Two (good) articles today about the riskiness of starting up an airline and the comments they got shared with, triggered some controversial thoughts with me.

The Articles + Comments

OAG summarized on the Evolution of airlines since 2019 (just before the Pandemic) to today. While their findings are very interesting, there is a tone in the summary and a resulting summarization by Tim (someone I generally value) that I happen to disagree with. OAG’s John Grant wrote:

OAG summarized on the Evolution of airlines since 2019 (just before the Pandemic) to today. While their findings are very interesting, there is a tone in the summary and a resulting summarization by Tim (someone I generally value) that I happen to disagree with. OAG’s John Grant wrote:

“Airline start-ups are incredibly difficult, cash rapidly disappears and securing the necessary operating licences frequently takes longer than expected and that’s even before sourcing aircraft, securing slots, avoiding the competition, and building all the necessary reservations systems and back-office support functions.”

And Tim shared the full post with a comment: “OAG is a great data resource for large scale review and schedule activity. This data really doe strike a chord. Airlines are a very risky business. This is very illustrative.”

The other one was an analysis by McKinsey, checking on the aviation value chain’s recovery shared by Patrick, which he introduced with these words: “McKinsey & Company has done an interesting analysis of the aviation value chain. For each subsector, they’ve calculated the “economic profit”, meaning (return on invested capital – weighted average cost of capital) x invested capital. In other words, are firms in that sector creating or destroying value? Their conclusion: only fuel suppliers and freight forwarders created value last year, and airports and airlines lost a lot!”

The Economist’s (My) Response

As an economist by original education and having experience with Startups and Business Angels, I do happen to believe in a sound “business case”. As an airliner, I learned with American to focus on the business case. Like to reconsider twice before approving any waiver on fare rules or trying to upsell to the more expensive (i.e. more flexible) air fare. But I also learned the value of a renowned brand (AA) and service. Or to treat your colleagues as your most valuable customers – they help you sell each and every day. And can ruin a customer relation as quickly.

As an economist by original education and having experience with Startups and Business Angels, I do happen to believe in a sound “business case”. As an airliner, I learned with American to focus on the business case. Like to reconsider twice before approving any waiver on fare rules or trying to upsell to the more expensive (i.e. more flexible) air fare. But I also learned the value of a renowned brand (AA) and service. Or to treat your colleagues as your most valuable customers – they help you sell each and every day. And can ruin a customer relation as quickly.

In “global fares training”, I learned the cost of a flight transfer, something that I never forgot; thanks Ruth King (our fares trainer), I will never forget you.

At Northwest Airlines, I learned that airlines and their managers just sold “cheap”. With full flights in summer season, the airline generated losses on the transatlantic flights. A lesson I’ve seen later over and again. Most sales staff had neither information, nor idea about the “yield” they had to generate to fly profitable. Northwest focused on a minimum yield (revenue per seat-mile) half of that of American. Then sold at that yield as the standard “special fare” and making group offers or “reseller-rebates” below that rate aplenty. As I summarized 2019 on my article about why airlines keep failing, “know your cost”.

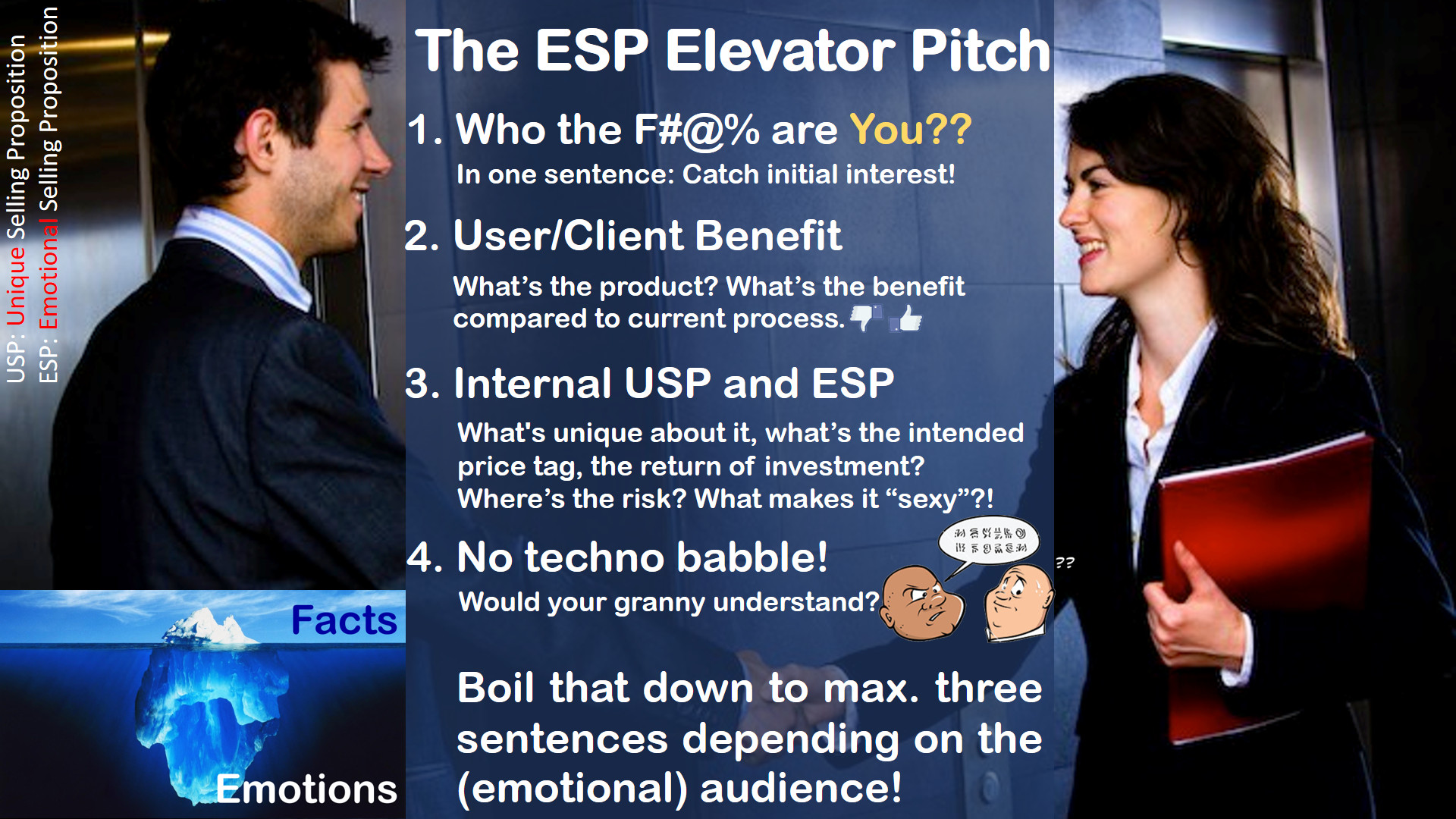

Yes, talking about Why Do Airlines Keep Failing. It’s the same response I have on the above two mentioned articles. And many like them. At ASRA 2008, I emphasized brand faces. But I also told those brand faces – the airline sales managers – that they are not there to sell the cheapest price. Anyone can do that, the Internet lives of that. A real sales manager understands that they have to sell the high-end tickets.

