Two (good) articles today about the riskiness of starting up an airline and the comments they got shared with, triggered some controversial thoughts with me.

The Articles + Comments

OAG summarized on the Evolution of airlines since 2019 (just before the Pandemic) to today. While their findings are very interesting, there is a tone in the summary and a resulting summarization by Tim (someone I generally value) that I happen to disagree with. OAG’s John Grant wrote:

OAG summarized on the Evolution of airlines since 2019 (just before the Pandemic) to today. While their findings are very interesting, there is a tone in the summary and a resulting summarization by Tim (someone I generally value) that I happen to disagree with. OAG’s John Grant wrote:

“Airline start-ups are incredibly difficult, cash rapidly disappears and securing the necessary operating licences frequently takes longer than expected and that’s even before sourcing aircraft, securing slots, avoiding the competition, and building all the necessary reservations systems and back-office support functions.”

And Tim shared the full post with a comment: “OAG is a great data resource for large scale review and schedule activity. This data really doe strike a chord. Airlines are a very risky business. This is very illustrative.”

The other one was an analysis by McKinsey, checking on the aviation value chain’s recovery shared by Patrick, which he introduced with these words: “McKinsey & Company has done an interesting analysis of the aviation value chain. For each subsector, they’ve calculated the “economic profit”, meaning (return on invested capital – weighted average cost of capital) x invested capital. In other words, are firms in that sector creating or destroying value? Their conclusion: only fuel suppliers and freight forwarders created value last year, and airports and airlines lost a lot!”

The Economist’s (My) Response

As an economist by original education and having experience with Startups and Business Angels, I do happen to believe in a sound “business case”. As an airliner, I learned with American to focus on the business case. Like to reconsider twice before approving any waiver on fare rules or trying to upsell to the more expensive (i.e. more flexible) air fare. But I also learned the value of a renowned brand (AA) and service. Or to treat your colleagues as your most valuable customers – they help you sell each and every day. And can ruin a customer relation as quickly.

As an economist by original education and having experience with Startups and Business Angels, I do happen to believe in a sound “business case”. As an airliner, I learned with American to focus on the business case. Like to reconsider twice before approving any waiver on fare rules or trying to upsell to the more expensive (i.e. more flexible) air fare. But I also learned the value of a renowned brand (AA) and service. Or to treat your colleagues as your most valuable customers – they help you sell each and every day. And can ruin a customer relation as quickly.

In “global fares training”, I learned the cost of a flight transfer, something that I never forgot; thanks Ruth King (our fares trainer), I will never forget you.

At Northwest Airlines, I learned that airlines and their managers just sold “cheap”. With full flights in summer season, the airline generated losses on the transatlantic flights. A lesson I’ve seen later over and again. Most sales staff had neither information, nor idea about the “yield” they had to generate to fly profitable. Northwest focused on a minimum yield (revenue per seat-mile) half of that of American. Then sold at that yield as the standard “special fare” and making group offers or “reseller-rebates” below that rate aplenty. As I summarized 2019 on my article about why airlines keep failing, “know your cost”.

Yes, talking about Why Do Airlines Keep Failing. It’s the same response I have on the above two mentioned articles. And many like them. At ASRA 2008, I emphasized brand faces. But I also told those brand faces – the airline sales managers – that they are not there to sell the cheapest price. Anyone can do that, the Internet lives of that. A real sales manager understands that they have to sell the high-end tickets.

Live story, also happened today. Qatar Airways passengers (mother and three kindergarden-aged kids) arrived with >18 hour delay in Düsseldorf. German Rail (clerk) sold tickets to the customer to pick up the passengers that are neither change- nor refundable. So they had to buy completely new (expensive) tickets. A good clerk of this company renowned for it’s unpunctual trains (<60%) would have mentioned the possibility of a flight delay and sold the slightly more expensive tickets that allow for a change. Or at least the optional insurance.

So thinking back to my experiences with Northwest and other such airlines, it’s my questioning about KPIs as well. If my KPI is load and not revenue, I must expect to loose money. It remains beyond me, why airlines offer connecting flight at what a rough calculation on Ryanair or easyJet CASK/CASM (cost per available seat km/mile) proves as below cost, even without the “stop en-route” (landing fees, complexity, etc.). Those are managers who had a nap, when their tutors talked about sound economical calculation? And I keep questioning, why airlines publish loads without revenue per seat. To date, we have hundreds, if not thousands of flights every day, that fly full but loose money. All this is confirmed by the above mentioned and many other such articles.

The Fairy-Tale of Loss Making Airlines

To claim “aviation” is a loss making business is true and can’t be further from the truth.

