Ready for Routes Europe

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

by Jürgen Barthel

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Our hommage to the aviation network planning industry:

https://www.youtube.com/watch?v=-Na_fkD7cDg

We’ve been asked, why we don’t add our image video to our blog. So here you are. Just in time for Routes Europe!

See you in Krakow

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

I keep telling people that you have to understand your business model, you got to understand your “Unique Selling Proposition” (USP). But then I fall in the same trap. Implying “initial” understanding…

I keep telling people that you have to understand your business model, you got to understand your “Unique Selling Proposition” (USP). But then I fall in the same trap. Implying “initial” understanding…

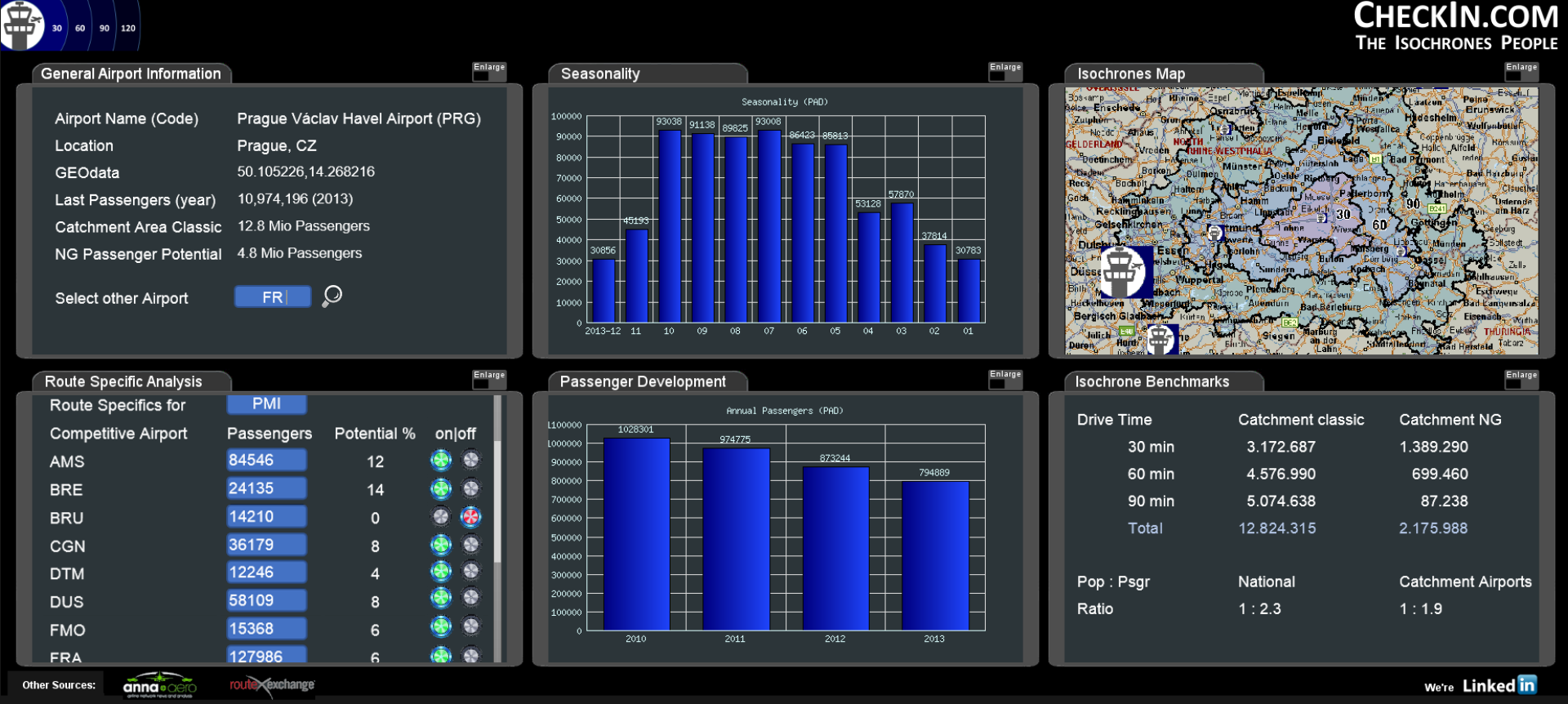

We recently had a discussion on this with […] on CheckIn.com and found them to have a typical misunderstanding, considering us “competitive”… Say what?

So yes, it brings up the question: What’s our USP… And why are we not competitive to anyone? What makes our dashboard “different” (unique)? And why is it so difficult to make professionals understand…?

It seems simple enough.