Live story, also happened today. Qatar Airways passengers (mother and three kindergarden-aged kids) arrived with >18 hour delay in Düsseldorf. German Rail (clerk) sold tickets to the customer to pick up the passengers that are neither change- nor refundable. So they had to buy completely new (expensive) tickets. A good clerk of this company renowned for it’s unpunctual trains (<60%) would have mentioned the possibility of a flight delay and sold the slightly more expensive tickets that allow for a change. Or at least the optional insurance.

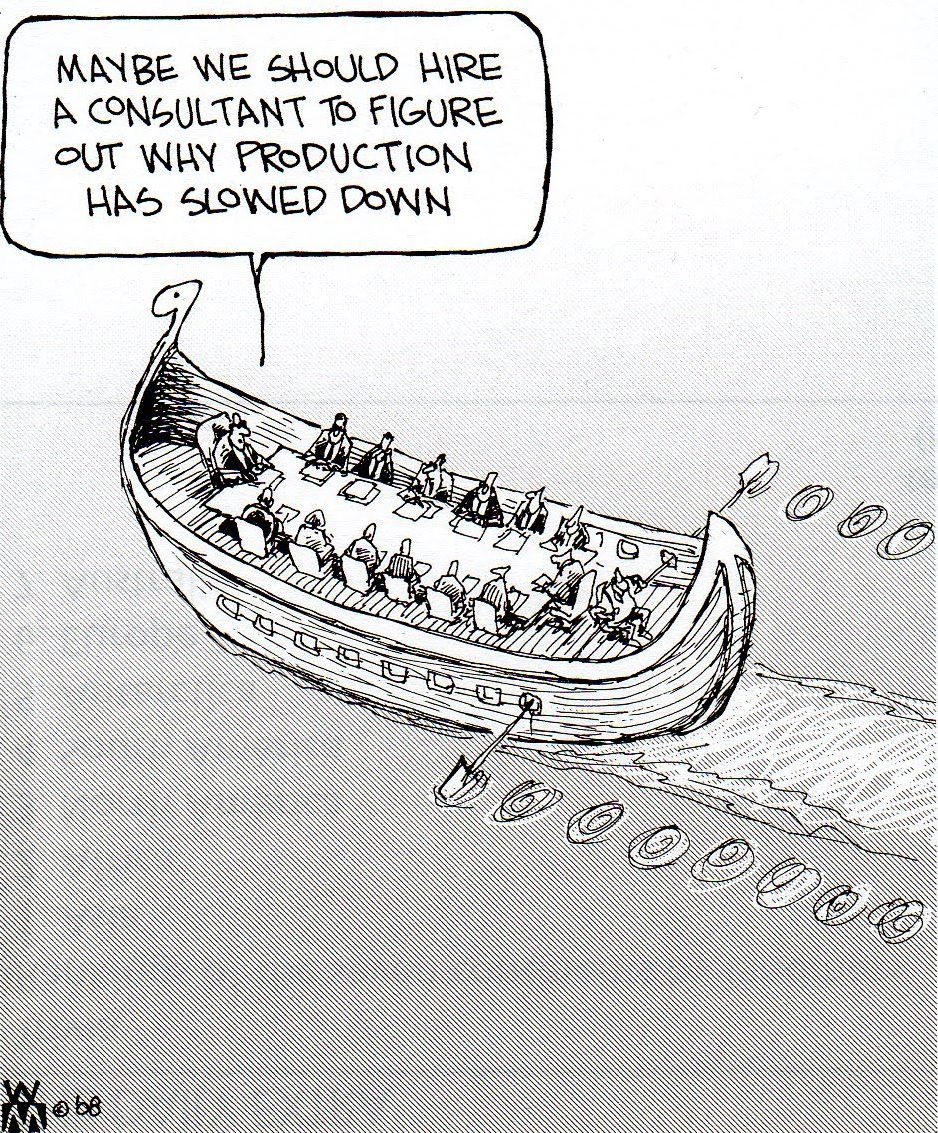

So thinking back to my experiences with Northwest and other such airlines, it’s my questioning about KPIs as well. If my KPI is load and not revenue, I must expect to loose money. It remains beyond me, why airlines offer connecting flight at what a rough calculation on Ryanair or easyJet CASK/CASM (cost per available seat km/mile) proves as below cost, even without the “stop en-route” (landing fees, complexity, etc.). Those are managers who had a nap, when their tutors talked about sound economical calculation? And I keep questioning, why airlines publish loads without revenue per seat. To date, we have hundreds, if not thousands of flights every day, that fly full but loose money. All this is confirmed by the above mentioned and many other such articles.

The Fairy-Tale of Loss Making Airlines

To claim “aviation” is a loss making business is true and can’t be further from the truth.

To claim “aviation” is a loss making business is true and can’t be further from the truth.

Yes, many airlines are loss making. And it fits the common reasons I elaborated before. And yes, you can make airlines very profitable, if you have a management that thinks just a bit outside the box and applies economic rules to their modus operandi (mode of operation). But this also goes in line with route development and other areas. If you don’t have your numbers under control and focus on the ones that are “good to sell to shareholders”, you’ll fail.

Like with any company, with any startup, in and outside the aviation sphere, we must constantly have an understanding of our cost. And of the competition. What is it our customer wants? There is a psychological price. If you missed that in your economics studies, make your Internet-search for it now. If you have sales teams, train them to upsell the seats. Sell the higher yield fares. Not at a discount, but at a value!

This is one reason, I do not believe we can make Kolibri ever happen by taking over an already failing or failed airline. Wrong structures, wrong thinking in place. I learned this lesson with Air Berlin. The force of inertia was simply too strong. There are some airline that make revenue, but even their managers I find often blindly “follow the worms” (a Pink Floyd referral, yes, the picture is lemmings).

