Greetings from Routes Europe

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

by Jürgen Barthel

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

Our hommage to the aviation network planning industry:

https://www.youtube.com/watch?v=-Na_fkD7cDg

We’ve been asked, why we don’t add our image video to our blog. So here you are. Just in time for Routes Europe!

See you in Krakow

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

I keep telling people that you have to understand your business model, you got to understand your “Unique Selling Proposition” (USP). But then I fall in the same trap. Implying “initial” understanding…

I keep telling people that you have to understand your business model, you got to understand your “Unique Selling Proposition” (USP). But then I fall in the same trap. Implying “initial” understanding…

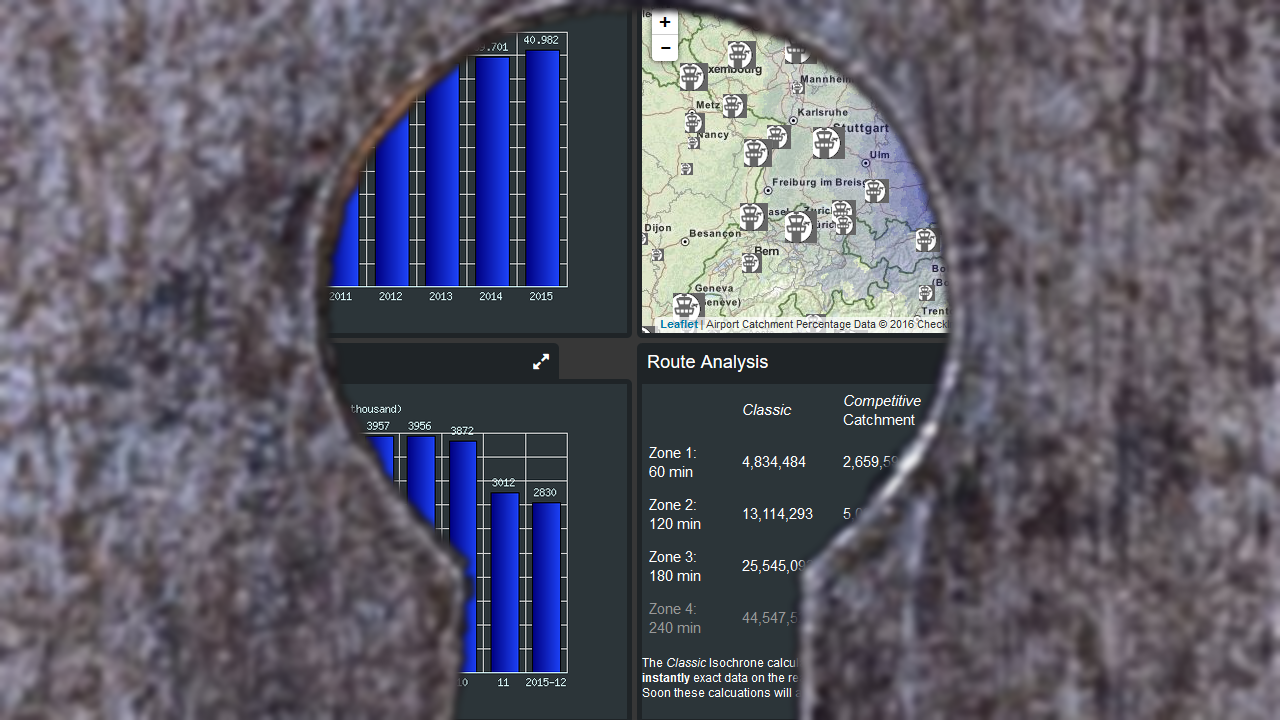

We recently had a discussion on this with […] on CheckIn.com and found them to have a typical misunderstanding, considering us “competitive”… Say what?

So yes, it brings up the question: What’s our USP… And why are we not competitive to anyone? What makes our dashboard “different” (unique)? And why is it so difficult to make professionals understand…?

It seems simple enough.