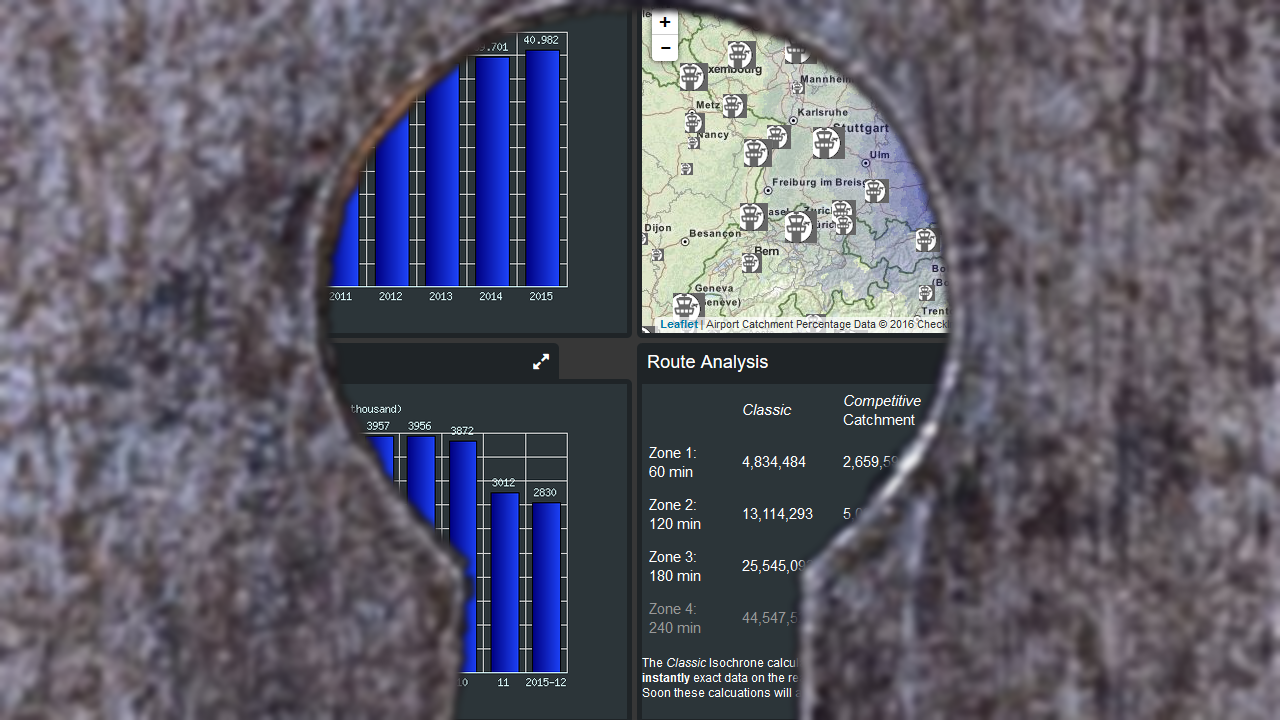

Current “solutions” focus on flight data (MIDT, etc.). We focus on passenger potentials. And thinking further down the road; our “route level” will focus on commercial relations between the regions, ethnic traffic (VFR, visiting friends & relatives) as well as Tourism (taking into account the hotelrooms per population). We believe (from own airport and route development experience) that flight data is for established routes, but nevertheless require – other – experts to analyze. As they also relate to frequencies, flight times, air fares, reputation, and other “soft factors”.

But we look on the ground.

Own experience: A low cost carrier “cannibalized” a regional aviation route, the regional carrier was forced out. A year later, the route was dead. For the flight profile was on a double daily, small airplane, business travel. The low cost tried triple weekly, big aircraft, low fares, tourists. Sorry, no tourists that route…

So don’t put us in the box “passenger review”. This is new. Our tools are especially useful on routes without any previous flight operations, without comparable flights from neighboring airports. When “MIDT & Co.” leave you in the blind.

It’s not really about Isochrones either (though we call ourselves The Isochrones People). Where common Isochrones usually are results of more or less creative guesswork and simply look at how far you get in 30, 60, 90 minutes driving from the airport, their source data is usually on county level or worse, often the figures do not compute with our own findings – not even close. So what’s the source and do you trust it?

Just some examples from public sources, what we had to deal with:

It took us four years (out of five) to compile our data sources, test, throw away, dig into them, correct them (usually very much) and compile the sources in a way we can reuse them without too much work. Because every year there are changes, communities merging, splitting, renaming, …

Find solutions to calculate mass drive times. Where the commercial services limit to 1 million requests a year (at a fortune), we have that number in a few weeks. So we use commercial “standalone” solutions like the logistics industry uses, but still – running a country takes some days of pure computing time.

Still having some bugs, using commercial software for the mapping caused the maps to be close to unusable in Eastern Europe. Not professional for sure. So we had to relaunch. Now we use Open Street Map with a mix of their data and mapping data we receive from the countries. Which differ from what the commercial map providers sold us, but “suddenly” and to our expressed delight fit the statistical sources we use. And the bugs we solve one by one.

Wonder why no-one did our stunt before? Wonder why we think no-one (in his/her right mind) will? Above is your answer. But was that really necessary?

From our experience and that of the experts out there supporting us (airlines, airports, and their consultants), we know there is need for understanding the local customer base. And highly expensive, often outdated analyses of questionable quality at exorbitant prices. So yes, we think our services are needed. And if you don’t use them, you remain blind on one eye.

We’re not just polishing your Crystal Ball as I keep saying. We expand your vision and understanding to what’s truly important. But wasn’t yet available for no-one dared to address the complexity behind it. So trust the airport they know their market? The best you could do. Now we do better. We qualify their impressions with hard data.