This is one reason, I do not believe we can make Kolibri ever happen by taking over an already failing or failed airline. Wrong structures, wrong thinking in place. I learned this lesson with Air Berlin. The force of inertia was simply too strong. There are some airline that make revenue, but even their managers I find often blindly “follow the worms” (a Pink Floyd referral, yes, the picture is lemmings).

(That’s) The Way Airlines Operate

But unfortunately, all investors we talk to, always think inside their boxes. Can’t tell how many talks I had to radically change our approach and take A320 and do like everyone else does. Ain’t that contrary to the concept of Unique Selling Propositions?

And has ever a “disruptive investment” (another investor buzz word) been developed out of the box using the same thinking? The same values (I’m the cheapest)?

The others are usually starting to tell you that you have to start with smaller amount of money. Sure way to burn your money is a cheap business plan. As OAG writes “getting to size is so important”. You can’t produce a low cost in small numbers. For us, the ideal mix is seven aircraft, where the “administrative overhead cost” becomes manageable. i.e. You have the same cost if you maintain one – or seven aircraft. The same reservations office (just less staff and calls), only little less marketing. You must outsource your operations (at cost) to share the necessary organization with other small airlines. Etc., etc.

To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

But even taking that into account, we believe the business and financial plans we developed are sound. And profitable from the outset. With a focus on services and a military-style responsibility “for ours” (no “HR” in that company), a “service-focused concept”. Everyone to pull on the same side of the rope. Yes, not starting with a dead corpse, trying to revive, adds some bureaucratic hurdles. But it allows you to think outside the box and instead of following the worms (or other airlines), to do things “right”.

So ever since I entered into the business, I learned at American Airlines under Bob Crandall how to do things right. And learned over and again that the same mistakes are made by short-sighted, narrow-minded managers. And I know all the reasoning used to distract and divert off the incompetence to operate an economically sound business. Usually, I account this as “no faith in your brand”. That then goes along with topics I mentioned before, like brand dissolution (airlines are often academic example), missing USPs, etc. – Cobalt CEO told me about their USP shortly before their demise “We are Cypriotic”. Seriously? When I started, Lufthansa was the brand. Lufthanseat was the employee. All employees of American Airlines knew “Proud to be AAmerican”. Then came the button counters. And mighty AAmerican was taken over by their once-small rival U.S. Airways. Another box of memories.

So yes, airlines are often a loss making business. With bureaucrats leading them into disaster. Sometimes fast, often times a veeeery long death. Air Berlin and Alitalia are very good examples. “Too big to fail”? Simply “prestigious”? And there are “the others”. Airlines that have an idea about what they are doing. That know their niche(s). That know their cost and marketing. That value their brand. That build a reputation. Until button counters (aka. bureaucrats) take over.

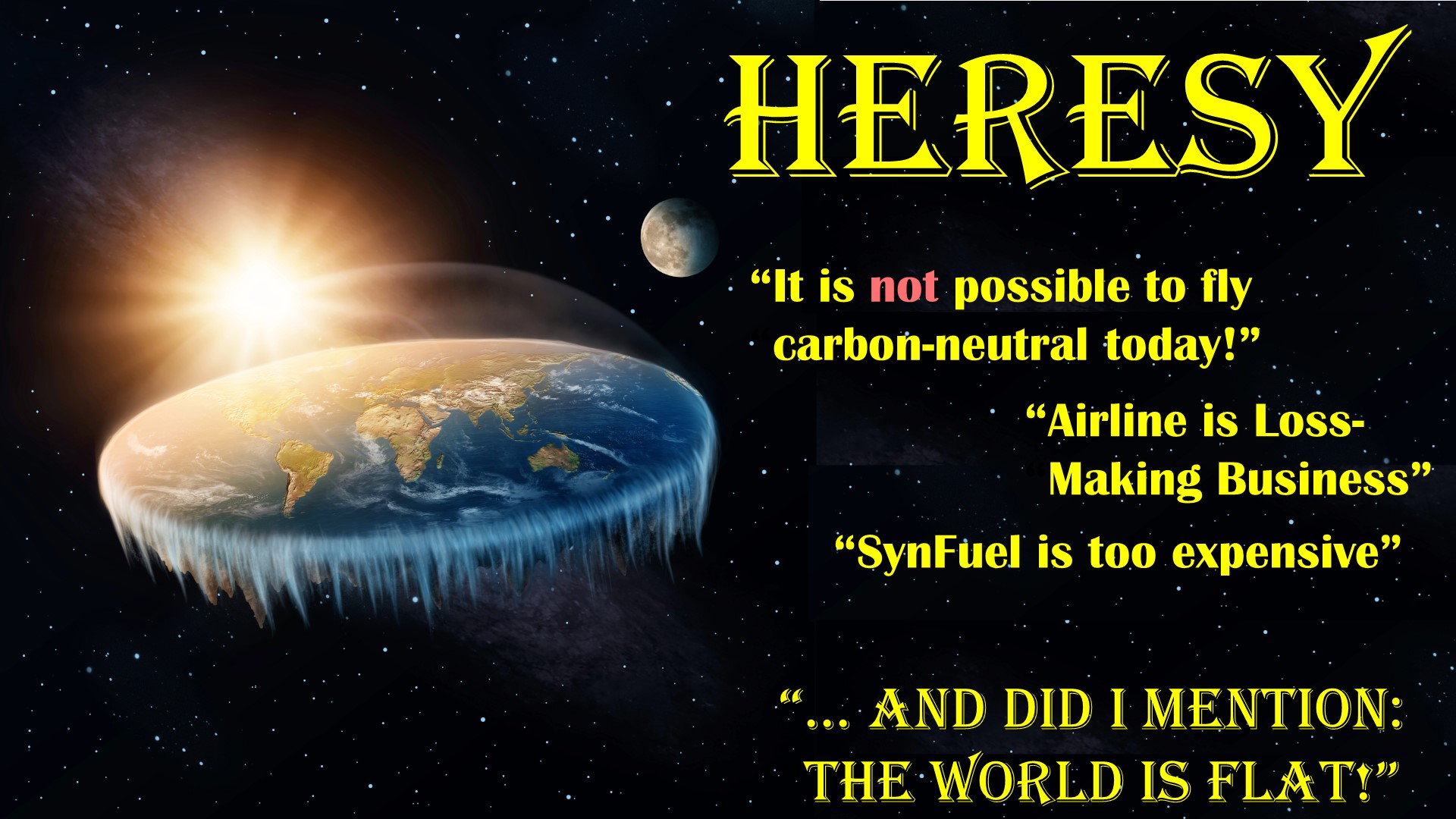

I hope that someone of my hundreds if not thousands of readers (hard to believe, that’s what my server stats claim I’d have) knows some investor with the guts to understand that profitable aviation and sustainable aviation can be the same thing. That the stories those consultancies and their statistics and reports tell have two sides to the coin. And that we get a chance to proof, that climate neutral flying is no heresy, but the future of flight.