Current “solutions” focus on flight data (MIDT, etc.). We focus on passenger potentials. And thinking further down the road; our “route level” will focus on commercial relations between the regions, ethnic traffic (VFR, visiting friends & relatives) as well as Tourism (taking into account the hotelrooms per population). We believe (from own airport and route development experience) that flight data is for established routes, but nevertheless require – other – experts to analyze. As they also relate to frequencies, flight times, air fares, reputation, and other “soft factors”.

But we look on the ground.

Own experience: A low cost carrier “cannibalized” a regional aviation route, the regional carrier was forced out. A year later, the route was dead. For the flight profile was on a double daily, small airplane, business travel. The low cost tried triple weekly, big aircraft, low fares, tourists. Sorry, no tourists that route…

So don’t put us in the box “passenger review”. This is new. Our tools are especially useful on routes without any previous flight operations, without comparable flights from neighboring airports. When “MIDT & Co.” leave you in the blind.

It’s not really about Isochrones either (though we call ourselves The Isochrones People). Where common Isochrones usually are results of more or less creative guesswork and simply look at how far you get in 30, 60, 90 minutes driving from the airport, their source data is usually on county level or worse, often the figures do not compute with our own findings – not even close. So what’s the source and do you trust it?

Just some examples from public sources, what we had to deal with:

It took us four years (out of five) to compile our data sources, test, throw away, dig into them, correct them (usually very much) and compile the sources in a way we can reuse them without too much work. Because every year there are changes, communities merging, splitting, renaming, …

Find solutions to calculate mass drive times. Where the commercial services limit to 1 million requests a year (at a fortune), we have that number in a few weeks. So we use commercial “standalone” solutions like the logistics industry uses, but still – running a country takes some days of pure computing time.

Still having some bugs, using commercial software for the mapping caused the maps to be close to unusable in Eastern Europe. Not professional for sure. So we had to relaunch. Now we use Open Street Map with a mix of their data and mapping data we receive from the countries. Which differ from what the commercial map providers sold us, but “suddenly” and to our expressed delight fit the statistical sources we use. And the bugs we solve one by one.

Wonder why no-one did our stunt before? Wonder why we think no-one (in his/her right mind) will? Above is your answer. But was that really necessary?

From our experience and that of the experts out there supporting us (airlines, airports, and their consultants), we know there is need for understanding the local customer base. And highly expensive, often outdated analyses of questionable quality at exorbitant prices. So yes, we think our services are needed. And if you don’t use them, you remain blind on one eye.

We’re not just polishing your Crystal Ball as I keep saying. We expand your vision and understanding to what’s truly important. But wasn’t yet available for no-one dared to address the complexity behind it. So trust the airport they know their market? The best you could do. Now we do better. We qualify their impressions with hard data.

And we make it comparable.

And that’s why we don’t compete with the flight data providers. We do something new. We do the other side of business. The hard one ツ

Seen our demo yet? Three airports. Full analysis. Free to use. But we have almost 600 more: https://www.CheckIn.com/

We’ll debut at Routes and hope to speak to many of you. It’s still “brand new” with cuts and edges. We will smooth them out and improve, we promise. But what we have was simply beyond imagination.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

