Discussing Routes conferences, I recently appreciated several discussions about the imbalance of route financing in Europe. In the discussion, we boiled it down to a simple question:

Who Takes the Risk?

As we all know, airlines struggle to make money. Which I personally believe is a house-made problem. The use of legacy systems, legacy distribution models make the legacy carriers operate on a cost per seat that’s no longer competitive. In the 70s, a cheap return flight Frankfurt-New York was 2.500 German Marks, about 1.300 Euros. That was 40 years ago. Today the cheap flights sell for below 400 Euros. Return! So the revenue melted away. The cost for aircraft and seats got cheaper too with bigger aircraft. The fixed cost of the flight divided by seats. But that’s another story.

So who are the players in the game.

- The Airline

- The Airport

- The Traveler

- The Region

Let us look at my example I keep using consulting airlines and airports about new routes. At Join! we usually start discussing new routes with airports and quickly learn day in / day out: Everyone wants new Routes, the analyses supporting the case are mostly biased, it all looks sunny-shiny, but no, they don’t want to take the risk. In EU-Europe, they are often not even allowed to take the risk. How stupid is that?

So we usually approach the chamber of commerce, state development agencies and such asking for concrete demand for the routes the airport asks for. All we usually get is some wishful thinking. This company wants flights there? How many seats a year? 4-6… You got to be kidding me…? When we tell them the simple maths, they frequently retreat and have no answer.

The Maths?

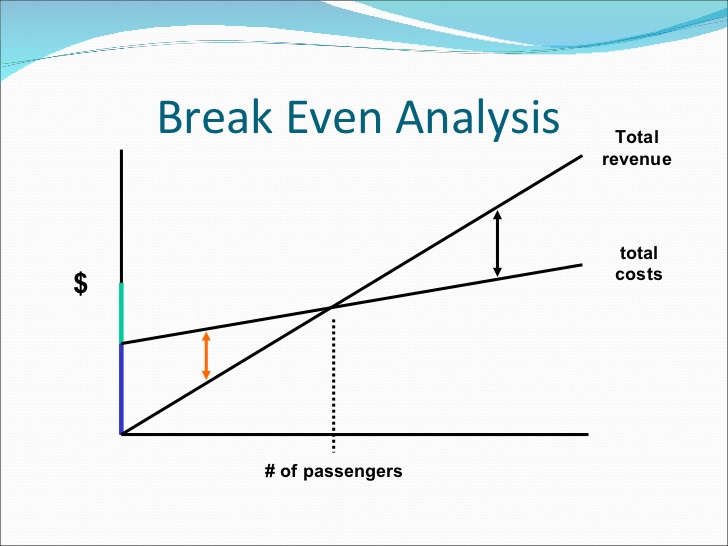

An A319 has 124 seats. At 80% average load (which is low nowadays), we talk about 96 seats. Which have to sell out and inbound. At four flight pairs a day (five to six weekdays, two to four on weekends), we talk about eight legs in average (more is better). At 365 days, we talk about 280 thousand passengers the aircraft should fly every year. Let’s take out some maintenance, but we still get to a target of 250 thousand passengers. For each daily return flight, we talk about 200 seats target. For a double daily, double that.

The A320 or 737-800 is around 189 seats, so roughly 50% more.

Keep in mind there are disruptions. Less frequently on the technical side, the aircraft makers understand the cost involved in a technical grounding. But the airline has to have resources to survive such groundings. But we also talk about weather related flight cancellations. Flights remaining empty for the one or other reasons. Days people tend not to fly (religious holidays), fluctuation in demand… We talk about delays made worse by passenger compensations required by law. The disappearance of interline agreements allowing for involuntary rerouting of the passengers, not to talk about regional routes where the flight might be the only choice.

The cost of aircraft, crew, kerosene, insurance, distribution, maintenance etc. pp. being calculated, adding the “taxes and fees” on top, you talk about a cost per seat per leg at 80% load factor as somewhere between 70 and 100 Euro. On a 99 Euro return fare on the Erfurt-Munich flight in 2010, Cirrus Airlines after taxes and fees had less than seven Euros.

Risk Scenarios

The airports are restricted in what they can do, usually to discounts on the local fees. So the classic:

The Airline Takes the Risk. The very common approach. Yes, we give you discount on the landing fees. A drop on a (very) hot stone.

Guaranteed Load. Classically the field of tour operators, purchasing a fixed number of seats on the flights. Works very well in high season, but in the past two decades, the number of flights where the tour operator charters the aircraft became negligible. Even in that market, most flights are “set up” by the airline and then marketed to a number of tour operators. Once the shit hits the fan, as recently i.e. in Turkey, the tour operators cancel their seat allocations leaving the airline suddenly with unfilled air planes. But the aircraft is still there, it costs money!

A similar approach is to get such guaranteed seats from corporate clients, though they usually demand “lowest fare” for the guarantee at “last seat guarantee”, adding difficulty on the pricing games the airline can play. So a good airline sales makes sure to keep the flexibility. We discussed the purchase of (virtual) ticket stock at cost per seat + X, but very few of the corporations demanding a specific route then come up and commit. So we’re back to the airline taking the risk.

So in reality, we can (and have to) look at realistic scenarios.

Who Benefits?

“What are the facts? Again and again and again-what are the facts? Shun wishful thinking, ignore divine revelation, forget what “the stars foretell,” avoid opinion, care not what the neighbors think, never mind the unguessable “verdict of history”–what are the facts, and to how many decimal places? You pilot always into an unknown future; facts are your single clue. Get the facts!” [Lazarus Long]

And even with all the facts, navigating the future is a risk. Get what you can in the best quality. The better and unbiased the data, the less your risk!

Permanent Subsidies

If you know me, I am no fan of subsidies. You got to understand who benefits and to what extend. Get the maths down. then invest.

On the other side, there may be reason for permanent “subsidies” by the region flown from and to. As they benefit from better flight connections, from tourists, business travelers, commerce, taxes. Why is it that I keep asking if anyone has some sound research to share about the impact of a new flight to the economy? Why are the state development agencies “in need” but unable to qualify that impact to their economy? I am still convinced airports like Erfurt-Weimar, Lübeck or Kassel need scheduled services to be connected to the global aviation networks. Not to the nearby hubs that they can reach easily with rail or car. But studies exist that confirm that beyond four hours drive time a flight makes sense.

Temporary Investment

Risk Sharing

Who benefits?

![“Our Heads Are Round so our Thoughts Can Change Direction” [Francis Picabia]](https://foodforthought.barthel.eu/wp-content/uploads/2021/10/Picabia-Francis-Round-Heads.jpg)