Food for Thought – Jürgen

Computer Literacy

Computer Literacy Cloud Computing

Cloud Computing Aircraft System Redundancy

Aircraft System Redundancy Faith in The Computer

Faith in The Computer Fly by Wire, Drones and Air Taxis

Fly by Wire, Drones and Air Taxis A similar case is the automated drones as envisioned by Amazon, DHL and others, for automatic passenger delivery. As the air taxis, they will rely on a fully-automated flight planning and flight plan filing with the authorities’ computers. Simply to avoid in-air-collisions.

A similar case is the automated drones as envisioned by Amazon, DHL and others, for automatic passenger delivery. As the air taxis, they will rely on a fully-automated flight planning and flight plan filing with the authorities’ computers. Simply to avoid in-air-collisions.

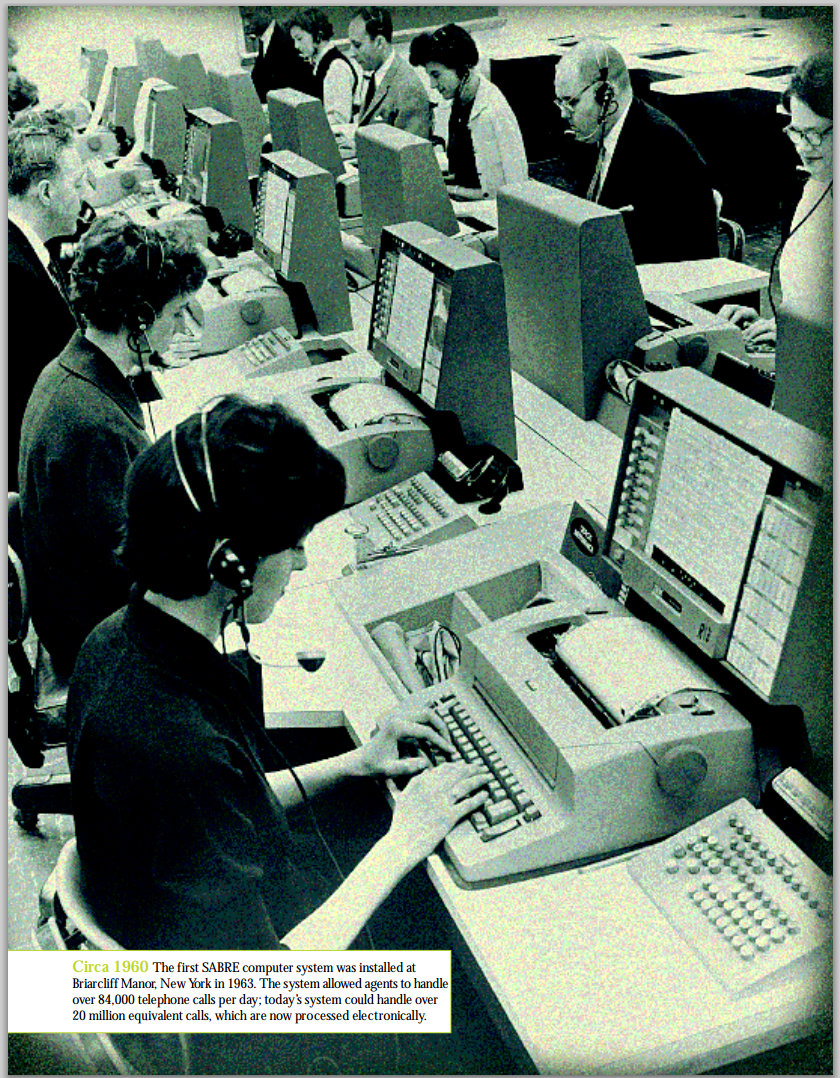

Back in the 90’s, I became the honorary member of the

Back in the 90’s, I became the honorary member of the  Speaking about Sales Managers ignorance to the cost of their airline’s operation, I found the fish stinks from the head first being a true proverb. I’ve met too many investors, airline managers, airport managers, not understanding the cost involved. Then they try to compete on the price with the large, established airlines. I have no idea, what those managers learned, I heavily doubt the quality of university education…

Speaking about Sales Managers ignorance to the cost of their airline’s operation, I found the fish stinks from the head first being a true proverb. I’ve met too many investors, airline managers, airport managers, not understanding the cost involved. Then they try to compete on the price with the large, established airlines. I have no idea, what those managers learned, I heavily doubt the quality of university education…

From Cobalt, Germany, Primera (alphabetical order), feedback said “disruption cost”, attributed i.e. to EU261 “passenger rights” to having been a major reason for their financial troubles. Still, most business plans, I was asked to have a look at last year failed to address that issue at all. Or they used “easyJet figures”, neglecting the fact that easyJet has a spare fleet to cover and minimize the effects of flight disruptions.

From Cobalt, Germany, Primera (alphabetical order), feedback said “disruption cost”, attributed i.e. to EU261 “passenger rights” to having been a major reason for their financial troubles. Still, most business plans, I was asked to have a look at last year failed to address that issue at all. Or they used “easyJet figures”, neglecting the fact that easyJet has a spare fleet to cover and minimize the effects of flight disruptions. Carolin McCall understood “service” to be a difference maker. Since her leave, very quickly they dropped from my “role model” and preferred airline to “me too”. Taking over aircraft from Air Berlin with additional and “bulkier” seats, I suddenly experienced less leg space. Their airport manager at one of their hubs found himself quickly “obsolete”, the new paradigm being “cost savings”. In turn they seized my (half-sized) cabin bag due to “full overheads”. Aside the seat next to me being empty, there was more than enough space below the seat. Heard meanwhile from many frequent flyers they no longer wait if they have an aisle seat but make sure they have their seat and the cabin baggage with them. Would be indeed interesting to have some statistics how that impacts boarding time.