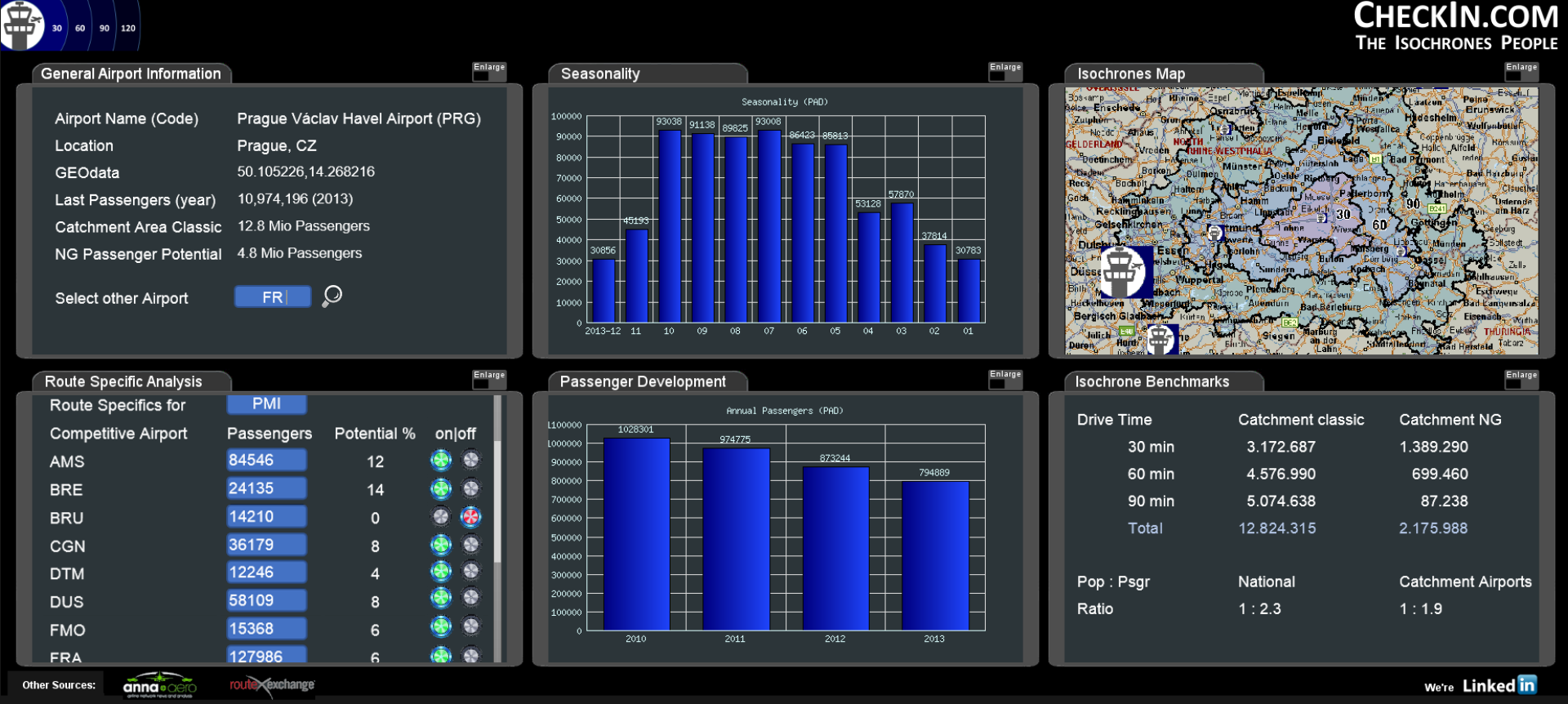

Following my leave from SITA, Yulia and I have now launched CheckIn.com accompanied by a press release promoting the new services.

We are still in prototype stage, but are confident to cover Europe by Routes Europe.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