And we make it comparable.

And that’s why we don’t compete with the flight data providers. We do something new. We do the other side of business. The hard one ツ

Seen our demo yet? Three airports. Full analysis. Free to use. But we have almost 600 more: https://www.CheckIn.com/

We’ll debut at Routes and hope to speak to many of you. It’s still “brand new” with cuts and edges. We will smooth them out and improve, we promise. But what we have was simply beyond imagination.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Following my leave from SITA, Yulia and I have now launched CheckIn.com accompanied by a press release promoting the new services.

We are still in prototype stage, but are confident to cover Europe by Routes Europe.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

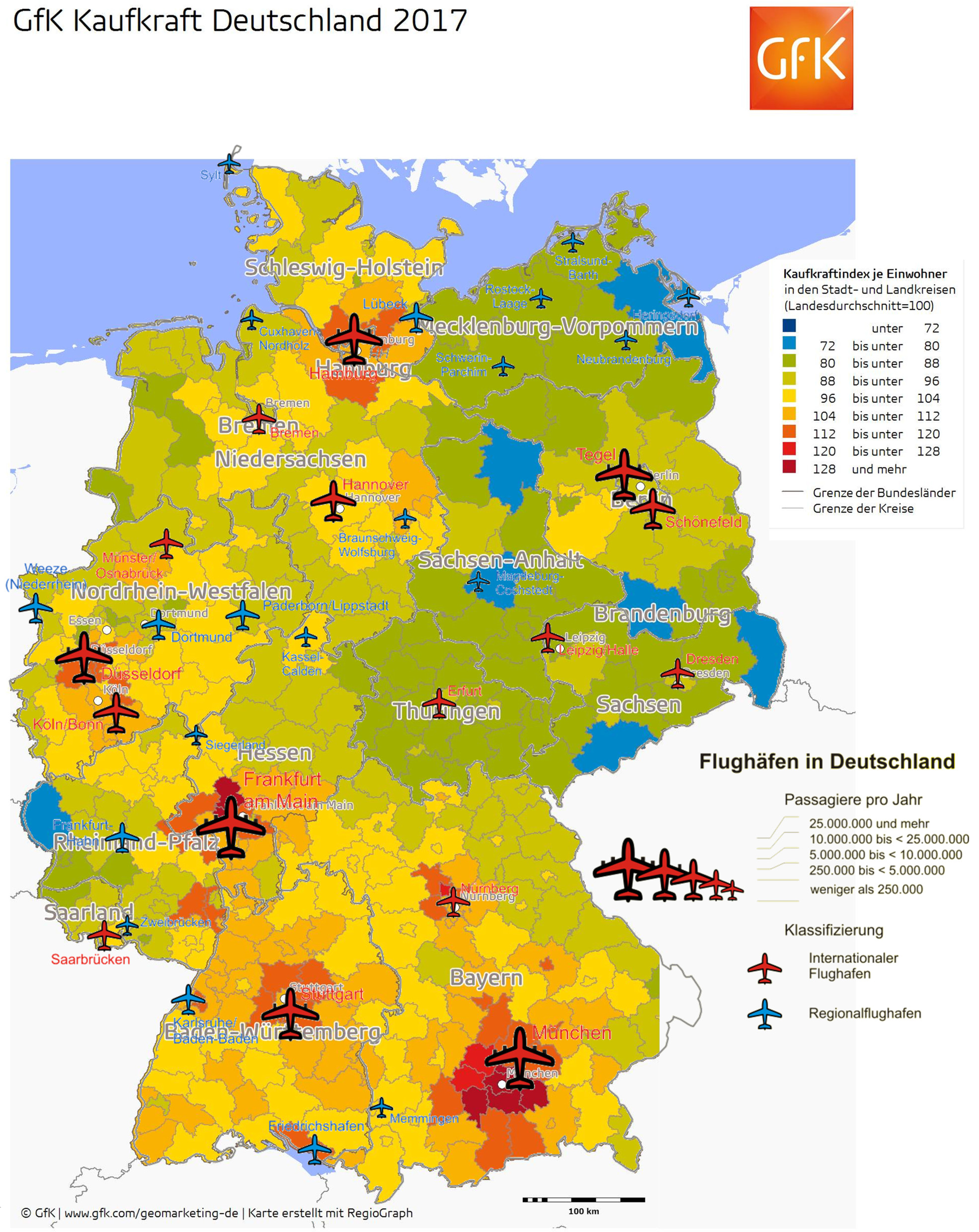

For many years, I use a graphic overlay in Germany in my presentations. I plan to make it available in CheckIn.com in the near future on a European level… I think it speaks for itself.

The influence on airports to purchasing power. Yes, it’s a hen-egg question, but a fact that politicians should think about. Here’s the latest. May it be useful for you too…

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Discussing Airport Development on a general and global scale lately with some renowned influencers in this industry, there were some thoughts, I would like to share today.

Who’s the Customer?