To claim “aviation” is a loss making business is true and can’t be further from the truth.

Yes, many airlines are loss making. And it fits the common reasons I elaborated before. And yes, you can make airlines very profitable, if you have a management that thinks just a bit outside the box and applies economic rules to their modus operandi (mode of operation). But this also goes in line with route development and other areas. If you don’t have your numbers under control and focus on the ones that are “good to sell to shareholders”, you’ll fail.

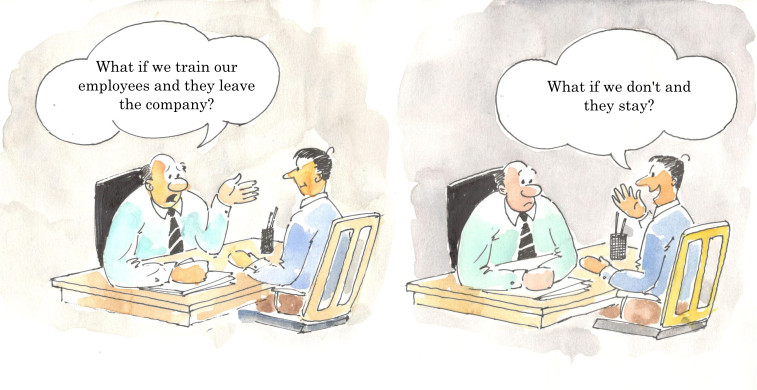

Like with any company, with any startup, in and outside the aviation sphere, we must constantly have an understanding of our cost. And of the competition. What is it our customer wants? There is a psychological price. If you missed that in your economics studies, make your Internet-search for it now. If you have sales teams, train them to upsell the seats. Sell the higher yield fares. Not at a discount, but at a value!

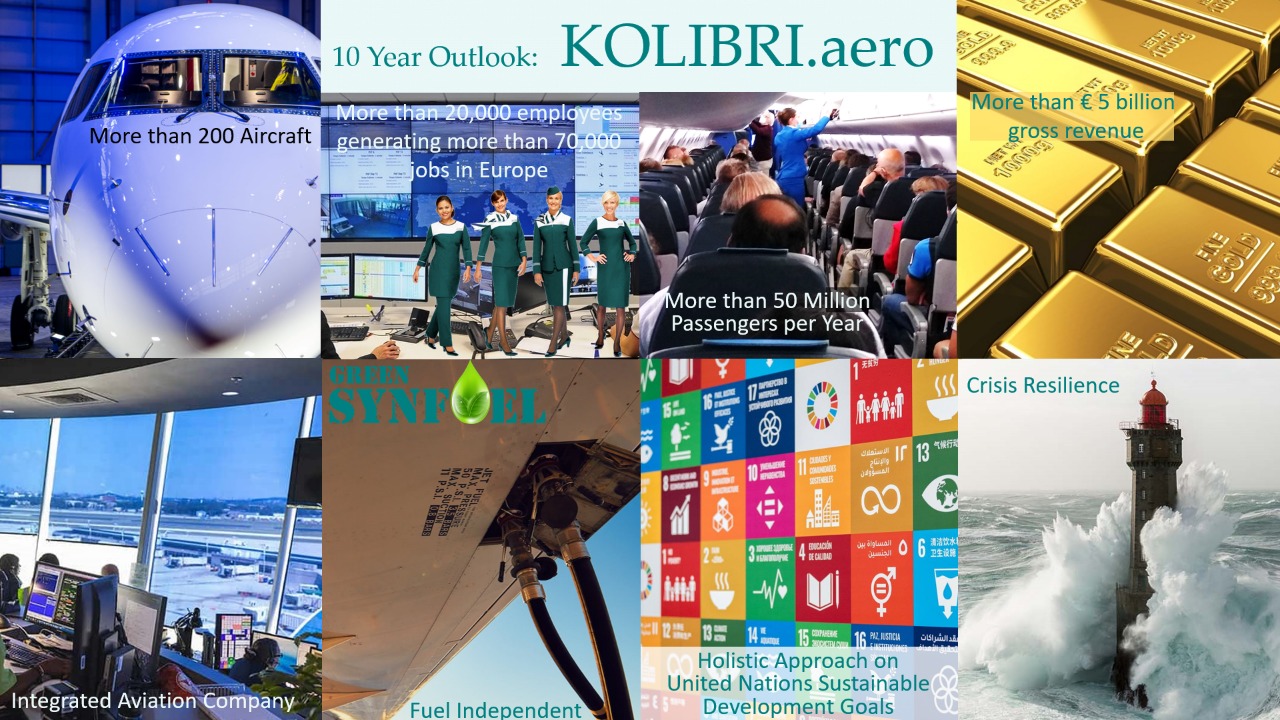

This is one reason, I do not believe we can make Kolibri ever happen by taking over an already failing or failed airline. Wrong structures, wrong thinking in place. I learned this lesson with Air Berlin. The force of inertia was simply too strong. There are some airline that make revenue, but even their managers I find often blindly “follow the worms” (a Pink Floyd referral, yes, the picture is lemmings).

