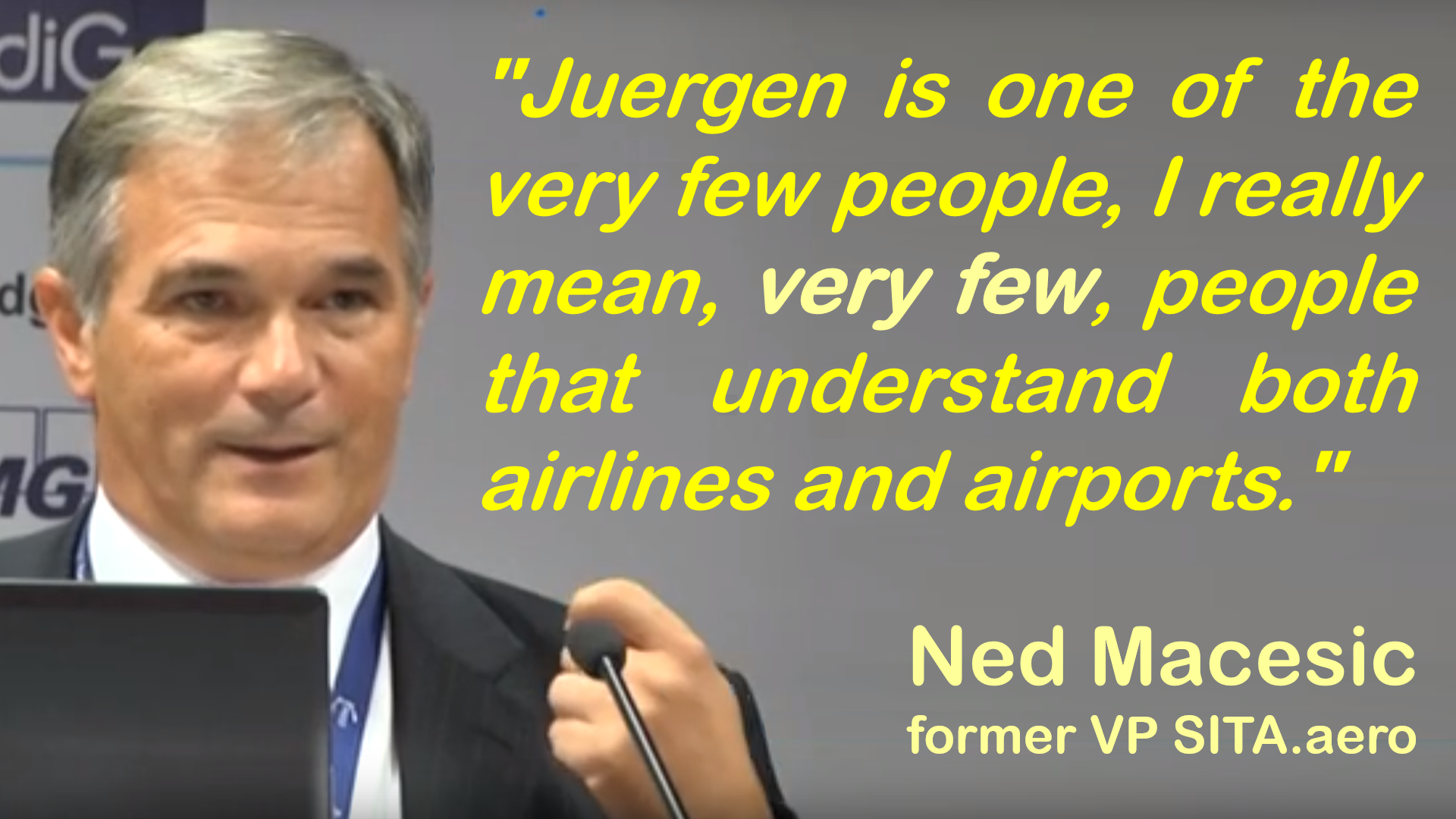

Having worked last year on the business plan for KOLIBRI.aero as well as on projects related to Airport and Airline Operations Control Centers, flight disruptions have reappeared as an ongoing topic of increasing concern. And my experience doing a study a few years ago at delair together with Zürich Airport (ZRH) about the impact of the deicing forecasting and management tool on Swiss (airline) operations at Zürich became a strong source for my advise to airport operations managers.