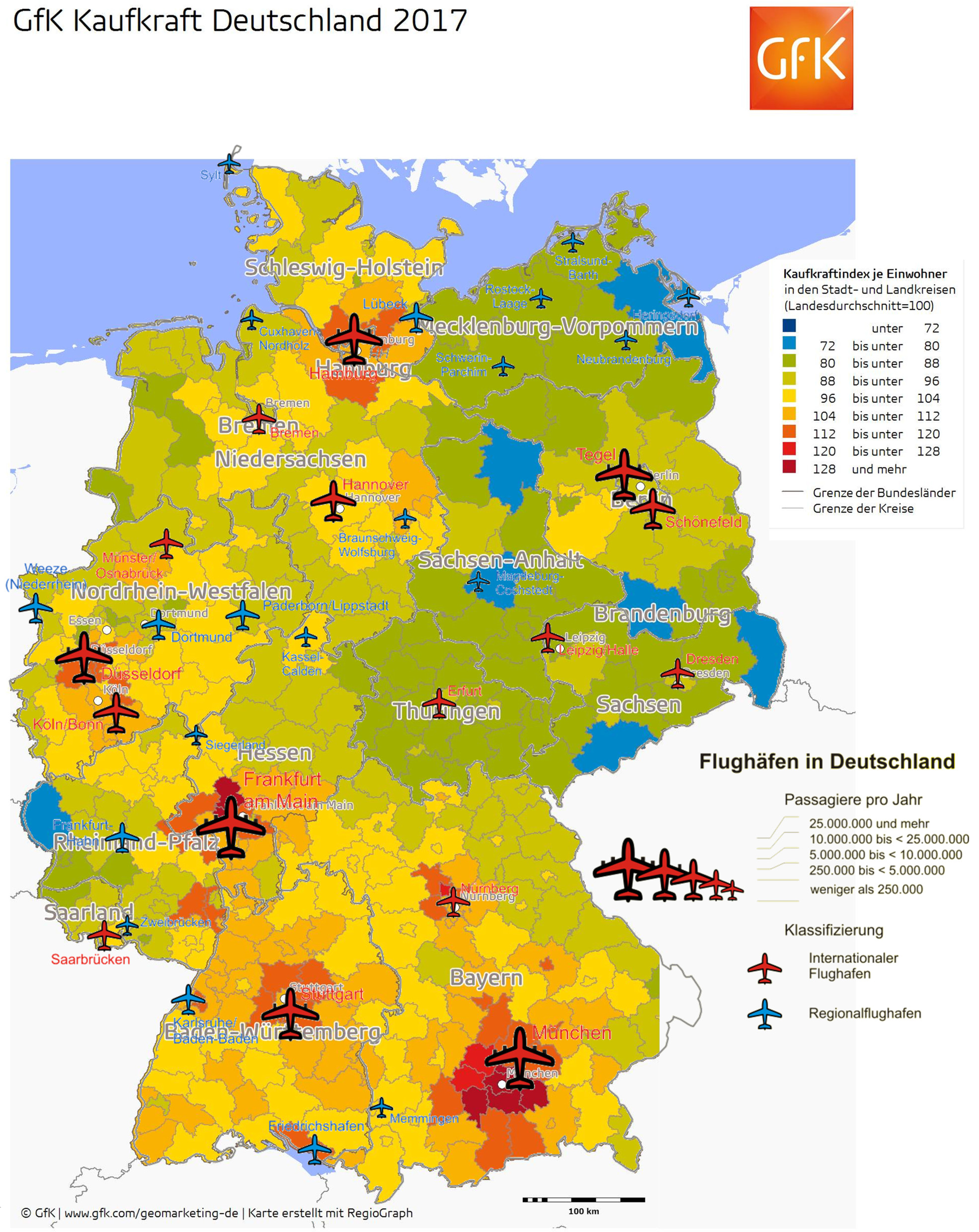

For many years, I use a graphic overlay in Germany in my presentations. I plan to make it available in CheckIn.com in the near future on a European level… I think it speaks for itself.

The influence on airports to purchasing power. Yes, it’s a hen-egg question, but a fact that politicians should think about. Here’s the latest. May it be useful for you too…

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

![]() Braunschweig, March 2015 Thanks to unforseen circumstances, the last days forced us to reconsider the entire development and timeline for the CheckIn.com project. So far, it was planned to be ready with development by February, Mid March and prepare for rollout at Routes Europe in April in Aberdeen. We have now decided to cancel that event overall, a hard and unhappy decision! But. Especially to digg out the U.K. statistical basics caused us major delays, getting incompatible figures from the same source, not just self-researched but also from the ONS (U.K. Office of National Statistics). We learned they mostly only cover England & Wales, neither Scotland or Northern Ireland. Sure with exceptions, which, if you’re kept unaware, simply cannot compute!