This is one reason, I do not believe we can make Kolibri ever happen by taking over an already failing or failed airline. Wrong structures, wrong thinking in place. I learned this lesson with Air Berlin. The force of inertia was simply too strong. There are some airline that make revenue, but even their managers I find often blindly “follow the worms” (a Pink Floyd referral, yes, the picture is lemmings).

(That’s) The Way Airlines Operate

But unfortunately, all investors we talk to, always think inside their boxes. Can’t tell how many talks I had to radically change our approach and take A320 and do like everyone else does. Ain’t that contrary to the concept of Unique Selling Propositions?

And has ever a “disruptive investment” (another investor buzz word) been developed out of the box using the same thinking? The same values (I’m the cheapest)?

The others are usually starting to tell you that you have to start with smaller amount of money. Sure way to burn your money is a cheap business plan. As OAG writes “getting to size is so important”. You can’t produce a low cost in small numbers. For us, the ideal mix is seven aircraft, where the “administrative overhead cost” becomes manageable. i.e. You have the same cost if you maintain one – or seven aircraft. The same reservations office (just less staff and calls), only little less marketing. You must outsource your operations (at cost) to share the necessary organization with other small airlines. Etc., etc.

To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

To date, I am still working with consulting companies reviewing airline business plans. Aside the usual failure issues, size is a recurring issue. Another being the lack of fallback in case of flight disruptions, may they be caused by technical issues, weather or other events. Their focus on cheap “human resources” and missing team building results in friction and internal competition that further weakens their product offering.

But even taking that into account, we believe the business and financial plans we developed are sound. And profitable from the outset. With a focus on services and a military-style responsibility “for ours” (no “HR” in that company), a “service-focused concept”. Everyone to pull on the same side of the rope. Yes, not starting with a dead corpse, trying to revive, adds some bureaucratic hurdles. But it allows you to think outside the box and instead of following the worms (or other airlines), to do things “right”.

So ever since I entered into the business, I learned at American Airlines under Bob Crandall how to do things right. And learned over and again that the same mistakes are made by short-sighted, narrow-minded managers. And I know all the reasoning used to distract and divert off the incompetence to operate an economically sound business. Usually, I account this as “no faith in your brand”. That then goes along with topics I mentioned before, like brand dissolution (airlines are often academic example), missing USPs, etc. – Cobalt CEO told me about their USP shortly before their demise “We are Cypriotic”. Seriously? When I started, Lufthansa was the brand. Lufthanseat was the employee. All employees of American Airlines knew “Proud to be AAmerican”. Then came the button counters. And mighty AAmerican was taken over by their once-small rival U.S. Airways. Another box of memories.

So yes, airlines are often a loss making business. With bureaucrats leading them into disaster. Sometimes fast, often times a veeeery long death. Air Berlin and Alitalia are very good examples. “Too big to fail”? Simply “prestigious”? And there are “the others”. Airlines that have an idea about what they are doing. That know their niche(s). That know their cost and marketing. That value their brand. That build a reputation. Until button counters (aka. bureaucrats) take over.