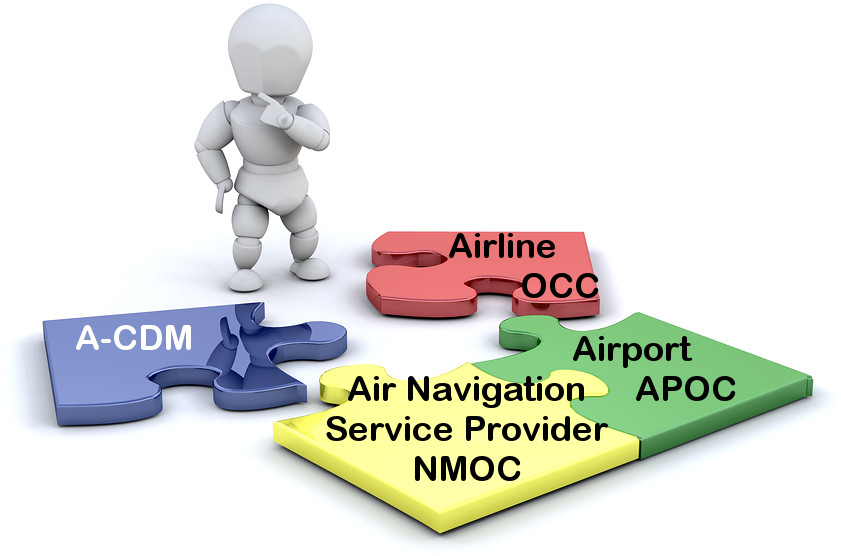

Who’s the Customer?It was rather fascinating to discuss the “customer” issue with airports recently. Though despite we all know that we compete about the passengers, the airline is just as much a customer of the airport as are ground handling companies. As we published in our case study on Zurich’s new deicing management, one of the main cost savings factors, reflecting millions of savings (Euro, Dollar, …) comes from reduction of delay, faster recovery from overall delays or disruptions. With passengers and airlines alike benefiting from “pre-tactical” information.

or why only the dead fish swims with the stream? There is a great tendency in our industry today to wait and see “others” and especially “the big ones” to invest in new technologies and try them. And only with many years of delays implement the investment into the own budget plans and maybe get it year(s) later. Be that the use of (free) WiFi at the airports for all customers or CDM developments to the benefit of airport operations – especially under adverse conditions.

Saving, no matter the cost

Saving, no matter the costA common argument against the investment is that the status quo functions. Airlines are i.e. “used” to have major delays during and after winter events. The throughput is lower, flights must be cancelled, after disruptions, the recovery takes time. Zurich having saved +20 million Euros in one season alone by “managed” deicing is a good counter example. With other airports/airlines stalling the implementation of the tool for their airports/terminals “for cost reasons”. Sorry, I will never get used to burning the amounts of money our industry does. We invest into “customer experience” but don’t bother about reducing flight delays.

Collaboration vs. Silo

Collaboration vs. SiloThe global Civil Air Navigation Services Organisation (CANSO) and the Airports Council International have declared Airport Collaborative Decision Making (A-CDM) a management matter, joining forces in the promotion of the concept. Now airports and airlines alike keep pointing out that they have no common data. A major U.S. airport disqualifying it with the example that they don’t even get an Estimated Time of Arrival (ETA) or Departure (ETD) from their airlines. They learn of arrivals or departures once the aircraft is on approach or on engine start-up or pushback – thanks to kind information by the tower. The operator of a terminal at one major hub tells us, collaboration won’t work at their airport as the terminal operators strongly competing. Yes, there are workarounds possible (considering the controlled apron/tarmac area “the airport”), but as long as airlines and ground handlers keep up such self-understanding, we are a long way from “effective operations” or even a basic management of delays, disruptions and recovery.

In the discussion, we also talked about airport strategy. New airports are being build without giving consideration to A-CDM or TAMS (Total Airport Management, expanding A-CDM into the land side), but focusing on fancy design. (New) Nordic airports having trouble with the positioning of their deicing pads (also called “Central Deicing Facilities” or CDFs). Space for an “Airport Operations Control Center” (APOC) being later taken from existing office space, instead of pre-planning the necessity. Airport Operators like Avialliance, Vinci or even Fraport (a CDM-airport) focus on CDM locally, instead of considering solutions that improve the airport group. Just some thoughts on the issue as we discussed it and I joggled down my notes…

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

![]() Braunschweig, March 2015 Thanks to unforseen circumstances, the last days forced us to reconsider the entire development and timeline for the CheckIn.com project. So far, it was planned to be ready with development by February, Mid March and prepare for rollout at Routes Europe in April in Aberdeen. We have now decided to cancel that event overall, a hard and unhappy decision! But. Especially to digg out the U.K. statistical basics caused us major delays, getting incompatible figures from the same source, not just self-researched but also from the ONS (U.K. Office of National Statistics). We learned they mostly only cover England & Wales, neither Scotland or Northern Ireland. Sure with exceptions, which, if you’re kept unaware, simply cannot compute!