Having worked last year on the business plan for KOLIBRI.aero as well as on projects related to Airport and Airline Operations Control Centers, flight disruptions have reappeared as an ongoing topic of increasing concern. And my experience doing a study a few years ago at delair together with Zürich Airport (ZRH) about the impact of the deicing forecasting and management tool on Swiss (airline) operations at Zürich became a strong source for my advise to airport operations managers.

When working with ZRH “Ice Man” Urs Haldimann on the study, I also got some feedback from Swiss. While managing the deicing in winter is not that much a problem, neither airports, nor passengers understand the rippling effect to the schedule. And often enough, not the airline’s own managers. That in the evening in warm Mallorca, the flight may be late, because of a deicing delay in the morning. So while higher force is accepted for the flight cancelled in Zürich, very often, the airline is required to pay EU Passenger “compensation” multiple the price for the ticket. So a major delay can be far more costly than just related to the immediate flight.

The harsh winter 2013/14 in North America (as likely this recent one) became known in the deicing industry as the Polar Vortex. The accumulating delays forced JetBlue into a “two day network reset”. Crews and airplanes were anywhere but where according to schedule and crew planning they were suppose to be. It took the better part of two days to relocate aircraft and crews back to the planned position, also to make sure the crews received their legally due rest, to then start the new day with a fresh start. As needed as that decision was, imagine the impact to passengers on flights that are booked usually 80-90%.

Disruptions can also be thanks to airport closures for other reasons, delays can be caused by as trivial as a broken baggage belt, a common thunderstorm or a ground handling crew doing a coffee break in the wrong time window – all things I experienced in my professional life. Flight crew duty times and technical delays are more common. Did you know that the Top 10 of “punctual” airlines have 15-20% of their flights delayed? That means 1 out of 5 flights is late. To “celebrate” such achievement is beyond me, I honestly feel embarrassed that our industry cannot do better! Don’t come with the typical “explanations” covering for the incompetence to do better. Needless to mention that this is about “departure delay”, whereas passengers truly don’t care about those as long as the flight arrives on time, right? I was recently on a flight that left “on time”. Doors were close, the aircraft was sitting at the gate, waiting for it’s slot in the deicing and departure.

More recently, Primera Air, Azur Air or Small Planet Airlines closed down. Cobalt Air followed shortly after I published the blog post. At least for two of those airlines the cause was said by their respective CEOs to have been “unexpected” cost for delays and disruptions. Though not reconfirmed, rumors have it such were also the cause for the financial troubles Germania faced in Mid-January 2019, filing insolvency early February (see P.S. above). “Refund portals” organizing refunds for delayed passengers result in higher number of refunds. Small fleets with no spare aircraft causes the ripple-effect to sometimes swap over into the next day(s).

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

What I expected quite a while ago is the information of upcoming delay situation to the inbound planned airlines. The example I keep using: Once Zürich (or any other airport) learns about arrival-, turnaround- or departure-delays would inform KLM before their flight leaves, that it would likely develop delays in Zürich and may have an excessive delay departure, maybe KLM would cancel the flight?

The concern: But if those airlines cancel their flights, then the flights will leave early, so KLM could operate on-time…?

Ain’t that shortsighted? Oh holy dear Saint Florian – don’t burn my house, take the neighbor’s one…

So what would be needed would be a bonus/malus system. If an airline “volunteers” for the sake of the overall operation, to cancel a flight in such a situation, maybe it’s relatively empty, could be merged with the following flight – the airline gets a priority the next time, so the full flight gets an on-time departure. An airline deciding not to join that system will never get prioritized and take what they get – including the delays.