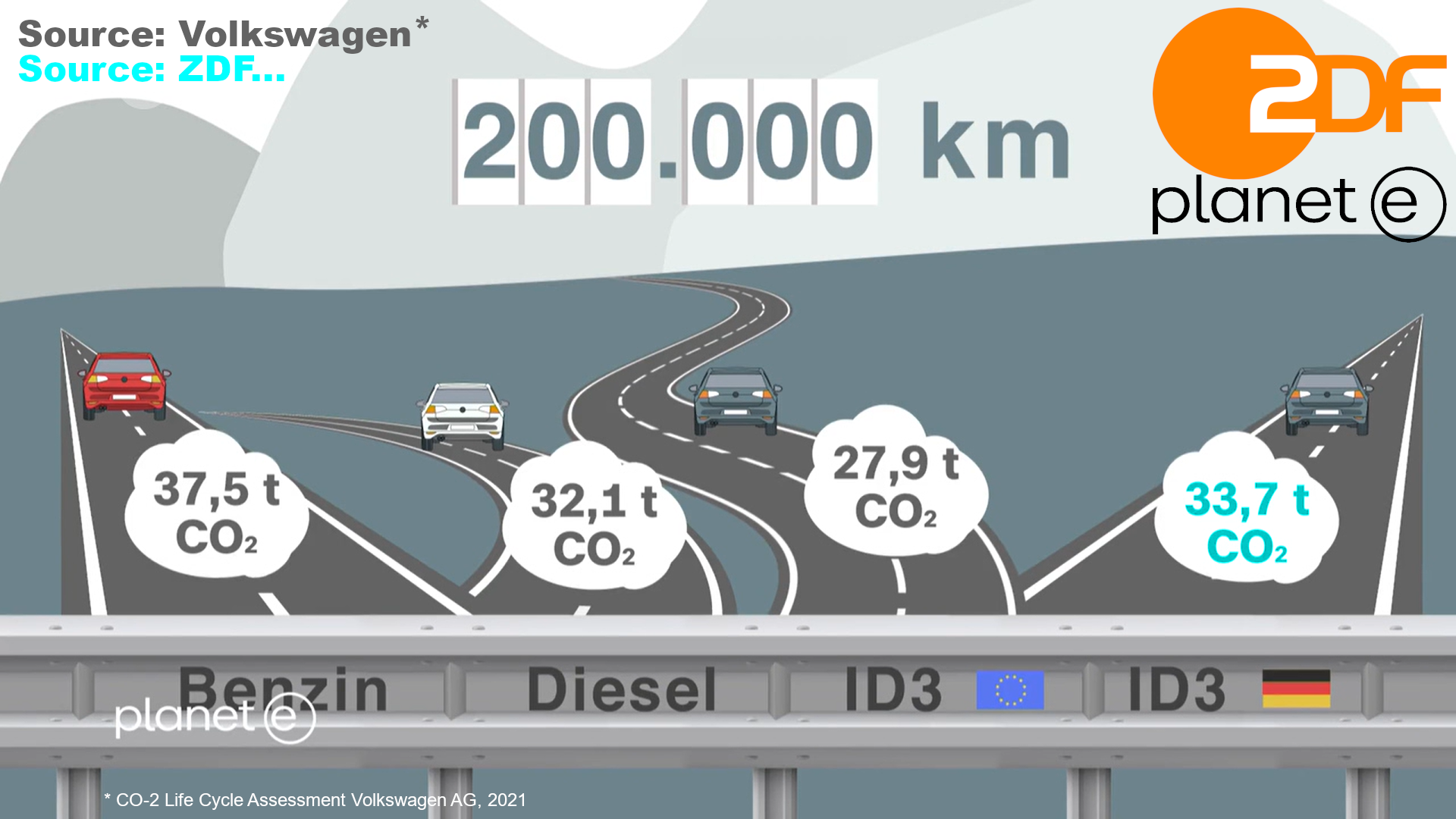

I hope that someone of my hundreds if not thousands of readers (hard to believe, that’s what my server stats claim I’d have) knows some investor with the guts to understand that profitable aviation and sustainable aviation can be the same thing. That the stories those consultancies and their statistics and reports tell have two sides to the coin. And that we get a chance to proof, that climate neutral flying is no heresy, but the future of flight.

Food for Thought – Jürgen

0 - click to show Jürgen you liked the post

The

The !["Our Obsession with technology will slow down the green transition.” [Lubomila Jordanova]](https://foodforthought.barthel.eu/wp-content/uploads/2021/11/Jordanova-Lubomila-Techfocus-slows-down-green-transition.jpg) Having been reminded again of

Having been reminded again of

In 2008, I developed another “disruptive” idea of a hydrogen-powered WIG, to promote the need to think sustainable on a global aviation conference. While it made it through viability study into serious negotiations by a tropical government and a major green fund, it fell victim to Lehman, but I still think it should have been developed. Though since

In 2008, I developed another “disruptive” idea of a hydrogen-powered WIG, to promote the need to think sustainable on a global aviation conference. While it made it through viability study into serious negotiations by a tropical government and a major green fund, it fell victim to Lehman, but I still think it should have been developed. Though since

While my readers and followers know that I question

While my readers and followers know that I question

Another issue that keeps coming up in my discussions is that we must stop competing on sustainable solutions. This is a major, not even just an industry or generational challenge. It’s a global one. So let’s stop competing and start joining forces! Back to my example of offshore wind farms and tidal energy turbines. Why not using them side-by-side in the same sea region we anyway impact by building those humongous wind farm structures? Why not using old Oil Rigs to apply tidal energy turbines, clean them, make them an artificial island structure for sea life (also arial one)?