Braunschweig, March 2015 Thanks to unforseen circumstances, the last days forced us to reconsider the entire development and timeline for the CheckIn.com project. So far, it was planned to be ready with development by February, Mid March and prepare for rollout at Routes Europe in April in Aberdeen. We have now decided to cancel that event overall, a hard and unhappy decision! But. Especially to digg out the U.K. statistical basics caused us major delays, getting incompatible figures from the same source, not just self-researched but also from the ONS (U.K. Office of National Statistics). We learned they mostly only cover England & Wales, neither Scotland or Northern Ireland. Sure with exceptions, which, if you’re kept unaware, simply cannot compute!

Scotland does not cover the Local Administrative Units Level 2 of Eurostat, they consider those useless and calculate “something” only on demand. Ireland came last (by end of February) and again with non-standard numbers we now have to “make compatible”. To qualify the difficulty to get the basics for the U.K.: Covering geographic Europe, including Balkan countries and other non-EU countries, the U.K. made it a multitude more difficult for us to get some useful information.

Another issue is drive times, where we have to deal with the fact that “unique administrative places” are not being found either in Google, nor by other on- and offline mapping tools. Often, road data is missing completely, making it impossible to calculate any drive times. Especially going east that caused us quite some headaches (and night shifts). So now finally, though with already some delay, we have everything covered. But we recognize that “mapping” is a major fuzziness, if we go with existing technologies – we should buy into commercial collections of administrative borders, though which also don’t completely match with the data we are having.

Another issue is drive times, where we have to deal with the fact that “unique administrative places” are not being found either in Google, nor by other on- and offline mapping tools. Often, road data is missing completely, making it impossible to calculate any drive times. Especially going east that caused us quite some headaches (and night shifts). So now finally, though with already some delay, we have everything covered. But we recognize that “mapping” is a major fuzziness, if we go with existing technologies – we should buy into commercial collections of administrative borders, though which also don’t completely match with the data we are having.

So January 1st, we started the crowdfunding on Indiegogo, hopeful to get enough interest to finance the necessary development. Generating interest and funds mostly from unexpected sources, by early February our hopes shattered, our friends leaving us out alone in the cold. Very little buzz, not even supportive comments to us, even from our close friends, ad sure no orders for Isochrones. A real nice classic barrel burst. Simply dead silence. Not a bad thing, in fact it confirmed our initial approach to go in a step-by-step process, fund as we can, do what we can, but not to rely on investors (requiring fast return-of-investment, having their own agendas) and do “ourselves”.

So January 1st, we started the crowdfunding on Indiegogo, hopeful to get enough interest to finance the necessary development. Generating interest and funds mostly from unexpected sources, by early February our hopes shattered, our friends leaving us out alone in the cold. Very little buzz, not even supportive comments to us, even from our close friends, ad sure no orders for Isochrones. A real nice classic barrel burst. Simply dead silence. Not a bad thing, in fact it confirmed our initial approach to go in a step-by-step process, fund as we can, do what we can, but not to rely on investors (requiring fast return-of-investment, having their own agendas) and do “ourselves”.

Then came the shock. Within days, Jürgen went into sickleave, undergoing a major surgery Feb 27th, taken completely out of the loop for the better part of 14 days and being still hospitalized (4th week), depriving us from the most knowledgable and networked expert in our team. He is well now, still recovering, still hospitalized. The tumors identified turned out a haemangiome (as “known” since 2002) and a benign neuroendokrineous one.

Then came the shock. Within days, Jürgen went into sickleave, undergoing a major surgery Feb 27th, taken completely out of the loop for the better part of 14 days and being still hospitalized (4th week), depriving us from the most knowledgable and networked expert in our team. He is well now, still recovering, still hospitalized. The tumors identified turned out a haemangiome (as “known” since 2002) and a benign neuroendokrineous one.

So after recovering from the major surgery, he shall be almost as new (minus half a pancreas, the spleen and a bit of his liver and plus a possible diabetes). Celebrating his 50th birthday recently, he feels “old now” thanks to the fact that for the remainder of life he got to carry a pillbox and injection pens with him to cover for the lost half pancreas.