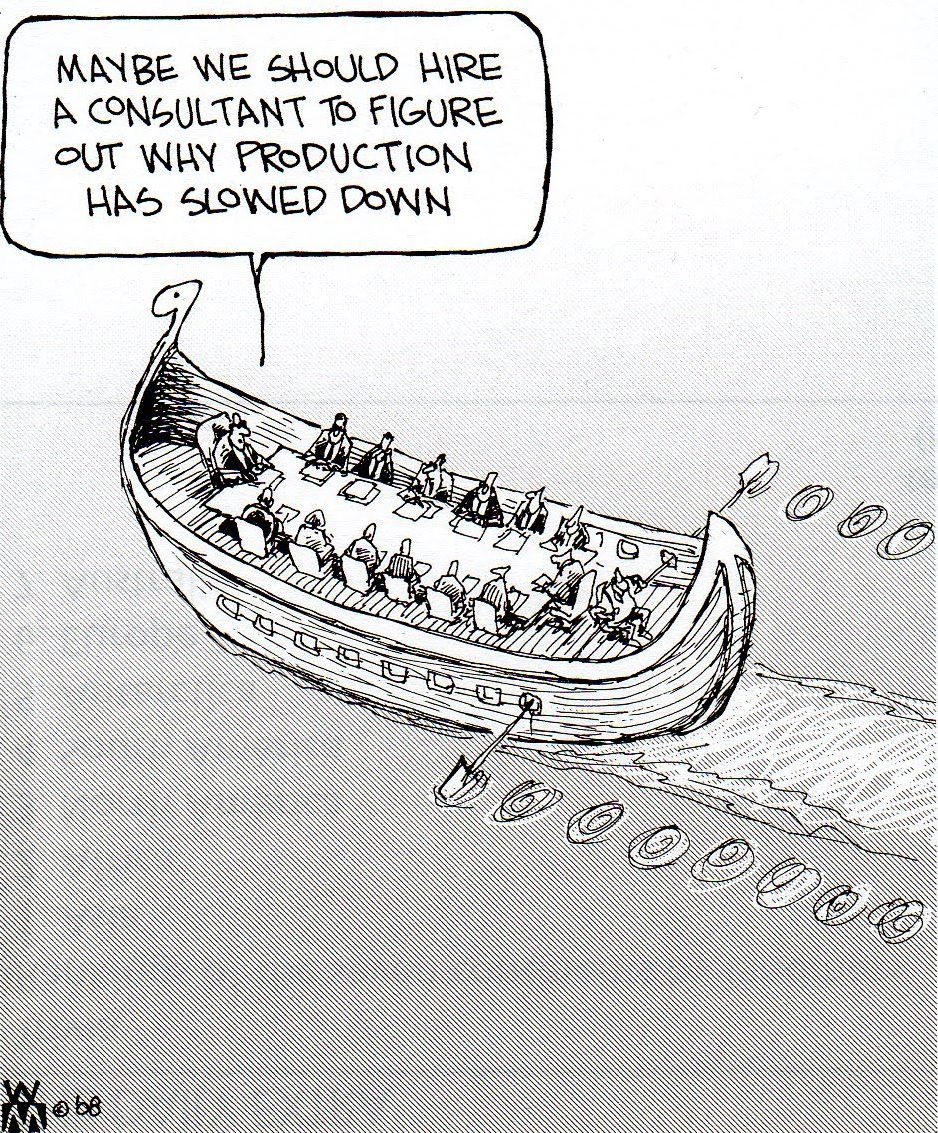

Another ongoing discussion is the promotion of the big players for “SaaS”, Software-as-a-Service, more commonly known as “Cloud Computing”. What in my experience lacks of one vital thing, the fallback for a “line down”. There have been three cases that I (just me) know of last year, where line-down caused major flight delays. Because there is no fall-back in place.