Another issue that keeps coming up in my discussions is that we must stop competing on sustainable solutions. This is a major, not even just an industry or generational challenge. It’s a global one. So let’s stop competing and start joining forces! Back to my example of offshore wind farms and tidal energy turbines. Why not using them side-by-side in the same sea region we anyway impact by building those humongous wind farm structures? Why not using old Oil Rigs to apply tidal energy turbines, clean them, make them an artificial island structure for sea life (also arial one)? What I learned in my discussions with “green” activists up to government and U.N. levels, is that there is a lot of

What I learned in my discussions with “green” activists up to government and U.N. levels, is that there is a lot of

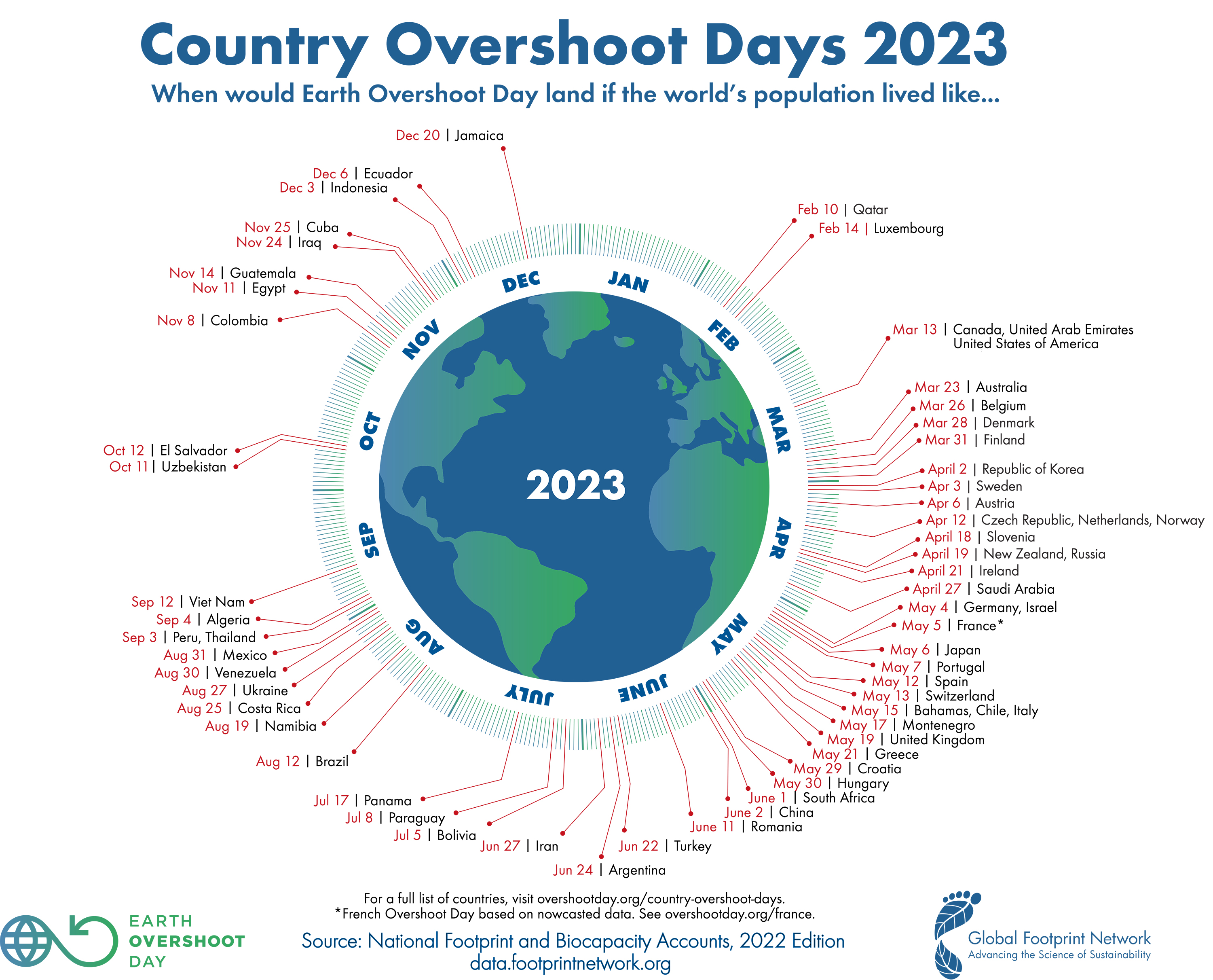

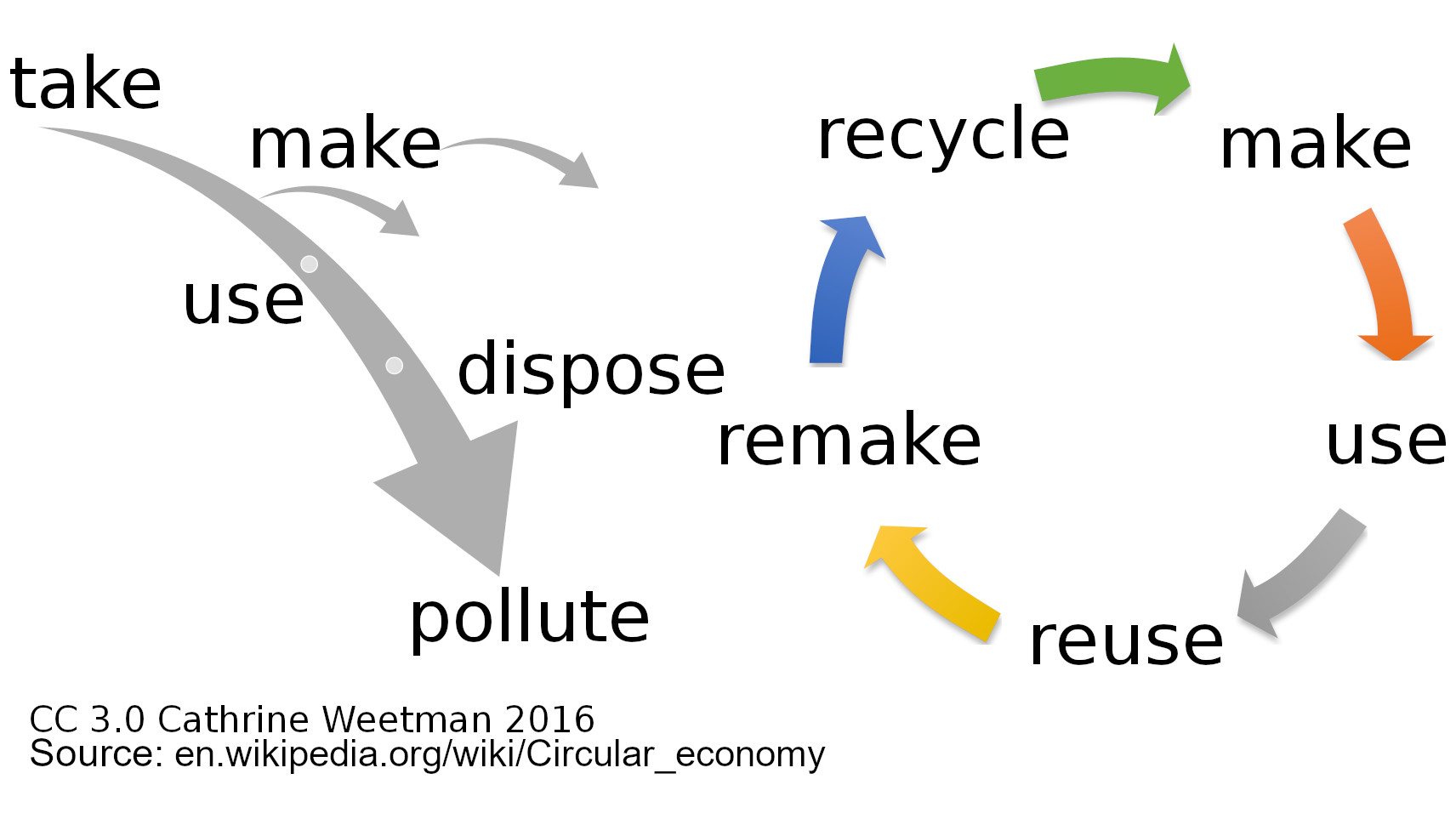

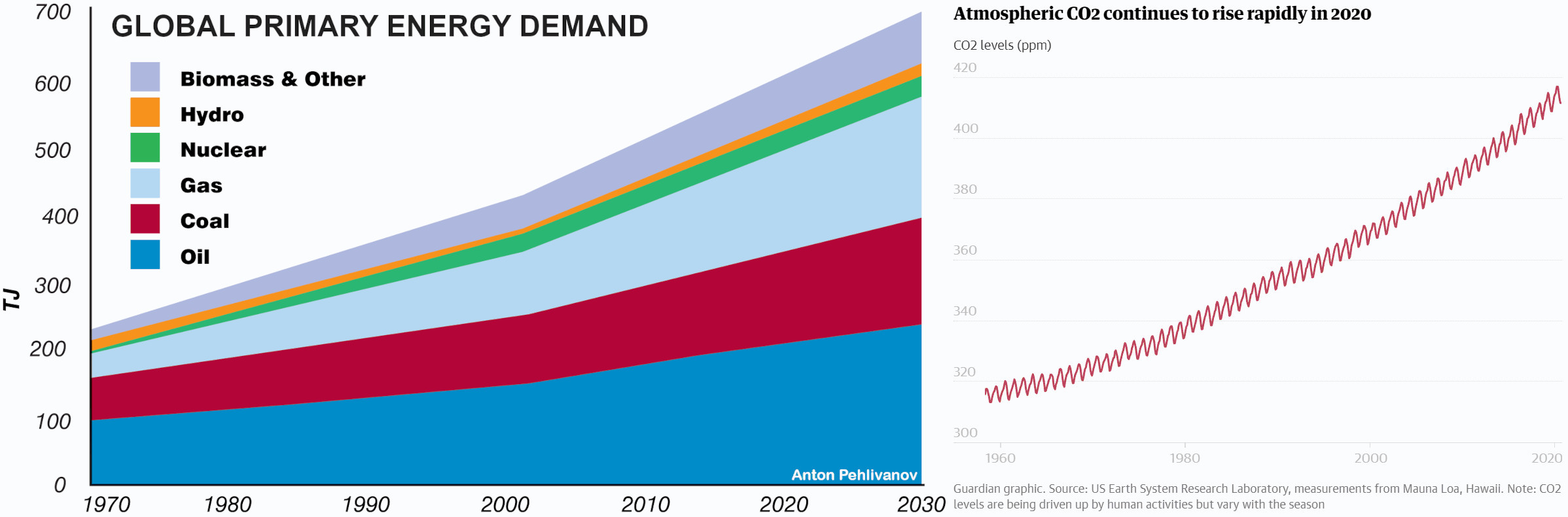