But the main setback is the delayed recovery; instead of the expected 10-14 days we now talk more about min. 4-5 weeks that we lost his support for. With all that baggage, we were faced with a tough decision. Do we keep up the plan to go live at Routes Europe? Or do we have to postpone? Especially with the desinterest showed for our crowdfunding, the missing funds to secure external development for the remaining solutions, problems with providing a solution for maps now and Jürgen’s missing help, we decided against Routes Europe and for a delay.

Having the drive time calculations completeted for Europe, we will now start to work on North America already. With the custom tool received by Richard Marsden, we are hopeful to get that covered maybe in time for World Routes, for sure until next Routes Americas. Having the solution for the most complex of our algorithms (thanks Ori) we are also pre-computing the impact values for each airport from the municipality-view. As in most cases the passengers have not just one airport, but optional others to choose from. Depending on the size of the airport, the drive time to get there as well as the flight services offered. But yes, it is quite a bit work and even computerized a real lengthy task to apply these algorithms to all the airport-municipality pairs…

Having the drive time calculations completeted for Europe, we will now start to work on North America already. With the custom tool received by Richard Marsden, we are hopeful to get that covered maybe in time for World Routes, for sure until next Routes Americas. Having the solution for the most complex of our algorithms (thanks Ori) we are also pre-computing the impact values for each airport from the municipality-view. As in most cases the passengers have not just one airport, but optional others to choose from. Depending on the size of the airport, the drive time to get there as well as the flight services offered. But yes, it is quite a bit work and even computerized a real lengthy task to apply these algorithms to all the airport-municipality pairs…

For the maps, we now need to check “low cost solutions”, looking into Google (no “freebees” as Bing), offline mapping tools and maybe Open Street Maps. We assume this takes another 4-6 weeks minimum and we might have to use “offline mapping” as a work-around, with map-creation taking some additional “non-automated” time.

Without the admin borders, we think about a solution to quantify the passenger potential by municipality, thus making “hot spots” visible. Also something to keep us busy, but the benefits of not needing the municipal borders in the display justifying for that. We also got the funding to do a real good prototype of the dashboard, but it takes time to write the necessary software requirements specification.

Then we have to find a web-agency that can do it (the famous needle in the haystack problem). But without map(s), the dashboard is incomplete, so there must be some “placeholder” while we create the map(s). All those tasks we now have to do on our own finally summed up to the painful decision to reschedule the development plans and skip Routes. Which was especially hard on Jürgen to convince, who is a great fan of that event. We do hope you can understand the reasoning behind our decision and appreciate your feedback – supportive, critical, honest. And if you have ideas how to speed up our agenda, if you have reference to a real good web-agency, you are very welcome! Just a little bit

Then we have to find a web-agency that can do it (the famous needle in the haystack problem). But without map(s), the dashboard is incomplete, so there must be some “placeholder” while we create the map(s). All those tasks we now have to do on our own finally summed up to the painful decision to reschedule the development plans and skip Routes. Which was especially hard on Jürgen to convince, who is a great fan of that event. We do hope you can understand the reasoning behind our decision and appreciate your feedback – supportive, critical, honest. And if you have ideas how to speed up our agenda, if you have reference to a real good web-agency, you are very welcome! Just a little bit

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

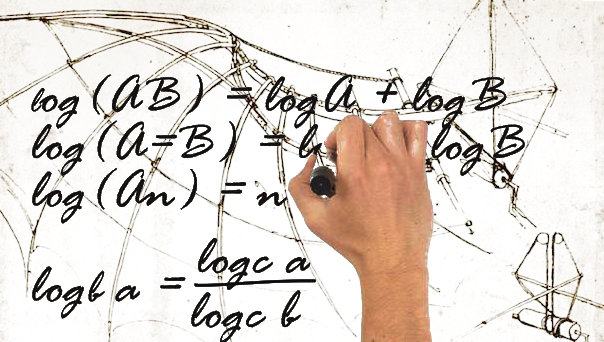

Thanks Ori for the speedy answer!