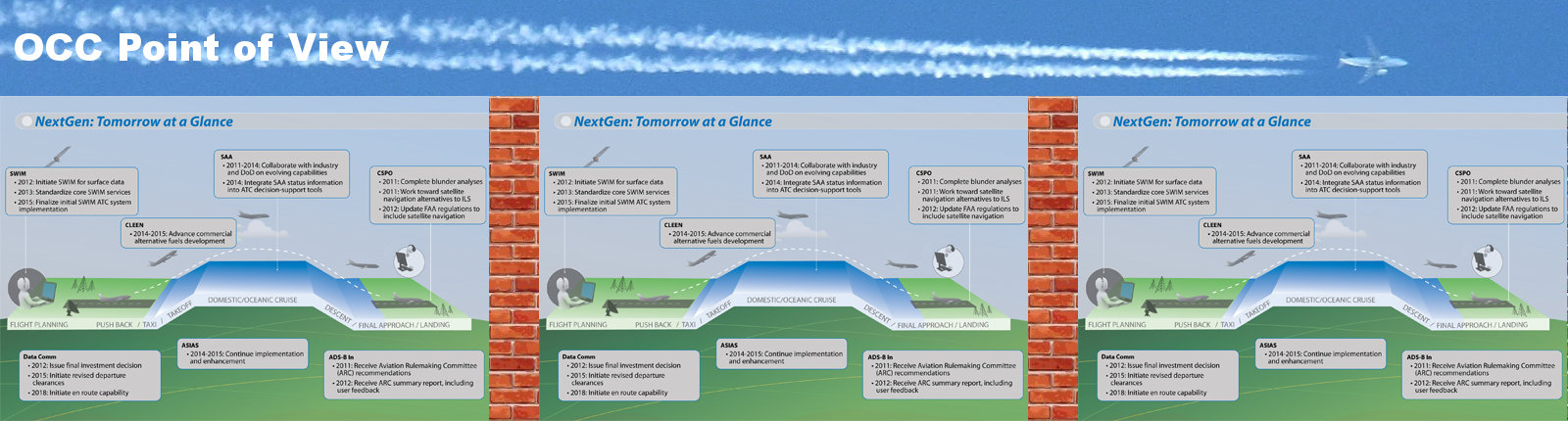

That problem is multiplied by data silos. As Daniel, VP at IBS points out, there are too many screens an operations manager in the typical airline Operations Control Center (OCC) or also in the AirPort Operations Center (APOC) have on their desk, using old-style Gantt-charts, weather maps and other “sophisticated tools” that show them what happens out there. Very little tools that analyse the data automatically, giving you decision support on a disruption. Or warning you of potential disruptions giving you decision support how to avoid them.

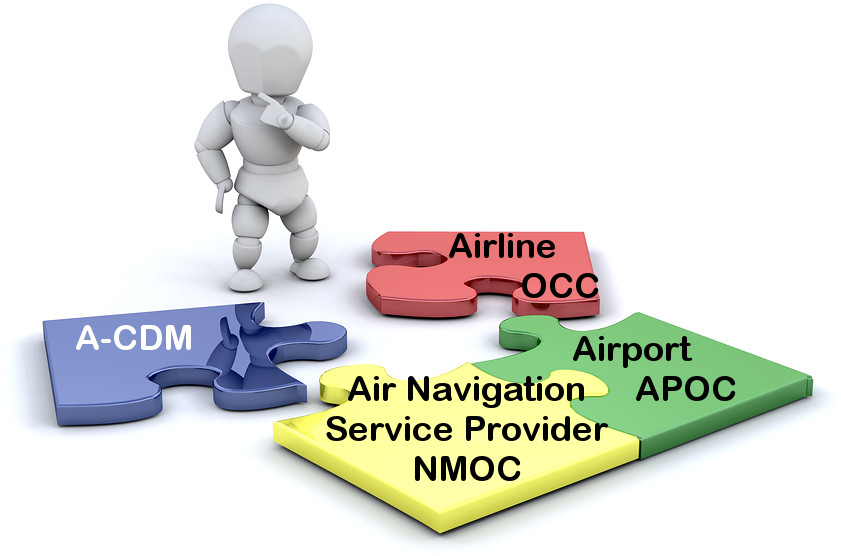

While we do need to replace those multiple screens with dashboards, highlighting what to look at, I disagree to some extend with Daniel’s implications, as I believe we will need to be able to expand from the problem, onto the relevant Gantt charts, graphs, tables and maps. Worse in my eyes is the underlying reason for those screens, as they are clearly attributed to data silos. And if the left tool does not know what the right does, if the airport, the ground handler, the airline have different “realities”, no wonder we have friction that results in ineffective operation causing “issues” and delays. As I mentioned in my article about APOC, OCC, NMOC five years ago. And if I ask about interfaces and am told “XML” or “ASCII”, we talk about triggered “push” or “pull”, but not about a live interface. Another data silo.

Coming back, to close this FoodForThought-article, let’s come back to Germania and other airlines which we have lost recently. If you have no assets (aircraft leased or sold/leased-back which is the same), if you outsourced everything (to which I include “cloud”), if you don’t have “spares” for covering up disruptions, you make a very good business case on the old joke: “How do I become a millionaire in aviation? I start with a billion.” Or the other one: “Saving, no matter the cost”. It’s called a “virtual airline”. And I predict we see increasingly those virtual airlines to fail, as they lack size, assets and revenue (RASK) to compete with their competitors.

Food for Thought

Feedback welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Now all those airlines have operated Airbus A320 and/or Boeing 737. An aircraft in surplus, a saturated market, flooded not only by the aircraft makers but also by lease offers from the low-cost airlines seeking utilization for their own surplus. And while everyone wants aircraft in summer, the eroding revenues do not pay enough for those airlines to survive the winter. I learned so long ago, an ice cream shop needs to create enough revenue to survive the winter.