While we now suffer from decades of management misconception that everything must be subordinate to (quick) financial profit and that profits justify the means, we now start to recognize that “sustainability” must be a “shareholder’s value”, as long as “long-term success” (viability). My friends and audience do know I questioned the pure financially focused “shareholder value” for the past 25 years at minimum. And as an economist by “original” profession, I question all those dreamworld models that burn money in the next big hype.

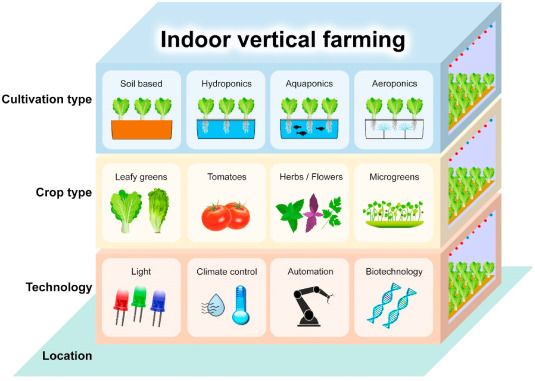

While we now suffer from decades of management misconception that everything must be subordinate to (quick) financial profit and that profits justify the means, we now start to recognize that “sustainability” must be a “shareholder’s value”, as long as “long-term success” (viability). My friends and audience do know I questioned the pure financially focused “shareholder value” for the past 25 years at minimum. And as an economist by “original” profession, I question all those dreamworld models that burn money in the next big hype. Given the current droughts and considering circular economy, thinking about greenhouses filling entire regions in Spain, I think we will need to invest into vertical farming. Given a “closed system” to improve the water usage. Reduce use of chemical fertilizers, herbicides and pesticides. Discussing with a startup recently, I was surprised on the efforts on seed sequence. Not for the plant or the soil, but to make sure the bees they use at all times find sufficient nectar.

Given the current droughts and considering circular economy, thinking about greenhouses filling entire regions in Spain, I think we will need to invest into vertical farming. Given a “closed system” to improve the water usage. Reduce use of chemical fertilizers, herbicides and pesticides. Discussing with a startup recently, I was surprised on the efforts on seed sequence. Not for the plant or the soil, but to make sure the bees they use at all times find sufficient nectar.