Braunschweig, March 2015 Thanks to unforseen circumstances, the last days forced us to reconsider the entire development and timeline for the CheckIn.com project. So far, it was planned to be ready with development by February, Mid March and prepare for rollout at Routes Europe in April in Aberdeen. We have now decided to cancel that event overall, a hard and unhappy decision! But. Especially to digg out the U.K. statistical basics caused us major delays, getting incompatible figures from the same source, not just self-researched but also from the ONS (U.K. Office of National Statistics). We learned they mostly only cover England & Wales, neither Scotland or Northern Ireland. Sure with exceptions, which, if you’re kept unaware, simply cannot compute!

Scotland does not cover the Local Administrative Units Level 2 of Eurostat, they consider those useless and calculate “something” only on demand. Ireland came last (by end of February) and again with non-standard numbers we now have to “make compatible”. To qualify the difficulty to get the basics for the U.K.: Covering geographic Europe, including Balkan countries and other non-EU countries, the U.K. made it a multitude more difficult for us to get some useful information.

Another issue is drive times, where we have to deal with the fact that “unique administrative places” are not being found either in Google, nor by other on- and offline mapping tools. Often, road data is missing completely, making it impossible to calculate any drive times. Especially going east that caused us quite some headaches (and night shifts). So now finally, though with already some delay, we have everything covered. But we recognize that “mapping” is a major fuzziness, if we go with existing technologies – we should buy into commercial collections of administrative borders, though which also don’t completely match with the data we are having.

Another issue is drive times, where we have to deal with the fact that “unique administrative places” are not being found either in Google, nor by other on- and offline mapping tools. Often, road data is missing completely, making it impossible to calculate any drive times. Especially going east that caused us quite some headaches (and night shifts). So now finally, though with already some delay, we have everything covered. But we recognize that “mapping” is a major fuzziness, if we go with existing technologies – we should buy into commercial collections of administrative borders, though which also don’t completely match with the data we are having.

So January 1st, we started the crowdfunding on Indiegogo, hopeful to get enough interest to finance the necessary development. Generating interest and funds mostly from unexpected sources, by early February our hopes shattered, our friends leaving us out alone in the cold. Very little buzz, not even supportive comments to us, even from our close friends, ad sure no orders for Isochrones. A real nice classic barrel burst. Simply dead silence. Not a bad thing, in fact it confirmed our initial approach to go in a step-by-step process, fund as we can, do what we can, but not to rely on investors (requiring fast return-of-investment, having their own agendas) and do “ourselves”.

So January 1st, we started the crowdfunding on Indiegogo, hopeful to get enough interest to finance the necessary development. Generating interest and funds mostly from unexpected sources, by early February our hopes shattered, our friends leaving us out alone in the cold. Very little buzz, not even supportive comments to us, even from our close friends, ad sure no orders for Isochrones. A real nice classic barrel burst. Simply dead silence. Not a bad thing, in fact it confirmed our initial approach to go in a step-by-step process, fund as we can, do what we can, but not to rely on investors (requiring fast return-of-investment, having their own agendas) and do “ourselves”.

Then came the shock. Within days, Jürgen went into sickleave, undergoing a major surgery Feb 27th, taken completely out of the loop for the better part of 14 days and being still hospitalized (4th week), depriving us from the most knowledgable and networked expert in our team. He is well now, still recovering, still hospitalized. The tumors identified turned out a haemangiome (as “known” since 2002) and a benign neuroendokrineous one.

Then came the shock. Within days, Jürgen went into sickleave, undergoing a major surgery Feb 27th, taken completely out of the loop for the better part of 14 days and being still hospitalized (4th week), depriving us from the most knowledgable and networked expert in our team. He is well now, still recovering, still hospitalized. The tumors identified turned out a haemangiome (as “known” since 2002) and a benign neuroendokrineous one.

So after recovering from the major surgery, he shall be almost as new (minus half a pancreas, the spleen and a bit of his liver and plus a possible diabetes). Celebrating his 50th birthday recently, he feels “old now” thanks to the fact that for the remainder of life he got to carry a pillbox and injection pens with him to cover for the lost half pancreas.

But the main setback is the delayed recovery; instead of the expected 10-14 days we now talk more about min. 4-5 weeks that we lost his support for. With all that baggage, we were faced with a tough decision. Do we keep up the plan to go live at Routes Europe? Or do we have to postpone? Especially with the desinterest showed for our crowdfunding, the missing funds to secure external development for the remaining solutions, problems with providing a solution for maps now and Jürgen’s missing help, we decided against Routes Europe and for a delay.

