I keep telling people that you have to understand your business model, you got to understand your “Unique Selling Proposition” (USP). But then I fall in the same trap. Implying “initial” understanding…

I keep telling people that you have to understand your business model, you got to understand your “Unique Selling Proposition” (USP). But then I fall in the same trap. Implying “initial” understanding…

We recently had a discussion on this with […] on CheckIn.com and found them to have a typical misunderstanding, considering us “competitive”… Say what?

So yes, it brings up the question: What’s our USP… And why are we not competitive to anyone? What makes our dashboard “different” (unique)? And why is it so difficult to make professionals understand…?

It seems simple enough.

It’s not the “MIDT”

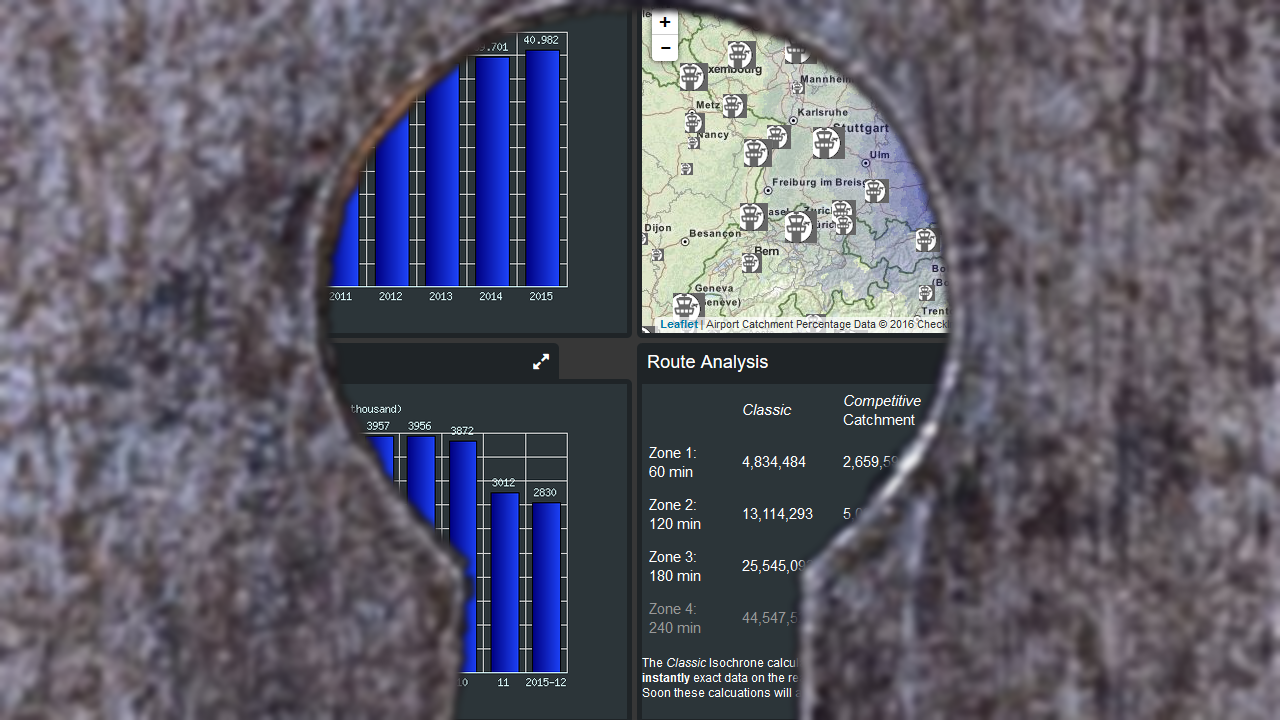

Current “solutions” focus on flight data (MIDT, etc.). We focus on passenger potentials. And thinking further down the road; our “route level” will focus on commercial relations between the regions, ethnic traffic (VFR, visiting friends & relatives) as well as Tourism (taking into account the hotelrooms per population). We believe (from own airport and route development experience) that flight data is for established routes, but nevertheless require – other – experts to analyze. As they also relate to frequencies, flight times, air fares, reputation, and other “soft factors”.

But we look on the ground.

Own experience: A low cost carrier “cannibalized” a regional aviation route, the regional carrier was forced out. A year later, the route was dead. For the flight profile was on a double daily, small airplane, business travel. The low cost tried triple weekly, big aircraft, low fares, tourists. Sorry, no tourists that route…

So don’t put us in the box “passenger review”. This is new. Our tools are especially useful on routes without any previous flight operations, without comparable flights from neighboring airports. When “MIDT & Co.” leave you in the blind.

The Isochrones People

It’s not really about Isochrones either (though we call ourselves The Isochrones People). Where common Isochrones usually are results of more or less creative guesswork and simply look at how far you get in 30, 60, 90 minutes driving from the airport, their source data is usually on county level or worse, often the figures do not compute with our own findings – not even close. So what’s the source and do you trust it?

Just some examples from public sources, what we had to deal with:

It took us four years (out of five) to compile our data sources, test, throw away, dig into them, correct them (usually very much) and compile the sources in a way we can reuse them without too much work. Because every year there are changes, communities merging, splitting, renaming, …

Find solutions to calculate mass drive times. Where the commercial services limit to 1 million requests a year (at a fortune), we have that number in a few weeks. So we use commercial “standalone” solutions like the logistics industry uses, but still – running a country takes some days of pure computing time.

The Stuntmen

Still having some bugs, using commercial software for the mapping caused the maps to be close to unusable in Eastern Europe. Not professional for sure. So we had to relaunch. Now we use Open Street Map with a mix of their data and mapping data we receive from the countries. Which differ from what the commercial map providers sold us, but “suddenly” and to our expressed delight fit the statistical sources we use. And the bugs we solve one by one.

Wonder why no-one did our stunt before? Wonder why we think no-one (in his/her right mind) will? Above is your answer. But was that really necessary?

Eyesight for the Blind…

From our experience and that of the experts out there supporting us (airlines, airports, and their consultants), we know there is need for understanding the local customer base. And highly expensive, often outdated analyses of questionable quality at exorbitant prices. So yes, we think our services are needed. And if you don’t use them, you remain blind on one eye.

So what’s our USP again?

We’re not just polishing your Crystal Ball as I keep saying. We expand your vision and understanding to what’s truly important. But wasn’t yet available for no-one dared to address the complexity behind it. So trust the airport they know their market? The best you could do. Now we do better. We qualify their impressions with hard data.

And we make it comparable.

And that’s why we don’t compete with the flight data providers. We do something new. We do the other side of business. The hard one ツ

Seen our demo yet? Three airports. Full analysis. Free to use. But we have almost 600 more: https://www.CheckIn.com/

We’ll debut at Routes and hope to speak to many of you. It’s still “brand new” with cuts and edges. We will smooth them out and improve, we promise. But what we have was simply beyond imagination.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)