Now all those airlines have operated Airbus A320 and/or Boeing 737. An aircraft in surplus, a saturated market, flooded not only by the aircraft makers but also by lease offers from the low-cost airlines seeking utilization for their own surplus. And while everyone wants aircraft in summer, the eroding revenues do not pay enough for those airlines to survive the winter. I learned so long ago, an ice cream shop needs to create enough revenue to survive the winter.

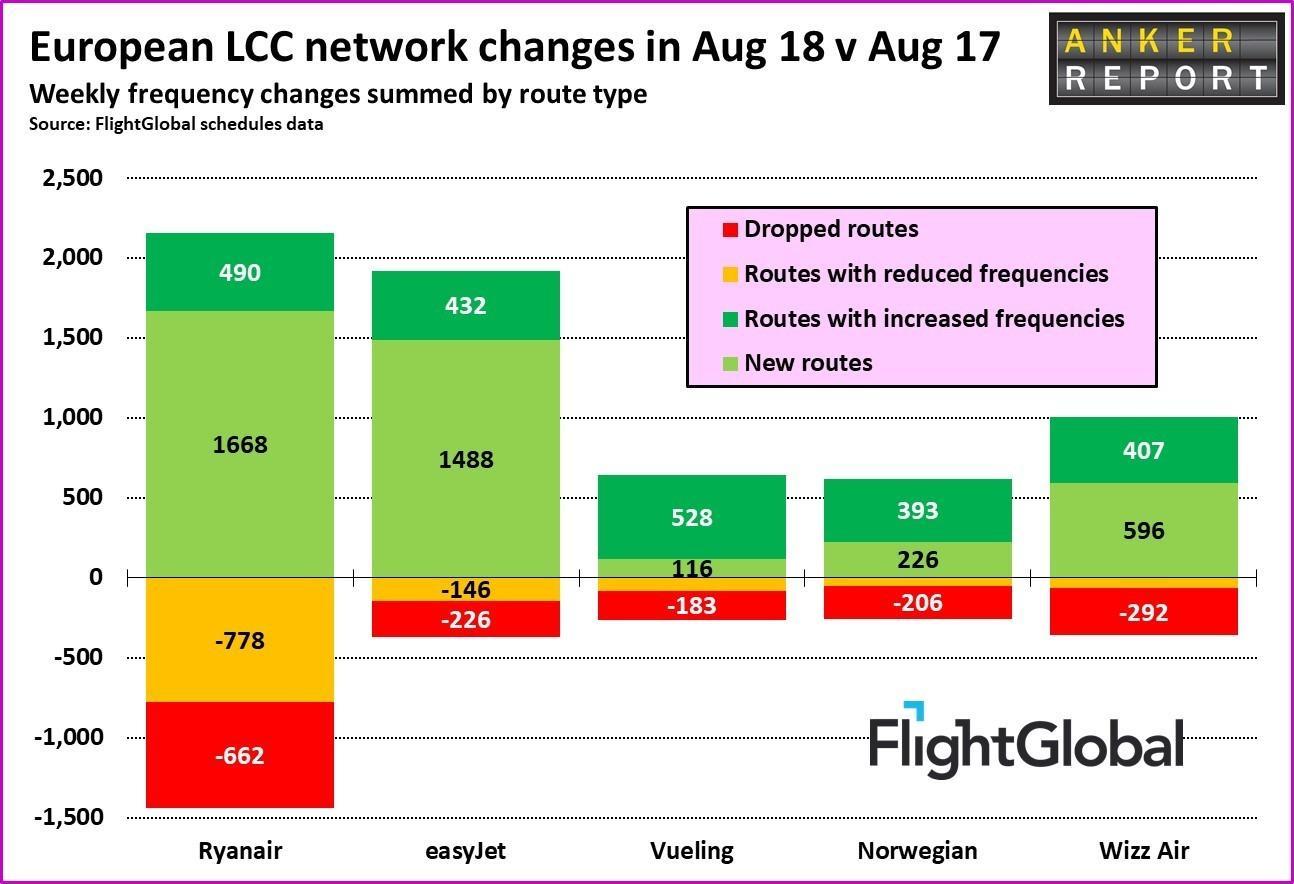

Then we come to the flight crews. While pilots usually are either type-rated on the Airbus A320-family or Boeing 737-family, a mixed Boeing/Airbus-fleet either requires respective crews for each aircraft or the cross type-rating. While pilots usually pay for their flight training, in return, they require high salaries in order to pay off for their – substantial – investment. Even Ryanair now faces the consequences of their “outsourcing” and slave-kind payments of their pilots. While I keep seeing their pilots recruiters immediately jumping on Primera Air but also trying to convince pilots from South America or Asia, if they don’t change their attitude to their pilots, they will keep having problems. Their recent announcement to close the base in Bremen and Eindhoven and reduce the base in Weeze are simply puffing. As Ralph Anker showed in his