Having the drive time calculations completeted for Europe, we will now start to work on North America already. With the custom tool received by Richard Marsden, we are hopeful to get that covered maybe in time for World Routes, for sure until next Routes Americas. Having the solution for the most complex of our algorithms (thanks Ori) we are also pre-computing the impact values for each airport from the municipality-view. As in most cases the passengers have not just one airport, but optional others to choose from. Depending on the size of the airport, the drive time to get there as well as the flight services offered. But yes, it is quite a bit work and even computerized a real lengthy task to apply these algorithms to all the airport-municipality pairs…

Having the drive time calculations completeted for Europe, we will now start to work on North America already. With the custom tool received by Richard Marsden, we are hopeful to get that covered maybe in time for World Routes, for sure until next Routes Americas. Having the solution for the most complex of our algorithms (thanks Ori) we are also pre-computing the impact values for each airport from the municipality-view. As in most cases the passengers have not just one airport, but optional others to choose from. Depending on the size of the airport, the drive time to get there as well as the flight services offered. But yes, it is quite a bit work and even computerized a real lengthy task to apply these algorithms to all the airport-municipality pairs…

For the maps, we now need to check “low cost solutions”, looking into Google (no “freebees” as Bing), offline mapping tools and maybe Open Street Maps. We assume this takes another 4-6 weeks minimum and we might have to use “offline mapping” as a work-around, with map-creation taking some additional “non-automated” time.

Without the admin borders, we think about a solution to quantify the passenger potential by municipality, thus making “hot spots” visible. Also something to keep us busy, but the benefits of not needing the municipal borders in the display justifying for that. We also got the funding to do a real good prototype of the dashboard, but it takes time to write the necessary software requirements specification.

Then we have to find a web-agency that can do it (the famous needle in the haystack problem). But without map(s), the dashboard is incomplete, so there must be some “placeholder” while we create the map(s). All those tasks we now have to do on our own finally summed up to the painful decision to reschedule the development plans and skip Routes. Which was especially hard on Jürgen to convince, who is a great fan of that event. We do hope you can understand the reasoning behind our decision and appreciate your feedback – supportive, critical, honest. And if you have ideas how to speed up our agenda, if you have reference to a real good web-agency, you are very welcome! Just a little bit

Then we have to find a web-agency that can do it (the famous needle in the haystack problem). But without map(s), the dashboard is incomplete, so there must be some “placeholder” while we create the map(s). All those tasks we now have to do on our own finally summed up to the painful decision to reschedule the development plans and skip Routes. Which was especially hard on Jürgen to convince, who is a great fan of that event. We do hope you can understand the reasoning behind our decision and appreciate your feedback – supportive, critical, honest. And if you have ideas how to speed up our agenda, if you have reference to a real good web-agency, you are very welcome! Just a little bit

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

|

Important News: Help us evolve our analyses from PDF (with map-image) to instant, web-based access (including export for further use!). Join our crowdfunding at Indiegogo and spread the word please! |

|

[Update: Crowdfunding ended]

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

During my initial business education, more than 30 years ago, the General Manager of the company hosting me for the practical part told me: “Someone else always can sell cheaper”. At the time, concepts like “USPs” (Unique Selling Propositions) had not been “common”, but it practically was about how to position for success.

During my initial business education, more than 30 years ago, the General Manager of the company hosting me for the practical part told me: “Someone else always can sell cheaper”. At the time, concepts like “USPs” (Unique Selling Propositions) had not been “common”, but it practically was about how to position for success.

The mantra in the aviation industry is to be always the cheapest. The mantra in procurement / purchasing is to buy the cheapest. In Germany, we have two different words for “cheap”. Billig and preiswert: Billig is cheap. Preiswert is “worth the price”.

Another old saying is “You get, what you pay for”. And yet another saying I heard in procurement is: “Save money, no matter the cost”.

But my friend Richard told me some 15 years ago that there is a psychological price. He also told me that IT (what we both worked in and now work again in) is the first thing that procurement “saves” upon, as they don’t understand its value.

So if it is not the price, what could it be?

A unique identity could be one. For airlines: When I started in the industry, I could distinguish airline crews by their uniform. Today, the differences in the uniforms are so minor that flight attendants of different airlines standing in one group can not be distinguished any more.

For conferences, I keep refering to Hamburg Airport Marketing. From afar they can be identified. And even promoting Hamburg big on the shirts, it doesn’t look “cheap”, but gives identity! It can be even worn at the “business casual evening event”. And believe me, if you look for the Hamburg team, you do find them!

Though for some reason inexplicable to me, many sales managers deny to wear uniform, much less some easily identifiable wardrobe as that. They seemingly prefer to blend in with all the other black ties. Though why you want your company and products and yourself to “blend in” instead of standing out, is simply beyond me 🙂

If you can establish a unique identity, your customers associate intuively with your product, you increase your reseller base, as they will remember you when opportunity arises. If your reputation is bad, all you can do is to undercut your competitors in price. If that is your USP, I’d say you may have the problem with the fact that always, someone else can produce cheaper.

Quality is a good USP. And quality comes in many aspects. Part of quality can be friendliness – in the beginning of my career, at the time with American Airlines, we got “beaten in” that we always have to smile when interacting with other people. Not just customers, but also our own colleagues. As the saying goes “Formal courtesy between husband and wife is even more important than it is between strangers.” [Lazarus Long] – I found this especially true in companies. If you treat your own people bad, you will treat your customers likewise. Unfortunately, service is something that button sorters (accountants) don’t understand. Friendly Service does not have a price tag. Just if you don’t have it, you will pay the price. In lost customers.

Service is also how you manage with problems. Can you truly afford your customer(s) to be upset, just to save some money? Even if you do not pay, you got to talk to the customer and explain. Do not write. And don’t “outsource” your customer communication or you will loose them.