Carolin McCall understood “service” to be a difference maker. Since her leave, very quickly they dropped from my “role model” and preferred airline to “me too”. Taking over aircraft from Air Berlin with additional and “bulkier” seats, I suddenly experienced less leg space. Their airport manager at one of their hubs found himself quickly “obsolete”, the new paradigm being “cost savings”. In turn they seized my (half-sized) cabin bag due to “full overheads”. Aside the seat next to me being empty, there was more than enough space below the seat. Heard meanwhile from many frequent flyers they no longer wait if they have an aisle seat but make sure they have their seat and the cabin baggage with them. Would be indeed interesting to have some statistics how that impacts boarding time.

As mentioned above and before and again. I usually don’t believe in the survival of virtual airlines. A few leased aircraft of the same kind than their competitors, outsourced IT, ground handling, maintenance and other “services”, often even the call and service center (to “GSAs”). Then they believe to be competitive to the large players. If you operate in an un- or under-served market, you may be able to ask for the higher ticket prices required by your increased cost levels. Most airlines I see trying to take off or change their business to survive try to compete to the large network and low cost carriers, but without a secure market (using the same aircraft).

As mentioned above and before and again. I usually don’t believe in the survival of virtual airlines. A few leased aircraft of the same kind than their competitors, outsourced IT, ground handling, maintenance and other “services”, often even the call and service center (to “GSAs”). Then they believe to be competitive to the large players. If you operate in an un- or under-served market, you may be able to ask for the higher ticket prices required by your increased cost levels. Most airlines I see trying to take off or change their business to survive try to compete to the large network and low cost carriers, but without a secure market (using the same aircraft).