Whoever gets me the result first in a way I can use it (calculate “percent” based on variable Z and time) can select either a dinner or a 100€ Amazon (or other online available) voucher. We need a curve calculation, fitting the following requirements…

The curve must not meet the X-Axis, so Y (percent) must always be larger 0, no negative values. At minute 30, the percent value should be 100. Or at minute Zero, then we simply add 30 minutes 😉 Depending on variable Z value, the curve shall slope faster or slower, but “reversed proportional”, the lower Z is, the faster the curve falls. Target values…

* 10% or 20%, but preferably not more! But the curve bending should be variable based on Z within that rough frame. If we have the curve, we need to calculate the coordinates, so percent (with min. two decimals), at given X minutes. We “know” minutes and the variable Z.

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

|

Important News: Help us evolve our analyses from PDF (with map-image) to instant, web-based access (including export for further use!). Join our crowdfunding at Indiegogo and spread the word please! |

|

[Update: Crowdfunding ended]

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)

New Airport Insider recently published a blog by one of who they call the “Generation Y”, students, getting ready for the travel and aviation industry. What triggered my attention there was a very basic, though very common misperception, what I call “the inside-out-look”.

New Airport Insider recently published a blog by one of who they call the “Generation Y”, students, getting ready for the travel and aviation industry. What triggered my attention there was a very basic, though very common misperception, what I call “the inside-out-look”.

What’s wrong with that?

That is rather easy. If you provide flight services, you fly both directions. Worse, if you subsidize any airport, you likely do it to attract commerce to your region (tourism is commerce too). You likely don’t do it to make the people in your region to take their money elsewhere. As such, the focus of airports and politicians alike must be on the outside in, or as we say in the travel industry; the incoming.

In the example, which is very common, the French author considered “rail” a competitor to flight. Which is true on the inside-out-look, or outgoing, but it’s simply missing the point once you look outside-in.

Aside of Germany, France and a handful other nations, train is usually no issue. Within these countries, train is very competitive on the local market, especially the high speed trains like French TGV or German ICE. But now I go abroad. Into another country. I go into any travel agency, even in France or Germany and ask for international travel. Give me a guess: How often will they offer you train, even i.e. Paris-Frankfurt? All they intuitively look for in phase 1 is “flight”. Is the city the client wants to connect to bookable on the GDS (Global Travel Booking System)? If not, the agent (hopefully without showing you) rolls the eyes, curses you and starts looking up how the f*** to get you to that godforsaken town you ask for…

Aside of Germany, France and a handful other nations, train is usually no issue. Within these countries, train is very competitive on the local market, especially the high speed trains like French TGV or German ICE. But now I go abroad. Into another country. I go into any travel agency, even in France or Germany and ask for international travel. Give me a guess: How often will they offer you train, even i.e. Paris-Frankfurt? All they intuitively look for in phase 1 is “flight”. Is the city the client wants to connect to bookable on the GDS (Global Travel Booking System)? If not, the agent (hopefully without showing you) rolls the eyes, curses you and starts looking up how the f*** to get you to that godforsaken town you ask for…

In short: If you have an airport “nearby” with scheduled services that link you into the global aviation networks on the GDSs (connections are important), you are visible. Else, you’re an annoyance. If there is an airport “nearby”, travelers may take train, bus, rental car or taxi for the remainder of the trip.

Likely, not knowing the language, maybe not even the local alphabeth, it’s going to be a taxi or a car from a large (global) rental car company offering navigation system. Or a personal pickup…

Likely, not knowing the language, maybe not even the local alphabeth, it’s going to be a taxi or a car from a large (global) rental car company offering navigation system. Or a personal pickup…

Later, the train may become a competitor. But that’s another story. To trigger global commercial interest, an airport is a strategic answer.

But not just the airports, but also the connectivity by scheduled flights, which can be booked in the GDS, connecting the airport to the global aviation networks! Second lesson, most local-minded politicos miss to understand with their inside-out-look…