Time is also an essential difference maker. Why else would airlines reduce the prices if you connect making a detour through their hub (connecting airport), compared to a nonstop flight? In IT, time to delivery is of essence. Too many companies succeed by selling you dreams, but failing to deliver. Leading to the next Soft USP:

Honesty. I was tought early in my life to never lie if possible. Bend the truth, better tell some truth that makes the people believe you lie (and proof them better later). When Obama visited Erfurt, press asked. All I communicated was “The Pilots’ Union said that Obama’s 747 cannot land in Erfurt”. What I did not tell them, that the Union’s “experts” had missed the fact that Air Force One is usually not “fully loaded” and has the advantage of some (so public sources say) 20% higher engine power. When it came to Erfurt, I had never lied. And ever since had a good standing with them. Honesty creates trust. If you lie once, you’ll have a hard time to recover.

Honesty. I was tought early in my life to never lie if possible. Bend the truth, better tell some truth that makes the people believe you lie (and proof them better later). When Obama visited Erfurt, press asked. All I communicated was “The Pilots’ Union said that Obama’s 747 cannot land in Erfurt”. What I did not tell them, that the Union’s “experts” had missed the fact that Air Force One is usually not “fully loaded” and has the advantage of some (so public sources say) 20% higher engine power. When it came to Erfurt, I had never lied. And ever since had a good standing with them. Honesty creates trust. If you lie once, you’ll have a hard time to recover.

These are sure just examples. But it strikes me odd, how many companies, especially in aviation, do not have an understanding of their business culture and their USPs. But if you don’t communicate that to your own, how do you think your customers will learn about them?

A final example for this article today shall be Apple. I loved Apple. Past tense. They made the first smart phones. All others copied them. Now they struggle and their answer is “me too”-products. What was their USP?

A final example for this article today shall be Apple. I loved Apple. Past tense. They made the first smart phones. All others copied them. Now they struggle and their answer is “me too”-products. What was their USP?

I took the iPhone6 into my hand and decided: Too big. My iPhone 4S does all I need. Intuitively and without some double tab on home to be able to access the upper screen.

If I want to watch video, I use my tablet (did I mention I shunned the iPad and got a Windows-Hybrid?).

So Apple lost a customer. Because they evolved from the pioneers to the ones limping behind. It would be time for them to reassess their USPs, their business propositions and their strategy. Then maybe they might find that they left frustrated customers behind with their “bigger is better” and instead made their phones expensive Samsung-clones, just without a “Mini”.

Sell, sell, sell. But if you do not know what you sell, all you do is lower the price until someone buys. I predict that fate even for Apple. But if you can explain the differences, if you can explain the quality, you hardly need to sell. The people buy. Though that requires management to understand and support that, to drive, not being driven.

Hmm… None of the business plans and their revisions I worked on took less than several weeks to come from an idea or product to a sales strategy for the different “customers”. Capital investors, buyers, suppliers, partners. And to answer the main three questions (beyond the idea) that all business plans contain:

Once you can answer these three questions, you have your sales strategies, your elevator pitches, you understand. Then all you still need to do is: Communicate it to your people! Spread the word.

Food for Thought

Comments welcome

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

An interview in ATN with Girma Wake, Chairman, RwandAir triggered a question that spooks around for quite a while now.

ATN: Are you afraid that this new environment will bring more low-cost carriers or do you believe that this model does not fit into the African environment?

ATN: Are you afraid that this new environment will bring more low-cost carriers or do you believe that this model does not fit into the African environment?Can a regional carrier with small airlines operate low cost? Can a long haul carrier operate low cost? Why can’t the big ones operate low cost?

Just my idea on that: I truly believe that a small carrier can operate a low cost model. In the beginning the carriers operated large narrow-body like 737-800 or A320 with some 185 seats. More and more, they also operate smaller aircraft like the 737-700 or the A319. And the time the prices were really low are gone as well. In the end you have to cover cost of operations as well as secondary cost like marketing, call center, claims and refunds, taxes and the likes. Not to forget the kerosene as a main cost block, forcing the models to slowly converge. Did I mention Intersky’s regional low-cost operations?

Just my idea on that: I truly believe that a small carrier can operate a low cost model. In the beginning the carriers operated large narrow-body like 737-800 or A320 with some 185 seats. More and more, they also operate smaller aircraft like the 737-700 or the A319. And the time the prices were really low are gone as well. In the end you have to cover cost of operations as well as secondary cost like marketing, call center, claims and refunds, taxes and the likes. Not to forget the kerosene as a main cost block, forcing the models to slowly converge. Did I mention Intersky’s regional low-cost operations?

German DLR recently made a study on the fare levels. Comparable flights turned out i.e. an average fare incl. taxes/fees (selected days) like

| Ryanair (FR) | 78,78 |

| Easyjet (U2) | 97,44 |

| Germanwings (4U) | 144,33 |

| Air Berlin (AB) | 158,64 |

| Wizz (W6) | 69,99 |

With “low cost” and “traditional” airlines offering about the same price levels, it is about cost of operations and you got to cover your cost – low cost or “old model”.