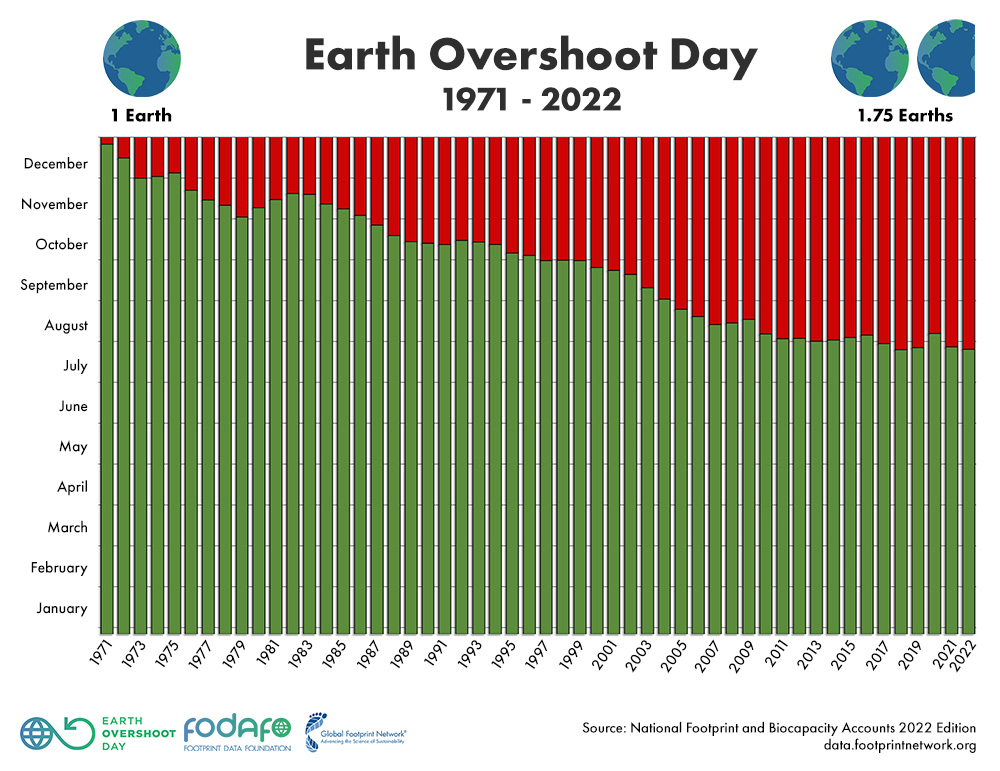

There are many investments into small-scale change, with a focus on two to three years. That by itself should be an issue of concern for any real impact investor. As for climate change and sustainability that can only be a start. What is the 10 year outlook? What impact will it make by 2050?

There are many investments into small-scale change, with a focus on two to three years. That by itself should be an issue of concern for any real impact investor. As for climate change and sustainability that can only be a start. What is the 10 year outlook? What impact will it make by 2050? One of the main concerns we are faced with at Kolibri is our approach to sustainability. First of all, why would an airline turn sustainable, it’s heresy, ain’t it? And why would we pay salaries above country average? Maybe, because they are sustainable and secure the people’s motivation and loyalty?

One of the main concerns we are faced with at Kolibri is our approach to sustainability. First of all, why would an airline turn sustainable, it’s heresy, ain’t it? And why would we pay salaries above country average? Maybe, because they are sustainable and secure the people’s motivation and loyalty?

Is your job “system relevant”? If you work in home office, I can tell you the answer is No. If you work in consulting, I can very likely tell you the answer being No. Working in aviation and transport, the answer very likely is No. And if your salary is above average, the answer also very likely is No.

Is your job “system relevant”? If you work in home office, I can tell you the answer is No. If you work in consulting, I can very likely tell you the answer being No. Working in aviation and transport, the answer very likely is No. And if your salary is above average, the answer also very likely is No. My “intern” boss (again) taught me respect for everyone. The guy on the fork-lift, the cleaners, truck drivers and “secretaries” (yeah, we still had those). He taught us to set up the coffee when it was empty and not bother the secretaries. To clean up ourselves to make the cleaners’ jobs easier. To think beyond our petty box as “office workers” and value the hard work of the real workers. Also to question, but then also embrace the value of our work. IF we added value.

My “intern” boss (again) taught me respect for everyone. The guy on the fork-lift, the cleaners, truck drivers and “secretaries” (yeah, we still had those). He taught us to set up the coffee when it was empty and not bother the secretaries. To clean up ourselves to make the cleaners’ jobs easier. To think beyond our petty box as “office workers” and value the hard work of the real workers. Also to question, but then also embrace the value of our work. IF we added value.