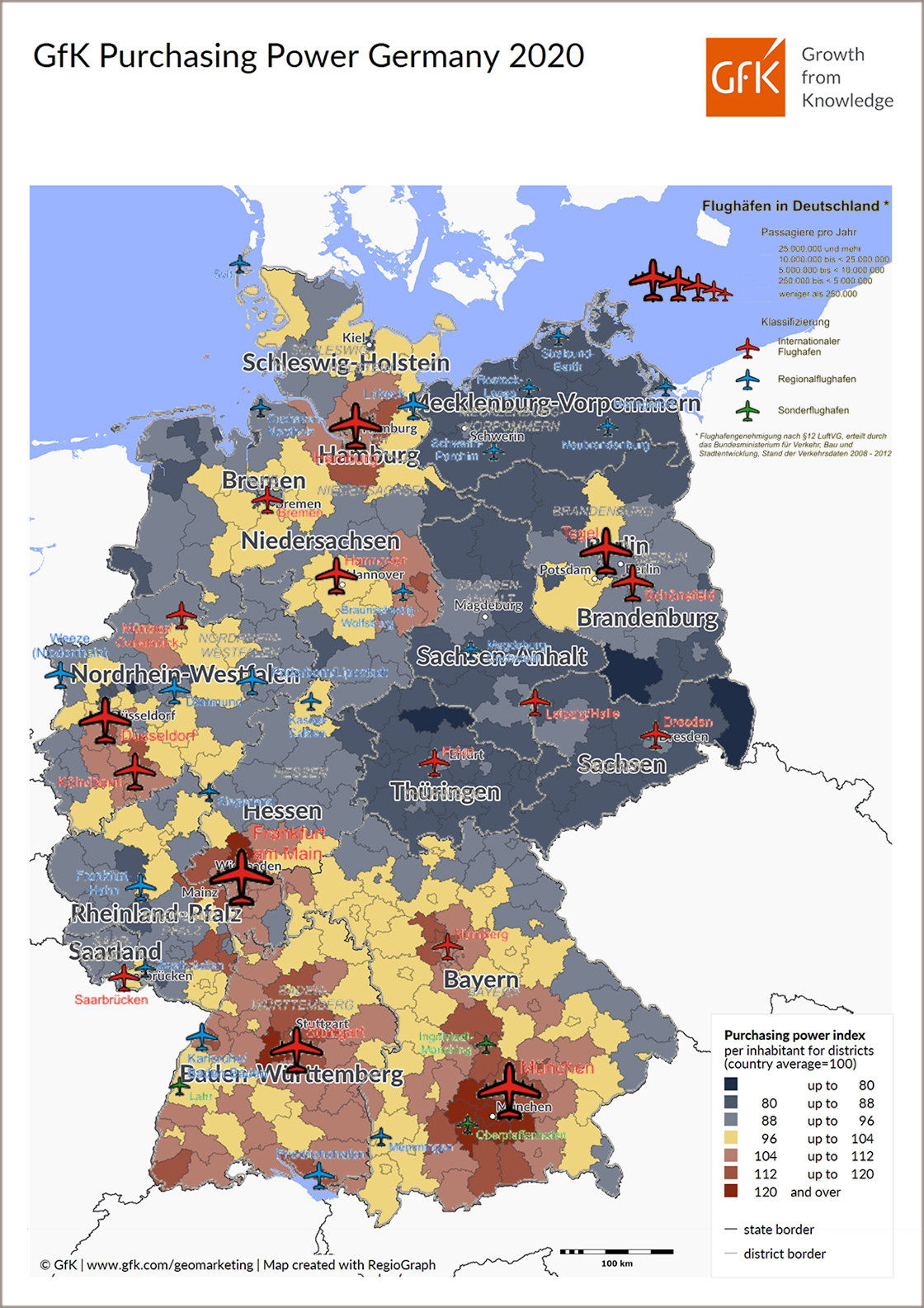

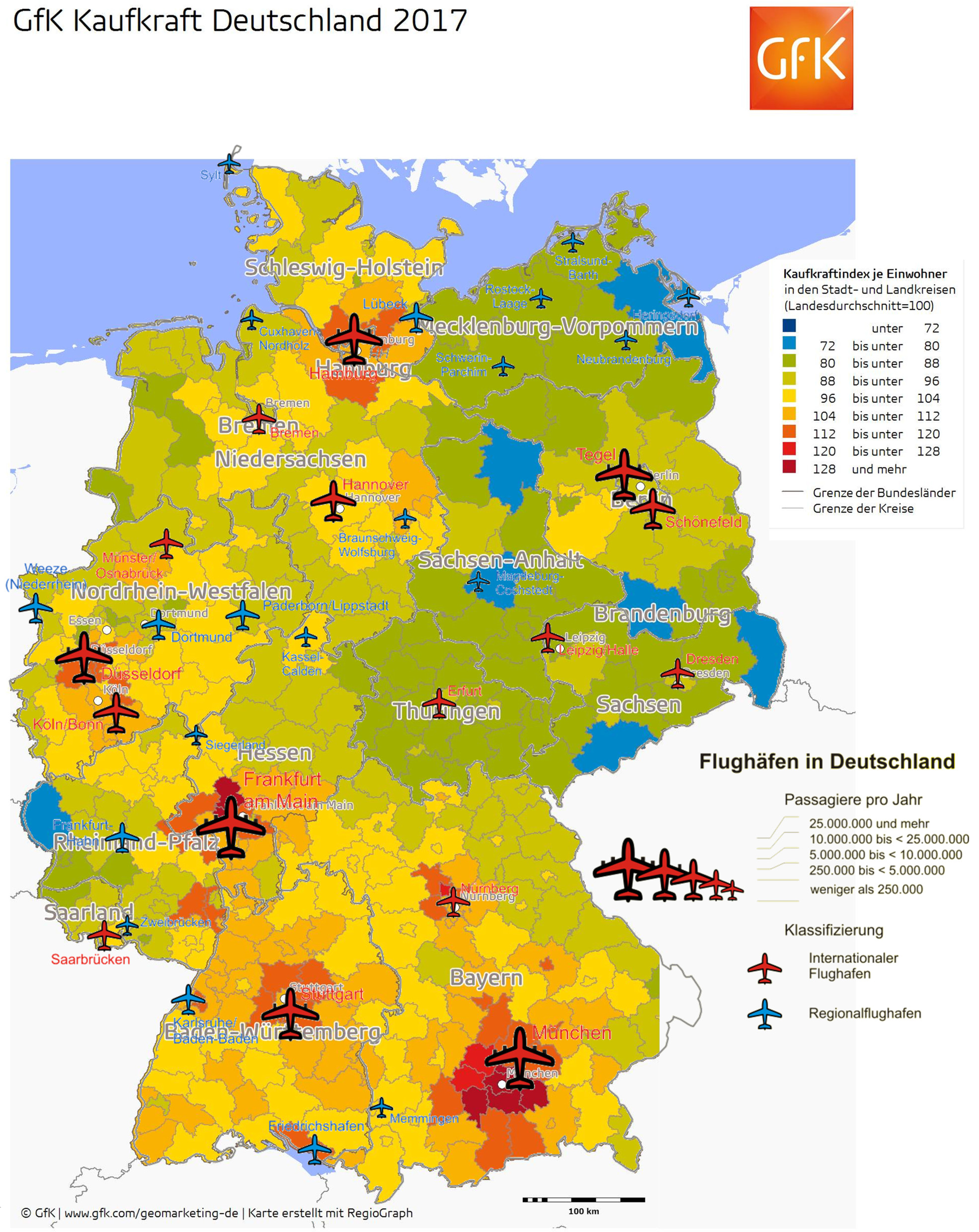

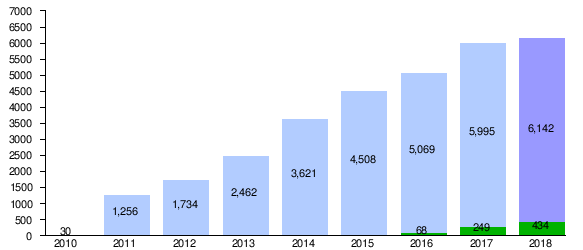

So let me quickly adjust Ged’s numbers.

So let me quickly adjust Ged’s numbers. Now comes Ged’s mistake, a rather common one, the “inside-out” look.

Now comes Ged’s mistake, a rather common one, the “inside-out” look. Which triggers the other issue. At the

Which triggers the other issue. At the

Regional Airports vs. large Hubs

Regional Airports vs. large Hubs A necessary step to compete with the new “global hubs” in Istanbul, Dubai, etc., build to size of about 150 million passengers. Berlin? Build to 27 million passengers, when finally ready one day. Current news questions the next opening data in October 2020… As German “Postillon24” satire site published 2015:

A necessary step to compete with the new “global hubs” in Istanbul, Dubai, etc., build to size of about 150 million passengers. Berlin? Build to 27 million passengers, when finally ready one day. Current news questions the next opening data in October 2020… As German “Postillon24” satire site published 2015:

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

P.S.: While I wrote this article, Germania, an airline that I know from the beginning of my career, who’s team I booked at

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

Lesson learned from my research about Zürich delays: It very often is cheaper for the airline to cancel the flight to make sure the further aircraft “rotation” (planned flights for the remaining day/week) are not impacted. Especially if i.e. winter operations allow for “higher force” reasoning of the cancellation. While the airline can show goodwill and help the stranded passengers, in such situation they are not legally forced to add the legal, excessive passenger compensation for delays. It also in fact reduces the overall passenger upset. And Zürich can predict the delays!

Now all those airlines have operated Airbus A320 and/or Boeing 737. An aircraft in surplus, a saturated market, flooded not only by the aircraft makers but also by lease offers from the low-cost airlines seeking utilization for their own surplus. And while everyone wants aircraft in summer, the eroding revenues do not pay enough for those airlines to survive the winter. I learned so long ago, an ice cream shop needs to create enough revenue to survive the winter.

Now all those airlines have operated Airbus A320 and/or Boeing 737. An aircraft in surplus, a saturated market, flooded not only by the aircraft makers but also by lease offers from the low-cost airlines seeking utilization for their own surplus. And while everyone wants aircraft in summer, the eroding revenues do not pay enough for those airlines to survive the winter. I learned so long ago, an ice cream shop needs to create enough revenue to survive the winter.