IHS actually reports on the importance of low cost carriers for the smaller regional airports. With cost savings programs reducing services (and service), the “old carriers” loose quickly ground to the ever-expanding, young and hungry competitors. Where Lufthansa services about any German airport in the past, today Turkish Airlines offers more services to German Airports from Istanbul than Lufthansa from Frankfurt! easyJet (with a large base in Berlin) today operates more aircraft (199) than Air Berlin Group (153). And easyJet has 166 aircraft on order plus 100 options (Air Berlin Group 55 orders).

But easyJet can be booked in the GDS. There website even supports to book multiple flights connecting, which I did myself to the U.K. lately (via LGW). As I keep saying: The difference between Lufthansa or Air Berlin and easyJet is NOT that they are only bookable on the Internet (which is simply not true), but that easyJet doesn’t have legacy systems and processes – for easyJet, they focus on the business case! Where “airline sales” often gives special rates to portals and travel agency chains, easyJet does not see a benefit to sell low. They focus to sell high. So if you negotiate with them, you don’t negotiate competing the cheap fares. Also repeating myself: Anyone can sell “cheap”, you need no sales manager to do that.

And two remarks closing: Carolyn McCall, CEO of easyJet is known to understand and promote “service” as a unique selling proposition (USP). And WestJet with its Christmas Miracle had clearly a promotion for the WestJet trade mark in mind. While the “established” airlines keep diluting their own trade marks: What again has “Lufthansa” to do with “Germanwings” (Swiss, Austrian, …)? Ain’t they competitors?

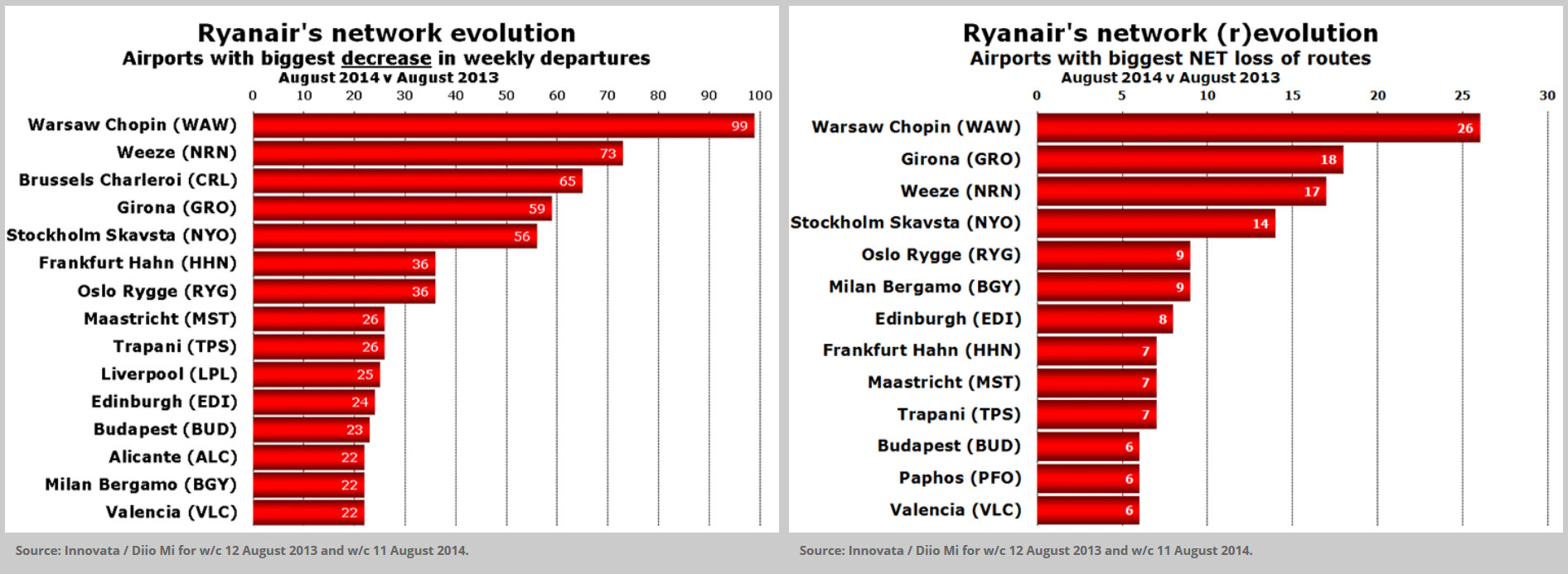

Post Scriptum: ANNA.aero just announced axing of Ryanair, mostly of regional routes.

You should not rely on Ryanair for anything more than a door opener to make your airport known… And as an airport and region, you should have a strategy to sustainably place your airport on the “road map” of the global aviation network. That requires a strategy, incoming, route feasibility studies and all that common homework.

Food for Thought

Comments welcome

Having addressed “Airline Sales & e-Commerce” in presentations between 1994 and 2007, I became honorary member in 1999. I have tried to raise awareness for the changes our industry faces but now regretfully have to accept the official disbanding of the association effective August 1st, 2014.