Then we come to the flight crews. While pilots usually are either type-rated on the Airbus A320-family or Boeing 737-family, a mixed Boeing/Airbus-fleet either requires respective crews for each aircraft or the cross type-rating. While pilots usually pay for their flight training, in return, they require high salaries in order to pay off for their – substantial – investment. Even Ryanair now faces the consequences of their “outsourcing” and slave-kind payments of their pilots. While I keep seeing their pilots recruiters immediately jumping on Primera Air but also trying to convince pilots from South America or Asia, if they don’t change their attitude to their pilots, they will keep having problems. Their recent announcement to close the base in Bremen and Eindhoven and reduce the base in Weeze are simply puffing. As Ralph Anker showed in his

BlueSwanDaily believes in the future of

BlueSwanDaily believes in the future of  I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

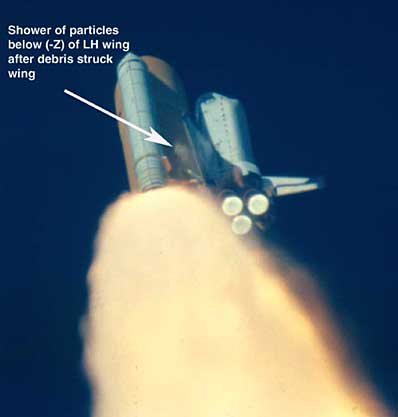

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

20 years ago (!) my friend

20 years ago (!) my friend

Clear as can be, there is no “software panacea” either. In North America, the closest thing in my experience is

Clear as can be, there is no “software panacea” either. In North America, the closest thing in my experience is

Ryanair

Ryanair Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

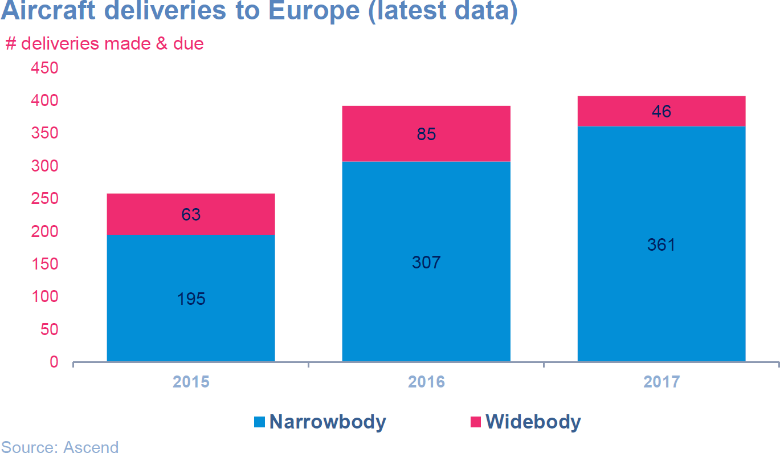

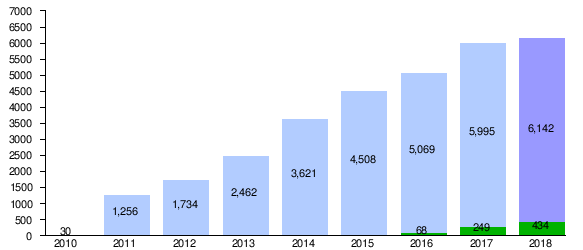

Another issue is a feedback I got from a financial expert. There are financial funds for aircraft. All those funds currently suffer as soon as the initial leasing is over from eroding revenue, often resulting in substantial financial losses even before the end of the first 10 years. Thanks to the eroding prices of A320 and B737 aircraft, thanks to the low cost airlines passing on the substantial discounts they received from the aircraft makers on their mass-deals, result in a faster drop of value than anyone anticipated. As FlightGlobal reported already back in 2014 in their special report

Another issue is a feedback I got from a financial expert. There are financial funds for aircraft. All those funds currently suffer as soon as the initial leasing is over from eroding revenue, often resulting in substantial financial losses even before the end of the first 10 years. Thanks to the eroding prices of A320 and B737 aircraft, thanks to the low cost airlines passing on the substantial discounts they received from the aircraft makers on their mass-deals, result in a faster drop of value than anyone anticipated. As FlightGlobal reported already back in 2014 in their special report  With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut?