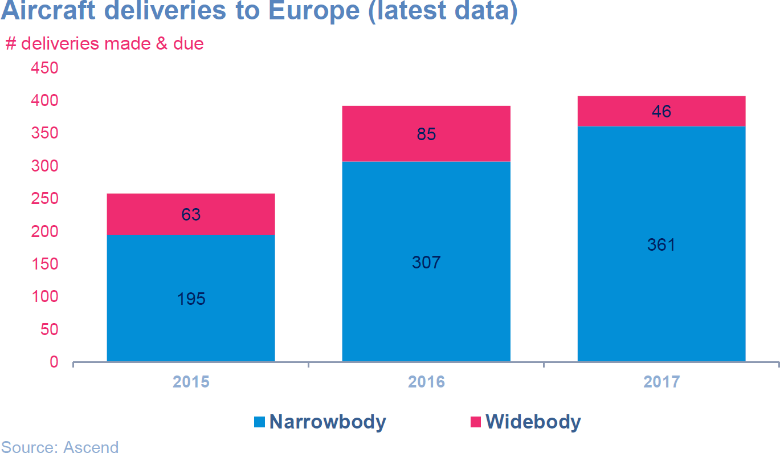

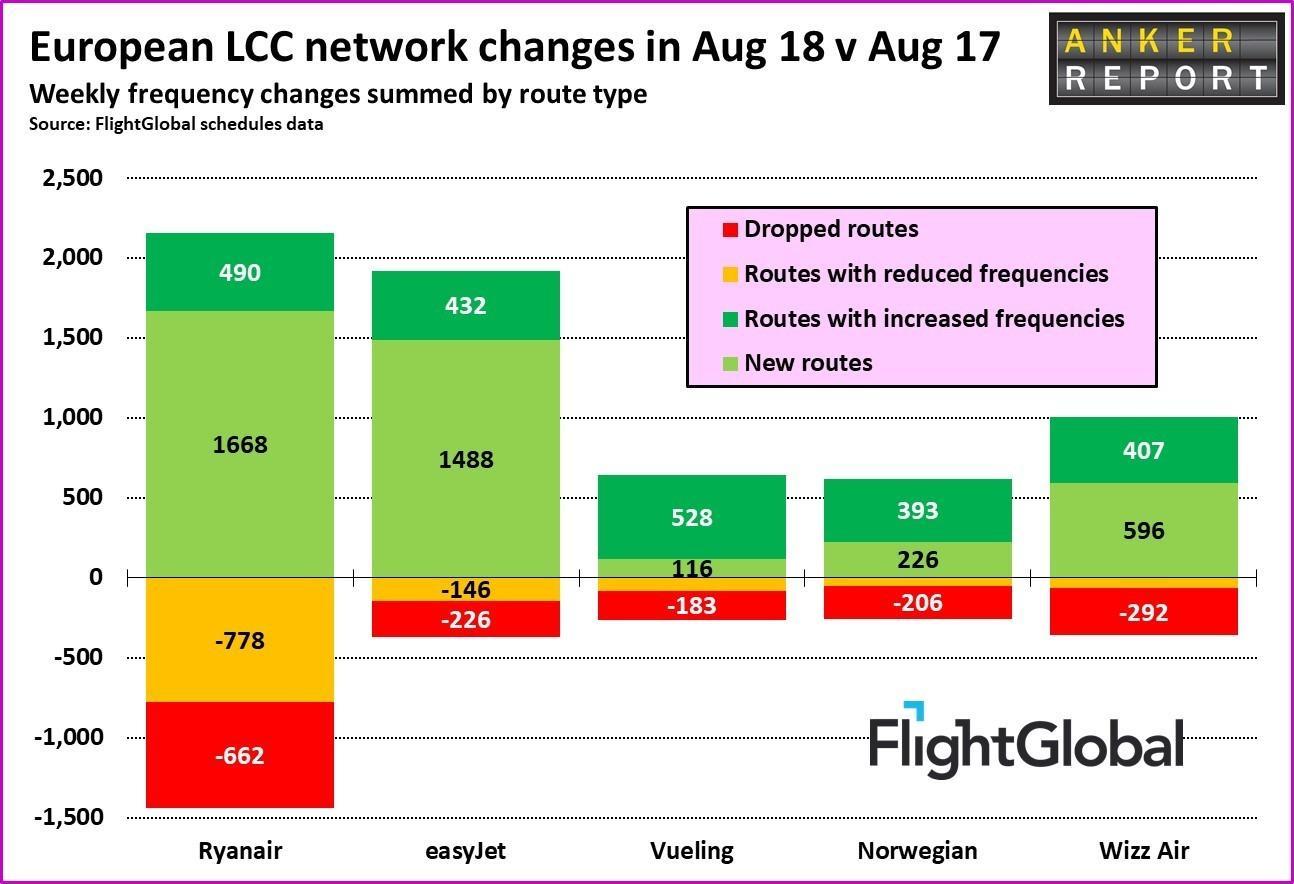

Then we come to the flight crews. While pilots usually are either type-rated on the Airbus A320-family or Boeing 737-family, a mixed Boeing/Airbus-fleet either requires respective crews for each aircraft or the cross type-rating. While pilots usually pay for their flight training, in return, they require high salaries in order to pay off for their – substantial – investment. Even Ryanair now faces the consequences of their “outsourcing” and slave-kind payments of their pilots. While I keep seeing their pilots recruiters immediately jumping on Primera Air but also trying to convince pilots from South America or Asia, if they don’t change their attitude to their pilots, they will keep having problems. Their recent announcement to close the base in Bremen and Eindhoven and reduce the base in Weeze are simply puffing. As Ralph Anker showed in his

Then we come to the flight crews. While pilots usually are either type-rated on the Airbus A320-family or Boeing 737-family, a mixed Boeing/Airbus-fleet either requires respective crews for each aircraft or the cross type-rating. While pilots usually pay for their flight training, in return, they require high salaries in order to pay off for their – substantial – investment. Even Ryanair now faces the consequences of their “outsourcing” and slave-kind payments of their pilots. While I keep seeing their pilots recruiters immediately jumping on Primera Air but also trying to convince pilots from South America or Asia, if they don’t change their attitude to their pilots, they will keep having problems. Their recent announcement to close the base in Bremen and Eindhoven and reduce the base in Weeze are simply puffing. As Ralph Anker showed in his

BlueSwanDaily believes in the future of

BlueSwanDaily believes in the future of  I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

I myself worked out a “green” concept a few years ago, but we’re neither getting there… The project got grounded in the wake of Lehmann Brother’s and a world financial crisis and the original interested investors gone never took up speed again. [Update: The Korean

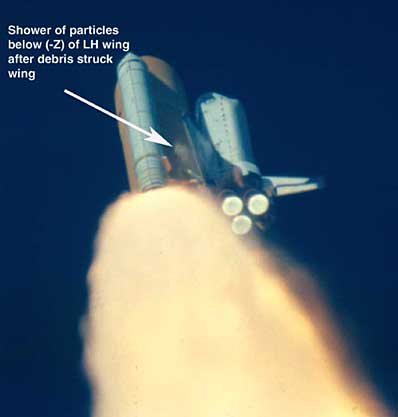

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.

Later I learned the same lesson from space shuttle Challenger, management ignoring their own experts warning them of the temperature being below safety specifications. Shuttle Columbia dying of a piece of foam worth a few cent perforating the heat shield. Of Concorde crashing from a “minor” piece of scrap metal.![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Ryanair

Ryanair Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

Some smart-asses say that was already clear from last year that Monarch would have to close down. But Monarch did quite some development in the past year and it hit about anyone I know rather unexpected – as well as passengers, airports, media! Not having any true details on that, it only confirms by view about Boeing 737/Airbus A320 families.

With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut?

With order books exceeding delivery times beyond 10 years, only large airlines or institutional investors have the funds to invest over a time frame of 10 years. With new aircraft makers building aircraft competing with the Airbus, offering similar or better economics and substantially lower delivery times, airlines using “The Work Horse” take a more or (likely) less calculated risk to bet their money on a work horse. I wonder if there’ll be some (Arab) race horses suddenly and unexpectedly coming up with new business models and more efficient aircraft using the unbeaten path as a shortcut? As many of the readers of this blog know, I am somewhat personally attached to that little airport in Central Germany, Erfurt-Weimar.

As many of the readers of this blog know, I am somewhat personally attached to that little airport in Central Germany, Erfurt-Weimar. First day at work, the GM of Tourism Thuringia, Bärbel Grönegres was quoted in the local newspaper (TA, 02Mar09), having visited the United Arab Emirates to promote medical tourism to Thuringia. Having a Munich-Erfurt flight by Lufthansa-Partner

First day at work, the GM of Tourism Thuringia, Bärbel Grönegres was quoted in the local newspaper (TA, 02Mar09), having visited the United Arab Emirates to promote medical tourism to Thuringia. Having a Munich-Erfurt flight by Lufthansa-Partner  The next winter, the Thuringian Olympic athletes brought home a record number of medals. But at the following ITB, it was more important to promote

The next winter, the Thuringian Olympic athletes brought home a record number of medals. But at the following ITB, it was more important to promote  In order to promote the government-funded route, after fierce discussions, Cirrus Airlines agreed to offer a low-cost ticket at 99€ return, having only about 6€ after the high taxes on the ticket. That offer was made available especially to the Thuringian government offices and the state development agency (LEG). Nevertheless, LEG planned and executed delegations traveling with the train to Berlin to take flights from Berlin, instead of promoting the route. The same also for the ministries and ministers. Even the responsible minister taking flights from Frankfurt and Munich instead of using the PSO-route he signed responsible for. During the months we’ve actively promoted that 99€-fare also to the industry and the travel agencies and also had it largely available, not one of the flights used up the 99€ tickets allocated to them. Being at the verge of a bankruptcy, Cirrus Airlines finally ceased to operate that route in December 2010.

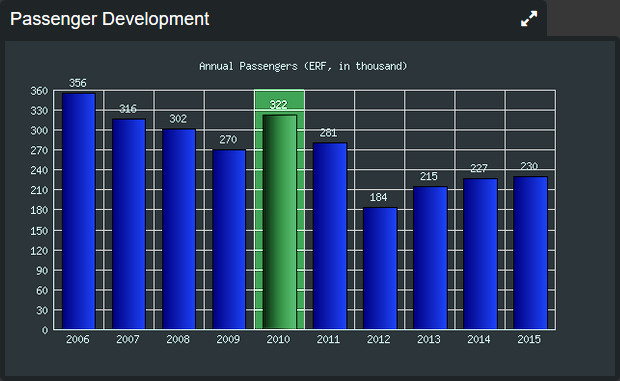

In order to promote the government-funded route, after fierce discussions, Cirrus Airlines agreed to offer a low-cost ticket at 99€ return, having only about 6€ after the high taxes on the ticket. That offer was made available especially to the Thuringian government offices and the state development agency (LEG). Nevertheless, LEG planned and executed delegations traveling with the train to Berlin to take flights from Berlin, instead of promoting the route. The same also for the ministries and ministers. Even the responsible minister taking flights from Frankfurt and Munich instead of using the PSO-route he signed responsible for. During the months we’ve actively promoted that 99€-fare also to the industry and the travel agencies and also had it largely available, not one of the flights used up the 99€ tickets allocated to them. Being at the verge of a bankruptcy, Cirrus Airlines finally ceased to operate that route in December 2010. By the time, working with the local industry associations, political parties I have been able to increase the passenger numbers by about 20 percent. In fact, to date, the airport is far from the 320 thousand passengers I left them with. With Weimar being the neighboring but historically better known city internationally, I pushed forward the renaming to Erfurt-Weimar with the attempt to improve the incoming for the airport. Paid almost completely from the limited marketing budget. A strategic decision executed after our parting-of-ways in December 2010 after my two-year contract was not extended in the wake of the retreat of Cirrus Airlines. A strategic decision though made obsolete by the “political” decision by traffic minister Christian Carius to not replace the route as I recommended with an Amsterdam-service. Sad decision indeed, as with our parting ways, the discussions with KLM were simply discontinued (KLM calling my number reached someone speaking German only, I was gone) and despite their interest in a PSO (public service obligation) financial route support, we had discussed flights based on mere startup incentives and marketing support.

By the time, working with the local industry associations, political parties I have been able to increase the passenger numbers by about 20 percent. In fact, to date, the airport is far from the 320 thousand passengers I left them with. With Weimar being the neighboring but historically better known city internationally, I pushed forward the renaming to Erfurt-Weimar with the attempt to improve the incoming for the airport. Paid almost completely from the limited marketing budget. A strategic decision executed after our parting-of-ways in December 2010 after my two-year contract was not extended in the wake of the retreat of Cirrus Airlines. A strategic decision though made obsolete by the “political” decision by traffic minister Christian Carius to not replace the route as I recommended with an Amsterdam-service. Sad decision indeed, as with our parting ways, the discussions with KLM were simply discontinued (KLM calling my number reached someone speaking German only, I was gone) and despite their interest in a PSO (public service obligation) financial route support, we had discussed flights based on mere startup incentives and marketing support. Opposing myself ongoing subsidies, to demand a route but to leave the (substantial) risk completely with the airline is neither the answer. Whereas comparing the

Opposing myself ongoing subsidies, to demand a route but to leave the (substantial) risk completely with the airline is neither the answer. Whereas comparing the

Now since I started in aviation 30 years ago, the market has drastically changed. In the good old days, there were (often highly subsidized) “national airlines”, used to promote the country. Back in my early days, the airlines were the executive for the tourist offices and also worked closely with commercial development agencies. But ever since, those national airlines have either adapted or went out of business. The emerging “low cost” airlines virtually evaporated the income of the airlines, competition becoming fierce.

Now since I started in aviation 30 years ago, the market has drastically changed. In the good old days, there were (often highly subsidized) “national airlines”, used to promote the country. Back in my early days, the airlines were the executive for the tourist offices and also worked closely with commercial development agencies. But ever since, those national airlines have either adapted or went out of business. The emerging “low cost” airlines virtually evaporated the income of the airlines, competition becoming fierce.