With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut?

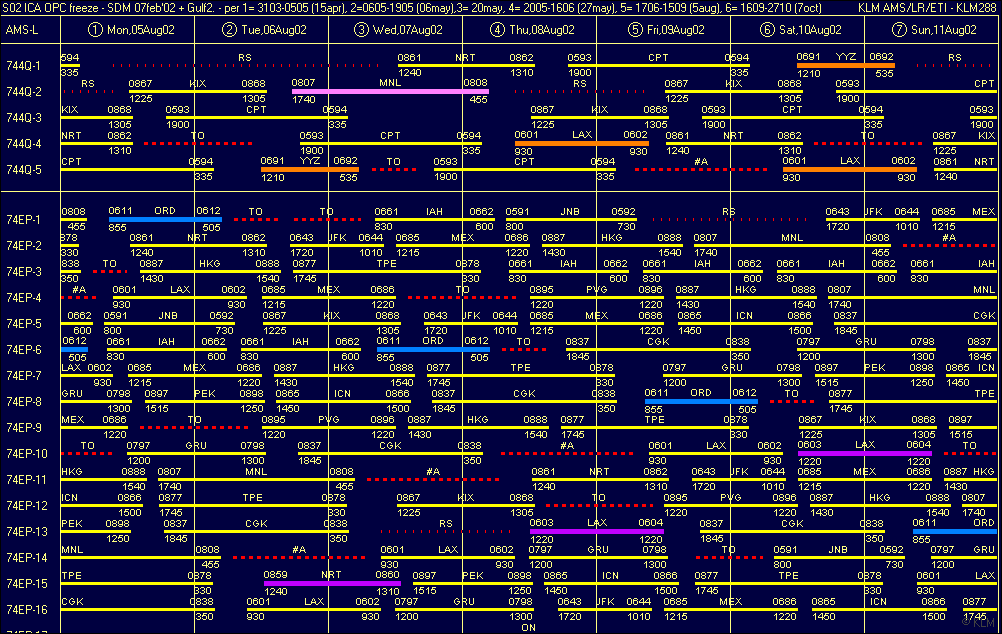

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket!

While doing the research at late delair for the Zurich Airport case study, focusing on the impact of a contemporary deicing management, just that improvement in (IT-supported) process saved about 20 million in one winter alone there. For Swiss (about 50% of the flights). Now working on a financial summary that thanks to the acquisition of delair by SITA never made it “to market”, I spoke with the OCC (Operations Control Center) manager of Swiss in Zurich. Who confirmed what they all knew (and know), but their management remains blissfully ignorant about: It is all about rotations in an airline. The aircraft starts somewhere in the morning and flies to different places throughout the day. And a disruption or delay anywhere en-route is prone to impact the entire rotation. Worse, a late aircraft usually accumulates more delays as ground handling is also tightly scheduled without spare manpower to cover up for such situations. Then crews fall out of schedule as they have to have their rest times. And while the airline may reduce the financial damage by calling for higher force on a snow event in the morning, on the flights down the line, I am told they tend to pay. And passenger compensation often exceeds the value of a single ticket! In 2014 I wrote

In 2014 I wrote  And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.

And while the airlines benefit, I hear from the airports that they do not show any interest in A-CDM and A-CDM improvements. While they cut into the flesh on most airport’s fees, while they let them starve; while most airports need to invest heavily to compensate the losses from “aircraft handling” by doing their best to increase “non-aviation revenue”, while this is daily life today, airlines demand airports to invest into those technologies and development and process improvements, but are not willing to pay. Did Swiss pay a Penny (Rappen) for the improved deicing at their home airport? Make a guess.

While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple.

While the first may be a career move for Dame Carolyn McCall (and that is all that counts from any employee view), it is a tragic loss to our industry. And I might be wrong, but I believe this will be similar to the loss of Steve Jobs at Apple. easyJet on the Move?

easyJet on the Move? A320/321neo. A Change-Maker?

A320/321neo. A Change-Maker? Quo Vadis easyJet?

Quo Vadis easyJet?